|

Backed up by strong demand for labor, the Federal Reserve, the European Central Bank, and the Bank of England all had the luxury of sticking to their implied guidance in the week’s run of rate hikes, hikes aimed to a substantial degree at slowing wage inflation. But there were policy surprises: the ECB warning outright that another sharp hike will be made next month and the BoE raising its economic forecasts. The latter is of special interest after the International Monetary Fund earlier in the week ranked UK performance last on its list of major economies.

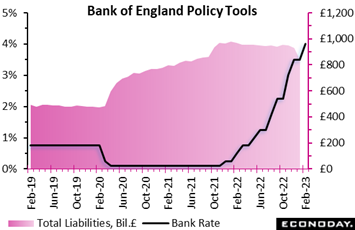

As widely expected, the BoE hiked its Bank Rate by 50 basis points, the tenth successive hike that lifts the benchmark rate to 4.0 percent and brings the cumulative tightening to date to 390 basis points. However, in line with December, the latest vote was far from unanimous as the two main doves, Swati Dhingra and Silvana Tenreyro, continued to push for no change. Hawk Catherine Mann, who wanted a full 75 basis point rise last time, joined with the other six MPC members preferring 50 basis points. Nonetheless, the split again underscores the very mixed views on where the economy goes from here. As widely expected, the BoE hiked its Bank Rate by 50 basis points, the tenth successive hike that lifts the benchmark rate to 4.0 percent and brings the cumulative tightening to date to 390 basis points. However, in line with December, the latest vote was far from unanimous as the two main doves, Swati Dhingra and Silvana Tenreyro, continued to push for no change. Hawk Catherine Mann, who wanted a full 75 basis point rise last time, joined with the other six MPC members preferring 50 basis points. Nonetheless, the split again underscores the very mixed views on where the economy goes from here.

The bank acknowledged that domestic inflationary pressures had been firmer than expected with both private sector regular pay growth and services CPI inflation notably higher than forecast in the November Monetary Policy Report (MPR). Some survey indicators of wage growth had eased, but the labour market remained tight.

In the November MPR the market-implied path for Bank Rate put the peak at around 5.25 percent in the third quarter of this year, a level that the bank made plain it thought to be too high. The new path tops out at 4.5 percent in mid-year and falls to just over 3.25 percent in three years' time. This sees CPI inflation slide below its 2 percent target over the medium-term, implicitly suggesting that another 50 basis points on Bank Rate would be too aggressive. That said, the risks to the inflation outlook in the medium term are seen to be both large and asymmetric, with a skew towards greater persistence.

Turning to growth, the bank no longer sees the economy sliding into a record 2-year long recession. Contraction is still expected through the first quarter of 2024 but the downturn is now seen to be much shallower and the economy is predicted to recover over the latter half of the forecast horizon. The growth estimate for last quarter has been revised up from a quarterly decline of 0.1 percent to a rise of 0.1 percent.

On balance, the bank’s statement and minutes are more dovish than expected and may well mean that the latest 50 basis point hike will be the last of the big tightenings that began back in August. If nothing else, the still wide splits over the need to raise rates, let alone the size of any hike, will make securing another 50 basis point move in March tricky. The economy is still expected to be weak and at least some leading inflation indicators are moving down. Nonetheless, with the labour market still tight and wage growth currently well above anything compatible with the 2 percent inflation target, a smaller 25 basis point move next month is a real possibility. Indeed, the outcome of ongoing strikes over pay across a large number of industries will play an important role in just how much higher Bank Rate has to go. Should the government acquiesce to labor demands, market expectations for a cut in key rates before year-end could prove well wide of the mark. In any event, it will be the data that determine what happens next.

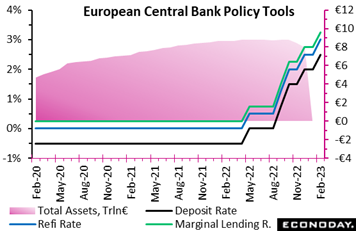

As essentially forewarned at the December meeting, the ECB also matched market expectations and raised key interest rates by a further 50 basis points. The move lifts the deposit rate to 2.5 percent, the refi rate to 3.0 percent and the rate on the marginal lending facility to 3.25 percent, the highest levels seen since 2008. Importantly too, while supposedly having ended forward guidance last year, the bank also stated that due to underlying inflation pressures, it "intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March". As essentially forewarned at the December meeting, the ECB also matched market expectations and raised key interest rates by a further 50 basis points. The move lifts the deposit rate to 2.5 percent, the refi rate to 3.0 percent and the rate on the marginal lending facility to 3.25 percent, the highest levels seen since 2008. Importantly too, while supposedly having ended forward guidance last year, the bank also stated that due to underlying inflation pressures, it "intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March".

