|

The Bank of England’s upsized 50-basis-point rate hike surprised the markets even though the country’s economic data have been coming in hotter than expected, at 22 on Econoday’s Consensus Divergence Index and half that at 11 when excluding inflation data which have been elevating the overall score. Inflation in the UK and also to a degree in Japan is running hotter than expected, though producer price data across the global economy continue to deflate to the zero line and below. And given June’s weak run of PMI business flashes, further disinflation at the producer level could be in store however much, or whether or not, savings are passed through to the consumer. But before turning to the BoE’s inflation fight, let’s first look at monetary policy in China where prices aren’t a concern, and then at Switzerland where prudent policy and safe-haven status make this country the Camelot of the global economy.

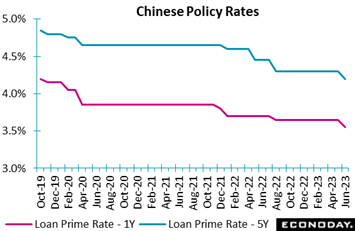

The People's Bank of China lowered the one-year loan prime rate by 10 basis points from 3.65 percent to 3.55 percent at its monthly review, in line with the consensus forecast. The equivalent five-year rate was also cut by 10 basis points from 4.30 percent to 4.20 percent. These rates were last lowered in August 2022 by 5 basis points and 15 basis points respectively. The People's Bank of China lowered the one-year loan prime rate by 10 basis points from 3.65 percent to 3.55 percent at its monthly review, in line with the consensus forecast. The equivalent five-year rate was also cut by 10 basis points from 4.30 percent to 4.20 percent. These rates were last lowered in August 2022 by 5 basis points and 15 basis points respectively.

These cuts follow the PBoC’s moves in the prior week to lower short-term and medium lending rates. Officials advised that these adjustments to policy settings are designed to "keep the liquidity in the banking system adequate at a reasonable level" rather than signaling a major shift in the stance of monetary policy. Nevertheless, recent data have generally shown subdued economic activity and weak price pressures (see Bottom Line for details), suggesting officials are concerned that China's economy requires additional policy support.

Comments from PBoC Governor Yi Gang published earlier this month indicated that officials remain confident that both economic activity and price pressures will pick up in the second half of the year. He reiterated that monetary policy will be kept "stable" while arguing there is "ample policy room" to support economic recovery.

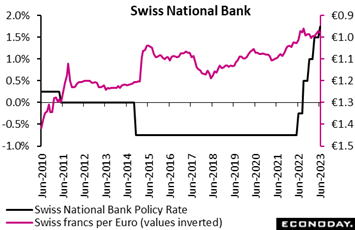

In line with expectations, the Swiss National Bank opted to tighten policy again but at a slower pace. The policy rate was raised by 25 basis points, halving the pace of the 50-point hikes seen in March and December and putting the benchmark at 1.75 percent. The bank again noted that additional rate hikes may be necessary to ensure price stability in the medium term. In line with expectations, the Swiss National Bank opted to tighten policy again but at a slower pace. The policy rate was raised by 25 basis points, halving the pace of the 50-point hikes seen in March and December and putting the benchmark at 1.75 percent. The bank again noted that additional rate hikes may be necessary to ensure price stability in the medium term.

As in previous assessments, the latest Monetary Policy Assessment indicates that the central bank will intervene in the FX markets as necessary to ensure price stability, and noted that in the current environment, the focus is on selling foreign currency.

The bank said deposits held at the SNB will be remunerated at the new policy rate up to a certain threshold above which they will be remunerated at 1.25 percent. This tiered structure maintains the 0.5 percentage point discount with the policy rate and is aimed at ensuring that secured short-term local money market rates are held close to the policy rate.

Citing a significant decline in inflation in recent months to 2.2 percent in May, the bank's new conditional inflation forecast is below that of March for 2023 but, due to second-round effects, higher from 2024 onward. The new projections are for average annual inflation of 2.2 percent this year (versus 2.6 percent in March), 2.2 percent in 2024 (2.0 percent) and 2.1 percent in 2025 (2.0 percent). Swiss GDP growth this year is put at 1.0 percent, unchanged from last time but subject to a high degree of uncertainty.

