|

Fed Chair Jerome Powell set the stage Friday for another 75-basis-point hike at the upcoming FOMC meeting on September 20-21, a mere six weeks ahead of the mid-term elections in what really can’t be great news for incumbents. Bringing inflation down “will take some time”, Powell said, and he warned that slower growth and efforts to reduce inflation will impose continued pain on households. “These are unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.” But the week’s data did offer some immediate good news on inflation which, however, Powell largely dismissed saying “a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down.”

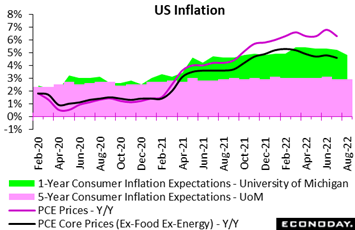

The price indexes for personal consumption expenditures are central gauges for Fed monetary policy, and the results for July, released Friday, were more favorable than expected. The overall PCE index fell 0.1 percent on the month while the ex-food ex-energy core edged only 0.1 percent higher, in turn bringing down the overall year-over-year rate by 5 tenths to 6.3 percent and the core by 2 tenths to 4.6 percent. The results indicate a rapid slowing in the pace of price increases for consumers. Yet inflation remains well above the Fed's 2 percent flexible average inflation target and, as Powell said, a one-month decline is not a trend. It does appear that recent rate increases have worked to cool the demand aspect of inflation, but there is a distance yet to go before the readings reflect a balance with available supply and sustainable improvement in inflationary conditions. The price indexes for personal consumption expenditures are central gauges for Fed monetary policy, and the results for July, released Friday, were more favorable than expected. The overall PCE index fell 0.1 percent on the month while the ex-food ex-energy core edged only 0.1 percent higher, in turn bringing down the overall year-over-year rate by 5 tenths to 6.3 percent and the core by 2 tenths to 4.6 percent. The results indicate a rapid slowing in the pace of price increases for consumers. Yet inflation remains well above the Fed's 2 percent flexible average inflation target and, as Powell said, a one-month decline is not a trend. It does appear that recent rate increases have worked to cool the demand aspect of inflation, but there is a distance yet to go before the readings reflect a balance with available supply and sustainable improvement in inflationary conditions.

Friday also saw the release of favorable readings on inflation expectations, falling 2 tenths over the last two weeks to 4.8 percent for the year-ahead outlook and 1 tenth for the 5-year outlook to 2.9 percent, as tracked by the University of Michigan. This improvement helped to substantially lift the report’s consumer sentiment measure which ended August much higher than expected, up more than 3 points from mid-month to 58.2 in a reading that implies a roughly low 60s pace over the last two weeks, a pace that matches readings early in the year. This is good news for incumbents, suggesting that oversized rate hikes – as long as they bring down inflation – may actually make consumers happy (or that is less unhappy). Turning back to Powell, he described inflation expectations as “well anchored” though he said this is “not grounds for complacency, with inflation having run well above our goal for some time.”

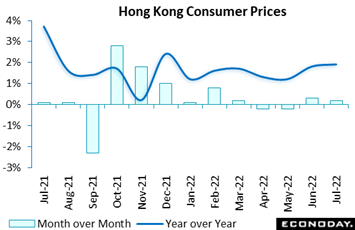

Inflation readings in China as well as Hong Kong have been consistently contained all along. The latter's headline consumer price index was up only 1.9 percent on the year in July versus 1.8 percent in June. The index rose 0.2 percent on the month after advancing 0.3 percent previously. Excluding the impact of one-off government relief measures, Hong Kong's underlying inflation rate also rose from 1.8 percent to 1.9 percent. Officials again expressed confidence that domestic inflation will remain "moderate" in the near-term, with "mild" domestic cost pressures expected to offset the impact of higher prices for imported items. Inflation readings in China as well as Hong Kong have been consistently contained all along. The latter's headline consumer price index was up only 1.9 percent on the year in July versus 1.8 percent in June. The index rose 0.2 percent on the month after advancing 0.3 percent previously. Excluding the impact of one-off government relief measures, Hong Kong's underlying inflation rate also rose from 1.8 percent to 1.9 percent. Officials again expressed confidence that domestic inflation will remain "moderate" in the near-term, with "mild" domestic cost pressures expected to offset the impact of higher prices for imported items.

