|

This past week, there were two key opportunities for enlightenment on monetary and fiscal policy with speeches on Thursday by Fed Chairman Ben Bernanke in the afternoon and President Barack Obama in the evening. Despite plenty of telegraphing about key points, markets were disappointed in the policy remarks. Concern about Greek sovereign debt moved equities in both directions this past week but significantly more down than up. Meanwhile, light economic news in the U.S. was more on the positive side.

Equities ended the holiday-shortened week down significantly with a Friday plunge offsetting what had appeared to be a positive week. The prior Friday’s news continued to weigh on equities as the deeply disappointing August employment situation weighed on markets. Also, the FHFA’s after-close announcement the prior Friday that it is filing lawsuits against 17 large banks over subprime mortgage-backed securities tugged down on financials. A better-than-expected non-manufacturing ISM report helped to limit Tuesday's losses. Equities ended the holiday-shortened week down significantly with a Friday plunge offsetting what had appeared to be a positive week. The prior Friday’s news continued to weigh on equities as the deeply disappointing August employment situation weighed on markets. Also, the FHFA’s after-close announcement the prior Friday that it is filing lawsuits against 17 large banks over subprime mortgage-backed securities tugged down on financials. A better-than-expected non-manufacturing ISM report helped to limit Tuesday's losses.

Stocks gained at mid-week as investors were buoyed by the German Constitutional Court’s rejection of challenges that aimed to block German participation in eurozone bailouts. But the court said future financial rescues must be approved by Parliament’s budget committee. Also, traders got their hopes up that the next day Fed Chairman Ben Bernanke would announce details on possible Fed easing and that President Barack Obama would announce job creation legislation that would boost the economy significantly. The day’s release of the Fed’s Beige Book showed slowing economic conditions but about as expected.

But on Thursday, Bernanke’s early afternoon speech on the economy and monetary policy offered no new details on what the Fed might do at its September 20-21 FOMC meeting. Apparently, traders have forgotten that this is Chairman Bernanke and not Chairman Greenspan. Bernanke prefers to build the consensus rather than force the policy lead. Nonetheless, stocks fell sharply on the lack of news. Initial jobless claims were close to expectations, taking into account revisions.

After close Thursday, President Barack Obama announced his proposal to create jobs and to strengthen the recovery. Even though most of the key points of his some $447 billion package had already been leaked during trading hours on Thursday, traders apparently expected more and stocks dropped significantly at Friday open. Traders also believed that Congress will not pass Obama’s proposal. But the downdraft worsened on speculation and rumors that Greece would default on its debt, worsening the economic slowdown in Europe. Fears worsened on news that officials in Germany are working on a plan to protect that country’s banks if Greece were to default. Greek officials vehemently denied that default is pending but stocks sold off sharply globally.

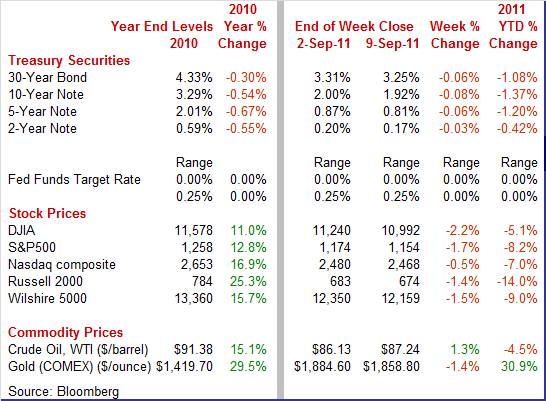

Equities were down this past week. The Dow was down 2.2 percent; the S&P 500, down 1.7 percent; the Nasdaq, down 0.5 percent; and the Russell 2000, down 1.4 percent.

