|

US economic data as measured by Econoday’s Consensus Divergence Index, at plus 25, have been running solidly above expectations all year, which helps explain the Federal Reserve’s hawkish tilt. Minutes from the meeting three weeks ago indicate that not everyone at the meeting wanted to lower the rate hike to 25 basis points with some instead arguing for another 50 points instead. This of course sets the stage for hawkish debate and a further rate hike at the March 21-22 policy meeting, should economic data over the next month remain strong and especially if inflation readings exceed expectations.

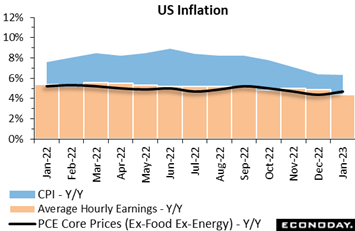

Both the headline PCE price index and the core index, excluding food and energy, jumped an over heated and greater than expected 0.6 percent on the month in January. These not only exceeded Econoday’s consensus estimates by 2 tenths but also exceeded December’s rates by the same 2 tenths. In other words, these readings, which are what the Federal Reserve uses as its inflation guides, were supposed to hold steady, not accelerate. The annual rates, at 5.4 percent overall and 4.7 percent for core, also moved higher and also came in above expectations. Prices for both goods and services appreciated 0.6 percent on the month in January, with food up 0.4 percent and energy 2.0 percent. On a 12-month basis, consumers paid 11.1 percent more for food and 9.6 percent more for energy. Both the headline PCE price index and the core index, excluding food and energy, jumped an over heated and greater than expected 0.6 percent on the month in January. These not only exceeded Econoday’s consensus estimates by 2 tenths but also exceeded December’s rates by the same 2 tenths. In other words, these readings, which are what the Federal Reserve uses as its inflation guides, were supposed to hold steady, not accelerate. The annual rates, at 5.4 percent overall and 4.7 percent for core, also moved higher and also came in above expectations. Prices for both goods and services appreciated 0.6 percent on the month in January, with food up 0.4 percent and energy 2.0 percent. On a 12-month basis, consumers paid 11.1 percent more for food and 9.6 percent more for energy.

Though these results will feed the hawks at the FOMC, other inflation readings have not been accelerating whether overall prices as measured by the CPI, which eased slightly in January to an annual 6.3 percent, nor average hourly earnings which slipped 3 tenths to 4.4 percent. Nevertheless, all these rates are far above the Federal Reserve’s 2 percent target. As long as the US jobs market remains strong, that is as long as tech sector layoff announcements fail to make their appearance in the government’s actual employment data, the Fed will have plenty of leeway to raise rates further and squash talk of a year-end rate cut.

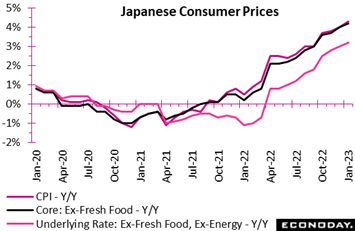

Inflation readings across the global economy have been mixed. Consumer inflation in Japan picked up pace further in January with the core measure (ex-fresh food) setting a fresh 41-year high at 4.2 percent. The spike has been caused by elevated energy and commodity costs offsetting lack of price pressures for services (the latter in contrast to the US where service inflation has been stubbornly high). On wages, many Japanese firms have been cautious about offering more although some big firms are giving higher salaries or increasing benefits ahead of their annual reviews in April. In addition, the yen remains relatively weak eroding Japan's purchasing power and keeping the costs for imported materials and products high. Inflation readings across the global economy have been mixed. Consumer inflation in Japan picked up pace further in January with the core measure (ex-fresh food) setting a fresh 41-year high at 4.2 percent. The spike has been caused by elevated energy and commodity costs offsetting lack of price pressures for services (the latter in contrast to the US where service inflation has been stubbornly high). On wages, many Japanese firms have been cautious about offering more although some big firms are giving higher salaries or increasing benefits ahead of their annual reviews in April. In addition, the yen remains relatively weak eroding Japan's purchasing power and keeping the costs for imported materials and products high.

Looking ahead, households will see some easing in utility costs as the government has begun providing subsidies to consumer electricity and natural gas providers, effects which will appear in February’s report. The Bank of Japan projects that the increase in the core CPI will slow to 1.6 percent in fiscal 2023 (ending in March next year) as the base effects of the current spike in energy and commodity prices fade. For fiscal 2024, the bank expects the core reading to rise 1.8 percent, slightly higher than its 1.6 percent projection made three months ago, noting the waning impact of government subsidies to cap retail gasoline and utility prices.