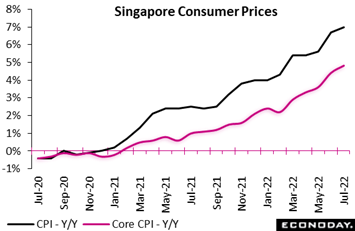

But the inflation news elsewhere in Asia has been less favorable. Singapore's headline consumer price index rose 7.0 percent on the year in July, accelerating further from 6.7 percent in June and the strongest rate since 2008. The index rose 0.2 percent on the month after an increase of 1.0 percent previously. The Monetary Authority of Singapore's preferred measure of core inflation, which excludes the cost of accommodation and private road transport, increased from 4.4 percent to 4.8 percent, also its highest since 2008. This index increased 0.6 percent on the month after June’s advance of 0.7 percent. But the inflation news elsewhere in Asia has been less favorable. Singapore's headline consumer price index rose 7.0 percent on the year in July, accelerating further from 6.7 percent in June and the strongest rate since 2008. The index rose 0.2 percent on the month after an increase of 1.0 percent previously. The Monetary Authority of Singapore's preferred measure of core inflation, which excludes the cost of accommodation and private road transport, increased from 4.4 percent to 4.8 percent, also its highest since 2008. This index increased 0.6 percent on the month after June’s advance of 0.7 percent.

July’s increase was broad-based across major categories. Private transport costs rose 22.2 percent on the year after increasing 21.9 percent previously, while the year-over-year increase in food prices picked up from 5.4 percent to 6.1 percent. Prices for services, electricity and gas, and accommodation also rose at a faster year-over-year pace, partly offset by a smaller increase in prices of retail and other goods.

MAS officials expect core inflation to remain elevated "over the next few months" but then moderate towards the end of the year to average between 3.0 and 4.0 percent over 2022. They expect annual headline inflation in 2022 will be between 5.0 percent and 6.0 percent but note that global commodity prices and domestic wage pressures remain upside risks.

At their semi-annual policy review in April MAS officials tightened policy by targeting a faster appreciation of Singapore's exchange rate, citing a need to "slow the inflation momentum." With their next scheduled meeting taking place in October, there’s a chance the MAS may tighten policy further with an off-schedule move if inflation fails to slow sufficiently in coming months.

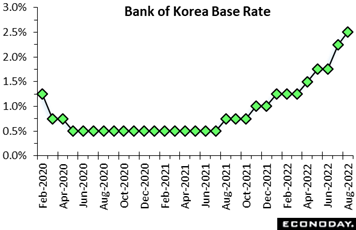

South Korea has also yet to see any inflationary relief. The Bank of Korea increased its main policy rate by an as-expected 25 basis points to 2.50 percent at its policy meeting held Thursday. This followed an increase of 50 basis points at the bank’s July meeting and takes the cumulative amount of rate increases made this cycle to 200 basis points. Since their meeting last month, data have shown an increase in headline inflation to 6.3 percent in July, its highest level since 1998 and further above the BoK's target level of 2.0 percent. South Korea has also yet to see any inflationary relief. The Bank of Korea increased its main policy rate by an as-expected 25 basis points to 2.50 percent at its policy meeting held Thursday. This followed an increase of 50 basis points at the bank’s July meeting and takes the cumulative amount of rate increases made this cycle to 200 basis points. Since their meeting last month, data have shown an increase in headline inflation to 6.3 percent in July, its highest level since 1998 and further above the BoK's target level of 2.0 percent.

