|

The headline number for October payrolls surprised on the upside. There was improvement in the jobs report but more is needed. And there were soft spots as well.

Hurricane Sandy shortened the week substantially, shutting down major exchanges on Monday and Tuesday. Wall Street had not been shut down two days in a row for weather-related reasons since 1888. Equities ended the week mixed. Hurricane Sandy shortened the week substantially, shutting down major exchanges on Monday and Tuesday. Wall Street had not been shut down two days in a row for weather-related reasons since 1888. Equities ended the week mixed.

On Wednesday, economic news was light and stocks were mixed. Two positives on the earnings front were GM and Ford with earnings beating expectations (although Ford had released Tuesday with markets closed). On the downside was Apple which declined on news of a management reshuffle.

Solid gains were seen Thursday on mostly positive economic news, including a dip in initial jobless claims, a boost in construction outlays, a jump in ADP employment, and a rise in consumer confidence. The week’s gains were pared notably on Friday despite the payroll jobs gain for October well topping expectations. After initially seeing lift from the employment report, traders decided that there were weak spots in the report and that the labor market is still sluggish. Others still saw the report as strong but anticipated an earlier reversal of Fed ease, also leading to downward pressure on stocks. Traders also headed to the sidelines ahead of the U.S. presidential election. Solid gains were seen Thursday on mostly positive economic news, including a dip in initial jobless claims, a boost in construction outlays, a jump in ADP employment, and a rise in consumer confidence. The week’s gains were pared notably on Friday despite the payroll jobs gain for October well topping expectations. After initially seeing lift from the employment report, traders decided that there were weak spots in the report and that the labor market is still sluggish. Others still saw the report as strong but anticipated an earlier reversal of Fed ease, also leading to downward pressure on stocks. Traders also headed to the sidelines ahead of the U.S. presidential election.

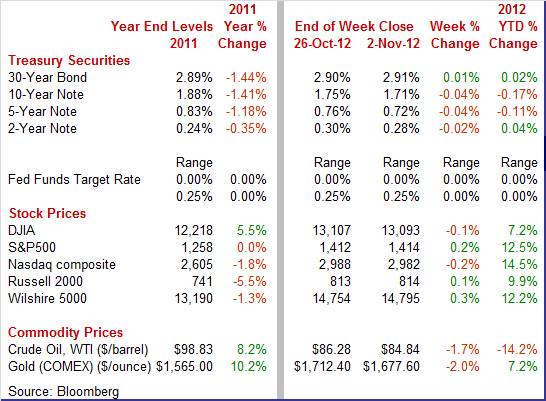

Equities were mixed this past week. The Dow was down 0.1 percent; the S&P 500, up 0.2 percent; the Nasdaq, down 0.2 percent; the Russell 2000, up 0.1 percent; and the Wilshire 5000, up 0.3 percent.

Equities were down in the month of October. The Dow was down 2.5 percent; the S&P 500, down 2.0percent; the Nasdaq, down 4.5 percent; the Russell 2000, down 2.2 percent; and the Wilshire 5000, down 1.8 percent.

For the year-to-date, major indexes are up as follows: the Dow, up 7.2 percent; the S&P 500, up 12.5 percent; the Nasdaq, up 14.5 percent; the Russell 2000, up 9.9 percent; and the Wilshire 5000, up 12.2 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Bond traders also saw a shortened week. Due to Hurricane Sandy, trading on Monday stopped at midday and left most rates down slightly despite strong numbers on spending in the personal income report released that morning. Yields eased on concern that Greece will have to restructure its debt. Treasury markets were closed Tuesday. Bond traders also saw a shortened week. Due to Hurricane Sandy, trading on Monday stopped at midday and left most rates down slightly despite strong numbers on spending in the personal income report released that morning. Yields eased on concern that Greece will have to restructure its debt. Treasury markets were closed Tuesday.

On reopening Wednesday, rates dipped slightly with little economic news. Also, demand for Treasuries was up somewhat on month-end needs and on worries that Hurricane Sandy would cut into economic growth.

Treasury rates firmed modestly Thursday on a spate of moderately strong economic indicators. Friday saw little change despite a stronger-than-expected payroll employment number as traders decided that there also were signs of weakness in the jobs report.

