|

The Bank of England’s 25-basis-point rate hike was not surprising in its result but, relative to a more dovish Federal Reserve of the prior week which also raised rates by 25 points, was surprising in that there was no signal for a pause. The week’s inflation news was mostly favorable but not entirely so, whether the BoE’s updated forecasts or the latest on inflation expectations in the US. Also not favorable were updates on demand, production and international trade, pointing to global contraction underway. And all of this is combined with the risk that interest rates may after all continue to climb.

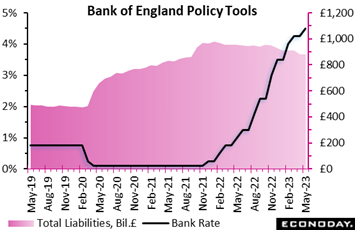

Another MPC meeting and yet another increase in interest rates. As generally, but not wholly, expected, this month's announcement saw Bank Rate raised by a further 25 basis points to 4.50 percent, its highest level since April 2008. This was the twelfth hike in a row but, in line with recent meetings, the decision was not unanimous. The two main doves (Swati Dhingra and Silvana Tenreyro) continued to call for no change leaving another 7-2 majority in favour of tightening. Another MPC meeting and yet another increase in interest rates. As generally, but not wholly, expected, this month's announcement saw Bank Rate raised by a further 25 basis points to 4.50 percent, its highest level since April 2008. This was the twelfth hike in a row but, in line with recent meetings, the decision was not unanimous. The two main doves (Swati Dhingra and Silvana Tenreyro) continued to call for no change leaving another 7-2 majority in favour of tightening.

The latest tightening reflects a notably more optimistic view of the real economy growth and a slower decline in inflation. Indeed, the new GDP growth forecast shows no negative quarters and incorporates the sharpest upward revision in the MPC's history (a contrast with subsequent GDP data posted on Friday as detailed later on in this article). GDP in the first half of 2023 is now expected to be flat and to expand modestly excluding strike and holiday distortions. In three years' time, total output is projected to be fully 2.25 percent higher than anticipated in the February Monetary Policy Report (MPR).

At the same time, the bank indicated that it is worried about food and core goods prices and warned that the risk of persistence in price and wage setting has increased, potentially hindering efforts to return inflation to target. That said, CPI inflation is still seen at just 1.1 percent in the second quarter of 2025 and only 1.2 percent a year later. However, the committee continues to judge that the risks around the inflation forecast are skewed significantly to the upside. Note that the latest outlook is conditioned on a market-implied path for Bank Rate that peaks at around 4.75 percent in the fourth quarter of 2023 before ending the projection horizon at just over 3.25 percent.

Active quantitative tightening continues in the background and the bank indicated that as of May 10th the total stock of QE assets had been reduced to £816 billion, comprising £813 billion of UK government bond purchases and £2.7 billion of sterling non-financial investment-grade corporate bond purchases. Sales will proceed as previously outlined.

Thursday's statement and minutes are hawkish and suggest most MPC members have become more concerned about the buoyancy of domestic pressures. Wages and inflation remain key to interest rate decisions so next Tuesday's labour marker report and the April CPI data due in the following week on May 24th will be instrumental to how the MPC votes next month. Following March's surprisingly strong CPI, further strength here could well mean another hike in Bank Rate is just a few weeks away.

