|

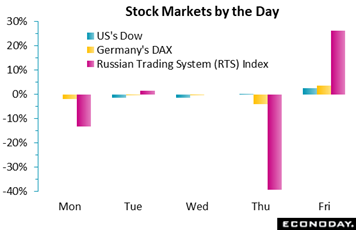

Revulsion to what Putin's doing to Ukraine hasn't undermined the global economic outlook, at least not yet based on the end-of-week rally for the global stock markets. The West's response has been measured, meting out sanctions in a wait-and-see mode with markets ready perhaps to rally further if the military advance, slowed by Ukrainian resistance, begins to falter and in turn increases unrest inside Russia, or if it succeeds and Putin can put down his nuclear saber. Policy withdrawal of monetary stimulus may also follow a careful path, one of incrementalism that will call for no more than 25-basis-point moves in an effort, inflation aside, not to press too hard on the brakes at a very delicate time. We'll start the week's rundown with one bank which has stopped raising rates, at least for now.

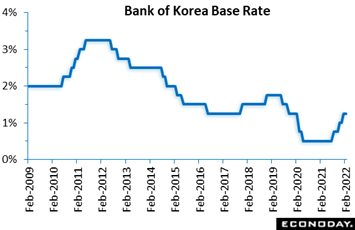

The Bank of Korea was the first major central bank to raise rates last year, beginning in August and followed by successive hikes at its November and January meetings. But at February's meeting, ahead of a presidential election in March, the bank left its main policy rate unchanged at 1.25 percent, this despite further raising its inflation forecast. The BoK said South Korea's economy "has continued to recover" despite a recent resurgence of domestic Covid cases and the tightening of public health restrictions. Officials noted that growth in consumption and investment has moderated but they pointed to continued strength in external demand and the labor market. Officials retained their forecast for GDP to grow by around 3 percent in 2022 but revised up their assessment of inflation which has been above the bank's 2 percent target since April and above 3 percent for the last four months. Officials now believe inflation "will run substantially above 3 percent for a considerable time" and see core inflation rising to the mid-2 percent level over this year. The BoK didn't mention the election in its statement but did cite Ukraine (which was being invaded at the time of the meeting) as well as concerns about the possible pace of policy tightening by the Federal Reserve. The Bank of Korea was the first major central bank to raise rates last year, beginning in August and followed by successive hikes at its November and January meetings. But at February's meeting, ahead of a presidential election in March, the bank left its main policy rate unchanged at 1.25 percent, this despite further raising its inflation forecast. The BoK said South Korea's economy "has continued to recover" despite a recent resurgence of domestic Covid cases and the tightening of public health restrictions. Officials noted that growth in consumption and investment has moderated but they pointed to continued strength in external demand and the labor market. Officials retained their forecast for GDP to grow by around 3 percent in 2022 but revised up their assessment of inflation which has been above the bank's 2 percent target since April and above 3 percent for the last four months. Officials now believe inflation "will run substantially above 3 percent for a considerable time" and see core inflation rising to the mid-2 percent level over this year. The BoK didn't mention the election in its statement but did cite Ukraine (which was being invaded at the time of the meeting) as well as concerns about the possible pace of policy tightening by the Federal Reserve.

