|

Most of this past week’s indicator news was housing related. Starts and home prices were on the favorable side but the levels of activity—especially for sales—indicate that this sector still has a long way to go for recovery. Earnings and progress on Greek sovereign debt and on boosting the U.S. debt ceiling lifted equities.

Economic news was mixed this past week but earnings reports were mostly favorable. But stocks started on the wrong foot Monday as worries about Greek debt and then lack of progress on the U.S. debt ceiling bumped them down. Economic news was mixed this past week but earnings reports were mostly favorable. But stocks started on the wrong foot Monday as worries about Greek debt and then lack of progress on the U.S. debt ceiling bumped them down.

But after close Monday, the mood grew cheerier on strong earnings from IBM and Coca-Cola. Helping to keep the mood positive Tuesday were unexpectedly strong housing starts data. Also, stocks jumped after President Barack Obama endorsed a bipartisan $3.7 trillion deficit reduction plan from the “Gang of Six.” Strong earnings reports also were posted by Harley-Davidson and Apple. At mid-week, existing home sales disappointed somewhat, doubts returned about the federal government being able to pass an increase in the debt ceiling, and equities slipped.

Thursday, stocks rose significantly on optimism about a European agreement on Greece and on the debt ceiling negotiations in Washington. Afternoon reports indicated that President Obama and others in the negotiations denied the reports. Shortly before markets closed in the US, eurozone heads of government reached agreement on a rescue packages for Greece, lowering interest rates on debt and extending the repayment schedules.

On the final day of trading, equities were mostly up even though the Dow was pulled down by a sharp decline in Caterpillar as the construction equipment maker’s earnings fell short of forecasts, attributed largely to a reduction in sales in Japan due to the earthquake. Other earnings reports were mostly positive, providing lift for broader indexes. Standouts included General Electric, Sandisk, AMD, McDonald’s, and Honeywell. Doubts, however, returned regarding enacting debt ceiling legislation, taking some of the steam out of the day’s gains.

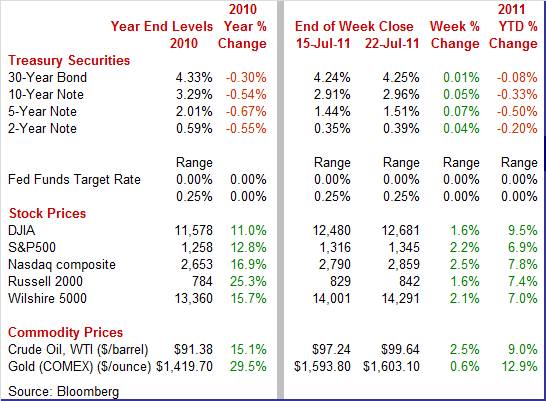

Equities were up this past week. The Dow was up 1.6 percent; the S&P 500, up 2.2 percent; the Nasdaq, up 2.5 percent; and the Russell 2000, up 1.6 percent.

For the year-to-date, major indexes are up as follows: the Dow, up 9.5 percent; the S&P 500, up 6.9 percent; the Nasdaq, up 7.8 percent; and the Russell 2000, up 7.4 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury yields swung moderately during the week on changes in sentiment on progress on Greek debt and on the U.S. debt ceiling and deficit reduction plans. Rates dipped notably Tuesday on news of President Obama endorsing a bipartisan plan for addressing the debt ceiling and deficit reduction. Events in Europe bumped Treasury rates up on Wednesday on reversal of flight to safety amid optimism that the European sovereign debt crisis is being resolved. Resistance from some House Republicans to the bipartisan debt ceiling proposal also added to rates firming. On Thursday, European leaders’ announcement of a bailout plan for Greece led funds out of Treasuries where rates have been extremely low or nonexistent. At close of the week, bond traders leaned toward the view that President Barack Obama will reach an agreement with lawmakers to raise the debt ceiling and cut the U.S. budget deficit, bumping rates back down. Treasury yields swung moderately during the week on changes in sentiment on progress on Greek debt and on the U.S. debt ceiling and deficit reduction plans. Rates dipped notably Tuesday on news of President Obama endorsing a bipartisan plan for addressing the debt ceiling and deficit reduction. Events in Europe bumped Treasury rates up on Wednesday on reversal of flight to safety amid optimism that the European sovereign debt crisis is being resolved. Resistance from some House Republicans to the bipartisan debt ceiling proposal also added to rates firming. On Thursday, European leaders’ announcement of a bailout plan for Greece led funds out of Treasuries where rates have been extremely low or nonexistent. At close of the week, bond traders leaned toward the view that President Barack Obama will reach an agreement with lawmakers to raise the debt ceiling and cut the U.S. budget deficit, bumping rates back down.

