|

Economic news this past week was mostly positive and topped expectations. A key exception was the first employment situation report out this year.

Stock indexes for the most part got off to a good start for the year. Providing lift the first day of trading was positive reports on ISM manufacturing and construction outlays. Upgrades by analysts for Alcoa, General Motors, and Boeing also helped. Equities, however, declined on Tuesday as a stronger dollar bumped down prices of many commodities and shares of their producers. Damage on Tuesday was reduced by comments in the Fed’s FOMC minutes that the economy is gaining strength. Stock indexes for the most part got off to a good start for the year. Providing lift the first day of trading was positive reports on ISM manufacturing and construction outlays. Upgrades by analysts for Alcoa, General Motors, and Boeing also helped. Equities, however, declined on Tuesday as a stronger dollar bumped down prices of many commodities and shares of their producers. Damage on Tuesday was reduced by comments in the Fed’s FOMC minutes that the economy is gaining strength.

At mid-week, an unexpectedly strong ADP private payrolls report sparked a rally with a healthy ISM non-manufacturing index adding to upward movement. Stocks began a retreat late in the week, starting on Thursday on news from chain stores of weaker sales in December than projected. Sluggish sales were attributed to consumer fatigue from strong spending in November with an East Coast blizzard limiting sales in some areas.

While the employment report on Friday was disappointing with December’s payroll increase being only about two-thirds of expectations, traders largely shrugged the report off on the belief that economic momentum is still building and hiring is coming. The culprit behind a moderate selloff in the afternoon was an appellate ruling from the Supreme Court of Massachusetts. The court ruled against Wells Fargo and US Bancorp in a case involving home foreclosure. The ruling indicates that banks are going to have more difficulty and higher costs unloading properties in foreclosure. This led to a selloff in bank stocks which tugged down on the broader market.

Nonetheless, the mostly favorable economic news lifted most indexes for the week.

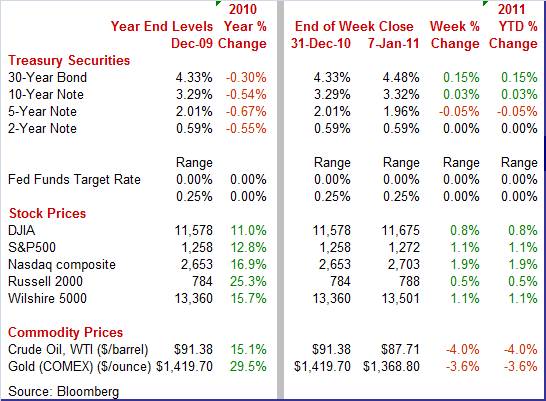

Major indexes were up this past week. The Dow was up 0.8 percent; the S&P 500, up 1.1 percent; the Nasdaq, up 1.9 percent; and the Russell 2000, up 0.5 percent.

For this week, with the trading week starting with the first business day of the year, the year-to-date changes match the weekly changes.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury rates generally tracked stocks daily this past week but ended mixed. Positive economic news lifted yields on Monday and especially Wednesday (ADP upside surprise). In between, rates were little changed Tuesday. The boost in rates reflected expectations of stronger economic growth ahead. However, Treasury yields eased Thursday on sluggish chain store numbers for December and on reconsideration of how much to believe the surprisingly strong ADP report. On the final day of the week, bond traders paid more attention to the sluggish payroll number in the government’s jobs report and came away with a less optimistic view of the economy than equities traders. Greater caution on the part of bond traders is not uncommon. Treasury rates generally tracked stocks daily this past week but ended mixed. Positive economic news lifted yields on Monday and especially Wednesday (ADP upside surprise). In between, rates were little changed Tuesday. The boost in rates reflected expectations of stronger economic growth ahead. However, Treasury yields eased Thursday on sluggish chain store numbers for December and on reconsideration of how much to believe the surprisingly strong ADP report. On the final day of the week, bond traders paid more attention to the sluggish payroll number in the government’s jobs report and came away with a less optimistic view of the economy than equities traders. Greater caution on the part of bond traders is not uncommon.

