|

Jerome Powell's opening remarks at an IMF panel on the global economy did not downplay the possibility of a 50 basis point increase in rates at the May 2-3 FOMC meeting. The Fed chief said the US economy is very strong and "a bit more" removed from the immediate effects of Ukraine than others, but he warned the US will nevertheless be feeling the war's effects "over time" especially in regard to inflationary pressures. The Fed's Beige Book, released during the week and covering much of the month of April, will help inform the coming FOMC, and the report's assessment, which is visibly more upbeat than the February edition, also does nothing to reduce the possibility of a 50 point hike: "Inflationary pressures remained strong since the last report, with firms continuing to pass swiftly rising input costs through to customers". Inflation pass through, in the ever balancing and rebalancing effects of economic forces, has its own dampening effects on demand, something interestingly that may speak against a 50 point hike.

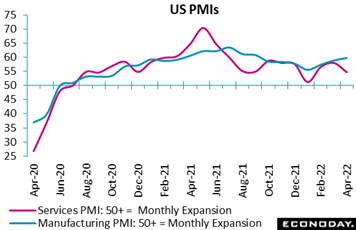

In another early read on the month of April, the US services PMI eased by more than 3 points to an unexpectedly moderate 54.7. The report blames inflation and its impact on customer spending for the slowing. Prices are clearly overheated with services respondents citing higher wage and input bills and in turn hiking their selling prices at the steepest rate in the history of the report. Costs for manufacturers are also high and rising and, like the services sample, pass through to customers is at a record pace. Yet inflation hasn't yet slowed incoming orders for this sample as the manufacturing index, at a very strong 59.7, beat Econoday's consensus by nearly 2 points. Common themes for both samples are building backlogs and with this rising employment, the latter pointing to further wage inflation. In another early read on the month of April, the US services PMI eased by more than 3 points to an unexpectedly moderate 54.7. The report blames inflation and its impact on customer spending for the slowing. Prices are clearly overheated with services respondents citing higher wage and input bills and in turn hiking their selling prices at the steepest rate in the history of the report. Costs for manufacturers are also high and rising and, like the services sample, pass through to customers is at a record pace. Yet inflation hasn't yet slowed incoming orders for this sample as the manufacturing index, at a very strong 59.7, beat Econoday's consensus by nearly 2 points. Common themes for both samples are building backlogs and with this rising employment, the latter pointing to further wage inflation.

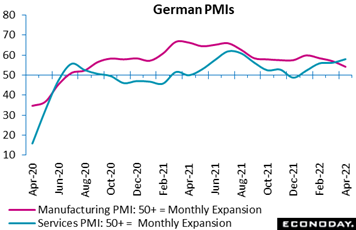

Inflation pressures were likewise unabated in April's PMI flashes for Germany, with both costs and selling prices continuing to surge. In contrast to the US, it was German manufacturing, not services, that is slowing this month, down nearly 2 points to 54.1. Both output and new orders, the latter in outright contraction, are near 2-year lows for this sample. Supply chain problems are again a major factor restraining manufacturing activity with the war in Ukraine and China's zero Covid policy widely cited as key factors. By contrast Germany's services sample, benefiting from looser Covid restrictions, is reporting accelerating conditions, at an index of 57.9 that easily exceeded expectations. Output for this sample is rising steeply this month with new orders coming in at an 8-month best. Yet very high rates of inflation, including record pass through of services costs, do pose a risk to services demand. Inflation pressures were likewise unabated in April's PMI flashes for Germany, with both costs and selling prices continuing to surge. In contrast to the US, it was German manufacturing, not services, that is slowing this month, down nearly 2 points to 54.1. Both output and new orders, the latter in outright contraction, are near 2-year lows for this sample. Supply chain problems are again a major factor restraining manufacturing activity with the war in Ukraine and China's zero Covid policy widely cited as key factors. By contrast Germany's services sample, benefiting from looser Covid restrictions, is reporting accelerating conditions, at an index of 57.9 that easily exceeded expectations. Output for this sample is rising steeply this month with new orders coming in at an 8-month best. Yet very high rates of inflation, including record pass through of services costs, do pose a risk to services demand.

