|

Though carefully balanced, Jerome Powell 's Jackson Hole speech may have tilted the bias for September's Federal Reserve policy meeting toward further tightening. After July's 25-basis-point tightening, the vague expectation at the time was that the Fed would step aside and keep rates unchanged in September as they did at their June meeting. But Powell spoke about needing to be "agile" and committed to fighting inflation. It remains to be seen whether inflation updates justify a sense of urgency but, given strength in labor demand including expectations for another solid showing in the coming week's employment report, the Fed may well see less risk in tightening too much than tightening not enough. Yet August's developments have not been favorable, especially a giant spike underway in US mortgage rates as well as uniformly weak flash PMI reports, not only for the US but also Europe amid a breakdown in the service sector.

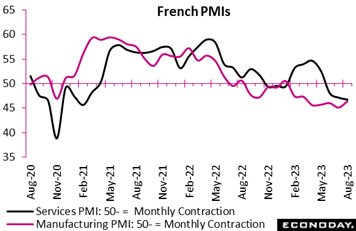

Business activity in France contracted again in August. The service sector lost further ground, sliding from 47.1 to 46.7, a 30-month trough as tracked by the black line in the accompanying graph. Manufacturing, at 46.4 as tracked in the red line, continued to decline, albeit at a slightly shallower rate than in July. Importantly, new orders for both samples declined at accelerating rates. Similarly, total backlogs decreased at the sharpest rate in close to three years. Overall employment still rose but the rate of job creation eased to its weakest mark since January 2021, and business confidence worsened but remained above June's 32-month low. Business activity in France contracted again in August. The service sector lost further ground, sliding from 47.1 to 46.7, a 30-month trough as tracked by the black line in the accompanying graph. Manufacturing, at 46.4 as tracked in the red line, continued to decline, albeit at a slightly shallower rate than in July. Importantly, new orders for both samples declined at accelerating rates. Similarly, total backlogs decreased at the sharpest rate in close to three years. Overall employment still rose but the rate of job creation eased to its weakest mark since January 2021, and business confidence worsened but remained above June's 32-month low.

Inflation indications were mixed with manufacturing pressures easing but service pressures rising both in costs and pass through to customers.

Taken at face value, August's update points to another poor month for French economic activity that warns growth this quarter could be a good deal slower if not negative.

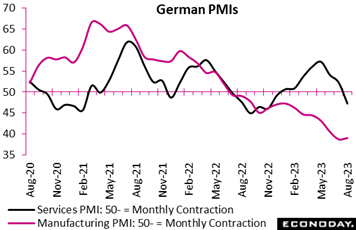

German PMI measurements are very weak so far this month; recessionary conditions would appear to be deepening. The services index slumped badly from July's 52.3 to 47.3, back in sub-50 contraction and a 9-month trough. At the same time manufacturing remained deep in the contraction zone, at 39.1 and hardly less ominous than July’s 38.8. The output index for manufacturing, at 39.7, saw its worst level in more than three years. German PMI measurements are very weak so far this month; recessionary conditions would appear to be deepening. The services index slumped badly from July's 52.3 to 47.3, back in sub-50 contraction and a 9-month trough. At the same time manufacturing remained deep in the contraction zone, at 39.1 and hardly less ominous than July’s 38.8. The output index for manufacturing, at 39.7, saw its worst level in more than three years.

Ominously, combined new orders between the two sectors fell again, led by particular weakness in manufacturing but also reflecting a steeper decline in services. Combined output would have been even weaker but for backlogs which respondents are working down and which fell by the most in more than three years. Employment was broadly stable as firms remained reluctant to shed staff but, while ticking marginally higher, confidence about the year ahead was again pessimistic.

Not helping matters, inflation pressures increased with the overall input cost rate (first rise in 11-months) and output price rate (first rise in 7 months) both climbing to 3-month highs.

In sum, the August update warns of potentially another contraction in third quarter GDP. However, with pipeline inflation apparently on the rise again, the European Central Bank will not see the data as providing any reason for taking its foot off the monetary brake.

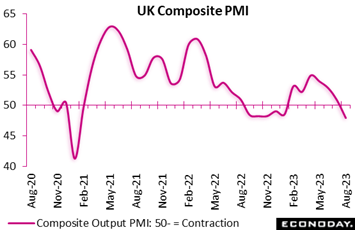

Business activity in the UK has slowed much more rapidly than expected this month. The flash composite output index slumped from July's 50.8 to 47.9, more than 2 points short of the consensus and its worst result since January 2021. This is the first sub-50 reading in half a year. Business activity in the UK has slowed much more rapidly than expected this month. The flash composite output index slumped from July's 50.8 to 47.9, more than 2 points short of the consensus and its worst result since January 2021. This is the first sub-50 reading in half a year.

Activity rates for both manufacturing and services decelerated sharply. In the former, to 42.5 after July's 45.3 to signal the weakest performance in 39 months with output (43.3) hitting a 12-month low. In services the PMI fell to 48.7, down from 51.5 and a 7-month trough.

