|

Global Economics will be taking the next week off. Next article will be dated January 5.

The global economy is ending 2023 as favorably as policy makers could have hoped. Consumer inflation is moderating and convincingly so, consumer demand has been flat overall despite strength in the US, production has been uneven but with glimpses of strength, while international trade has stabilized. Europe may be on the verge of recession but improvement in consumer confidence may be hinting at a favorable outcome here as well. And unlike this time last year, the global economy isn’t facing headwinds from central banks as monetary policy has been steady across the major economies and looks to become accommodative as soon as inflation eases just a bit more. We’ll start the week’s run with China, the only major economy where monetary policy has been accommodative all along.

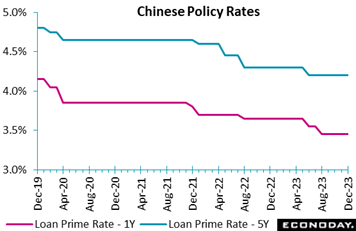

The People's Bank of China left the one-year loan prime rate unchanged at 3.45 percent at its monthly review, in line with the consensus forecast. The equivalent five-year rate was also left on hold at 4.20 percent. The one-year rate was cut by 10 basis points in August. The People's Bank of China left the one-year loan prime rate unchanged at 3.45 percent at its monthly review, in line with the consensus forecast. The equivalent five-year rate was also left on hold at 4.20 percent. The one-year rate was cut by 10 basis points in August.

Officials characterized official activity data published earlier in the month as evidence that "the national economy further consolidated its good momentum" and that conditions are "turning for the better". These comments along with this rate decision suggest that officials remain comfortable with current policy settings for now, despite ongoing weakness in the property market.

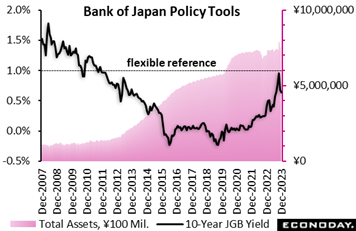

The Bank of Japan voted unanimously, as widely expected, to maintain its seven-year-old yield curve control framework and retain guidance that it will "patiently continue with monetary easing" in order to "achieve the price stability target of two percent in a sustainable and stable manner, accompanied by wage increases." The bank kept targets of minus 0.1 percent for the short-term policy rate and "around zero percent" for the 10-year bond yield, the latter of which was last adjusted in October after having been made flexible in July, to allow an upward swing to around 1.0 percent in light of higher yields in the US bond market at the time.

Market focus has been on when the central bank will end its negative interest rate policy introduced in January 2016. The BoJ charges 0.1 percent interest on a part of cash reserves parked at the bank by financial institutions; this is designed to encourage banks to lend more, but it squeezes profits and is unpopular among lenders.

BoJ policymakers are largely expected to refrain from raising rates at least until April, when they will get a clearer sign whether wages will continue rising substantially in the next fiscal year. The results of annual wage talks between major firms and their trade unions won't be available until mid-March and indications of how that will influence smaller businesses, which employ about 70 percent of the workforce, are likely to emerge after the April 1 start of fiscal 2024.

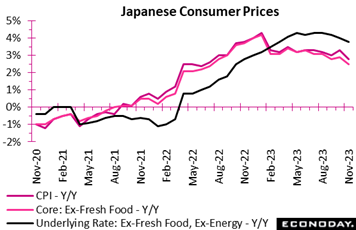

Ahead of those talks, wages in Japan are adding pressure even though overall inflation continues to cool. Consumer inflation slowed to a 16-month low of 2.8 percent in November from 3.3 percent in October; core inflation excluding fresh food slowed to 2.5 percent from 2.9 percent; and underlying inflation excluding both fresh food and energy eased to 3.8 from 4.0 percent. Yet all these measures, though moving in the right direction, remain above the Bank of Japan’s 2 percent target. Ahead of those talks, wages in Japan are adding pressure even though overall inflation continues to cool. Consumer inflation slowed to a 16-month low of 2.8 percent in November from 3.3 percent in October; core inflation excluding fresh food slowed to 2.5 percent from 2.9 percent; and underlying inflation excluding both fresh food and energy eased to 3.8 from 4.0 percent. Yet all these measures, though moving in the right direction, remain above the Bank of Japan’s 2 percent target.