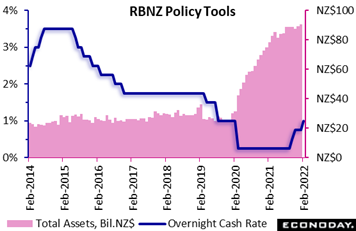

The Reserve Bank of New Zealand also met in the week (just before Russia invaded Ukraine) and did raise rates, by 25 basis points to 1.00 percent. This followed identical moves at their two previous meetings in October and December as officials continue to unwind the aggressive policy accommodation put in place during the initial stages of the pandemic. Officials also announced they would begin to reduce the level of their assets through both bond maturities and managed sales. The bank said recent Covid developments are likely to cause "short-term economic disruption" but officials also argued that conditions remain "supported by aggregate household and business balance sheet strength, fiscal policy support, and strong export returns." This confidence in the underlying strength of economic activity has kept officials focused on challenges to the inflation outlook, with the statement again noting that capacity pressures have continued to tighten and that there is a risk that an expected increase in near-term inflation could lead to "more generalised price rises". Based on this assessment, officials consider that it remains appropriate to continue reducing the level of monetary stimulus in order to meet their inflation and employment objectives. They also noted that a further removal of policy stimulus is expected over time, indicating that additional rate hikes will likely be considered at upcoming meetings. The Reserve Bank of New Zealand also met in the week (just before Russia invaded Ukraine) and did raise rates, by 25 basis points to 1.00 percent. This followed identical moves at their two previous meetings in October and December as officials continue to unwind the aggressive policy accommodation put in place during the initial stages of the pandemic. Officials also announced they would begin to reduce the level of their assets through both bond maturities and managed sales. The bank said recent Covid developments are likely to cause "short-term economic disruption" but officials also argued that conditions remain "supported by aggregate household and business balance sheet strength, fiscal policy support, and strong export returns." This confidence in the underlying strength of economic activity has kept officials focused on challenges to the inflation outlook, with the statement again noting that capacity pressures have continued to tighten and that there is a risk that an expected increase in near-term inflation could lead to "more generalised price rises". Based on this assessment, officials consider that it remains appropriate to continue reducing the level of monetary stimulus in order to meet their inflation and employment objectives. They also noted that a further removal of policy stimulus is expected over time, indicating that additional rate hikes will likely be considered at upcoming meetings.

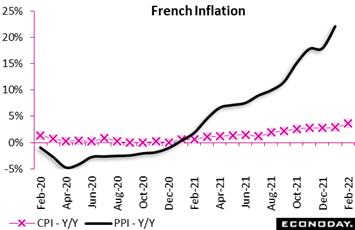

The inflation outcome from the Ukrainian crisis probably won't be favorable, and going into this effect the news wasn't getting any better. A provisional 0.7 percent monthly increase in French consumer prices for the month of February was more than double the consensus and large enough to lift the annual rate from January's 2.9 percent to 3.6 percent, equaling its strongest print since 1991. The annual acceleration was broad-based but mainly due to manufactured goods where the rate spiked from 0.6 percent to 2.2 percent; services (2.2 percent after 2.0 percent) saw a much smaller rise but also provided a boost as did food (1.9 percent after 1.5 percent) and energy (21.0 percent after 19.9 percent). February's provisional report makes for upside risk to the Eurozone flash report due in the coming week, and will also add to pressure on the European Central Bank to announce a policy recalibration at next month's meeting. The inflation outcome from the Ukrainian crisis probably won't be favorable, and going into this effect the news wasn't getting any better. A provisional 0.7 percent monthly increase in French consumer prices for the month of February was more than double the consensus and large enough to lift the annual rate from January's 2.9 percent to 3.6 percent, equaling its strongest print since 1991. The annual acceleration was broad-based but mainly due to manufactured goods where the rate spiked from 0.6 percent to 2.2 percent; services (2.2 percent after 2.0 percent) saw a much smaller rise but also provided a boost as did food (1.9 percent after 1.5 percent) and energy (21.0 percent after 19.9 percent). February's provisional report makes for upside risk to the Eurozone flash report due in the coming week, and will also add to pressure on the European Central Bank to announce a policy recalibration at next month's meeting.

Further adding pressure will be France's producer price report for the month of January which was also released in the week. A 4.6 percent monthly increase was the steepest since 1995 and followed an upwardly revised 1.3 percent rise in December. Annual PPI inflation climbed from 18.0 percent to 22.2 percent. The monthly headline increase was dominated by coke and refined petroleum (16.2 percent) but mining and quarrying, energy and water (9.8 percent) also posted a hefty advance. Elsewhere, all the other categories recorded further rises, notably food, drink and tobacco (1.2 percent) and other manufactured products (2.1 percent). The update shows that inflationary pressures in manufacturing remained as intense as ever in January. The gap between PPI inflation and CPI inflation continues to widen and without a significant easing in the PPI rate soon, consumer price rises are almost guaranteed to accelerate further.