For this past week Treasury rates mostly were down as follows: 3-month T-bill, down 2 basis points; the 2-year note, down 2 basis points; the 5-year note, down 4 basis points; the 7-year note, down 4 basis points; and the 10-year note, down 4 basis points. The 30-year bond edged up 1 basis point.

The price of crude ended the week down modestly. Although floor trading at the NYMEX was suspended Monday and Tuesday, electronic trading continued all week. At the first of the week, West Texas Intermediate declined somewhat under a dollar a barrel as East Coast refineries cut operations on the approach of Hurricane Sandy, reducing demand temporarily. After little change Tuesday, prices firmed Wednesday on belief that refinery production would soon return to normal after Hurricane Sandy. The price of crude ended the week down modestly. Although floor trading at the NYMEX was suspended Monday and Tuesday, electronic trading continued all week. At the first of the week, West Texas Intermediate declined somewhat under a dollar a barrel as East Coast refineries cut operations on the approach of Hurricane Sandy, reducing demand temporarily. After little change Tuesday, prices firmed Wednesday on belief that refinery production would soon return to normal after Hurricane Sandy.

Strong economic news and an unexpected drop in inventories lifted crude by about a dollar on Thursday. However, on Friday crude fell more than $2, following equities down and on a jump in the dollar. Also, sentiment changed on how quickly refineries on the East Coast would return to normal as the return was seen as taking longer.

Net for the week, the spot price for West Texas Intermediate dropped $1.44 per barrel to settle at $84.84.

Economic news was moderately positive for the consumer and housing. Manufacturing, however, is struggling.

The labor market appears to be improving modestly and somewhat more than expected. Payroll jobs growth topped expectations for October. However, the unemployment rate edged up one tenth in October to 7.9 percent after dropping to 7.8 percent the prior month from 8.1 percent in August. The labor market appears to be improving modestly and somewhat more than expected. Payroll jobs growth topped expectations for October. However, the unemployment rate edged up one tenth in October to 7.9 percent after dropping to 7.8 percent the prior month from 8.1 percent in August.

Payroll jobs in October increased 171,000, following a gain of 148,000 in September (originally up 114,000) and a boost of 192,000 in August (previous estimate of 142,000). The net revisions for August and September were up 84,000. Analysts projected a 125,000 rise for October. Payroll jobs in October increased 171,000, following a gain of 148,000 in September (originally up 114,000) and a boost of 192,000 in August (previous estimate of 142,000). The net revisions for August and September were up 84,000. Analysts projected a 125,000 rise for October.

Private payrolls increased 184,000 in October after gaining 128,000 the month before.

Payroll gains were widespread in the private sector. Gains mostly accelerated but mildly. Private service-providing jobs rose 163,000 in October after a 141,000 boost in September. For October, notable gains were in professional & business services (up 51,000), health care (up 31,000), and retail trade (up 36,000).

Apparently, there is some optimism held by managers within manufacturing and construction with increased hiring. The goods-producing sector rebounded with a 21,000 increase in October after a 13,000 decline the prior month. In October, manufacturing jobs gained 13,000, construction increased 17,000, and mining fell 9,000.

Government jobs shrank 13,000 in October after a 20,000 advance in September.

Wage inflation has been a little volatile in recent months but still on a slowing trend. Average hourly earnings were flat in October, following a 0.3 percent jump the month before. Unfortunately, the year-ago pace has been trending downward for wages, posting at 1.6 percent in October. The average workweek was unchanged at 34.4 hours in October.

Turning to the household survey, the rise in the unemployment rate reflected a jump in the labor force of 578,000 while household employment rose 410,000. The number of unemployed rebounded 170,000.

Looking ahead, the manufacturing component of industrial production may be sluggish in October as aggregate production hours for manufacturing edged up only 0.1 percent. Also, the private wages & salaries component in personal income may be soft as aggregate private earnings rose a modest 0.1 percent.

On a special note, Hurricane Sandy had no discernible effect on October numbers, according to the BLS. Household data had already been collected and establishment collection rates were within normal ranges.

With upward revisions, the latest employment report is mostly an improvement compared to spring of the year. Still, unemployment is high and job growth needs to pick up in order to bring unemployment down. And income growth is sluggish. However, net, the report appears to be an improvement.