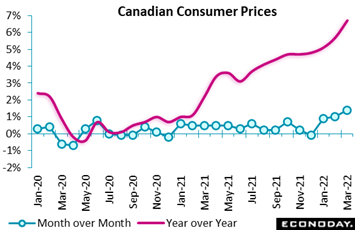

Pass through lands ultimately in consumer prices which, like those at the business level, are showing no signs of slowing. Inflationary pressures in Canada are at their strongest since January 1991 as the country's CPI rose a further 1.4 percent on the month in March after 1.0 percent in February. On a year-over-year basis, the inflation rate is at 6.7 percent, a jump from 5.7 percent in February. Both of these results were well beyond Econoday's consensus forecasts. Homeowner costs tied to a tight housing market, ongoing supply issues and geopolitical tensions all fed March's pressure as did food, up 0.9 percent on the month and 7.7 percent on the year, and energy, up 7.5 and 27.8 percent respectively. Excluding these food and energy, prices were still up 0.9 percent on the month and 4.6 percent on the year. The Bank of Canada warned earlier this month that the peak for inflation has yet to come and that the country's economy "is moving into excess demand", outlooks seemingly confirmed by the March CPI report. Pass through lands ultimately in consumer prices which, like those at the business level, are showing no signs of slowing. Inflationary pressures in Canada are at their strongest since January 1991 as the country's CPI rose a further 1.4 percent on the month in March after 1.0 percent in February. On a year-over-year basis, the inflation rate is at 6.7 percent, a jump from 5.7 percent in February. Both of these results were well beyond Econoday's consensus forecasts. Homeowner costs tied to a tight housing market, ongoing supply issues and geopolitical tensions all fed March's pressure as did food, up 0.9 percent on the month and 7.7 percent on the year, and energy, up 7.5 and 27.8 percent respectively. Excluding these food and energy, prices were still up 0.9 percent on the month and 4.6 percent on the year. The Bank of Canada warned earlier this month that the peak for inflation has yet to come and that the country's economy "is moving into excess demand", outlooks seemingly confirmed by the March CPI report.

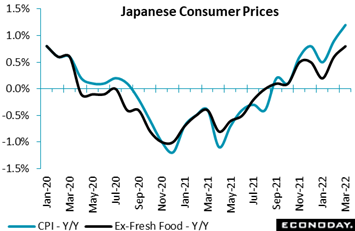

Japan, like China, is seeing a much lower level of price pressures at the consumer level, but they are on the rise. The country's CPI, at a year-over-year rate of 1.2 percent in March, was up 3 tenths from February to post a seventh straight rise on surging costs for food, utilities and fuels. The ex-fresh food core rate rose 2 tenths to an annual 0.8 percent. Looking ahead, downward pressure from low-cost mobile-phone plans introduced in April 2021 roll off comparisons in April 2022 data due next month, possibly pushing up the ex-fresh food rate close to 2 percent. Yet however much prices may approach or even hit target, the Bank of Japan, citing slow wage growth and weak services prices, doesn't believe inflation is likely to hold any time soon around the bank's 2 percent target. Japan, like China, is seeing a much lower level of price pressures at the consumer level, but they are on the rise. The country's CPI, at a year-over-year rate of 1.2 percent in March, was up 3 tenths from February to post a seventh straight rise on surging costs for food, utilities and fuels. The ex-fresh food core rate rose 2 tenths to an annual 0.8 percent. Looking ahead, downward pressure from low-cost mobile-phone plans introduced in April 2021 roll off comparisons in April 2022 data due next month, possibly pushing up the ex-fresh food rate close to 2 percent. Yet however much prices may approach or even hit target, the Bank of Japan, citing slow wage growth and weak services prices, doesn't believe inflation is likely to hold any time soon around the bank's 2 percent target.

