|

Global Economics will be taking the next two weeks off. Next article will be dated January 7, 2022

They kept saying bottlenecks were only temporary and sure to pass, sure to pass. Throw out the transitory inflation doctrine as the Federal Reserve's Jerome Powell is now a proponent of the entrenched doctrine, saying at his press conference that the risk of "entrenched inflation", driven he said by rising inflation expectations, has "certainly increased". Instead of the Fed's less urgent plan to unwind emergency asset purchases by mid-June, the US central bank doubled its tapering pace to $30 billion per month which will end the scheme by mid-March,. And what about outright rate hikes in the USA? They're on the way, based on the Fed's own updated forecasts, now to start by the spring instead of the summer. And the Fed is only one of the week's sensations! The Bank of England, as it was expected to at its last meeting, made a splash of its own.

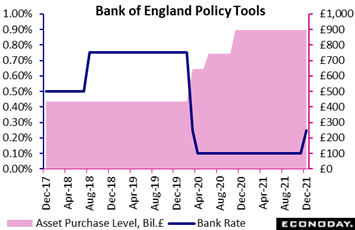

In what was probably a finely balanced decision (despite a clear majority), the BoE opted to raise Bank Rate from its record low of 0.10 percent to 0.25 percent. Previous dissenters Michael Saunders and Dave Ramsden, who wanted a 15 basis point hike in November, were joined by the rest of the Monetary Policy Committiee with the exception of Silvana Tenreyro who voted for no change. This made for an 8-1 majority in favour of the first increase in the benchmark rate since August 2018. Although the market consensus was for no change, there was no strong conviction and move came as no major surprise. In what was probably a finely balanced decision (despite a clear majority), the BoE opted to raise Bank Rate from its record low of 0.10 percent to 0.25 percent. Previous dissenters Michael Saunders and Dave Ramsden, who wanted a 15 basis point hike in November, were joined by the rest of the Monetary Policy Committiee with the exception of Silvana Tenreyro who voted for no change. This made for an 8-1 majority in favour of the first increase in the benchmark rate since August 2018. Although the market consensus was for no change, there was no strong conviction and move came as no major surprise.

As expected, QE, which has almost reached its £895 billion ceiling, will continue over the next week or so until the fund has been fully utilised. The vote here was a unanimous 9-0. With the labour market performing strongly despite the end of the government's furlough programme in September, the main hurdle to a tightening move is now out of the way. Consequently, having just seen November's inflation rate surge to fully 5.1 percent and so more than 3 percentage points above target, the MPC decided that the time is right to send a clear signal that it has not abandoned its remit. In fact, the bank now expects inflation to rise as high as 6 percent by April.

Yet the rate hike comes when the doubling time of the Omicron variant has fallen to less than two days in most of the UK, inevitably increasing the likelihood of tighter, and economically more damaging, restrictions at some point. The economic outlook is very uncertain and the bank's move is unlikely to presage a period of aggressive rate hikes. Indeed, the bank has again trimmed its fourth-quarter GDP growth forecast by 5 tenths to just 1.5 percent and now expects a poor first quarter too.

