|

While financial markets continued their roller coaster ride on news of off and on progress on Greek sovereign debt, the U.S. economy continued to grow, albeit at a moderate pace.

October ended badly and November started likewise as fears of Greek default on sovereign debt resurfaced with a vengeance as late Monday afternoon Greek Prime Minister George Papandreou said he intended to put the European Union’s new agreement on financing for Greece to a referendum. Also, MF Global filed for bankruptcy protection, weighing especially on financials. On Tuesday, events in Greece continued to weigh on stocks, especially with an announcement of a no confidence vote to take place Friday at midnight, Greek time. October ended badly and November started likewise as fears of Greek default on sovereign debt resurfaced with a vengeance as late Monday afternoon Greek Prime Minister George Papandreou said he intended to put the European Union’s new agreement on financing for Greece to a referendum. Also, MF Global filed for bankruptcy protection, weighing especially on financials. On Tuesday, events in Greece continued to weigh on stocks, especially with an announcement of a no confidence vote to take place Friday at midnight, Greek time.

On Wednesday, equities rebounded after the Federal Reserve indicated it would do what is necessary to support the recovery. A new dissenting vote—this time toward additional ease—added to that view.

Stocks got further lift on Thursday from several fronts. First, Greek Prime Minister George Papandreou canceled his controversial plan to hold a popular referendum on the European debt deal, saying the plan served its purpose by creating a broader consensus behind the deal. But the no confidence vote on his tenure remained set for Friday. The European Central Bank cut its key policy rate by 25 basis points. And initial jobless claims in the U.S. dipped.

But equities headed back down on Friday despite a jobs report with some positive detail. Investors were wary of the outcome of the no confidence vote on the Greek prime minister’s future. A vote of no confidence would create additional uncertainty over whether a newly formed Greek government would go along with austerity plans that would limit contagion in the region. Also, the G-20 summit meeting in Cannes, France failed to come up with a plan to increase the resources of the International Monetary Fund for assisting in resolving the European sovereign debt crisis.

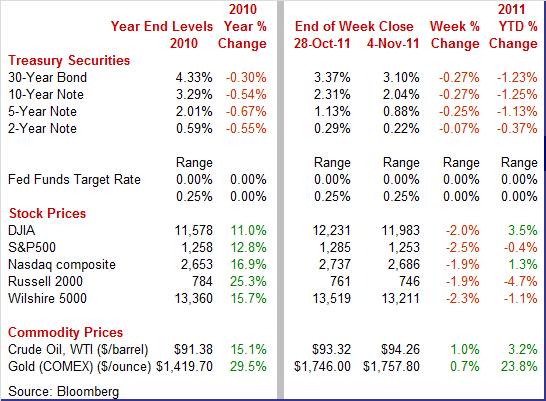

Equities were down this past week. The Dow was down 2.0 percent; the S&P 500, down 2.5 percent; the Nasdaq, down 1.9 percent; and the Russell 2000, down 1.9 percent.

Despite hefty losses on Monday, October 31, major indexes were up sharply for the month of October on earlier favorable economic news and apparent progress on Greek debt. The Dow was up 9.5 percent; the S&P 500, up 10.8 percent; the Nasdaq, up 11.1 percent; and the Russell 2000, up 15.0 percent. Despite hefty losses on Monday, October 31, major indexes were up sharply for the month of October on earlier favorable economic news and apparent progress on Greek debt. The Dow was up 9.5 percent; the S&P 500, up 10.8 percent; the Nasdaq, up 11.1 percent; and the Russell 2000, up 15.0 percent.

For the year-to-date, major indexes are mixed as follows: the Dow, up 3.5 percent; the S&P 500, down 0.4 percent; the Nasdaq, up 1.3 percent; and the Russell 2000, down 4.7 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury yields declined notably this past week. Movement downward was primarily Monday and Tuesday on worries over developments in Greece regarding an announced referendum on the bailout plan for the country’s sovereign debt. Also, money flowed out of Italian and Spanish bonds on concern that Europe will be unable to contain the debt crisis to Greece. And adding to Treasury demand, Japan sold yen to weaken its rally. Treasury yields declined notably this past week. Movement downward was primarily Monday and Tuesday on worries over developments in Greece regarding an announced referendum on the bailout plan for the country’s sovereign debt. Also, money flowed out of Italian and Spanish bonds on concern that Europe will be unable to contain the debt crisis to Greece. And adding to Treasury demand, Japan sold yen to weaken its rally.