The accompanying statement presented a less optimistic assessment of the outlook for South Korea's economy, mainly reflecting the impact of weaker global growth on external demand. Officials revised down their 2022 GDP growth forecast from 2.7 percent to 2.6 percent and their 2023 GDP growth forecast from 2.4 percent to 2.1 percent. At the same time they revised up their inflation forecasts significantly to 5.2 percent this year and 3.7 percent in 2023 versus the previous forecasts of 4.5 percent and 2.9 percent. The statement said "continued rate hikes” are “warranted” as “inflation is expected to remain high, substantially above the target level."

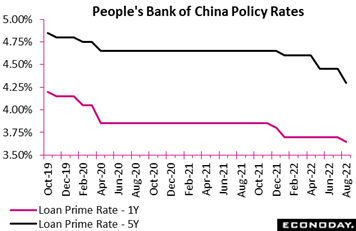

China, like Hong Kong, offers another view. The People's Bank of China opened the week Monday by cutting its one-year loan prime rate by 5 basis points from 3.70 percent to 3.65 percent at its monthly review, with the equivalent five-year rate lowered by 15 basis points from 4.45 percent to 4.30 percent. The five-year rate and the one-year rate were last cut in May and January respectively. Other PBoC settings were eased in the prior week when officials injected CNY400 billion in additional liquidity to domestic financial institutions via its medium-term lending facility, with the rate charged to access these funds cut from 2.85 percent to 2.75 percent. China, like Hong Kong, offers another view. The People's Bank of China opened the week Monday by cutting its one-year loan prime rate by 5 basis points from 3.70 percent to 3.65 percent at its monthly review, with the equivalent five-year rate lowered by 15 basis points from 4.45 percent to 4.30 percent. The five-year rate and the one-year rate were last cut in May and January respectively. Other PBoC settings were eased in the prior week when officials injected CNY400 billion in additional liquidity to domestic financial institutions via its medium-term lending facility, with the rate charged to access these funds cut from 2.85 percent to 2.75 percent.

These measures followed the prior’s week run of data showing slower growth in industrial production, retail sales, and fixed asset investment and a third consecutive year-over-year decline in house prices. Although the ongoing impact of China's "zero-Covid" policy has weighed on economic activity for several months, concerns about the outlook for China's property market have also intensified in recent weeks and may prompt further measures from authorities to boost confidence and support credit conditions. An additional and developing risk is an ongoing heat wave and drought which are threatening the country’s agricultural and industrial sectors.

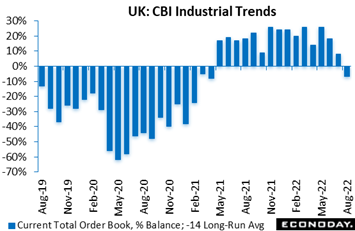

The week’s run of August business surveys were weak nearly across the board, an echo of Powell’s warning that high rates will bring demand down in line with available supply. Headline orders in the UK’s industrial trends survey slipped from 8 percent to minus 7 percent, some 10 percentage points below the market consensus and an even larger 15 percentage points short of its reading in July. This was its first negative reading since April 2021. The week’s run of August business surveys were weak nearly across the board, an echo of Powell’s warning that high rates will bring demand down in line with available supply. Headline orders in the UK’s industrial trends survey slipped from 8 percent to minus 7 percent, some 10 percentage points below the market consensus and an even larger 15 percentage points short of its reading in July. This was its first negative reading since April 2021.

Manufacturing output (minus 7 percent after 6 percent) similarly decreased for the first time since February last year and expectations for the coming three months (minus 2 percent) are for no improvement. Food, drink and tobacco, mechanical engineering and paper, printing and media were particularly weak. Not weak are selling price expectations which were up quite significantly (57 percent after 48 percent) and remained well above their long-run average, a reminder that the Bank of England’s focus is on getting inflation back on target. The industrial trends results were in line with a more than 6 point loss in the UK’s manufacturing PMI which at 46.0 for the August flash is signaling contraction for the first time in more than two years.