Combined new orders declined for a second month and by the most since November 2022; backlogs fell for a fourth straight month and at the fastest rate since June 2020; weak demand contributed to the smallest increase in overall headcount since March. Even so, business sentiment deteriorated only marginally and remained close to its long-run average.

Average costs continued to rise as higher wages, mainly in services, offset cheaper prices for energy and raw materials. Nevertheless cost inflation was still the lowest since February 2021. Pass through to customers similarly moderated to a multi-year low.

The August results point to a significant loss of economic momentum this month and are consistent with a 0.2 percent quarterly contraction in GDP. With pipeline inflation rates also easing the Bank of England, still battling inflation pressures at the consumer level, will face a tricky decision in September.

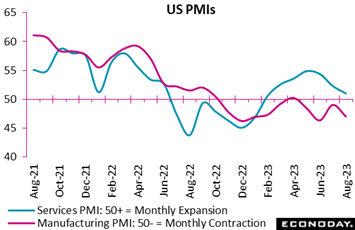

Trouble in services, an unwelcome theme from the European PMI's, combined with extending contraction in manufacturing, a global theme in general, pulled down the US PMI composite to 50.4, roughly at breakeven 50 to indicate very little change in the pace of month-over-month economic activity. Survey respondents are blaming high interest rates and inflationary pressures for the trouble. Trouble in services, an unwelcome theme from the European PMI's, combined with extending contraction in manufacturing, a global theme in general, pulled down the US PMI composite to 50.4, roughly at breakeven 50 to indicate very little change in the pace of month-over-month economic activity. Survey respondents are blaming high interest rates and inflationary pressures for the trouble.

Services (blue line in graph) are holding above 50 but at 51.0 are down 1.4 points for their slowest pace of growth since February. This sample has reined in hiring this month which may have forecasters marking down estimates for the August employment report. Manufacturing’s headline index fell a sizable 2 points to 47.0 to indicate noticeable contraction for the sample. A steepening decrease in new orders is this sector's unwanted highlight.

Costs are another negative in the US report with inputs reaccelerating on wage bills and higher costs for raw materials and fuel. Yet pass through to customers is slowing this month, capped in part by customer requests for discounts.

These results point to deterioration in the coming ISM reports and may be seized upon by the pessimists that the US, again due to high interest rates, may well be edging toward for recession.

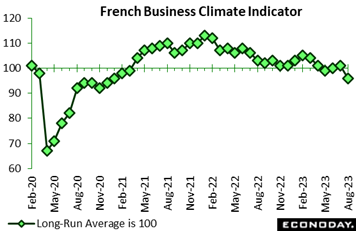

Echoing contraction in the country’s PMIs, French manufacturing sentiment has deteriorated sharply this month. At 96 in August, the business climate indicator dropped a very steep 5 points to match its lowest level since December 2020. This was 3 points below Econoday’s consensus and the biggest drop since April 2020, just after the arrival of Covid. This is only the second reading below the 100 long-run average since March 2021. Echoing contraction in the country’s PMIs, French manufacturing sentiment has deteriorated sharply this month. At 96 in August, the business climate indicator dropped a very steep 5 points to match its lowest level since December 2020. This was 3 points below Econoday’s consensus and the biggest drop since April 2020, just after the arrival of Covid. This is only the second reading below the 100 long-run average since March 2021.

The August slump reflected a sharp fall in past output (minus 5 percent after plus 9 percent) and renewed decline in order books (minus 21 percent after minus 15 percent). Personal production expectations also worsened with general production expectations flat. Expected selling prices (3 percent after 7 percent) eased back below their historic norm (4 percent).

August's update suggests that French manufacturing had a particularly poor August, consistent with PMI data and likewise warning that general economic activity is slowing.

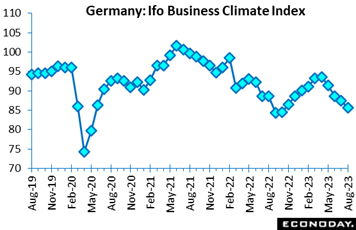

Once again, Ifo's August survey found German business sentiment deteriorating more rapidly than expected. At 85.7, the headline index was down 1.7 points versus July to record its fourth fall in as many months. The measure now stands at its lowest level since October last year. Once again, Ifo's August survey found German business sentiment deteriorating more rapidly than expected. At 85.7, the headline index was down 1.7 points versus July to record its fourth fall in as many months. The measure now stands at its lowest level since October last year.

Current conditions shed 2.4 points to 89.0, their fifth straight drop and the worst reading since August 2020. Expectations declined a smaller 1.0 point, but this was their fourth successive decrease and, at 82.6, a 9-month trough.