For the year-to-date, major indexes are down as follows: the Dow, down 5.1 percent; the S&P 500, down 8.2 percent; the Nasdaq, down 7.0 percent; and the Russell 2000, down 14.0 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury rates declined this past week, largely on worries about European sovereign debt on the belief the Fed will be easing further. Also, some flight to safety out of equities set in. Treasury rates declined this past week, largely on worries about European sovereign debt on the belief the Fed will be easing further. Also, some flight to safety out of equities set in.

On Tuesday, mid-maturity yields dipped as bond traders concluded that odds were rising that the Fed will be easing soon in light of the weak jobs numbers. The 10-year note yield hit a record low for the day at 1.97 percent.

Rates had a one-day respite from the week’s down trend on Wednesday as speculation that President Obama’s stimulus package would actually do that—create jobs and boost the recovery. Funds moved out of fixed income into equities as stocks rallied. The German Constitutional Court’s decision to allow Germany’s participation in euro rescue funds was seen as reducing risk.

Rates eased Thursday as bond traders had a different take on Fed Chairman Bernanke’s speech. His remarks were seen as laying the groundwork for additional ease at the upcoming FOMC meeting. On the last day of trading, flight to safety set in on speculation that Greece may default and on the news of Germany preparing for such a default. Huge losses for equities also boosted demand for Treasuries. Yields on the 10-year note set a record low at 1.92 percent. Rates eased Thursday as bond traders had a different take on Fed Chairman Bernanke’s speech. His remarks were seen as laying the groundwork for additional ease at the upcoming FOMC meeting. On the last day of trading, flight to safety set in on speculation that Greece may default and on the news of Germany preparing for such a default. Huge losses for equities also boosted demand for Treasuries. Yields on the 10-year note set a record low at 1.92 percent.

For this past week Treasury rates were down as follows: 3-month T-bill, down 1 basis point; the 2-year note, down 3 basis points; the 5-year note, down 6 basis points; the 7-year note, down 6 basis points; the 10-year note, down 8 basis points; and the 30-year bond, down 6 basis points.

In a choppy week of trading, the spot price of crude ended the week up modestly. After a quiet day Tuesday, West Texas Intermediate shot up over $3 per barrel on Wednesday. Crude was boosted by a tropical storm in the Gulf of Mexico that threatened U.S. production there. Also, traders were anticipating the holiday-delayed release of inventory numbers. Tropical Storm Lee shut output the prior week and was believed to reduce inventories. In a choppy week of trading, the spot price of crude ended the week up modestly. After a quiet day Tuesday, West Texas Intermediate shot up over $3 per barrel on Wednesday. Crude was boosted by a tropical storm in the Gulf of Mexico that threatened U.S. production there. Also, traders were anticipating the holiday-delayed release of inventory numbers. Tropical Storm Lee shut output the prior week and was believed to reduce inventories.

On Thursday, the government reported a sizeable drop in crude inventories but prices were little changed on the news as the numbers had been anticipated the day before.

Crude dropped somewhat under $2 per barrel on Friday as the euro crumbled against the dollar on worries about Greek sovereign debt. For the day, the euro fell about 1.5 percent against the dollar.

Net for the week, spot prices for West Texas Intermediate rose $1.11 per barrel to settle at $87.24.

Economic news ranged from mixed to positive this past week. International trade and ISM non-manufacturing posted in the positive column while the Beige Book was sluggish. But the big news on the domestic front was on fiscal and monetary policy speeches.

The economy needs a source of strength and it got it—at least for July. Exports rebounded smartly in July, leading to a better-than-expected trade gap which narrowed to $44.8 billion from $51.6 the month before. Importantly, exports rebounded 3.6 percent after dropping 2.2 percent in June. The gain was the biggest in four months and the level set a record high. On the flip side, imports slipped 0.2 percent in July, following a 1.1 percent decline the month before. The economy needs a source of strength and it got it—at least for July. Exports rebounded smartly in July, leading to a better-than-expected trade gap which narrowed to $44.8 billion from $51.6 the month before. Importantly, exports rebounded 3.6 percent after dropping 2.2 percent in June. The gain was the biggest in four months and the level set a record high. On the flip side, imports slipped 0.2 percent in July, following a 1.1 percent decline the month before.