France was the first to post consumer prices for the month of February with Germany to follow with its CPI report on Tuesday of the coming week. But Germany, like France, did post producer prices for January and the story is the same. Extending an unbroken sequence of gains that began back in September 2020, a 2.2 percent monthly increase was again well above the consensus and large enough to lift annual PPI inflation from December's previous record high of 24.2 percent to yet another fresh peak of 25.0 percent. The yearly rate has climbed 23.6 percentage points since January 2021. In line with the pattern seen over much of 2021, energy (2.5 percent) provided a significant boost to the overall monthly change. However, intermediates (3.1 percent) and consumer durables (3.0 percent) posted even sharper rises and there were increases too in capital goods (1.8 percent) and consumer non-durables (2.0 percent). As a result, the annual core rate climbed from 10.4 percent to 12.5 percent, similarly a new all-time high. The January update points to no let up in pipeline price pressures in the manufacturing sector and suggests that CPI inflation is likely to stay historically very high for some time yet. France was the first to post consumer prices for the month of February with Germany to follow with its CPI report on Tuesday of the coming week. But Germany, like France, did post producer prices for January and the story is the same. Extending an unbroken sequence of gains that began back in September 2020, a 2.2 percent monthly increase was again well above the consensus and large enough to lift annual PPI inflation from December's previous record high of 24.2 percent to yet another fresh peak of 25.0 percent. The yearly rate has climbed 23.6 percentage points since January 2021. In line with the pattern seen over much of 2021, energy (2.5 percent) provided a significant boost to the overall monthly change. However, intermediates (3.1 percent) and consumer durables (3.0 percent) posted even sharper rises and there were increases too in capital goods (1.8 percent) and consumer non-durables (2.0 percent). As a result, the annual core rate climbed from 10.4 percent to 12.5 percent, similarly a new all-time high. The January update points to no let up in pipeline price pressures in the manufacturing sector and suggests that CPI inflation is likely to stay historically very high for some time yet.

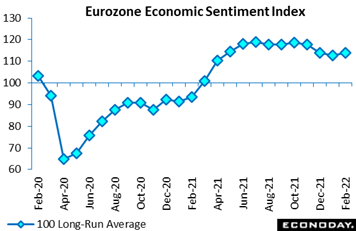

No measures are yet available on what the attack on Ukraine has done to sentiment, but we can establish where sentiment was going into the attack. With Covid restrictions having eased in most member states, the EU Commission's February survey found a modest improvement in Eurozone economic sentiment. At 114.0, the headline gauge was up 1.3 points versus January, its first increase since October and a 3-month high. It was also on the firm side of the market consensus and well above its 100 long-run average. February's headline gain reflected stronger confidence in industry (14.0 after 13.9), construction (9.9 after 8.1), retail trade (5.4 after 3.7) and, in particular, services (13.0 after 19.1). However, consumer confidence (minus 8.8 after minus 8.5) deteriorated slightly and for a fifth successive month. Meantime, inflation expectations remained elevated. Expected selling prices in both manufacturing (49.8 after 47.4) and services (22.3 after 21.0) hit new record highs while household inflation expectations (37.7 after 38.4) remained close to their all-time peak (39.9). The findings reinforce a picture of strong inflation pressures, and that before the new surge suddenly underway in energy prices. No measures are yet available on what the attack on Ukraine has done to sentiment, but we can establish where sentiment was going into the attack. With Covid restrictions having eased in most member states, the EU Commission's February survey found a modest improvement in Eurozone economic sentiment. At 114.0, the headline gauge was up 1.3 points versus January, its first increase since October and a 3-month high. It was also on the firm side of the market consensus and well above its 100 long-run average. February's headline gain reflected stronger confidence in industry (14.0 after 13.9), construction (9.9 after 8.1), retail trade (5.4 after 3.7) and, in particular, services (13.0 after 19.1). However, consumer confidence (minus 8.8 after minus 8.5) deteriorated slightly and for a fifth successive month. Meantime, inflation expectations remained elevated. Expected selling prices in both manufacturing (49.8 after 47.4) and services (22.3 after 21.0) hit new record highs while household inflation expectations (37.7 after 38.4) remained close to their all-time peak (39.9). The findings reinforce a picture of strong inflation pressures, and that before the new surge suddenly underway in energy prices.

