|

The highlight of the week was an unexpectedly strong jobs report. But other data were also positive indicating that momentum is picking up in all sectors—including manufacturing, construction, and services. The weak spot remains housing prices.

Equities posted strong gains this past week with lift especially strong after Friday’s employment situation report. However, the week started on a modest down note on worries that European officials could not nail down a debt reduction deal for Greece. Equities posted strong gains this past week with lift especially strong after Friday’s employment situation report. However, the week started on a modest down note on worries that European officials could not nail down a debt reduction deal for Greece.

Stocks were mixed Tuesday on disappointing economic news on soft consumer confidence and a drop in home prices.

Wednesday saw equities post solid gains after a moderately strong ADP employment report and better-than-expected ISM manufacturing and construction outlays. Motor vehicle sales were healthy and supported stocks. Also, comments on progress on debt by Greek Finance Minister Evangelos Venizelos added lift to markets. Shares were mostly up Thursday on a sizeable decline in initial jobless claims.

But the big surge for equities came Friday as nonfarm payroll employment jumped far above expectations and even above the upper range of the consensus. And the unemployment rate dipped to 8.3 percent—the lowest rate since February 2009.

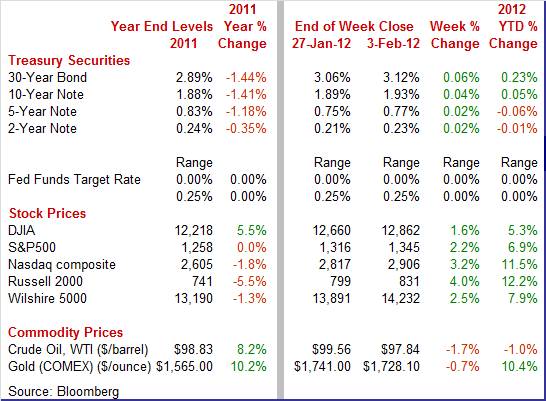

Equities were up this past week. The Dow was up 1.6 percent; the S&P 500, up 2.2 percent; the Nasdaq, up 3.2 percent; and the Russell 2000, up 4.0 percent. The Dow is at its highest level since 2008 while the Nasdaq is at its highest since 2000. Equities were up this past week. The Dow was up 1.6 percent; the S&P 500, up 2.2 percent; the Nasdaq, up 3.2 percent; and the Russell 2000, up 4.0 percent. The Dow is at its highest level since 2008 while the Nasdaq is at its highest since 2000.

Equities were up sharply in January. The Dow was up 3.4 percent; the S&P 500, up 4.4 percent; the Nasdaq, up 8.8 percent; and the Russell 2000, up 7.0 percent. The latest month was the best January for the S&P and Dow since 1997 and since 2001 for the Nasdaq.

For the year-to-date, major indexes are up as follows: the Dow, up 5.3 percent; the S&P 500, up 6.9 percent; the Nasdaq, up 11.5 percent; and the Russell 2000, up 12.2 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury rates ended the week up although they headed in the other direction the first two days of trading. Lack of progress on Greek debt and lackluster spending in the personal income report drove funds to Treasuries, nudging rates down. On Tuesday an easing in consumer confidence weighed on yields. Treasury rates ended the week up although they headed in the other direction the first two days of trading. Lack of progress on Greek debt and lackluster spending in the personal income report drove funds to Treasuries, nudging rates down. On Tuesday an easing in consumer confidence weighed on yields.

Treasury rates were bumped up at mid-week on healthy indicators—including motor vehicles, ADP, ISM manufacturing, and construction outlays.

After a quiet Thursday, yields jumped Friday on the unexpectedly strong jobs report as funds flowed into equities. Rates are up despite last week’s announcement by the Fed to likely keep policy rates exceptionally low until late 2014. Some Fed officials have since pointed out that the low rate pledge is contingent on the economy. And now some traders see the latest employment report as indicating that the Fed will have to revisit that pledge and raise rates sooner.

For this past week Treasury rates were up as follows: 3-month T-bill, up 2 basis points; the 2-year note, up 2 basis points; the 5-year note, up 2 basis points; the 7-year note, up 3 basis points; the 10-year note, up 4 basis points; and the 30-year bond, up 6 basis points.

The spot price for West Texas Intermediate traded relatively quietly this past week with modest daily volatility. The only notable swings were on Thursday and Friday. After small daily declines the first three days of the week, oil dipped a little more than a buck and a half Thursday on higher supply and on news that U.N. inspectors would be returning to Iran to inspect nuclear facilities. However, the strong jobs report led to a near $2 rebound on Friday. The spot price for West Texas Intermediate traded relatively quietly this past week with modest daily volatility. The only notable swings were on Thursday and Friday. After small daily declines the first three days of the week, oil dipped a little more than a buck and a half Thursday on higher supply and on news that U.N. inspectors would be returning to Iran to inspect nuclear facilities. However, the strong jobs report led to a near $2 rebound on Friday.