For the week, mid-range maturities ended with modestly lower yields while the 10-year and 30-year rates gained.

For this past week Treasury rates were mixed as follows: 3-month T-bill, up 1 basis point; the 2-year note, unchanged; the 5-year note, down 5 basis points; the 7-year note, down 2 basis points; the 10-year bond, up 3 basis points; and the 30-year bond, up 15 basis points.

Crude oil prices fell significantly this week with some notable daily swings in prices. But first, weighing on prices was a steady rise in the dollar. Over the week, the dollar index jumped 2.6 percent. Crude oil prices fell significantly this week with some notable daily swings in prices. But first, weighing on prices was a steady rise in the dollar. Over the week, the dollar index jumped 2.6 percent.

The first big move was down by $2-1/2 on Tuesday with a boost in the dollar and a downdraft in commodities prices overall tugging oil down. There was a moderate and partial rebound at midweek with the favorable reports from ADP and ISM non-manufacturing. On Thursday, crude fell not far under $2 per barrel on another gain by the dollar. At week's end, the disappointing jobs report bumped spot West Texas Intermediate down by nearly a dollar.

The bottom line is that a stronger dollar trumped net stronger economic news. Net for the week, spot prices for West Texas Intermediate fell $3.67 per barrel to settle at 87.71.

All of the major economic indicators were quite healthy this past week except for the jobs report. Manufacturing and non-manufacturing activity both are strengthening. And even with the soft employment news, consumers are increasingly willing to spend.

After an unexpectedly strong ADP report on private payrolls two days prior to the employment report, traders were disappointed with a sluggish gain in December payrolls even as the unemployment rate surprisingly dipped. Overall payroll employment in December gained 103,000, following a revised 71,000 rise in November and a 210,000 boost in October. The December advance came in significantly below analysts’ estimate for a 160,000 gain. However, the October and November revisions were up net 70,000. After an unexpectedly strong ADP report on private payrolls two days prior to the employment report, traders were disappointed with a sluggish gain in December payrolls even as the unemployment rate surprisingly dipped. Overall payroll employment in December gained 103,000, following a revised 71,000 rise in November and a 210,000 boost in October. The December advance came in significantly below analysts’ estimate for a 160,000 gain. However, the October and November revisions were up net 70,000.

Private sector payrolls increased 113,000 in December, following a 79,000 advance the month before. The consensus expected an 180,000 boost which had been upwardly revised after ADP estimated private payrolls would gain 297,000.

For the latest month, strength was in private service-providing jobs which rose 115,000 after an 84,000 increase in November. Goods-producing jobs declined 2,000, following a 5,000 decrease in November. In December, manufacturing grew 10,000; construction fell 16,000; and mining rose 3,000.

Government jobs fell 10,000, following an 8,000 dip in November. The drop in government jobs was led by a 20,000 fall in local government, with non-education declining 12,000. Federal employment increased 10,000 while state government jobs were unchanged.

Wage inflation remains anemic. Average hourly earnings in December edged up 0.1 percent, following no change the previous month. On a year-ago basis, average hourly earnings growth slowed to 1.9 percent from 2.1 percent in November, suggesting little wage pressure on inflation.

Turning to the household survey, the unemployment rate unexpectedly fell to 9.4 percent from 9.8 percent in November. Analysts had called for 9.7 percent. The rate declined in part due to a notable drop in the labor force, suggesting the unemployment rate will rebound when discouraged workers return. Turning to the household survey, the unemployment rate unexpectedly fell to 9.4 percent from 9.8 percent in November. Analysts had called for 9.7 percent. The rate declined in part due to a notable drop in the labor force, suggesting the unemployment rate will rebound when discouraged workers return.

However, there are continuing signs of stress in the labor market. The expanded rate of underemployment—the so-called “U-6” alternative measure—slipped to 16.7 percent from 17.0 percent in November but remains very high. This measure adds in part-time workers for economic reasons, discouraged workers, plus those not looking for work but would take a job if offered one. Finally, the median duration of being unemployed continued to creep higher at 22.4 weeks from 21.7 weeks in November. The long-term unemployed are going to have a more difficult time finding new work as job skills deteriorate or do not keep up with employer needs.