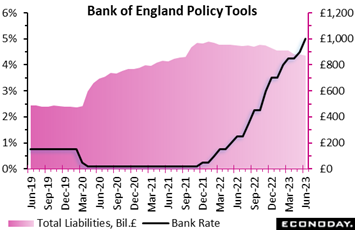

With inflation stubbornly high and reflecting the “primacy of price stability” in the policy framework, the Bank of England raised Bank Rate by a greater-than-expected 50 basis points to 5.00 percent. This is the 13th hike in a row but follows two 25-point moves in March and May to mark the first 50-point move since February. Once again the Monetary Policy Committee’s vote was not unanimous as the two main doves (Swati Dhingra and Silvana Tenreyro) continued to call for no change leaving another 7-2 majority in favour of tightening. The other seven members all voted for 50 points. With inflation stubbornly high and reflecting the “primacy of price stability” in the policy framework, the Bank of England raised Bank Rate by a greater-than-expected 50 basis points to 5.00 percent. This is the 13th hike in a row but follows two 25-point moves in March and May to mark the first 50-point move since February. Once again the Monetary Policy Committee’s vote was not unanimous as the two main doves (Swati Dhingra and Silvana Tenreyro) continued to call for no change leaving another 7-2 majority in favour of tightening. The other seven members all voted for 50 points.

The BoE is trying to catch up to the market, noting in the statement that back at May’s meeting the market-implied three-year path for Bank Rate averaged just over 4 percent but now averages, due to a “material” rise in gilt yields, 5-1/2 percent. The bank further noted that mortgage rates have risen “notably” and that sterling has appreciated further.

Only the day before, the government reported an 8.7 percent annual inflation rate in May, unchanged from April and disappointing expectations for cooling to 8.4 percent. But the statement’s first reference to inflation is average weekly earnings, data released in the prior week that increased to 7.5 percent in the three months to April which was a full 1/2 point above expectations. On the CPI, the bank underlined not only the headline rate but also services inflation of 7.4 percent, also a 1/2 point above expectations and projected to remain “broadly unchanged” in the near term.

Yet in a note of optimism, the statement stressed that inflation for core goods, though also running stronger than expected, is “less likely to imply persistent inflationary pressures” and is expected to decline later this year supported by cost and price indicators in the supply chain; producer output price inflation has fallen “very sharply” in recent months, as described in the statement. For the CPI overall, the bank expects it to “fall significantly” during the course of the year mainly reflecting developments in energy prices.

“The MPC recognises that the second-round effects in domestic price and wage developments generated by external cost shocks are likely to take longer to unwind than they did to emerge. There has been significant upside news in recent data that indicates more persistence in the inflation process, against the background of a tight labour market and continued resilience in demand,” the statement said.

Citing the need to return inflation to its 2 percent target, the MPC warned that if price pressures prove more persistent, “then further tightening in monetary policy would be required”.

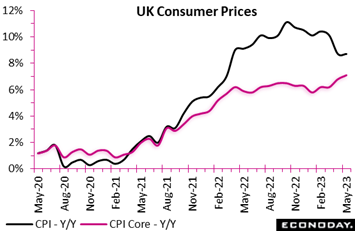

UK consumer prices were stronger than expected in May. A 0.7 percent monthly gain exceeded the consensus of 0.4 percent and matched the monthly rise a year ago, keeping the headline annual inflation rate unchanged from April at 8.7 percent. UK consumer prices were stronger than expected in May. A 0.7 percent monthly gain exceeded the consensus of 0.4 percent and matched the monthly rise a year ago, keeping the headline annual inflation rate unchanged from April at 8.7 percent.

Contributing to the overall monthly gain and supporting the annual rate were increases in prices for health (up 0.6 percent on the month versus minus 0.6 percent in May last year), communication (0.9 percent versus minus 0.6 percent), recreation and culture (0.7 percent versus 0.3 percent), alcohol and tobacco (0.6 percent versus 0.4 percent), clothing and footwear (1.3 percent versus 1.1 percent). and restaurants and hotels (1.0 percent versus 0.9 percent).