Despite the moderate daily volatility, rates have remained extremely low as reflected in the 3-month T-bill which even traded at times with a marginally negative yield. By week’s close, reversal of flight to safety on progress on Greece was the deciding factor as rates firmed for the week. Despite the moderate daily volatility, rates have remained extremely low as reflected in the 3-month T-bill which even traded at times with a marginally negative yield. By week’s close, reversal of flight to safety on progress on Greece was the deciding factor as rates firmed for the week.

For this past week Treasury rates were mostly up as follows: 3-month T-bill, up 2 basis points; the 2-year note, up 4 basis points; the 5-year note, up 7 basis points; the 7-year note, up 7 basis points; the 10-year note, up 5 basis points; and the 30-year bond, up 1 basis point.

The spot price of crude trended up this past week. Much of the rise was related to progress on bailing out Greece as the euro was up about 1.5 percent against the dollar for the week and as the Dollar Index declined about 1.3 percent. Also supporting the increase in the price of oil were generally better-than-expected earnings. Providing a little extra lift on Tuesday were housing starts which topped expectations. The spot price of crude trended up this past week. Much of the rise was related to progress on bailing out Greece as the euro was up about 1.5 percent against the dollar for the week and as the Dollar Index declined about 1.3 percent. Also supporting the increase in the price of oil were generally better-than-expected earnings. Providing a little extra lift on Tuesday were housing starts which topped expectations.

Overall, prices have been drifting up since late June. Net for the week, spot prices for West Texas Intermediate gained $2.40 per barrel to settle at $99.64.

The latest economic news shows the housing sector to still be anemic, though not worsening. Meanwhile, manufacturing may be coming out of a soft patch.

Housing construction is continuing to move up—but from near rock bottom. Housing starts jumped 14.6 percent in June, following no change in May. June’s annualized pace of 0.629 million units came in higher than the consensus projection for 0.575 million units and is up 16.7 percent on a year-ago basis. The boost in June was led by a 30.4 percent surge in the multifamily component, following a 2.2 percent dip in May. The single-family component rose 9.4 percent after gaining 0.7 percent the prior month. Housing construction is continuing to move up—but from near rock bottom. Housing starts jumped 14.6 percent in June, following no change in May. June’s annualized pace of 0.629 million units came in higher than the consensus projection for 0.575 million units and is up 16.7 percent on a year-ago basis. The boost in June was led by a 30.4 percent surge in the multifamily component, following a 2.2 percent dip in May. The single-family component rose 9.4 percent after gaining 0.7 percent the prior month.

New construction is not being weighed down by heavy supply quite as much as over most of the past two years. From last month’s report on new home sales, months’ supply is now down to almost 6 months. Homebuilders are beginning to venture back with increased activity as housing permits advanced 2.5 percent, following an 8.2 percent surge in May. But the level of activity is still very subdued as the percent changes are large due to a very low baseline. Overall permits stood at an annualized rate of 0.624 million units and are up 6.7 percent on a year-ago basis. New construction is not being weighed down by heavy supply quite as much as over most of the past two years. From last month’s report on new home sales, months’ supply is now down to almost 6 months. Homebuilders are beginning to venture back with increased activity as housing permits advanced 2.5 percent, following an 8.2 percent surge in May. But the level of activity is still very subdued as the percent changes are large due to a very low baseline. Overall permits stood at an annualized rate of 0.624 million units and are up 6.7 percent on a year-ago basis.

