|

It was a mixed week for earnings as traders debated whether stocks had gotten ahead of the economy or not. Meanwhile, U.S. economic news pointed toward net improvement for housing and manufacturing.

For the most part, stocks retraced some of the robust gains of earlier this year. However, it was not because of economic news as indicators generally were positive in the U.S. Focus was on mixed earnings reports, though numbers were more positive than negative. The week got a late start with no trading on Monday with the Martin Luther King, Jr. Day holiday. For the most part, stocks retraced some of the robust gains of earlier this year. However, it was not because of economic news as indicators generally were positive in the U.S. Focus was on mixed earnings reports, though numbers were more positive than negative. The week got a late start with no trading on Monday with the Martin Luther King, Jr. Day holiday.

Stocks got lift Tuesday from a positive and better-than-expected Empire State manufacturing survey. Also, Boeing boosted the Dow as an announcement of another delay in the delivery of the 787 Dreamliner was not worse than anticipated. News of a medical leave by Steve Jobs from Apple and disappointing earnings from Citigroup softened gains for the day.

The one day of the week hit by negative economic news was Wednesday as housing starts for December declined instead of gaining as expected. Traders focused on the headline number rather than on a boost in permits. Also, Goldman Sachs tugged down on equities after profits fell short of analysts’ forecasts.

Stocks dropped Thursday despite mostly favorable economic news in the U.S. First, initial jobless claims fell significantly. Existing home sales posted a sharp rise for December — though from depressed levels. The Philly Fed manufacturing index was notably positive but was not quite up to expectations — though the miss was small. Stocks declined after China released its latest economic data which was stronger than expected. Traders now are anticipating that the People’s Bank of China will increase interest rates in coming months to damp inflation pressures.

Equities were mixed Friday with no notable economic news in the U.S. Strong earnings from General Electric were the positive news for the day. The company’s announcement of strong orders was favorable.

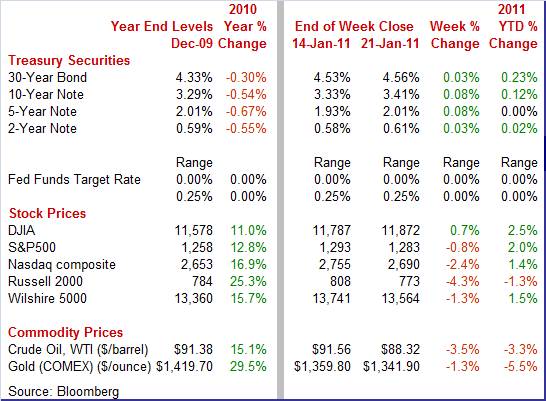

Equities were mostly down this past week. The S&P 500 was down 0.8 percent; the Nasdaq, down 2.4 percent; and the Russell 2000, down 4.3 percent. However, the Dow rose 0.7 percent, being the only major index to post a net gain for the week.

For the year-to-date, major indexes are mostly up as follows: the Dow, up 2.5 percent; the S&P 500, up 2.0 percent; and the Nasdaq, up 1.4 percent. The Russell 2000, however, is down 1.3 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

As usual, bond traders tend to pay more attention to economic news than equity traders. The economic news was mostly positive and it showed in Treasuries as yields firmed over the week. As usual, bond traders tend to pay more attention to economic news than equity traders. The economic news was mostly positive and it showed in Treasuries as yields firmed over the week.

Rates were up on Tuesday and especially Thursday. On Tuesday, yields were nudged up by the healthy Empire State report. Thursday saw a notable rise in rates from better-than-expected data on jobless claims, leading indicators and existing home sales. In between, rates softened a bit Tuesday with the dip in housing starts. Yields eased somewhat Friday as traders saw positions as being oversold on Thursday’s news and on the Fed making more purchases than expected Friday.

For this past week Treasury rates were mostly up as follows: the 2-year note, up 3 basis points; the 5-year note, up 8 basis points; the 7-year note, up 10 basis points; the 10-year bond, up 8 basis points; and the 30-year bond, up 3 basis points. The 3-month T-bill was flat all week.

