|

The economic outlook is shifting higher as back-to-back strength in employment reports punctuates what is a run of strengthening indications. These indications start where they are best placed -- in the American consumer who's benefiting from high rates of employment and is on a spending spree to prove it.

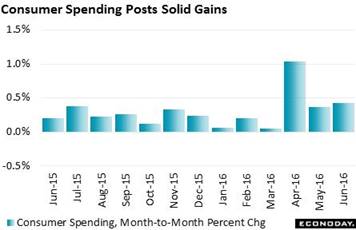

Before turning to July's employment report, let's first look at data released earlier in the week. The spending side of the personal income & spending report has been solid the last three months. As seen on the accompanying graph, spending surged more than 1 percent in April which was also, by the way, a very good month for vehicle sales and which really stands out as the first indication of the economic strength that would follow. But even the May and June gains, at a bit below 1/2 percent each, are also comparatively strong. And the first definitive spending indication for July -- unit vehicle sales -- is very positive, surging more than 7 percent to a 17.9 million annualized rate which is the best since November last year. Nothing can be more potent for the U.S. economy than a consumer who is spending. Before turning to July's employment report, let's first look at data released earlier in the week. The spending side of the personal income & spending report has been solid the last three months. As seen on the accompanying graph, spending surged more than 1 percent in April which was also, by the way, a very good month for vehicle sales and which really stands out as the first indication of the economic strength that would follow. But even the May and June gains, at a bit below 1/2 percent each, are also comparatively strong. And the first definitive spending indication for July -- unit vehicle sales -- is very positive, surging more than 7 percent to a 17.9 million annualized rate which is the best since November last year. Nothing can be more potent for the U.S. economy than a consumer who is spending.

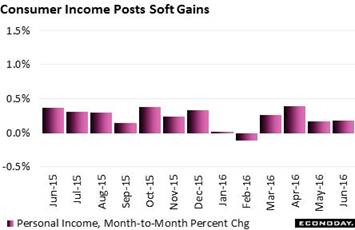

But the personal income side of the report is less spectacular, inching only 0.2 percent higher in both June and May and which does not compare favorably to trend. Yes, employment is high but income isn't, which says that consumers must be funding their purchases with debt or savings. Consumer credit, driven by vehicle financing, has been on the climb though growth in credit-card debt has been uneven and limited. The consumer has, however, been definitely drawing on savings as the savings rate has come down from 6 percent early in the year to 5.3 percent in June. Improved wages, not tapping savings, is the best source for future spending strength and, for you optimists, the July jobs report does offer a hint or two of that.

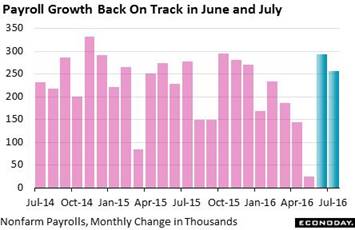

The July employment report stands out in its decisive strength. Payroll growth was expected to fall back sharply from June's surge but it didn't, at least not by much. Nonfarm payroll growth in July came in at 255,000 which is only slightly lower than June's upward revised 292,000, one of the best showings of the cycle. Also for once there is actual evidence of wage traction. Average hourly earnings rose 0.3 percent with year-on-year growth on the rise at 2.6 percent. And the first rise since January in the workweek, up 1 tenth to 34.5 hours, points to further hiring ahead and further wage traction as well. The July employment report stands out in its decisive strength. Payroll growth was expected to fall back sharply from June's surge but it didn't, at least not by much. Nonfarm payroll growth in July came in at 255,000 which is only slightly lower than June's upward revised 292,000, one of the best showings of the cycle. Also for once there is actual evidence of wage traction. Average hourly earnings rose 0.3 percent with year-on-year growth on the rise at 2.6 percent. And the first rise since January in the workweek, up 1 tenth to 34.5 hours, points to further hiring ahead and further wage traction as well.

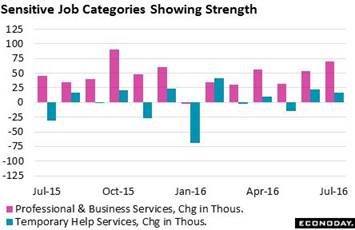

Highlights among highlights of the report are strength in two readings that are especially sensitive to change. Professional & business services, and within this temporary help, have been coming on strong and posting some of their best results over the past year, at more than 50,000 per month for the former and not quite 25,000 for the latter. These gains not only reflect rising demand for labor but are also likely to turn into permanent staff additions in the months ahead. Highlights among highlights of the report are strength in two readings that are especially sensitive to change. Professional & business services, and within this temporary help, have been coming on strong and posting some of their best results over the past year, at more than 50,000 per month for the former and not quite 25,000 for the latter. These gains not only reflect rising demand for labor but are also likely to turn into permanent staff additions in the months ahead.

