|

It was not gangbusters but the September employment report was largely positive and beat expectations with gains topping 100,000 for total and private payrolls. And July and August were better than previously believed. Apparently, businesses are seeing enough activity to no longer refuse to hire. So, the latest employment report gives the economy an upgrade to not quite as sluggish as thought. And there is a lower probability of another recession, at least technically. But it was the belief that progress is being made regarding European debt that mainly moved markets.

Equities posted net gains for the week as progress was seen in resolving the European sovereign debt crisis. But the week started ugly with large losses on Monday as investors weighed continued pessimism over Europe’s efforts to contain its sovereign debt problems against positive news in the U.S. Europe’s problems outweighed better-than-expected ISM manufacturing and construction outlays. Equities posted net gains for the week as progress was seen in resolving the European sovereign debt crisis. But the week started ugly with large losses on Monday as investors weighed continued pessimism over Europe’s efforts to contain its sovereign debt problems against positive news in the U.S. Europe’s problems outweighed better-than-expected ISM manufacturing and construction outlays.

But a three-day winning streak started Tuesday initially with Fed Chairman Bernanke’s comments before Congress bumping up stocks. But real lift came just before close on a web story in the Financial Times of London saying that European Union finance ministers are examining ways of coordinating recapitalizations of financial institutions to shore up the region’s banks. Short covering also added lift.

At mid-week, a better-than-expected (according to some surveys) ADP employment report bolstered equities. Also, the ISM non-manufacturing report was positive and topped analysts’ projections. On Thursday, stocks got an initial boost from overseas as the European Central Bank said it will revive its 12-month loan operations and purchases of covered bonds, while keeping its key interest rate unchanged at 1.5 percent. And the Bank of England said it will be engaging in another round of quantitative easing. Back in the U.S., initial jobless claims posted lower than expected, adding to upward momentum in equities.

At week’s close, in thin markets (Yom Kippur weekend starting Friday evening), major indexes were down for the day despite a largely favorably employment report for September. Better-than-expected payroll gains were offset by rating agency Fitch downgrading the credit ratings of Italy and Spain.

Net for the week, apparent progress on resolving European sovereign debt issues and improved economic data boosted equities.

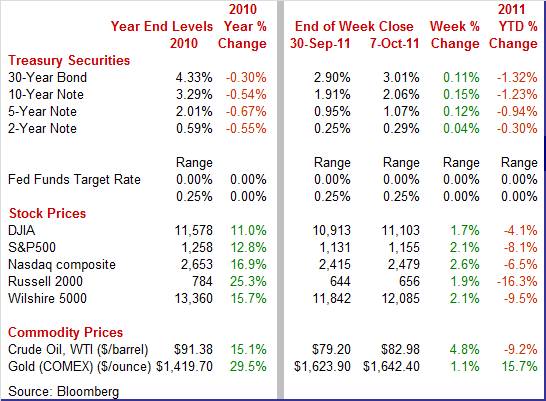

Equities were up this past week. The Dow was up 1.7 percent; the S&P 500, up 2.1 percent; the Nasdaq, up 2.6 percent; and the Russell 2000, up 1.9 percent.

For the year-to-date, major indexes are down as follows: the Dow, down 4.1 percent; the S&P 500, down 8.1 percent; the Nasdaq, down 6.5 percent; and the Russell 2000, down 16.3 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

On favorable economic news and progress on European sovereign debt, Treasury yields rose this past week. But rates headed down at the start of the week as on Monday,  the Fed started its Maturity Extension Program (commonly called “Operation Twist”) early in the day and bumped long rates down. Also, later in the day flight to safety set in as equities sank, further lowering yields. the Fed started its Maturity Extension Program (commonly called “Operation Twist”) early in the day and bumped long rates down. Also, later in the day flight to safety set in as equities sank, further lowering yields.

Rates headed up during the remainder of the week. Tuesday through Thursday, progress was seen in resolving European debt problems. Also, economic news was favorable with ADP and ISM non-manufacturing on Wednesday and jobless claims on Thursday (not up as much as expected). Fitch’s downgrade to Italy and Spain on Friday was outweighed by the unexpectedly strong employment situation report, nudging rates further up.

For this past week Treasury rates were up as follows: the 2-year note, up 4 basis points; the 5-year note, up 12 basis points; the 7-year note, up 16 basis points; the 10-year note, up 15 basis points; and the 30-year bond, up 11 basis points. The 3-month T-bill slipped 1 basis point.