While the 3-month T-bill continues to be pegged down by the near zero fed funds target rate, other yields continue to drift upward on favorable economic news and rising inflation pressures in commodities.

The price of crude oil eased throughout the week despite mostly healthy economic news in the U.S. The bottom line is that China is seen as the swing source of demand currently and its economy has been quite strong. With China raising interest rates, forecasts for growth there have been tapped down and the price of crude has followed. The price of crude oil eased throughout the week despite mostly healthy economic news in the U.S. The bottom line is that China is seen as the swing source of demand currently and its economy has been quite strong. With China raising interest rates, forecasts for growth there have been tapped down and the price of crude has followed.

China raised interest rates twice in 2010 and more recently boosted bank reserve requirements. These moves are seen as anti-inflation measures that also will reduce demand for oil.

Net for the week, spot prices for West Texas Intermediate declined $3.24 per barrel to settle at $88.32.

This past week the focus was on housing and regional manufacturing. Housing numbers were mixed but net positive while both the Empire State and Philly Fed reports showed improvement.

The latest housing starts report was mixed with starts declining but permits gaining. Special factors likely played a role in each. The latest housing starts report was mixed with starts declining but permits gaining. Special factors likely played a role in each.

Housing starts in December slipped back 4.3 percent, following a 3.8 percent rebound in November. The December annualized pace of 0.529 million units is down 8.2 percent on a year-ago basis. The reversal in December was led by a 9.0 percent drop in single-family starts, following a 5.8 percent gain the month before. The multifamily component rebounded 17.9 percent after declining 5.0 percent in November.

But severe weather in the Midwest and Northeast likely limited the ability of construction companies to get the bulldozers moving and start breaking ground. By region, declines were seen in the Midwest, down 38.4; the Northeast, down 24.7; and South, down 2.2 percent. The sharp weakness in the Midwest and Northeast indicates that snow storms played a role in damping starts. For the West, starts jumped 45.8 percent.

Housing permits, in contrast, made a 16.7 percent comeback in December after declining 1.4 percent in November. Overall permits posted at an annualized rate of 0.635 million units and are down 6.8 percent on a year-ago basis. The latest boost was led by the multifamily component which was up a sharp 53.5 percent while single-family permits improved 5.5 percent. Housing permits, in contrast, made a 16.7 percent comeback in December after declining 1.4 percent in November. Overall permits posted at an annualized rate of 0.635 million units and are down 6.8 percent on a year-ago basis. The latest boost was led by the multifamily component which was up a sharp 53.5 percent while single-family permits improved 5.5 percent.

While permits are much less affected by atypical weather than are starts (filing paperwork indoors is less constrained), this likely does not entirely explain permits’ relative strength for December. The Commerce Department noted in its report that building code changes took effect on January 1 in California, Pennsylvania and New York. In turn, some of the multifamily strength likely is due to construction companies getting approval before the tighter regulations.

The bottom line is that housing has stabilized especially as even the single-family component for starts advanced in December. Nonetheless, housing is still at anemic levels and construction companies now appear to be more optimistic about the multifamily component than the single-family component.

You usually do not associate higher mortgage rates with a boost in home sales. But that was the case for the latest existing home sales report. You usually do not associate higher mortgage rates with a boost in home sales. But that was the case for the latest existing home sales report.

Higher mortgage rates and fears of further increases appear to have motivated buyers during December as existing home sales surged 12.3 percent to a higher-than-expected annual rate of 5.280 million. Details show even strength across regions and a big draw down in supply to 8.1 months from November's 9.5 months. Supply is the lowest it has been since March.

Home prices slipped in the month, down nearly one percent to a median $168,800. While lower prices can boost demand, they also make it tougher to get appraisals that top loan values so deals can close.