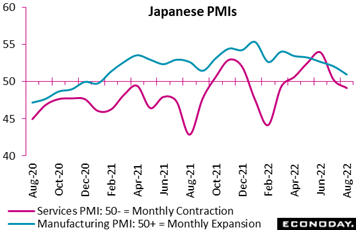

Business conditions is Japan's manufacturing sector eased for the fifth straight month in August reflecting high producer costs as well as global slowing. The sector’s PMI fell more than a point to 51.0 in August for a 19-month low as output contracted for the second month while new orders fell at the sharpest pace since September 2020. Labor shortages due to employees contracting the coronavirus are prompting some factories to reduce operations. Covid is also a factor for the services sample; this PMI also fell just over a point to a sub-50 reading of 49.2 for the first contraction in five months as the Omicron BA.5 subvariant has sparked record numbers of new coronavirus infections. The pandemic is forcing fast-food chains to temporarily close some shops and shorten business hours. Business conditions is Japan's manufacturing sector eased for the fifth straight month in August reflecting high producer costs as well as global slowing. The sector’s PMI fell more than a point to 51.0 in August for a 19-month low as output contracted for the second month while new orders fell at the sharpest pace since September 2020. Labor shortages due to employees contracting the coronavirus are prompting some factories to reduce operations. Covid is also a factor for the services sample; this PMI also fell just over a point to a sub-50 reading of 49.2 for the first contraction in five months as the Omicron BA.5 subvariant has sparked record numbers of new coronavirus infections. The pandemic is forcing fast-food chains to temporarily close some shops and shorten business hours.

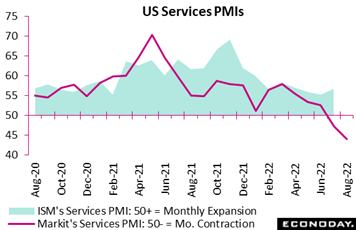

The services PMI from the US was one of the weakest of any report during the week, but not due to Covid. At 44.1 for a more than 3-point loss, this index is signaling substantial contraction. New orders are also in contraction in what is a negative signal for September’s report. Unusually severe losses were also posted in the prior week’s Empire State manufacturing index and the home builder’s housing market index, the result of rising interest rates and high inflation -- a combination that's dampening activity across the US economy. The services PMI from the US was one of the weakest of any report during the week, but not due to Covid. At 44.1 for a more than 3-point loss, this index is signaling substantial contraction. New orders are also in contraction in what is a negative signal for September’s report. Unusually severe losses were also posted in the prior week’s Empire State manufacturing index and the home builder’s housing market index, the result of rising interest rates and high inflation -- a combination that's dampening activity across the US economy.

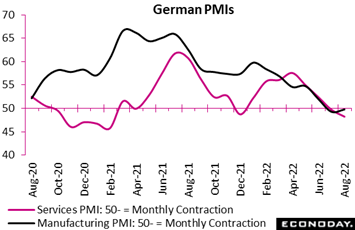

Germany’s services PMI is also in contraction, down 1.5 points to 48.2 for an 18-month low. The manufacturing counterpart, however, firmed by more than a point to a nearly breakeven 49.8 though output, at 46.4, continued to contract at a significant pace. New orders for both samples also declined again and at a more rapid rate with weakness in exports the key factor. Ominously, there were near-record increases in both pre- and post-production inventories despite back-to-back falls in purchases of materials and components. Inflation pressures were again strong but eased for a fourth straight month, in what is at least one positive. Nevertheless, the PMI findings increase the likelihood of an outright fall in total output this quarter which would leave the German economy teetering on the brink of recession. Germany’s services PMI is also in contraction, down 1.5 points to 48.2 for an 18-month low. The manufacturing counterpart, however, firmed by more than a point to a nearly breakeven 49.8 though output, at 46.4, continued to contract at a significant pace. New orders for both samples also declined again and at a more rapid rate with weakness in exports the key factor. Ominously, there were near-record increases in both pre- and post-production inventories despite back-to-back falls in purchases of materials and components. Inflation pressures were again strong but eased for a fourth straight month, in what is at least one positive. Nevertheless, the PMI findings increase the likelihood of an outright fall in total output this quarter which would leave the German economy teetering on the brink of recession.