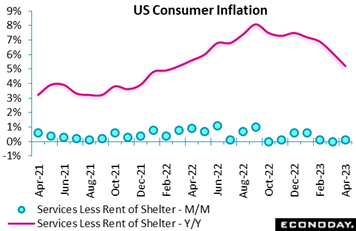

As expected for the US, the country’s CPI rose 0.4 percent in April after edging up 0.1 percent in March. But the 12-month growth rate came sightly down to 4.9 percent from 5.0 percent, the lowest level since April 2021. Econoday's consensus had the 12-month rate at 5.0 percent, with forecasts ranging from 4.8 percent to 5.1 percent. The core CPI, excluding food and energy, also rose 0.4 percent on the month. It was up 5.5 percent year-over-year, down from 5.6 percent the previous month, in line with expectations. Food prices were flat for the second consecutive month, bringing down the 12-month rate to 7.7 percent from 8.5 percent, the smallest increase since January 2022. Energy prices rebounded 0.6 percent on the month but fell 5.1 percent from a year earlier. As expected for the US, the country’s CPI rose 0.4 percent in April after edging up 0.1 percent in March. But the 12-month growth rate came sightly down to 4.9 percent from 5.0 percent, the lowest level since April 2021. Econoday's consensus had the 12-month rate at 5.0 percent, with forecasts ranging from 4.8 percent to 5.1 percent. The core CPI, excluding food and energy, also rose 0.4 percent on the month. It was up 5.5 percent year-over-year, down from 5.6 percent the previous month, in line with expectations. Food prices were flat for the second consecutive month, bringing down the 12-month rate to 7.7 percent from 8.5 percent, the smallest increase since January 2022. Energy prices rebounded 0.6 percent on the month but fell 5.1 percent from a year earlier.

The monthly increase was largely due to a 0.4 percent rise in shelter, although this marked a slowdown from 0.6 percent in March and 0.8 percent in February. Used cars and trucks, motor vehicle insurance, recreation, household furnishings and operations, and personal care also drove the core index higher in April. On the other hand, prices for airline fares and new vehicles declined.

A substantial plus in April's report is noticeable improvement in the year-over-year rate for services less rent of shelter, a reading tracked in the accompanying graph and which shadows the Federal Reserve's focus on non-housing services inflation. This reading slowed from 6.1 percent to 5.2 percent, still highly elevated but the least elevated since March last year.

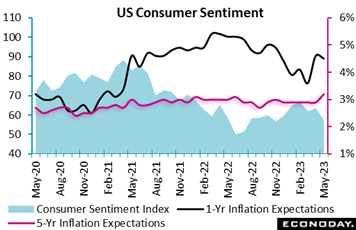

With annual rates at the headline level and for the core and especially non-housing services all slowing the outlook would seem favorable. Yet the Federal Reserve keeps close watch on inflation expectations which in data closing out the week came in way too high. Year-ahead expectations this month are at 4.5 percent following April’s 4.6 percent, the highest readings since 4.9 percent in November 2022. But 5-year expectations, a reading frequently cited by Jerome Powell as a key indicator in the Fed’s policy discussions, jumped 2 tenths to 3.2 percent. While this isn't enough to talk about inflation expectations becoming unanchored, it is enough to say that consumers don’t expect price increases to be going away any time soon.

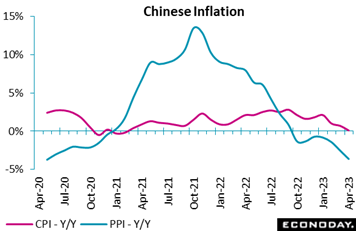

There’s no question at all, by contrast, that price pressures in China are easing, if not contracting. China's headline consumer price index increased by just 0.1 percent on the year in April, down from 0.7 percent in March and falling short of the consensus forecast of 0.3 percent. This is the weakest inflation rate since February 2021 and suggests that demand pressures remain subdued despite the lifting of public health restrictions in late 2022. The index fell 0.1 percent on the month after dropping 0.3 percent previously. There’s no question at all, by contrast, that price pressures in China are easing, if not contracting. China's headline consumer price index increased by just 0.1 percent on the year in April, down from 0.7 percent in March and falling short of the consensus forecast of 0.3 percent. This is the weakest inflation rate since February 2021 and suggests that demand pressures remain subdued despite the lifting of public health restrictions in late 2022. The index fell 0.1 percent on the month after dropping 0.3 percent previously.

April’s fall in the CPI largely reflected a smaller increase in food prices, up 0.4 percent on the year after a previous increase of 2.4 percent. Core inflation, in contrast, was steady at 0.7 percent in April. PMI surveys also indicated that price pressures were subdued in April.

Looking at producer prices, they fell 3.6 percent on the year in April after dropping 2.5 percent in March, below the consensus forecast for a decline of 3.2 percent. This is biggest year-over-year decline in the index since May 2020 and partly reflects the base effects of a solid month-over-month increase in the index 12 months previously. The index fell 0.5 percent on the month, after no change previously.