Net for the week, the spot price for West Texas Intermediate dipped $1.72 per barrel to settle at $97.84.

The overall economy is picking up momentum broadly with home prices the key exception.

Momentum is building in the labor market. Payroll jobs in January advanced 243,000 after jumping 203,000 in December (originally 200,000) and rising 157,000 in November (prior estimate up 100,000). The net revisions for November and December were up 60,000. Momentum is building in the labor market. Payroll jobs in January advanced 243,000 after jumping 203,000 in December (originally 200,000) and rising 157,000 in November (prior estimate up 100,000). The net revisions for November and December were up 60,000.

As for some time, private payrolls outstripped the total, increasing 257,000 in January, following a gain of 220,000 in December. Private-sector employment was led by gains in professional and business services (+70,000), leisure and hospitality (+44,000), and manufacturing.

In the private sector, goods-producing jobs advanced 81,000 after a 71,000 boost in December. Manufacturing jobs increased 50,000 in January after rising 32,000 the month before. Construction employment gained 21,000 after increasing 31,000 in December. Mining increased 10,000, following an 8,000 advance the prior month. Private service-providing jobs jumped 176,000 in January, following a 149,000 expansion in December.

The public sector continued to shrink as government employment slipped 14,000, following a 7,000 decline in December. Federal dipped 6,000; state rose 3,000; and local declined 11,000 with 9,600 in local government education.

Average hourly earnings rose 0.2 percent in January, following a 0.1 percent increase the prior month. The consensus called for a 0.2 percent gain. The average workweek for all workers in January held steady at 34.5 hours. Average hourly earnings rose 0.2 percent in January, following a 0.1 percent increase the prior month. The consensus called for a 0.2 percent gain. The average workweek for all workers in January held steady at 34.5 hours.

From the household survey, the unemployment rate dropped to 8.3 percent from 8.5 percent in December. This is the lowest rate in three years. Underlying the latest decline was an 847,000 surge in household employment and 339,000 decline in the number of unemployed. The size of the jump in household employment is atypical and may be related to strong seasonal factors and/or shifts in seasonal employment. Also, more workers are shifting to contract work (self employment) after being unemployed. Reversal of household employment next month would not be a surprise.

The latest employment report is favorable toward improvement in personal income and industrial production. Aggregate private earnings rose 0.4 percent in January while production worker hours in manufacturing surged 1.3 percent.

While the jobs market still is subpar for recovery, it appears to have gained momentum and should bolster the consumer sector.

While consumer wallets are getting padded a bit more, consumers have been reluctant to open them up very much. Personal income picked up strength in December but spending softened. Personal income in December advanced 0.5 percent, following a 0.1 percent rise the prior month. The important wages & salaries component grew a healthy 0.4 percent after no change in November. In the earlier employment report, aggregate private earnings had been strong. While consumer wallets are getting padded a bit more, consumers have been reluctant to open them up very much. Personal income picked up strength in December but spending softened. Personal income in December advanced 0.5 percent, following a 0.1 percent rise the prior month. The important wages & salaries component grew a healthy 0.4 percent after no change in November. In the earlier employment report, aggregate private earnings had been strong.

Consumer spending in December was sluggish, coming in at flat after edging up 0.1 percent in November. Weakness was in both durables and nondurables, reflecting in part a decline in auto sales and gasoline prices. Durables dipped 0.4 percent after a 0.3 percent gain in November. Nondurables fell 0.4 percent, following a 0.3 percent decline. Services in December advanced 0.2 percent in both December and November. Consumer spending in December was sluggish, coming in at flat after edging up 0.1 percent in November. Weakness was in both durables and nondurables, reflecting in part a decline in auto sales and gasoline prices. Durables dipped 0.4 percent after a 0.3 percent gain in November. Nondurables fell 0.4 percent, following a 0.3 percent decline. Services in December advanced 0.2 percent in both December and November.

Inflation at the headline and core levels was soft. The headline PCE price index firmed a bit to a 0.1 percent rise after no change in November. The core pace was a touch warmer at 0.2 percent in December, compared to 0.1 percent in November and expectations of 0.1 percent. Inflation at the headline and core levels was soft. The headline PCE price index firmed a bit to a 0.1 percent rise after no change in November. The core pace was a touch warmer at 0.2 percent in December, compared to 0.1 percent in November and expectations of 0.1 percent.

Year-on-year, headline prices were up 2.4 percent, compared to 2.6 percent in November. The core was up 1.8 percent versus 1.7 percent the month before. Headline inflation is a little above the Fed’s newly clarified long-term goal of 2 percent inflation while the core a marginally lower.