The smaller trade gap came from shrinkage in all three major components. The improvement in the trade gap was led by the petroleum deficit which narrowed to $25.6 billion from $29.4 billion in June. The nonpetroleum goods gap also narrowed—to $34.1 billion from $36.6 billion the prior month. The services surplus grew to $15.8 billion in July from $15.5 billion the month before.

Looking at end use categories for goods, exports surged 4.8 percent while imports declined 0.3 percent in the latest month. The increase in exports was led by a $2.7 billion jump in industrial supplies, with increases also seen in capital goods excluding autos (up $2.2 billion) and automotive (up $1.3 billion). Modest declines were seen in consumer goods (down $0.6 billion) and food, feeds & beverages (down $0.1 billion). Looking at end use categories for goods, exports surged 4.8 percent while imports declined 0.3 percent in the latest month. The increase in exports was led by a $2.7 billion jump in industrial supplies, with increases also seen in capital goods excluding autos (up $2.2 billion) and automotive (up $1.3 billion). Modest declines were seen in consumer goods (down $0.6 billion) and food, feeds & beverages (down $0.1 billion).

The dip in imports by end use categories was led by a $2.5 billion drop in industrial supplies ($2.2 billion from crude oil). Food, feeds & beverages declined $0.3 billion. Import gains were seen in automotive (up $2.9 billion), capital goods excluding autos (up $0.3 billion), and in consumer goods (up $0.1 billion). The gains in imports for automotive and capital goods are encouraging in that they suggest a pickup in demand for those goods.

The rise in both exports and imports of autos probably was due in part to the lessening of supply disruptions of parts from Japan.

July’s trade numbers are good news for manufacturers, indicating a continuation of demand. Also, the smaller trade gap should lead economists to nudge up their forecasts for third quarter GDP.

A key plus this past week was the ISM non-manufacturing report. But it was not because the numbers were so strong but because key indexes did not turn negative. The Institute For Supply Management’s non-manufacturing composite edged 0.6 points higher to 53.3. This was a sharp contrast with a number of regional surveys that had turned negative. It also topped market expectations for a reading of 51.1. A key plus this past week was the ISM non-manufacturing report. But it was not because the numbers were so strong but because key indexes did not turn negative. The Institute For Supply Management’s non-manufacturing composite edged 0.6 points higher to 53.3. This was a sharp contrast with a number of regional surveys that had turned negative. It also topped market expectations for a reading of 51.1.

The reading is above 50 and indicates monthly growth in activity, albeit modest growth. Because its slightly higher than July, it also indicates a slight acceleration in growth.

New orders show slight but welcome monthly acceleration to 52.8 for a 1.1 point gain from July. The drawdown in backlog orders slowed, which is a positive, while export orders picked up nicely in the month. Though orders have been soft in recent months, business activity, that is production, still remains brisk at 55.6. The ISM's sample, which includes firms in the service sector together with construction and mining, added to their workforces in the month though only slightly and at a slightly lower rate than in July. Supplier deliveries, which slowed in what is a sign of demand, were a major positive for the composite. Notably, inventory growth slowed but remained positive, suggesting that no inventory overhang is developing.

The consumer is managing to contribute to the economy despite the high unemployment rate. This is confirmed in part with the latest consumer credit outstanding numbers. Overall consumer credit advanced $12.0 billion in July, following an $11.3 billion boost the prior month. But the latest increase was due to a solid gain for auto sales in July as nonrevolving credit rose $15.4 billion. Nonrevolving credit has now risen for 11 straight months. The consumer is managing to contribute to the economy despite the high unemployment rate. This is confirmed in part with the latest consumer credit outstanding numbers. Overall consumer credit advanced $12.0 billion in July, following an $11.3 billion boost the prior month. But the latest increase was due to a solid gain for auto sales in July as nonrevolving credit rose $15.4 billion. Nonrevolving credit has now risen for 11 straight months.

