|

Several events stood out this past week. The off and on rescue of Greece from its sovereign debt problems was more on than off. Oil traders got a jolt from the International Energy Agency (IEA). And the Fed started more serious thinking about its post-QE2 monetary policy.

The least you could say is that it was not a boring week. Equities ended the period mixed with blue chips down and gains seen for techs and small caps. The big positives were Monday and Tuesday. At the start of the week, Eurozone finance chief Jean-Claude Juncker assured investors that a solution will be found to Greece’s sovereign debt problem. The Eurozone finance ministers gave Greece two weeks to implement new austerity measures in order to obtain emergency loans. A key hurdle in doing so was Tuesday night's confidence vote for Greek Prime Minister George Papandreou. The least you could say is that it was not a boring week. Equities ended the period mixed with blue chips down and gains seen for techs and small caps. The big positives were Monday and Tuesday. At the start of the week, Eurozone finance chief Jean-Claude Juncker assured investors that a solution will be found to Greece’s sovereign debt problem. The Eurozone finance ministers gave Greece two weeks to implement new austerity measures in order to obtain emergency loans. A key hurdle in doing so was Tuesday night's confidence vote for Greek Prime Minister George Papandreou.

Tuesday saw stocks lifted by a smaller-than-expected decline in existing home sales. Also, markets increasingly became confident that Papandreou would survive the vote of confidence that evening, allowing him to push through reform measures to pay down Greek sovereign debt. Bank stocks in the U.S. rose in sympathy with European bank gains. Voting in Parliament just after midnight in Athens gave Papandreou a win.

At mid-week, the FOMC concluded with no change in policy rates and with no mention of additional quantitative easing when QE2 finishes at the end of June. Also, it should have been no surprise that the Fed lowered its GDP growth forecast and nudged up its projected unemployment rate. Nonetheless, these forecast changes led stocks down notably for the day. Helping to limit damage, FedEx beat expectations on earnings and sales and boosted its outlook. The company (along with UPS) is considered by many analysts to be a proxy of the strength of the economy.

On Thursday, equities were weighed down at the start of the day by a jump in initial jobless claims. At mid-day, the International Energy Agency announced a coordinated action by its members to release oil from strategic reserves to alleviate lost production from Libyan. The energy patch fell sharply on the resulting drop in crude oil prices. Exxon Mobil and Chevron were big losers. Also weighing on equities was oil traders selling stocks to cover losses on oil. But helping the overall equity market mostly recover for the day was an announcement that Greece had agreed to a new five-year austerity plan with new tax hikes and spending cuts.

Equities were down the last day of the week despite a better-than-expected gain in durables orders for May. Techs were led down by Oracle reporting an unexpected drop in hardware sales. Weighing on broad markets and banks in particular was an announcement by Moody’s that it may downgrade 13 Italian lenders. This revived worried that contagion from Europe’s sovereign debt problems may be getting worse.

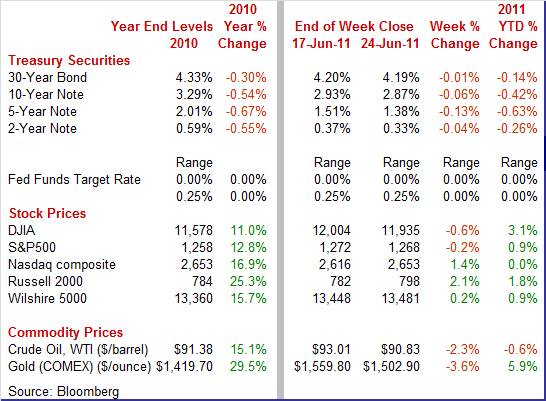

Equities were mixed this past week. The Dow was down 0.6 percent percent; the S&P 500, down 0.2 percent; the Nasdaq, up 1.4 percent; and the Russell 2000, up 2.1 percent.

For the year-to-date, major indexes are up as follows: the Dow, up 3.1 percent; the S&P 500, up 0.9 percent; and the Russell 2000, up 1.8 percent. The Nasdaq is up but less than 0.1 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury yields generally moved in tandem with equities—flight to safety was a big factor. Rates were down notably overall for the week. However, the first two days of the week, rates firmed on positive news on progress in providing a rescue package for Greece. Existing home sales being less negative than expected on Tuesday also nudged rates up. Treasury yields generally moved in tandem with equities—flight to safety was a big factor. Rates were down notably overall for the week. However, the first two days of the week, rates firmed on positive news on progress in providing a rescue package for Greece. Existing home sales being less negative than expected on Tuesday also nudged rates up.