Held down by energy subsidies and a strengthening yen, goods prices excluding fresh food slowed to 2.7 percent, down sharply from 3.6 percent in October. Yet due to labor shortages, service costs continued to rise; service prices excluding owners' equivalent rent rose 3.4 percent on the year in November from 3.1 percent in October.

These results raise questions over what to expect for the BoJ’s next round of quarterly forecasts. Back in October, the bank revised up its core CPI forecast for fiscal 2023 ending next March to 2.8 percent from 2.5 percent forecast in July, and raised its projection for fiscal 2024 to 2.8 percent from 1.9 percent. The board's median forecast for fiscal 2025 was 1.7 percent, revised up slightly from 1.6 percent but still below its 2 percent inflation target.

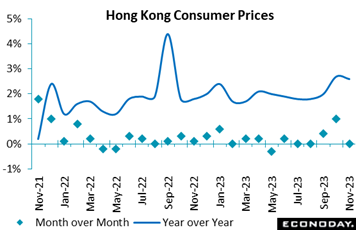

Hong Kong's headline consumer price index rose 2.6 percent on the year in November, easing from an increase of 2.7 percent in October. The index was flat on the month after advancing 1.0 percent previously and was largely driven by the expiry of housing relief measures provided to low-income households. Excluding the impact of government one-off relief measures, Hong Kong's underlying inflation rate also fell slightly, from 1.7 percent to 1.6 percent. Officials again expressed confidence that domestic inflation will remain "moderate" in the near-term, with external price pressures expected to weaken further and offset a potential increase in domestic price pressures as economic conditions improve. Hong Kong's headline consumer price index rose 2.6 percent on the year in November, easing from an increase of 2.7 percent in October. The index was flat on the month after advancing 1.0 percent previously and was largely driven by the expiry of housing relief measures provided to low-income households. Excluding the impact of government one-off relief measures, Hong Kong's underlying inflation rate also fell slightly, from 1.7 percent to 1.6 percent. Officials again expressed confidence that domestic inflation will remain "moderate" in the near-term, with external price pressures expected to weaken further and offset a potential increase in domestic price pressures as economic conditions improve.

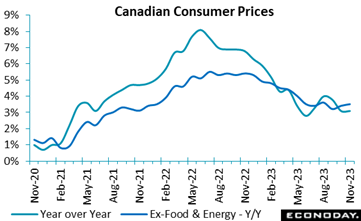

Consumer prices in Canada edged up 0.1 percent in November, for a 12-month increase of 3.1 percent, both above expectations of a 0.1 percent monthly decline and a 2.9 percent annual rate. Excluding food and energy, consumer prices were up 0.2 percent on the month and 3.5 percent year-over-year, up from 3.4 percent. Consumer prices in Canada edged up 0.1 percent in November, for a 12-month increase of 3.1 percent, both above expectations of a 0.1 percent monthly decline and a 2.9 percent annual rate. Excluding food and energy, consumer prices were up 0.2 percent on the month and 3.5 percent year-over-year, up from 3.4 percent.

Despite the higher-than-expected headline CPI number, overall inflation could still meet or be below the Bank of Canada's projection of an average 3.3 percent in the fourth quarter. In addition, the Bank of Canada's own core measures eased further, with the average coming down to 3.6 percent from 3.7 percent in October. That said, the acceleration of CPI excluding food and energy is a disappointment that reduces the odds of rate cuts soon.

Food prices were up 0.6 percent on the month and rose 5.0 percent year-over-year, and energy fell 1.9 percent and 5.7 percent, respectively.

Service prices increased 0.2 percent from October and 4.6 percent from a year earlier, and goods prices were up 0.1 percent and 1.4 percent, respectively. Five of the eight major categories increased on the month, including a 0.5 percent gain in shelter. Five categories also increased year-over-year.

Mortgage interest cost increased 1.9 percent on the month and 29.8 percent year-over-year, making it the largest upward contributor to both the monthly and 12-month CPI advance. Rent appreciated 0.4 percent from October and 7.4 percent year-over-year. Rent was the second largest upward contributor on a 12-month basis and the fourth largest to monthly inflation. Gasoline was down 3.5 percent on the month and 7.7 percent year-over-year, making it the largest downward contributor to both the monthly and year-over-year CPI.