The December jobs report indicates that businesses so far remain reluctant to hire. In the near term, growth in consumer spending will continue to rely on those with jobs and the release of moderate pent up demand. Given that many indicators have been strengthening, there is hope that businesses will pick up the pace of hiring in coming months. For now, consumers with jobs apparently see their own situation as stable and are out spending.

Auto manufacturers are smiling—at least domestic producers. Motor vehicle sales in December are at their highest pace since cash-for-clunkers in mid-2009. Unit motor vehicle sales rose 2 percent in December to a 12.5 million annual rate from 12.3 million in November. December's strength was concentrated in North American-made vehicles, which sold at a 9.4 million rate, up 4 percent from November. Domestic cars jumped 8 percent while light trucks gained 2 percent. Sales of imports slipped 3 percent to 3.1 million from 3.2 million the month before. Auto manufacturers are smiling—at least domestic producers. Motor vehicle sales in December are at their highest pace since cash-for-clunkers in mid-2009. Unit motor vehicle sales rose 2 percent in December to a 12.5 million annual rate from 12.3 million in November. December's strength was concentrated in North American-made vehicles, which sold at a 9.4 million rate, up 4 percent from November. Domestic cars jumped 8 percent while light trucks gained 2 percent. Sales of imports slipped 3 percent to 3.1 million from 3.2 million the month before.

The latest unit sales numbers point to a healthy retail sales number for December and also to a robust PCEs component in fourth quarter GDP.

There is another indicator added to the list of those pointing to a strengthening in the manufacturing sector. The ISM’s composite index rose four tenths in December to 57.0, well over 50 to indicate significant monthly growth for the month. This is the healthiest reading since May 2010. There is another indicator added to the list of those pointing to a strengthening in the manufacturing sector. The ISM’s composite index rose four tenths in December to 57.0, well over 50 to indicate significant monthly growth for the month. This is the healthiest reading since May 2010.

Forward momentum also seems to be building. The new orders index jumped 4.3 points to 60.9 in December—the highest level also since May 2010. Production was moderately positive. An encouraging sign that manufacturers are gearing up for faster assembly lines is that the employment index remained in positive territory at 55.7, though down marginally from November. Overall, the report indicates that the manufacturing sector is regaining strength.

Not only is the manufacturing sector gaining momentum but so is the non-manufacturing sector. The ISM's composite index in December rose to 57.1, up 2.1 points from November’s reading of 55.0. The December figure set a new high for the recovery. Not only is the manufacturing sector gaining momentum but so is the non-manufacturing sector. The ISM's composite index in December rose to 57.1, up 2.1 points from November’s reading of 55.0. The December figure set a new high for the recovery.

And further improvement is likely as the new orders index jumped 5.3 points to 63.0, also a recovery best.

The big negative in the report was a spike in the prices paid index to 70.0 from 63.2 in November. This is the highest level since September 2008. Of the 17 industry groups defined in the ISM report, 15 showed price increases in December with the remaining two indicating no change. The industries with the most notable price increases were agriculture, forestry, fishing & hunting; wholesale trade; and educational services.

Overall, the non-manufacturing economy was strengthening notably at the end of 2010, suggesting further improvement this year.

Not only is the manufacturing sector looking healthier but so is construction. Well, maybe it's better to say this sector is not getting sicker—but recent news has been somewhat on the encouraging side. Construction outlays in November posted a 0.4 percent gain, following a 0.7 percent boost the prior month. Construction spending has been up for three consecutive months. Not only is the manufacturing sector looking healthier but so is construction. Well, maybe it's better to say this sector is not getting sicker—but recent news has been somewhat on the encouraging side. Construction outlays in November posted a 0.4 percent gain, following a 0.7 percent boost the prior month. Construction spending has been up for three consecutive months.