Fears of higher mortgage rates, however, are the likely factor behind the spike in sales. The recent low for 30-year conventional mortgage rates was 4.23 percent in October 2010 (monthly average) but rose to 4.71 percent in December.

The year finished well but at sales of 4.908 million, 2010 is the worst year for existing-home sales since 1997. The National Association of Realtors sees improvement for 2011, forecasting sales of 5.20 million.

While sales numbers are seasonally adjusted, the seasonal factors are large during winter months to take into account the fact that sales are much lower than the monthly average over the year. So, a moderate rise in actual sales during a winter month can be exaggerated by the seasonal adjustment factor. Essentially, the surge in sales in December should be taken with a grain of salt. Until spring returns, focus should be on two or three month averages.

Manufacturing activity is accelerating in the New York and mid-Atlantic regions this month. First, the Empire State general business conditions index in January rose 2.03 points to 11.92, a reading well over the breakeven zero level. Another positive was a jump in the new orders index to 12.39 from 2.03 in December and much improved from November's steep contraction of minus 23.80. Manufacturing activity is accelerating in the New York and mid-Atlantic regions this month. First, the Empire State general business conditions index in January rose 2.03 points to 11.92, a reading well over the breakeven zero level. Another positive was a jump in the new orders index to 12.39 from 2.03 in December and much improved from November's steep contraction of minus 23.80.

Despite improvement in general conditions and new orders, manufacturing still is not running hot. Shipments jumped, keeping unfilled orders in negative territory. Nonetheless, another sign of optimism by management in manufacturing is that the employment index and workweek index were modestly positive for the latest month.

The mid-Atlantic region is showing more strength than in New York State. The Philly Fed’s general business conditions index came in at 19.3 in January indicating significant month-to-month growth though at a slightly slower pace than December's 20.8 level. Still, this index has been notably healthy for three months in a row. The mid-Atlantic region is showing more strength than in New York State. The Philly Fed’s general business conditions index came in at 19.3 in January indicating significant month-to-month growth though at a slightly slower pace than December's 20.8 level. Still, this index has been notably healthy for three months in a row.

New orders were even more robust in January, doubling in growth to 23.6 from 10.6 in November. Shipments nearly tripled, to 13.4 from 5.2.

The employment index rose further into positive territory while the average workweek eased a bit though remained well above breakeven.

While both the New York and Philly Fed reports show improvement in manufacturing activity, there is one area of growing concern—prices. The Empire State report showed the prices paid index jumping to 35.79 from 28.41 in December and prices received gaining to 15.79 from 3.41 the month before. The Philly report had the prices paid index at 54.3 from 47.9 in December and prices received at 17.1 compared to 9.4 in December. The numbers are especially notable given that breakeven is zero and the prices received indexes were negative just as recently as November 2010. While input prices have been rising for months, manufacturers are starting to pass along these costs to retailers and other businesses.

The Conference Board’s index of leading indicators in December posted a second consecutive robust gain with an increase of 1.0 percent, following a 1.1 percent boost the month before. Component strength was widespread in both months. For the latest, a surge in building permits added 0.41 percentage points with the interest rate spread adding 0.33 percentage points. Also contributing to the December jump were initial jobless claims, stock prices, new orders for nondefense capital goods, and consumer expectations. Slight negatives were seen in new orders for consumer goods & materials and in vendor performance. Money supply was neutral. The Conference Board’s index of leading indicators in December posted a second consecutive robust gain with an increase of 1.0 percent, following a 1.1 percent boost the month before. Component strength was widespread in both months. For the latest, a surge in building permits added 0.41 percentage points with the interest rate spread adding 0.33 percentage points. Also contributing to the December jump were initial jobless claims, stock prices, new orders for nondefense capital goods, and consumer expectations. Slight negatives were seen in new orders for consumer goods & materials and in vendor performance. Money supply was neutral.

The coincident index, which measures current activity, is rising but only slowly, at plus 0.2 percent following gains of 0.1 percent and 0.2 percent in the prior months.

