|

It has been a roller coaster ride with the on and off progress on the European sovereign debt problem. This past week ended on an optimistic note on political progress in Greece and Italy that should lead to further progress in resolving the European debt crisis.

Major indexes ended the week mixed after being deep in the hole at mid-week. Equities had a positive but shaky start on Monday after the weekend announcement by Greek Prime Minister George Papandreou that he would resign on condition that the country’s bailout plan would be approved by parliament. Partially offsetting this was worry that Italy’s financial condition was worsening as indicated by a rise in rates on Italian bonds. Stocks advanced Tuesday on news that Italian Prime Minister Silvio Berlusconi would resign after the parliament approves the country’s austerity plans. Major indexes ended the week mixed after being deep in the hole at mid-week. Equities had a positive but shaky start on Monday after the weekend announcement by Greek Prime Minister George Papandreou that he would resign on condition that the country’s bailout plan would be approved by parliament. Partially offsetting this was worry that Italy’s financial condition was worsening as indicated by a rise in rates on Italian bonds. Stocks advanced Tuesday on news that Italian Prime Minister Silvio Berlusconi would resign after the parliament approves the country’s austerity plans.

Equities fell sharply at mid-week as a spike in Italian bond yields fanned worries about contagion in the European debt crisis. Political indecision in both Italy and Greece did not help. Italian Prime Minister Silvio Berlusconi's insistence on elections instead of an interim government raised concerns of prolonged instability and delays to economic reform. In Greece, the political parties were yet to decide on a successor to George Papandreou.

Stocks rebounded Thursday on several factors. Jobless claims were down more than expected and the U.S. trade balance narrowed on a jump in exports. Progress was made toward Europe’s debt problems as political developments were seen paving the way toward resolution. In Greece, Lucas Papademos was named prime minister and will lead a unity government. Italian bond yields dipped on news that the ECB was purchasing the nation’s bonds. Finally, corporate news was positive. Cisco Systems gained after the company reported fiscal first quarter earnings and revenue that exceeded expectations. Merck advanced after it increased its quarterly dividend for the first time in seven years. Kohl's was up after reporting fiscal second quarter profits gained 20 percent on continued sales growth. However, Green Mountain Coffee Roasters slumped after quarterly revenue fell short of forecasts.

Stocks soared Friday as Greece swore in a new prime minister, Lucas Papademos, who is seen as more technically capable of addressing the country’s financial difficulties. He is a former banker and European Central Bank vice president. Also Friday, Italy's senate approved a number of austerity measures demanded by Europe. An unexpectedly strong rise in early November consumer sentiment also added lift to stocks. For now, equities are up along with moderate optimism about Europe. However, next week could be a different story. But the good news is that U.S. economic data continue to trudge upward.

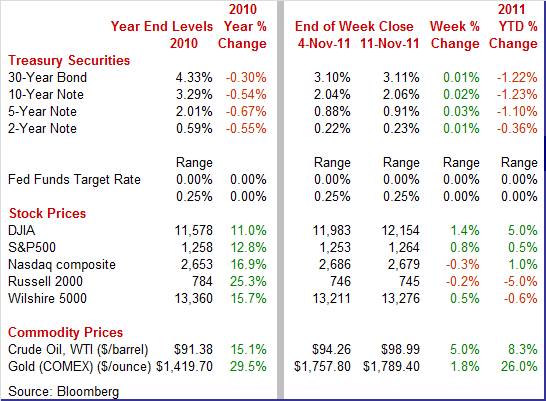

Equities were mixed this past week. The Dow was up 1.4 percent; the S&P 500, up 0.8 percent; the Nasdaq, down 0.3 percent; and the Russell 2000, down 0.2 percent.