While spending was sluggish in December, income gains are likely to continue in January, given the healthy earnings number in the employment report. And more recent auto sales numbers point toward a boost in consumer spending.

Unit new motor vehicle sales jumped to a 14.2 million annual rate in January for a 4.6 percent gain from December. But sales, no doubt due to rising gas prices, were concentrated on cars which jumped 13.8 percent to a 7.4 million rate. Truck sales actually fell in January, down 4.0 percent to a 6.8 million rate. This is the first time in nine months that the car sales rate exceeded the truck sales rate. The concentration in cars, which have lower sticker prices, trims dollar totals and softens the likely jump in the auto component of Commerce’s retail sales number later this month. Unit new motor vehicle sales jumped to a 14.2 million annual rate in January for a 4.6 percent gain from December. But sales, no doubt due to rising gas prices, were concentrated on cars which jumped 13.8 percent to a 7.4 million rate. Truck sales actually fell in January, down 4.0 percent to a 6.8 million rate. This is the first time in nine months that the car sales rate exceeded the truck sales rate. The concentration in cars, which have lower sticker prices, trims dollar totals and softens the likely jump in the auto component of Commerce’s retail sales number later this month.

Weakness in the assessment of current conditions -- likely reflecting rising gas prices and perhaps a continuing difficult jobs market -- pulled down consumer confidence in January to 61.1 from December's revised 64.8. The report's present situation component fell more than 8 points to 38.4 in what nearly erases December's strong showing. Weakness here was centered unfortunately in the jobs market where 43.5 percent say jobs are hard to get. Weakness in the assessment of current conditions -- likely reflecting rising gas prices and perhaps a continuing difficult jobs market -- pulled down consumer confidence in January to 61.1 from December's revised 64.8. The report's present situation component fell more than 8 points to 38.4 in what nearly erases December's strong showing. Weakness here was centered unfortunately in the jobs market where 43.5 percent say jobs are hard to get.

The expectations component also slipped but just barely, to 76.2 versus 77.0 in December. The job readings on the expectations side showing rising optimism that contrasts with the current assessment of the jobs market. This suggests that consumers think current troubles will be temporary.

Manufacturing posted slightly stronger but moderate growth in January, according to the Institute for Supply Management. The January ISM manufacturing composite index rose to 54.1, safely over 50 to indicate monthly expansion and 1.0 point over December to indicate a slightly faster rate of expansion. The higher the index is above breakeven of 50, the higher the rate of growth. Manufacturing posted slightly stronger but moderate growth in January, according to the Institute for Supply Management. The January ISM manufacturing composite index rose to 54.1, safely over 50 to indicate monthly expansion and 1.0 point over December to indicate a slightly faster rate of expansion. The higher the index is above breakeven of 50, the higher the rate of growth.

A key highlight of the report was the new orders index which rose 2.8 points to 57.6 to indicate a little bit more than just a moderate rate of monthly expansion. In another positive, backlog orders increased 4.5 points to show a build at 52.5.

While ISM manufacturing is favorable, manufacturing probably is doing better than suggested by this report, given the hefty gain in production worker hours in the employment report.

Manufacturing appears to be leading the economy but non-manufacturing may be adding to economic momentum. A gigantic surge in employment and almost an equally dramatic surge in new orders headline a very strong ISM non-manufacturing report where the headline composite index jumped to 56.8—a strong 3.6 points above December's upwardly revised 53.0. Manufacturing appears to be leading the economy but non-manufacturing may be adding to economic momentum. A gigantic surge in employment and almost an equally dramatic surge in new orders headline a very strong ISM non-manufacturing report where the headline composite index jumped to 56.8—a strong 3.6 points above December's upwardly revised 53.0.

New orders jumped nearly 5 points to a 59.4 level that indicates strong monthly growth and points to acceleration in general activity in the months ahead.

Home prices are continuing to erode with no meaningful signs of a turnaround in the offing. This is the conclusion of the Case-Shiller report where in November, for the third straight month, the composite-20 index fell a sizable 0.7 percent. The seasonally adjusted index has fallen six months in a row. Home prices are continuing to erode with no meaningful signs of a turnaround in the offing. This is the conclusion of the Case-Shiller report where in November, for the third straight month, the composite-20 index fell a sizable 0.7 percent. The seasonally adjusted index has fallen six months in a row.

For the latest month, all but 3 of the 20 cities showed monthly contraction. The year-on-year rate of contraction for the composite-20 deepened slightly to minus 3.7 percent from minus 3.4 percent.

Falling prices are a major factor that's helping to lift housing sales from depressed levels. But at the same time, lower prices are cutting into sales when valuations come in lower than prices in pending contracts. While the employment report suggests that the Fed will need to consider unwinding loose policy before late 2014, the latest home prices report provides ammunition otherwise.