Risks to both economic growth and inflation are seen more balanced than in December. However, the bank stressed the need to closely monitor wages, which are accelerating, and inflationary expectations, which were thought to be broadly stable around 2 percent. There are no major surprises here but the clear statement of intent regarding higher interest rates next month underlines the bank's determination to get underlying inflation under control. This further enhances the significance of the core HICP measures. It also reflects the ECB's unhappiness with market pricing that sees cash rates falling towards the end of the year.

Alongside the changes in interest rates, the bank also confirmed that passive QT will begin next month. As outlined in December, from March, the asset purchase programme (APP) portfolio will be reduced by an average €15 billion a month until the end of the second quarter of 2023 when the bank will determine the subsequent pace of decline. In addition, by the end of the year, the Governing Council (GC) will review its operational framework for steering short-term interest rates and provide information regarding the endpoint of the balance sheet normalisation process. For the pandemic emergency purchase programme (PEPP), full reinvestment will continue, as previously scheduled, until at least the end of 2024 and the reinvestment will remain flexible so as not to interfere with the desired policy stance.

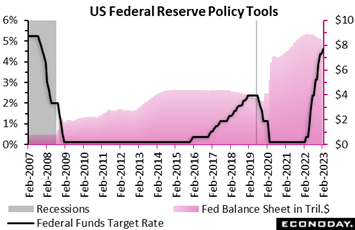

The Federal Reserve on Wednesday stepped down its pace from 50 to 25 points, a move that appears certain to be repeated at March’s policy meeting given Friday’s vast 500,000-plus surge in nonfarm payrolls. Jerome Powell did indeed sound hawkish at his press conference, repeating there is "still more work to do", that "ongoing increases" in the federal funds rate as well as the ongoing shrinkage of the bank's balance sheet "will be appropriate". He said that a "restrictive stance" of monetary will be needed "for some time". Note that based on the Fed’s last quarterly outlook in December, another 50 basis points are still penciled in for this year. The Federal Reserve on Wednesday stepped down its pace from 50 to 25 points, a move that appears certain to be repeated at March’s policy meeting given Friday’s vast 500,000-plus surge in nonfarm payrolls. Jerome Powell did indeed sound hawkish at his press conference, repeating there is "still more work to do", that "ongoing increases" in the federal funds rate as well as the ongoing shrinkage of the bank's balance sheet "will be appropriate". He said that a "restrictive stance" of monetary will be needed "for some time". Note that based on the Fed’s last quarterly outlook in December, another 50 basis points are still penciled in for this year.

Powell said that the effects of prior hikes are most evident in those economic sectors most sensitive to interest rates, especially housing which is cooling. Yet the labor market is not cooling, still "extremely tight" according to the Fed chair with job growth strong, job vacancies unusually high and wage gains, despite some signs of easing, nevertheless "robust".

On inflation, Powell cited last year's 5.0 percent rate for the PCE price index and 4.4 percent core rate excluding food and energy, both of which are far above the Fed's 2 percent target. Yet he did note a reduction in the 3-month average pace which he described as "encouraging" though he added that this is "not grounds for complacency" and that officials will "need substantially more evidence" that inflation has cooled before easing policy.

Powell repeatedly mentioned that non-housing services inflation (such as medical and transportation services) has yet to show much improvement. While pandemic-related inflation has yielded to restrictive monetary policy, the core within the core still remains elevated. It is this type of inflation that Powell is especially referring to when he says the Fed’s job isn’t yet done.

Powell does see a path, however narrow, for monetary policy to tame inflation without sending the US economy into recession. "It is a good thing that the disinflation that we have seen so far has not come at the expense of the job market," he said.