Treasuries were little changed at mid-week. Rates firmed Thursday on the ECB’s rate cut which was seen as stimulative. Also bumping rates up was the announcement by Greek Prime Minister George Papandreou that he was calling off the referendum on the Greek bailout plan. Rates nudged down Friday ahead of the no confidence vote in Greece. Treasuries were little changed at mid-week. Rates firmed Thursday on the ECB’s rate cut which was seen as stimulative. Also bumping rates up was the announcement by Greek Prime Minister George Papandreou that he was calling off the referendum on the Greek bailout plan. Rates nudged down Friday ahead of the no confidence vote in Greece.

For this past week Treasury rates were down as follows: the 2-year note, down 7 basis points; the 5-year note, down 25 basis points; the 7-year note, down 30 basis points; the 10-year note, down 27 basis points; and the 30-year bond, down 27 basis points. The 3-month T-bill edged up 1 basis point.

It has been almost stealthy. The price of crude rose modestly this past week but it hit a three month high. Net for the week, the spot price for West Texas Intermediate rose 94 cents per barrel to settle at $94.26. This is the highest since August 1 when WTI stood at $94.88. It has been almost stealthy. The price of crude rose modestly this past week but it hit a three month high. Net for the week, the spot price for West Texas Intermediate rose 94 cents per barrel to settle at $94.26. This is the highest since August 1 when WTI stood at $94.88.

For the latest week, there was the standard daily volatility. On the downside, the biggest move was on Tuesday as spot WTI declined a little more than $2 per barrel as the announced plan for a Greek referendum was seen as raising the risk of Greek default and contagion. Crude rose about a buck and a half on Wednesday and again on Thursday. On Wednesday, a favorable ADP employment report supported prices while on Thursday prices rose on the ECB rate cut and on news that Greece would not hold a referendum on a bailout package. Crude was little changed the last trading day of the week.

The economy showed moderate gains this past week. The jobs report was not quite as strong as hoped at the headline level but detail suggests somewhat more strength. Other indicators were modestly positive. And the Fed’s latest policy decision was steady but indicated the Fed is ready to act further if appropriate.

Nonfarm payroll employment continued upward in October but without much conviction. However, the household numbers suggested more underlying strength. Nonfarm payroll employment continued upward in October but without much conviction. However, the household numbers suggested more underlying strength.

Turning to back to payrolls, the headline number for October was a little disappointing but upward revisions were more than offsetting. Payroll jobs in October posted a gain of 80,000 after rising a revised 158,000 in September (originally 103,000) and increased a revised 104,000 in August (previously 57,000). Market expectations were for a 90,000 boost for the latest month. Revisions for August and September were up net 102,000.

As in recent months, greater strength was seen in private nonfarm payrolls which advanced 104,000, following a 191,000 rise in September and a 72,000 increase in August.

In the private sector, goods-producing jobs were tugged down by construction but with manufacturing and mining partially offsetting. Goods-producing jobs declined 10,000 after a 29,000 boost in September. Construction jobs fell 20,000 in October after rebounding 27,000 the month before. Weakness in October was in nonresidential construction as was the strength the prior month. Manufacturing employment gained 5,000 after a 3,000 dip in September. Motor vehicles added 6,000 to this sector in the latest month. Mining advanced 6,000, following a 4,000 gain the prior month.

Private service-providing jobs rose 114,000 in October, following a 162,000 boost the prior month. The October increase was led by professional & business services (up 32,000) and trade & transportation (up 35,000). The temp help subcomponent of professional & business services rose 15,000 after a 21,000 gain.

The public sector contracted as government employment fell 24,000, following a 33,000 decline in September. Most of the October decrease was in the non-educational component of state government.

Earnings were moderately healthy as average hourly earnings in October rose 0.2 percent, following an upwardly revised 0.3 percent the month before. Analysts had forecast a 0.2 percent increase. The average workweek for all workers in October was unchanged at 34.3 hours. Analysts called for 34.3 hours.