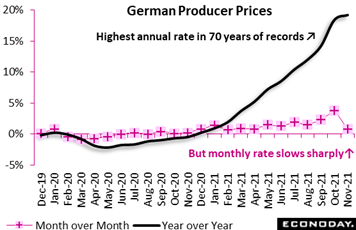

In contrast to the BoE, the European Central Bank left the immediate thurst of its policy unchanged including holding its main policy rate at dead zero. The ECB is still in the transitory camp, waiting to see if inflation can "durably" hold over its 2 percent target. And there are some points to the anti-entrenched view, centered on the recent decline in oil prices and the risk that Omicron may prove to be a demand buster. Producer prices in Germany are a fair place to look when anticipating European inflation, and the head-spinning pace may be slowing. Producer prices continued to rise in November but for once fell short of expectations. The PPI advanced 0.8 percent on the month, a highly elevated gain yet 3 full percentage points below October's surge and the smallest gain since February. The yearly rate did climb 8 tenths to 19.2 percent, its highest reading since November 1951, but the slope of this curve, as tracked in the black line of the graph, could be flattening especially given December's decline in Brent, down more than $10 so far this month. This decline together with November's PPI data do offer hope that pipeline price pressures in German manufacturing may now be easing. In contrast to the BoE, the European Central Bank left the immediate thurst of its policy unchanged including holding its main policy rate at dead zero. The ECB is still in the transitory camp, waiting to see if inflation can "durably" hold over its 2 percent target. And there are some points to the anti-entrenched view, centered on the recent decline in oil prices and the risk that Omicron may prove to be a demand buster. Producer prices in Germany are a fair place to look when anticipating European inflation, and the head-spinning pace may be slowing. Producer prices continued to rise in November but for once fell short of expectations. The PPI advanced 0.8 percent on the month, a highly elevated gain yet 3 full percentage points below October's surge and the smallest gain since February. The yearly rate did climb 8 tenths to 19.2 percent, its highest reading since November 1951, but the slope of this curve, as tracked in the black line of the graph, could be flattening especially given December's decline in Brent, down more than $10 so far this month. This decline together with November's PPI data do offer hope that pipeline price pressures in German manufacturing may now be easing.

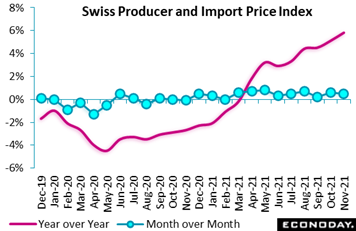

Like the ECB, the Swiss National Bank left its policy unchanged, here with a rate deeply in the negative zone at minus 0.75 percent. The SNB once again nudged its inflation forecast higher calling, however, for a still subdued 1.0 percent CPI rate in 2022. Heading into the meeting, the country's combined producer and import price index rose for a ninth month in a row, posting a 0.5 percent monthly advance in November that was higher than expected to lift the year-over-year rate from 5.1 percent to 5.8 percent, for its highest showing since 1989. Yet domestic producer prices rose only 0.2 percent on the month, raising this yearly rate from 3.1 percent to 3.4 percent. Import prices, reflecting oil, were up a much sharper 1.1 percent, putting their annual rate at 10.9 percent, up from 9.4 percent. With regard to the Swiss franc, which is a sought-after safe-haven currency the appreciation of which poses perenniel risks to Swiss exports, the bank somewhat surprisingly adhered its "highly valued" assessment rather than offering a more aggressive description such as "overvalued" as used in the past. This may indicate that the SNB has reluctantly accepted that the franc will continue to trade at stronger levels than the bank was previously prepared to tolerate. That said, the SNB did reiterate its preparedness to intervene in the foreign exchange market as necessary in order to counter upward pressure on the currency, waiting no doubt for an opportunity to catch the market significantly long the franc, and then sell the currency aggressively. Like the ECB, the Swiss National Bank left its policy unchanged, here with a rate deeply in the negative zone at minus 0.75 percent. The SNB once again nudged its inflation forecast higher calling, however, for a still subdued 1.0 percent CPI rate in 2022. Heading into the meeting, the country's combined producer and import price index rose for a ninth month in a row, posting a 0.5 percent monthly advance in November that was higher than expected to lift the year-over-year rate from 5.1 percent to 5.8 percent, for its highest showing since 1989. Yet domestic producer prices rose only 0.2 percent on the month, raising this yearly rate from 3.1 percent to 3.4 percent. Import prices, reflecting oil, were up a much sharper 1.1 percent, putting their annual rate at 10.9 percent, up from 9.4 percent. With regard to the Swiss franc, which is a sought-after safe-haven currency the appreciation of which poses perenniel risks to Swiss exports, the bank somewhat surprisingly adhered its "highly valued" assessment rather than offering a more aggressive description such as "overvalued" as used in the past. This may indicate that the SNB has reluctantly accepted that the franc will continue to trade at stronger levels than the bank was previously prepared to tolerate. That said, the SNB did reiterate its preparedness to intervene in the foreign exchange market as necessary in order to counter upward pressure on the currency, waiting no doubt for an opportunity to catch the market significantly long the franc, and then sell the currency aggressively.