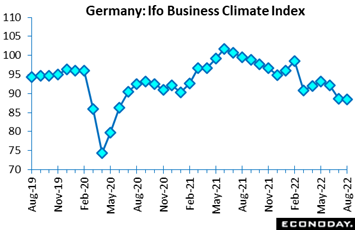

Germany’s Ifo survey generally echoed the PMI results, as the overall business climate index dipped 0.2 points to 88.5, its third straight fall and its lowest level since June 2020. The headline decline reflected minor losses by both current conditions and expectations. The former sub-index fell 0.2 points to 97.5, also its third drop in as many months and a 4-month low. Expectations shed just 0.1 point to 80.3, making for a cumulative 6.7 point slide since May and their worst reading since April 2020. At a sector level, morale in manufacturing was stable and improved in services and construction but deteriorated again in retail trade. Germany’s Ifo survey generally echoed the PMI results, as the overall business climate index dipped 0.2 points to 88.5, its third straight fall and its lowest level since June 2020. The headline decline reflected minor losses by both current conditions and expectations. The former sub-index fell 0.2 points to 97.5, also its third drop in as many months and a 4-month low. Expectations shed just 0.1 point to 80.3, making for a cumulative 6.7 point slide since May and their worst reading since April 2020. At a sector level, morale in manufacturing was stable and improved in services and construction but deteriorated again in retail trade.

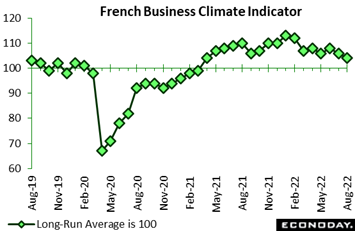

France’s business climate indicator for manufacturing likewise deteriorated but by slightly less than expected, down 2 points in August to 104 but still its lowest mark since April 2021. It also remained on the right side of its 100 long-run average. August's drop reflected both weaker past output and shrinking order books. Production (4 percent after 8 percent) posted its worst reading since August 2020 and overall orders (minus 10 percent after minus 5 percent) their lowest print in 17 months. However, personal production expectations improved as did general production expectations. Expected selling prices (40 percent after 35 percent) picked up after July's 18 percentage point slump but were still well short of May's record high at 55 percent. Across the other sectors the picture was mixed: sentiment improved marginally in construction (114 after 113) and more markedly in retail trade (99 after 96) but deteriorated in services (106 after 107). As a result, the economy-wide index was flat at 103. France’s business climate indicator for manufacturing likewise deteriorated but by slightly less than expected, down 2 points in August to 104 but still its lowest mark since April 2021. It also remained on the right side of its 100 long-run average. August's drop reflected both weaker past output and shrinking order books. Production (4 percent after 8 percent) posted its worst reading since August 2020 and overall orders (minus 10 percent after minus 5 percent) their lowest print in 17 months. However, personal production expectations improved as did general production expectations. Expected selling prices (40 percent after 35 percent) picked up after July's 18 percentage point slump but were still well short of May's record high at 55 percent. Across the other sectors the picture was mixed: sentiment improved marginally in construction (114 after 113) and more markedly in retail trade (99 after 96) but deteriorated in services (106 after 107). As a result, the economy-wide index was flat at 103.