The total CPI surged 4.3 percent on year in January, marking the 17th consecutive year-over-year increase following 4.0 percent in December. The underlying inflation rate, excluding fresh food as well as energy, accelerated to 3.2 percent in January from 3.0 percent in December, marking the 10th straight increase.

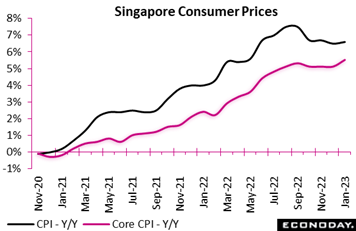

Consumer prices in Singapore rose 6.6 percent on the year in January, up slightly from 6.5 percent in December. The Monetary Authority of Singapore's preferred measure of core inflation, which excludes the cost of accommodation and private road transport, picked up noticeably from 5.1 to 5.5 percent, partly reflecting seasonal effects associated with the timing of Lunar New Year holidays. On the month, this index increased 0.8 percent after advancing 0.6 percent previously. Consumer prices in Singapore rose 6.6 percent on the year in January, up slightly from 6.5 percent in December. The Monetary Authority of Singapore's preferred measure of core inflation, which excludes the cost of accommodation and private road transport, picked up noticeably from 5.1 to 5.5 percent, partly reflecting seasonal effects associated with the timing of Lunar New Year holidays. On the month, this index increased 0.8 percent after advancing 0.6 percent previously.

January’s results reflect offsetting moves in key components. Food prices rose 8.1 percent on the year after advancing 7.5 percent previously, with prices for services, retail and other goods, and accommodation also rising at a faster pace. This was partly offset by smaller increases in electricity and gas prices and private transport costs.

MAS officials expect core inflation to "remain elevated" in the first half of this year before moderating in the second half. An increase in the goods and services tax this year will deliver a one-off increase in prices, and officials forecast that core inflation will average between 3.5 percent and 4.5 percent in 2023 when the impact of the tax increase is included, and average between 2.5 percent and 3.5 percent when that impact is excluded.

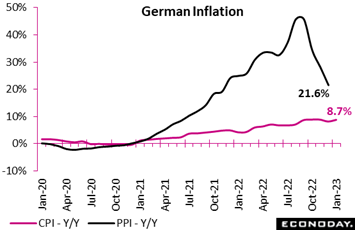

An anomaly appeared in the week from Germany which, reflecting a new base year (2020 versus 2015) slashed last year’s consumer inflation rate by a full percentage point, from 7.9 percent to 6.9 percent. Yet more immediately, the annual rate for January this year was unrevised at 8.7 percent as was January’s harmonised rate at 9.2 percent, the latter still 7.2 percentage points above the European Central Bank’s target. An anomaly appeared in the week from Germany which, reflecting a new base year (2020 versus 2015) slashed last year’s consumer inflation rate by a full percentage point, from 7.9 percent to 6.9 percent. Yet more immediately, the annual rate for January this year was unrevised at 8.7 percent as was January’s harmonised rate at 9.2 percent, the latter still 7.2 percentage points above the European Central Bank’s target.

Within January’s CPI, goods inflation was 12.7 percent reflecting a particularly hefty rate for non-durables (17.0 percent). Durables (6.0 percent) were comparatively a good deal softer. Services (4.5 percent) were boosted by maintenance and repair of dwellings (16.9 percent) and catering services in restaurants and cafes (10.9 percent). Food (20.2 percent) was again especially strong but slightly weaker than in December (20.4 percent) and below the energy rate (23.1 percent) which remained very high despite relief measures. Excluding food and energy, inflation stood at 5.6 percent, up from 5.2 percent at year-end.

January’s results will not sit at all well with the Bundesbank which will certainly be pushing for another 50 point hike in ECB interest rates next month.

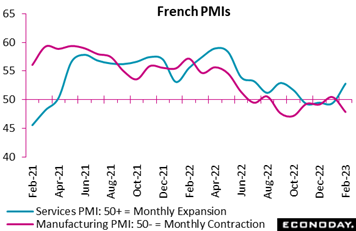

February’s flash PMI’s have a consistent theme: expansion for services, contraction for manufacturing. French services jumped to a 5-month peak, up a sharp 3.4 points to 52.8 indicating a modest rate of overall growth relative to January. By contrast, the manufacturing PMI dropped 2.6 points to 7.9, a 4-month trough. Moreover, a separate reading on manufacturing output, at 45.9, is especially weak. February’s flash PMI’s have a consistent theme: expansion for services, contraction for manufacturing. French services jumped to a 5-month peak, up a sharp 3.4 points to 52.8 indicating a modest rate of overall growth relative to January. By contrast, the manufacturing PMI dropped 2.6 points to 7.9, a 4-month trough. Moreover, a separate reading on manufacturing output, at 45.9, is especially weak.