For the year-to-date, major indexes are mixed follows: the Dow, up 5.0 percent; the S&P 500, up 0.5 percent; the Nasdaq, 1.0 percent; and the Russell 2000, down 5.0 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury rates ended the week up slightly except for the short end. Starting the week, longer-maturity yields dipped on concern that Italy would not be able to fully implement needed austerity measures, more than offsetting favorable news from Greece of the formation of a national unity government to secure international funding of a bailout. Yields firmed Tuesday on news that Italian Prime Minister Silvio Berlusconi agreed to resign once the country’s parliament approves its austerity plans. The news led to some reversal of flight to safety. Treasury rates ended the week up slightly except for the short end. Starting the week, longer-maturity yields dipped on concern that Italy would not be able to fully implement needed austerity measures, more than offsetting favorable news from Greece of the formation of a national unity government to secure international funding of a bailout. Yields firmed Tuesday on news that Italian Prime Minister Silvio Berlusconi agreed to resign once the country’s parliament approves its austerity plans. The news led to some reversal of flight to safety.

On Wednesday, fears of European contagion surged and Treasury rates dropped on safe haven moves. Weighing down on Treasury rates was a jump in Italian yields that well topped 7 percent, hitting euro-era records. The Italian rate rose after certain European clearing houses raised margins on deposits of Italian bonds. On Wednesday, fears of European contagion surged and Treasury rates dropped on safe haven moves. Weighing down on Treasury rates was a jump in Italian yields that well topped 7 percent, hitting euro-era records. The Italian rate rose after certain European clearing houses raised margins on deposits of Italian bonds.

Treasury rates rebounded Thursday on progress in Europe. Lucas Papademos, the former vice president of the European Central Bank, was picked to lead a Greek unity government. This opens the door for a coalition to secure additional funding to bolster the country’s finances. Separately, the ECB was believed to be buying Italian debt, lowering the rate on those bonds. Somewhat adding to upward pressure on Treasury rates, initial jobless claims fell more than expected. Bond markets were closed Friday for the Veterans Day holiday.

For this past week Treasury rates were up as follows: the 2-year note, up 1 basis point; the 5-year note, up 3 basis points; the 7-year note, up 2 basis points; the 10-year note, up 2 basis points; and the 30-year bond, up 1 basis point. The 3-month T-bill slipped 1 basis point.

The price of crude posted a sizeable gain this past week. On Monday and Tuesday the spot price of West Texas Intermediate gained a cumulative $2-1/2 on news of political progress in Italy and Greece favorable toward implementing austerity measures. The price of crude posted a sizeable gain this past week. On Monday and Tuesday the spot price of West Texas Intermediate gained a cumulative $2-1/2 on news of political progress in Italy and Greece favorable toward implementing austerity measures.

But crude dipped more than a buck a barrel at mid-week on worries about European sovereign debt as Italian bond yields topped 7 percent. Not helping was news that German Chancellor Angela Merkel’s Christian Democratic Union may adopt a motion to allow countries to exit the common currency. This would increase the probability of Greece leaving the euro-zone. Also, a drop in Japanese machine orders undermined the price of crude.

On Thursday, spot crude jumped more than $2 per barrel, largely on a decline in jobless claims. At the end of the week, the spot price of crude rose about a dollar a barrel after Italy’s Senate approved budget reform legislation and on a jump in consumer sentiment.

Net for the week, the spot price for West Texas Intermediate gained $4.73 per barrel to settle at $98.99. Crude has been creeping upward and now is at its highest since July of this year.

The economic news was light but favorable as exports were unexpectedly strong in September and consumer sentiment showed surprising improvement. Also, import prices dipped but that improvement may not last.

Despite a slowdown in growth in Europe, the uptrend in exports continues. The U.S. trade deficit unexpectedly improved in September but a significant part of it appears to have been related to flight to safety to gold during September’s weak financial markets. The September trade gap shrank to $43.1 billion from $44.9 billion in August. Exports gained 1.4 percent after edging up 0.1 percent in August. September exports hit a record high level. Imports rose 0.3 percent in September, following a 0.2 percent decline the prior month. Despite a slowdown in growth in Europe, the uptrend in exports continues. The U.S. trade deficit unexpectedly improved in September but a significant part of it appears to have been related to flight to safety to gold during September’s weak financial markets. The September trade gap shrank to $43.1 billion from $44.9 billion in August. Exports gained 1.4 percent after edging up 0.1 percent in August. September exports hit a record high level. Imports rose 0.3 percent in September, following a 0.2 percent decline the prior month.