Though the US consumer sentiment index offers some hints that American households, when it comes to rate hikes, may be understanding, Germany’s GfK survey doesn’t offer any reassurance, falling more than 6 points to minus 36.5 in a reading that tracks September’s outlook. Households are increasingly nervous about their prospective real earnings stream as inflation, already at 7.5 percent in Germany, looks likely to climb still higher over coming months. Some additional retrenchment is to be expected and consumer spending could well subtract from real GDP growth this quarter. This report’s details for August included a seventh straight decline in buying propensity to its weakest level since the financial crisis of October 2008. At the same time, the propensity to save jumped some 17.6 points to 3.5, its highest mark in more than 11 years and a clear indication of consumer caution. Though the US consumer sentiment index offers some hints that American households, when it comes to rate hikes, may be understanding, Germany’s GfK survey doesn’t offer any reassurance, falling more than 6 points to minus 36.5 in a reading that tracks September’s outlook. Households are increasingly nervous about their prospective real earnings stream as inflation, already at 7.5 percent in Germany, looks likely to climb still higher over coming months. Some additional retrenchment is to be expected and consumer spending could well subtract from real GDP growth this quarter. This report’s details for August included a seventh straight decline in buying propensity to its weakest level since the financial crisis of October 2008. At the same time, the propensity to save jumped some 17.6 points to 3.5, its highest mark in more than 11 years and a clear indication of consumer caution.

Last week’s data left Econoday’s Consensus Divergence Indexes above zero for the major economies in Europe, although only just in some cases.. For the Eurozone as a whole, readings of 20 for the ECDI and 30 for its inflation-adjusted counterpart (ECDI-P) indicate sustained moderate outperformance. This should keep financial markets looking for a 50-basis-point hike from the European Central Bank on September 8. Of note is Germany which, despite the increasing talk of recession, is at 32 overall and 35 when excluding prices which have been surprising the most on the upside.

In the UK, a 16 point gap between the ECDI (20) and ECDI-P (4) underlines the extent to which inflation is overshooting expectations in this economy. To this end, the Bank of England still looks likely to raise Bank Rate by another 50 points next month.

In Japan the recent period of outperformance was extended and an ECDI of 14 will not worry a Bank of Japan that remains as determined as ever to get inflation sustainably to its medium-term level. China, at minus 17 both overall and ex-prices, reflects the general run of weak numbers which have the People’s Bank of China increasing stimulus.

For the US, the ECDI is at minus 14 to indicate that economic data have been running slightly below expectations, though the index excluding price effects (which are coming in on the low side of expectations and holding down the overall index) is at plus 13 to indicate a degree of outperformance by the real economy.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Germany’s CPI on Tuesday – the global calendar’s first definitive inflation reading for the month of August – is expected to show increasing pressure at a 7.8 percent annual rate. The Eurozone HICP will follow on Wednesday and is seen rising only slightly but to a 9.0 percent pace. Also watch for the Eurozone PPI on Friday which is expected to surge 2.8 percent on the month for an annual rate of 36.4 percent. If these readings come in as expected, there won’t be much talk that inflation is beginning to come down.

Employment data will start with Germany’s unemployment rate, again the first definitive reading for this category for the month of August. ADP’s refurbished report will debut in the US on Wednesday followed on Friday by the US employment report which is expected to show slowing but still very strong job growth together with stubbornly high wages.

Sentiment data will be centered on Tuesday: first EC economic sentiment where further deterioration is the call, then US consumer confidence where some relief is expected. Business surveys will include two reports from Switzerland – leading indicators as well as the SVME PMI – both of which are expected to edge lower. CFLP PMIs from China are estimated for Wednesday with the Caixin manufacturing PMI on Thursday in what are expected to be flat results. The US ISM manufacturing report on Thursday is expected to show yet another month of slowing growth. Another report to watch will be German retail sales on Thursday where continued contraction is the expectation.

