|

Stocks started the week looking to rally on merger and acquisition news along with favorable earnings. But disappointing economic news—especially a jump in first-time jobless claims—pushed equities back down.

Stocks got off to a good start this past week, but it did not end that way. Several deals got traders excited that companies might be starting to spend their cash stockpiles on acquisitions. Dell announced it is buying data-storage company 3PAR. Intel made public its plan to purchase Texas Instrument’s line of cable modem products. BHP’s bid for Potash Corp. also boosted M&A excitement. And Intel is looking to absorb McAfee. Early in the week, earnings were positive from Lowe’s while Wal-Mart and Home Depot boosted earnings forecasts. Stocks got off to a good start this past week, but it did not end that way. Several deals got traders excited that companies might be starting to spend their cash stockpiles on acquisitions. Dell announced it is buying data-storage company 3PAR. Intel made public its plan to purchase Texas Instrument’s line of cable modem products. BHP’s bid for Potash Corp. also boosted M&A excitement. And Intel is looking to absorb McAfee. Early in the week, earnings were positive from Lowe’s while Wal-Mart and Home Depot boosted earnings forecasts.

Economic news was a big net negative this week for equities. Empire State manufacturing was disappointing due to a negative number for new orders. Housing starts edged up but were notably below expectations. The low light for the week was on Thursday with an unexpected jump in initial jobless claims which hit the magically negative level of 500,000. The same day the Philly Fed manufacturing index fell back into negative territory and the index of leading indicators was less robust than hoped. Net, Thursday was a big down day for equities as traders either took the news as slow growth ahead or maybe, just maybe, a double dip. And though there was no economic news at week end, negative sentiment carried over to the last day of trading.

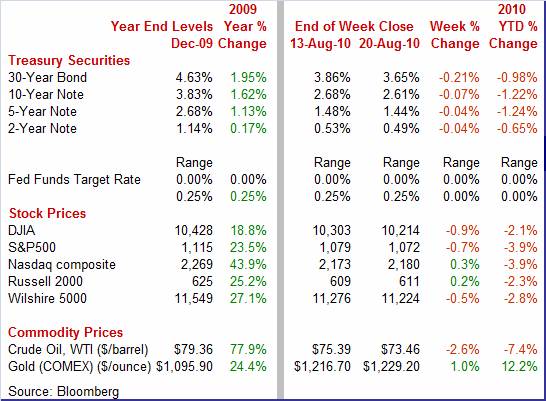

Equities were mixed this past week. The Nasdaq was up 0.3 percent and the Russell 2000 was up 0.2 percent. The Dow was down 0.9 percent and the S&P 500 was down 0.7 percent.

For the year-to-date, major indexes are down as follows: the Dow, down 2.1 percent; the S&P 500, down 3.9 percent; the Nasdaq, down 3.9 percent; and the Russell 2000, down 2.3 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury yields ended the week mostly down with the rate on the long bond down sharply. Early in the week, renewed worries over sovereign debt in some European countries boosted flight to safety and the dip in yields was abetted by the soft Empire State manufacturing report. A surge in equities on Tuesday did result in a partial rebound in rates as funds flowed into stocks. But weak economic news the rest of the week kept yields low with the bottom on rates on Thursday after the boost in initial unemployment claims. Treasury yields ended the week mostly down with the rate on the long bond down sharply. Early in the week, renewed worries over sovereign debt in some European countries boosted flight to safety and the dip in yields was abetted by the soft Empire State manufacturing report. A surge in equities on Tuesday did result in a partial rebound in rates as funds flowed into stocks. But weak economic news the rest of the week kept yields low with the bottom on rates on Thursday after the boost in initial unemployment claims.

Rates edged up a little on Friday as Treasuries were seen as overbought. Nonetheless, Treasury yields have been at or close to yearly lows all week. On Thursday, the 10-year yield was the lowest since March 2009. The 2-year note hit a record low at 0.49 percent. And the long bond yield was at its lowest since April 2009. Basically, flight to safety and weak economic news have bumped rates down. The Fed’s plan to reinvest principal paid on agency debt and mortgage-backed securities into Treasuries also weighed on yields.

For this past week Treasury rates were down as follows: the 2-year note, down 4 basis points; the 5-year note, down 1 basis point; the 7-year note, down 1 basis point; the 10-year bond, down 7 basis points; and the 30-year bond, down 21 basis points. The 3-month T-bill was unchanged for the week.

Oil prices fell further this past week. Worse-than-expected economic news led the spot price of West Texas Intermediate down. Oil prices fell further this past week. Worse-than-expected economic news led the spot price of West Texas Intermediate down.