The spot price of crude rebounded this week on favorable economic indicator news, on progress on sovereign debt, and on lower inventories. Stockpiles for the latest week fell 4.68 million barrels to 336.3 million last week. This was in contrast to analysts expecting a gain of 1.5 million barrels. The spot price of crude rebounded this week on favorable economic indicator news, on progress on sovereign debt, and on lower inventories. Stockpiles for the latest week fell 4.68 million barrels to 336.3 million last week. This was in contrast to analysts expecting a gain of 1.5 million barrels.

Net for the week, the spot price for West Texas Intermediate gained $3.78 per barrel to settle at $82.98.

The week’s economic news was better-than-expected and largely positive, culminating in a favorable employment situation report for September.

The September employment situation provided several modest and positive surprises. The consumer sector may be in slightly better condition than believed. But employment growth is still too soft to bring down the unemployment rate. The September employment situation provided several modest and positive surprises. The consumer sector may be in slightly better condition than believed. But employment growth is still too soft to bring down the unemployment rate.

Job growth improved more than expected in September as payroll jobs advanced 103,000 in September, following a revised 57,000 rise in August (originally flat) and revised 127,000 increase in July (previously 85,000). Private nonfarm payrolls were somewhat stronger than the total, gaining 137,000 in September, following a 42,000 increase in August and 173,000 boost in July. A return of striking telecommunications workers added about 45,000 to the payroll total and private tally. Still, prior months’ revisions were substantial at a net gain of 99,000 and more than offset the returning strikers effect.

In the private sector, goods-producing jobs rebounded modestly while service-providing jobs posted a notable gain. Goods-producing jobs rebounded 18,000 after a 9,000 decrease in August. Manufacturing jobs fell 13,000 after a 4,000 dip the month before. Motor vehicle industry jobs were flat in September and declined 6,000 in August. Some of the volatility may be related to difficulty in seasonally adjusting for retooling and due to on and off supply constraints from Japanese parts. But given recently healthy auto sales, the auto industry is likely to see moderate employment gains.

Construction rebounded a sizeable 26,000, following a 7,000 decline in August. However, some of the construction gain may be related to improved weather after a hurricane stricken August. Mining grew 5,000, following a 3,000 gain the prior month.

Private service-providing jobs jumped 119,000 in September, following a 51,000 gain the prior month. The August gain was led by professional & business services (up 48,000) and health care (up 44,000). Temp help gained 19,400. Employment in information was up by 34,000 over the month due to the return of about 45,000 telecommunications workers to payrolls after an August strike.

The public sector shrank as government employment fell 34,000, following a 15,000 rise in August. August overall government employment would have declined other than due to a return of 22,000 Minnesota government workers from a partial government shutdown. The September drop in government employment was led by local government, down 35,000 with 24,400 in local government education. Federal employment edged down 1,000 while state government rose 2,000. The public sector shrank as government employment fell 34,000, following a 15,000 rise in August. August overall government employment would have declined other than due to a return of 22,000 Minnesota government workers from a partial government shutdown. The September drop in government employment was led by local government, down 35,000 with 24,400 in local government education. Federal employment edged down 1,000 while state government rose 2,000.

Wages rebounded 0.2 percent in September after dipping 0.2 percent the prior month. On a year-ago basis, average hourly earnings are up 1.9 percent, compared to 1.8 percent in August. The average workweek for all workers in September ticked up to 34.3 hours from 34.2 hours in August. Wages rebounded 0.2 percent in September after dipping 0.2 percent the prior month. On a year-ago basis, average hourly earnings are up 1.9 percent, compared to 1.8 percent in August. The average workweek for all workers in September ticked up to 34.3 hours from 34.2 hours in August.

From the household survey, the unemployment rate held steady at 9.1 percent. However, an expanded definition of underemployment showed notable worsening as the percent unemployed, underemployed for economic reasons, and those wanting but not looking for a job rose to 16.5 percent from 16.2 percent in August. The rise in this broad measure was largely due to a jump in those employed only part time for economic reasons. This could be due to either previously full-time workers getting reduced hours or due to new hires getting fewer hours than desired. So, it is hard to say if this expanded measure rose for a bad reason or a good reason. However, for the long-term unemployed, conditions are worsening as the median number of weeks of unemployment rose to 22.2 weeks in September from 21.8 the prior month.