On a seasonally adjusted basis, the headline CPI increased 0.3 percent on the month after being flat in October, while the core index, excluding food and energy, increased at a steady and sharp pace of 0.4 percent.

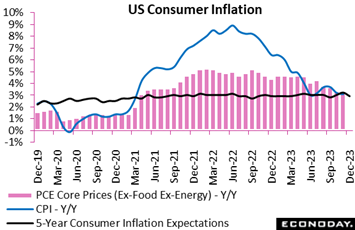

The latest inflation readings from the US, in contrast to those from Canada, are more favorable, led by the core PCE price index which excludes food and energy and is arguably the most important gauge for Federal Reserve policy. This index has posted back-to-back adjusted monthly gains of only 0.1 percent to indicate virtually no momentum while year-over-year the index edged 2 tenths lower to 3.2 percent for its lowest showing since April 2021. Rounding up key US readings, the overall CPI edged down 3.1 percent from 3.2 percent in November while year-ahead consumer expectations fell dramatically in data for December to 3.1 percent from 4.5 percent. This is the best showing since March 2021. Nevertheless, while Fed policymakers will be pleased with the ongoing improvement, they’re likely to remain cautious about the outlook. The core PCE deflator will not change their view that underlying inflation remains elevated and that the distance to reaching the two percent inflation objective remains too wide to let up on restrictive monetary policy yet. The latest inflation readings from the US, in contrast to those from Canada, are more favorable, led by the core PCE price index which excludes food and energy and is arguably the most important gauge for Federal Reserve policy. This index has posted back-to-back adjusted monthly gains of only 0.1 percent to indicate virtually no momentum while year-over-year the index edged 2 tenths lower to 3.2 percent for its lowest showing since April 2021. Rounding up key US readings, the overall CPI edged down 3.1 percent from 3.2 percent in November while year-ahead consumer expectations fell dramatically in data for December to 3.1 percent from 4.5 percent. This is the best showing since March 2021. Nevertheless, while Fed policymakers will be pleased with the ongoing improvement, they’re likely to remain cautious about the outlook. The core PCE deflator will not change their view that underlying inflation remains elevated and that the distance to reaching the two percent inflation objective remains too wide to let up on restrictive monetary policy yet.

Producer prices in Germany continued to slide in November. A 0.5 percent monthly drop was a good deal steeper than the consensus and was the sixth decline in the last seven months. However, in line with October, positive base effects still saw annual PPI inflation rise from minus 11.0 percent to minus 7.9 percent. Producer prices in Germany continued to slide in November. A 0.5 percent monthly drop was a good deal steeper than the consensus and was the sixth decline in the last seven months. However, in line with October, positive base effects still saw annual PPI inflation rise from minus 11.0 percent to minus 7.9 percent.

Energy prices were down 1.4 percent versus October but even excluding this category prices dipped a further 0.1 percent, nudging the yearly core rate just a tick higher to a still subdued 0.3 percent. Elsewhere, intermediates fell 0.2 percent while both capital goods and consumer durables were flat. Consumer non-durables were just 0.1 percent more expensive.

November’s update leaves intact a solid downtrend in producer prices and offers further proof of the underlying weakness in the German manufacturing sector.

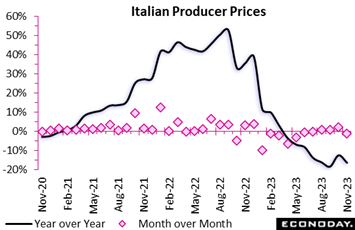

Producer prices in Italy dropped by 1.2 percent in November, partially reversing a 2.2 percent gain in October. But base effects meant that annual PPI declined by 16.3 percent, accelerating from October's 12.4 percent slump. Producer prices in Italy dropped by 1.2 percent in November, partially reversing a 2.2 percent gain in October. But base effects meant that annual PPI declined by 16.3 percent, accelerating from October's 12.4 percent slump.

Energy prices accounted for much of the decline, falling by 3.0 percent from October and by 34.9 percent over the same month of 2022. Intermediate goods prices declined by an annual pace of 6.3 percent.

But consumer goods prices rose by an annual rate of 2.6 percent, with durables jumping by 3.1 percent, which could suggest a slowdown in the reduction of consumer price inflation down the road.