There were contradictory inventory numbers this past week with private tallies by the American Petroleum Institute showing a build but the government report indicating a draw. But the bottom line is that supplies are too high for the re-evaluated status of the economy.

Net for the week, spot prices for West Texas Intermediate fell $1.93 per barrel to settle at $73.46. This is the lowest since $71.98 on July 6 of this year.

There are additional signs that the recovery is slowing but still no clear warning bells of a repeat downturn. Housing is flat while manufacturing is oscillating but upward.

Housing improved in July – but it was due to the fact that June was revised down. Housing starts in July posted a modest comeback, rising 1.7 percent after an 8.7 percent decrease in June. The July annualized pace of 0.546 million units is down 7.0 percent on a year-ago basis. In fact, the latest number is also down fractionally from the initial June estimate of 0.549. That is, July would have been a decline instead of a rebound were it not for a downward revision to June. Housing improved in July – but it was due to the fact that June was revised down. Housing starts in July posted a modest comeback, rising 1.7 percent after an 8.7 percent decrease in June. The July annualized pace of 0.546 million units is down 7.0 percent on a year-ago basis. In fact, the latest number is also down fractionally from the initial June estimate of 0.549. That is, July would have been a decline instead of a rebound were it not for a downward revision to June.

Recent swings in starts have been due to volatility in the multifamily component. The July improvement was led by a 32.6 percent bounce back in multifamily starts, following a 33.3 percent drop in June. The single-family component—weighed down by inventories—declined 4.2 percent after dipping 1.7 percent in June. Recent swings in starts have been due to volatility in the multifamily component. The July improvement was led by a 32.6 percent bounce back in multifamily starts, following a 33.3 percent drop in June. The single-family component—weighed down by inventories—declined 4.2 percent after dipping 1.7 percent in June.

Prospects for housing do not look good for the near term. While the multifamily component appears to be bouncing along bottom, the single-family component appears to be back on a mild downturn. Prospects for housing do not look good for the near term. While the multifamily component appears to be bouncing along bottom, the single-family component appears to be back on a mild downturn.

Overall building permits fell back 3.1 percent in July, following a 1.6 percent rebound in June. Overall permits stood at an annualized rate of 0.565 million units and are down 3.7 percent on a year-ago basis. The single-family component has been sliding since a recent peak of 0.542 million units in February of this year. Since, they have fallen 23.2 percent to 0.416 million units annualized. Most of the weakness was in April and May. June and July dipped 3.4 percent and 1.2 percent, respectively. Still, momentum is downward.

There are other indications that housing construction is not going to pick up much in the near term and could even head lower. Months’ supply of both new and existing homes remains high. Also, the National Association of Homebuilders’ Housing Market Index has edged back toward the cycle low. This index includes homebuilders’ measure of potential purchaser traffic through new homes.

Housing starts improved modestly in July at the headline level. But it largely was a technical rebound in the multifamily component. The current trend appears to be flat at best.

For now, the manufacturing sector is doing its part to keep the recovery going. Manufacturing—which has been a key source of strength for the recovery but faltered in June—showed significant resurgence in the latest month. Overall industrial production in July jumped 1.0 percent, following a revised 0.1 percent down tick in June. For now, the manufacturing sector is doing its part to keep the recovery going. Manufacturing—which has been a key source of strength for the recovery but faltered in June—showed significant resurgence in the latest month. Overall industrial production in July jumped 1.0 percent, following a revised 0.1 percent down tick in June.

By components, manufacturing posted a 1.1 percent comeback, following a 0.5 percent decline in June. The boost was broad-based as manufacturing excluding motor vehicles increased 0.6 percent, following a 0.3 percent dip the month before. Rounding out industry group components for July, utilities output was up 0.1 percent while mining advanced 0.9 percent. By components, manufacturing posted a 1.1 percent comeback, following a 0.5 percent decline in June. The boost was broad-based as manufacturing excluding motor vehicles increased 0.6 percent, following a 0.3 percent dip the month before. Rounding out industry group components for July, utilities output was up 0.1 percent while mining advanced 0.9 percent.

Strength in the latest month was broad based by sources of demand. By market group, business equipment jumped 1.8 percent and consumer goods posted a 1.1 percent gain. Nonindustrial supplies advanced 0.4 percent and materials were up 0.9 percent.