Looking ahead to economic indicators partially reliant on input from the employment report, today’s numbers point to a healthy private wages & salaries component in the upcoming personal income report. Aggregate private weekly earnings jumped 0.6 percent in September. However, industrial production for September is likely to be soft outside of autos as production worker hours in manufacturing were flat for the month.

September's report indicates that the labor market is not quite as sluggish as earlier believed. Importantly, the services sector may be gaining mild momentum. The good news is that despite continuing headwinds in the labor market, we are likely to see some favorable numbers for the consumer sector this month. And the first set of numbers out of the starting gate was motor vehicle sales which indeed looked good.

Consumers returned to showrooms in September and were happy to see replenished inventories previously held back by disrupted supply in Japan. Car buyers responded by boosting overall unit new motor vehicle sales to an annualized 13.1 million units which were up 8.0 percent from August’s 12.1 million units. Also, higher incentives were a factor behind the sales jump. Consumers returned to showrooms in September and were happy to see replenished inventories previously held back by disrupted supply in Japan. Car buyers responded by boosting overall unit new motor vehicle sales to an annualized 13.1 million units which were up 8.0 percent from August’s 12.1 million units. Also, higher incentives were a factor behind the sales jump.

The gain was centered strongly in light trucks which have higher sticker prices and which strengthens the likelihood for a huge monthly gain in the motor vehicle component of the retail sales report. Sales of domestic models rose to 10.0 million units in September from 9.4 million the prior month while imports increased to 3.1 million from 2.7 million.

Manufacturing grew in September, according to the Institute for Supply Management, but there is little forward momentum. The composite index rose 1.0 point to 51.6 in September, largely on production and employment. The production index gained 2.6 points to 51.2. And factories were hiring as the employment index rose further into positive territory, moving to 53.8 from 51.8 in August. Manufacturing grew in September, according to the Institute for Supply Management, but there is little forward momentum. The composite index rose 1.0 point to 51.6 in September, largely on production and employment. The production index gained 2.6 points to 51.2. And factories were hiring as the employment index rose further into positive territory, moving to 53.8 from 51.8 in August.

But the new orders index was under 50 for a third month in a row, though just barely at 49.6. Manufacturers, waiting for new orders to pick up, have been chewing through back orders in recent months and continued to do so in September as backlog orders fell 4.5 points to a 41.5 level that indicates sizable contraction. One plus on the order side was a pickup in new export orders which rose two points to 53.5.

The services and construction sectors appear to be picking up modest strength. Current activity is modestly positive with new orders showing improvement. The overall composite index posted at 53.0 in September, above breakeven of 50 and barely down from August’s 53.3. The services and construction sectors appear to be picking up modest strength. Current activity is modestly positive with new orders showing improvement. The overall composite index posted at 53.0 in September, above breakeven of 50 and barely down from August’s 53.3.

The new orders index rose a very solid 3.7 points to 56.5, over 50 to indicate monthly growth and well above August to indicate an accelerating rate of monthly growth. Backlog orders are now over 50, up five points to 52.5 to end three months of contraction. These are solid readings that point to rising overall strength for the non-manufacturing sector in the months ahead.

Construction made a comeback in August, largely from the public sector although major private components also gained. Construction spending in August rebounded 1.4 percent in August, following a 1.4 percent drop in July. The rise in August came in much higher than the consensus forecast for a 0.2 percent decrease. Construction made a comeback in August, largely from the public sector although major private components also gained. Construction spending in August rebounded 1.4 percent in August, following a 1.4 percent drop in July. The rise in August came in much higher than the consensus forecast for a 0.2 percent decrease.

The latest month's rebound was led by a 3.1 percent jump in public sector outlays, following a 1.5 percent dip in July. Private residential construction spending made a partial rebound of 0.7 percent, following a 3.2 percent fall the prior month. Private nonresidential outlays edged up 0.2 percent after a 0.3 percent advance the prior month.

The recession mongers were in retreat this past week. The data were mostly soft but an improved soft. And auto sales were actually strong. Looking ahead, there are a number of moderately healthy consumer indicators in the queue for later this month, including retail sales, personal income, and possibly consumer sentiment (based on lower gasoline prices). Momentum appears to be improved for the third quarter but growth still appears to be modest.