Given the recent volatility in crude oil prices, energy could continue to distort intermediate inflation readings in months to come. Crude oil prices have fallen dramatically over the fourth quarter, declining by 23 percent between late September and mid-December, before recovering somewhat over the past week to stand some 17 percent below that September peak.

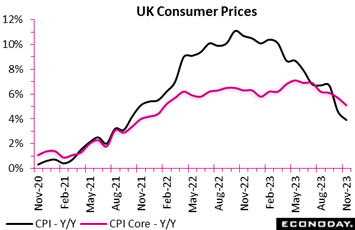

Producer prices in the UK are no less falling, down 0.1 percent on the month in November for annual contraction of 0.2 percent and reflecting declines for coke and petroleum products. And lack of pipeline pressures once again assured easing in consumer prices which were once again significantly weaker than expected. A surprise 0.2 percent drop in November reduced the annual inflation rate from 4.6 percent to 3.9 percent, some 0.5 percentage points short of the market consensus. Inflation now stands at its lowest level since September 2021 and the overshoot versus its medium-term target has been trimmed to 1.9 percentage points from fully 9.1 percentage points just a year ago. Producer prices in the UK are no less falling, down 0.1 percent on the month in November for annual contraction of 0.2 percent and reflecting declines for coke and petroleum products. And lack of pipeline pressures once again assured easing in consumer prices which were once again significantly weaker than expected. A surprise 0.2 percent drop in November reduced the annual inflation rate from 4.6 percent to 3.9 percent, some 0.5 percentage points short of the market consensus. Inflation now stands at its lowest level since September 2021 and the overshoot versus its medium-term target has been trimmed to 1.9 percentage points from fully 9.1 percentage points just a year ago.

There was also good news on the core rate for which a 0.3 percent monthly drop was steep enough to slash its yearly gain from 5.7 percent to 5.1 percent, its lowest print since January 2022. Overall goods inflation dropped from 2.9 percent to 2.0 percent while the rate in services eased from 6.6 percent to 6.3 percent.

The main downward contribution to the change in the annual headline rate came from transport, where prices fell 1.7 percent on the month, and recreation and culture, down 0.4 percent. Food and soft drink fell 0.3 percent. There were no positive contributions of any note.

The surprisingly soft November report leaves headline and core inflation on a solid downward trend which will inevitably please the Bank of England. Nonetheless, with service sector inflation still above 6 percent, the bank will be cautious.

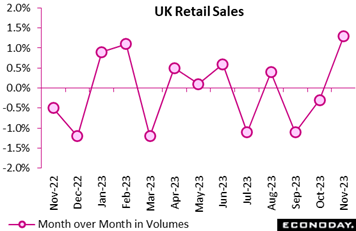

Retail sales in the UK surprised on the upside in November. A 1.3 percent monthly bounce in volumes was much stronger than the consensus and matched the best performance since April 2021. Following a 0.3 percent drop in October, the increase boosted annual growth from minus 2.5 percent to 0.1 percent, the first positive print since March 2022. Retail sales in the UK surprised on the upside in November. A 1.3 percent monthly bounce in volumes was much stronger than the consensus and matched the best performance since April 2021. Following a 0.3 percent drop in October, the increase boosted annual growth from minus 2.5 percent to 0.1 percent, the first positive print since March 2022.

Excluding auto fuel, the picture was much the same with purchases also up 1.3 percent versus the previous month and 0.3 percent firmer on the year.

November's monthly spurt mainly reflected a 2.3 percent bounce in non-food sales, excluding auto fuel. Household goods (3.5 percent) were especially robust as were textiles and clothing (1.3 percent) and the other stores category (2.6 percent). Moreover, with food (0.8 percent) and auto fuel (0.6 percent) similarly posting gains, the headline advance was truly broad-based.