One sector that clearly is holding its own and even strengthening is the auto sector. Assemblies of autos and light trucks jumped to an 8.4 million unit pace in July from 7.4 million the month before and compared to the recession low of 3.6 million for January 2009. Light trucks weigh 10,000 pounds or less and include vans, minivans, and SUVs. Production of heavy and medium trucks, however, has not rebounded as much with assemblies at an annualized 150,000 pace in July, up from 130,000 in June and compared to the recession low of 100,000 units last seen in May 2009. One sector that clearly is holding its own and even strengthening is the auto sector. Assemblies of autos and light trucks jumped to an 8.4 million unit pace in July from 7.4 million the month before and compared to the recession low of 3.6 million for January 2009. Light trucks weigh 10,000 pounds or less and include vans, minivans, and SUVs. Production of heavy and medium trucks, however, has not rebounded as much with assemblies at an annualized 150,000 pace in July, up from 130,000 in June and compared to the recession low of 100,000 units last seen in May 2009.

A key factor affecting investment and inflation, capacity utilization jumped to 74.8 percent in July from 74.1 percent the prior month. While this recent trend likely is helping support business investment in equipment, it likely is still too low to boost investment in structures and it certainly is too low to impact inflation.

However, there are signs from regional manufacturing surveys that this sector is not as robust as July production numbers were.

The latest of the New York Fed and Philly Fed manufacturing reports showed manufacturing losing strength in August with the Philly headline actually posting negative. The latest of the New York Fed and Philly Fed manufacturing reports showed manufacturing losing strength in August with the Philly headline actually posting negative.

The headline Empire State number for general business conditions was positive at 7.1, rising 2 points from July and indicating modest growth for manufacturing overall in New York State. But details suggest slowing ahead. The new orders and shipments indexes both dipped below zero for the first time in more than a year. The unfilled orders index was also negative. On the upside, the employment index was positive and higher than last month.

Manufacturing indications out of the Mid-Atlantic region are decidedly more negative for August. The Philadelphia Fed's general business conditions index fell to minus 7.7 from plus 4.1 in July to indicate month-to-month contraction in business activity. New orders were in negative territory for the second month in a row, posting at minus 7.1 and worsening from July’s minus 4.3. Unfilled orders extended a run of declines. Shipments also fell in the month as did employment and the workweek.

Despite the disappointing numbers for current activity, manufacturing is still on an uptrend. For the New York Fed’s survey, the six-month outlook weakened, though future indexes were generally still positive. For the Philly Fed survey, the future general activity index remained positive for the 20th consecutive month but weakened slightly. The future new orders index increased to 25.7.

Overall PPI inflation moved up in July, with the headline PPI up 0.2 percent, following a 0.5 percent fall in June. At the core level, the PPI gained 0.3 percent, following a 0.1 percent uptick in June. Overall PPI inflation moved up in July, with the headline PPI up 0.2 percent, following a 0.5 percent fall in June. At the core level, the PPI gained 0.3 percent, following a 0.1 percent uptick in June.

For the latest month, energy costs actually declined, posting a 0.9 percent decrease. Meanwhile, food prices jumped 0.7 percent.

Bumping the core rate up were light trucks, up 1.5 percent; autos, up 0.3 percent, and pharmaceuticals, up 0.7 percent.

The surge in food prices was seen largely in fresh and dried vegetables, fresh fruits, and fresh eggs. The decrease in energy costs came from declines in prices for home heating oil dropped and gasoline. The surge in food prices was seen largely in fresh and dried vegetables, fresh fruits, and fresh eggs. The decrease in energy costs came from declines in prices for home heating oil dropped and gasoline.

Despite the firming in PPI inflation in July, the longer-term trends are favorable. For the overall PPI, the year-on-year rate increased to 4.1 percent from 2.7 percent in June (seasonally adjusted) but is well down from the six percent pace seen earlier this year. The core year-ago rate rose to 1.5 percent from 1.0 percent the prior month but this is still modest.

The index of leading indicators made a modest comeback in July, suggesting that forward momentum for the economy continues. The index of leading economic indicators rose 0.1 percent in July after dipping 0.3 percent the month before. The index of leading indicators made a modest comeback in July, suggesting that forward momentum for the economy continues. The index of leading economic indicators rose 0.1 percent in July after dipping 0.3 percent the month before.

Most of the heavy lifting for putting the index back on an uptrend came from loose monetary policy by the Fed. The interest rate spread component (10-year T-bond rate less fed funds) added 0.30 percentage points to July growth. Slight positive contributions also came from the factory workweek, vendor performance, initial jobless claims (yes, they actually went down in July although that seems like an eternity ago), and new orders for nondefense capital goods.