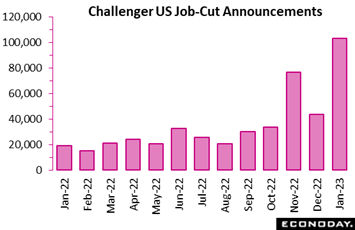

The biggest indicator surprise in the week was the great 517,000 increase in nonfarm payrolls, a complete outlier but, in a cross current, not enough to drive up wage inflation which eased 5 tenths to an annual 4.4 percent, the lowest pressure since August 2021. Another cross current in US employment data are layoff announcements which are also surging, a negative not yet reflected in payroll growth nor in weekly jobless claims which moved lower through January. But there’s no escaping it. US companies plan to cut jobs and a lot of them. Challenger’s job-cut count spiked 136 percent in January to 102,943 as tracked in the accompanying graph, up from 43,651 in December and 440 percent higher than the 19,064 in January 2022. The report noted the latest total is the highest January count since 2009 and the largest monthly count since September 2020. The biggest indicator surprise in the week was the great 517,000 increase in nonfarm payrolls, a complete outlier but, in a cross current, not enough to drive up wage inflation which eased 5 tenths to an annual 4.4 percent, the lowest pressure since August 2021. Another cross current in US employment data are layoff announcements which are also surging, a negative not yet reflected in payroll growth nor in weekly jobless claims which moved lower through January. But there’s no escaping it. US companies plan to cut jobs and a lot of them. Challenger’s job-cut count spiked 136 percent in January to 102,943 as tracked in the accompanying graph, up from 43,651 in December and 440 percent higher than the 19,064 in January 2022. The report noted the latest total is the highest January count since 2009 and the largest monthly count since September 2020.

The planned cuts, however, are concentrated in a relatively few sectors. There was another big wave of layoffs for technology at 41,829 which accounted for 40.6 percent of the total; the next largest were retail at 13,000 and financial at 10,603. Together the three sectors accounted for nearly two-thirds of all announced cuts. Technology and financial firms are likely reviewing their staffing after the pandemic hiring burst, while retail may be preparing for an economic downturn and weaker consumer spending. Large scale layoffs in the broader economy do not appear to be occurring, certainly not based on January’s nonfarm total. Many companies may simply be cutting open positions or restructuring operations.

Unemployment in Eurozone was unchanged in December at 6.6 percent, a tick above expectations but a record-equaling low nevertheless. Yet following a 59,000 increase in November, joblessness rose a further 23,000 to 11.048 million to indicate that the Eurozone’s labor market did lose a little ground at year-end. Regionally, France’s rate rose a tick to 7.1 percent as did Spain’s at 13.1 percent while Germany’s fell a tick to 2.9 percent. Italy was steady at 7.8 percent. The rise in joblessness, and its implication of easing wage pressure likely comes as some relief to the ECB. Nonetheless, conditions remain very tight and, as stated clearly at its meeting, the central bank's tightening mode is not about to go away anytime soon. Unemployment in Eurozone was unchanged in December at 6.6 percent, a tick above expectations but a record-equaling low nevertheless. Yet following a 59,000 increase in November, joblessness rose a further 23,000 to 11.048 million to indicate that the Eurozone’s labor market did lose a little ground at year-end. Regionally, France’s rate rose a tick to 7.1 percent as did Spain’s at 13.1 percent while Germany’s fell a tick to 2.9 percent. Italy was steady at 7.8 percent. The rise in joblessness, and its implication of easing wage pressure likely comes as some relief to the ECB. Nonetheless, conditions remain very tight and, as stated clearly at its meeting, the central bank's tightening mode is not about to go away anytime soon.

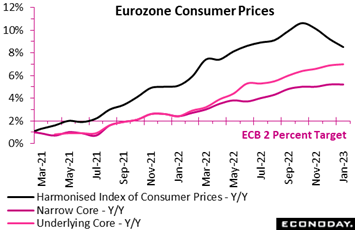

Wages pressures aside, headline inflation in the Eurozone once again posted a surprisingly sharp decline. A provisional 8.5 percent year-over-year rate was well down from December’s 9.2 percent and 6 tenths below the market consensus. The rate is now at its lowest level since last May but still leaves a gap of 6.5 percentage points above the ECB's 2 percent target. Wages pressures aside, headline inflation in the Eurozone once again posted a surprisingly sharp decline. A provisional 8.5 percent year-over-year rate was well down from December’s 9.2 percent and 6 tenths below the market consensus. The rate is now at its lowest level since last May but still leaves a gap of 6.5 percentage points above the ECB's 2 percent target.