Aggregate new orders saw a seventh successive decline, mainly, but not solely, due to manufacturing, with export demand again declining. However, the fall here was not steep enough to prevent a services-driven increase in backlogs, and overall employment growth was little changed from the 3-month high seen in January. In addition, although optimism about the year ahead dipped, it is still the second-strongest since July 2022.

Meantime, input cost inflation continues to trend lower and, while still historically firm, is at its lowest rate since December 2021. Importantly too, output price inflation, after hitting an 8-month peak in January, also eased.

February’s update bodes cautiously well for France’s first-quarter GDP which looks on course to beat the meager 0.1 percent rate achieved at the end of 2022. Nonetheless, the expansion is far from balanced and declining demand in manufacturing remains a major problem. For Europe as a whole, February’s services PMI rose more than 2 points to 53.0 for an 8-month peak while manufacturing fell 3 tenths to 48.5 and a little deeper into recession territory.

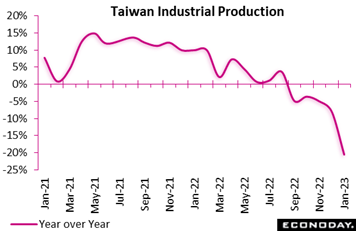

Manufacturing appears to be at its weakest in Asia, underscoring concerns over falling chip production. Taiwan's industrial production index fell 20.5 percent on the year in January, weakening sharply from a decline of 7.93 percent in December. This is the biggest year-over-year decline in output since 2009 though – very importantly – the scale of the fall likely reflects the timing of Lunar New Year holidays. These holidays in 2022 were mainly observed in February while in 2023 they were mainly observed in January, offering an explanation for this January’s big annual drop. Combining January and February data together, when the latter are published next month, will provide the most useful information on the strength of economic conditions at the start of the year. Manufacturing appears to be at its weakest in Asia, underscoring concerns over falling chip production. Taiwan's industrial production index fell 20.5 percent on the year in January, weakening sharply from a decline of 7.93 percent in December. This is the biggest year-over-year decline in output since 2009 though – very importantly – the scale of the fall likely reflects the timing of Lunar New Year holidays. These holidays in 2022 were mainly observed in February while in 2023 they were mainly observed in January, offering an explanation for this January’s big annual drop. Combining January and February data together, when the latter are published next month, will provide the most useful information on the strength of economic conditions at the start of the year.

Looking specifically at manufacturing, output fell 21.4 percent on the year, in line with PMI survey data that also showed a sharp contraction in the sector during January. Output in the mining, water supply and electricity and gas sectors also declined on the year.

How long central banks will be raising rates is the key question right now for the economic and financial outlooks. These questions are up in the air in Europe and North America but maybe less so in Asia. The Bank of Korea was the first major central bank to begin to raise rates this cycle, and now the bank is holding off, perhaps offering a leading signal for monetary policy in general. The BoK left its main policy rate unchanged at 3.50 percent at its Thursday meeting, in line with the consensus forecast. This leaves the cumulative amount of rate increases made since late 2021 at 275 basis points, with the policy rate at its highest level since 2008. How long central banks will be raising rates is the key question right now for the economic and financial outlooks. These questions are up in the air in Europe and North America but maybe less so in Asia. The Bank of Korea was the first major central bank to begin to raise rates this cycle, and now the bank is holding off, perhaps offering a leading signal for monetary policy in general. The BoK left its main policy rate unchanged at 3.50 percent at its Thursday meeting, in line with the consensus forecast. This leaves the cumulative amount of rate increases made since late 2021 at 275 basis points, with the policy rate at its highest level since 2008.

Since the previous BoK meeting in early January, data have shown headline inflation picking up from 5.0 percent in both November and December to 5.2 percent in January, further above the BoK's target level of 2.0 percent. Core CPI inflation has been relatively steady but high in recent months.

The statement accompanying the decision noted that a weaker global outlook and tighter monetary policy will likely weigh on growth in the first half of 2023, but officials expect some improvement later in the year as conditions in China recover. They also expect inflation to moderate over 2023, revising their annual forecast slightly lower from 3.6 percent to 3.5 percent.