The gain in November was led by a 0.7 percent increase in private residential outlays, following a 3.9 percent surge in October. For the latest month, the multifamily component increased 3.0 percent while the single-family component rebounded 0.6 percent. Also, public outlays rose 0.7 percent after a 0.3 percent dip in October. Meanwhile, private nonresidential spending declined 0.1 percent in November, following a 0.7 percent drop the previous month.

While the most recent news points to stabilization, construction activity is still anemic. On a year-ago basis, overall construction outlays rose to minus 6.0 percent in November from down 8.8 percent in October. The bottom line is that this is one more sign that overall construction has hit bottom with some modest strength in multifamily housing and possibly public outlays (from stimulus). This sector is no longer dragging the economy down.

Participants at the December 14 FOMC meeting apparently were more optimistic than indicated in the meeting statement. Nonetheless, with inflation below target, the Fed is focusing on a high unemployment rate as reason to maintain its plan for further expansion of its balance sheet.

"In their discussion of the economic situation and outlook, meeting participants saw the information received during the intermeeting period as pointing to some improvement in the near-term outlook, and they expected that economic growth, which had been moderate, would pick up somewhat going forward."

"A number of participants noted that their business contacts had become more optimistic about the outlook for sales and production."

Also adding to this view was their belief that the recently enacted fiscal package would support the recovery in 2011 with QE2 also contributing.

Still, inflation was seen as too low and unemployment as too high

"Members noted that, while incoming information over the intermeeting period had increased their confidence in the economic recovery, progress toward the Committee's dual objectives of maximum employment and price stability was disappointingly slow."

Overall, the minutes show the Fed officials were quite aware of the improvement in economic news. But the final consideration was that risks remain and that the Fed prefers to take out an insurance policy to ensure an improving recovery and to help bring down the unemployment rate.

Economic momentum is growing in manufacturing and non-manufacturing sectors. Firms are still reluctant to pick up the pace of hiring but many traders and economists believe that further economic growth will lead to stronger payroll gains soon this year.

The week’s market movers kick off Wednesday afternoon with the Fed’s Beige Book. Three major announcements are highlighted on Thursday including international trade, producer prices and jobless claims. The week winds up with consumer prices and sentiment along with retail sales and industrial production.

The Beige Book is prepared for the January 25-26 FOMC meeting. Traders will be parsing the report for signs that the recovery is gaining momentum. Given the disappointment over the latest employment situation report, more attention will likely be given to labor market conditions and whether hiring is picking up.

The U.S. Treasury monthly budget report showed a deficit for November at $150.4 billion, about $20 billion worse than expectations, partially boosted by a $27 billion calendar timing shift for government payments held down October at the expense of November. Looking ahead, the month of December typically shows a modest surplus for the month, reflecting end of quarter and end of year payments. Over the past 10 years, the average surplus for the month of December has been $12.6 billion and $9.4 billion over the past 5 years. In contrast, for December 2009 there was a $91.4 deficit.

Consensus forecast not yet available.

The U.S. international trade gap in October shrank to $38.7 billion from a $44.6 billion shortfall the month before. Exports improved, jumping 3.2 percent, following a 0.5 percent rise in September. Imports declined 0.5 percent after slipping 0.7 percent the prior month. The narrowing of the trade gap was primarily in the petroleum gap which dropped to $19.1 billion from $21.7 billion in September. On the boost in exports, the nonpetroleum shortfall also shrank—to $31.0 billion from $34.1 billion the prior month.

International trade balance Consensus Forecast for November 10: -$41.0 billion

Range: -$43.2 billion to -$39.0 billion

The producer price index for finished goods in November jumped to a monthly 0.8 percent increase from a 0.4 percent pace in October. The headline PPI has risen by at least 0.4 percent for four consecutive months. At the core level, the November PPI rebounded 0.3 percent after dropping 0.6 percent the month before. Recent reports from manufacturing surveys suggest that the inflation is picking up at the producer level. This is more likely to show up at the crude and intermediate levels than for finished goods.

