|

For once, Europe and the federal debt debate were not the highlights of the week—though they never were too far from center stage. This time, markets awaited Fed Chairman Ben Bernanke’s annual speech at close of the week before the Kansas City Fed’s conference at Jackson Hole, Wyoming.

Despite the intraday volatility and daily drama, stocks made a sharp rebound for the week. Stocks were from flat to up at the start of the week. Gains were robust most of Monday as a notable minority of traders believed that Fed Chairman Ben Bernanke would announce a third round of quantitative easing during his Friday speech at an annual meeting of Fed officials and other central bankers in Jackson Hole, Wyoming. Equities pulled back sharply late in the day, led down by financials on news that Goldman Sachs CEO hired a defense attorney. Despite the intraday volatility and daily drama, stocks made a sharp rebound for the week. Stocks were from flat to up at the start of the week. Gains were robust most of Monday as a notable minority of traders believed that Fed Chairman Ben Bernanke would announce a third round of quantitative easing during his Friday speech at an annual meeting of Fed officials and other central bankers in Jackson Hole, Wyoming. Equities pulled back sharply late in the day, led down by financials on news that Goldman Sachs CEO hired a defense attorney.

Stocks posted major advances Tuesday on a “bad news is good news” philosophy. New home sales and the Richmond Fed manufacturing index unexpectedly dropped. This added to speculation that the Fed will be easing again and soon. On a positive note, the FDIC released a report indicating that the number of failing banks had eased.

But on Wednesday, stocks advanced on good news being good news. Durables orders were much stronger than expected and house prices continued to rise according to the FHFA.

The three-day rally ended Thursday as concern over Europe’s debt crisis re-emerged. Rumors were rampant that ratings agencies would downgrade Germany. All three major ratings agencies stated Thursday that they did not have any changes to their AAA-rating on Germany. Initial jobless claims were up more than expected.

The week ended on a roller coaster ride as tension heightened ahead of Fed Chairman Bernanke’s speech Friday morning. Before the speech, the second estimate for Q2 GDP was in line with expectations. But consumer sentiment unexpectedly nudged higher. The 10:00 a.m. ET Bernanke speech initially was met with disappointment as no new policy initiatives were announced. Bernanke indicated that the Fed is open to considering more stimulus but implied more data are needed. Later in trading hours, traders essentially remembered and took a more forceful position that few really believed the Fed chairman would announce additional balance sheet expansion, meaning the speech met expectations on policy. But lift for stocks came from focus on the belief that the economy is not slowing enough to call for additional stimulus by the Fed.

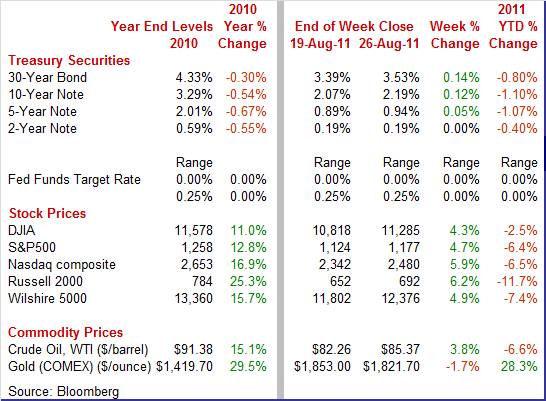

Equities rebounded significantly this past week. The Dow was up 4.3 percent; the S&P 500, up 4.7 percent; the Nasdaq, up 5.9 percent; and the Russell 2000, up 6.2 percent.

For the year-to-date, major indexes are down as follows: the Dow, down 2.5 percent; the S&P 500, down 6.4 percent; the Nasdaq, down 6.5 percent; and the Russell 2000, down 11.7 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

This past week, Treasury yields rebounded moderately.

On the first two days of the week, rates firmed on the belief that likely Fed easing would boost the economy and reduce flight to safety. However, earlier in the day, Tuesday’s 2-year note auction resulted in a coupon rate of 12.5 basis points and is the lowest on record. Yields rose further Wednesday on a very strong durables orders report. Again, earlier in the day, the Treasury auction—this time for 5-year notes—sold at a record low yield.