In line with July, sentiment deteriorated across the board: manufacturing (minus 16.6 after minus 13.9), services (minus 4.2 after 1.0), trade (minus 25.5 after minus 23.7) and construction (minus 29.3 after minus 24.6).

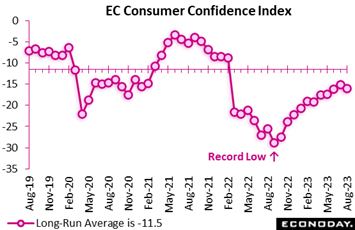

Turning to the Eurozone as a whole and specifically the consumer, confidence this month has deteriorated. At minus 16.0, the flash estimate fell from July's minus 15.1 to register its first fall since March. The result was nearly 2 points below Econoday’s consensus. Turning to the Eurozone as a whole and specifically the consumer, confidence this month has deteriorated. At minus 16.0, the flash estimate fell from July's minus 15.1 to register its first fall since March. The result was nearly 2 points below Econoday’s consensus.

Though recent levels have been well above the record minus 28.7 low posted last September, they do remain below the minus 11.5 long-run average. Indeed, retail sales have hardly grown so far this year and in June (data separate from the confidence report) were still 0.3 percent short of their mark a year ago. High inflation continues to squeeze real incomes and it is far from certain that the ECB's tightening cycle has run its course. For the time being, Eurozone households are likely to remain cautious.

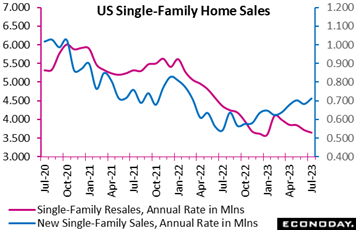

A sub-surface negative for the US that has yet to appear in government data is this month’s major surge in mortgage rates. The contract rate for a 30-year fixed rate mortgage as tracked by the Mortgage Bankers Association (MBA) rose 15 basis points in the August 18 week to 7.31 percent, up 44 basis points from four weeks earlier and up 166 basis points from a year earlier. This is the highest rate in more than 23 years! Applications for home-purchase mortgages as tracked by the MBA have dropped to their lowest level in more than 28 years! The purchase index fell 5.0 percent on the week, were down 10.8 percent on the month and down 30.0 percent on the year. A sub-surface negative for the US that has yet to appear in government data is this month’s major surge in mortgage rates. The contract rate for a 30-year fixed rate mortgage as tracked by the Mortgage Bankers Association (MBA) rose 15 basis points in the August 18 week to 7.31 percent, up 44 basis points from four weeks earlier and up 166 basis points from a year earlier. This is the highest rate in more than 23 years! Applications for home-purchase mortgages as tracked by the MBA have dropped to their lowest level in more than 28 years! The purchase index fell 5.0 percent on the week, were down 10.8 percent on the month and down 30.0 percent on the year.

Turning back to July and before Fitch’s US rate cut tripped the rate jump, official data are still coming in. July sales of new single-family homes jumped 4.4 percent on the month to a 714,000 annual rate from June’s 684,000. July likely got a boost from those who prequalified for a mortgage in May or June acted to close a purchase before losing the lock on a lower rate. Freddie Mac’s 30-year fixed rate averaged 6.50 percent in May, 6.70 percent in June, and 6.85 percent in July.

July sales of new homes also benefited from lack of supply in the existing home market. There is also the advantage of being able to buy a home that is not yet started or under construction before rates and prices climb any further. The median price of a new single-family home rose 4.8 percent in July to $436,700 after $416,700 in June. Much of the homebuying market has shifted to smaller units that are more affordable and appealing to entry-level buyers. But buyer competition for the limited supply is keeping prices up.

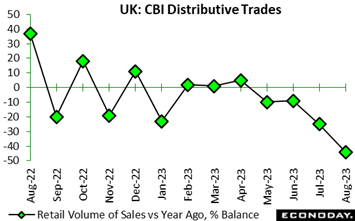

Just like July, the UK’s Confederation of British Industry distributive trades survey was much weaker than expected . At minus 45 percent in August, the headline sales balance was 30 percentage points short of the consensus and down a sizeable 20 percentage points versus the previous month. This was its fourth successive sub-zero print and its weakest reading since early 2021 in the midst of Covid. With actual sales falling 1.5 percent on the month a year ago, August's data should imply a particularly poor period for retailers. The CBI's forecast for September is minus 21 percent. Just like July, the UK’s Confederation of British Industry distributive trades survey was much weaker than expected . At minus 45 percent in August, the headline sales balance was 30 percentage points short of the consensus and down a sizeable 20 percentage points versus the previous month. This was its fourth successive sub-zero print and its weakest reading since early 2021 in the midst of Covid. With actual sales falling 1.5 percent on the month a year ago, August's data should imply a particularly poor period for retailers. The CBI's forecast for September is minus 21 percent.