At mid-week, bond traders apparently anticipated the Fed on Wednesday better than equity traders as there was little change in rates.

But yields dipped sharply the last two days. Initially bumping rates down was the jump in jobless claims. Adding to worries about the strength of the recovery was a decline in new home sales. Treasury rates also dipped as Republican negotiators dropped out of talks with Vice President Joe Biden on measures to cut the federal deficit. But yields dipped sharply the last two days. Initially bumping rates down was the jump in jobless claims. Adding to worries about the strength of the recovery was a decline in new home sales. Treasury rates also dipped as Republican negotiators dropped out of talks with Vice President Joe Biden on measures to cut the federal deficit.

Despite the favorable report on durables orders, rates fell further at close of the week after Moody’s indicated it may cut the ratings of Italian banks.

For this past week Treasury rates were down as follows: 3-month T-bill, down 2 basis points; the 2-year note, down 4 basis points; the 5-year note, down 13 basis points; the 7-year note, down 11 basis points; the 10-year note, down 6 basis points; and the 30-year bond, down 1 basis point.

Crude oil prices got a surprise shock this past week when on Thursday the International Energy Agency announced that its members will be selling oil from strategic reserves to help offset lost production from Libya. Starting this coming week, 2 million barrels will be released per day for a 30 day period. About half of the reserves will come from the U.S. Strategic Petroleum Reserves (SPR). The announcement sent the spot price of West Texas Intermediate down nearly $4-1/2 for the day. While not discussed too openly by U.S. or other officials, the move to sell strategic oil reserves and lower the price of oil certainly has the intent of providing some stimulus to the global economy, putting more discretionary money in consumer pockets and cutting costs for many businesses. Crude oil prices got a surprise shock this past week when on Thursday the International Energy Agency announced that its members will be selling oil from strategic reserves to help offset lost production from Libya. Starting this coming week, 2 million barrels will be released per day for a 30 day period. About half of the reserves will come from the U.S. Strategic Petroleum Reserves (SPR). The announcement sent the spot price of West Texas Intermediate down nearly $4-1/2 for the day. While not discussed too openly by U.S. or other officials, the move to sell strategic oil reserves and lower the price of oil certainly has the intent of providing some stimulus to the global economy, putting more discretionary money in consumer pockets and cutting costs for many businesses.

The only other big move during the week was earlier on Wednesday as spot WTI rose about $1-1/2 per barrel after the Energy Department said inventories dropped 1.71 million barrels to 363.8 million last week. Also, refinery operating rates were up, indicating higher demand for crude.

Net for the week, spot prices for West Texas Intermediate declined $2.18 per barrel to settle at $90.83.

Economic data were mixed with GDP higher, manufacturing improved, and housing slipping. Meanwhile, the Fed began to address what happens after the end of QE2.

Economic growth in the first quarter was quite sluggish even with a slight upward revision to first quarter GDP. The economy in the first quarter was marginally stronger than previously believed as the Commerce Department’s third estimate for GDP growth was nudged up to 1.9 percent annualized from the prior estimate of 1.8 percent. Economic growth in the first quarter was quite sluggish even with a slight upward revision to first quarter GDP. The economy in the first quarter was marginally stronger than previously believed as the Commerce Department’s third estimate for GDP growth was nudged up to 1.9 percent annualized from the prior estimate of 1.8 percent.

But final demand numbers were even softer. Final sales of domestic product were unrevised at an annualized 0.6 percent. Final sales to domestic purchasers (excludes exports and imports) were revised down to 0.4 percent from the earlier estimate of 0.7 percent annualized. The lower estimate for final sales to domestic purchasers was from weaker numbers for investment in equipment & software and government purchases. PCEs growth was unrevised overall.

Inventory growth, net exports, residential investment, and nonresidential structures were revised up slightly.

Economy-wide inflation was incrementally higher with the GDP price index rising 2.0 percent, compared to the earlier estimate of 1.9 percent. Analysts expected 1.9 percent.

The third estimate for first quarter GDP does not change how current momentum is viewed. Overall strength was in PCEs (up 2.2 percent annualized), equipment investment (up 8.8 percent), and inventory investment. Despite recent soft patch numbers, relative strength is still in those components.