The consumer sector made gains on the income and spending sides in September. But strong headline inflation undermined the real impact. Personal income in September advanced 0.4 percent, following a 0.1 percent increase the prior month. The wages & salaries component gained 0.3 percent, following a boost of 0.1 percent in August. The consumer sector made gains on the income and spending sides in September. But strong headline inflation undermined the real impact. Personal income in September advanced 0.4 percent, following a 0.1 percent increase the prior month. The wages & salaries component gained 0.3 percent, following a boost of 0.1 percent in August.

Consumer spending was strong with a 0.8 percent increase in September, following a 0.5 percent rise in August. The good news is that auto sales lifted spending but the bad news is that so did higher gasoline prices. Consumer spending was strong with a 0.8 percent increase in September, following a 0.5 percent rise in August. The good news is that auto sales lifted spending but the bad news is that so did higher gasoline prices.

By components for spending, durables jumped 1.5 percent after a 1.6 percent rise the prior month. Again on higher gasoline prices, nondurables increased 1.7 percent, equaling the August rate. Services improved to a 0.4 percent boost a flat August.

Turning to inflation, the headline PCE price index jumped another 0.4 percent in September, matching the August rate. The core rate rose a softer 0.1 percent, the same as the month before.

Year-on-year, headline prices were up 1.7 percent in September versus 1.5 percent in August. The core was up 1.7 percent in September, compared to 1.6 percent the prior month. The latest year-ago numbers are below the Fed’s inflation goal of 2.0 percent.

Nonetheless, the latest monthly inflation numbers left real disposable income at no change in September, following a 0.3 percent drop the month before. Real spending gained 0.4 percent after a 0.1 percent rise in August. Nonetheless, the latest monthly inflation numbers left real disposable income at no change in September, following a 0.3 percent drop the month before. Real spending gained 0.4 percent after a 0.1 percent rise in August.

While real income was flat for the month of September, the encouraging news is that real spending is up. And crude oil prices have since come down. In real terms, the report is mixed but suggests that the consumer sector is making modest progress, taking into account the recent decline in oil prices, the recent dip in initial jobless claims, and improved pace of job gains.

As Hurricane Sandy approached the U.S. East Coast, consumers in the East decided to spend more time prepping for the impact than shopping for a new car. And recovery mode slowed sales for which the monthly period goes all the way out to October 31. The month's annual sales rate came in at 14.29 million which was a sharp 4.4 percent lower than September's and which points to weakness in the motor vehicle component of the monthly retail sales report. Weakness in the month was evenly split between cars and trucks and domestic-made and foreign-made. As Hurricane Sandy approached the U.S. East Coast, consumers in the East decided to spend more time prepping for the impact than shopping for a new car. And recovery mode slowed sales for which the monthly period goes all the way out to October 31. The month's annual sales rate came in at 14.29 million which was a sharp 4.4 percent lower than September's and which points to weakness in the motor vehicle component of the monthly retail sales report. Weakness in the month was evenly split between cars and trucks and domestic-made and foreign-made.

The consumer is slowly growing cautiously more upbeat about the economy. October consumer confidence improved in October to a reading of 72.2, up from 68.4 in September. The present situation index increased to 56.2 from 48.7 while expectations climbed to 82.9 from 81.5 last month. Consumer confidence is now at its highest level this year. The consumer is slowly growing cautiously more upbeat about the economy. October consumer confidence improved in October to a reading of 72.2, up from 68.4 in September. The present situation index increased to 56.2 from 48.7 while expectations climbed to 82.9 from 81.5 last month. Consumer confidence is now at its highest level this year.

Consumers were considerably more positive in their assessment of current conditions, with job market improvements as the major driver. Consumers were modestly more upbeat about their financial situation and the short term economic outlook. Consumers' assessment of current conditions improved in the month. Consumers' were more positive about the labor market as well with those stating that jobs are plentiful increasing and those claiming jobs are hard to get decreasing.

Consumers were generally more optimistic about the short-term outlook in October. Those anticipating an improvement in business conditions over the next six months increased but so did those expecting business conditions to worsen. Consumers' outlook for the labor market was also mixed. Those anticipating more jobs in the months ahead increased as did those expecting fewer jobs.