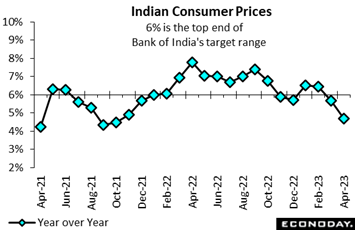

Favorable inflation news also came from India where the consumer price index rose 4.70 percent on the year in April, down from 5.66 percent in March and well below the consensus forecast of 5.50 percent. This is the lowest inflation rate since late 2021 and brings inflation closer to the mid-point of the Reserve Bank of India's target range of two percent to six percent. Food and beverage prices, which account for more than half the weight of the CPI index, were the major factor driving headline inflation lower in April. These prices rose 4.22 percent on the year after increasing 5.11 percent previously. Fuel and light charges, around 8 percent of the index, also rose at a slower pace, up 5.52 percent on the year after increasing 8.91 percent previously. Inflation in urban areas fell from 5.89 percent in March to 4.85 percent in April, while inflation in rural areas dropped from 5.51 percent to 4.68 percent. Favorable inflation news also came from India where the consumer price index rose 4.70 percent on the year in April, down from 5.66 percent in March and well below the consensus forecast of 5.50 percent. This is the lowest inflation rate since late 2021 and brings inflation closer to the mid-point of the Reserve Bank of India's target range of two percent to six percent. Food and beverage prices, which account for more than half the weight of the CPI index, were the major factor driving headline inflation lower in April. These prices rose 4.22 percent on the year after increasing 5.11 percent previously. Fuel and light charges, around 8 percent of the index, also rose at a slower pace, up 5.52 percent on the year after increasing 8.91 percent previously. Inflation in urban areas fell from 5.89 percent in March to 4.85 percent in April, while inflation in rural areas dropped from 5.51 percent to 4.68 percent.

The RBI left policy rates on hold at their most recent meeting held last month, after increasing rates by a cumulative 250 basis points since May 2022. Officials stressed that they "remain resolutely focused on aligning inflation with the target" but also noted that previous policy tightening is "working through the system". They also promised to "remain focused" on withdrawing policy accommodation, though the fall in inflation suggests officials may keep rates on hold again in upcoming meetings.

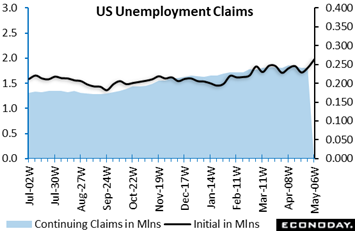

The Fed has yet to stop raising rates though guidance and comments from Jerome Powell do suggest that they may well be on hold at their next meeting in mid-June. Employment growth has remained “robust” according to the Fed giving them the latitude for extending the rate hikes. But his strength may be fading based on initial jobless claims which have been climbing the last couple of weeks, up 13,000 in the April 29 week and up a very sharp 22,000 to 264,000 in the May 6 week. The level at 242,000 is the highest level since October 2021. The four-week moving average is at 245,250 which is the highest since November 2021. While the increase is not immediately alarming – one week does not make a trend – it does suggest that the tightness in the labor market is easing. The Fed has yet to stop raising rates though guidance and comments from Jerome Powell do suggest that they may well be on hold at their next meeting in mid-June. Employment growth has remained “robust” according to the Fed giving them the latitude for extending the rate hikes. But his strength may be fading based on initial jobless claims which have been climbing the last couple of weeks, up 13,000 in the April 29 week and up a very sharp 22,000 to 264,000 in the May 6 week. The level at 242,000 is the highest level since October 2021. The four-week moving average is at 245,250 which is the highest since November 2021. While the increase is not immediately alarming – one week does not make a trend – it does suggest that the tightness in the labor market is easing.

Continuing claims rose 12,000 to 1.813 million in lagging data for the April 29 week with the four-week moving average up 2,250 to 1.830 million. These are relatively small moves that do not change the underlying picture of a labor market where workers are not remaining on the unemployment rolls for extended periods. The insured rate of unemployment remains at 1.2 percent in the April 29 week. At least among workers eligible for unemployment benefits, the US labor market, despite the jump in initial claims, remains tight.