With negative numbers in some recent manufacturing surveys, markets have been nervous about the possibility that the economy is losing a source of strength. However, based on the latest durables report, manufacturing may not be as weak as suggested by recent manufacturing surveys. New factory orders for durables in May rebounded 1.9 percent, following a revised 2.7 percent decline the month before (previously estimated at down 3.6 percent). New durables orders excluding transportation also made a comeback, increasing 0.6 percent after a 0.4 percent drop in April. With negative numbers in some recent manufacturing surveys, markets have been nervous about the possibility that the economy is losing a source of strength. However, based on the latest durables report, manufacturing may not be as weak as suggested by recent manufacturing surveys. New factory orders for durables in May rebounded 1.9 percent, following a revised 2.7 percent decline the month before (previously estimated at down 3.6 percent). New durables orders excluding transportation also made a comeback, increasing 0.6 percent after a 0.4 percent drop in April.

For the latest month, gains were broad-based by industry. Transportation led the way with a monthly 5.8 percent jump, following a 9.4 percent drop in April. The swing in both months was largely nondefense aircraft (Boeing) which surged 36.5 percent in May after a 29.0 percent fall the month before. Defense aircraft rebounded 5.5 percent after a 0.4 percent dip. However, the auto industry appears to still be suffering from supply shortages. Motor vehicles edged up only 0.6 percent, following a 5.3 percent fall in April. For the latest month, gains were broad-based by industry. Transportation led the way with a monthly 5.8 percent jump, following a 9.4 percent drop in April. The swing in both months was largely nondefense aircraft (Boeing) which surged 36.5 percent in May after a 29.0 percent fall the month before. Defense aircraft rebounded 5.5 percent after a 0.4 percent dip. However, the auto industry appears to still be suffering from supply shortages. Motor vehicles edged up only 0.6 percent, following a 5.3 percent fall in April.

Also seeing gains in May were primary metals, up 1.8 percent; machinery, up 1.2 percent; computers & electronics, up 0.4 percent; and electrical equipment, up 3.2 percent. Fabricated metals were flat while “other durables” slipped 0.8 percent.

Business investment is improving in coming months as new orders for nondefense capital goods excluding aircraft also rebounded, by 1.6 percent after dipping 0.8 percent in April. Shipments for this series rose 1.4 percent, following a 1.5 percent decline the month before.

The latest home sales numbers indicate that the housing sector is still anemic. The latest home sales numbers indicate that the housing sector is still anemic.

Existing home sales fell 3.8 percent in May to a 4.81 million annual rate. The year-on-year rate deepened to minus 15.3 percent from April's minus 13.8 percent. Even the modest good news in the latest report is not good enough. Supply on the market, at 3.72 million, is falling but not enough relative to the decline in sales as months’ supply rose to 9.3 months from April's 9.0 months.

Prices did rise 3.4 percent for the median to $166,500 but the heavy supply does not point to much pricing power in the months ahead.

However, severe weather may have played a role as the month's sales contraction is deepest in the Midwest. Looking ahead, the National Association of Realtors is definitely looking at the bright side and has spilled the beans on the upcoming pending home sales data saying that the report, though based on incomplete data, will show "solid gains."

Turning to new home sales, we are seeing a similar pattern. New home sales fell 2.1 percent in May to a 319,000 annualized pace. Supply in terms of months dipped slightly to 6.2 months from 6.3 in April and from 6.9 in March. Supply in terms of the number of homes on the market, down 6,000 to 166,000, has never been lower in nearly 50 years of data. Turning to new home sales, we are seeing a similar pattern. New home sales fell 2.1 percent in May to a 319,000 annualized pace. Supply in terms of months dipped slightly to 6.2 months from 6.3 in April and from 6.9 in March. Supply in terms of the number of homes on the market, down 6,000 to 166,000, has never been lower in nearly 50 years of data.

Low supply is a plus for prices which may be firming, up 2.6 percent to a median $222,600 and for the average, up 0.5 percent to $266,400. But in year-on-year terms prices are eroding to the negative single to mid digits.