PPI Consensus Forecast for December 10: +0.8 percent

Range: +0.2 to +1.2 percent

PPI ex food & energy Consensus Forecast for December 10: +0.2 percent

Range: +0.1 to +0.6 percent

Initial jobless claims for the January 1 week rose to 409,000 in the January 1 week following the prior week's 391,000 for the second best reading of the recovery. Many had viewed the December 25 week as somewhat suspect due to adverse weather limiting workers’ ability to file claims. Nonetheless, the latest number reflects a gradual downtrend in initial filings.

Jobless Claims Consensus Forecast for 1/5/11: 405,000

Range: 400,000 to 415,000

The consumer price index in November rose a modest 0.1 percent, following a 0.2 percent increase in October. Excluding food and energy, CPI inflation firmed to up 0.1 percent from no change the month before. Energy increased only 0.2 percent, following a 2.6 percent surge in October. Most of the November rise was from fuel oil which jumped 4.2 percent. Gasoline was up 0.7 percent while electricity rose 0.9 percent. Damping these was a 5.7 percent drop in natural gas costs. And food was relatively tame, rising 0.2 percent after a 0.1 percent uptick the prior month. For the core, increases in the indexes for shelter and airline fares accounted for most of the rise, while the indexes for new vehicles, used cars and trucks, and household furnishings and operations all declined. Softness was widespread within major expenditure components. Looking ahead, higher gasoline prices are likely to boost at least the headline number.

CPI Consensus Forecast for December 10: +0.4 percent

Range: +0.2 to +0.5 percent

CPI ex food & energy Consensus Forecast for December 10: +0.1 percent

Range: +0.1 to +0.1 percent

Retail sales for November posted a healthy 0.8 percent gain, following a 1.7 percent boost in October. Excluding autos, sales were even more robust with a 1.2 percent rise, following a 0.8 percent jump in October. Sales excluding autos and gasoline rose 0.8 percent, matching October’s advance. For the latest month, overall sales were led by a 4.0 percent spike in gasoline station sales which likely was price related. But strength still was widespread in most major components. Looking ahead, a 2 percent boost in unit new motor vehicle sales for December suggests a healthy headline number for retail sales in December.

Retail sales Consensus Forecast for December 10: +0.8 percent

Range: +0.2 to +1.1 percent

Retail sales excluding motor vehicles Consensus Forecast for December 10: +0.7 percent

Range: +0.2 to +1.1 percent

Industrial production improved in November, rising 0.4 percent, following a revised 0.2 percent dip the month before. By major components, manufacturing gained 0.3 percent, matching the boost in October. For other major industry groups, utilities output rebounded 1.9 percent while mining edged down 0.1 percent. Within manufacturing, gains were broad based. Overall capacity utilization firmed to 75.2 percent in November from 74.9 percent in October. Looking ahead, production worker hours in manufacturing for December slipped 0.1 percent, suggesting that the manufacturing component of industrial production may be soft. However, recent manufacturing surveys—including ISM, Philly Fed, and New York Fed—have been more positive.

Industrial production Consensus Forecast for December 10: +0.5 percent

Range: +0.1 to +0.8 percent

Capacity utilization Consensus Forecast for December 10: 75.6 percent

Range: 75.1 to 75.8 percent

The Reuter's/University of Michigan's Consumer sentiment index improved in December to 74.5, up three tenths from November. Details showed mild and extending improvement for the six-month outlook, a leading component that is still less improved than the assessment of current conditions.

Consumer sentiment Consensus Forecast for preliminary January 11: 75.0

Range: 74.0 to 77.5

Business inventories rose 0.7 percent in October, trailing a very strong 1.4 percent rise in business sales. The mismatch pulled the inventory-to-sales ratio down one notch to 1.27.

Details show a 0.6 percent draw at the retail level, the result of October's very strong 1.8 percent rise in retail sales. More recently, manufacturers’ inventories rose 0.8 percent in November, supporting a gain in overall business inventories for the month.

Business inventories Consensus Forecast for November 10: +0.7 percent

Range: +0.6 to +1.3 percent

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|