The domestic side is the strength of the U.S. economy, an economy that otherwise isn't getting much help from foreign demand. Weak foreign demand is felt most in the nation's factory sector where the downward tilt for exports, along of course with weakness in the oil sector, have been keeping growth rates flat the past two years. Recent news has been no better than mixed with some readings good one month then bad the next, up-and-down patterns typical of less-than-robust conditions. Likewise in conflict are the week's two key sets of factory data -- factory orders and the ISM new orders index. Factory orders, which are actual data from a large sample, have been very weak, down more than 1 percent the last two reports which are for June and May. In contrast the ISM's new orders index, which is based on subjective assessments from a small sample, has been on a tear, holding at the 57 line through July to indicate substantial monthly growth. Exactly how substantial growth, however, is open to question. According to the report, the 50 line should in theory be the break between monthly growth and monthly contraction. But the government says no! At least not in this particular case where the breakeven line, due to the ISM's generally high order readings, is actually nearer to 52. Note that in the graph the zero line for factory orders is lined up with the 52 line which matches things up nicely. And judging by the mismatched message of the graph, the government may soon be moving the breakeven line even higher. The domestic side is the strength of the U.S. economy, an economy that otherwise isn't getting much help from foreign demand. Weak foreign demand is felt most in the nation's factory sector where the downward tilt for exports, along of course with weakness in the oil sector, have been keeping growth rates flat the past two years. Recent news has been no better than mixed with some readings good one month then bad the next, up-and-down patterns typical of less-than-robust conditions. Likewise in conflict are the week's two key sets of factory data -- factory orders and the ISM new orders index. Factory orders, which are actual data from a large sample, have been very weak, down more than 1 percent the last two reports which are for June and May. In contrast the ISM's new orders index, which is based on subjective assessments from a small sample, has been on a tear, holding at the 57 line through July to indicate substantial monthly growth. Exactly how substantial growth, however, is open to question. According to the report, the 50 line should in theory be the break between monthly growth and monthly contraction. But the government says no! At least not in this particular case where the breakeven line, due to the ISM's generally high order readings, is actually nearer to 52. Note that in the graph the zero line for factory orders is lined up with the 52 line which matches things up nicely. And judging by the mismatched message of the graph, the government may soon be moving the breakeven line even higher.

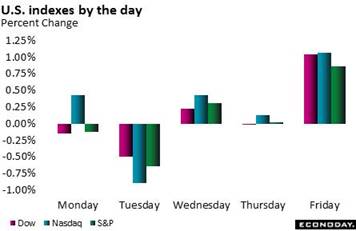

Hawkish news has been the theme the last two weeks, first with the FOMC and their upgrade for the economy and then of course with the July employment report. But the reaction in the markets has been limited. Stocks are roughly where they were before the July FOMC while Treasury yields, which typically go up when the economy heats up, are only slightly higher. Yes foreign markets are slow, yes Brexit is a potential shock, and yes foreign central banks are doing everything they can to lower rates, but that's not the setup for the Fed where, due to domestic strength, a rate hike may now be approaching. And if the August employment report proves as strong as July and June, the questions for the bond market will be how high will yields rise and how fast? The 2-year yield did rise in the latest week but only by 5 basis points to what is still a very low 0.73 percent. The 10-year yield also rose but not dramatically, 11 basis points higher to 1.59 percent. Given all the strong news, yields perhaps really haven't moved much at all. Hawkish news has been the theme the last two weeks, first with the FOMC and their upgrade for the economy and then of course with the July employment report. But the reaction in the markets has been limited. Stocks are roughly where they were before the July FOMC while Treasury yields, which typically go up when the economy heats up, are only slightly higher. Yes foreign markets are slow, yes Brexit is a potential shock, and yes foreign central banks are doing everything they can to lower rates, but that's not the setup for the Fed where, due to domestic strength, a rate hike may now be approaching. And if the August employment report proves as strong as July and June, the questions for the bond market will be how high will yields rise and how fast? The 2-year yield did rise in the latest week but only by 5 basis points to what is still a very low 0.73 percent. The 10-year yield also rose but not dramatically, 11 basis points higher to 1.59 percent. Given all the strong news, yields perhaps really haven't moved much at all.

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2015 |

29-Jul-16 |

5-Aug-16 |

Change |

Change |

| DJIA |

17,425.03 |

18,432.24 |

18,543.53 |

6.4% |

0.6% |

| S&P 500 |

2,043.94 |

2,173.60 |

2,182.87 |

6.8% |

0.4% |

| Nasdaq Composite |

5,007.41 |

5,162.13 |

5,221.12 |

4.3% |

1.1% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$37.40 |

$41.46 |

$41.96 |

12.2% |

1.2% |

| Gold (COMEX) ($/ounce) |

$1,060.00 |

$1,359.40 |

$1,343.20 |

26.7% |

-1.2% |

|

|

|

|

|

|

| Fed Funds Target |

0.25 to 0.50% |

0.25 to 0.50% |

0.25 to 0.50% |

0 bp |

0 bp |

| 2-Year Treasury Yield |

1.05% |

0.68% |

0.73% |

–32 bp |

5 bp |

| 10-Year Treasury Yield |

2.27% |

1.48% |

1.59% |

–68 bp |

11 bp |

| Dollar Index |

98.84 |

95.59 |

96.17 |

-2.7% |

0.6% |

Thanks to the strong jobs market, the consumer has been throwing down some serious spending numbers and, given payroll gains not to mention vehicle sales, more strength should be expected for July. Retail sales, which will be released earlier than usual this month on Friday, August 12, is the next big report to watch and if it shows the outsized strength that unit vehicle sales did, a September FOMC rate hike could suddenly become the consensus expectation.