In contrast, gains in revolving credit, reflecting credit-card use, have been hard to come by with the component down $3.4 billion in July to end a short run of strength. Consumers continue to deleverage credit card balances and banks are still writing off bad credit card debt though at a slower pace.

Indeed, the latest business cycle for consumer credit has been very different. Growth in revolving credit barely paused during and after the 2001 recession. Revolving credit peaked at $973.6 billion in August 2008 and for July 2011 stands at $792.5 billion—an 18.6 percent cumulative drop.

The good news is that consumers are still spending—but increasingly with cash. Retail sales excluding autos hit a recent bottom of $278.9 billion in March 2009 and for July 2011 posts at $323.6 billion—a cumulative 16.0 percent rebound. Keeping the plastic in wallets has slowed retail sales growth but it likely has been necessary to strengthen consumer balance sheets that had become way out of balance with debt. Until job growth picks up, consumers will likely be reluctant to take on more debt and sales growth will remain moderate. And importantly, sales growth is possible even without the plastic.

The Beige Book prepared for the September 20-21 FOMC meeting indicates that there is no double-dip recession and that the economy continues to expand, although at a “modest pace.” However, some Districts noted mixed or weakening activity. Overall, the report confirms the view that the recovery continues but at a very sluggish pace. Consumer spending is up somewhat but largely on motor vehicle sales. Manufacturing is growing but at a slower pace. Housing is still flat and depressed. Most Districts characterized commercial real estate and construction activity as weak or little changed, but improvements were noted in several areas. Labor markets were generally steady, although some Districts reported modest employment growth. On the inflation front, the majority of Districts reported fewer price pressures, but input costs continued to rise in select industries.

The recent federal debt ceiling legislative fiasco and resulting impact on financial markets did affect the outlook. “Several Districts also indicated that recent stock market volatility and increased economic uncertainty had led many contacts to downgrade or become more cautious about their near-term outlooks.”

Manufacturing conditions were mixed with the pace of activity slowing in many Districts. A positive appears to be that supply disruptions from Japan for the auto sector are easing. Housing is still flat and depressed. Most Districts characterized commercial real estate and construction activity as weak or little changed, but improvements were noted in several areas. Labor markets were generally steady, although some Districts reported modest employment growth. Several Districts reported a shortage of skilled workers such as engineers, mechanics and software developers.

Overall, there were no real surprises in the latest Beige Book and no dramatic ammunition to push for another round of quantitative easing although some on the FOMC could continue to argue that the economy is too sluggish and needs help. The latest Beige Book appears to leave the next policy move on September 21 very much up in the air.

This past Thursday evening, President Barack Obama announced his legislative proposals to rev the recovery back up and to create jobs. His proposals include payroll tax cuts for individuals and businesses, an extension of unemployment benefits, funds for roads and bridges and repairing schools, aid to states for keeping teachers and emergency workers on payrolls, tax credits for businesses that hire long-term unemployment, and tax cuts for hiring Iraq and Afghanistan war veterans.

Temporary payroll tax cuts for workers are already in place but are scheduled to expire at the end of this year. Obama's proposal is to reduce the tax even further from the temporary 4.2 percent for workers to 3.1 percent. Prior to temporary cuts, the rate was 6.2 percent. He also proposes to reduce employers' share of payroll taxes from 6.2 percent to 3.1 percent. The cut for businesses would be limited to the first $5 million for existing payrolls, meaning the reductions primarily benefit small and medium size businesses. The entire 6.2 percent employer contribution would be waived for net increases in a company's payroll up to $50 million.

President Obama also plans to send to Congress his plan on how the 12-member super committee should cut the federal deficit by $1.5 trillion.

The American Jobs Act, according to the president's remarks, should provide significant benefits. It is expected that this act will top $447 billion in tax cuts, tax credits, extended unemployment benefits, and other measures. About $100 billion is expected to be for infrastructure development such as for roads and bridges.