Rates slipped Thursday on rumors that Germany’s credit rating might be downgraded, leading to flight to safety. Also jobless claims rose more than expected. Once again, the Treasury auction resulted in record low yields—this time for the 7-year note. At week’s close, rates slipped after Fed Chairman Bernanke failed to announce new monetary stimulus which was seen as boosting economic growth if implemented.

During the week, demand for 3-month T-bills was heavy as yields turned negative at close for Monday, Wednesday, and Thursday.

For this past week Treasury rates were up as follows: the 5-year note, up 5 basis points; the 7-year note, up 11 basis points; the 10-year note, up 12 basis points; and the 30-year bond, up 14 basis points. The 3-month T-bill and 2-year T-note were unchanged.

The spot price of West Texas Intermediate rose moderately this past week. Essentially, all of the action was on Monday and Tuesday. Crude advanced almost $2 per barrel the first day and just over $1 the second. Gains both days were fueled by speculation that Fed Chairman Bernanke would announce new stimulus later in the week. Also, the rally in stocks also lifted crude. The spot price of West Texas Intermediate rose moderately this past week. Essentially, all of the action was on Monday and Tuesday. Crude advanced almost $2 per barrel the first day and just over $1 the second. Gains both days were fueled by speculation that Fed Chairman Bernanke would announce new stimulus later in the week. Also, the rally in stocks also lifted crude.

The near completion of rebel takeover of Libya was seen as favorable for prices but more medium term than immediate.

Crude was little changed the last three days of trading during the week.

Net for the week, spot prices for West Texas Intermediate firmed $3.11 per barrel to settle at $85.37.

The economy was mixed this past week. Second quarter growth was revised down. More recent data were mixed—returning to the pattern of manufacturing leading the momentum but with housing tugging down. Despite the gyrations in the political and financial arenas, the consumer is no gloomier. But the Fed is still in debate mode before making further policy moves.

The economy got a downgrade for the second quarter but it was in line with expectations. The Commerce Department’s second estimate for second quarter GDP growth was nudged down to a modest gain of 1.0 percent annualized, compared to the initial estimate of 1.3 percent and to first quarter growth of 0.4 percent. Analysts had projected a revision to 1.1 percent annualized. The economy got a downgrade for the second quarter but it was in line with expectations. The Commerce Department’s second estimate for second quarter GDP growth was nudged down to a modest gain of 1.0 percent annualized, compared to the initial estimate of 1.3 percent and to first quarter growth of 0.4 percent. Analysts had projected a revision to 1.1 percent annualized.

The downward revision to GDP primarily reflected downward revisions to private inventory investment and to exports. These were partly offset by upward revisions to nonresidential fixed investment and to personal consumption expenditures.

Final sales of domestic product were revised to an annualized 1.2 percent from the initial estimate of 1.1 percent. Final sales to domestic purchasers were revised up to 1.1 percent from the original estimate of 0.5 percent annualized.

Economy-wide inflation was revised up marginally to 2.4 percent annualized, compared to the original estimate of 2.3 percent and the first quarter rise of 2.5 percent. The consensus forecast was for 2.3 percent.

While GDP growth was revised down, the more important measure of momentum—final sales—were revised up slightly but are still sluggish.

The timing could not have been better with increased concern about the health of the manufacturing sector. A monthly surge in new orders for motor vehicles & parts, the best in eight years, headlined a strong durable goods report for July. New orders for durable goods surged 4.0 percent in the month with the motor vehicle component up 11.5 percent in what appears to be the hoped for snapback from an earlier shortage of Japanese parts. Aircraft orders, which nearly always show wide month-to-month swings, rose 43 percent and together with motor vehicles made for a 14.6 percent jump in the transportation category. The timing could not have been better with increased concern about the health of the manufacturing sector. A monthly surge in new orders for motor vehicles & parts, the best in eight years, headlined a strong durable goods report for July. New orders for durable goods surged 4.0 percent in the month with the motor vehicle component up 11.5 percent in what appears to be the hoped for snapback from an earlier shortage of Japanese parts. Aircraft orders, which nearly always show wide month-to-month swings, rose 43 percent and together with motor vehicles made for a 14.6 percent jump in the transportation category.

Excluding transportation, new orders rose a solid 0.7 percent following 0.6 and 0.8 percent gains in the two prior months.