Japanese Unemployment Rate for July (Mon 2330 GMT; Tue 0830 JST; Mon 1930 EDT)

Consensus Forecast, Unemployment Rate: 2.6%

Japan's unemployment rate is expected to hold steady at 2.6 percent in July, matching both June’s and May’s rate.

KOF Swiss Leading Indicator for August (Tue 0700 GMT; Tue 0900 CEST; Tue 0300 EDT)

Consensus Forecast: 89.0

KOF's leading indicator, which fell more than 5 points in July, is expected to shed just over another point in August to a consensus 89.0.

Eurozone: EC Economic Sentiment for August (Tue 0900 GMT; Tue 1100 CEST; Tue 0500 EDT)

Consensus Forecast: 97.7

Consensus Forecast, Industry Sentiment: 2.2

Consensus Forecast, Consumer Sentiment: -25.0

Having only edged lower in prior months, economic sentiment fell sharply in July, down 4.5 points to a much lower-than-expected 99.0. August’s consensus forecast, at 97.7, is calling for a further loss. In other readings, industry sentiment is seen at 2.2 versus 3.5 with consumer sentiment slipping a tenth from its advance reading (released last week) to minus 25.0.

German CPI, Preliminary August (Tue 1200 GMT; Tue 1400 CEST; Tue 0800 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 7.8%

Consumer prices in August are expected to rise 0.4 percent on the month for a year-over-year rate of 7.8 percent. This would compare with respective increases of 0.9 and 7.5 percent in July.

US Consumer Confidence Index for August (Tue 1400 GMT; Tue 1000 EDT)

Consensus Forecast: 97.4

Consumer confidence is expected to improve to a still soft 97.4 versus 95.7 in July, a month that showed a collapse in buying plans for vehicles, homes, and major appliances.

Japanese Industrial Production for July (Tue 2350 GMT; Wed 0850 JST; Tue 1950 EDT)

Consensus Forecast, Month over Month: -0.5%

Consensus Forecast, Year over Year: -2.4%

The government upgraded its view of the industrial sector in June, to mixed from weak. After June’s 9.2 percent monthly jump that followed prior declines, industrial production in July is expected to fall back 0.5 percent. Year-over-year, production is expected to fall 2.4 percent versus 2.8 percent declines in the prior two months.

Japanese Retail Sales for July (Tue 2350 GMT; Wed 0850 JST; Tue 1950 EDT)

Consensus Forecast, Year over Year: 1.9%

Retail sales are expected to post their fifth straight year-over-year rise in July, at a consensus 1.9 percent versus 1.5 percent in June. The government described sales in the June report as “picking up gradually”.

China: CFLP PMIs for August (Estimated: Wed 0130 GMT; Wed 0930 CST; Tue 2130 EDT)

Manufacturing PMI, Consensus Forecast: 49.4

Non-manufacturing PMI, Consensus Forecast: 52.2

The CFLP manufacturing PMI is expected to rise slightly in August to 49.4 following July’s unexpected move back into contraction at 49.0. The non-manufacturing index is expected to come in at 52.2 versus 52.5.

German Unemployment Rate for August (Wed 0755 GMT; Wed 0955 CEST; Wed 0355 EDT)

Consensus Forecast: 5.5%

Germany's unemployment rate has been moving higher, to 5.4 percent in July with August’s consensus at 5.5 percent.

Eurozone HICP Flash for August (Wed 0900 GMT; Wed 1100 CEST; Wed 0500 EDT)

Consensus Forecast, Year over Year: 9.0%

Narrow Core

Consensus Forecast, Year over Year: 4.0%

The flash headline annual rate for August is seen rising 1 tenth to 9.0 percent; June’s higher-than-expected 8.9 percent was another record rate. The narrow core is expected to hold steady at 4.0 percent.

Italian CPI, Preliminary for August (Wed 1000 GMT; Wed 1100 CEST; Wed 0500 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 8.1%

Price pressures leveled in July to an annual 7.9 percent with August’s consensus at 8.1 percent.