November's update was probably helped by increased discounting and strong Black Friday sales. In any event, following earlier weakness, the November rise was large enough to leave average sales in the first two months of the quarter unchanged from their mean level in the third quarter. As a result, absent any revisions, December would need at least a 0.6 percent monthly decline for the retail sector to subtract from fourth quarter GDP growth. This reduces, but does not eliminate, the risk of UK recession by year-end

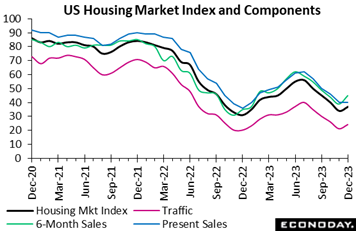

There was a load of data in the week on US housing but mostly for the month of November when mortgage rates were still near their peak and were still depressing activity. But one report, the housing market index from the National Association of Home Builders, tracked data for December and showed noticeable improvement. rising 3 points to 37 and led by future sales, up 6 points to 45, and buyer traffic up 3 points to 24. The index for current sales stayed flat at 40 reflecting financing taken out at higher interest rates. The average rate for a 30-year fixed rate mortgage hit a near-term peak of 7.7 percent in November with December-to-date down to about 7.4 percent. There was a load of data in the week on US housing but mostly for the month of November when mortgage rates were still near their peak and were still depressing activity. But one report, the housing market index from the National Association of Home Builders, tracked data for December and showed noticeable improvement. rising 3 points to 37 and led by future sales, up 6 points to 45, and buyer traffic up 3 points to 24. The index for current sales stayed flat at 40 reflecting financing taken out at higher interest rates. The average rate for a 30-year fixed rate mortgage hit a near-term peak of 7.7 percent in November with December-to-date down to about 7.4 percent.

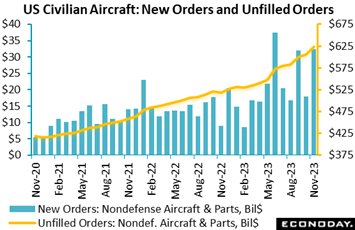

Another swing higher for commercial aircraft lifted US durable orders 5.4 percent higher in November; this followed October’s swing lower for commercial aircraft that left orders down 5.1 percent. Excluding transportation shows visible progress: up 0.5 percent to more than reverse October's 0.3 percent decline and add to September's 0.2 percent gain. Another swing higher for commercial aircraft lifted US durable orders 5.4 percent higher in November; this followed October’s swing lower for commercial aircraft that left orders down 5.1 percent. Excluding transportation shows visible progress: up 0.5 percent to more than reverse October's 0.3 percent decline and add to September's 0.2 percent gain.

Commercial aircraft (nondefense aircraft and parts) jumped 80.1 percent to $32.3 billion following October's 43.8 percent drop and September's 90.6 percent surge. For comparison, the dollar value of total durable orders in November came in at $295.4 billion.

Also part of the transportation group are motor vehicles which, likely reflecting the end of labor actions, jumped 2.8 percent to $60.8 billion following declines of 4.1 and 2.5 percent in the prior two months.

Another sign of progress comes from core capital goods orders (nondefense ex-aircraft) which jumped 0.8 percent to reverse a 0.6 percent drop in October and a 0.2 percent decline in September. November's dollar value for the core capital goods group totaled $74.0 billion and included sharp gains for computers, communications equipment, and electrical equipment.

Unfilled orders are becoming a great positive for the US factory sector, jumping 1.3 percent for the second time in three months in what are giant builds tied directly to commercial aircraft where unfilled orders have surged the last three months, by 3.0 percent in November and surpassed by a 3.2 percent jump in September.

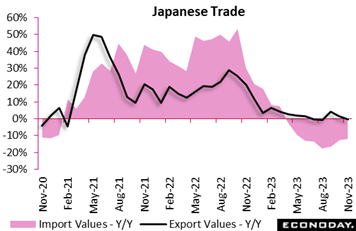

Japan’s trade balance came to a deficit of ¥777 billion in November following a ¥661 billion deficit in October and a surplus of ¥65.4 billion in September. Imports are not the problem for the balance, falling 11.9 percent on the year following 12.5 percent contraction in October as energy prices remained well below last year's levels. Exports rather are behind the trouble, falling 0.2 percent which was much weaker than Econoday’s consensus for a 1.9 percent rise. Exports of chip-producing equipment continued to drop as did exports of iron and steel as well as ships. Exports of autos and semiconductors, however, posted solid gains. On a volume basis, exports fell 5.6 percent on the year in November after falling 3.3 percent in October. Japan’s trade balance came to a deficit of ¥777 billion in November following a ¥661 billion deficit in October and a surplus of ¥65.4 billion in September. Imports are not the problem for the balance, falling 11.9 percent on the year following 12.5 percent contraction in October as energy prices remained well below last year's levels. Exports rather are behind the trouble, falling 0.2 percent which was much weaker than Econoday’s consensus for a 1.9 percent rise. Exports of chip-producing equipment continued to drop as did exports of iron and steel as well as ships. Exports of autos and semiconductors, however, posted solid gains. On a volume basis, exports fell 5.6 percent on the year in November after falling 3.3 percent in October.