Despite weakness in home prices, the construction sector is showing signs of modest improvement. Construction spending in December jumped another 1.5 percent after a 0.4 percent increase the month before. Despite weakness in home prices, the construction sector is showing signs of modest improvement. Construction spending in December jumped another 1.5 percent after a 0.4 percent increase the month before.

The boost in December was led by a 3.3 percent surge in private nonresidential outlays after a 0.5 percent dip the month before. Residential spending rebounded 0.8 percent after a 0.3 percent decline. Public outlays rose 0.5 percent, following a 1.7 percent boost in November.

Within the private residential component, new one-family construction advanced 1.5 percent while the new multifamily subcomponent eased 0.3 percent after a 6.1 percent surge in November. Private nonresidential spending was led by a monthly 13.6 percent spike in manufacturing.

Overall, the construction sector is showing signs of improvement though still at low levels of activity. The broad-based gains in the private sector are moderately encouraging.

Overall, the past week’s indicator news clearly shows the economy improving with the exception being home prices. Manufacturing has regained earlier strength and is leading the recovery. Importantly, the latest employment report points to strengthening in the consumer sector.

The upcoming week’s highlights are on Friday as the international trade report along with consumer sentiment will be tracked closely by manufacturers and traders alike. Traders will be looking to see if sentiment gets a lift after Friday's positive employment data. Consumer credit (Tuesday) and weekly jobless claims (Thursday) wrap up the week.

Consumer credit outstanding in November jumped a huge $20.4 billion in the month led by non-revolving credit, up $14.8 billion, and including a very large gain for revolving credit, up $5.6 billion. The non-revolving gain largely reflects strength in car sales with the gain on the revolving side reflecting credit card use.

Consumer credit Consensus Forecast for December 11: +$7.0 billion

Range: -$4.0 billion to +$15.0 billion

Initial jobless claims fell 12,000 in the January 28 week to 367,000. The 4-week average improved with a 2,000 decline to 375,750. This was the third straight decline and the 8th decline in 9 weeks for the average which has held below the 400,000 mark for a very convincing 12 weeks in a row. Continuing claims in data for the January 21 week fell a very steep 130,000 to 3.437 million, bringing down the unemployment rate for insured workers by 1 tenth to 2.7 percent. The 4-week average for this series was 3.528 million, down nearly 100,000 from December's trend.

Jobless Claims Consensus Forecast for 2/4/12: 370,000

Range: 365,000 to 375,000

Wholesale inventories in November slowed to a 0.1 percent gain from October's outsized build of 1.2 percent. Build relative to sales has been steady with the inventory-to-sales ratio holding at 1.15.

Wholesale inventories Consensus Forecast for December 11: +0.4 percent

Range: +0.4 to +0.7 percent

The U.S. international trade gap in November widened sharply due largely to a jump in oil imports but also due to a dip in exports. The trade gap grew to $47.8 billion from $43.3 billion in October. Exports declined 0.9 percent after dipping 0.7 percent in October. Imports rebounded 1.3 percent in November, following a 1.0 percent decline the prior month. The worsening in the trade gap was led by the petroleum gap which expanded to $27.6 billion from $24.2 billion in October. The nonpetroleum goods deficit widened to $34.8 billion from $33.2 billion the month before. The services surplus was slightly improved at $15.4 billion from $15.3 billion in September.

International trade balance Consensus Forecast for December 11: -$47.8 billion

Range: -$50.0 billion to -$45.5 billion

The Reuter's/University of Michigan's consumer sentiment index rose 1 point in the final January reading to 75.0. The mid-month reading of 74.0 was up more than 4 points from the final December reading which is a very strong gain. The implied reading for the last two weeks was a very solid 76.0 (based on the monthly survey sample being about equally distributed between the first half and second half). Levels were above the year-ago comparison for the first time in a year.

The latest rise in the sentiment index was led by the leading component of expectations which was at 69.1 for a 5.5 point gain from December. Current conditions, at 84.2, were up 4.6 points from December.

Consumer sentiment Consensus Forecast for preliminary February 12: 74.3

Range: 71.0 to 79.5

The U.S. Treasury monthly budget report showed a December deficit of $86.0 billion. The deficit for the first three months of the government's fiscal year continued to show sizable improvement with receipts up 4.4 percent and spending down 2.6 percent. Looking ahead, the month of January typically shows a modest surplus for the month. Over the past 10 years, the average surplus for the month of January has been $10.9 billion. However, over the past 5 years it has averaged a deficit of $5.8 billion. The January 2011 deficit came in at $49.8 billion.

Treasury Statement Consensus Forecast for January 12: -$50.1 billion

Range: -$62.5 billion to -$15.0 billion.

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|