However, new orders for nondefense capital goods softened with a 1.5 percent dip in July, following gains of 0.6 percent and 1.9 percent in June and May, respectively. Still, shipments of nondefense capital goods rose 0.2 percent in July, following a 1.9 percent boost in June and 1.7 percent jump in May. July’s shipments are at a strong level, indicating a healthy gain in the third quarter for business equipment, exports or both.

More recent regional surveys on manufacturing have been soft, perhaps limiting the impact of the latest durables reports. But recent regional surveys have been more pessimistic than the national data on durables for several months.

Housing just cannot seem to hold on to improvement—and the bad news is spreading. The prior week's report on existing home sales showed surprising contraction and now new home sales declined again. New single-family home sales dipped 0.7 percent in July to an annualized 298,000 units. This was the third contraction in a row, including decreases of 2.9 percent for June and 2.2 percent for May. Housing just cannot seem to hold on to improvement—and the bad news is spreading. The prior week's report on existing home sales showed surprising contraction and now new home sales declined again. New single-family home sales dipped 0.7 percent in July to an annualized 298,000 units. This was the third contraction in a row, including decreases of 2.9 percent for June and 2.2 percent for May.

Due to the fact that July of last year was a very weak month, this year’s July pace is up 6.8 percent on a year ago basis, compared to minus 2.3 percent in June.

The good news in the report is that supply did not worsen, holding at 6.6 months. New homes for sale slipped an adjusted 0.6 percent in the month to a new record low of 165,000.

Prices of existing homes contracted in July, down a steep 6.3 percent in the month to $222,000. The price numbers, however, are not based on repeat transactions. House price data from the FHFA—which are based on repeat transactions—showed modest strength.

Prices of homes with agency-conforming mortgages rose for a third straight month in June and at an accelerating rate. The FHFA purchase only house price index rose an unexpectedly strong 0.9 percent in June following a 0.4 percent increase in May and 0.3 percent in April. Prices of homes with agency-conforming mortgages rose for a third straight month in June and at an accelerating rate. The FHFA purchase only house price index rose an unexpectedly strong 0.9 percent in June following a 0.4 percent increase in May and 0.3 percent in April.

The year-on-year rate improved for a second straight month, to minus 4.3 percent from minus 6.2 in May (revised from minus 6.3 percent).

Seven of nine census divisions posted monthly gains led by a 3.3 percent gain for the East North Central. At minus 0.8 percent, the Pacific region was the weakest.

Despite negative news on prices from the new home and existing home sales reports, this more reliable measure (based on repeat transactions) is suggesting that prices have bottomed. With lower mortgage rates, buyers appear to be willing to accept higher prices. The FHFA index covers homes with mortgages originating or bundled by government agencies. A broader measure—the Case-Shiller home price index—is out Tuesday, August 30.

It could have been worse. With the debt-ceiling drama, the U.S. credit downgrade, heightened concern over European sovereign debt, and stock market selloff (yes, that’s a long list), there are plenty of reasons for the consumer to grow gloomier. Instead, consumers apparently decided it just can't get any worse and see better days ahead—albeit still sluggish days. It could have been worse. With the debt-ceiling drama, the U.S. credit downgrade, heightened concern over European sovereign debt, and stock market selloff (yes, that’s a long list), there are plenty of reasons for the consumer to grow gloomier. Instead, consumers apparently decided it just can't get any worse and see better days ahead—albeit still sluggish days.

The Reuters/University of Michigan full month reading for July posted at 55.7 versus 54.9 at mid-month to imply over the last two weeks a 56.5 reading. A look back shows a 55 reading in November 2008 just after the Lehman-led bank meltdown. A 56 is seen in February 2009. So, essentially the index is just up from completely depressed.

While conditions are poor currently, the good news is that consumers see a little improvement ahead. Improvement was in the leading component of expectations which rose 1.7 points from mid-month to 47.4. Not surprisingly, the assessment of current conditions actually weakened further, to a final 68.7 for August versus 69.3 at mid-month. These levels were seen in late 2008 and early 2009 during some of the worst of the past recession.

It was hyped from the even the previous week as traders, analysts, and investors considered the likelihood of Fed Chairman Ben Bernanke announcing a new Fed initiative on quantitative easing at the Kansas City Fed conference in Jackson Hole, Wyoming for internal Fed debate. Though some argued that QE3 would be announced, nearly all analysts and economists expected no new policy announcement. This consensus was met as Bernanke primarily reaffirmed the Fed's commitment to at least two more years of low policy rates.