Offsetting these in the annual rate were smaller monthly gains than a year ago in prices for food and alcoholic beverages (0.9 percent versus a 1.5 percent jump in May last year) housing and household services (0.1 percent versus 0.3 percent), and transport (0.4 percent versus 0.6 percent).

The core CPI rate rose 0.8 percent in May versus 0.5 percent in the year ago month, pulling up the annual core rate from April's 6.8 percent to 7.1 percent, the highest rate since March 1992.

Wednesday's report definitely stirred hawkish impulses at the BoE, as inflation pressures appeared stubbornly persistent and the annual rate remained far above the bank's medium-term target.

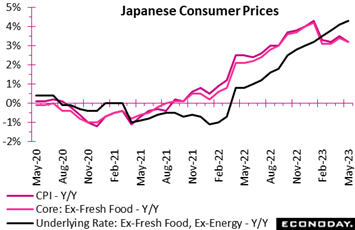

Consumer inflation in Japan eased back toward 3 percent in May for both the total and core indexes as utility and gasoline subsidies continued to cap cooling energy costs while widespread markups for processed food pushed up the narrow measure to a fresh 41-year high. Consumer inflation in Japan eased back toward 3 percent in May for both the total and core indexes as utility and gasoline subsidies continued to cap cooling energy costs while widespread markups for processed food pushed up the narrow measure to a fresh 41-year high.

The total CPI rose an as-expected 3.2 percent on year in May. Fresh food prices, a volatile factor, rose 5.2 percent on year and pushed up the overall index by 0.22 percentage points after rising 5.3 percent (up 0.22 points) the previous month. The 4.3 percent increase January's total CPI is a 41-year high, the largest since the 4.3 percent rise in December 1981.

The ex-fresh food core rose 3.2 percent from a year earlier in May, 1 tenth firmer than the median economist forecast for a 3.1 percent rise. Service prices in Japan have moved up in recent months as more firms are raising wages to secure workers, although the average cash earnings per employee are falling in real terms. Service prices excluding owners' equivalent rent rose 2.5 percent on the year in May, up from a 2.4 percent increase in April. Goods prices excluding fresh food gained 4.6 percent, slowing from a 5.1 percent rise the previous month.

The underlying inflation rate -- measured by the core-core CPI (excluding fresh food and energy) -- rose to a fresh 41-year high of 4.3 percent on year in May which was 1 tenth above the consensus, accelerating further from 4.1 percent in April. This narrow measure has been pushed up by markups in various items including processed food.

Among key components of the CPI basket of goods and services, energy prices fell further also as the government lowered the renewal energy promotion surcharge on electricity bills for fiscal 2023, effective in April, which was reflected in bills due in May. Energy slumped 8.2 percent on year in May, pushing down the CPI by 0.69 percentage points, after falling 4.4 percent with a negative 0.37-point contribution to April.

The government has contained retail gasoline prices by providing subsidies to refineries. It also began providing subsidies for electricity and natural gas in January (reflected in February bills onward) and the program will continue through September. In addition, the government lowered the renewal energy promotion surcharge on electricity bills to ¥1.40 per kilowatt-hour for fiscal 2023, effective in April, from ¥3.45 in fiscal 2022. The official estimate is that a typical household that uses about 400 kilowatt-hours will pay around ¥820 less per month, or an annual decrease of ¥10,000.

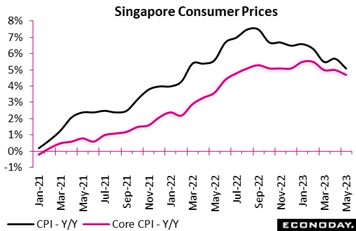

Consumer inflation in Singapore eased to 5.1 percent in May from 5.7 percent in April for the slowest pace of increase since February 2022, when the overall consumer price index rose 4.3 percent on the year. The CPI rose 0.3 percent on the month after rising 0.1 percent the previous month. Consumer inflation in Singapore eased to 5.1 percent in May from 5.7 percent in April for the slowest pace of increase since February 2022, when the overall consumer price index rose 4.3 percent on the year. The CPI rose 0.3 percent on the month after rising 0.1 percent the previous month.