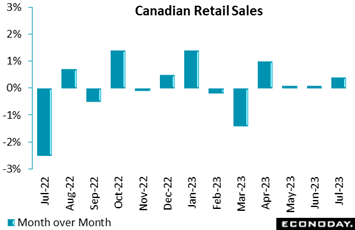

Retail sales in Canada edged up 0.1 percent on the month versus expectations for no change. In a positive, the preliminary estimate for July points to a further advance of 0.4 percent. Yet year-over-year sales in June were down 0.6 percent with underlying details also exposing a weaker picture. Monthly growth in May was revised down to 0.1 percent from an already modest 0.2 percent. And June’s advance was price related, as volumes fell 0.2 percent. In addition, gains were concentrated in three of nine subsectors, led by a 2.5 percent advance in motor vehicles without which sales would have been down 0.8 percent from May for a 12-month decline of 3.3 percent. A 0.3 percent increase of sales at gasoline stations and fuel vendors also boosted the overall index. Excluding vehicles and gas, core sales declined 0.9 percent in June. Retail sales in Canada edged up 0.1 percent on the month versus expectations for no change. In a positive, the preliminary estimate for July points to a further advance of 0.4 percent. Yet year-over-year sales in June were down 0.6 percent with underlying details also exposing a weaker picture. Monthly growth in May was revised down to 0.1 percent from an already modest 0.2 percent. And June’s advance was price related, as volumes fell 0.2 percent. In addition, gains were concentrated in three of nine subsectors, led by a 2.5 percent advance in motor vehicles without which sales would have been down 0.8 percent from May for a 12-month decline of 3.3 percent. A 0.3 percent increase of sales at gasoline stations and fuel vendors also boosted the overall index. Excluding vehicles and gas, core sales declined 0.9 percent in June.

Among core sales, the sporting goods, hobby, musical instrument, book, and miscellaneous subsector was up 0.4 percent, with cannabis up 2.6 percent. Other major categories posted declines on the month, led by housing-related sectors: furniture, home furnishings, electronics and appliances fell 1.6 percent and building materials and garden equipment and supplies were down 1.4 percent. General merchandise contracted 1.4 percent.

Sales growth was also concentrated regionally, with only four provinces reporting higher sales, led by Ontario and Quebec. Over the second quarter, overall sales were unchanged, while volumes, more relevant to real GDP, contracted 0.8 percent.

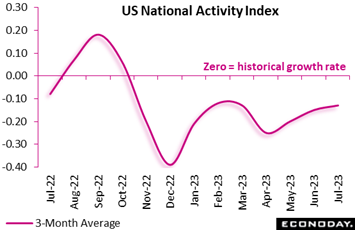

Lifted by industrial production, the US national activity index jumped to a much better-than-expected index level 0.12 in July following contraction of minus 0.33 in June and minus 0.18 in May. The 3-month average, however, is little changed, at minus 0.13 versus June's minus 0.15 and remains in the negative column – a zone indicating sub-par historical growth – where it has been since November last year. Lifted by industrial production, the US national activity index jumped to a much better-than-expected index level 0.12 in July following contraction of minus 0.33 in June and minus 0.18 in May. The 3-month average, however, is little changed, at minus 0.13 versus June's minus 0.15 and remains in the negative column – a zone indicating sub-par historical growth – where it has been since November last year.

The good news in July's report is a 0.18-point monthly contribution from industrial production that followed a 36-point negative contribution in June. But production data can be choppy and continued gains, especially given mostly negative indications from various business surveys including August's PMI, is far from certain.

The consumer reading (personal consumption and housing) provided a marginal 0.02 lift in July with the outlook for this component also uncertain, split between what are positive indications for retail spending but, given the ongoing spike in mortgage rates, negative indications for housing.

Employment was marginally negative in July, at minus 0.02, while sales, orders and inventories was moderately negative at minus 0.05.

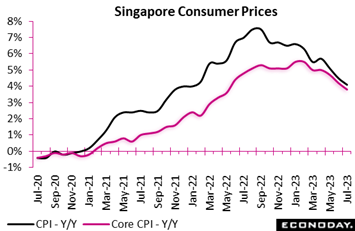

However much activity is becoming more subdued, inflation at least also continues to come down. Singapore's headline consumer price index rose 4.1 percent on the year in July, slowing from 4.5 percent in June and the lowest rate since January 2022. The index fell 0.2 percent on the month after an increase of 0.5 percent previously. The Monetary Authority of Singapore's preferred measure of core inflation, which excludes the cost of accommodation and private road transport, fell from 4.2 percent to 3.8 percent. This index increased 0.2 percent on the month as it did in June. However much activity is becoming more subdued, inflation at least also continues to come down. Singapore's headline consumer price index rose 4.1 percent on the year in July, slowing from 4.5 percent in June and the lowest rate since January 2022. The index fell 0.2 percent on the month after an increase of 0.5 percent previously. The Monetary Authority of Singapore's preferred measure of core inflation, which excludes the cost of accommodation and private road transport, fell from 4.2 percent to 3.8 percent. This index increased 0.2 percent on the month as it did in June.