Home prices continue to improve. The Case-Shiller seasonally adjusted home price index for the 20-city composite advanced 0.5 percent in August, following a 0.3 percent gain the prior month. Home prices continue to improve. The Case-Shiller seasonally adjusted home price index for the 20-city composite advanced 0.5 percent in August, following a 0.3 percent gain the prior month.

On an unadjusted basis, the 20-city composite increased a monthly 0.9 percent, following a 1.6 percent boost in July.

On a year-ago basis, the 20-city index is up 2.0 percent, following 1.2 percent in August, NSA.

By city, the strongest monthly gain was seen in Detroit with a 2.3 percent boost. Seattle saw a 0.1 percent dip. On a year-ago basis, Phoenix is up 18.8 percent while Atlanta is down 6.1 percent.

But overall, housing is continuing to heal, albeit gradually. Continued gains in home prices may be considered by some vindication of Fed policy.

While manufacturing remains sluggish, construction made a comeback. Construction spending rebounded 0.6 percent in September, following a decline of 0.1 percent the prior month. While manufacturing remains sluggish, construction made a comeback. Construction spending rebounded 0.6 percent in September, following a decline of 0.1 percent the prior month.

The boost in September was led by a 2.8 percent increase in private residential outlays after a 1.2 percent fall the month before. For the latest month, the new 1-family subcomponent jumped 3.9 percent while the new multifamily component gained 1.3 percent. But over the past year, the new multifamily component has led the way with a 48.9 percent surge (but from low baseline) while the new 1-family component is up 25.7 percent.

For the current month, private nonresidential spending slipped 0.1 percent while public outlays decreased 0.8 percent.

On a year-ago basis, overall construction was up 7.8 percent in September, compared to 7.6 percent the month before.

The construction sector continues to improve but largely in housing with the single-family component perhaps joining the multifamily component with notable strength.

Manufacturing showed mild improvement in October, according to ISM, but remained soft. The ISM manufacturing index rose two-tenths on the month to 51.7. Manufacturing showed mild improvement in October, according to ISM, but remained soft. The ISM manufacturing index rose two-tenths on the month to 51.7.

Importantly, forward momentum may be picking up as the new orders index rose to 54.2 from 52.3 in September. Production also improved, moving into positive territory at 52.4 from 49.5 in September.

Weakness was in employment, down to 52.1 from 54.7; supplier deliveries, slipping to 49.6 from 50.3; inventories, edging down 50.0 from 50.5; and backlog orders, declining to 41.5 from 44.0. Orders continue to be held back by exports which fell further into negative territory to 48.0 from 48.5 in September.

Overall, the latest ISM report was a clear improvement from some recent regional surveys but the sector is still soft.

October Markit PMI index slipped to a final reading of 51.0 from 51.1 in October. The final reading was also slightly weaker than the flash estimate of 51.3. Although growing, manufacturing began the fourth quarter weakly. Output increased at the second slowest rate of the past three years, as new order growth lost further momentum. New export business remained a drag on the sector, with a fifth successive monthly decline.

The weaker reading mainly reflected a slower increase in new order volumes. New orders advanced, but the rate of expansion was broadly in line with July's 34-month low. Output growth was maintained, supported mainly through domestic new orders and the erosion of backlogs. The rate of expansion was the second slowest in three years, accelerating only slightly from September's near stagnant pace. In good news, manufacturers continued to expand their workforces, extending the current sequence of job creation in the sector to 33 months.

Texas factory activity increased in October, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, dipped from 10 to 7.9, indicating slightly slower but positive growth. Texas factory activity increased in October, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, dipped from 10 to 7.9, indicating slightly slower but positive growth.

Most other measures of current manufacturing activity also suggested growth in October, although new orders declined. The shipments index held steady at 4.7, suggesting shipments rose at about the same pace as in September. The new orders index fell from 5.3 to minus 4.5, reaching its lowest level this year and indicating a decrease in demand.

Perceptions of general business conditions improved slightly in October. The general business activity index rose to 1.8, registering its first positive reading since June. The company outlook index was positive for the sixth month in a row and remained unchanged at 2.4.

Labor market indicators reflected slow but steady labor demand growth and shrinking workweeks. The employment index was 5.2 in October, largely unchanged from last month but well below the higher levels seen earlier in the year.