The Monetary Authority of Singapore's preferred measure of core inflation, which excludes the cost of accommodation and private road transport, slowed to 4.7 percent in May from 5.0 percent seen in the previous two months. The core CPI edged up 0.1 percent following a 0.4 percent gain.

The year-over-year increase in food prices decelerated to 6.8 percent in May from 7.1 percent in April while the increase in transport costs slowed more sharply to 6.0 percent from 8.6 percent. Clothing and footwear prices rose 4.1 percent, slower than 5.6 percent previously.

In April, MAS predicted that its core inflation measure "will remain elevated in the next few months" but that it "should progressively ease in the second half of 2023 and end the year significantly lower."

The central bank has assessed that the current appreciating path of the Singapore dollar nominal effective exchange rate policy band is "sufficiently tight and appropriate" for securing medium-term price stability.

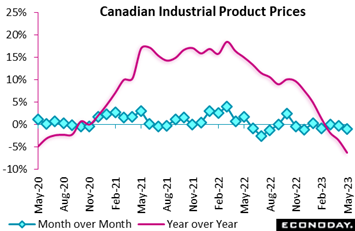

Canada’s industrial product price index fell a further 1.0 percent on the month in May after declining 0.6 percent in April, for a year-over-year decrease of 6.3 percent. The raw materials price index (RMPI) was down 4.9 percent from April and 18.4 percent from a year earlier. Canada’s industrial product price index fell a further 1.0 percent on the month in May after declining 0.6 percent in April, for a year-over-year decrease of 6.3 percent. The raw materials price index (RMPI) was down 4.9 percent from April and 18.4 percent from a year earlier.

The headline IPPI has been on a declining trend since October 2022, while the index excluding energy and petroleum products has been evolving within a flatter range. Energy and petroleum was down 5.9 percent on the month and 33.2 percent year-over-year, the largest 12-month drop since May 2020. The IPPI excluding this category edged down 0.4 percent from April and 1.6 percent from a year earlier. StatCan cited lower crude oil prices (despite OPEC production cuts) amid negative sentiment about global macroeconomic prospects.

Other negative contributors to the monthly IPPI decline included primary non-ferrous metal, primary ferrous metal, food and pulp and paper.

The RMPI monthly decline, down 4.9 percent, was due to widespread price contractions across the main categories, except non-metallic minerals. Crude energy product prices were down 9.3 percent from April and 32.9 percent from May 2022. Excluding this category, the RMPI fell 2.2 percent on the month and 6.8 percent year-over-year.

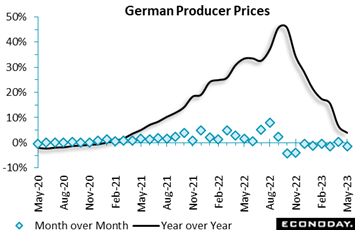

German producer prices were much weaker than expected in May. A 1.4 percent monthly fall came in far steeper than the market consensus calling for a decline of 0.3 percent. The annual rate, at 1.0 percent for the lowest reading since January 2021, has now cooled for eight consecutive months since the August and September peak of 45.8 percent. German producer prices were much weaker than expected in May. A 1.4 percent monthly fall came in far steeper than the market consensus calling for a decline of 0.3 percent. The annual rate, at 1.0 percent for the lowest reading since January 2021, has now cooled for eight consecutive months since the August and September peak of 45.8 percent.

As usual, it was energy that did much of the work and prices here were down 3.5 percent versus April. Elsewhere, intermediates fell 1.1 percent on the month while non-durable goods rose 0.1 percent. As a result, the core PPI fell 0.4 percent versus April and was up 3.2 percent year-over-year.

Capital goods and non-durable consumer goods, up 6.5 percent and 10.1 percent year-over-year, respectively, remain as the strongest sources of upward pressure on both the overall and core annual rate.