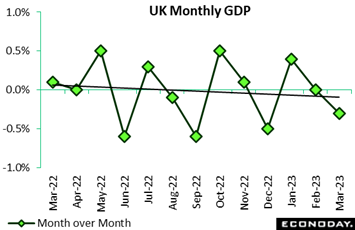

UK GDP came out on Friday, the following the BoE meeting. The first quarter’s results matched both expectations and the prior quarter’s rate, at a 0.1 percent quarterly rise. Annual growth fell to 0.2 percent, down from 0.6 percent, and its weakest reading since the Covid-led 7.7 percent contraction seen in the first quarter of 2021. GDP was still 0.5 percent below its pre-Covid mark in the fourth quarter of 2019. UK GDP came out on Friday, the following the BoE meeting. The first quarter’s results matched both expectations and the prior quarter’s rate, at a 0.1 percent quarterly rise. Annual growth fell to 0.2 percent, down from 0.6 percent, and its weakest reading since the Covid-led 7.7 percent contraction seen in the first quarter of 2021. GDP was still 0.5 percent below its pre-Covid mark in the fourth quarter of 2019.

But the monthly profile (as tracked in the accompanying graph) was especially weak, contracting 0.3 percent on the month in March, well short of the market consensus and the weakest performance since a 0.5 percent contraction in December. March’s decline was largely attributable to services where output dropped a monthly 0.5 percent after a 0.1 percent dip in February. Output in consumer facing services was down fully 0.8 percent, easily more than unwinding the February's 0.4 percent gain.

Turning back to the quarterly data, household spending was flat quarter-over-quarter after a 0.2 percent increase in the previous period and government consumption (minus 2.5 percent) subtracted for the first time in three quarters. However, gross fixed capital formation expanded 1.3 percent within which business investment rose 0.7 percent and so comfortably more than reversed the fourth quarter's 0.2 percent decline. Business inventories (excluding alignment and balancing) had a small positive impact, but this was essentially offset by net foreign trade as an 8.1 percent drop in exports more than offset a 7.2 percent decline in imports.

Though the first quarter was in keeping with the BoE's revised expectations for essentially stagnant output in the first half of the year, March’s results were especially sluggish and suggest that momentum going into the current period had faded; this may be seen by some as arguing against the BoE’s twelfth consecutive hike. And the weakness of consumption will be seen by the MPC's doves as reason for being cautious about any additional hike in interest rates.

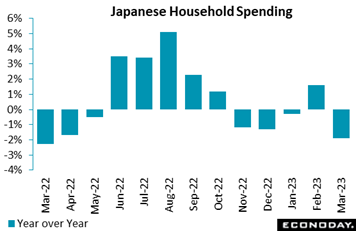

Japan's real household spending came in much weaker than expected in March, posting drops both on the year and month as consumers switch to discount mobile phone plans amid elevated food costs. Real average spending by households with two or more people plunged 1.9 percent on the year in March, giving up all of the 1.6 percent rebound in February and following a 0.3 percent dip in January. It was much weaker the median economist forecast of a 0.3 percent rise. The decrease was the sixth in 12 months. Japan's real household spending came in much weaker than expected in March, posting drops both on the year and month as consumers switch to discount mobile phone plans amid elevated food costs. Real average spending by households with two or more people plunged 1.9 percent on the year in March, giving up all of the 1.6 percent rebound in February and following a 0.3 percent dip in January. It was much weaker the median economist forecast of a 0.3 percent rise. The decrease was the sixth in 12 months.

Aside from discount phone plans, households continued spending less on groceries (fish), compared to the earlier phase of the pandemic when households had cooked more at home and bought takeout food to avoid contact. Backed by the government's tourism subsidy program, households continued spending more on eating out, hotels and domestic travel packages.