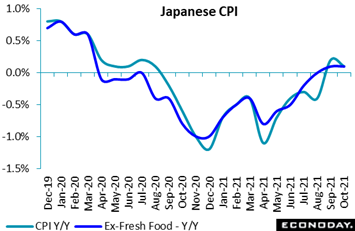

If the SNB is in a long war against currency appreciation, the Bank of Japan is in an eternal war against deflation. Japanse consumer prices will be a highlight of the coming week's calendar, data for November that will follow no improvement in October when both the overall and ex-fresh food rates declined on the month and, as shown in the graph, flattened on the year, at fractional gains of only 0.1 percent for both. November's consensus forecasts are calling for some improvement, at respective gains of plus 0.4 percent for both which, for course, for an annual rate is still paltry to underscore the continuing trouble facing the Bank of Japan. At its meeting, the bank held its rate targets and main asset purchase program unchanged, vowing to keep zero to negative interest rates "as long as necessary" to achieve its ever-elusive 2 percent inflation target. The vote wasn't unanimous as reflationist board member Goushi Kataoka, a former private-sector economist, continued to call for yet more, arguing that it was "desirable to further strengthen monetary easing by lowering short-and long-term interest rates, with a view to encouraging firms to make active business fixed investment for the post Covid-19 era." And there were some upbeat notes in the announcement, including the closing down of an emergency financing program for large firms and cautious optimism over the economic asssessment despite the risk of "amplified or prolonged" supply-chain disruptions. If the SNB is in a long war against currency appreciation, the Bank of Japan is in an eternal war against deflation. Japanse consumer prices will be a highlight of the coming week's calendar, data for November that will follow no improvement in October when both the overall and ex-fresh food rates declined on the month and, as shown in the graph, flattened on the year, at fractional gains of only 0.1 percent for both. November's consensus forecasts are calling for some improvement, at respective gains of plus 0.4 percent for both which, for course, for an annual rate is still paltry to underscore the continuing trouble facing the Bank of Japan. At its meeting, the bank held its rate targets and main asset purchase program unchanged, vowing to keep zero to negative interest rates "as long as necessary" to achieve its ever-elusive 2 percent inflation target. The vote wasn't unanimous as reflationist board member Goushi Kataoka, a former private-sector economist, continued to call for yet more, arguing that it was "desirable to further strengthen monetary easing by lowering short-and long-term interest rates, with a view to encouraging firms to make active business fixed investment for the post Covid-19 era." And there were some upbeat notes in the announcement, including the closing down of an emergency financing program for large firms and cautious optimism over the economic asssessment despite the risk of "amplified or prolonged" supply-chain disruptions.