He did not elaborate on any likely new quantitative easing but he did announce that the upcoming FOMC meeting has been expanded from one day to two days (September 20-21) to allow for more in-depth discussion about monetary policy. The Fed chief called for more effective fiscal policy. He sees the need for a more sustainable fiscal path. Bernanke stated that the debt ceiling squabble and credit downgrade has hurt consumer and business confidence. He also sees the need for effective tax, trade, and regulatory policies.

Playing the role of realist, Bernanke noted disappointing strength in the recovery. Importantly, he still sees a modest rebound in growth in the second half of this year.

"Notwithstanding these more positive developments, however, it is clear that the recovery from the crisis has been much less robust than we had hoped. . . . Importantly, economic growth has for the most part been at rates insufficient to achieve sustained reductions in unemployment, which has recently been fluctuating a bit above 9 percent. Temporary factors, including the effects of the run-up in commodity prices on consumer and business budgets and the effect of the Japanese disaster on global supply chains and production, were part of the reason for the weak performance of the economy in the first half of 2011; accordingly, growth in the second half looks likely to improve as their influence recedes. However, the incoming data suggest that other, more persistent factors also have been at work."

In terms of monetary policy, the Fed chief neither rules in nor rules out further quantitative easing but states that the FOMC will be engaging in more in-depth discussion of policy. He asserts that the Fed still has additional bullets if needed. Bernanke may be frustrated about the lack of coordination of fiscal policy with monetary policy to encourage a stronger recovery while taking a tack toward long-term fiscal responsibility. He essentially calls on the Administration and Congress to do more to boost the recovery and enact policies that encourage growth in the long term.

Not so low key comments were made about the rancorous debt ceiling debate, implicitly telling Congress to behave and not repeat that poor performance.

"The negotiations that took place over the summer disrupted financial markets and probably the economy as well, and similar events in the future could, over time, seriously jeopardize the willingness of investors around the world to hold U.S. financial assets or to make direct investments in job-creating U.S. businesses."

Overall, Bernanke's remarks were very close to expectations by most analysts. The Fed chairman realizes that with three dissenting votes at the last FOMC meeting, he must act collegially and make sure there is a consensus for further action by the Fed. He also may be providing some cover for Congress to enact more stimulus measures. Markets will be focusing on the outcome of the September 20-21 FOMC meeting and the outcome of the super-committee to determine the details of deficit reduction in the debt ceiling legislation recently enacted.

Despite increased chatter about rising probability of recession, the latest economic news is mixed and not decidedly negative as would be needed for recession. Importantly, of the two very cyclical sectors, manufacturing appears to be regaining strength while housing cannot slip to a much lower level of activity. Monetary policy is still quite accommodative and is providing significant support.

This week’s calendar is jam packed with a heavy focus on the consumer. The week kicks off with personal income (Monday), consumer confidence (Tuesday), ADP (Wednesday) and motor vehicles sales (Thursday). Weekly jobless claims are on tap Thursday followed by the week’s highlight—the employment situation—Friday. Manufacturing updates are posted with Wednesday’s factory orders and Thursday’s ISM. Fed watchers will pick apart the Fed’s FOMC minutes released Tuesday afternoon.

Personal income in June edged up a modest 0.1 percent, easing from a 0.2 percent rise in May. Wages & salaries were unchanged, following a gain of 0.2 percent the prior month. Weighed down by modest job growth, a decline in motor vehicle sales, and a decrease in gasoline prices, consumer spending declined 0.2 percent after posting a 0.1 percent uptick in May. On a more favorable note, real disposable personal income increased 0.3 percent in June, compared to no change in May as inflation was negative and taxes dipped in the latest month. On the inflation front, the headline PCE price index declined 0.2 percent on lower energy costs, after increasing 0.2 percent the month before. The core rate rose but eased to 0.1 percent from 0.2 percent in May. Looking ahead, a 0.6 percent jump in aggregate weekly earnings in July suggests a strong gain in the private wages & salaries component of personal income. PCE price inflation is likely to be hot as the headline CPI for July jumped 0.5 percent. The CPI core rose a more moderate 0.2 percent.