Unfortunately, this week’s report on existing home sales indicates that homebuilders should remain cautious.

Based on existing home sales, there is not much reason to expect starts to accelerate soon. Sales of existing homes failed to pick up in June, slipping 0.8 percent to an annual adjusted rate of 4.770 million and following May’s 3.8 percent decline. Based on existing home sales, there is not much reason to expect starts to accelerate soon. Sales of existing homes failed to pick up in June, slipping 0.8 percent to an annual adjusted rate of 4.770 million and following May’s 3.8 percent decline.

More homes are coming on the market, at an unadjusted 508,000 for an 11 percent gain from May. Certainly, some of the increased supply is seasonal but months’ supply is now back up to 9.5 months at the current sales rate versus 9.1 months in May. This is still lower than the recent high of 12.5 months in July 2010.

Distressed sales made up 30 percent of sales in the latest month, little changed from May, with all cash transactions making up 29 percent of sales, also little changed. First-time buyers fell back to 31 percent from 36 percent in May. These numbers suggest that the credit is still tight and that traditional demand from household formation is still soft.

Price readings are positive but come with a couple of caveats. The median price jumped a monthly 8.9 percent to $184,300 with the year-on-year rate moving into positive ground for the first time this year at plus 0.8 percent. Note that prices in this report are not seasonally adjusted and spring and summer are when prices are seasonally stronger. Still, year-on-year strength does point to strength outside of seasonal factors. However, the second caveat is that prices are not a repeat transactions measure (same house price changes) and shifts in composition of sales (high end versus low end) affect the median prices. The good news is that some of the price improvement does appear to be real—based on FHFA data in a separate report.

Home prices certainly do not move as dramatically on a monthly basis as suggested by existing home sales data. But there is evidence that prices are stabilizing. Home prices in in May rose for the second month in a row. The FHFA (Federal Housing Finance Agency) purchase only house price index rose 0.4 percent in May, following a 0.2 percent increase in April. Home prices certainly do not move as dramatically on a monthly basis as suggested by existing home sales data. But there is evidence that prices are stabilizing. Home prices in in May rose for the second month in a row. The FHFA (Federal Housing Finance Agency) purchase only house price index rose 0.4 percent in May, following a 0.2 percent increase in April.

On a year-on-year basis, the FHFA HPI is down 6.3 percent versus down 6.4 percent in April.

For the nine Census Divisions, seasonally adjusted monthly price changes for month-ago May ranged from minus 1.0 percent in the West South Central Division to plus 2.0 percent in the Mountain Division. Six of the nine Census Divisions improved in May.

The next update on home prices is with the Case-Shiller home price index out on Tuesday, July 26.

Manufacturing in the Mid-Atlantic region may be starting to recover from a soft patch. The Philly Fed's general business conditions index improved to 3.2 for July, only a bit above break-even zero to indicate very slight growth compared to June. But this is better than June's reading of minus 7.7 and is in line with the soft reading in May of 3.9. Basically, overall conditions are improving marginally after a dip in June. Manufacturing in the Mid-Atlantic region may be starting to recover from a soft patch. The Philly Fed's general business conditions index improved to 3.2 for July, only a bit above break-even zero to indicate very slight growth compared to June. But this is better than June's reading of minus 7.7 and is in line with the soft reading in May of 3.9. Basically, overall conditions are improving marginally after a dip in June.

But forward momentum is flat instead of gaining strength. New orders posted at 0.1, compared to June's depressed level of minus 7.6 that indicated contraction. Backlogs, at minus 16.3 for a second month, show significant contraction and indicate that manufacturers in the region are keeping production running by working down orders in their pipeline. In turn, shipments are showing modest growth from the work down in orders.