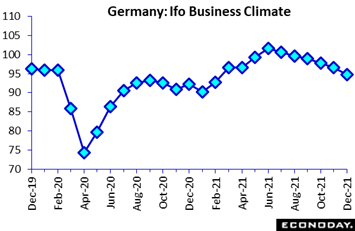

However much the BoJ wants to see the glass half full, the onset of Omicron isn't making greater optimism an easy sell. Germany's new Chancellor Olaf Scholz said in the week that "Unfortunately, many citizens have not been sure for a long time whether their future will be better. That is not good, it endangers cohesion in our society. We need more confidence again." Scholz may have been looking at the latest Ifo data when he made those comments as overall economic business sentiment deteriorated for a sixth successive month in December. The headline climate indicator dropped nearly 2 points to 94.7, short of the market consensus and its weakest print since early in the year. It now stands 1.6 points below its pre-pandemic level in February last year. December's setback once again saw declines for both current conditions and expectations. At a sector level, morale eked out a gain in manufacturing in contrast to services, trade, and construction which all posted sizable losses. Inflation risks are part of the pessimism, echoed by the new chancellor who, staking his place in the entrenched camp, said he is taking people's fear of inflation seriously and "won't be idle" if inflation doesn't ease next year. However much the BoJ wants to see the glass half full, the onset of Omicron isn't making greater optimism an easy sell. Germany's new Chancellor Olaf Scholz said in the week that "Unfortunately, many citizens have not been sure for a long time whether their future will be better. That is not good, it endangers cohesion in our society. We need more confidence again." Scholz may have been looking at the latest Ifo data when he made those comments as overall economic business sentiment deteriorated for a sixth successive month in December. The headline climate indicator dropped nearly 2 points to 94.7, short of the market consensus and its weakest print since early in the year. It now stands 1.6 points below its pre-pandemic level in February last year. December's setback once again saw declines for both current conditions and expectations. At a sector level, morale eked out a gain in manufacturing in contrast to services, trade, and construction which all posted sizable losses. Inflation risks are part of the pessimism, echoed by the new chancellor who, staking his place in the entrenched camp, said he is taking people's fear of inflation seriously and "won't be idle" if inflation doesn't ease next year.

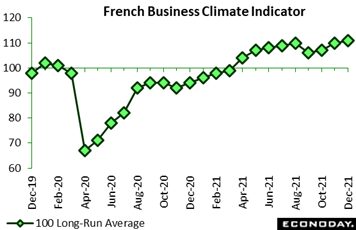

In contrast to Germany, however, French business confidence has actually improved so far this month despite rising Covid cases across much of the country and continuing supply chain problems. The country's business climate indicator rose 1 point to 111, some 3 points above the consensus and a sizeable 11 points above its long-run average. Yet December's advance was largely attributable to a sharp jump in past output which masked weakness in orders and export demand. Still, production expectations saw gains while expected selling prices hit another high. Optimitism in France's construction sector is on the rise in contrast to services and retail trade where Covid restrictions loom. In contrast to Germany, however, French business confidence has actually improved so far this month despite rising Covid cases across much of the country and continuing supply chain problems. The country's business climate indicator rose 1 point to 111, some 3 points above the consensus and a sizeable 11 points above its long-run average. Yet December's advance was largely attributable to a sharp jump in past output which masked weakness in orders and export demand. Still, production expectations saw gains while expected selling prices hit another high. Optimitism in France's construction sector is on the rise in contrast to services and retail trade where Covid restrictions loom.

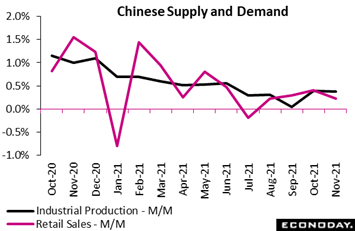

The most disappointing news in the week came once again, as it has through much of the year, from China. Growth in industrial production was flat in November, at a monthly 0.37 percent from October's 0.39 percent; this in line with previously published PMI data which were stagnant. Monthly growth in retail sales also slowed, to 0.22 percent from October's 0.40 percent in what was an especially disappointing report. Sales of home appliances and communications equipment fell in the month. Sales weakened in both rural and urban areas. Other Chinese data in the week included a sixth straight decline in house prices and also weak data on fixed asset investment that showed further slowing in property investment. The most disappointing news in the week came once again, as it has through much of the year, from China. Growth in industrial production was flat in November, at a monthly 0.37 percent from October's 0.39 percent; this in line with previously published PMI data which were stagnant. Monthly growth in retail sales also slowed, to 0.22 percent from October's 0.40 percent in what was an especially disappointing report. Sales of home appliances and communications equipment fell in the month. Sales weakened in both rural and urban areas. Other Chinese data in the week included a sixth straight decline in house prices and also weak data on fixed asset investment that showed further slowing in property investment.