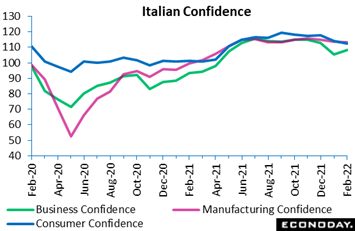

In slight contrast to Europe overall, sentiment in Italy has been struggling slightly with overall business confidence staging only a partial rebound in February. From 105.3 in January, Istat's headline sentiment gauge climbed to 108.2, reversing less than half of the prior period's 7.4 point drop. Yet the improvement did widen the gap with its pre-pandemic level in February 2020 to 8.6 points. At a sector level February was a poor month for manufacturing where confidence dropped from 113.7 to 113.4, its third successive decline and weaker than the market consensus. Retail trade (104.9 after 106.6) also saw a worsening but there were gains in construction (159.7 after 158.8) and, particularly steeply, in services (100.5 after 94.9). At the same time, consumer confidence (112.4 after 114.2) decreased to its lowest level since last May, also undershooting the market consensus. The results do confirm an improvement in services following the relaxation of Covid restrictions but also warn that supply chain problems are still an issue for manufacturing. Moreover, household confidence appears to be getting undermined by rising inflation. In slight contrast to Europe overall, sentiment in Italy has been struggling slightly with overall business confidence staging only a partial rebound in February. From 105.3 in January, Istat's headline sentiment gauge climbed to 108.2, reversing less than half of the prior period's 7.4 point drop. Yet the improvement did widen the gap with its pre-pandemic level in February 2020 to 8.6 points. At a sector level February was a poor month for manufacturing where confidence dropped from 113.7 to 113.4, its third successive decline and weaker than the market consensus. Retail trade (104.9 after 106.6) also saw a worsening but there were gains in construction (159.7 after 158.8) and, particularly steeply, in services (100.5 after 94.9). At the same time, consumer confidence (112.4 after 114.2) decreased to its lowest level since last May, also undershooting the market consensus. The results do confirm an improvement in services following the relaxation of Covid restrictions but also warn that supply chain problems are still an issue for manufacturing. Moreover, household confidence appears to be getting undermined by rising inflation.

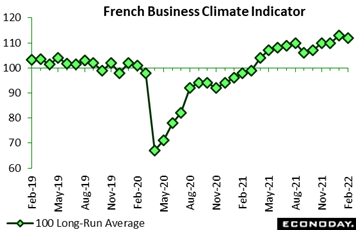

February sentiment in French manufacturing was little changed. INSEE's business climate indicator dipped just a point from January to 112. This was its first fall since September but in line with the market consensus and still a sizeable 12 points above its long-run average. February's minor setback was largely attributable to weaker past output (14 percent after 25 percent) and foreign orders (minus 2 percent after 2 percent). However, setbacks here masked an increase in overall orders (1 percent after minus 1 percent) and an improvement in both personal production expectations (24 percent after 22 percent) and general production expectations (22 percent after 15 percent). That said, expected selling prices (45 percent after 33 percent) reversed much of January's 17 percentage point drop. Elsewhere the picture was rather brighter: sentiment improved in retail trade (107 after 105) and construction (114 after 113) and, in particular, in services (112 after 106) where looser Covid rules provided a significant boost. As a result, the economy-wide index climbed from 107 to 112, a 3-month high. February's update suggests that businesses in general were, at least before Ukraine, becoming more optimistic about the 2022 outlook as the recovery in demand gained momentum. February sentiment in French manufacturing was little changed. INSEE's business climate indicator dipped just a point from January to 112. This was its first fall since September but in line with the market consensus and still a sizeable 12 points above its long-run average. February's minor setback was largely attributable to weaker past output (14 percent after 25 percent) and foreign orders (minus 2 percent after 2 percent). However, setbacks here masked an increase in overall orders (1 percent after minus 1 percent) and an improvement in both personal production expectations (24 percent after 22 percent) and general production expectations (22 percent after 15 percent). That said, expected selling prices (45 percent after 33 percent) reversed much of January's 17 percentage point drop. Elsewhere the picture was rather brighter: sentiment improved in retail trade (107 after 105) and construction (114 after 113) and, in particular, in services (112 after 106) where looser Covid rules provided a significant boost. As a result, the economy-wide index climbed from 107 to 112, a 3-month high. February's update suggests that businesses in general were, at least before Ukraine, becoming more optimistic about the 2022 outlook as the recovery in demand gained momentum.