July's easing was largely driven by private transport costs, up 4.8 percent on the year after increasing 5.8 percent previously, and also by food, up 5.3 percent after a previous increase of 5.9 percent. Prices for services, electricity and gas fell 1.6 percent on the year after a previous increase of 3.1 percent. Price increases were elevated but steady for services, accommodation, and retail goods.

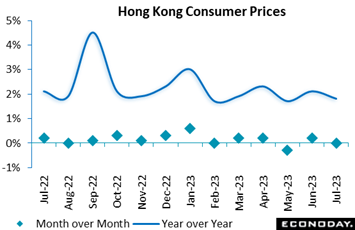

Hong Kong's headline consumer price index rose 1.8 percent on the year in July, easing slightly from an increase of 1.9 percent in June. The index was unchanged on the month after advancing 0.2 percent previously. Excluding the impact of one-off government relief measures, Hong Kong's underlying inflation rate also eased from 1.7 percent to 1.6 percent. Electricity prices again increased strongly on the year, but at a less pronounced rate. Officials expressed confidence that domestic inflation will remain "moderate" in the near-term, with external price pressures expected to weaken further and domestic price pressures expected to remain contained. Hong Kong's headline consumer price index rose 1.8 percent on the year in July, easing slightly from an increase of 1.9 percent in June. The index was unchanged on the month after advancing 0.2 percent previously. Excluding the impact of one-off government relief measures, Hong Kong's underlying inflation rate also eased from 1.7 percent to 1.6 percent. Electricity prices again increased strongly on the year, but at a less pronounced rate. Officials expressed confidence that domestic inflation will remain "moderate" in the near-term, with external price pressures expected to weaken further and domestic price pressures expected to remain contained.

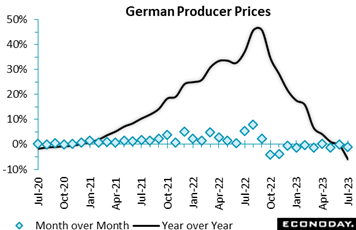

Producer prices in Germany fell sharply and by more than expected in July. A 1.1 percent monthly drop was much steeper than the market consensus and, with base effects strongly negative, reduced annual inflation rate from minus 0.3 percent to minus 6.0 percent. Producer prices in Germany fell sharply and by more than expected in July. A 1.1 percent monthly drop was much steeper than the market consensus and, with base effects strongly negative, reduced annual inflation rate from minus 0.3 percent to minus 6.0 percent.

Energy prices declined a sizeable 2.5 percent versus June and were off fully 19.3 percent from a year ago. However, even excluding this category the PPI fell a further 0.4 percent on the month, trimming this yearly rate from 2.8 percent to 2.0 percent. Elsewhere, the other main area of weakness was again intermediates where prices were down a monthly 1.0 percent. By contrast, both durable and non-durable consumer goods saw no change while capital goods were up 0.3 percent.

The latest declines confirm a clear downward trend in underlying pipeline pressures in German manufacturing. Nevertheless in order for Germany's CPI to cool, consumer service prices, which have remained sticky, will have to ease. Watch for Germany's flash CPI report for August in the coming week which will precede the much awaited Eurozone HICP report (see Looking Ahead section below).

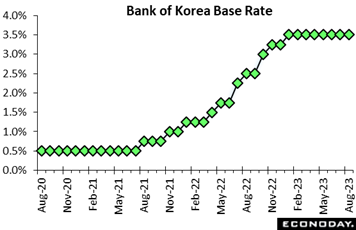

The Bank of Korea left its main policy rate unchanged at 3.50 percent at its policy meeting on Thursday, in line with the consensus forecast. This leaves the cumulative amount of rate increases made since late 2021 at 275 basis points, with the policy rate at its highest level since 2008. The Bank of Korea left its main policy rate unchanged at 3.50 percent at its policy meeting on Thursday, in line with the consensus forecast. This leaves the cumulative amount of rate increases made since late 2021 at 275 basis points, with the policy rate at its highest level since 2008.

The BoK has now left rates on hold for five consecutive meetings, indicating that officials are increasingly confident that previous policy tightening is working to bring inflation toward its target level of 2.0 percent. Since the previous BoK meeting mid-July, data have shown headline inflation fell from 2.7 percent in June to 2.3 percent in July. Core CPI inflation has also moderated in recent months to 3.3 percent in July.

In the statement accompanying today's decision, however, officials note that the fall in headline inflation largely reflects base effects from higher oil prices last year. They expect headline inflation to pick up again in coming months and retain their previous forecast for it to average 3.5 percent for the year. They have also revised up their 2023 core inflation forecast slightly from 3.3 percent to 3.4 percent.

The statement noted that the recent improvement in domestic growth has "somewhat moderated" since the last meeting, but officials remain confident that private consumption and exports will improve in coming months. They continue to forecast that South Korea's economy will grow 1.4 percent in 2023.