President Obama also called for trade reforms to benefit American producers and exporters.

The president plans to pay for this proposal in part by closing corporate loopholes while at the same time lowering corporate tax rates.

The debate over the Fed’s next policy move heated up a bit this past week. Markets looked forward to Chairman Bernanke’s remarks this past Thursday afternoon but comments were similar to those given in his Jackson Hole speech on August 26 with him not tipping his hand on upcoming Fed moves. Other Fed speakers, however, took relatively strong positions for or against further ease.

Bernanke confirmed many points made earlier, including the commitment to keep the fed funds rate very low through mid-2013. Bernanke noted that the recovery is less robust than hoped. He expects inflation to moderate. The Fed chief also calls for fiscal policymakers to not disregard the economy's current fragility.

Regarding the FOMC's recent dissention, Bernanke notes that the reason for the FOMC structure is to bring together different points of view and analysis. He stated that he has encouraged debate on monetary policy. He stated that debate is "ultimately constructive" and that in the Fed the debate is always "collegial."

But this past week, some of the internal Fed debate was not so internal and sometimes was a little more vocal. Three District Bank presidents spoke up with two leaning toward additional ease and one against.

Minneapolis Fed President Narayana Kocherlakota on Tuesday stated that it is "unlikely" that any more ease in monetary policy is justified at the upcoming meeting. Of course, these comments come on the heels of Friday's deeply disappointing jobs report and reflect the view of a sizeable minority on the FOMC that monetary policy is already substantially loose and the costs of further ease offset minimal benefits. At the August 9 FOMC meeting, Kocherlakota cast one of the three dissenting votes against stating that the Fed likely would keep rates exceptionally low until mid-2013. The Minneapolis Fed chief's comments were relatively strong for the generally collegial Fed debate.

Chicago Fed President disagrees with the view that inflation risks are too high from additional easing and, indeed, calls for further accommodation to help bring down unemployment.

"I would argue that this view [of higher inflation risks from further easing] is extremely, and inappropriately, asymmetric in its weighting of the Fed's dual objectives to support maximum employment and price stability."

In plain English, Evans is saying that the faction within the Fed that is worried about inflation has given the risk of a boost in inflation too much weight relative to the problem of unemployment being too high. Evans specifically calls for additional action by the Fed.

"However, given how truly badly we are doing in meeting our employment mandate, I argue that the Fed should seriously consider actions that would add very significant amounts of policy accommodation. Such further policy accommodation does increase the risk that inflation could rise temporarily above our long-term goal of 2%."

San Francisco Fed President John Williams argued in favor of additional action by the Fed.

"Right now, though, the real threat is an economy that is at risk of stalling and the prospect of many years of very high unemployment, with potentially long-run negative consequences for our economy. There are a number of potential steps the Fed could take to ease financial conditions further and move us closer to our mandated goals of maximum employment and price stability. Of course, these “treatments” won’t make our economic problems go away and their costs and benefits must be carefully balanced. But they could offer a measure of protection against further deterioration in the patient’s condition and perhaps help him get back on his feet."

The bottom line is the Bernanke is waiting on the September 20-21 FOMC meeting. But he has laid the groundwork for some type of move by the Fed at the next meeting. And Bernanke did not choose to dissuade markets that another easing move is pending. Given the 7 to 3 vote at the last FOMC meeting in favor of more aggressive language in the meeting statement, there appear to be enough votes for further easing. And it is almost certain there will be dissent—but Bernanke appears to be fine with that.

Despite weakness in the stock market this past week, economic news in the U.S. was actually favorable. It is the problems in Europe and U.S. fiscal uncertainty that are keeping markets rattled more that recession concerns here. A bi-partisan deficit reduction package and jobs creation bill likely would go a long way to soothing the markets. Whether further Fed action would calm markets or lead them to wonder if the Fed knows more about the economy’s fragility than they are letting on is debatable.