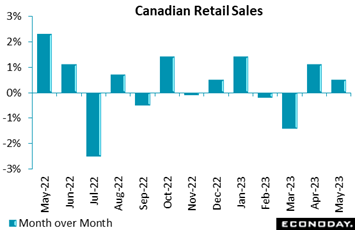

Retail sales in Canada rebounded more than expected in April, up 1.1 percent, for a 12-month increase of 2.9 percent. The consensus in an Econoday survey was 0.2 percent. The flash estimate for May points to a further 0.5 percent advance. Retail sales in Canada rebounded more than expected in April, up 1.1 percent, for a 12-month increase of 2.9 percent. The consensus in an Econoday survey was 0.2 percent. The flash estimate for May points to a further 0.5 percent advance.

Much of the increase was price related, as volumes were up a more modest 0.3 percent on the month. In April, consumer prices rose 0.7 percent after increasing 0.5 percent in March. The 12-month inflation rate edged up to 4.4 percent from 4.3 percent on higher rents and mortgage interest costs. The core index, excluding food and energy, came down to 4.4 percent from 4.5 percent. Both remain far above the central bank's 2 percent target.

Nominal retail sales gains were widespread across eight of nine subsectors, led by general merchandise (3.3 percent) and food and beverages (1.5 percent).

Core sales, excluding gas and fuel and motor vehicles and parts, were up 1.5 percent. Motor vehicles and parts sales increased 0.5 percent, and gasoline and fuel receipts rose 0.3 percent on the month.

Furniture, home furnishings, electronics and appliances sales were the one category to post a monthly decline, to the tune of 1.6 percent. The other housing-related sector, building material and garden equipment and supplies dealers, recorded a 0.7 percent increase.

Regionally, the recovery was broad based across eight provinces, led by Ontario.

The higher-than-anticipated headline number drove Econoday’s Consensus Divergence Index up to 42, consistent with an economy that is appreciably stronger than expected (see Bottom Line for details). The Bank of Canada hasn't been satisfied by the response of the economy to its rate hikes, citing persisting excess demand for hiking rates at its June 7 meeting, a possibility that had already been considered in April.

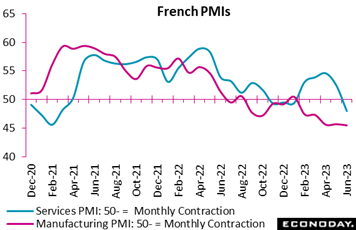

Private sector business activity in France fell sharply in June and into contraction for the first time since January. The services PMI dropped from 52.5 in May to 48.0, a 28-month low. The manufacturing PMI also fell but only modesty, slipping from May’s 45.7 to 45.5, a 37-month trough going back to the first effects of Covid. Private sector business activity in France fell sharply in June and into contraction for the first time since January. The services PMI dropped from 52.5 in May to 48.0, a 28-month low. The manufacturing PMI also fell but only modesty, slipping from May’s 45.7 to 45.5, a 37-month trough going back to the first effects of Covid.

Survey respondents attributed the fall in business activity to inflation, more challenging business conditions such as difficulties in securing credit and, in some cases, business shutdowns. Weak demand was also noted, as aggregate new orders declined at the sharpest rate since November 2020, with the fall experienced by both sectors, though it was most pronounced at manufacturers. Export orders also continued to fall in June.

Employment advanced again in June though job creation eased to a 6-month low, with most hiring occurring in the service sector while the manufacturing workforce modestly declined. Business confidence deteriorated to its weakest level in over three years.

Overall inflation rates of input costs and output prices slowed. But the picture is mixed, because while manufacturers' input cost inflation eased to its weakest mark since March 2016 amid falling raw material prices, service providers reported that rising wage pressures are still pushing up their expenses. And although overall output price inflation slowed to a 22-month low, manufacturers are discounting prices for the first time since June 2020, while service providers continue to raise their fees.