On the month, real average household spending fell a seasonally adjusted 0.8 percent in March after slumping 2.4 percent in February. This was much weaker than the consensus forecast for a 1.6 percent rebound. On the quarter, expenditures dipped 0.3 percent in the first quarter after edging up 0.2 percent in the fourth quarter, indicating that private consumption provided little contribution to preliminary first-quarter GDP to be posted on Wednesday of the coming week. Econoday’s consensus for this report is 0.2 percent quarterly growth for modest annualized growth rate of 0.6 percent.

Goods production in Germany ended the first quarter on a surprisingly weak note. A 3.4 percent monthly slump was more than three times steeper than the consensus and easily more than reversed February's 2.1 percent gain. This was the sector's worst performance since March 2022 although with base effects strongly positive, annual growth still accelerated from 0.8 percent to 1.6 percent. That said, output was still some 5.8 percent below its pre-pandemic level in February 2020. Goods production in Germany ended the first quarter on a surprisingly weak note. A 3.4 percent monthly slump was more than three times steeper than the consensus and easily more than reversed February's 2.1 percent gain. This was the sector's worst performance since March 2022 although with base effects strongly positive, annual growth still accelerated from 0.8 percent to 1.6 percent. That said, output was still some 5.8 percent below its pre-pandemic level in February 2020.

Manufacturing fared little better, posting a 3.3 percent monthly fall with motor vehicles and parts down 6.5 percent. Capital goods decreased 4.4 percent, intermediates 3.5 percent and consumer goods 0.1 percent. Elsewhere, construction also fell 3.3 percent but energy rose 0.8 percent.

March's hefty setback came after a cumulative 5.9 percent advance in January/February and so still makes for a positive first quarter by the sector. In fact, total industrial production was up a healthy 2.4 percent versus the fourth quarter of last year. Even so, with March manufacturing orders nosediving some 10.7 percent (data released in the prior week), the recovery is now looking a good deal softer than seen previously.

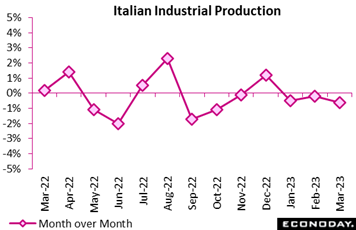

Industrial production in Italy was also surprisingly weak in March. With February slipping 0.2 percent, a 0.6 percent monthly fall was again well wide of the consensus and means output has now declined in six of the last seven months. Annual workday adjusted growth was minus 3.2 percent, down from 2.3 percent and a 5-month low. Industrial production in Italy was also surprisingly weak in March. With February slipping 0.2 percent, a 0.6 percent monthly fall was again well wide of the consensus and means output has now declined in six of the last seven months. Annual workday adjusted growth was minus 3.2 percent, down from 2.3 percent and a 5-month low.

The monthly setback reflected fresh falls in consumer goods (1.4 percent), intermediates (0.4 percent) and energy (1.4 percent). Capital goods rose 0.7 percent and was the only category to record positive yearly growth (3.9 percent).

March's disappointing results leave the goods producing sector mired in the recession that started back in the third quarter of last year. Moreover, with France (minus 1.1 percent) and Germany (minus 3.4 percent) both seeing even steeper monthly declines, Eurozone industrial production almost certainly had a very poor March. The Eurozone update will be posted on Monday of the coming week with expectations looking for a 1.6 percent monthly decline which, if realized, could lead to a downward revision to the region's first-quarter GDP growth (provisionally just 0.1 percent).