Bumping along the very bottom is a good description for both the existing and new home sales market. A broader look at the pattern in sales shows little net improvement in home sales since the end of the overall recession. Home sales have followed a very erratic pattern over the last five years. The housing bubble unwound dramatically from peak levels in 2006 to recession bottom in 2009. Thereafter, sales were boosted by two separate rounds of special tax incentives in late 2009 and early 2010. Sales surged with the incentives (especially existing homes), in part by stealing future sales. The drop off in mid-2010 was particularly sharp, resulting in a sales pace even lower than during the bottom of overall recession. Existing home sales improved on a moderately stronger economy in 2010 but new home sales have been basically flat since the end of special tax incentives. Tight credit and modest gains in jobs are holding back sales.

Home prices in April unexpectedly rose, breaking a string of monthly declines. The FHFA purchase only house price index rose 0.8 percent in April, following a 0.4 percent decrease in March. April’s gain followed six consecutive monthly losses. Home prices in April unexpectedly rose, breaking a string of monthly declines. The FHFA purchase only house price index rose 0.8 percent in April, following a 0.4 percent decrease in March. April’s gain followed six consecutive monthly losses.

On a year-on-year basis, the FHFA HPI is down 5.7 percent versus down 6.2 percent in March.

The FHFA house price index is derived from transactions involving conforming conventional mortgages purchased or securitized by Fannie Mae or Freddie Mac. This means that this index does not include high end houses or non-confirming loans. Excluding houses with non-conforming loans means leaving out a sizeable portion of the low end and the riskier purchases. But for “middle-of-the road” housing, there was a nice bump up in prices for May. This coming week’s Case-Shiller report will cover a broader range of mortgage types not included in FHFA. Both FHFA and Case-Shiller are based on repeat transactions are better price measures than in the existing and new home sales reports which are not based on repeat transactions.

As expected, at the June 21-22 meeting, the FOMC left its policy federal funds target rate unchanged, at a range of zero to 0.25 percent and retained the "extended period" language on keeping rates low for some time. It is also allowing QE2 to end this month, but has decided to delay the natural unwinding of its expanded balance sheet. That is, the Fed will continue to reinvest pay down on mortgage-backed securities and agency debt. There were no dissenting votes. As expected, at the June 21-22 meeting, the FOMC left its policy federal funds target rate unchanged, at a range of zero to 0.25 percent and retained the "extended period" language on keeping rates low for some time. It is also allowing QE2 to end this month, but has decided to delay the natural unwinding of its expanded balance sheet. That is, the Fed will continue to reinvest pay down on mortgage-backed securities and agency debt. There were no dissenting votes.

The FOMC gave the current economy a modest downgrade, mentioning recent events in Japan for the first time as one of the causes. The Fed retained its outlier position that current sluggishness in the economy is temporary. Even more striking, the Fed not only sees the current bump up in inflation as temporary, it also sees inflation easing to below its implicit target. This belief in the direction of inflation is almost certainly due to recent declines in crude oil prices.

At the press conference after the announcement, Chairman Ben Bernanke reiterated that the FOMC expects the economy to strengthen but not at the pace previously anticipated. He noted that headwinds are stronger than thought earlier. On the issue of whether to allow the balance sheet to unwind, Bernanke stated that the FOMC has not made a commitment on the timing of reinvesting. Bernanke stated that there has been improvement in labor markets with payroll growth improving. He noted that a year ago the Fed was falling short on both mandates--unemployment was too high and inflation was falling below desirable levels. Since then, there has been improvement on both fronts.

Overall, the Fed is a little less negative than most economists and analysts, calling for improved recovery in coming quarters. Some of this clearly is the economy moving past supply disruptions from Japan. Nonetheless, the Fed is keeping monetary policy as loose as is possible without actually engaging in a third round of quantitative easing.

The Fed’s second round of quantitative easing is nearing an end. For the latest reporting period, the Fed’s balance sheet in the June 22 week surged $28.8 billion, reaching $2.860 trillion, a record high.

The economy’s relative strength and weakness remain the same—manufacturing and housing, respectively. While there is little sign of housing improving in the near term, manufacturing may be regaining some momentum.

The focus is on the consumer throughout the week and on manufacturing on Friday before the long weekend. Monday brings personal income and spending along with the Fed’s favorite inflation numbers, PCE prices. The consumer mood is parsed on Tuesday with consumer confidence and Friday's consumer sentiment. Weekly jobless claims are on tap Thursday followed on Friday with motor vehicle sales and ISM manufacturing.