From the household survey, the unemployment rate edged down to 9.0 percent from 9.1 percent in September. The consensus expected 9.1 percent. The unemployment rate declined largely on a sizeable 277,000 boost in household employment which has posted significant increases for three months in a row. The increases in August and September were 331,000 and 398,000, respectively.

And there is additional favorable news in the detail of the household survey. Part-time employment for economic reasons is down and the duration of unemployment declined in October. In nonagricultural industries, the number of those employed part time instead of full time for economic reasons dropped 328,000. And there is additional favorable news in the detail of the household survey. Part-time employment for economic reasons is down and the duration of unemployment declined in October. In nonagricultural industries, the number of those employed part time instead of full time for economic reasons dropped 328,000.

There is modest good news in changes of the unemployed by reason of unemployment. Permanent job losers have been declining recently. Also, the number of “job leavers” has been rising. Generally, job leavers have another job set up for starting soon, indicating that the labor market is warming up. The median duration of unemployment slipped from 22.2 weeks in September to 20.8 weeks in October. Finally, the expanded measure of underemployment (the “U-6” measure including part-time for economic reasons, discouraged workers, and those who are not looking for work but would if offered) dipped to 16.2 percent from 16.5 percent in September.

For the major numbers, the October employment report was about as expected net. The best news was the upward revisions to payroll employment and the continued gains in household employment. These suggest that there might be a little more momentum than seen in the headline payroll number for October. The upward revisions might also help explain moderate strength in retail sales in recent months.

Looking ahead, the payroll data suggest a moderate gain in income and sizeable boost in manufacturing output. The private wages and salaries component in personal income is likely to be healthy in October as aggregate earnings for total private workers gained 0.3 percent. The manufacturing component in industrial production is likely to be robust in October as aggregate production worker hours in manufacturing surged 1.0 percent in October.

At the conclusion of the November 1-2 FOMC meeting, the Fed kept policy steady but still quite loose. In addition to keeping the fed funds target rate unchanged, the Fed retained language that rates will remain exceptionally low through mid-2013 and will continue to extend the average maturity of its holdings of Treasuries in Operation Twist. The FOMC also said that principal payments from its holdings of agency debt and agency mortgage-backed securities will be reinvested in agency mortgage-backed securities. Maturing Treasury securities will be rolled over at auction. There was one dissenting vote—by Charles Evans of the Chicago Fed “who supported additional policy accommodation at this time.” At the conclusion of the November 1-2 FOMC meeting, the Fed kept policy steady but still quite loose. In addition to keeping the fed funds target rate unchanged, the Fed retained language that rates will remain exceptionally low through mid-2013 and will continue to extend the average maturity of its holdings of Treasuries in Operation Twist. The FOMC also said that principal payments from its holdings of agency debt and agency mortgage-backed securities will be reinvested in agency mortgage-backed securities. Maturing Treasury securities will be rolled over at auction. There was one dissenting vote—by Charles Evans of the Chicago Fed “who supported additional policy accommodation at this time.”

The Fed remains moderately positive about economic growth—though less so for labor markets. The Fed sees a stronger economy in the third quarter and now expects a moderate pace of economic growth in coming quarters.

“Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee continues to expect a moderate pace of economic growth over coming quarters and consequently anticipates that the unemployment rate will decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Moreover, there are significant downside risks to the economic outlook, including strains in global financial markets.”

“The Committee also anticipates that inflation will settle, over coming quarters, at levels at or below those consistent with the Committee's dual mandate as the effects of past energy and other commodity price increases dissipate further.”

Essentially, the Fed is leaving the door open for additional ease with the emphasis on significant downside risks remaining. Also supporting possible future action is the Fed’s belief that inflation is going to be relatively low in coming quarters. And the new angle of dissent coming from a dove instead of from hawks on the FOMC adds to the view that QE3 is still possible. But the comments that the economy is getting better suggest that QE3 is not imminent. Essentially, the Fed is leaving the door open for additional ease with the emphasis on significant downside risks remaining. Also supporting possible future action is the Fed’s belief that inflation is going to be relatively low in coming quarters. And the new angle of dissent coming from a dove instead of from hawks on the FOMC adds to the view that QE3 is still possible. But the comments that the economy is getting better suggest that QE3 is not imminent.