Officials noted that policy uncertainty remains "high" and concluded that this warrants keeping the policy stance "restrictive" for "a considerable time". They also again indicated that further policy tightening may yet be required. Incoming inflation data will likely remain the key factor driving policy decisions in coming months.

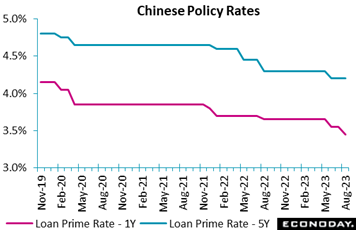

The People's Bank of China lowered the one-year loan prime rate by 10 basis points from 3.55 percent to 3.45 percent at its monthly review, close to the consensus forecast for a cut of 15 basis points. The equivalent five-year rate, however, was left on hold at 4.20 percent, contrary to the consensus forecast for a cut of 15 basis points. These rates were last lowered in June by 10 basis points. The People's Bank of China lowered the one-year loan prime rate by 10 basis points from 3.55 percent to 3.45 percent at its monthly review, close to the consensus forecast for a cut of 15 basis points. The equivalent five-year rate, however, was left on hold at 4.20 percent, contrary to the consensus forecast for a cut of 15 basis points. These rates were last lowered in June by 10 basis points.

Monday's reduction in the one-year rate followed similar reductions in the prior week to the rate on the one-year medium-term lending facility and the reverse repo rate. These moves follow the publication of data showing weak domestic activity and trade data and a return to consumer price deflation in July.

Officials have characterized recent changes in policy settings as adjustments designed to manage liquidity conditions rather than a change in the stance of monetary policy. Nevertheless, officials have noted recent volatility in economic conditions and that the economy is currently facing "difficulties and challenges". These difficulties are more than evident in Econoday's Consensus Divergence Index (ECDI) for China which remains deeply in the negative zone, at minus 71 to indicate very substantial underperformance relative to expectations.

At minus 25, the global ECDI slipped further below zero last week, fairly raising the question whether aggressive monetary tightening is slowing global growth more rapidly than anticipated.

Economic activity in the Eurozone is similarly falling short of expectations and the chances of contraction in third quarter GDP are rising steadily. At minus 14, neither the ECDI nor the index less prices (ECDI-P) is very deep in negative surprise territory but in the main the data have been disappointingly soft since early May. Germany (ECDI minus 39, ECDI-P minus 45) continues to be a major drag. For the ECB, this Thursday’s flash HICP report will be key but the central bank’s doves must be becoming increasingly worried that policy could be tightened too far.

In the UK, a suite of unexpectedly weak reports saw the ECDI plummet to minus 31 and the ECDI-P to minus 53 , the latter’s lowest reading since the beginning of February. Inflation pressures still leave the BoE on course to raise Bank Rate again in September but the surprising softness of domestic demand and output will not make the vote an easy one.

In Japan, both the ECDI (9) and ECDI-P (20) remain in positive surprise territory but signs of a sharper-than-expected deceleration in inflation, including August's Tokyo flash that slowed to 2.9 from 3.2 percent, are helping to ease pressure on the Bank of Japan to tighten.

US data, at plus 4 with or without prices, are coming in very near expectations which if extended through the next several weeks would offer no handles at what to expect for September's FOMC.

The better-than-expected retail sales report lifted Canada to plus 14, a score however that falls to minus 1 when excluding what have been overheated inflation results. A third straight rate hike at next month’s Bank of Canada policy meeting might, at least for now, be in the cards.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Germany’s CPI flash on Wednesday, which is expected to cool slightly to 6.0 percent in August from July’s 6.2 percent, will offer major clues on what to expect from Thursday’s Eurozone HICP flash where slow improvement is also expected at 5.1 from 5.3 percent with the narrow core likewise expected to improve to 5.3 from 5.5 percent. PCE price indexes from the US (part of Thursday’s personal income and outlays report) are expected to hold steady on a monthly basis though heat up a bit for the annual rates.

Thursday will also see China’s CFLP PMIs for an early look at August activity and whether the Chinese economy continues to slow, which incrementally at least is the expectation. US job growth is also expected to slow with Econoday’s nonfarm payroll consensus at 170,000 for Friday’s employment report, growth that is expected to be hot enough for a monthly uptick in monthly wage growth to 0.3 percent and with no improvement expected for the year-over-year rate of 4.4 percent.

Slightly slowing is expected for Australia’s July CPI on Wednesday where the consensus rate of 5.2 percent would, nevertheless, still be far too high. Perhaps too low is the risk for the Swiss CPI, seen at 1.6 percent in data for Friday.

Losses are expected for Japanese industrial production on Thursday in contrast to Japanese retail sales also on Thursday where gains are expected. Robust and accelerating GDP growth is expected from India on Thursday with steps backward expected for Canada’s GDP reports on Friday, both quarterly and monthly.