Once again the deceleration in the overall rate was not mirrored in key core measures. The narrowest gauge was only unchanged at 5.2 percent and higher than expected while the broader index which excludes energy and unprocessed food climbed another tick to 7.0 percent, another new record high. The stickiness of the core rates means that January’s inflation update will not go down as well at the ECB as first appearances might suggest.

More generally, the rate for non-energy industrial goods jumped from 6.4 percent to 6.9 percent while its services counterpart unwound December's gain by easing from 4.4 percent to 4.2 percent. Energy (17.2 percent after 25.5 percent) subtracted significantly but food, alcohol and tobacco (14.1 percent after 13.8 percent) continued to provide a boost.

Regionally, the picture was very mixed, partly reflecting differences in the energy crisis support packages offered by the various member states. Hence, a fall in Italy (10.9 percent after 12.3 percent) contrasted with rises in both France (7.0 percent after 6.7 percent) and Spain (5.8 percent after 5.5 percent). Of note, German data are not yet available (now expected in the coming week) and these could have an important impact on the final Eurozone rate. Elsewhere, Latvia (21.6 percent) remained at the top of the inflation ladder ahead of Estonia (18.8 percent).

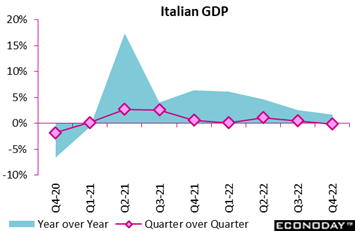

GDP graphs among the major Eurozone economies all look alike. The accompanying graph is for Italy and is virtually indistinguishable from France or Germany. Down 0.1 percent compared to the prior quarter, Italy’s economy contracted in the fourth quarter for the first time since the fourth quarter of 2020. This is marginal but still enough to pull year-over-year growth down a full percentage point to 1.7 percent, its weakest rate since the first quarter of 2021. Total output was a modest 1.8 percent above its pre-pandemic level at the end of 2019. GDP graphs among the major Eurozone economies all look alike. The accompanying graph is for Italy and is virtually indistinguishable from France or Germany. Down 0.1 percent compared to the prior quarter, Italy’s economy contracted in the fourth quarter for the first time since the fourth quarter of 2020. This is marginal but still enough to pull year-over-year growth down a full percentage point to 1.7 percent, its weakest rate since the first quarter of 2021. Total output was a modest 1.8 percent above its pre-pandemic level at the end of 2019.

In terms of output, the limited flash information provided by Italy’s Istat cited quarterly falls in industry as well as agriculture, forestry and fishing which combined were enough to offset stronger growth in services. From the demand side, the domestic component subtracted but net exports made a positive contribution.

Italy’s results, together with France’s 0.1 percent quarterly gain and Germany’s 0.2 percent quarterly dip, are not necessarily harbingers of darker days ahead. Recession in the Eurozone is far from certain.

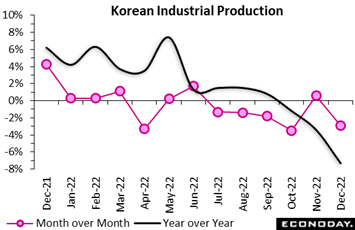

Global chip demand is down and substantially so based on industrial production data from both South Korea and Taiwan. Korea's index of industrial production fell 2.9 percent in December, the fourth monthly decline in the last five months and dwarfing November’s 0.6 percent advance. Contraction on the year deepened from 3.4 percent to 7.3 percent. Within the industrial sector, manufacturing output fell 3.5 percent on the month while yearly contraction deepened from 3.3 percent to 8.0 percent. Global chip demand is down and substantially so based on industrial production data from both South Korea and Taiwan. Korea's index of industrial production fell 2.9 percent in December, the fourth monthly decline in the last five months and dwarfing November’s 0.6 percent advance. Contraction on the year deepened from 3.4 percent to 7.3 percent. Within the industrial sector, manufacturing output fell 3.5 percent on the month while yearly contraction deepened from 3.3 percent to 8.0 percent.