While the recovery is still sub-par compared to prior business cycles, there are signs that it is gradually gaining momentum in the goods-producing sectors. While manufacturing is starting to reach decent levels of activity, housing is still depressed. Manufacturing clearly is adding to economic growth. Although not adding much to the recovery, the fact that housing is not a negative is a notable positive.

This week, investors will focus on the Fed’s policy statement on Wednesday and advance Q4 GDP on Friday. The first may indicate if there will be any adjustments to the current round of quantitative easing while the second likely will show faster growth. Along the way, we see updates on housing with new home sales Wednesday morning and on manufacturing with durables orders on Thursday.

The Conference Board's consumer confidence index for December unexpectedly declined 1.8 points to 52.5. The latest setback was largely related to soft labor market conditions. Of the report's roughly 3,000 initial sample, 46.8 percent say jobs are currently hard to get in what is the worst reading since February.

Consumer confidence Consensus Forecast for January 11: 54.3

Range: 53.0 to 57.3

New home sales in November rose 5.5 percent to a 290,000 unit annual rate. Prices firmed solidly in the month, up eight percent on both the average and median, the latter at $213,000. Another plus is that supply eased in the month, to 8.2 months from 8.8 months but still above September's 7.9 months. Looking ahead, if the past week’s release for existing home sales is an indication, then new home sales should be up for December. Existing home sales surged 12.3 percent for the month.

New home sales Consensus Forecast for December 10: 300 thousand-unit annual rate

Range: 276 thousand to 320 thousand-unit annual rate

The FOMC announcement for the January 25-26 FOMC policy meeting is expected to leave the fed funds target rate unchanged at a range of 0 to 0.25 percent. Market focus will be on any update on the current round of quantitative easing and if there are any upgrades on the economy.

FOMC Consensus Forecast for 1/26/11 policy vote on fed funds target range: unchanged at a range of 0 to 0.25 percent

Durable goods in November declined a revised 0.3 percent, following a 3.1 percent drop the prior month. Weakness was led by a drop in civilian aircraft orders. However, excluding transportation, new orders for durables jumped a revised 3.6 percent after a 2.0 percent contraction in October. Strength in core orders was broad based. Looking ahead, manufacturing surveys suggest a somewhat positive figure for December.

New orders for durable goods Consensus Forecast for December 10: +1.5 percent

Range: -3.0 percent to +2.8 percent

Initial jobless claims for the January 15 week fell an unexpectedly sharp 37,000 to 404,000 from a revised 441,000 the prior week. The latest decline more than offset the prior week's 30,000 boost. With recent weekly volatility, the four-week average likely provides the best insight. The average is down 4,000 to 411,750 and is down more than 14,000 from a month ago.

Jobless Claims Consensus Forecast for 1/22/11: 405,000

Range: 375,000 to 425,000

GDP growth for the third quarter growth was revised up in the third estimate to 2.6 percent annualized from the prior estimate of 2.5 percent. The upward revision was primarily due to a higher estimate for inventory investment with small improvements to net exports and residential investment also contributing. Softening the upgrade were downward estimates for personal consumption, nonresidential fixed investment, and government purchases. On the inflation front, the GDP price index's growth rate for the third quarter was nudged down to 2.1 percent annualized from the prior estimate of 2.3 percent.

Real GDP Consensus Forecast for advance estimate Q4 10: +3.5 percent annual rate

Range: +2.9 to +5.4 percent annual rate

GDP price index Consensus Forecast for advance estimate Q4 10: +1.5 percent annual rate

Range: +0.5 to +2.2 percent annual rate

The Reuter's/University of Michigan's Consumer sentiment index slipped 1.8 points from December to a reading of 72.7 for January preliminary. The reversal came from the current conditions component which dropped to 79.8 from 85.3. The reading is the lowest since October. In contrast, the expectations index actually nudged up to 68.2 from 67.5 in December.

Consumer sentiment Consensus Forecast for final January 11: 73.0

Range: 72.0 to 74.5

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|