The week’s parade of inflation reports starts with import prices Tuesday and is followed by the PPI on Tuesday and the CPI Wednesday. Manufacturing updates begin with Empire State and industrial production out at mid-week with Philly Fed on tap for Thursday. The highlight, however, is retail sales on Wednesday. A preliminary reading of September consumer sentiment follows on Friday.

Import prices in July gained 0.3 percent—a somewhat slower pace than June's revised 0.6 percent decline in a month when petroleum prices fell. Prices for imported petroleum products rose 0.6 percent in July and fed through to a 0.2 percent rise in industrial supplies excluding petroleum. Excluding petroleum, import prices rebounded 0.2 percent, following a 0.1 percent dip in June. Prices for imported finished goods were mixed showing no change for capital goods though consumer goods showed a less-than-moderate gain of 0.4 percent.

Import prices Consensus Forecast for August 11: -0.9 percent

Range: -2.0 to -0.2 percent

The U.S. Treasury monthly budget report showed a monthly deficit $129.4 billion in July which is very large but an improvement from last July's $165.0 billion deficit. The fiscal year-to-date deficit was $1.10 trillion which is 5.9 percent below this time last year. Receipts, due to gains in the individual income tax component, were up 8.0 percent so far this fiscal year. But outlays were also up, 2.4 percent higher led by increased interest expense. Looking ahead, the month of August typically shows a deficit for the month. Over the past 10 years, the average deficit for the month of August has been $79.1 billion and $97.5 billion over the past 5 years. The August 2010 deficit came in at $90.5 billion.

Treasury Statement Consensus Forecast for August 11: -$132.0 billion

Range: -$161.0 billion to -$121.5 billion.

The producer price index in July rebounded 0.2 percent, following a 0.4 percent drop the month before. By major components, energy dipped 0.6 percent after a 2.8 percent fall in June. Gasoline declined 2.8 percent after dropping 4.7 percent the month before. In contrast, food costs jumped another 0.6 percent in July, following a rebound of 0.6 the previous month. At the core level, PPI inflation accelerated to a 0.4 percent rise after jumping 0.3 percent in June. Strong gains were seen in tobacco products, light trucks, and pharmaceutical preparations.

PPI Consensus Forecast for August 11: -0.1 percent

Range: -0.4 to +0.5 percent

PPI ex food & energy Consensus Forecast for August 11: +0.2 percent

Range: +0.1 to +0.4 percent

Retail sales in July jumped 0.5 percent, following a 0.3 percent rise the month before. Auto sales continued to rebound, rising 0.4 percent, following a 0.7 percent jump in June. Excluding autos, sales were healthy, posting a 0.5 percent increase, following a 0.2 percent rise in June. Sales excluding autos and gasoline in July advanced 0.3 percent, following a 0.5 percent rise in June. Outside of autos and gasoline, sales were mostly positive. Looking ahead, overall retail sales for August are likely to be held back by the autos component as unit new motor vehicle sales slipped 0.8 percent for the month. Also, Hurricane Irene likely weighed on sales along much of the East Coast.

Retail sales Consensus Forecast for August 11: +0.2 percent

Range: -0.3 to +0.7 percent

Retail sales excluding motor vehicles Consensus Forecast for August 11: +0.3 percent

Range: -0.2 to +0.6 percent

Business inventories rose moderate 0.3 percent in June against a 0.4 percent rise in business sales to keep the stock-to-sales ratio unchanged at 1.28. The retail sales component showed a 0.2 percent rise in June versus a 0.3 percent rise in sales. The manufacturing component gained 0.2 percent while wholesaler inventories (largely imports) jumped 0.6 percent. More recently, manufacturers’ inventories increased 0.5 percent in July while, for the same month, wholesalers’ inventories jumped 0.8 percent.