Taking into account the latest measures on manufacturing (manufacturing jobs, production hours, ISM, Markit, and Dallas Fed), this sector is growing but just barely.

The recent overall economic crosscurrents have changed little. Construction is improving, but only due to housing. Manufacturing is flat to growing slightly. And the consumer sector is very slowly gaining momentum. Net, economic growth appears to be improving but remains sluggish.

While the upcoming week is on the light side, there are important details ahead. The consumer sector has shown improved signs of life and updates will be posted on consumer credit and sentiment. The international trade sector has been wavering and the trade report provides new data on exports and imports. Crude oil had boosted recent inflation numbers and the October import/export price report will be the first after recent oil declines. Finally, the ISM non-manufacturing survey provides a broad reading on the economy.

The composite index from the ISM non-manufacturing survey advanced to 55.1 in September from 53.7 the prior month. Notably, the new orders index increased to 57.7 from 53.7 in August. This indicates acceleration in monthly orders to a healthy level. Export orders also show a monthly increase, though just barely, while total backlog orders contracted slightly. Another big gain in the report was in business activity which means that non-manufacturers are very busy filling orders.

ISM non-manufacturing composite index Consensus Forecast for October 12: 54.9

Range: 53.0 to 56.0

Consumer credit outstanding in August jumped $18.1 billion, split between a $13.9 billion rise for non-revolving credit and a $4.2 billion rise for revolving credit. Non-revolving credit showed across the board gains reflecting that month's very strong vehicle sales but mostly a surge in the federal government component which is where Sallie Mae student loans are classified.

Consumer credit Consensus Forecast for September 12: +$10.2 billion

Range: +$7.0 billion to +$15.0 billion

The U.S. international trade gap in August worsened and partially for the worst reason—exports declined, likely reflecting economic weakness in Europe and slower growth in Asia. Also, oil and petroleum product imports jumped on higher prices. The trade deficit expanded to $44.2 billion from $42.5 billion in July. Exports fell 1.0 percent, following a 1.1 percent decrease in July. Imports slipped 0.1 percent after a 0.6 percent dip the prior month. The latest report continues to suggest that global trade is shrinking somewhat. This suggests soft economic growth ahead for the U.S. and other countries.

International trade balance Consensus Forecast for September 12: -$45.4 billion

Range: -$46.5 billion to -$42.0 billion

Initial jobless claims for the week ending October 27, initial jobless claims fell 9,000 to 363,000. The prior week was revised up 3,000 from the original 369,000. The 4-week moving average was 367,250, a decrease of 1,500 from the previous week's revised average of 368,750.

Jobless Claims Consensus Forecast for 11/3/12: 370,000

Range: 335,000 to 410,000

Import prices jumped 1.1 percent in September which was very sharp and matched August's revised surge. Energy prices were the main factor behind this two month spike, but there's other pressure as well. Excluding petroleum, import prices rose 0.2 percent in September to end four straight months of decline for this key reading. Many readings showed gains, including for imported motor vehicles and imported capital goods. But consumer goods other than vehicles continue to show no pressure. The export side showed a 0.8 percent rise for a third straight gain. Pressure in September includes a third straight rise for agricultural exports but also includes increases for other exports including both consumer goods and motor vehicles.

Import prices Consensus Forecast for October 12: +0.1 percent

Range: -0.9 to +0.6 percent

The Reuters/University of Michigan's consumer sentiment index eased 5 tenths for the final October reading of 82.6 from mid-month but remained well above September's 78.3. Both the current conditions and the expectations components slipped 5 tenths from mid-month, to 88.1 and 79.0. Still, the 88.1 reading for current conditions was up a noticeable 2.4 points from September. The expectations index is up a sizable 5.5 points from September. The big question is what is happening on the margin. Month end readings are up versus the prior month but down compared to mid-October.

Consumer sentiment index Consensus Forecast for preliminary November 12: 83.3

Range: 80.0 to 86.0

Wholesale inventories in August rose 0.5 percent. But a burst of sales brought down inventories relative to sales in the wholesale sector during August. Sales in the sector, showing wide strength and including special strength for autos, jumped 0.9 percent for the strongest increase since February.

Wholesale inventories Consensus Forecast for September 12: +0.3 percent

Range: -0.2 to +0.5 percent

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|