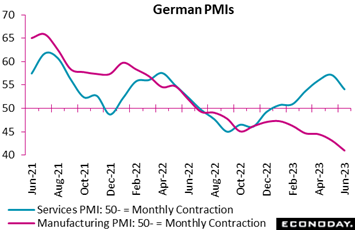

German private sector activity also lost momentum in June. Both goods producing and service sectors registered significant slowing albeit from different levels. For the former, the flash sector PMI slumped further into contraction from May's final 43.2 to 41.0, a 37-month low. The services counterpart fell from 57.2 to 54.1, a 3-month low though still well in expansion territory. Manufacturing output (44.2 after 47.4) hit an 8-month low. German private sector activity also lost momentum in June. Both goods producing and service sectors registered significant slowing albeit from different levels. For the former, the flash sector PMI slumped further into contraction from May's final 43.2 to 41.0, a 37-month low. The services counterpart fell from 57.2 to 54.1, a 3-month low though still well in expansion territory. Manufacturing output (44.2 after 47.4) hit an 8-month low.

Aggregate new orders shrank for the second month in a row and at the fastest pace since December, reflecting mostly weakness in new orders at manufacturers but also slower growth in service sector new orders. Backlog of work fell at a faster rate in June, reflecting a deepening backlog decline at manufacturers and the first marginal decline in service sector backlogs.

Overall employment growth remained positive though slowing to a 3-month low, but it was unevenly distributed, with factory workforce growth coming close to stalling while the service sector continued to increase staffing at an accelerated pace.

Business sentiment deteriorated to the lowest level of 2023, as pessimism grew in manufacturing, and sentiment among service firms, while still positive, was the weakest in six months.

Meantime, inflation eased, as overall input costs rose at the slowest rate in 31 months and overall output prices rose at the slowest rate in 28 months.

Like the Bank of England, the Bank of Canada also surprised the markets with an unexpected 25- basis-point hike of its own earlier this month. And judging by the continuing overperformance of the country’s economic data, at a substantial 42 on Econoday’s Consensus Divergence Index, another hike at the bank’s next meeting on July 12 shouldn’t be a surprise. The strength of US data, at 10 on the ECDI to indicate only modest outperformance, is not yet signaling an end of the Federal Reserve’s rate-hike pause.

Though Christine Lagarde flagged another rate hike at the ECB’s July 27 meeting, economic data from the Eurozone have been underperforming, at minus 21 on Econoday’s scale, which combined with the region’s ongoing recession are indicating that a pause could in fact prove to be the next meeting’s outcome. This is possibility is underscored by Germany’s minus 33 score and France’s minus 28, the zone’s two leading economies.

The BoE’s next meeting isn’t until August 1 making for a lot of economic data between now and then. As of now, the UK’s ECDI is at plus 18, squarely in positive ground to indicate continuing outperformance and continuing inflation risk which is evident in the less-prices score (ECDI-P) which goes down to 5 to indicate that inflation results are boosting the headline index.

Monetary stimulus in Japan appears certain to remain in overdrive regardless of inflation and regardless of economic performance which is hitting Econoday’s consensus forecasts on the nose with a score at zero. In contrast to the other major economies, China may further ease policy given substantial underperformance, at minus 50 on this country’s ECDI.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

CPI’s will roll out late in the week: Germany on Thursday, Tokyo on Friday, capped off by Eurozone harmonised prices later on Friday. All these reports will be for the month of June amid expectations for mixed results. Looking back at May, key inflation data will include Canada’s CPI on Tuesday and Australia’s CPI on Wednesday, both of these are expected to slow noticeably. PCE price indexes from the US on Friday will be for the month of May and are expected to be favorable at the headline level but unfavorable at the core.

Sentiment data are heavy in the week and seen as flat: German Ifo on Monday, US consumer confidence on Tuesday; German GfK consumer climate Wednesday, and EC economic sentiment Thursday.

Canadian monthly GDP for April will be posted Friday amid expectations for a respectable gain. Another sizable gain is expected for US core capital goods orders in Tuesday’s durable goods report, while Friday’s CFLP PMI’s from China are expected to be soft.

Singapore Industrial Production for May (Mon 0500 GMT; Mon 1300 SGT; Mon 0100 EDT)

Consensus Forecast, Year over Year: -7.1%

Industrial production in May, which in April was down 6.9 percent on the year, is expected to fall 7.1 percent.