Shipments to China, one of the key export markets for Japanese goods, fell 2.2 percent in value terms for their 12th straight year-over-year decline in November, but the pace of decrease continued to decelerate. Semiconductors, food and organic compounds led exports lower while exports of semiconductor-producing equipment continued to rise as did autos and mineral fuels. The recent trend is in stark contrast to the middle of last year, when shipments to China rose 12.8 percent to a record high ¥1.78 trillion in July 2022.

Japanese exports to Asia as a whole slipped 4.1 percent in November for the 11th straight drop. The decline was led by iron and steel and ships but exports of semiconductors and autos recorded gains.

Exports to the U.S., which have exceeded those to China since October 2022, recorded their 26th straight year-on-year rise, up 5.3 percent in November following an 8.5 percent rise in October. The increase was led by automobiles and auto parts, as seen in recent months, as well as aircraft. Exports of metal processing machinery, construction/mining equipment and semiconductor-producing equipment declined.

Shipments to the European Union posted their first year-on-year drop in 33 months, down by a fractional 0.03 percent in November, following an 8.9 percent rise in October and a 12.9 percent gain in September. The decrease reflected lower demand for iron and steel, heating and cooling equipment as well as motorcycles, which was nearly offset by solid demand for automobiles, ships and drugs.

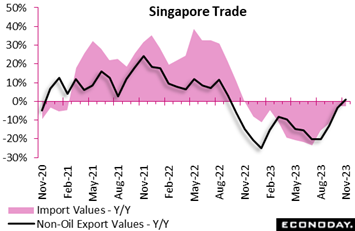

Singapore's non-oil domestic exports rose 1.0 percent on the year in November after falling 3.5 percent in October and advanced 0.3 percent on the month after a previous increase of 5.7 percent. Imports fell 2.5 percent on the year in November after falling 2.3 percent in October and fell 4.0 percent on the month after an increase of 4.1 percent previously. Singapore's non-oil domestic exports rose 1.0 percent on the year in November after falling 3.5 percent in October and advanced 0.3 percent on the month after a previous increase of 5.7 percent. Imports fell 2.5 percent on the year in November after falling 2.3 percent in October and fell 4.0 percent on the month after an increase of 4.1 percent previously.

Exports of electronics products fell 12.7 percent on the year after dropping 5.6 percent previously, while exports of non-electronic products increased 5.2 percent after a previous decline of 2.9 percent. Exports of pharmaceuticals, a volatile category, recorded particularly strong growth. The increase in headline exports was driven a rebound in exports to United States and stronger growth in exports to Hong Kong, partly offset by a weaker growth in exports to China and a bigger year-over-year decline in exports to Japan.

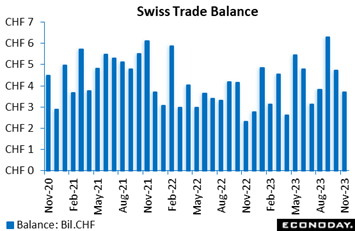

Switzerland’s merchandise trade surplus narrowed from October's CHF4.71 billion to CHF3.71 billion in November. However, this was still up from the CHF2.16 billion posted in the same month in 2022. The improvement reflected a 3.3 percent yearly gain in exports and a 3.7 percent fall in imports. The latter has been sub-zero every month since February. Switzerland’s merchandise trade surplus narrowed from October's CHF4.71 billion to CHF3.71 billion in November. However, this was still up from the CHF2.16 billion posted in the same month in 2022. The improvement reflected a 3.3 percent yearly gain in exports and a 3.7 percent fall in imports. The latter has been sub-zero every month since February.