Nonetheless, plant managers appear to be a little optimistic about improving conditions as hiring picked up a bit this month. This sunnier outlook is showing up in the six-month outlook index for general business conditions which jumped to 23.7 from 2.5 in June. The bottom line is that current conditions are soft but there are signs of moderate strengthening ahead.

Economic growth during the first half of the year was quite sluggish. But leading indicators suggest that growth will strengthen in the second half. Economic growth during the first half of the year was quite sluggish. But leading indicators suggest that growth will strengthen in the second half.

The Conference Board’s index of leading indicators rose 0.3 percent in June on top of May's outsized gain of 0.8 percent. The top factor for June was an increase in money supply with the second factor once again the yield spread between long rates and short rates with the latter being kept near zero by the Federal Reserve. Building permits are a slight plus as is a slowing in vendor performance, a slowing that points to activity in the supply chain. The negative side is led by consumer expectations which have slid back toward recovery lows. The stock market is also a negative for June as is the factory workweek.

The composite index of coincident indicators confirms current softness in growth, edging up only 0.1 percent—the same rate as in May.

Housing has improved only modestly from recession lows. But home prices appear to have stabilized. Manufacturing may be regaining some strength and leading indicators are moderately positive. Initial indications are that the second half of the year is going to be somewhat better than the first half.

Numerous reports on the health of the manufacturing sector including the Dallas, Richmond and Kansas City Fed regional reports and durable goods orders are on tap. The housing sector is updated with Case-Shiller home price index, new homes sales and pending home sales. But the highlight is Friday’s advance report on second quarter GDP. Finally, Fed watchers will hone in on the Beige Book in preparation for the August 9 FOMC meeting.

The Dallas Fed general business activity index weakened further in June, declining to minus 17.5 from minus 7.4 in May. However, the production index remained positive but slowed to 5.6 from 12.7 in May. A modest positive in the report was a rise in the new orders index which improved to 6.4 from 1.1 the prior month. But profit spreads may be improving as the prices paid index softened to 31.1 in June from 42.3 in April while the prices received index rose to 10.0 from 8.8.

The S&P/Case-Shiller home price index, 10-city composite that's seasonally adjusted, was unchanged in April, following a 0.1 percent dip in March. This index had declined four months in a row. Importantly, the Case-Shiller data are three-month moving averages of the underlying data which suggest an actual gain for April. Unadjusted readings were very positive though seasonality plays a big part in the housing market which benefits from warm weather and many sales are timed for moving when school is not in session during the summer. The unadjusted composite 10 index gained 0.8 percent in the month, offsetting an equal decline in March. However, the year-on-year rate remains negative at minus 3.1 percent (the same reading as the adjusted rate).

The Conference Board's consumer confidence index in June fell significantly for a second straight month, down more than three points to 58.5. The assessment of the present situation dipped 1.7 points to 37.6 while the expectations measure declined 4.3 points to 72.4.

Consumer confidence Consensus Forecast for July 11: 57.0

Range: 50.0 to 60.0

New home sales fell 2.1 percent in May to a 319,000 annualized pace. Supply in terms of months dipped slightly to 6.2 months from 6.3 in April and from 6.9 in March. Supply in terms of the number of homes on the market, down 6,000 to 166,000, has never been lower in nearly 50 years of data. Low supply is a plus for prices which may be firming, up 2.6 percent to a median $222,600.

New home sales Consensus Forecast for June 11: 321 thousand-unit annual rate

Range: 309 thousand to 342 thousand-unit annual rate

The Richmond Fed manufacturing index in June rose a sizable nine points to plus three to indicate mild month-to-month expansion in business conditions. New orders were a plus in the report, showing a small month-to-month gain that contrasts with a big month-to-month decline in May. Backlog orders, however, show a third month of contraction.

Durable goods orders in May rebounded a revised 2.1 percent (originally 1.9 percent), following a revised 2.5 percent decline the month before. New durables orders excluding transportation also made a comeback, increasing 0.7 percent (originally 0.6 percent) after a 0.1 percent dip in April. For the latest month, gains were broad-based by industry. Transportation led the way with a monthly 6.3 percent jump, following a 9.3 percent drop in April.