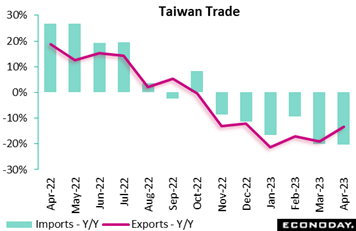

Country after country continue to report declines in both exports and imports indicating outright contraction in total global trade. Yet when contraction in imports exceeds contraction in exports, then trade balances deceptively improve. This is the case for Taiwan whose trade surplus widened from US$4.22 billion in March to US$6.71 billion in April. This is the largest surplus since October 2020. Taiwan’s exports fell 13.3 percent on the year after falling 19.1 percent previously, while imports dropped 20.2 percent, little changed from the previous decline of 20.1 percent. PMI survey data published in the prior week showed Taiwan's manufacturing sector contracted again in April and at a more pronounced rate. Country after country continue to report declines in both exports and imports indicating outright contraction in total global trade. Yet when contraction in imports exceeds contraction in exports, then trade balances deceptively improve. This is the case for Taiwan whose trade surplus widened from US$4.22 billion in March to US$6.71 billion in April. This is the largest surplus since October 2020. Taiwan’s exports fell 13.3 percent on the year after falling 19.1 percent previously, while imports dropped 20.2 percent, little changed from the previous decline of 20.1 percent. PMI survey data published in the prior week showed Taiwan's manufacturing sector contracted again in April and at a more pronounced rate.

Exports of electronic components fell 8.6 percent on the year in April after dropping 14.6 percent in March, offset by a rebound in exports of information, communication and audio-video products, up 5.4 percent after a fall of 15.8 percent previously. Exports to mainland China and Hong Kong were again weak, down 22.0 percent on the year after falling 28.5 percent previously, while year-over-year growth in exports to the US dropped 10.3 percent after a previous fall of 20.7 percent. Petroleum imports fell 11.6 percent on the year after falling 30.4 percent previously, while imports from mainland China and Hong Kong fell 23.4 percent after a previous decline of 26.5 percent.

We end the week’s data run with a closer look at the University of Michigan consumer sentiment index which not only showed sharp rates for inflation expectations as discussed earlier but a corresponding drop in sentiment, falling to 57.7 in early May from 63.5 in April. The decline reflects lower sentiment both for current conditions and six-month expectations. US consumers are likely more worried about the prospect of declining labor demand and recession, stubborn inflation, rising borrowing costs, and the failure of Congress to raise the debt limit and avoid a default that would deeply harm the economy and household finances. The May decline erases all the improvement seen in 2023 to-date and is the lowest since 56.8 in November 2022. We end the week’s data run with a closer look at the University of Michigan consumer sentiment index which not only showed sharp rates for inflation expectations as discussed earlier but a corresponding drop in sentiment, falling to 57.7 in early May from 63.5 in April. The decline reflects lower sentiment both for current conditions and six-month expectations. US consumers are likely more worried about the prospect of declining labor demand and recession, stubborn inflation, rising borrowing costs, and the failure of Congress to raise the debt limit and avoid a default that would deeply harm the economy and household finances. The May decline erases all the improvement seen in 2023 to-date and is the lowest since 56.8 in November 2022.

The index for current conditions is down 3.7 points to 64.5 in May and its lowest since 59.4 in December 2022. The future conditions index is down 7.1 points to 53.4 and its lowest since 47.3 in July 2022. There is room for an upward revision when the revised final number is released on May 26th, which could well depend on whether the showdown on raising the debt limit goes right up to the last minute.

The disappointing sentiment results leave Econoday's Consensus Divergence Index for the US at minus 12 overall and at minus 15 excluding prices (ECDI-P), back again below the zero line where the readings spent the whole of April.

Eurozone indicators were light in the week shifting focus to member states. Surprisingly soft reports left the German ECDI at minus 19 and the ECDI-P at minus 11 and their French and Italian counterparts at 4 and minus 15 and zero and minus 10 respectively. These readings warn that Eurozone real economic activity may be falling behind expectations.

In the UK, the recent run of unexpectedly robust data is manifested in yet another hike in the BoE’s Bank Rate. At 13 and 19 respectively, the ECDI and ECDI-P closed out the week still in positive surprise territory.

In Japan, surprisingly weak consumer spending trimmed the ECDI to 4 and the ECDI-P to exactly zero. Both readings indicate that overall economic activity is running as expected.

However in China, worries that the anticipated economic recovery will undershoot expectations are echoed in the ECDI at minus 57 and the ECDI-P at minus 60, easily their weakest posts since early January. These scores are something to note given very strong expectations for the coming week’s reports on industrial production and retail sales.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Very sharp acceleration is expected Tuesday for both Chinese industrial production and retail sales. Chinese fixed asset investment, however, is expected to slow. US retail sales are expected to rebound sharply in data also released Tuesday, but less so when excluding cars and also gasoline. CPI updates include expected slowing for Canada on Tuesday and expected acceleration for Japan on Friday.