Australian Retail Sales for July (Mon 0130 GMT; Mon 1130 AEST; Sun 2130 EDT)

Consensus Forecast, Month over Month: 0.3%

Retail sales fell an unexpected 0.8 percent in June for the year’s only decline. Forecasters see sales rebounding 0.3 percent in July.

Eurozone M3 Money Supply for July (Mon 0800 GMT; Mon 1000 CEST; Mon 0400 EDT)

Consensus Forecast, Year-over-Year: 0.1%

Broad money growth (on a 3-month basis) is expected to slow to a 0.1 percent gain versus 1.0 percent in June.

Japanese Unemployment Rate for July (Mon 2330 GMT; Tue 0830 JST; Mon 1930 EDT)

Consensus Forecast, Unemployment Rate: 2.5%

Japan's unemployment rate for July is expected to hold steady at 2.5 percent. The government maintained its recent upgrade that employment is “showing signs of improvement”.

Germany: GfK Consumer Climate for September (Tue 0600 GMT; Tue 0800 CEST; Tue 0200 EDT)

Consensus Forecast: -24.3

Consumer climate is expected to hold steady at minus 24.3 in September after minus 24.4 in an August report that saw improvement in income expectations but nevertheless remained historically weak.

US Consumer Confidence Index for August (Tue 1400 GMT; Tue 1000 EDT)

Consensus Forecast: 116.5

The consumer confidence index is expected to hold roughly steady in August, at a consensus 116.5 versus July’s 117.0. This report has exceeded not only the consensus in the last three reports but the consensus range as well.

Australian July CPI (Wed 0130 GMT; Wed 1130 AEST; Tue 2130 EDT)

Consensus Forecast, Year over Year: 5.2%

Consumer prices in July are expected to ease to 5.2 versus 5.4 percent in June which was down from 5.6 percent in May. The CPI has cooled in five of the last six months.

KOF Swiss Leading Indicator for August (Wed 0700 GMT; Wed 0900 CEST; Wed 0300 EDT)

Consensus Forecast: 90.9

After rising from 90.7 in June to 92.2 in July, KOF's leading indicator is expected to fall back to 90.9 in August.

Eurozone: EC Economic Sentiment for August (Wed 0900 GMT; Wed 1100 CEST; Wed 0500 EDT)

Consensus Forecast: 93.7

Consensus Forecast, Industry Sentiment: -9.9

Consensus Forecast, Consumer Sentiment: -16.0

Economic sentiment in August is expected to fall back to 93.7 from 94.5 in July which was a full point improvement from June.

German CPI, Preliminary August (Wed 1200 GMT; Wed 1400 CEST; Wed 0800 EDT)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 6.0%

August’s consensus is a 6.0 percent year-over-year rate versus 6.2 percent in July which was down from June’s 6.4 percent.

US ADP Private Payrolls for August (Wed 1215 GMT; Wed 0815 EDT)

Consensus Forecast: 200,000

Forecaster see ADP's August employment number at 200,000. This would compare with July growth in private payrolls reported by the Bureau of Labor Statistics of 172,000. ADP’s number for July was high for a second month in a row at 324,000.

US International Trade in Goods (Advance) for July (Wed 1230 GMT; Wed 0830 EDT)

Consensus Forecast, Balance: -$90.8 billion

The US goods deficit (Census basis) is expected to widen by $2.0 billion to $90.8 billion in July after narrowing by $2.8 billion in June to $88.8 billion.

Japanese Industrial Production for July (Wed 2350 GMT; Thu 0850 JST; Wed 1950 EDT)

Consensus Forecast, Month over Month: -1.4%

Consensus Forecast, Year over Year: -1.9%

Industrial production in July is expected to fall back 1.4 percent following June’s 2.0 percent gain. Perhaps in contrast to the expected results, the Ministry of Economy, Trade and Industry maintained its assessment in the June report that production “is showing signs of a gradual pickup”.

Japanese Retail Sales for July (Wed 2350 GMT; Thu 0850 JST; Wed 1950 EDT)

Consensus Forecast, Month over Month: 1.9%

Consensus Forecast, Year over Year: 5.8%

Retail sales are expected to rise 5.8 percent on the year in July versus a 5.9 percent rise in June. On the month, sales are expected to increase 1.9 percent versus a 0.4 percent fall in June. The government maintained its assessment in June that retail sales were "on an uptrend".

Australian Second-Quarter Capital Expenditures (Thu 0130 GMT; Thu 1130 AEST; Wed 2130 EDT)

Consensus Forecast, Quarter over Quarter: 1.0%

Capital expenditures for the second quarter are expected to slow to a 1.0 percent gain on the quarter versus 2.4 percent expansion in the first quarter.