The improvement in the trade gap was led by the nonpetroleum goods gap which shrank to $31.5 billion from $33.9 billion in August. Exports of industrial supplies jumped $1.4 billion with $1.6 billion coming from nonmonetary gold. This was likely flight to safety with demand for gold up in the month. The petroleum gap worsened to $26.6 billion from $26.0 billion the prior month. The services surplus slipped to $15.8 billion from $16.0 billion in August.

For the goods component, export gains were widespread. The September increase in exports of goods reflected increases in industrial supplies and materials ($1.4 billion); consumer goods ($0.8 billion); automotive vehicles, parts, and engines ($0.2 billion); and capital goods ($0.1 billion). A decrease occurred in other goods ($0.1 billion). Foods, feeds, and beverages were virtually unchanged.

The September increase in imports of goods reflected increases in industrial supplies and materials ($0.9 billion); automotive vehicles, parts, and engines ($0.5 billion); and foods, feeds, and beverages ($0.2 billion). Decreases occurred in other goods ($0.6 billion); capital goods ($0.4 billion); and consumer goods ($0.2 billion).

In recent months, export growth has been outpacing that for imports. On a year-ago basis, exports were up 15.9 percent in September, compared to 14.9 percent the month before. Imports rose 11.9 percent, compared to 11.2 percent in August.

The latest monthly numbers are encouraging—especially for manufacturers. Even though about half of the unexpected improvement in the deficit came from gold exports, other exports were moderately strong. Given weakness in Europe, the report is encouraging even after discounting te gold movement. The September numbers also will have many economists raising their estimate for third quarter GDP revisions.

Inflation pressure from imports is easing with import prices down 0.6 percent in October, following a revised no change in September and a 0.4 percent decline in August. The headline decline reflects a third straight decline for petroleum prices which fell 1.0 percent in the month and which pulled a host of petroleum-related categories lower including industrial supplies which fell 1.4 percent. Inflation pressure from imports is easing with import prices down 0.6 percent in October, following a revised no change in September and a 0.4 percent decline in August. The headline decline reflects a third straight decline for petroleum prices which fell 1.0 percent in the month and which pulled a host of petroleum-related categories lower including industrial supplies which fell 1.4 percent.

Yet in isolated but still important signs of pressure, import prices for consumer goods excluding autos jumped 0.7 percent following a run of 0.3 percent gains going back to June. The latest increase was largely in manufactured nondurables. Import prices for capital goods declined 0.3 percent, following a 0.1 percent uptick in September. Yet in isolated but still important signs of pressure, import prices for consumer goods excluding autos jumped 0.7 percent following a run of 0.3 percent gains going back to June. The latest increase was largely in manufactured nondurables. Import prices for capital goods declined 0.3 percent, following a 0.1 percent uptick in September.

Year-on-year rates of inflation slowed with imports at plus 11.0 percent, compared to 12.9 percent in September. Excluding petroleum, the October pace was 4.8 percent, following 5.5 percent the month before.

Looking ahead, there is a significant chance of a worsening in import prices in the near term as oil prices have risen significantly over the last few weeks. However, a recently stronger dollar is favorable toward keeping import prices on the soft side.

Apparently, consumers just opened their 401(k) statements for October and liked the rebound as the consumer mood remained less gloomy in early November. Consumer sentiment held on to its strong gain in the last half of October, coming in at 64.2 for the mid-month November reading. This compares with an implied 64.3 reading in the last half of last month and a 60.9 reading for all of October. Sentiment is at its highest since June of this year. Apparently, consumers just opened their 401(k) statements for October and liked the rebound as the consumer mood remained less gloomy in early November. Consumer sentiment held on to its strong gain in the last half of October, coming in at 64.2 for the mid-month November reading. This compares with an implied 64.3 reading in the last half of last month and a 60.9 reading for all of October. Sentiment is at its highest since June of this year.