Growth was also weak in other key sectors. Output in the public administration sector weakened from an increase of 3.7 percent on the month in November to a fall of 1.1 percent in December, output in the construction sector dropped 9.5 percent after increasing 2.7 previously, and service sector output fell 0.2 percent after a previous decline of 0.3 percent.

Taiwan's downward slope is no less severe. Production fell 7.93 percent on the year in December after a decline of 4.93 percent in November. Output in the manufacturing sector fell 8.40 percent on the year, in line with PMI survey data that also showed contraction in the sector in December and with PMI survey data for January showing further weakness.

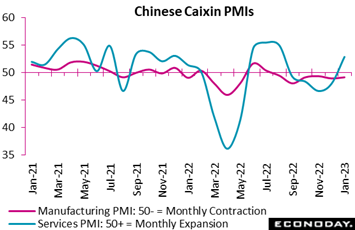

January’s purchasing manager indexes from Asia are of particular interest. Some remain in sub-50 contraction including Taiwan manufacturing 44.3, Korea manufacturing 48.5, and Japan manufacturing 48.9, but others are beginning to move above the 50 line: Hong Kong 51.2, Singapore 51.2, and China’s Caixin composite at 51.1. The latter is up from 48.3 in December indicating that China's economy expanded after four consecutive months of contraction. The business activity index for China's services sector rose sharply from 48.0 in December to 52.9 in January, while the manufacturing PMI survey showed ongoing contraction but at a slightly less pronounced rate, with its headline index rising from 49.0 to 49.2 January’s purchasing manager indexes from Asia are of particular interest. Some remain in sub-50 contraction including Taiwan manufacturing 44.3, Korea manufacturing 48.5, and Japan manufacturing 48.9, but others are beginning to move above the 50 line: Hong Kong 51.2, Singapore 51.2, and China’s Caixin composite at 51.1. The latter is up from 48.3 in December indicating that China's economy expanded after four consecutive months of contraction. The business activity index for China's services sector rose sharply from 48.0 in December to 52.9 in January, while the manufacturing PMI survey showed ongoing contraction but at a slightly less pronounced rate, with its headline index rising from 49.0 to 49.2

These improvements were less pronounced than China’s official PMI, the CFLP which showed a very strong rebound in both the manufacturing and the non-manufacturing sectors in January. After easing public health restrictions late last year, authorities have reported a decline in Covid cases in recent weeks, and January’s PMI data suggest this improvement in public health conditions may be starting to drive improved economic conditions.

Respondents to Caixin’s services survey reported the first increase in output and new orders in five months in January and the biggest increase in new export orders sine April 2022. Payrolls were reported to have been cut at a slower pace, with respondents noting substantial staff absences due to illness. The survey shows much improved confidence about the outlook, with this indicator surging to its highest level in nearly 12 years. Respondents also reported a bigger but still subdued increase in input costs but little change in selling prices.

PMI surveys are one of the few Chinese economic indicators that show January data separately. Most official economic data for China are not reported separately for January and February but are instead combined and reported together in order to remove distortions caused by changes in the timing of lunar new year holidays each year. This means that most official data for the first two months of the year will not be reported until mid-March.

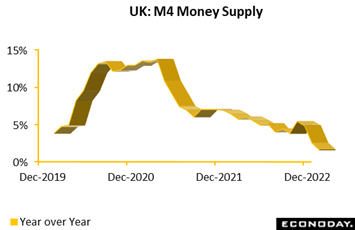

M4 in the UK closed out 2022 with a 0.8 percent drop in December following a 1.5 percent slump in November for its first back-to-back fall since March-April 2018. Annual growth was 1.6 percent, down from 2.5 percent and the weakest result since February 2019. The key private sector lending counterpart edged up a monthly 0.1 percent but this followed sizeable declines in both October and November and still cut its yearly rate from 2.2 percent to just 1.7 percent, equalling a 14-month low. M4 in the UK closed out 2022 with a 0.8 percent drop in December following a 1.5 percent slump in November for its first back-to-back fall since March-April 2018. Annual growth was 1.6 percent, down from 2.5 percent and the weakest result since February 2019. The key private sector lending counterpart edged up a monthly 0.1 percent but this followed sizeable declines in both October and November and still cut its yearly rate from 2.2 percent to just 1.7 percent, equalling a 14-month low.