China: CFLP PMIs for August (Thu 0130 GMT; Thu 0930 CST; Wed 2130 EDT)

Manufacturing PMI, Consensus Forecast: 49.1

Non-manufacturing PMI, Consensus Forecast: 51.0

The CFLP manufacturing PMI is expected to deteriorate slightly to 49.1 in August from July’s 49.3 while the non-manufacturing PMI, which in July held flat at 51.5, is expected to slow slightly to 51.0.

German Retail Sales for July (Thu 0600 GMT; Thu 0800 CEST; Thu 0200 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: -1.4%

Retail sales volumes are expected to rise 0.3 percent in July versus June’s 0.8 percent fall.

German Unemployment Rate for August (Thu 0755 GMT; Thu 0955 CEST; Thu 0355 EDT)

Consensus Forecast: 5.7%

August’s rate is expected to rise 1 tenth to 5.7 percent .

Eurozone HICP Flash for August (Thu 0900 GMT; Thu 1100 CEST; Thu 0500 EDT)

Consensus Forecast, Year over Year: 5.1%

Narrow Core

Consensus Forecast, Year over Year: 5.3%

Consensus for August’s HICP flash is 5.1 percent and 5.3 percent for the narrow core. These would compare respectively with July’s 5.3 and 5.5 percent, the former down from June’s 5.5 percent and the latter unchanged.

Eurozone Unemployment Rate for July (Thu 0900 GMT; Thu 1100 CEST; Thu 0500 EDT)

Consensus Forecast: 6.4%

Consensus for July's unemployment rate is no change at 6.4 percent

Indian Second-Quarter GDP (Thu 1200 GMT; Thu 1730 IST; Thu 0800 EDT)

Consensus Forecast, Year over Year: 7.8%

Forecasters see GDP coming in at year-over-year growth of 7.8 percent in the June quarter versus 6.1 percent growth in the March quarter.

US Personal Income for July (Thu 1230 GMT; Thu 0830 EDT)

Consensus Forecast, Month over Month: 0.3%

US Consumption Expenditures

Consensus Forecast, Month over Month: 0.6%

US PCE Price Index

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 3.3%

US Core PCE Price Index

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 4.2%

Personal income is expected to rise 0.3 percent in July with consumption expenditures expected to increase a solid 0.6 percent. These would compare with June’s 0.3 percent increase for income and 0.5 percent increase for consumption. Inflation readings for July are expected at monthly increases of 0.2 percent both overall and for the core (versus June’s increases of 0.2 percent for both). Annual rates are expected at 3.3 percent overall and 4.2 percent for the core (versus June’s 3.0 and 4.1 percent).

South Korean Manufacturing PMI for August (Fri 0030 GMT; Fri 0930 KST; Thu 2030 EDT)

Consensus Forecast: 49.0

The manufacturing PMI for August is expected to slow to 49.0 following July’s 2.1-point rise to 49.4.

China: S&P Manufacturing PMI for August (Fri 0145 GMT; Fri 0945 CST; Thu 2145 EDT)

Consensus Forecast: 49.3

Having shown virtually no growth over the past year, S&P's manufacturing PMI in August is expected to hold steady at 49.3 versus 49.2 in July which was nearly a full point below expectations.

Swiss CPI for August (Fri 0630 GMT; Fri 0830 CEST; Fri 0230 EDT)

Consensus Forecast, Year over Year: 1.6%

A 1.6 percent annual rate is expected for August consumer prices which would match July’s as-expected and benign 1.6 percent rate.

Canadian Second-Quarter GDP (Fri 1230 GMT; Fri 0830 EDT)

Consensus Forecast, Quarter over Quarter: 0.8%

Consensus Forecast, Annualized: 1.3%

A 1.3 percent annual growth rate is the consensus for Canadian second-quarter GDP versus a strong 3.1 percent pace in the first quarter.

Canadian Monthly GDP for June (Fri 1230 GMT; Fri 0830 EDT)

Consensus Forecast, Month over Month: -0.2%

After rising 0.3 percent in May, GDP in June is expected to fall 0.2 percent.

US Employment Situation for August (Fri 1230 GMT; Fri 0830 EDT)

Consensus Forecast: Change in Nonfarm Payrolls: 170,000

Consensus Forecast: Unemployment Rate: 3.5%

Consensus Forecast: Average Hourly Earnings M/M: 0.3%

Consensus Forecast: Average Hourly Earnings Y/Y: 4.4%

A moderating but still solid 170,000 rise is the call for nonfarm payroll growth in August versus 187,000 in July which was a bit lower than expected. Average hourly earnings in August are expected to rise 0.3 percent on the month for a year-over-year rate of 4.4 percent; these would compare with 0.4 and 4.4 percent in the prior two reports. August’s unemployment rate is expected to hold unchanged at 3.5 percent.

US: ISM Manufacturing Index for August (Fri 1400 GMT; Fri 1000 EDT)

Consensus Forecast: 46.8

The ISM manufacturing index has been in contraction the last nine months. August’s consensus is 46.8 versus July’s 46.4.

|