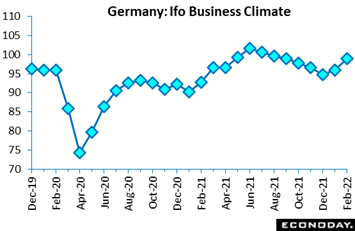

Ifo's February survey, which measure business sentiment in Germany, was notably more robust than anticipated. The headline climate indicator rose for only the second time since last June with a 2.9 point gain that lifted the index to 98.9. This was its strongest print since September and 2.5 points above its pre-Covid level. With the January reading revised up 0.3 points, the latest gain made for a 4.1 point increase since December and provides further evidence of improving pre-Ukraine sentiment in German industry. The overall increase reflected stronger outturns for both current conditions and expectations. The former sub-index was up 2.4 points at 98.6, its first advance since August 2021 and a 3-month high. However, it was still 0.5 points short of its pre-crisis mark. Expectations were up a larger 3.4 points and at 99.2, were standing at a 7-month peak and 5.4 points higher than in February 2020. At a sector level, climate indicators again improved across all of the major categories. Services (13.5 after 7.7) and trade (6.6 after minus 1.3) saw the steepest rises ahead of manufacturing (23.5 after 20.0) and construction (8.3 after 8.0). The February update is broadly consistent with February's flash PMI survey which, also released in the week, likewise pointed to a marked improvement in overall business conditions. Developments in Ukraine will of course result in a sober reassessment of conditions. Ifo's February survey, which measure business sentiment in Germany, was notably more robust than anticipated. The headline climate indicator rose for only the second time since last June with a 2.9 point gain that lifted the index to 98.9. This was its strongest print since September and 2.5 points above its pre-Covid level. With the January reading revised up 0.3 points, the latest gain made for a 4.1 point increase since December and provides further evidence of improving pre-Ukraine sentiment in German industry. The overall increase reflected stronger outturns for both current conditions and expectations. The former sub-index was up 2.4 points at 98.6, its first advance since August 2021 and a 3-month high. However, it was still 0.5 points short of its pre-crisis mark. Expectations were up a larger 3.4 points and at 99.2, were standing at a 7-month peak and 5.4 points higher than in February 2020. At a sector level, climate indicators again improved across all of the major categories. Services (13.5 after 7.7) and trade (6.6 after minus 1.3) saw the steepest rises ahead of manufacturing (23.5 after 20.0) and construction (8.3 after 8.0). The February update is broadly consistent with February's flash PMI survey which, also released in the week, likewise pointed to a marked improvement in overall business conditions. Developments in Ukraine will of course result in a sober reassessment of conditions.

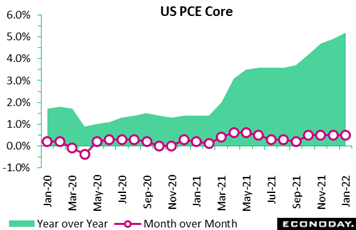

We end the week with a look at what's staring the Federal Reserve in the face: extending acceleration for the most key of all price gauges. The core PCE index posted a 0.5 percent monthly increase in January -- the fourth straight 0.5 percent gain. The annual rate at 5.2 percent climbed 3 tenths for its worst showing since 1983. The overall PCE (which excludes food and energy) was even higher, rising 0.6 percent on the month for an annual rate of 6.7 percent and its worst showing since 1982. With inflationary pressures continuing to build, the data reinforce the case for a Fed rate hike especially as consumption expenditures (which were also posted as part of this report) surged 2.1 percent in January despite certain Covid restrictions that were still in place. We end the week with a look at what's staring the Federal Reserve in the face: extending acceleration for the most key of all price gauges. The core PCE index posted a 0.5 percent monthly increase in January -- the fourth straight 0.5 percent gain. The annual rate at 5.2 percent climbed 3 tenths for its worst showing since 1983. The overall PCE (which excludes food and energy) was even higher, rising 0.6 percent on the month for an annual rate of 6.7 percent and its worst showing since 1982. With inflationary pressures continuing to build, the data reinforce the case for a Fed rate hike especially as consumption expenditures (which were also posted as part of this report) surged 2.1 percent in January despite certain Covid restrictions that were still in place.