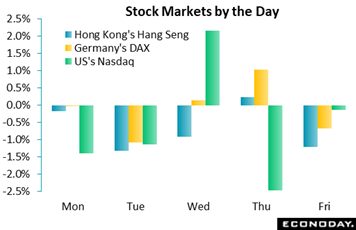

Hong Kong's Hang Seng fell 3.3 percent on the week and 1.3 percent in Tuesday's session amid falling property stocks and intensifying liquidity concerns at Shimao, considered one the stronger Chinese developers. Tech stocks in China were also pressured after government authorities fined social media giant Weibo and signaled a further tightening of control over the internet. Energy stocks were pressured in the week by the International Energy Agency which, citing rising Covid cases, lowered its global projections for oil demand. And Germany's DAX, down 0.6 percent, didn't get any help from the Ifo Institut whose monthly confidence data came in weak and after it downgraded its growth forecast for Germany citing expected supply disruptions flowing from the next wave of coronavirus infections,. Thursday saw a 2.5 percent sell-off for the Nasdaq after US software giant Adobe issued gloomy guidance. Reaction to the week's central bank announcements, where surprises were few, was limited. Hong Kong's Hang Seng fell 3.3 percent on the week and 1.3 percent in Tuesday's session amid falling property stocks and intensifying liquidity concerns at Shimao, considered one the stronger Chinese developers. Tech stocks in China were also pressured after government authorities fined social media giant Weibo and signaled a further tightening of control over the internet. Energy stocks were pressured in the week by the International Energy Agency which, citing rising Covid cases, lowered its global projections for oil demand. And Germany's DAX, down 0.6 percent, didn't get any help from the Ifo Institut whose monthly confidence data came in weak and after it downgraded its growth forecast for Germany citing expected supply disruptions flowing from the next wave of coronavirus infections,. Thursday saw a 2.5 percent sell-off for the Nasdaq after US software giant Adobe issued gloomy guidance. Reaction to the week's central bank announcements, where surprises were few, was limited.

Swap a pen for a pencil and ink in those rate hikes for Canada which, at plus 39, leads Econoday's consensus divergence scores, benefitting in the latest week from a jump in housing starts and a strong merchandise trade report that saw a surge in vehicle exports. France, getting a lift from conifdence data, is at plus 14 with Italy, where the week's price and trade data came in on the soft side, at plus11. This is down sharply from earlier levels but still in positive ground to extend a run for Italy that goes all the way back to July. The UK, helped by another month of surprising strength in retail sales, is at plus 5 with the US at minus 5. Readings within the plus-10 to minus-10 corridor are consistent with as-expected results, with the Eurozone at minus 7 and Switzerland at minus 8 also in this group. Not in this group are Germany which, at minus 22, has been missing estimates all month and China which is back in the dumps at minus 53.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Sentiment readings headline the coming week with declines mostly expected, no surprise given unfolding Covid risks not to mention the withdrawal of monetary stimulus by the Federal Reserve and Bank of England. GfK's consumer climate report will be posted Tuesday as will the Eurozone's consumer confidence flash followed on Wednesday by the US consumer confidence index (this latter report has been moved up from the prior week). Business and consumer confidence in Italy will be posted Thursday. Inflation data will open on Thursday with the PCE price indexes (part of the US personal income and outlays report) where no slowing is expected. And outright gains, though limited, are expected for Japanese consumer prices on Friday. Canada will post retail sales on Tuesday and monthly GDP on Thursday with US data to also include durable goods orders, jobless claims, and new home sales all on Thursday. Expectations for the US data are upbeat. US and UK GDP reports on Wednesday will be revisions.

Germany: GfK Consumer Climate for January (Tue 07:00 GMT; Tue 08:00 CET; Tue 02:00 EST)

Consensus Forecast: -2.5

GfK's index for the January outlook, which in December fell more sharply than expected to minus 1.6, is expected to fall further to minus 2.5.