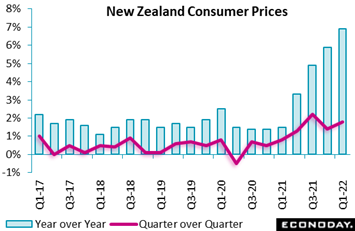

Unlike Japan and China, New Zealand's consumer prices are sky high, up 6.9 percent on the year in data for the first quarter versus 5.9 percent in the fourth quarter. The CPI, now at a 32-year high, has exceeded the Reserve Bank of New Zealand's 2 percent target for four consecutive quarters. On the quarter, the index advanced 1.8 percent versus 1.4 percent previously. The latest acceleration was largely driven by stronger increases for food, housing, and utilities. The report again highlighted the impact of supply-chain issues and increased labour costs on the cost of residential construction, with fuel prices also remaining at elevated levels. Unlike Japan and China, New Zealand's consumer prices are sky high, up 6.9 percent on the year in data for the first quarter versus 5.9 percent in the fourth quarter. The CPI, now at a 32-year high, has exceeded the Reserve Bank of New Zealand's 2 percent target for four consecutive quarters. On the quarter, the index advanced 1.8 percent versus 1.4 percent previously. The latest acceleration was largely driven by stronger increases for food, housing, and utilities. The report again highlighted the impact of supply-chain issues and increased labour costs on the cost of residential construction, with fuel prices also remaining at elevated levels.

At the RBNZ's meeting held earlier this month, officials advised that they are determined to ensure that current high levels of inflation do not become embedded into longer-term inflation expectations. The bank moved to reduce the level of monetary stimulus by increasing its main policy rate by 50 basis points to 1.50 percent after increasing it by 25 basis points at each of the three previous meetings. And the latest CPI data do boost the chances that additional rate hikes will be considered in coming months, with the RBNZ's next policy meeting scheduled for late May. Watch on the coming week's calendar for Australian consumer prices on Wednesday, which will also cover the first quarter.

Looking closer to the base of the price chain, producer prices in Germany continued to surge ahead in March. A 4.9 percent monthly jump was more than double the market consensus and only a tick short of December's record 5.0 percent gain. The jump was large enough to lift the annual inflation rate by fully 5 percentage points to 30.9 percent, a new all-time high. Prices have risen every month since October 2020. As usual, energy (10.4 percent) dominated the monthly advance and prices now stand some 83.8 percent above their level a year ago. All main categories posted further sharp gains, notably intermediates (3.5 percent) and non-durable consumer goods (2.9 percent). As a result, core prices rose a sizeable 2.3 percent versus February and were up 14.0 percent on the year after a 12.4 percent annual rate last time. The March update points to no let-up in pipeline price pressures and warns that CPI inflation will accelerate further over coming months. Looking closer to the base of the price chain, producer prices in Germany continued to surge ahead in March. A 4.9 percent monthly jump was more than double the market consensus and only a tick short of December's record 5.0 percent gain. The jump was large enough to lift the annual inflation rate by fully 5 percentage points to 30.9 percent, a new all-time high. Prices have risen every month since October 2020. As usual, energy (10.4 percent) dominated the monthly advance and prices now stand some 83.8 percent above their level a year ago. All main categories posted further sharp gains, notably intermediates (3.5 percent) and non-durable consumer goods (2.9 percent). As a result, core prices rose a sizeable 2.3 percent versus February and were up 14.0 percent on the year after a 12.4 percent annual rate last time. The March update points to no let-up in pipeline price pressures and warns that CPI inflation will accelerate further over coming months.

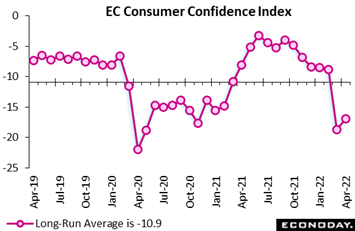

Rising inflation, now accelerated by war effects, has been pulling sentiment measures south, though the European Commission's index for consumer confidence did unexpectedly improve in April. At minus 16.9, the index was 1.8 points higher than March and posted its first increase since last September. Yet it's still the second weakest showing since May 2020 and also still on the soft side of its long-run average at minus 10.9. Nevertheless April's improvement will no doubt come as some relief for the European Central Bank, though the trend remains down and does not bode well for household spending near-term. Rising inflation, now accelerated by war effects, has been pulling sentiment measures south, though the European Commission's index for consumer confidence did unexpectedly improve in April. At minus 16.9, the index was 1.8 points higher than March and posted its first increase since last September. Yet it's still the second weakest showing since May 2020 and also still on the soft side of its long-run average at minus 10.9. Nevertheless April's improvement will no doubt come as some relief for the European Central Bank, though the trend remains down and does not bode well for household spending near-term.