The consumer has been the strength of this year's economy and strength is what's expected for July retail sales which will wind up the week. Jobs data will be an early theme including the Fed's experimental index on Monday and JOLTS job openings data on Wednesday. Thursday and Friday will see inflation updates from two reports that, in contrast to consumer prices, have in fact been showing pressure: import & export prices and producer prices. Then on Friday, retail sales are expected to show a solid vehicle-driven gain of 0.4 percent in July and respectable core strength (ex-auto ex-gas) of 0.3 percent. Sharper gains for retail sales could boost the odds of a September FOMC rate hike.

Small Business Optimism Index for July

Consensus Forecast: 94.5

Consensus Range: 93.2 to 96.0

The small business optimism index isn't expected to show any initial impact from Brexit with forecasters calling for no change at a consensus 94.5. If there is weakness, economic expectations is a possible component at risk as are expansion plans. Job readings have been mostly positive in this report.

Non-Farm Productivity, 1st Estimate, Second Quarter

Consensus Forecast, Annualized Rate: +0.5%

Consensus Range: +0.2% to +1.0%

Unit Labor Costs

Consensus Forecast, Annualized Rate: +1.8%

Consensus Range: +1.2% to +3.3%

First estimate for second-quarter non-farm productivity is expected to improve from a very weak first quarter with the consensus pointing at a plus 0.5 percent annualized rate and benefitting from a slightly higher but still weak rate of output. An improvement in output would hold down unit labor costs which are forecast to rise 1.8 percent, far lower than the 4.5 percent and 5.4 percent surges of the prior two quarters.

Wholesale Inventories for June

Consensus Forecast, Month-to-Month Change: +0.0%

Consensus Range: -0.2% to +0.3%

Wholesale inventories are expected to come in unchanged in June, in line with the advance report on wholesale inventories which made its data debut late last month. Wholesalers have been careful to keep their inventory growth at or under their sales growth.

Initial Jobless Claims for August 6 week

Consensus Forecast: 265,000

Consensus Range: 258,000 to 270,000

Initial jobless claims rose during the last half of July but not by much, pointing to a low rate of layoffs and strength for the economy. Initial claims are expected to inch back lower in the July 30 week, down 4,000 to 265,000 after rising a combined 17,000 in the prior two weeks. Seasonal layoffs tied to auto retooling are always a wildcard for weekly claims at this time of year though this year's effect, so far, has been limited.

Import Prices for July

Consensus Forecast for Import Prices, Month-to-Month Change: -0.4%

Consensus Range: -0.7% to +0.1%

Import prices are expected to fall back in July as petroleum prices eased, down a consensus 0.4 percent. Outside of petroleum, import prices have shown only isolated pressure this year and no pressure yet on finished goods prices.

Retail Sales for July

Consensus Forecast: +0.4%

Consensus Range: +0.2% to +0.7%

Retail Sales Ex-Autos

Consensus Forecast: +0.2%

Consensus Range: -0.1% to +0.5%

Retail Sales Ex-Autos Ex-Gas

Consensus Forecast: +0.3%

Consensus Range: +0.1% to +0.5%

Unit vehicle sales proved very strong in July and are the backbone for an expected 0.4 percent rise in retail sales. When excluding autos, retail sales are expected to post a less impressive 0.2 percent rise. But gasoline sales, pulled down by a drop in prices, will prove an outsized negative in report. When excluding both autos & gas, retail sales are expected to rise a solid 0.3 percent. This latter reading proved very strong during the spring.

PPI-FD for June

Consensus Forecast, Month-to-Month Change: +0.1%

Consensus Range: -0.1% to +0.4%

PPI-FD Less Food & Energy

Consensus Forecast: +0.2%

Consensus Range: 0.0% to +0.3%

Producer prices have shown unexpected strength the last two reports driven mostly by energy but also by services. Forecasters see the July's headline, held down by energy, rising only 0.1 percent but at a more constructive 0.2 percent when excluding food & energy. Continued strength in this report would point to eventual pass through to consumer prices where pressures have so far been hard to find.

Business Inventories for June

Consensus Forecast, Month-to-Month Change: +0.1%

Consensus Range: +0.1% to +0.3%

Despite the slow economic pace, business inventories have been kept in check by tight management. And forecasters see no tangible rise in June, at a consensus plus 0.1 percent.

Consumer Sentiment Index, August Flash

Consensus Forecast: 91.0

Consensus Range: 90.5 to 93.0

Consumer sentiment fell a moderate but noticeable 3.5 points in June to 90.0 with weakness centered in expectations, that is the outlook for the economy and the jobs market. This is a possible Brexit effect which forecasters see reversing slightly in the flash August report where the consensus is calling for a 1 point gain to 91.0. July's downtick aside, consumer confidence backed up by solid consumer spending have been the central strength of the U.S. economy.

|