Having left policy rates on hold, officials indicated that policy may not need to be tightened further in coming months if price pressures moderate in line with their forecasts. They advise that they will need to "judge" whether further rate increases are "warranted" based on "the pace of inflation slowdown and developments in the uncertainties".

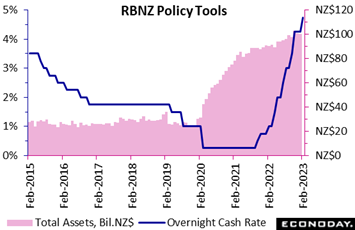

The Reserve Bank of New Zealand is also moderating policy, increasing its official cash rate by 50 basis points from 75 points at its last meeting in November. Officials have now increased this rate by a cumulative 450 basis points since October 2021 as they unwind policy accommodation put in place during the initial stages of the pandemic. The Reserve Bank of New Zealand is also moderating policy, increasing its official cash rate by 50 basis points from 75 points at its last meeting in November. Officials have now increased this rate by a cumulative 450 basis points since October 2021 as they unwind policy accommodation put in place during the initial stages of the pandemic.

The statement noted that core consumer inflation remains too high, with data released last month showing an increase from 6.7 percent in the three months to September to 7.4 percent in the three months to December. Headline inflation was steady at 7.2 percent, well above the target range of 1.0 percent to 3.0 percent. Officials noted that demand continues to outpace supply.

The meeting follows the prior week's devastating Cyclone Gabrielle and officials have noted that the scale of destruction and economic disruption this and other weather events will have is not yet clear. They expect prices will be stronger and activity weaker in the near-term as a result of these events but note that monetary policy will continue to be set with reference to the medium-term outlook; fiscal policy is expected to be adjusted in response. Rebuilding efforts are also expected to add to inflationary pressures. With inflation still running well above target, it appears likely that the bank’s bias will remain in favour of further tightening in coming months.

US data continue to run stronger than expected, including not only jobs but consumer spending and consumer sentiment as well. Econoday's Consensus Divergence Index (ECDI) is at 25 for the US, a level consistent with tangible outperformance relative to expectations, a trend evident all year and pointing to no interruption in the Federal Reserve's rate-hike path.

In the Eurozone, the latest data have not been far off market expectations and are reflected in an ECDI of 5 though when excluding prices (ECDI-P) of minus 8. Taking the two together, the positive overall reading is due to upside inflation surprises so even a more negative value for the latter would not stop the European Central Bank from raising rates again next month.

In the UK, the recent period of economic underperformance came to an end last week as both the ECDI (17) and, in particular, the ECDI-P (36) moved back into positive surprise territory. This can only help to underpin expectations for a higher Bank Rate in March.

In Japan both the ECDI (minus 33) and ECDI-P (minus 32) slipped further below zero, supporting outgoing BoJ Governor Haruhiko Kuroda’s contention that there is no need yet for the central bank to move away from its longstanding ultra-loose monetary stance.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

The week’s CPI numbers are expected to be mixed: steady and severe annual rates for France (Tuesday), Germany (Wednesday), Italy (Thursday) and a mixed showing for Europe as a whole (Thursday). Australia’s CPI on Wednesday is expected to slow but to an 8.0 percent rate! Tokyo consumer prices, however, are expected to cool substantially, to 3.3 percent reflecting government subsidies for electricity and natural gas.

Favorable results are the consensus for China’s PMI’s beginning with the official CFLP composite expected on Wednesday and including Caixin manufacturing also on Wednesday and Caixin services on Friday. ISM manufacturing is expected to remain in noticeable contraction in Wednesday’s US report while limited improvement is expected for US consumer confidence on Tuesday.

Unemployment rates will make headlines on Wednesday from Germany and the Eurozone on Thursday. ECB minutes will be sorted through on Thursday for indications on next month’s meeting. Other data to watch include Japanese industrial production and retail sales on Tuesday and Germany merchandise trade on Friday.

Eurozone M3 Money Supply for January (Mon 0900 GMT; Mon 1000 CET; Mon 0400 EST)

Consensus Forecast, Year-over-Year: 4.1%

Broad money growth (on a 3-month basis) is expected to slow a further 6 tenths to an annual rate of 4.1 percent in January versus 4.7 percent in December.