German Ifo for June (Mon 0800 GMT; Mon 10:00 CEST; Mon 0400 EDT)

Consensus Forecast, Business Climate: 90.7

Consensus Forecast, Current Conditions: 93.5

Consensus Forecast, Business Expectations: 88.4

The business climate index fell 1.7 points in May to 91.7, ending an extended run of improvement. Forecasters see a further 1.0 point decline in June to 90.7.

US Durable Goods Orders for May (Tue 1230 GMT; Tue 0830 EDT)

Consensus Forecast: Month over Month: -1.0%

Consensus Forecast: Ex-Transportation - M/M: 0.0%

Consensus Forecast: Core Capital Goods Orders - M/M: 0.6%

Forecasters see durable goods orders falling 1.0 percent in May after April’s 1.1 percent rise. Ex-transportation orders are seen unchanged with core capital goods orders, after jumping 1.3 percent in April, rising a further 0.6 percent.

Canadian CPI for May (Tue 1230 GMT; Tue 0830 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 3.4%

After April’s 4.4 percent rate, which compared with expectations for 4.0 percent, consumer prices in May are expected to fall noticeably to 3.4 percent.

US Consumer Confidence Index for June (Tue 1400 GMT; Tue 1000 EDT)

Consensus Forecast: 103.7

The consumer confidence index is expected to rebound slightly in June to a 103.7 consensus versus May’s 102.3 which was better than expected but still down 1.4 points from April. This index has sat at depressed levels for the past year.

US New Home Sales for May (Tue 1400 GMT; Tue 1000 EDT)

Consensus Forecast, Annual Rate: 663,000

After a solid 683,000 annualized rate in April, new home sales in May are expected to slow to 663,000.

Australian May CPI (Wed 0130 GMT; Wed 1130 AEST; Tue 2130 EDT)

Consensus Forecast, Year over Year: 6.1%

Consumer prices in May are expected to ease to 6.1 percent year-over-year versus 6.8 percent in April which compared with expectations for 6.3 percent.

Germany: GfK Consumer Climate for July (Wed 0600 GMT; Wed 0800 CEST; Wed 0200 EDT)

Consensus Forecast: -23.0

Consumer climate, which has been improving, is expected to fall to minus 23.0 in July’s report versus minus 24.2 in June.

US International Trade in Goods (Advance) for May (Wed 1230 GMT; Wed 0830 EDT)

Consensus Forecast, Balance: -$92.5 billion

The US goods deficit (Census basis) is expected to narrow by $4.6 billion to $92.5 billion in May after widening by a very steep $14.5 billion in April to $97.1 billion.

Japanese Retail Sales for May (Wed 2350 GMT; Thu 0850 JST; Wed 1950 EDT)

Consensus Forecast, Month over Month: 0.9%

Consensus Forecast, Year over Year: 5.4%

Retail sales are expected to rise 0.9 percent on the month in May versus a 1.1 percent fall in April; year-over-year sales are expected to rise 5.4 percent versus April’s 5.1 percent. Though April’s results were unexpectedly soft, the government maintained its assessment that retail sales were "on an uptrend".

Australian Retail Sales for May (Thu 0130 GMT; Thu 1130 AEST; Wed 2130 EDT)

Consensus Forecast, Month over Month: 0.1%

Retail sales, which were unchanged and weaker than expected in April, are expected to edge only 0.1 percent higher in May.

Eurozone: EC Economic Sentiment for June (Thu 0900 GMT; Thu 1100 CEST; Thu 0500 EDT)

Consensus Forecast: 96.0

Consensus Forecast, Industry Sentiment: -5.8

Consensus Forecast, Consumer Sentiment: -16.1

Economic sentiment in June is expected to fell back to 96.0 from 96.5 in May

German CPI, Preliminary June (Thu 1200 GMT; Thu 1400 CEST; Thu 0800 EDT)

Consensus Forecast, Year over Year: 6.3%

June’s consensus is a year-over-year 6.3 percent rate versus 6.1 percent in May which was down from April’s 7.2 percent.

Korean Industrial Production for May (Thu 2300 GMT; Fri 0800 KST; Thu 1900 EDT)

Consensus Forecast, Month over Month: -1.0%

Consensus Forecast, Year over Year: -7.7

Industrial production is expected to decrease 1.0 percent on the month in May versus a 1.2 percent decrease in April. Year-over-year contraction is seen at 7.7 percent versus 8.9 percent.