Personal income Consensus Forecast for July 11: +0.3 percent

Range: +0.1 to +0.8 percent

Personal consumption expenditures Consensus Forecast for July 11: +0.5 percent

Range: +0.1 to +0.7 percent

Headline PCE price index Consensus Forecast for July 11: +0.4 percent

Range: 0.0 to +0.4 percent

Core PCE price index Consensus Forecast for July 11: +0.2 percent

Range: +0.1 to +0.2 percent

The pending home sales index in June rose 2.4 percent, following May’s surge of 8.2 percent. But any increase will be taken with a grain of salt as an increased share of signings have fallen through recently, resulting in declines in closings for existing home sales.

Pending home sales Consensus Forecast for July 11: -1.0

Range: -2.0 to +2.5

The Dallas Fed general business activity index in July remained negative for the third month in a row but jumped from minus17.5 to minus 2, suggesting only a slight worsening the latest month. The production index, a key measure of state manufacturing conditions, rose from 5.6 to 10.8, suggesting output growth. Other measures of current manufacturing conditions also indicated growing activity. The shipments index rose to a reading of 7.8 after coming in at zero last month and the new orders index rose sharply from 6.4 in June to 16 in July. Thirty-four percent of firms said order volumes increased in July, the highest share since November 2010. Expectations regarding future business conditions were generally more optimistic in July.

Dallas Fed general business activity index Consensus Forecast for July 11: -6.0

Range: -15.0 to -4.0

The S&P/Case-Shiller home price index (seasonally adjusted 10-city composite) rose 0.1 percent in May, following a 0.4 percent gain the month before. Apparently, supply is down enough to keep monthly price changes from declining. A look at the unadjusted data shows wide gains as the unadjusted composite 10 index rose 1.1 percent. But spring and summer are when demand is strongest. Year-on-year, price contraction deepened slightly to minus 3.6 percent versus minus 3.4 percent in April.

The Conference Board's consumer confidence index rose 1.9 points in July to 59.5 from a revised 57.6 in June. These levels are very depressed and far from an 80 reading that would be consistent with strong economic conditions. The expectations component gained 3 points to 75.4 while the present situation index slipped 1.9 points to 35.7. While more respondents say jobs are hard to get and describe current business conditions as bad, there is less pessimism for coming months. For the six-month outlook, an increased percentage sees more jobs ahead and more say business conditions will improve. Also, more see their income on the rise.

Consumer confidence Consensus Forecast for August 11: 52.5

Range: 45.0 to 59.0

The Minutes of the August 9, 2011 FOMC meeting are scheduled for release at 2:00 p.m. ET.

Traders will be parsing the minutes for more on the reasoning behind the three dissenting votes and for what options the Fed is considering if additional easing is needed.

ADP private payroll employment in July rose 114,000. The BLS private payroll number came in at a higher 154,000.

ADP private payrolls Consensus Forecast for August 11: +110,000

Range: +40,000 to +140,000

The Chicago PMI in July eased but remained well above breakeven 50 at 58.8 versus 61.1 and 56.6 in the prior two months. New orders posted at 59.4 to indicate strong monthly growth though at a slightly slower monthly rate than June's 61.2. Backlog orders also rose in the month, at 55.7 versus June’s contraction of 49.3.

Chicago PMI Consensus Forecast for August 11: 54.0

Range: 49.0 to 56.5

Factory orders fell 0.8 percent in June reflecting a steep 1.9 percent decline in durable goods (revised from minus 2.1 percent). Orders for non-durable goods, the new data in the report, were unchanged in the month. Orders for nondefense capital goods, for defense goods and for transportation equipment were especially weak in June. But there should be a nice rebound in overall orders for July as the advance release for durables showed new orders for durable goods surged 4.0 percent in the month. Excluding transportation, new orders rose a solid 0.7 percent following 0.6 and 0.8 percent gains in the two prior months.

Factory orders Consensus Forecast for July 11: +2.0 percent

Range: +0.5 to +2.8 percent

Initial jobless claims in the August 20 week 5,000 to a seasonally adjusted 417,000 but were skewed higher by a labor strike at telecom provider Verizon that has since ended. The Labor Department says there were at least 8,500 claims related to the strike in the week and at least 12,500 in the prior week (these levels are before adjustment). The four-week average ended its seven-week run of declines, rising 4,000 to a 407,500 level that shows a 7,000 improvement from the month-ago comparison.