New orders for durable goods Consensus Forecast for June 11: +1.0 percent

Range: -1.9 percent to +1.5 percent

The Beige Book being prepared for the August 9 FOMC meeting will have some of the first evidence on whether the economy is strengthening or not in the second half of the year. Given recently soft employment and higher oil prices, the Fed and traders will take note of changes in the consumer sector and inflation numbers.

Initial jobless claims rose 10,000 in the July 16 week to a 418,000 level. The July 16 week is the survey week for the household employment section of the monthly employment report and a comparison with the prior survey week of June 18 shows an improvement but a small one at 9,000. A comparison of four-week averages during the same two weeks shows a smaller 5,000 improvement, to 421,250 versus 426,250.

Jobless Claims Consensus Forecast for 7/23/11: 425,000

Range: 405,000 to 436,000

The pending home sales index for existing homes rebounded 8.2 percent in May, following a drop of 11.3 percent the month before. Led by the West and Midwest, all four regions showed respectable gains. The pending sales numbers—based on contract signing—point to the direction of existing home sales (based on closing transactions) over the next one to three months. However, quite a few pending sales for June fell through and did not close as June existing home sales slipped 0.8 percent. But if pending home sales hold up in June, that would be a good sign for July and August closings on existing homes.

The Kansas City Fed manufacturing index showed notable improvement in June as the composite index rose to 14 from a reading of 1 in May. The strengthening was broad-based with production jumping to 22 from minus 2 in May; the new orders index rising to 10 from minus 15; and shipments gaining to 25 from minus 8 the month before. Even labor indexes improved with the number of employees index rising to 17 from 9 and the workweek index improving to 9 from minus 3.

The employment cost index rose a quarterly 0.6 percent in the first quarter versus a run of 0.4 percent gains in prior quarters. Year-on-year, the ECI is up 2.0 percent for no change compared to the fourth quarter. Wages rose 0.4 percent, the same pace as the fourth quarter, and are up only 1.6 percent year on year. Benefits jumped 1.1 percent for a 3.0 percent year-on-year increase with health benefits for employers up 3.4 percent.

Employment cost index Consensus Forecast for Q2 11: 0.5 percent

Range: 0.4 to 0.6 percent

GDP growth in the first quarter still was quite sluggish as the Commerce Department’s third estimate for GDP growth was nudged up to 1.9 percent annualized from the prior estimate of 1.8 percent. But final demand numbers were even softer. Final sales of domestic product were unrevised at an annualized 0.6 percent. Final sales to domestic purchasers (excludes exports and imports) were revised down to 0.4 percent from the earlier estimate of 0.7 percent annualized. Economy-wide inflation was incrementally higher with the GDP price index rising 2.0 percent, compared to the earlier estimate of 1.9 percent. Analysts expected 1.9 percent.

Real GDP Consensus Forecast for advance estimate Q2 11: +1.9 percent annual rate

Range: +1.0 to +2.1 percent annual rate

GDP price index Consensus Forecast for advance estimate Q2 11: +2.0 percent annual rate

Range: +1.4 to +2.6 percent annual rate

The Chicago PMI in June accelerated to a reading of 61.1 from 56.6 in May. The new orders index was even more favorable, gaining 7.7 points to 61.2. Production—perhaps reflecting a rebound in the auto industry—jumped 10.9 points to 66.9.

Chicago PMI Consensus Forecast for July 11: 61.1

Range: 56.5 to 62.5

The Reuter's/University of Michigan's consumer sentiment index in mid-July fell to a more than two-year low of 63.8 compared to 71.5 for the final June reading. Expectations, the leading component, fell nine points to a 55.8 level that indicates wide pessimism over the economic outlook. Current conditions fell nearly six points to 76.3.

Consumer sentiment Consensus Forecast for final July 11: 64.0

Range: 61.5 to 65.0

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|