Seasonally adjusted, the surplus stood at CHF2.01 billion, well short of October's CHF3.41 billion and the weakest outturn since November 2022. The deterioration was largely due to imports which, having declined 4.9 percent on the month at the start of the quarter, rebounded fully 7.2 percent. By contrast, exports compounded October's 10.7 percent slump with a 0.5 percent dip. However, the real trade balance still improved as export volumes rose 1.8 percent on the back of a 7.8 percent bounce in chemicals and pharmaceuticals and their import counterpart increased 1.7 percent.

In its new Monetary Policy Assessment announced in the prior week the Swiss National Bank warned that Swiss economic growth would be sluggish near-term, at least partly due to weak world growth. With local merchandise export volumes essentially flat so far this year, it may well prove right.

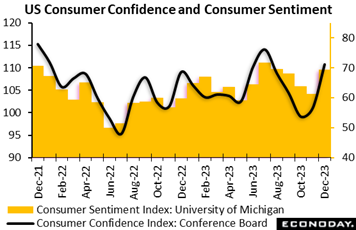

Consumer confidence in the US shot higher this month, to 110.7 which was nearly 6 points above Econoday's consensus range and confirmed a similar jump in December's consumer sentiment index. Outside of July's 114.0, this is the best level for the consumer confidence index in nearly two years. Consumer confidence in the US shot higher this month, to 110.7 which was nearly 6 points above Econoday's consensus range and confirmed a similar jump in December's consumer sentiment index. Outside of July's 114.0, this is the best level for the consumer confidence index in nearly two years.

In an indication of strength for the December employment report, the percentage of consumers describing jobs as currently "hard to get" fell 2.4 percentage points to 13.2 percent. Those describing jobs as plentiful rose 2.1 percentage points to 40.7 percent.

The outlook for the jobs market is likewise favorable as fewer see fewer jobs six months out, at 17.2 percent vs November's 20.1 percent, and more see their income rising, at 18.7 vs 17.7 percent.

Some of the income optimism is tied to the stock market where bulls have suddenly pulled well ahead of bears, at 37.4 vs 28.0 percent. Boosting bullishness are interest rate expectations, with 18.5 percent of the sample seeing rates falling over the next year versus 15.5 percent in November. Inflation indications in the report edged lower.

And in a positive signal for holiday spending, buying plans are up sharply including for major appliances as well as vehicles and also homes.

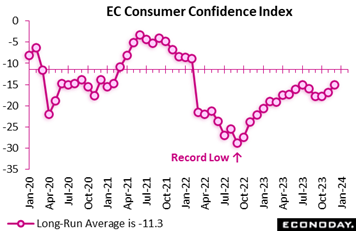

European consumer confidence continued to improve at year-end. At minus 15.1, the provisional December reading was up from November's minus 16.9, some 1.3 points above Econoday’s consensus to match its strongest result since February 2022. However, this was still well short of the minus 11.3 long-run average. European consumer confidence continued to improve at year-end. At minus 15.1, the provisional December reading was up from November's minus 16.9, some 1.3 points above Econoday’s consensus to match its strongest result since February 2022. However, this was still well short of the minus 11.3 long-run average.

December saw the first back-to-back gain in the EU Commission's gauge since June/July and offers hope that the recent trend decline in sentiment is at least beginning to flatten out. Even so with economic activity still weak prospects for a meaningful recovery in consumer spending early next year remain limited.

Global economic on net are exactly hitting consensus forecasts, producing a zero reading on the Relative Performance Index. But readings among individual economies show the usual variation with the Eurozone closing out a generally disappointing year at 23 on the index and when excluding prices (RPI-P) at minus 32 to indicate surprising weakness for both the real economy and for inflation. Having begun 2023 contemplating how high interest rates might rise, markets may soon focus on how many cuts the European Central Bank will deliver in 2024.

UK economic activity had a more balanced year versus expectations; the RPI will end 2023 at minus 7 and the RPI-P at plus 4 showing that forecasters have been in the right ball park. Speculation about monetary easing in the UK is less aggressive than across the Channel but with inflation in particular well below official and market projections, a cut in Bank Rate is just a matter of time.

In Switzerland, much of 2023 was characterized by unexpected weakness in economic activity that, however, had little impact on the Swiss National Bank which has been determined to cool inflation. More recently, the real economy has outperformed forecasts with the RPI-P at a solid 35. However, importantly, the overall RPI is just 4 and the sizeable gap between the two measures means that inflation is undershooting predictions. It will be the shortfall here that is key to interest rate expectations for 2024.