Excluding intermediate other financial corporations, the picture was no better with M4 down fully 1.2 percent versus November, its third straight fall and trimming annual growth by 1.4 percentage points to 2.7 percent. Similarly-adjusted lending was up 0.1 percent, leaving its yearly rate steady at 1.6 percent.

Elsewhere, mortgage lending (£3.24 billion after £4.26 billion) softened and approvals (35,612 after 46,186) saw their worst level since May 2020, warning of a potentially marked decline in housing demand. More generally, total consumer credit (£0.493 billion after £1.488 billion) was also well down on its November mark, also boding ill for household spending this quarter.

December’s sluggish report is consistent with slowing, if not contracting, private sector activity and should bolster expectations that the top to Bank Rate is not too far off.

The 517,000 showing was the fourth month in a row that nonfarm payrolls came in at the top of Econoday’s consensus range with January nearly doubling Econoday’s high estimate. January, in fact, was the ninth straight month and eleventh of the last twelve that payroll growth has exceeded Econoday’s consensus. US data in total have been consistently exceeding expectations since late December, reflected in Econoday’s Consensus Divergence Index (ECDI) which for the US is at 17 overall and also 17 when excluding price readings (ECDI-P).

The US results suggest that Federal Reserve rate hikes haven’t yet slowed the economy as much as expected, in some contrast to Canada where Bank of Canada hikes are slowing activity more visibly, and here as much as expected. Canada’s ECDI is at 4 overall and at minus 4 when excluding prices, both near the zero line.

Eurozone data have again been on the strong side of market expectations. At 35 and 31 respectively, the ECDI and ECDI-P show that overall economic outperformance has become slightly more marked and extend the run of largely positive readings that began in mid-December. The string of positive values is consistent with the ECB last week shifting its economic risk assessment from negative to balanced.

By contrast, recent UK economic data have continued to surprise almost uniformly on the downside and leave the ECDI at a lowly minus 26 and the ECDI-P at minus 25. Such readings increase the risk of a weak first quarter for economic activity in general and have boosted speculation that the BoE tightening cycle might be nearing an end.

In China, economic activity in general continues to beat market expectations by some margin and at 71, both the ECDI and ECDI-P are currently at an historically high level. In Japan, a suite of surprisingly firm data last week lifted both the ECDI (13) and ECDI-P (23) back above zero to signal a modest degree of overall economic outperformance for the first time in 2023.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Twenty five basis points is expected to be this week’s policy theme, first from the Reserve Bank of Australia on Tuesday and then from the Reserve Bank of India on Wednesday; both banks are fighting high rates of inflation. Inflation, however, isn’t a problem in China and no alarms are expected from the country’s inflation data on Friday, seen at an annual 2.2 percent for January’s CPI and minus 0.5 percent for January’s PPI.

January’s PPI in Japan will also be posted on Friday and here a highly elevated though slightly moderating rate of 9.6 percent is the consensus. Japanese household spending will be posted on Monday.

Eurozone data include December retail sales on Monday, which are expected to fall sharply, as well as German manufacturing orders also on Monday which, having tumbled in the prior report, are expected to rebound. German industrial production on Tuesday is expected to fall sizably while Italian industrial production on Friday is expected to fall slightly. UK GDP for the month of December will also be posted on Friday and is expected to be unchanged on a quarterly basis and up slightly year over year.

Canada’s labour force survey will be another highlight on Friday and marginal growth, following December’s vast growth, is the expectation. A February flash for US consumer sentiment will close the week’s calendar which, despite this country’s robust labor market, isn’t expected to show much strength.

German Manufacturing Orders for December (Mon 0700 GMT; Mon 0800 CET; Mon 0200 EST)

Consensus Forecast, Month over Month: 2.0%

Consensus Forecast, Year over Year: -11.4%

Orders in December are expected to rebound a monthly 2.0 percent after collapsing 5.3 percent November.

Eurozone Retail Sales for December (Mon 1000 GMT; Mon 1100 CET; Mon 0500 EST)

Consensus Forecast, Month over Month: -2.5%

Consensus Forecast, Year over Year: -2.7%

December is expected to fall back a sizable 2.5 percent on the month to more than reverse November’s 0.8 percent rise.