Just after the FOMC statement, the Fed released its latest economic forecasts. The FOMC’s forecast for GDP growth was downgraded from the June projection; the unemployment rate is expected to come down more slowly; and inflation is expected to ease but essentially on the same path as seen from June. Even though the last forecasts were downgraded, the Fed still sees improvement ahead.

For real GDP, the central tendency forecast for 2011 is now a range of 1.6 to 1.7 percent versus the prior range of 2.7 to 2.9 percent. The large downgrade likely is due to a large downside miss to second quarter growth. For 2012, forecast growth is 2.5 to 2.9 percent versus June’s 3.3 to 3.7 percent. For 2013, forecast growth is 3.0 to 3.5 percent versus June’s 3.5 to 4.2 percent. The FOMC just released its first projection for growth in 2014—a range of 3.0 percent to 3.9 percent.

Early data for October on actual purchases by consumers indicate that this sector is doing notably better than suggested by surveys on the consumer mood. Unit new motor vehicle sales rose 1.2 percent in October after surging 8.0 percent the month before. October’s sales pace was 13.3 million units annualized, compared to 13.1 million in September. Early data for October on actual purchases by consumers indicate that this sector is doing notably better than suggested by surveys on the consumer mood. Unit new motor vehicle sales rose 1.2 percent in October after surging 8.0 percent the month before. October’s sales pace was 13.3 million units annualized, compared to 13.1 million in September.

The October gain was centered in car sales, both domestic and import, while truck sales fell back slightly. Domestic car and light truck sales posted at 10.1 million, following 10.0 million in September. Imports came in at 3.1 million, matching September’s pace. Component levels do not add to the total due to rounding of components.

The latest sales numbers are relatively healthy in terms of the level of activity. However, the auto component in retail sales is not going to add dramatically to total retail sales as was the case in September. Auto sales could add or even detract from total retail sales depending in part on dealer discounts relative to September.

The October ISM manufacturing composite index was positive though it eased to 50.8 from 51.6 in September. However, weakness was largely in the inventory component which dropped from 52.0 in September to below breakeven at 46.7, indicating contraction for the latest month. The October ISM manufacturing composite index was positive though it eased to 50.8 from 51.6 in September. However, weakness was largely in the inventory component which dropped from 52.0 in September to below breakeven at 46.7, indicating contraction for the latest month.

With inventories down, manufacturers are likely to bump production up as ISM's new orders index which, after three straight of months of marginal contraction, moved to the plus column with a 2.8 point gain to 52.4. Backlogs dropped less rapidly as this index was up 6.0 points to 47.5. Employment is little changed at 53.5 to indicate moderate hiring in the sample. Production is steady as are supplier deliveries. New export orders show no change.

A big plus in the report is sharp contraction in prices paid, down 15 points to 41.0 which is the lowest reading in 2-1/2 years. Lower costs reflect slowing demand for commodities and other materials.

The ISM non-manufacturing composite index was essentially unchanged in October at 52.9 versus 53.0 the prior month. Recent numbers have been above the breakeven reading of 50, indicating expansion but at a modest pace. Forward momentum also is modest as the new orders index slowed to 52.4 from September's 56.5 while backlog orders moved back to monthly contraction at a sub-50 reading of 47.0. But businesses apparently are slightly optimistic about future conditions as hiring picked up somewhat with the employment index up 4.6 points to 53.3 to show the strongest rate of monthly expansion in five months. The ISM non-manufacturing composite index was essentially unchanged in October at 52.9 versus 53.0 the prior month. Recent numbers have been above the breakeven reading of 50, indicating expansion but at a modest pace. Forward momentum also is modest as the new orders index slowed to 52.4 from September's 56.5 while backlog orders moved back to monthly contraction at a sub-50 reading of 47.0. But businesses apparently are slightly optimistic about future conditions as hiring picked up somewhat with the employment index up 4.6 points to 53.3 to show the strongest rate of monthly expansion in five months.