Markets dropped early in the week on a flight to quality amid escalating Ukraine worries offset only in part by positive economic news including the German Ifo business sentiment report as well as supportive corporate news. Asia/Pacific markets improved on Wednesday as risk appetite recovered after initial US sanctions on Russia, ones that followed the formal recognition of the Donbass region, were seen as less aggressive than expected, but risk appetite then suffered in Europe and North America from a succession of troubling headlines, including warnings that Russian forces were entering Ukraine and the cancellation of planned meetings between US and Russian foreign ministers. Markets dropped early in the week on a flight to quality amid escalating Ukraine worries offset only in part by positive economic news including the German Ifo business sentiment report as well as supportive corporate news. Asia/Pacific markets improved on Wednesday as risk appetite recovered after initial US sanctions on Russia, ones that followed the formal recognition of the Donbass region, were seen as less aggressive than expected, but risk appetite then suffered in Europe and North America from a succession of troubling headlines, including warnings that Russian forces were entering Ukraine and the cancellation of planned meetings between US and Russian foreign ministers.

On Thursday, deep losses swept Asia and also Europe including a 4.0 percent loss for Germany's DAX. The Dow in the US opened 2.5 percent lower before rallying and actually ending 0.3 percent higher on the session. The rally was triggered by Biden’s afternoon announcement of sanctions that the market considered to be mild, none on Putin himself, none on Russian energy exports, and no ban from SWIFT, the global payments system. Biden did announce limits on Russia’s ability to transact in hard currencies, plus asset freezes on Russian banks, and the country's access to western financing.

Friday opened with an aggressive injection of liquidity from the People's Bank of China as well as reports that Russia could consider a diplomatic end to the crisis. And let's look at Russia's RTS which fell 32.7 percent on the week, one punctuated by a 39.4 percent fall on Thursday offset in part by a 26.1 percent rebound on Friday. The weekly loss for the DAX was 3.2 percent and for the Dow only 0.1 percent.

For US economic data, the week wound up mostly as expected leaving Econoday's consensus divergence index at plus 1, or at virtually zero to indicate that US data, on net, are hitting Econoday's consensus estimates exactly. Otherwise, global data as a whole are beating expectations very noticeably led by the Eurozone at a substantially positive 46 going into the Ukraine disaster. Germany is at 34, the UK at 30, France at 25, and Italy at 16. The four remaining countries tracked by Econoday -- Switzerland, Japan, Canada, and China -- are all within plus or minus 5 points of zero to indicate that forecasters are hitting their numbers very closely.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Announcements from the Reserve Bank of Australia on Tuesday, where no action is expected, and Bank of Canada on Wednesday, where a rate hike is the call, will offer early guidance on how global central banks will assess and respond to Russia's war on Ukraine. Economic data for February will offer a baseline to measure the war's impact beginning in the coming week with February CPIs from Germany on Tuesday, the Eurozone on Wednesday, followed on Thursday with Switzerland. Updates on February's general activity in China will also be posted including the official CFLP PMIs as well as the Caixan manufacturing PMI on Tuesday followed on Thursday by the Caixan non-manufacturing PMI. Switzerland will post February leading indicators on Monday with February readings on US activity to include the ISM manufacturing and non-manufacturing indexes, on Tuesday and Thursday respectively. The German unemployment rate on Wednesday and US employment report on Friday may also offer important baselines to measure the war's impact. January data will include a run of retail sales reports including from Australia, Germany, the Eurozone, and Japan which will open the week with January industrial production.

Japanese Industrial Production for January (Sun 23:50 GMT; Mon 08:50 JST; Sun 18:50 EST)

Consensus Forecast, Month over Month: -0.4%

Industrial production, which took a breather in December after two months of strong growth, is expected to fall 0.4 percent on the month in January following the prior month's as-expected 1.0 percent decline.

Japanese Retail Sales for January (Sun 23:50 GMT; Mon 08:50 JST; Sun 18:50 EST)

Consensus Forecast, Year over Year: 1.5%

Retail sales, which were up an annual 1.4 percent in December, are expected to increase 1.5 percent in January.