Jobless Claims Consensus Forecast for 8/27/11: 407,000

Range: 400,000 to 420,000

Nonfarm business productivity in the second quarter fell 0.3 percent versus a downwardly revised 0.6 percent decline in the first quarter. The decline reflected weak second-quarter output, at plus 1.8 percent, and even weaker first-quarter output, at plus 0.9 percent. Unit labor costs rose 2.2 percent in the second quarter compared the first quarter's upwardly revised 4.8 percent (plus 0.7 percent first reported). The second estimates for the second quarter are likely to result in a larger decline in productivity and larger rise in costs as real GDP growth was just revised down.

Nonfarm Business Productivity Consensus Forecast for revised Q2 11: -0.5 percent annual rate

Range: -0.8 to -0.2 percent annual rate

Unit Labor Costs Consensus Forecast revised Q2 11: +2.6 percent annual rate

Range: +2.0 to +3.6 percent annual rate

The composite index from the ISM manufacturing survey in July eased to a disappointing 50.9 reading from a moderately healthy 55.3 figure for June. Although the July index is still above 50 to indicate monthly expansion in business conditions, it indicates only very marginal growth and is now at the slowest rate so far of the recovery. Forward momentum has stalled. New orders technically contracted in the month, coming in below breakeven at 49.3. However, new orders are volatile and this is the first sub-50 reading since June 2009. Backlog orders contracted more deeply, down four points to 45.0 for the lowest reading since April 2009. Factory managers are still hopeful about output growth as the employment index posted in positive territory 53.5 (indicating workforce gain).

ISM manufacturing composite index Consensus Forecast for August 11: 48.5

Range: 47.0 to 51.9

Construction spending in June advanced 0.2 percent, following a revised 0.3 percent gain in May. The boost was led by private nonresidential outlays with public spending also up. Private nonresidential spending rose 1.8 percent, following a 1.2 percent boost in May. But weakness continues with the usual suspects. Public construction was down 0.7 percent in June after a 0.4 percent rise the month before. Private residential outlays slipped another 0.3 percent after falling 0.8 percent in May.

Construction spending Consensus Forecast for July 11: +0.1 percent

Range: -0.3 to +0.5 percent

Sales of domestic light motor vehicles in July jumped to an annualized 9.50 million unit pace from 8.88 million the month before. Sales improved even for imports which rose to 2.73 million from 2.68 million. Imports, however, still appear to be constrained by shortages of parts from Japan. Sales of combined unit new motor vehicles showed a big monthly gain in July, up 5.8 percent from June to a 12.23 million annual rate. Importantly, the numbers point to a consumer that is still willing to spend and to likely increases in motor vehicle assemblies.

Motor vehicle domestic sales Consensus Forecast for August 11: 9.5 million-unit rate

Range: 9.3 to 9.5 million-unit rate

Motor vehicle total sales Consensus Forecast for August 11: 12.1 million-unit rate

Range: 11.8 to 12.3 million-unit rate

Nonfarm payroll employment in July advanced 117,000, following a revised 46,000 rise in June, and a revised 53,000 increase in May. Private sector growth was somewhat healthier as private nonfarm payrolls grew 154,000 in July, following an 80,000 rise in June and 99,000 increase in May. In the private sector, improvement was seen in both goods-producing and services-providing sectors. The public sector weighed on overall employment. Wage growth picked up as average hourly earnings increased 0.4 percent, following no change in June. The average workweek for all workers in July was unchanged at 34.3 hours and matched the market consensus. From the household survey, the unemployment rate slipped to 9.1 percent from 9.2 percent in June.

Nonfarm payrolls Consensus Forecast for August 11: +67,000

Range: -5,000 to +150,000

Private payrolls Consensus Forecast for August 11: +93,000

Range: +5,000 to +180,000

Unemployment rate Consensus Forecast for August 11: 9.1 percent

Range: 9.0 to 9.2 percent

Average workweek Consensus Forecast for August 11: 34.3 hours

Range: 34.3 to 34.4 hours

Average hourly earnings Consensus Forecast for August 11: +0.2 percent

Range: 0.0 to +0.3 percent

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|