Eurozone: EC Economic Sentiment for February (Mon 1000 GMT; Mon 1100 CET; Mon 0500 EST)

Consensus Forecast: 101.0

Consensus Forecast, Industry Sentiment: 2.0

Consensus Forecast, Consumer Sentiment: -19.0

Economic sentiment has improved the last three reports and is expected to improve further in February, to a consensus 101.0 versus 99.9 in January.

US Durable Goods Orders for January (Mon 1330 GMT; Mon 0830 EST)

Consensus Forecast: Month over Month: -4.0%

Consensus Forecast: Ex-Transportation - M/M: -0.1%

Consensus Forecast: Core Capital Goods Orders - M/M: 0.0%

Forecasters see durable goods orders falling back 4.0 percent in January following December’s 5.6 percent surge tied to aircraft orders. Ex-transportation orders, which have been flat, are seen down 0.1 percent with core capital goods orders, which have also been flat, unchanged.

Japanese Industrial Production for January (Mon 2350 GMT; Tue 0850 JST; Mon 1850 EST)

Consensus Forecast, Month over Month: -3.0%

Consensus Forecast, Year over Year: -0.4%

Industrial production, after rising 0.3 percent on the month in December, is expected to fall a sharp 3.0 percent in January, the expected result of generally weak exports along with suspended shipments tied to Lunar New Year holidays.

Japanese Retail Sales for January (Mon 2350 GMT; Tue 0850 JST; Mon 1850 EST)

Consensus Forecast, Month over Month: -0.4%

Consensus Forecast, Year over Year: 4.1%

Retail sales are expected to fall 0.4 percent on the month in January though rise 4.1 percent on the year following December’s surprising monthly jump of 1.1 percent and yearly rise of 3.8 percent.

Australian Retail Sales for January (Tue 0030 GMT; Tue 1130 AEDT; Mon 1930 EST)

Consensus Forecast, Month over Month: 1.6%

Retail sales are expected to rise 1.6 percent on the month in January after falling a steep 3.9 percent in December.

French CPI, Preliminary February (Tue 0745 GMT: Tue 0845 CET; Tue 0245 EST)

Consensus Forecast, Year over Year: 6.0%

Inflation in February is expected to hold steady at 6.0 percent.

Swiss Fourth-Quarter GDP (Tue 0800 GMT; Tue 0900 CET; Tue 0300 EST)

Consensus Forecast, Quarter over Quarter: 0.2%

Fourth-quarter GDP is expected to rise a quarterly 0.2 percent versus 0.2 and 0.1 percent growth in the two prior quarters.

KOF Swiss Leading Indicator for February (Tue 0800 GMT; Tue 0900 CET; Tue 0300 EST)

Consensus Forecast: 98.0

KOF's leading indicator is expected to rise 8 tenths in February to 98.0. This index jumped 5 points in January to a 7-month high but still remained below its 100 long-run average.

US International Trade in Goods (Advance) for January (Tue 1330 GMT; Tue 0830 EST)

Consensus Forecast, Balance: -$90.7 billion

The US goods deficit (Census basis) is expected to widen by $1.0 billion to $90.7 billion in January after widening by $7.6 billion in December to $89.7 billion which was driven by a sharp rise in imports of consumer goods.

Canadian GDP for December (Tue 1330 GMT; Tue 0830 EST)

Consensus Forecast, Month over Month: 0.0%

GDP for December is expected to remain unchanged on the month following a run of marginal gains.

Canadian Fourth-Quarter GDP (Tue 1330 GMT; Tue 0830 EST)

Consensus Forecast, Annualized: 1.5%

A 1.5 percent annualized growth rate is the consensus for Canadian fourth-quarter GDP versus 2.9 percent expansion in the third quarter.

US Consumer Confidence Index for February (Tue 1500 GMT; Tue 10:00 EST)

Consensus Forecast: 108.3

After falling nearly 2 points in January to 107.1, the consumer confidence index is expected to rebound more than a point to 108.3 in February.

Australian January CPI (Wed 0030 GMT; Wed 1130 AEDT; Tue 1930 EST)

Consensus Forecast, Year over Year: 8.0%

Consensus for consumer prices in January are expected to ease to 8.0 year-over-year percent versus 8.4 percent in December.

Australian Fourth-Quarter GDP (Wed 0030 GMT; Wed 1130 AEDT; Tue 1930 EST)

Consensus Forecast, Quarter over Quarter: 0.7%

Consensus Forecast, Year over Year: 2.8%

Fourth-quarter GDP is expected to rise a quarterly 0.7 percent for year-over-year expansion of 2.8 percent.