Canadian housing starts are expected to rise on Monday with US starts expected to slow on Wednesday. Eurozone industrial production on Monday is expected to fall, US industrial production on Tuesday is expected to come in flat, while Canadian manufacturing sales, also on Tuesday, are expected to rise.

Australian data include the wage price index on Wednesday where further pressure is the consensus and the labour force survey on Thursday where slowing job growth is expected. Japanese first-quarter GDP on Wednesday is expected to show modest but improving growth. One report that is expected to show noticeable declines is Germany’s ZEW sentiment survey on Tuesday.

Japanese Producer Price Index for April (Sun 2350 GMT; Mon 0850 JST; Sun 1950 EDT)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 5.6%

Producer prices are expected to rise 0.2 percent on the month in April for a year-over-year rate of 5.6 percent. These would compare with no change on the month in March and a 7.2 percent annual rate on the year.

Eurozone Industrial Production for March (Mon 0900 GMT; Mon 1100 CEST; Mon 0500 EDT)

Consensus Forecast, Month over Month: -1.6%

Consensus Forecast, Year over Year: 1.3%

Production in March is expected to fall 1.6 percent after rising 1.5 percent in February which was well above expectations. Consensus for the year-over-year rate is growth of 1.3 percent.

Canadian Housing Starts for April (Mon 1215 GMT; Mon 0815 EDT)

Consensus Forecast, Annual Rate: 228,000

Housing starts are expected to rise to 228,000 in April from 213,865 in March.

Chinese Fixed Asset Investment for April (Mon 0200 GMT; Tue 1000 CST; Mon 2200 EDT)

Consensus Forecast, Year-to-Date on Y/Y Basis: 2.7%

Growth in fixed asset investment is expected to slow to 2.7 percent in April. This would compare with 5.1 percent growth in March which was lower than expected.

Chinese Industrial Production for April (Mon 0200 GMT; Tue 1000 CST; Mon 2200 EDT)

Consensus Forecast, Year over Year: 10.7%

Year-over-year growth in industrial production is expected to accelerate sharply to 10.7 percent in April versus growth of 3.9 percent in March.

Chinese Retail Sales for April (Mon 0200 GMT; Tue 1000 CST; Mon 2200 EDT)

Consensus Forecast, Year over Year: 22.0%

After rising a surprisingly robust 10.6 percent in March, year-over-year sales in April are expected to rise very sharply by 22.0 percent.

UK Labour Market Report (Tue 0600 GMT; Tue 0700 BST; Tue 0200 EDT)

Consensus Forecast, ILO Unemployment Rate for three months to March: 3.8%

The ILO unemployment rate for the three months to March is expected to hold steady at 3.8 percent.

Germany: ZEW Survey for May (Tue 0900 GMT; Tue 1100 CEST; Tue 0500 EDT)

Consensus Forecast, Current Conditions: -35.3

Consensus Forecast, Economic Sentiment: -5.0

Current conditions are expected to fall in May to minus 35.3 versus April’s minus 32.5. Expectations (economic sentiment) are expected to fall to minus 5.0 versus April’s sharp drop to plus 4.1.

US Retail Sales for April (Tue 1230 GMT; Tue 0830 EDT)

Consensus Forecast, Month over Month: 0.7%

Consensus Forecast, Ex-Vehicles - M/M: 0.4%

Consensus Forecast, Ex-Vehicles, Ex-Gas - M/M: 0.2%

April sales are expected to rise 0.7 percent versus March’s 1.0 percent decline that, in broad declines, was led by declines in autos and gasoline.

Canadian CPI for April (Tue 1230 GMT; Tue 0830 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 4.0%

After March’s as-expected 4.3 percent rate, which was down substantially from February’s 5.2 percent rate, consumer prices in April are expected to ease further to 4.0 percent.