A light week is highlighted with Friday’s retail sales report which is expected to show consumers spending at a moderately strong clip. Later the same day, consumer sentiment will indicate whether lower gasoline prices are improving the consumer mood. Earlier in the week, Fed minutes on Wednesday detail the debate on “Operation Twist” and Thursday’s international trade data update export trends.

U.S. Holiday: Columbus Day. Equity Markets Open. Bond Markets and Banks Closed.

The Minutes of the September 20-21 FOMC meeting are scheduled for release at 2:00 p.m. ET. Traders will be parsing the minutes for detail on the debate for implementing “Operation Twist” and on whether there are hints of another round of quantitative easing.

The U.S. international trade gap in July narrowed to $44.8 billion from $51.6 the month before. Importantly, exports rebounded 3.6 percent after dropping 2.2 percent in June. The gain was the biggest in four months and the level set a record high. On the flip side, imports slipped 0.2 percent in July, following a 1.1 percent decline the month before. The smaller trade gap came from shrinkage in all three major components. The improvement in the trade gap was led by the petroleum deficit which narrowed to $25.6 billion from $29.4 billion in June. The nonpetroleum goods gap also narrowed—to $34.1 billion from $36.6 billion the prior month. The services surplus grew to $15.8 billion in July from $15.5 billion the month before.

International trade balance Consensus Forecast for August 11: -$46.0 billion

Range: -$48.3 billion to -$42.6 billion

Initial jobless claims for the October 1 week rebounded 6,000 to 401,000. The four-week average posted at 414,000. Continuing claims likewise showed no conclusive change. Data for the September 24 week showed a 52,000 decrease to 3.700 million but the four-week average of 3.739 million was virtually unchanged with the month-ago comparison.

Jobless Claims Consensus Forecast for 10/8/11: 405,000

Range: 395,000 to 425,000

The U.S. Treasury monthly budget report showed an August deficit of $134.2 billion to lift the fiscal year-to-date deficit to $1.23 trillion which was just under the $1.26 trillion deficit for this time last year. Looking ahead, the month of September typically shows a moderate surplus. Over the past 10 years, the average surplus for the month of September has been $29.8 billion and $27.0 billion over the past 5 years. The September 2010 budget number came in at deficit of $34.6 billion.

Treasury Statement Consensus Forecast for September 11: -$64.5 billion

Range: -$85.0 billion to -$40.0 billion.

Retail sales in August slowed to flat after rising 0.3 percent in July. Excluding autos, sales edged up 0.1 percent, following a 0.3 percent rise in July. Gasoline sales rose 0.3 percent after jumping 0.9 percent in July. Sales excluding autos and gasoline in August increased 0.1 percent, following a 0.2 percent rise in July. Outside of autos and gasoline, sales were mixed.

Retail sales Consensus Forecast for September 11: +0.8 percent

Range: +0.4 to +1.6 percent

Retail sales excluding motor vehicles Consensus Forecast for September 11: +0.4 percent

Range: +0.1 to +1.0 percent

Import prices in July rose on higher petroleum costs with a 0.3 percent gain versus June's 0.6 percent decline in a month when petroleum prices fell. Prices for imported petroleum products rose 0.6 percent in July, following a 2.2 percent drop the month before. Excluding petroleum, import prices rose 0.2 percent, following a 0.1 percent rise in June.

Import prices Consensus Forecast for August 11: -0.5 percent

Range: -1.2 to +0.4 percent

The Reuter's/University of Michigan's consumer sentiment index improved marginally for the final reading for September, printing at 59.4 versus 57.8 at mid-month and 55.7 at month-end August. The 1.6 point gain in the month-end to mid-month September comparison implies a 61.0 reading for the last two weeks of the month. Though higher than the shock-infested month of August, this reading was the weakest since the recession period of early 2009.

Consumer sentiment Consensus Forecast for preliminary October 11: 60.0

Range: 57.0 to 64.0

Business inventories in July increased a moderate 0.4 percent against a 0.7 percent rise for business sales. The stock-to-sales ratio edged lower to 1.27 from June's 1.28. More recently, factory inventories gained 0.4 percent in August with wholesaler inventories also rising by the same percentage. These suggest a likely rise in overall business inventories for the month, baring a sharp decline in retail inventories.

Business inventories Consensus Forecast for August 11: +0.4 percent

Range: +0.1 to +0.6 percent

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|