Business inventories Consensus Forecast for July 11: +0.5 percent

Range: +0.3 to +0.6 percent

The consumer price index in July jumped 0.5 percent, following a 0.2 percent dip the prior month. Excluding food and energy, the CPI increased 0.2 percent after a 0.3 percent jump the prior month. Turning to major components, energy rebounded 2.8 percent after dropping 4.4 percent the month before. Gasoline jumped 4.7 percent, following a 6.8 percent plunge in June. Food price inflation accelerated, jumping 0.4 percent, following a 0.2 percent rise in June. Within the core the shelter index accelerated in July (largely lodging, up 0.9 percent), and the apparel index again increased sharply (up 1.2 percent).

CPI Consensus Forecast for August 11: +0.2 percent

Range: -0.2 to +0.3 percent

CPI ex food & energy Consensus Forecast for August 11: +0.2 percent

Range: +0.1 to +0.2 percent

The Empire State manufacturing index in August fell 3.96 points into more deeply negative territory to minus 7.72 to indicate monthly contraction in general business conditions. Details showed a third straight monthly contraction in new orders, down 2.37 points to minus 7.82. Unfilled orders contracted deeply, to minus 15.22 versus July's minus 12.22.

Empire State Manufacturing Survey Consensus Forecast for September 11: -3.6

Range: -15.0 to 0.0

Initial jobless claims were essentially steady in the latest period, up 2,000 to 414,000 in the September 3 week. The latest gain lifted the four-week average 3,750 to 414,750 which is nearly 9,000 above the month-ago comparison. Continuing claims fell 30,000 to 3.717 million in data for the August 27 week with the four-week average up 6,000 to 3.735 million.

Jobless Claims Consensus Forecast for 9/10/11: 412,000

Range: 405,000 to 434,000

Industrial production in July posted a 0.9 percent gain, following a 0.4 percent rise the prior month. By major industry, manufacturing showed significant improvement, advancing 0.6 percent, following rise of 0.2 percent in June. The auto component finally made a comeback, jumping a monthly 5.2 percent after three consecutive declines including June’s 0.9 percent decrease. Excluding motor vehicles, manufacturing rose 0.3 percent, following a 0.2 percent rise in June. Turning to other major sectors, utilities output rose 2.8 percent after increasing 0.8 percent in June. Mining output advanced 1.1 percent after growing 1.2 percent in June. Overall capacity utilization in July improved to 77.5 percent from 76.9 percent the prior month. Looking ahead, the manufacturing component of industrial production is likely to be soft in August as production worker hours slipped 0.1 percent for the month. Also, the ISM manufacturing index was just barely above breakeven while regional manufacturing indexes have been weak.

Industrial production Consensus Forecast for August 11: +0.1 percent

Range: -0.1 to +0.3 percent

Capacity utilization Consensus Forecast for August 11: 77.5 percent

Range: 77.3 to 77.7 percent

The general business conditions index of the Philadelphia Fed's Business Outlook Survey in August plunged to minus 30.7 from plus 3.2 in July. New orders fell to minus 26.8 from plus 0.1 and unfilled orders posted at minus 20.9 versus an already dismal minus 16.3. The six-month outlook for general business activity also crumbled, coming in above zero but just barely at 1.4 versus July's 23.7.

Philadelphia Fed survey Consensus Forecast for September 11: -15.0

Range: -25.0 to -10.0

Quadruple Witching

The Reuter's/University of Michigan's consumer sentiment index for the full month reading for July posted at 55.7 versus 54.9 at mid-month to imply over the last two weeks a 56.5 reading. A look back shows a 55 reading in November 2008 just after the Lehman-led bank meltdown. While conditions are poor currently, the good news is that consumers see a little improvement ahead. Improvement was in the leading component of expectations which rose 1.7 points from mid-month to 47.4. Not surprisingly, the assessment of current conditions actually weakened further, to a final 68.7 for August versus 69.3 at mid-month.

Consumer sentiment Consensus Forecast for preliminary September 11: 56.0

Range: 52.0 to 59.6

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|