The September gain was centered in the leading component of expectations which, compared to all of October, is up more than four points at 56.2. The coincident component of current conditions is at 76.6, compared to 75.1 for all of October.

Inflation readings were stable with one-year expectations unchanged at 3.2 percent. Five-year expectations were down one tenth to 2.6 percent. Inflation readings were stable with one-year expectations unchanged at 3.2 percent. Five-year expectations were down one tenth to 2.6 percent.

Consumer spirits have been unusually depressed in recent months likely due to sharp declines in stock prices, earlier highs in gasoline prices, and stubbornly high unemployment. But the mood measures have stood in contrast to strength in consumer spending. If gains for confidence can be extended in the weeks ahead, the economic outlook as well as expectations for holiday shopping will improve. Some thawing in the jobs market may be helping with sentiment.

Despite volatility in the financial markets, the real economy appears to be making progress with an improving recovery. The export sector is still an engine of growth and the consumer sector is regaining confidence.

The week comes with a boat load of wide-ranging economic news. However, the highlight of the week likely is retail sales on Tuesday. Posting the same day are producer prices and Empire State manufacturing. At mid-week, traders get to parse the October CPI and industrial production. Thursday is highlighted by housing starts with Philly Fed manufacturing released later in the day. The week closes with leading indicators.

The producer price index jumped 0.8 percent in September, following no change in August. By major components, energy rebounded 2.3 percent after falling 1.0 percent in August. Food costs slowed to a still warm 0.6 percent rise after surging 1.1 percent in August. At the core level, PPI inflation posted a 0.2 percent rise, compared to a 0.1 percent increase in August.

PPI Consensus Forecast for October 11: -0.2 percent

Range: -0.4 to +0.4 percent

PPI ex food & energy Consensus Forecast for October 11: +0.1 percent

Range: -0.1 to +0.3 percent

Retail sales in September made quite a comeback, jumping 1.1 percent, following a 0.3 percent increase the prior month. Excluding autos, sales gained a robust 0.6 percent after rising 0.5 percent in August. Gasoline sales boosted the core notably in the latest month. Nonetheless, sales excluding autos and gasoline in September were up a healthy 0.5 percent, following a 0.5 percent boost the month before. Component gains were widespread with only a few showing declines. Looking ahead, there will be less lift from auto sales as unit new motor vehicle sales gained a moderate 1.2 percent in October, compared to an 8.0 percent surge in September.

Retail sales Consensus Forecast for October 11: +0.2 percent

Range: -0.2 to +0.5 percent

Retail sales excluding motor vehicles Consensus Forecast for October 11: 0.0 percent

Range: -0.4 to +0.4 percent

The Empire State manufacturing index in October contracted for the fifth month in a row posting at minus 8.48 versus September's minus 8.82. Positives included new orders which at plus 0.16 showed a fractional monthly gain to end two months of contraction. Shipments, at plus 5.33, reflected a moderate monthly gain. Also positive was employment, at plus 3.37, to indicate a mild monthly rise in the sample's workforce.

Empire State Manufacturing Survey Consensus Forecast for November 11: -2.6

Range: -7.2 to 2.2

Business inventories rose 0.5 percent in August, a bit ahead of a 0.3 percent rise in business sales but not enough to change the stock-to-sales ratio, at least out to two decimal points, which held at 1.28. Looking ahead, business inventories in September are likely to be soft as manufacturers’ inventories edged up only 0.1 percent for that month.