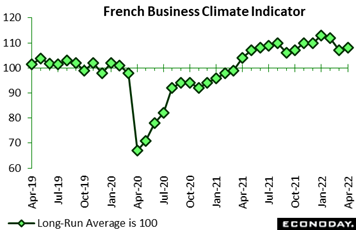

We close the week's data run with a look at business sentiment in France where a presidential election between status-quo incumbent Emmanual Macron and far-right challenger Marine Le Pen could well shape the future of the European Union itself. From an upwardly revised 107 in March, INSEE's headline indicator edged a point firmer to 108, its first increase since January and some 3 points stronger than the market consensus. It now stands 8 points above its 100 long-run average. We close the week's data run with a look at business sentiment in France where a presidential election between status-quo incumbent Emmanual Macron and far-right challenger Marine Le Pen could well shape the future of the European Union itself. From an upwardly revised 107 in March, INSEE's headline indicator edged a point firmer to 108, its first increase since January and some 3 points stronger than the market consensus. It now stands 8 points above its 100 long-run average.

The modest rise was attributable to strengthening order books (1 percent after minus 3 percent) which masked moderation in production (11 percent after 12 percent) and a further fall in general production expectations (minus 5 percent after minus 3 percent). Personal production expectations (11 percent) were unchanged. Elsewhere expected selling prices (44 percent after 54 percent) dropped from March's record high. Across other main sectors, the picture was mixed: sentiment deteriorated sharply again in retail trade, was flat in services, but did improve in construction. The results offer some hope that developments in Ukraine may not have as negative an impact on French manufacturing economy as originally thought.

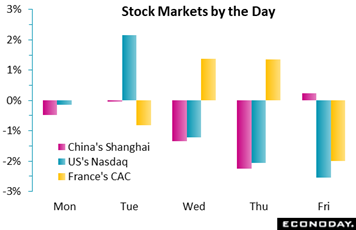

Monday sentiment drew no support from China's better-than-expected 4.8 percent rate of GDP growth as the impact of shutdowns in Shanghai and Guangzhou and the widening Covid outbreak have yet to appear in the country's data. A new round of regulatory trouble for China’s technology and e-commerce giants hit Hong Kong's Hang Seng index on Tuesday which dropped 2.3 percent. A plus on Tuesday were reports of Chinese government plans to boost support for industries hurt by anti-Covid lockdowns. Monday sentiment drew no support from China's better-than-expected 4.8 percent rate of GDP growth as the impact of shutdowns in Shanghai and Guangzhou and the widening Covid outbreak have yet to appear in the country's data. A new round of regulatory trouble for China’s technology and e-commerce giants hit Hong Kong's Hang Seng index on Tuesday which dropped 2.3 percent. A plus on Tuesday were reports of Chinese government plans to boost support for industries hurt by anti-Covid lockdowns.

Chinese markets sold off on Wednesday after the People's Bank of China disappointed investors who were hoping for a cut in the one-year loan prime rate from 3.7 percent. The PBOC did set the yuan exchange rate much lower, which may reduce the central bank's scope to cut interest rates in light of rising US rates. On the positive side, Shanghai authorities began to ease Covid restrictions.

Chinese markets sold off again on Thursday as analysts downgraded the country's growth forecasts amid disappointment that authorities have not acted more aggressively to stimulate the economy. President Xi Jinping's defense of strict lockdown policies also didn't help. Investors reacted badly when Fed's Powell, in response to a question at an IMF forum, declined to endorse the notion that inflation in the US has peaked, a possibility widely discussed in financial markets.

On Friday, several major sellside firms called for a 50 point rate increase at the Fed's next meeting, followed by 75 basis point moves in June and July. One analyst called 75 the new 25, referring to past expectations for the Fed to raise rates in modest increments of 25 basis points. Investors also remained on edge ahead of French presidential elections on Sunday. Polls suggest President Emmanuel Macron is ahead but a win over far-right candidate Marine Le Pen is not certain. Investors recall their surprise when Donald Trump upset Hillary Clinton in the 2016 US presidential election.

Chinese data have been consistently exceeding expectations since mid-March, underscored by the country's first-quarter GDP showing and reflected in Econoday's consensus divergence index (ECDI) of plus 29. Yet the effects of sweeping zero-Covid restrictions, which were expanded in force at the beginning of April, do point to an economic downturn; whether these effects prove greater or lesser than expected will determine the direction of China's ECDI when April data unroll (which will begin in the coming week on Friday, April 29 and Saturday, April 30 with the Caixan and CFLP PMIs).