Tokyo Consumer Price Index for June (Thu 2330 GMT; Fri 0830 JST; Thu 1930 EDT)

Consensus Forecast, Year over Year: 3.4%

Ex-Fresh Food, Consensus Forecast: 3.4%

Ex-Fresh Food & Energy, Consensus Forecast: 4.0%

Consumer inflation in Tokyo is expected to come in at a year-over-year 3.4 percent in June versus 3.2 percent in May. The ex-fresh food reading is also seen at 3.4 percent, also versus 3.2 percent. Ex-fresh food & energy is seen at 4.0 percent, up from May’s 3.9 percent. Note that all of May’s results were 1 tenth below Econoday’s consensus.

Japanese Unemployment Rate for May (Thu 2330 GMT; Fri 0830 JST; Thu 1930 EDT)

Consensus Forecast, Unemployment Rate: 2.5%

Japan's unemployment rate for May is expected to edge 1 tenth lower to 2.5 percent. The government in April’s report maintained its assessment that employment conditions were “picking up”.

Japanese Industrial Production for May (Thu 2350 GMT; Fri 0850 JST; Thu 1950 EDT)

Consensus Forecast, Month over Month: -1.0%

Consensus Forecast, Year over Year: 5.0%

Industrial production in May is expected to fall 1.0 percent following April’s 0.7 percent rise. The government maintained its assessment in the prior report that production “is showing signs of a gradual pickup.”

China: CFLP PMIs for June (Fri 0130 GMT; Fri 0930 CST; Thu 2130 EDT)

Manufacturing PMI, Consensus Forecast: 49.1

Non-manufacturing PMI, Consensus Forecast: 53.7

The CFLP manufacturing PMI is expected to improve only slightly in June to 49.1 after contracting further in May to 48.8, while the non-manufacturing PMI is expected to slip to 53.7 from 54.5.

German Retail Sales for May (Fri 0600 GMT; Fri 0800 CEST; Fri 0200 EDT)

Consensus Forecast, Month over Month: 0.0%

Retail sales are expected to come in unchanged on the month in May after rising 0.8 percent in April

German Unemployment Rate for June (Fri 0755 GMT; Fri 0955 CEST; Fri 0355 EDT)

Consensus Forecast: 5.6%

Unemployment in June is expected to hold steady at 5.6 percent .

Eurozone HICP Flash for June (Fri 0900 GMT; Fri 1100 CEST; Fri 0500 EDT)

Consensus Forecast, Year over Year: 5.7%

Narrow Core

Consensus Forecast, Year over Year: 5.4%

Consensus for June’s HICP flash is 5.7 percent and 5.4 percent for the narrow core. These would compare respectively with May’s 6.1 and 5.3 percent.

Eurozone Unemployment Rate for May (Fri 0900 GMT; Fri 1100 CEST; Fri 0500 EDT)

Consensus Forecast: 6.5%

Consensus for May's unemployment rate is no change at 6.5 percent.

Canadian Monthly GDP for April (Fri 1230 GMT; Fri 0830 EDT)

Consensus Forecast, Month over Month: 0.2%

After no change in March, GDP in April is expected to rise 0.2 percent.

US Personal Income for May (Fri 1230 GMT; Fri 0830 EDT)

Consensus Forecast, Month over Month: 0.4%

US Consumption Expenditures

Consensus Forecast, Month over Month: 0.2%

US PCE Price Index

Consensus Forecast, Month over Month: 0.1%

Consensus Forecast, Year over Year: 3.8%

US Core PCE Price Index

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 4.7%

Personal income is expected to rise 0.4 percent in May with consumption expenditures expected to increase 0.2 percent. These would compare with April’s 0.4 percent gain for income and 0.8 percent jump for consumption. Inflation readings for May are expected at monthly increases of 0.1 percent overall and 0.4 percent for the core (versus April’s respective increases of 0.4 percent for both) for annual rates of 3.8 and 4.7 percent (versus April’s 4.4 and 4.7 percent).

|