Japanese Household Spending for December (Mon 2330 GMT; Tue 0830 JST; Mon 1830 EST)

Consensus Forecast , Month over Month: 0.4%

Consensus Forecast , Year over Year: -0.4%

Real household spending is forecast to have posted a modest 0.4 percent drop on the year in December amid a spike in Covid cases after a surprise 1.2 percent slump in November reflecting the timing of cell phone payment timings and mild weather.

Australian Goods and Services Trade for December (Tue 0030 GMT; Tue 1130 AEDT; Mon 1930 EST)

Consensus Forecast, Balance: A$12.4 billion

Consensus for goods and services trade in December is a surplus of A$12.4 billion versus November’s surplus of A$13.2 billion.

Reserve Bank of Australia Announcement (Tue 0330 GMT; Tue 1430 AEDT; Mon 2030 EST)

Consensus Forecast, Change: 25 basis points

Consensus Forecast, Level: 3.35%

With inflation still way over target, the Reserve Bank of Australia is once again expected to raise its policy rate, by a 25-basis-point increment as it has at each of its last three meetings.

German Industrial Production for December (Tue 0700 GMT; Tue 0800 CET; Tue 0200 EST)

Consensus Forecast, Month over Month: -1.0%

Consensus Forecast, Year over Year: -1.2%

Industrial production in December is expected to fall 1.0 percent following a modest 0.2 percent rise in November that, nevertheless, was better than expected.

Canada Merchandise Trade Balance for December (Tue 1330 GMT; Tue 0830 EST)

Consensus Forecast: -C$0.2 billion

December’s trade balance is seen at a marginal C$0.2 billion deficit versus a marginal November deficit of $0.04 billion.

Reserve Bank of India Announcement (Tue 0430 GMT; Wed 1000 IST; Tue 2330 EST)

Consensus Change: 25 basis points

Consensus Level: 6.50%

In 2022, the Reserve Bank of India raised its benchmark repurchase rate by a total of 225 basis points and by 35 basis points at its last meeting in December. With inflation still running above target, at 5.72 percent in December, forecasters expect the bank to raise the rate by another 25 points at its February meeting.

Japanese Producer Price Index for January (Thu 2350 GMT; Fri 0850 JST; Thu 1850 EST)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 9.6%

Producer prices are expected to rise 0.3 percent on the month in January for a year-over-year rate of 9.6 percent. These would compare with respective increases in December of 0.5 and 10.2 percent, both of which were higher than expected.

Chinese CPI for January (Fri 0130 GMT; Fri 0930 CST; Thu 2030 EST)

Consensus Forecast, Year over Year: 2.2%

Forecasters see a 2.2 percent year-over-year rate in January versus 1.8 percent in December which was 1 tenth lower than expected. China’s CPI has come in below Econoday’s consensus the last three reports.

Chinese PPI for January (Fri 0130 GMT; Fri 0930 CST; Thu 2030 EST)

Consensus Forecast, Year over Year: -0.5%

Producer prices have been in contraction the last three reports. January’s consensus is minus 0.5 percent on the year versus minus 0.7 percent in December.

UK Fourth-Quarter GDP, First Estimate (Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, Quarter over Quarter: 0.0%

Consensus Forecast, Year over Year: 0.4%

Total output is seen unchanged in the fourth quarter versus 0.3 percent contraction in the third quarter, trimming annual growth to an expected 0.4 percent from the prior quarter’s growth of 1.9 percent.

Italian Industrial Production for December (Fri 0900 GMT; Fri 1000 CET; Fri 0400 EST)

Consensus Forecast, Month over Month: -0.2%

After sinking the last three reports, industrial production is expected to sink again in December by 0.2 percent.

Canadian Labour Force Survey for January (Fri 1330 GMT; Fri 0830 EST)

Consensus Forecast: Employment Change: 8,000

Consensus Forecast: Unemployment Rate: 5.2%

Employment in January is expected to rise 8,000, correcting lower following December’s 104,000 jump. January’s unemployment rate is expected to rise 2 tenths 5.2 percent.

US Consumer Sentiment Index, Preliminary February (Fri 1500 GMT; Fri 1000 EST)

Consensus Forecast: 65.0

Consumer sentiment is not expected to show much improvement, at a consensus 65.0 in the first reading for February versus 64.9 in January.

|