Australian Retail Sales for January (Mon 00:30 GMT; Mon 11:30 AEDT; Sun 19:30 EST)

Consensus Forecast, Month over Month: 0.3%

Distorted by Covid effects, retail sales in Australia have been swinging up and down in recent months. January's consensus is calling for a monthly 0.3 percent increase following December's sharp 4.4 percent decline.

China: CFLP Manufacturing PMI for February (Estimated: Mon 01:00 GMT; Mon 09:00 CST; Sun 20:00 EST)

Consensus Forecast: 50.0

Growth in the government's official CFLP manufacturing PMI has been dead flat, at 50.1 in January with February seen at 50.0 even.

Swiss Fourth-Quarter GDP (Mon 08:00 GMT; Mon 09:00 CET; Mon 03:00 EST)

Consensus Forecast, Quarter over Quarter: 0.3%

Fourth-quarter GDP is expected to rise a quarterly 0.3 percent versus 1.7 percent expansion in the third quarter that benefited from a rise in household spending.

KOF Swiss Leading Indicator for February (Mon 08:00 GMT; Mon 09:00 CET; Mon 03:00 EST)

Consensus Forecast: 108.5

Forecasters see KOF's leading indicator ending eight straight months of decline with a rise to 108.5 in February versus January's 107.8.

Indian Fourth-Quarter GDP (Mon 12:00 GMT; Mon 17:30 IST; Mon 07:00 EST)

Consensus Forecast, Year over Year: 6.1%

Forecasters see GDP coming in at year-over-year growth of 6.1 percent in the December quarter versus 8.4 percent growth in the September quarter.

US International Trade in Goods (Advance) for January (Mon 13:30 GMT; Mon 08:30 EST)

Consensus Forecast, Balance: -$98.5 billion

The US goods deficit (Census basis) is expected to narrow to $98.5 billion in January after deepening by $3.0 billion in December to $102.0 billion. Trade data have been highly volatile due to supply-chain issues.

China: Caixin Manufacturing PMI for February (Tue 01:45 GMT; Tue 09:45 CST; Mon 20:45 EST)

Consensus Forecast: 49.3

Expected at 49.3 in February, Caixan's manufacturing PMI dipped below the breakeven 50-line in January to a contractionary 49.1.

Reserve Bank of Australia Announcement (Tue 03:30 GMT; Tue 14:30 AEDT; Mon 22:30 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.10%

The Reserve Bank of Australia is not expected to change its policy rate of 0.10 percent. At its February meeting, the RBA announced the end of asset purchases with the bank citing "faster-than-expected progress" toward its goals.

German Retail Sales for January (Tue 07:00 GMT; Tue 08:00 CET; Tue 02:00 EST)

Consensus Forecast, Month over Month: 2.1%

Retail sales plummeted 5.5 percent in December reflecting Covid containment measures and soft consumer confidence. January is expected to see a 2.1 percent monthly rebound.

German CPI, Preliminary for February (Tue 13:00 GMT; Tue 14:00 CET; Tue 08:00 EST)

Consensus Forecast, Month over Month: 0.9%

Consensus Forecast, Year over Year: 5.0%

Consumer inflation slowed in January to a 0.4 percent monthly rate which, however, compared with expectations for a 0.3 percent decline. February is expected to show sharp acceleration of 0.9 percent. The annual rate, skewed by last January's increase in VAT, fell 4 tenths to 4.9 percent with 5.0 percent the expectation for February.

Canadian GDP for December (Tue 13:30 GMT; Tue 08:30 EST)

Consensus Forecast, Month over Month: 0.0%

GDP for December is expected to come in unchanged on the month versus a 0.6 percent rise in November that came in better than expected.

US: ISM Manufacturing Index for February (Tue 15:00 GMT; Tue 10:00 EST)

Consensus Forecast: 58.0

ISM's index has been strong but slowing, down more than a point in January to 57.6 with slight firming to 58.0 the expectation for February.

Australian Fourth-Quarter GDP (Wed 00:30 GMT; Wed 11:30 AEDT; Tue 19:30 EST)

Consensus Forecast, Quarter over Quarter: 2.7%

Fourth-quarter GDP is expected to rise a quarterly 2.7 percent versus contraction of 1.9 percent in the third quarter.