Canadian Manufacturing Sales for March (Tue 1230 GMT; Tue 08:30 EDT)

Consensus Forecast, Month over Month: 0.7%

Manufacturing sales, which have been swinging back and forth along a declining trend, are expected to rise 0.7 percent in March after falling 3.6 percent in February.

US Industrial Production for April (Tue 1315 GMT; Tue 0915 EDT)

Consensus Forecast, Month over Month: 0.0%

Consensus Forecast, Manufacturing Output - M/M: 0.1%

Consensus Forecast, Capacity Utilization Rate: 79.8%

Industrial production is expected to come in unchanged in April after March’s 0.4 percent increase that was boosted by utilities output. Manufacturing output is seen up 0.1 percent after falling 0.5 percent in March.

Japanese First-Quarter GDP, First Estimate (Tue 2350 GMT; Wed 0850 JST; Tue 1950 EDT)

Consensus Forecast, Quarter over Quarter: 0.2%

Consensus Forecast, Annualized Rate: 0.6%

GDP for the first quarter is expected to rise a quarterly 0.2 percent and rise of 0.6 percent on an annualized basis. This would compare with no change in the fourth quarter and marginal annualized growth of 0.1 percent. Exports and business investment lost some steam during the quarter amid slowing global growth while widely eased Covid public health rules helped consumer spending.

US Housing Starts for April (Wed 1230 GMT; Wed 0830 EDT)

Consensus Forecast, Annual Rate: 1.405 million

US Building Permits

Consensus Forecast: 1.430 million

Housing starts in March edged lower to a 1.420 million annualized rate; April is expected to slip further to 1.405 million. Permits, at 1.413 million in March and, though lower than expected, very near the starts rate, is expected to rise to 1.430 million.

Japanese Merchandise Trade for April (Wed 2350 GMT; Thu 0850 JST; Wed 1950 EDT)

Consensus Forecast: -¥670.0 billion

Consensus Forecast, Imports Y/Y: -0.5%

Consensus Forecast, Exports Y/Y: 3.0%

A deficit of ¥670.0 billion is the consensus for April’s trade balance versus a deficit of ¥755.1 billion in March.

Australian Wage Price Index for the First Quarter (Wed 0130 GMT; Wed 1130 AEST; Tue 2130 EDT)

Consensus Forecast, Quarter over Quarter: 0.9%

Consensus Forecast, Year over Year: 3.6%

Wage growth is expected to show increasing pressure in the first quarter, rising 0.9 percent on the quarter and 3.6 percent on the year. These would compare with fourth-quarter rates of 0.8 and 3.3 percent.

Australian Labour Force Survey for April (Thu 0130 GMT; Thu 1130 AEST; Wed 2130 EDT)

Consensus Forecast, Employment: 25,000

Consensus Forecast, Unemployment Rate: 3.5%

At a consensus rise of 25,000, employment in April is expected to slow versus a stronger-than-expected 53,000 increase in March. The unemployment rate is expected to hold steady at 3.5 percent.

Japanese Consumer Price Index for April (Thu 2330 GMT; Fri 0830 JST; Thu 1930 EDT)

Consensus Forecast, Year over Year: 3.5%

Consensus Forecast, Ex Fresh-Food; Y/Y: 3.4%

Consensus Forecast, Ex Fresh-Food Ex-Energy; Y/Y: 4.2%

Consumer inflation in April is expected to re-accelerate to a year-over-year 3.5 percent versus 3.2 percent in March, a month once again held down by expanded government subsidies for electricity and natural gas. Excluding fresh food, the rate is seen at 3.4 percent versus 3.1 percent for March and when also excluding energy, the rate is seen at 4.2 percent versus March’s 3.8 percent which was higher than expected and up from March’s 3.5 percent.

German PPI for April (Fri 0600 GMT; Fri 0800 CEST; Fri 0200 EDT)

Consensus Forecast, Month over Month: -0.4%

April’s PPI is expected to fall a monthly 0.4 percent versus March’s 2.6 percent decrease.

Canadian Retail Sales for March (Fri 1230 GMT; Fri 0830 EDT)

Consensus Forecast, Month over Month: -1.4%

Retail sales in March are expected to fall 1.4 percent following a 0.2 percent dip in February.

|