The construction sector nudged forward for two months in a row with relative strength alternating. Construction spending in September gained 0.2 percent after rebounding 1.6 percent in August, which was revised up from an original 1.4 percent increase. The construction sector nudged forward for two months in a row with relative strength alternating. Construction spending in September gained 0.2 percent after rebounding 1.6 percent in August, which was revised up from an original 1.4 percent increase.

September’s advance was led by a 0.9 percent increase in residential outlays, following a 0.4 percent rise in August. With still soft demand for housing, it appears many homeowners are choosing to improve their existing home rather than try to sell and then buy a bigger house. By subcomponents, strength was in non-new homes (improvements—including remodeling and additions to earlier completed original buildings) which jumped 1.4 percent, following no change in September. New one-family residential outlays rose 0.9 percent after a 0.4 percent gain the month before. New multifamily construction advanced 0.2 percent, following a 0.9 percent boost in September.

Private nonresidential construction spending advanced 0.3 percent, following a 0.8 percent rise the month before. Public outlays declined 0.6 percent after a 3.5 percent boost the prior month.

The October construction report shows this sector showing modest improvement and adds to the argument that the recovery is gradually picking up momentum.

The odds of an encore recession have dwindled but the economy is still in a soft patch. Importantly, there are signs that growth is picking up but not at a needed robust pace to bring down unemployment to a more favorable pace. The Fed is keeping policy very accommodative. Despite claims that the Fed still has additional tools for easing, any future moves by the Fed are going to have only minimal impact. Unless elected officials in Washington implement fiscal stimulus policies, economic growth is likely to continue at a sub-par pace for some time.

Economic news is light this week. Thursday's international trade report highlights the week. Traders will be looking for continuing gains in the export data despite global sluggishness. The consumer's mood will be tested Friday with the mid-November estimate of consumer sentiment.

Consumer credit outstanding in August fell for the first time in nine months, declining $9.5 billion with both revolving and non-revolving contracting. Revolving credit fell $2.2 billion while non-revolving credit fell $7.3 billion. The outlook for September is mixed with non-revolving likely popping higher given the month's strong unit sales of vehicles.

Consumer credit Consensus Forecast for September 11: +$5.0 billion

Range: +$2.0 billion to +$9.0 billion

Initial jobless claims fell 9,000 in the October 29 week to 397,000, a decline partly offset by a 4,000 upward revision to the prior week to 406,000. The four-week average is slowly approaching the 400,000 level, down 2,000 in the week to 404,500. Continuing claims in data for the October 22 week fell 15,000 to 3.683 million with the four-week average down 10,000 to 3.704 million.

Jobless Claims Consensus Forecast for 11/5/11: 400,000

Range: 394,000 to 410,000

The U.S. international trade gap in August trade deficit was unchanged at $45.6 billion. Exports nudged back down only 0.1 percent after rebounding a sharp 3.4 percent in July. Imports were flat in both August and July. A surprise within the report was the petroleum gap which worsened to $26.1 billion from $25.7 billion the prior month. The nonpetroleum goods gap shrank slightly to $34.3 billion from $34.5 billion in July. The services surplus slipped to $35.1 billion from $35.3 billion in July.

International trade balance Consensus Forecast for September 11: -$46.3 billion

Range: -$49.5 billion to -$44.2 billion

Import prices rose 0.3 percent in September, following a 0.2 percent dip the prior month. Leading the latest rise was a 0.3 percent gain in petroleum goods imports after dropping 1.6 percent in August. Nonpetroleum imports prices advanced a more moderate 0.2 percent in September, following a 0.3 percent increase the month before.

Import prices Consensus Forecast for October 11: -0.2 percent

Range: -1.0 to +0.3 percent

U.S. Holiday: Veterans Day. Bond Market Closed, Other Markets Open, Banks Closed.

The Reuter's/University of Michigan's consumer sentiment index jumped to 60.9 for final October, a reading that compared with a very weak 57.5 at mid-month to imply a 64.3 level for the final two weeks of the month. The 64.3 implied reading puts the last two weeks of this month on a par with July which was of course just before the shocks of August threw sentiment to 30 year lows. The latest improvement was centered in the leading component of expectations which jumped 4.8 points to 51.8. The current conditions component also rose, up 1.3 points to 75.1.

Consumer sentiment Consensus Forecast for preliminary November 11: 61.5

Range: 58.5 to 68.0

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|