Personal income in April posted a 0.4 percent gain equaling the pace in March. Importantly, the key wages & salaries component increased 0.4 percent, following a boost of 0.3 percent in March. Spending looked healthy at face value but inflation was the underlying factor for the most part. Personal consumption expenditures expanded at a 0.4 percent pace in April after increasing 0.5 percent the month before. The headline PCE price index posted a 0.3 percent gain, down marginally from 0.4 percent in March but still strong. However, the core rate firmed to 0.2 percent from 0.1 percent in March. Looking ahead, the private wages & salaries component of personal income should be moderately strong as private aggregate weekly earnings gained 0.4 percent in May. Personal spending—at least the goods portion—will likely be negative as unit new motor vehicle sales fell 10.4 percent in May while retail sales excluding autos rose only 0.3 percent. PCE inflation should ease at the headline level as the CPI slowed to 0.2 percent from 0.4 percent in April. Core PCE likely will firm as the core CPI rose 0.3 percent in May, compared to 0.2 percent the month before.

Personal income Consensus Forecast for May 11: +0.4 percent

Range: +0.1 to +0.5 percent

Personal consumption expenditures Consensus Forecast for May 11: 0.0 percent

Range: -0.2 to +0.3 percent

Core PCE price index Consensus Forecast for May 11: +0.2 percent

Range: +0.2 to +0.3 percent

The Conference Board's consumer confidence index in May fell 5.2 points to 60.8 in May, a six-month low. Weakness was centered in the expectations component which hit a seven-month low. More recently, the mid-June reading of the University of Michigan consumer sentiment index fell 2.5 points from the prior month’s final reading.

Consumer confidence Consensus Forecast for June 11: 62.0

Range: 55.0 to 66.7

Initial jobless claims for the June 18 week rose 9,000 to 429,000. However, the Labor Department had to estimate results for six states, which is a sizable number, due to what it says were "technology issues" which must mean computer problems. So, we may see a sizeable revision with this coming week’s number.

Jobless Claims Consensus Forecast for 6/25/11: 420,000

Range: 410,000 to 430,000

The Chicago PMI in May dropped 11 points to 56.6 to indicate the slowest rate of monthly growth since November 2009. The June reading may not improve as the new orders index fell nearly 13 points to 53.5.

Chicago PMI Consensus Forecast for June 11: 53.0

Range: 49.5 to 56.0

Special note: The employment situation for June will be released July 8 instead of the standard first Friday of the month.

Sales of domestic light motor vehicles in May declined to 9.1 million from 10.1 million. Imports dropped to 2.7 million from 3.1 million. Imports dropped to 2.7 million from 3.1 million. Sales of combined North American-made vehicles and imports fell to an annualized 11.8 million units from 13.2 million in April. Certainly, import sales were limited by shortages of Japanese brands. But the North American component also includes Japanese brands assembled in the U.S. with many parts from Japan, limiting supply of many models significantly.

Motor vehicle domestic sales Consensus Forecast for June 11: 9.6 million-unit rate

Range: 9.2 to 10.0 million-unit rate

The Reuter's/University of Michigan's Consumer sentiment index in mid-June dipped 2.5 points from final May to 71.8. The weakening was led by a 2.7 point drop in the expectations component to 66.8 while the current conditions index slipped 2.3 points to 79.6. Inflation expectations remain anchored as the one-year outlook dipped one tenth to 4.0 percent and the five-year nudged up only one tenth to 3.0 percent.

Consumer sentiment Consensus Forecast for final June 11: 71.8

Range: 71.0 to 73.0

The composite index from the ISM manufacturing survey in May dropped 6.9 points to 53.5. Near-term forward momentum eased as new orders slowed a very significant 10.7 points to 51.0, but remained over 50 to indicate growth compared to April (though slower growth). The export orders index slipped to 55.0 from 62.0 in April but remained moderately positive. A key issue is whether recent slowing was related to disruptions of supplies from Japan and any related softness could continue in the short term.

ISM manufacturing composite index Consensus Forecast for June 11: 52.0

Range: 51.0 to 55.0

Construction spending in April rose 0.4 percent after a 0.1 percent uptick in March. Strength for the latest month was led by a 3.1 percent improvement in private residential spending, following a 0.7 percent decline the month before. However, the gain in this component was improvements as non-new home spending jumped a monthly 7.6 percent after a 0.1 percent slip in March. For other components, private nonresidential gained 0.5 percent in April while public outlays fell 1.9 percent.

Construction spending Consensus Forecast for May 11: -0.3 percent

Range: -0.8 to +0.2 percent

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|