China: CFLP PMIs for February (Wed 0130 GMT; Wed 0930 CST; Tue 2030 EST)

Manufacturing PMI, Consensus Forecast: 50.9

Non-manufacturing PMI, Consensus Forecast: 54.5

After rising more than 3 points in January to 50.1, the CFLP manufacturing PMI is expected to rise further to 50.9 in February, while the non-manufacturing PMI, which surged nearly 13 points in January to 54.4, is expected to stabilize at 54.5. Covid effects have been making for wide swings in this report.

China: Caixin Manufacturing PMI for February (Wed 0145 GMT; Wed 0945 CST; Tue 2045 EST)

Consensus Forecast: 49.9

Caixin's manufacturing PMI has been in contraction for six months in a row but, at a consensus 49.9, only the most marginal contraction is expected for February.

German Retail Sales for January (Wed 0700 GMT; Wed 0800 CET; Wed 0200 EST)

Consensus Forecast, Month over Month: 1.4%

Consensus Forecast, Year over Year: -4.2%

Retail sales are expected to rise 1.4 percent on the month in January after collapsing by 5.3 percent in December.

German Unemployment Rate for February (Wed 0855 GMT; Wed 0955 CET; Wed 0355 EST)

Consensus Forecast: 5.6%

Unemployment in February is expected to rise 1 tenth to 5.6 percent .

German CPI, Preliminary February (Wed 1300 GMT; Wed 1400 CET; Wed 0800 EST)

Consensus Forecast, Month over Month: 0.7%

Consensus Forecast, Year over Year: 8.7%

February’s consensus is a year-over-year rate of 8.7 percent which would match January’s rate.

US: ISM Manufacturing Index for February (Wed 1500 GMT; Wed 1000 EST)

Consensus Forecast: 47.9

The ISM manufacturing index has been gradually deteriorating, but February’s consensus is 47.9, up from January’s 47.4.

Eurozone HICP Flash for February (Thu 1000 GMT; Thu 1100 CET; Thu 0500 EST)

Consensus Forecast, Year over Year: 8.2%

Narrow Core

Consensus Forecast, Year over Year: 5.3%

Consensus for February’s HICP flash is 8.2 percent and 5.3 percent for the narrow core. These would compare with 8.6 and 5.3 percent in January.

Eurozone Unemployment Rate for January (Thu 1000 GMT; Thu 1100 CET; Thu 0500 EST)

Consensus Forecast: 6.6%

Consensus for January's unemployment rate is a 1 tenth rise to 6.6 percent.

Italian CPI, Preliminary for February (Thu 1000 GMT; Thu 1100 CET; Thu 0500 EST)

Consensus Forecast, Year over Year: 10.1%

Consumer prices are not expected to improve in February, instead rising 1 tenth to 10.1 percent.

Tokyo Consumer Price Index for February (Thu 2330 GMT; Fri 0830 JST; Thu 1830 EST)

Consensus Forecast, Year over Year: 3.3%

Consumer inflation in Tokyo is expected to slow substantially to a year-over-year 3.3 percent rate in February, far lower than January’s 4.4 percent rate and reflecting government subsidies for electricity and natural gas.

Japanese Unemployment Rate for January (Thu 2330 GMT; Fri 0830 JST; Thu 1830 EST)

Consensus Forecast, Unemployment Rate: 2.5%

Japan's unemployment rate for January is expected to hold steady at 2.5 percent. The government repeated in the December report that employment was “picking up”.

China: Caixin PMI Composite PMI for February (Fri 0145 GMT; Fri 0945 CST; Thu 2045 EST)

Services Index, Consensus Forecast: 54.3

Caixin's services PMI in January, at 52.9, moved back into plus-50 expansion for the first time since August last year. February’s consensus is a sizable gain to 54.3.

German Merchandise Trade for January (Fri 0700 GMT; Fri 0800 CET; Fri 0200 EST)

Consensus Forecast, Balance: +-€11.0 billion

Germany’s goods balance is expected to widen to an €11.0 billion surplus in January versus a €10.0 billion surplus in December, a month however that saw sharp declines for both imports and exports.

Eurozone PPI for January (Fri 1000 GMT; Fri 1100 CET; Fri 0500 EST)

Consensus Forecast, Year over Year: 18.9%

Producer prices are expected to ease to 18.9 percent in January versus December’s 24.6 percent.

US: ISM Services Index for February (Fri 1500 GMT; Fri 1000 EST)

Consensus Forecast: 54.4

After a much stronger-than-expected 55.2 in January, the ISM services index in February is expected to slow slightly to 54.4.

|