Canadian data have been easily exceeding expectations for nearly two months straight, ending the week at an ECDI of 36 and benefiting from the higher-than-expected CPI but also better-than-expected housing starts and retail sales data, all supporting the Bank of Canada's aggressive tightening course.

Overheated inflation in the UK, data that have sharply exceeded expectations, have limited the decline underway for the country's ECDI which ended the week at minus 16 but, when excluding inflation effects, at a very low minus 50. The latest week included a poor showing for March retail sales which contracted sharply. The run of weak results could well tilt Bank of England policy in favor of only a 25 basis point hike in interest rates at next month's policy meeting.

Eurozone results turned higher in the week, ending six weeks of sub-zero performance to plus 21, benefiting from strong PMI results and improvement in the EC consumer confidence flash. Germany's score, also at 21, got a boost from the strong showing in the services PMI as it also did, however, by the great spike in the country's PPI which is a reminder of the skewing effects underway from inflation data.

The ECDI for the US has been choppy the last couple of months, spiking on Tuesday to a peak of 33 following surprisingly strong housing starts and permits (data that have yet to show much slowing from higher mortgage rates) but then slowing on Thursday to plus 11 following a rise in unemployment claims and a softer-than-expected showing for the Philadelphia Fed manufacturing index.

Japan at minus 24 has been missing expectations all month, pulled down in the prior week by a steep plunge in machinery orders and hit in the latest week by a deeper-than-expected trade deficit.

How much the economy plays in France's election still has to play out, though economic data have been hitting expectations since early last month. For the second week in a row, France's ECDI comes in at exactly zero to indicate that overall economic activity is performing right in line with market expectations -- a result perhaps that is neutral for the outcome of Sunday's election.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

The most critical data for policy will be Germany's consumer price flash on Thursday which, at a consensus annual rate of 7.3 percent for April, is expected to be no worse than March. April CPI flashes will follow on Friday from Italy and culminate in the Eurozone HICP flash which is also expected to be no worse, holding at 7.5 percent. PCE price indexes from the US will be posted on Friday with expectations for acceleration overall but easing for the core, along with the quarterly employment cost index, a reading that the Federal Reserve watches closely for indications on wage pressure and which isn't expected to cool any.

Germany's Ifo business climate on Monday will open a heavy week of confidence data which on net are expected to show continued weakness. GfK consumer climate will follow from Germany on Wednesday with US consumer confidence set for Tuesday and EC economic sentiment on Thursday.

One report that is certain to be closely watched will be China's Caixin manufacturing PMI on Friday which will offer the first read on zero-Covid effects. Expectations are downbeat. China's official CFLP manufacturing PMI is expected to follow on Saturday.

Major central bank announcements will be limited to the Bank of Japan on Thursday that will follow a run of Japanese data earlier in the week: the unemployment rate on Tuesday and industrial production and retail sales both on Thursday. Not to be left out of the week's run will be the first estimates of first-quarter GDP beginning with the US on Thursday followed on Friday from France, Germany, Italy, and finally the Eurozone. Other US data to watch include durable goods orders and new home sales both on Tuesday and international trade in goods on Wednesday.

German Ifo for April (Mon 08:00 GMT; Mon 10:00 CEST; Mon 04:00 EDT)

Consensus Forecast, Business Climate: 88.6

Consensus Forecast, Current Conditions: 95.9

Consensus Forecast, Business Expectations: 82.7

Conflict with Russia, which pulled the business climate indicator sharply lower in March, is expected to further depress this reading, to a consensus 88.6 versus March's 90.8. Current Conditions are seen at 95.9 versus 97.0 with business expectations at 82.7 versus 85.1.

Japanese Unemployment Rate for March (Mon 23:30 GMT; Tue 08:30 JST; Mon 19:30 EDT)

Consensus Forecast, Unemployment Rate: 2.7%

Japan's unemployment rate edged 1 tenth lower in February and is expected to hold unchanged in March at 2.7 percent.