Canadian Retail Sales for October (Tue 13:30 GMT; Tue 08:30 EST)

Consensus Forecast, Month over Month: 1.0%

Following September's 0.6 percent decline, which was much less weak than expected, a monthly rebound of 1.0 percent is the call for October.

Eurozone: EC Consumer Confidence Flash for December (Tue 15:00 GMT; Tue 16:00 CET; Tue 10:00 EST)

Consensus Forecast: -8.0

Consumer confidence has fallen the last two reports and surprisingly steeply in November, down 2.0 points to minus 6.8. Given unfolding Covid effects, a further decline to minus 8.0 is the consensus for December.

US Consumer Confidence Index for December (Wed 15:00 GMT; Wed 10:00 EST)

Consensus Forecast: 110.7

Confidence confidence in November fell back a couple of points to an even more depressed 109.5. December's expectations are 110.7.

Italian Business and Consumer Confidence for December (Thu 09:00 GMT; Thu 10:00 CET; Thu 04:00 EST)

Consensus Forecast, Manufacturing Confidence: 115.0

Consensus Forecast, Consumer Confidence: 116.0

Manufacturing confidence is expected to slip to 115.0, versus 116.0 in November, with consumer confidence expected to decline to 116.0 from 117.5.

US Durable Goods Orders for November (Thu 13:30 GMT; Thu 08:30 EST)

Consensus Forecast: Month over Month: 1.5%

Consensus Forecast: Ex-Transportation - M/M: 0.6%

Consensus Forecast: Core Capital Goods Orders - M/M: 0.5%

Durable goods orders have been falling overall but rising when excluding transportation equipment. And orders for core capital goods have been especially solid. Forecasters see a headline rebound of 1.5 percent in November with ex-transportation orders up 0.6 percent and capital goods up 0.5 percent.

US Initial Jobless Claims for the December 18 week (Thu 13:30 GMT; Thu 08:30 EST)

Consensus Forecast: 205,000

Jobless claims for the December 18 week (also the sample week for the monthly employment report) are expected to come in at 205,000 versus 206,000 in the prior week and 270,000 for the sample week for the November employment report.

US Personal Income for November (Thu 13:30 GMT; Thu 08:30 EST)

Consensus Forecast, Month over Month: 0.5%

US Consumption Expenditures

Consensus Forecast, Month over Month: 0.6%

US PCE Price Index

Consensus Forecast, Month over Month: 0.6%

Consensus Forecast, Year over Year: 5.7%

US Core PCE Price Index

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 4.5%

Personal income is expected to rise 0.5 percent in November with personal consumption expenditures, which jumped 1.3 percent in October, expected to rise another 0.6 percent. Inflation readings are not expected to slow, holding at outsized monthly gains of 0.6 percent overall and 0.4 percent for the core (matching October's respective rates) for annual rates of 5.7 and 4.5 percent (versus 5.0 and 4.1 percent in October).

Canadian GDP for October (Thu 13:30 GMT; Thu 08:30 EST)

Consensus Forecast, Month over Month: 0.8%

GDP for October is expected to climb 0.8 percent on the month versus a 0.1 percent rise in September.

US New Home Sales for November (Thu 15:00 GMT; Thu 10:00 EST)

Consensus Forecast, Annual Rate: 770,000

Monthly volatility aside, sales of new homes have been trending higher. Econoday's consensus for November is an annual rate of 770,000 which would compare with an 745,000 rate in October.

Japanese Consumer Price Index for November (Thu 23:30 GMT; Fri 08:30 JST; Thu 18:30 EST)

Consensus Forecast, Year over Year: 0.4%

Consensus Forecast, Ex-Fresh Food - Y/Y: 0.4%

Unlike other major economies, a spike in producer prices has not filtered through to consumer inflation in Japan though some gain is expected for November. Consumer prices are expected to post an annual rate of plus 0.4 percent versus plus 0.1 percent in October. Excluding fresh food the annual rate is also seen at plus 0.4 percent, also versus 0.1 percent.

|