The biggest negative was a drop in consumer expectations, subtracting 0.22 percentage points. Also making modest negative contributions were building permits, stock prices, and the money supply. New orders for consumer goods and materials had a neutral contribution.

Looking ahead for leading indicators, the picture currently is uncertain. There are notable downdrafts likely from initial jobless claims and stock prices. The workweek is in doubt based on the latest Philly and New York Fed reports. But lift for the index likely will come from a still strong rate spread component. Consumer sentiment was up at mid-month but could be revised down for the final.

A positive in the latest leading indicators report was a 0.2 percent rise in the coincident index which more than reversed June's 0.1 percent drop. This suggests that the economy is not now in recession but merely in a slow growth period.

Profits currently are doing better than the economy but traders and investors have lowered their expectations for coming quarters—both for the economy and earnings.

Existing and new home sales, Tuesday and Wednesday, provide a post-stimulus update on whether this sector is stabilizing. Is manufacturing wavering' Durables orders on Wednesday will add to the debate. And Friday’s revision to second quarter GDP will get more attention than usual, given increased economic uncertainty.

Existing home sales in June dropped 5.1 percent, following a 2.2 percent decline the month before. Sales for the latest month came in at a 5.37 million annual rate and are up 9.8 percent on a year-ago basis, compared to up 19.2 percent in May. Sales could dip further in July as MBA purchase applications were weak.

Existing home sales Consensus Forecast for July 10: 4.65 million-unit rate

Range: 3.96 to 5.20 million-unit rate

Durable goods orders in June fell 1.0 percent, following a 0.8 percent drop the month before. The June decline was led by the transportation component. Excluding transportation, new durables orders slipped 0.6 percent, following a 1.2 percent gain in June. Outside of transportation, major components were mixed, albeit net negative. Looking ahead, manufacturing surveys for July were mixed on new orders. The ISM new orders index stood at 53.5, just above break-even 50, and the Empire State index was 10.13, notably above its break-even of zero. However, Philly Fed’s new orders index was in negative territory at minus 4.3.

New orders for durable goods Consensus Forecast for July 10: +2.5 percent

Range: +1.0 percent to +6.5 percent

New home sales made much more of a comeback than expected in June, rebounding 23.6 percent after plunging 36.7 percent in May. The June pace recovered to an annualized 330,000 from a revised 267,000 for May. The June percentage was large and that primarily was due to coming off a record low base. Sales are still at a weak level. For July, we could see slippage in sales as the June and July numbers for the NAHB Housing Market Index fell notably. The consensus, however, is hoping for marginal improvement.

New home sales Consensus Forecast for July 10: 340 thousand-unit annual rate

Range: 310 thousand to 350 thousand-unit annual rate

Initial jobless claims for the August 14 week jumped 12,000 to 500,000. The four-week average of 482,500 is the largest since December. The Labor Department said there were no special factors affecting the numbers. Continuing claims continue to come down, down 13,000 in data for the August 7 week. The four-week average of 4.527 million is the lowest of the recovery, likely reflecting workers’ loss of regular benefits.

Jobless Claims Consensus Forecast for 8/1/10: 495,000

Range: 475,000 to 510,000

GDP growth for the second quarter came in at an annualized 2.4 percent for the initial estimate and followed a revised first quarter gain of 3.7 percent. Final sales of domestic product gained an annualized 1.3 percent in the second quarter, following a 1.1 percent rise the prior quarter. However, this measure includes weakness from the widening in net exports. Real final sales to domestic purchasers rose 4.1 percent, compared to a 1.3 percent gain in the first quarter. Economy-wide inflation accelerated in the second quarter as the GDP price index rose an annualized 1.8 percent, following a 1.0 percent in the first quarter. The acceleration in prices was due to the impact from net export components as domestic price inflation actually remained subdued.

Real GDP Consensus Forecast for second estimate Q2 10: +1.3 percent annual rate

Range: +1.0 to +1.5 percent annual rate

GDP price index Consensus Forecast for second estimate Q2 10: +1.8 percent annual rate

Range: +1.6 to +1.8 percent annual rate

The Reuter's/University of Michigan's Consumer sentiment index improved in mid-August to 69.6 from July's full-month reading of 67.8. The latest number was still below the recent high of 76.04 in June of this year, but was significantly higher than the recession low of 55.3 or November 2008. But we could see some reversal for the final reading given the jump in initial jobless claims and drop in stock prices.

Consumer sentiment Consensus Forecast for final August 10: 69.6

Range: 68.0 to 70.0

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books, October 2009.

Econoday Senior Writer Mark Pender contributed to this article.

|