German Unemployment Rate for February (Wed 08:55 GMT; Wed 09:55 CET; Wed 03:55 EST)

Consensus Forecast: 5.1%

Having fallen consistently, Germany's unemployment rate is expected to hold unchanged at 5.1 percent in February.

Eurozone HICP Flash for February (Wed 10:00 GMT; Wed 11:00 CET; Wed 05:00 EST)

Consensus Forecast, Year over Year: 5.3%

Narrow Core

Consensus Forecast, Year over Year: 2.4%

The flash headline annual rate for February is seen rising 2 tenths to 5.3 percent; the narrow core rate is expected to rise 1 tenth to 2.4 percent.

ADP, US Private Payrolls for February (Wed 13:15 GMT; Wed 08:15 EST)

Consensus Forecast: 320,000

Consensus Range: 163,000 to 700,000

The consensus forecast for ADP's February estimate is a 320,000 rise in private payrolls. Looking back at January, ADP's estimate for a sharp fall of 301,000 was, for a second month in a row, way off target. The actual result was growth of 444,000.

Bank of Canada Announcement (Wed 15:00 GMT; Wed 10:00 EST)

Consensus Forecast, Change: 25 basis points

Consensus Forecast, Level: 0.50%

At its January meeting, the Bank of Canada, facing a surge in food and energy prices, scratched its promise to keep its policy rate super low until mid-year presumably clearing the way for a near-term hike. And a 25-basis-point hike is the expectation for the March meeting.

China: Caixin Services PMI for February (Thu 01:45 GMT; Thu 09:45 CST; Wed 20:45 EST)

Consensus Forecast: 51.0

February's Caixan services PMI is expected to ease slightly to a modest 51.0 versus January's 51.4 which, for a second straight month, was better than expected.

Swiss CPI for February (Thu 07:30 GMT; Thu 08:30 CET; Thu 02:30 EST)

Consensus Forecast, Year over Year: 1.9%

January's CPI is seen rising 3 tenths in February to 1.9 percent.

Eurozone PPI for January (Thu 10:00 GMT; Thu 11:00 CET; Thu 05:00 EST)

Consensus Forecast, Month over Month: 2.1%

Consensus Forecast, Year over Year: 26.7%

After December's 2.9 percent surge, January's monthly consensus is a further rise of 2.1 percent with the annual rate seen at 26.7 percent versus 26.2 in the prior month which was yet another all-time high.

US: ISM Services Index for February (Thu 15:00 GMT; Thu 10:00 EST)

Consensus Forecast: 60.9

ISM services sample has been reporting substantial Covid effects that are restricting supplies of materials and the supply of labor. Yet demand has been strong making for a 60.0 showing in January. February's consensus is 60.9.

Japanese Unemployment Rate for January (Thu 23:30 GMT; Fri 08:30 JST; Thu 18:30 EST)

Consensus Forecast, Unemployment Rate: 2.7%

Japan's unemployment rate, which edged 1 tenth lower in December, is expected to hold unchanged at 2.7 percent in January.

Eurozone Retail Sales for January (Fri 10:00 GMT; Fri 11:00 CET; Fri 05:00 EST)

Consensus Forecast, Month over Month: 1.5%

After an unexpectedly poor 3.0 percent nosedive in December, retail sales are expected to rise 1.5 percent in January.

Eurozone Unemployment Rate for January (Fri 10:00 GMT; Fri 11:00 CET; Fri 05:00 EST)

Consensus Forecast: 6.9%

The Eurozone' s unemployment rate started 2021 at 8.1 percent and steadily declined to 7.0 percent in December, the latter decline 2 tenths lower than expected. December's consensus is 6.9 percent.

US Employment Situation for February (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast: Change in Nonfarm Payrolls: 390,000

Consensus Forecast: Average Hourly Earnings M/M: 0.5%

Consensus Forecast: Average Hourly Earnings Y/Y: 5.8%

A 390,000 rise is Econoday's consensus for nonfarm payroll growth in February which in January, at 467,000, far surpassed the high estimate. February consensus range is 197,000 to 625,000. Average hourly earnings, which in January also far surpassed expectations at a monthly 0.7 percent gain for an annual 5.7 percent rate, are expected to show continued pressure, at 0.5 and 5.8 percent respectively.

|