ADP, US Private Payrolls for August (Wed 1215 GMT; Wed 0815 EDT)

Consensus Forecast: 200,000

Consensus Range: 175,000 to 370,000

After taking a 2-month pause to rework its methodology, ADP is back once again with what is expected to be an August estimate of 200,000 for private payroll growth.

Canadian Second-Quarter GDP (Wed 1230 GMT; Wed 0830 EDT)

Consensus Forecast, Annualized: 4.5%

A 4.5 percent annualized growth rate is the consensus for Canadian second-quarter GDP versus 3.1 percent expansion in the first quarter.

South Korean External Trade for August (Thu 0000 GMT; Thu 0900 KST; Wed 2000 EDT)

Consensus Forecast, Balance: US$7.0 billion

August’s trade balance for both goods and services is expected to widen from a July deficit of US$4.67 billion to US$7.0 billion.

South Korean Manufacturing PMI for August (Thu 0030 GMT; Thu 0930 KST; Wed 2030 EDT)

Consensus Forecast: 50.0

The manufacturing PMI for August is expected to edge higher to dead even 50.0 versus July’s stagnant 49.8.

China: Caixin Manufacturing PMI for August (Thu 01:45 GMT; Thu 09:45 CST; Wed 21:45 EDT)

Consensus Forecast: 50.2

Caixin's manufacturing PMI for August is expected to edge lower to 50.2 versus July’s 50.4 that indicated activity was close to a standstill.

German Retail Sales for July (Thu 0600 GMT; Thu 0800 CEST; Thu 200 EDT)

Consensus Forecast, Month over Month: -0.4%

Consensus Forecast, Year over Year: -7.0%

Retail sales in July are expected to fall 0.4 percent on the month following June’s disappointingly weak decline of 1.6 percent. Year-over-year sales ae expected to fall 7.0 percent versus 9.8 percent contraction in June.

Switzerland: SVME PMI for August (Thu 0730 GMT; Thu 0930 CEST: Thu 0330 EDT)

Consensus Forecast: 56.9

The SVME PMI, expected at 56.9 in August, has held at strong levels but has been steadily slowing, down 1.1 points in July to 58.0.

Eurozone Unemployment Rate for July (Thu 0900 GMT; Thu 1100 CEST; Thu 0500 EDT)

Consensus Forecast: 6.6%

Consensus for July 's unemployment rate is no change at 6.6 percent.

US: ISM Manufacturing Index for August (Thu 1400 GMT; Thu 1000 EDT)

Consensus Forecast: 52.2

The ISM manufacturing index has been moving lower but only incrementally, to 52.8 in July from 53.0 in June. New orders, however, have been in sub-50 contraction the past two reports. Econoday’s consensus for August is further slowing for the headline to 52.2.

Eurozone PPI for July (Fri 0900 GMT; Fri 1100 CEST; Fri 0500 EDT)

Consensus Forecast, Month over Month: 2.8%

Consensus Forecast, Year over Year: 36.4%

Producer-price inflation has been severe, up 1.1 percent on the month in June for an annual rate of 35.8 percent that, however, was marginally slower than May’s 36.2 percent rate. Expectations for July are a 2.8 percent monthly surge for 36.4 percent annually.

US Employment Situation for August (Fri 1230 GMT; Fri 0830 EDT)

Consensus Forecast: Change in Nonfarm Payrolls: 293,000

Consensus Forecast: Average Hourly Earnings M/M: 0.4%

Consensus Forecast: Average Hourly Earnings Y/Y: 5.2%

A 293,000 rise is Econoday's consensus for nonfarm payroll growth in August which would compare with a far greater-than-expected 528,000 rise in July. Average hourly earnings in July rose 0.5 percent on the month and 5.2 percent on the year, both of which were also greater than expected. Earnings in August are expected to rise 0.4 percent on the month and 5.2 percent once again on the year.

|