In Japan, economic shocks over the year have shown an upside bias, but, on average only modestly and not sufficiently so to force the Bank of Japan to abandon its ultra-loose monetary stance. With the RPI currently at 31 and the RPI-P at 40, economic activity is on track to close out the year rather hotter than predicted. Accordingly, subject to the coming week’s data, overall conditions are likely to be supportive of speculation that the BoJ will finally tighten in the second quarter of the new year.

At 7 and 20 respectively, the latest Chinese RPI and RPI-P flatter to deceive as the economy has underperformed for much of the year. Despite a series of sizeable fiscal packages, the central bank may yet be forced to cut again, a prospect made more likely by what should be diminishing pressure on the local currency due to monetary easing overseas.

Canada’s RPI is near zero at plus 1 but when excluding prices it falls to minus 16 indicating that inflation has been higher than expected which will not please the Bank of Canada. US readings are neutral for both, at plus 2 and plus 7 to indicate that data are unfolding as expected, yet whether this means the Federal Reserve will be cutting rates sooner than expected has yet to play out.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Laurie Laird, Mace News, Max Sato, and Theresa Sheehan

Japanese data will help fill a very light week: industrial production is expected to fall back while retail sales are expected to improve; both will be posted Thursday. Slowing is expected especially for Singapore’s CPI on Tuesday and less so for South Korea’s CPI on Friday. Industrial production for Korea will be posted on Thursday. US data will center on international trade in goods on Thursday where the deficit is expected to hold deep but steady. Estimated for Saturday are the official CFLP PMIs from China which the consensus is for marginal improvement at still flat levels.

Japanese Unemployment Rate for November (Tue 0830 JST; Mon 1830 EST; Mon 2330 GMT)

Consensus Forecast, Unemployment Rate: 2.5%

After falling 1 tenth in October on hotel, restaurant and information hiring, Japan's unemployment rate for November is expected to hold steady at 2.5 percent.

Singapore CPI for November (Tue 1300 SGT; Tue 0000 EST; Tue 0500 GMT)

Consensus Forecast, Year over Year: 3.9%

Consumer prices in November, which in October rose from 4.1 to 4.7 percent on rising transport costs, are expected to slow back to 3.9 percent.

Japanese Industrial Production for November (Thu 0850 JST; Wed 1850 EST; Wed 2350 GMT)

Consensus Forecast, Month over Month: -1.7%

Consensus Forecast, Year over Year: -2.2%

Industrial production on the month in November is expected to fall 1.7 percent following a 1.0 percent rise in October. Year-over-year, November is expected to contract 2.2 percent versus 0.9 percent expansion in October. The government maintained its assessment in the October report that industrial output is “taking one step forward and one step back”.

Japanese Retail Sales for December (Thu 0850 JST; Wed 1850 EST; Wed 2350 GMT)

Consensus Forecast, Month over Month: 0.1%

Consensus Forecast, Year over Year: 4.9%

Retail sales are expected to rise 4.9 percent on the year in December versus November growth of 4.2 percent. The government maintained its assessment in November that retail sales were “on an uptrend”.

US International Trade in Goods (Advance) for November (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Balance: -$89.6 billion

The US goods deficit (Census basis) is expected to hold steady at $89.6 billion in November after deepening by $2.7 billion in October to $89.6 billion.

Korean CPI for December (Fri 0800 KST; Thu 1800 EST; Thu 2300 GMT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 3.2%

Consumer prices in December, which in November decreased sharply to 3.3 percent from October’s 3.8 percent, are expected to move further lower to 3.2 percent.

China: CFLP PMIs for December (Sat 0930 CST; Fri 2030 EST; Sat 0130 GMT)

Manufacturing PMI, Consensus Forecast: 49.9

Non-manufacturing PMI, Consensus Forecast: 50.4

The CFLP manufacturing PMI is expected to increase to 49.9 in December from November’s 49.4 which came in 2 tenths lower than expected and 1 tenth lower than October. while the non-manufacturing PMI, which in November fell 4 tenths to 50.2 and missed the consensus by 9 tenths, is expected to increase slightly to 50.4.

|