Business inventories Consensus Forecast for September 11: +0.2 percent

Range: -0.1 to +0.5 percent

The consumer price index in September increased 0.3 percent, following a 0.4 percent jump the month before. In contrast, excluding food and energy, the CPI posted a mild 0.1 percent boost after rising 0.2 percent in August. Turning to major components, energy increased a strong 2.0 percent after rising 1.2 percent in August. Food price inflation continued hot, rising 0.4 percent in September after accelerating to a 0.5 percent pace the month before. Within the core, apparel declined 1.1 percent after a series of strong gains. Recreation dipped 0.1 percent. Used vehicles fell 0.6 percent while new vehicles were flat. Also, shelter cost inflation slowed to a 0.1 percent rise after two moderately strong gains.

CPI Consensus Forecast for October 11: 0.0 percent

Range: -0.1 to +0.1 percent

CPI ex food & energy Consensus Forecast for October 11: +0.1 percent

Range: +0.1 to +0.2 percent

Industrial production in September advanced 0.2 percent, following no change the month before. By major industry, manufacturing improved to a 0.4 percent rise after a 0.3 percent boost in August. Overall industrial production was weighed down by a dip in utilities where output fell 1.8 percent after declining 2.9 percent in August. However, mining output expanded 0.8 percent, matching the growth rate for August. Overall capacity utilization in September improved to 77.4 percent from 77.3 percent in August.

Industrial production Consensus Forecast for October 11: +0.4 percent

Range: +0.3 to +0.8 percent

Capacity utilization Consensus Forecast for October 11: 77.6 percent

Range: 77.5 to 77.9 percent

Housing starts in September rebounded a sharp 15.0 percent after declining 7.0 percent the month before. The September annualized pace of 0.658 million units was up 10.2 percent on a year-ago basis. The comeback in September was led by a monthly 51.3 percent surge in the multifamily component, following a 16.8 percent drop in August. The single-family component edged up 1.7 percent after a 2.8 percent decrease the month before. By region, the jump in starts was led by an 18.1 percent increase in the West. Other regions also gained with Northeast up 12.7 percent; the Midwest up 9.3 percent; and the South up 15.7 percent. Only the increases in the Northeast and South were partially related to rebounding from hurricane effects in August. Housing permits edged slipped 5.0 percent after rebounding 4.0 percent in August. The September rate of 0.594 million units annualized was up 5.7 percent on a year-ago basis.

Housing starts Consensus Forecast for October 11: 0.605 million-unit rate

Range: 0.580 million to 0.640 million-unit rate

Housing permits Consensus Forecast for October 11: 0.605 million-unit rate

Range: 0.577 million to 0.630 million-unit rate

Initial jobless claims for the November 5 week fell a convincing 10,000 to 390,000 for the lowest level since April (prior week revised 3,000 higher to 400,000). The four-week average, down 5,250 to 400,000, is also at its lowest since April. Continuing claims, in data for the October 29 week, were down 92,000 to 3.615 million and are at their lowest level of the recovery.

Jobless Claims Consensus Forecast for 11/12/11: 395,000

Range: 382,000 to 400,000

The general business conditions index of the Philadelphia Fed's Business Outlook Survey in October ended two months of steep contraction with a moderate 8.7 reading for October. This compares with minus 17.5 in September and a very severe minus 30.7 for August. Improvement was also seen in new orders, at plus 7.8, and in shipments, at plus 13.6 which is a six-month high. Likewise, unfilled orders ended a run of monthly contractions with a plus 3.4 reading which is also a six-month high.

Philadelphia Fed survey Consensus Forecast for November 11: 9.0

Range: 2.0 to 14.3

The Conference Board's index of leading indicators rose 0.2 percent in September, following a 0.3 percent gain the month before and a 0.6 percent jump in July. The latest increase was led by the rate differential between the 10-year T-note and fed funds which contributed 0.20 percentage points. Positives were also seen in money supply, vendor performance, consumer expectations, and new orders for consumer goods. Negatives were led by a dip in housing permits with downward movement also seen in new orders for nondefense capital goods, stock prices, and initial jobless claims. The factory workweek was neutral. The index of coincident indicators rebounded 0.1 percent, following a 0.1 percent dip in August.

Leading indicators Consensus Forecast for October 11: +0.5 percent

Range: +0.2 to +0.8 percent

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|