US Durable Goods Orders for March (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast: Month over Month: 1.0%

Consensus Forecast: Ex-Transportation - M/M: 0.5%

Consensus Forecast: Core Capital Goods Orders - M/M: 0.5%

Durable goods orders fell 2.1 percent in February, a month that also saw declines for ex-transportation orders and core capital goods. March's expectations are a 1.0 percent rise for the headline and gains of 0.5 percent for both ex-transportation and capital goods.

US Consumer Confidence Index for April (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 106.8

The consumer confidence index showed initial resilience to the Ukraine crisis, edging past expectations in March at 107.2 which historically is soft but, given ongoing circumstances, was quite sold. April's consensus is a dip to 106.8.

US New Home Sales for March (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast, Annual Rate: 772,000

New home sales have been holding up despite rising mortgage rates though sales did slow in February to a 772,000 annual rate from January's 788,000. March's expectations are no change at 772,000.

Australian First-Quarter CPI (Tue 23:30 GMT; Wed 11:30 AEST; Tue 19:30 EDT)

Consensus Forecast, Quarter over Quarter: 1.7%

Consensus Forecast, Year over Year: 4.6%

Consensus for consumer prices in the first quarter is a 1.7 percent quarterly increase versus a 1.3 percent rise in the fourth quarter. Year over year the rate is seen at 4.6 versus 3.5 percent.

Germany: GfK Consumer Climate for May (Wed 06:00 GMT; Wed 08:00 CEST; Wed 02:00 EDT)

Consensus Forecast: -16.2

GfK's index for the May outlook is expected to sink further, to a consensus minus 16.2 versus April's minus 15.5 which was 4.5 points below the consensus.

US International Trade in Goods (Advance) for March (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Balance: -$105.0 billion

The US goods deficit (Census basis) is expected to narrow to $105.0 billion in March after deepening by $0.9 billion in February to $106.3 billion in what was a mixed report.

Japanese Industrial Production for March (Wed 23:50 GMT; Thu 08:50 JST; Wed 19:50 EDT)

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: -1.1%

Industrial production managed only a 0.1 percent rise in a monthly February gain that followed contraction in the two prior months. Yet the trade ministry maintained its view that output was "showing signs of a pickup," and a pickup is what's expected for March, at a consensus gain of 0.5 percent.

Japanese Retail Sales for March (Wed 23:50 GMT; Thu 08:50 JST; Wed 19:50 EDT)

Consensus Forecast, Year over Year: -0.5%

Retail sales fell 0.8 percent on the year in February, a month hit by heavy snow in some regions and record Covid infections. A further 0.5 percent decline is the expectation for March.

Bank of Japan Announcement (Expected sometime between 11:30 and 12:00 JST on Thursday, Apr-28)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: -0.10%

At its March meeting, the Bank of Japan held steady its interest rate targets and main asset purchase programs citing "extremely high uncertainties" over the global effects of the Ukraine crisis. No change in policy is expected at April's meeting.

Eurozone: EC Economic Sentiment for April (Thu 09:00 GMT; Thu 11:00 CEST; Thu 05:00 EDT)

Consensus Forecast: 107.8

Initial fallout from the war in Ukraine saw the EU Commission's measure of economic sentiment fall a sharp 5.4 points to 108.5. A decline to 107.8 is expected for April.

German CPI, Preliminary April (Thu 12:00 GMT; Thu 14:00 CEST; Thu 08:00 EDT)

Consensus Forecast, Month over Month: 0.6%

Consensus Forecast, Year over Year: 7.3%

Consumer inflation surged a far higher-than-expected 2.5 percent on the month in March for an annual rate of 7.3 percent. Expectations for April are respective rates of 0.6 percent and no change at 7.3 percent.

US First-Quarter GDP, First Estimate (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast, Annualized Rate: 1.1%

US Real Personal Consumption Expenditures

Consensus Forecast: 3.4%

First-quarter GDP is expected to slow sharply to 1.1 percent annualized growth versus fourth-quarter growth of 6.9 percent. Personal consumption expenditures, after the fourth-quarter's plus 2.5 percent rate, are expected to post very solid annualized growth of 3.4 percent.

China: Caixin Manufacturing PMI for April (Fri 01:45 GMT; Fri 09:45 CST; Thu 21:45 EDT)

Consensus Forecast: 47.1

In the first indications of the effects of China's expanded zero-Covid lockdowns, more pronounced contraction at 47.1 is the consensus for the manufacturing PMI in April. Caixan's manufacturing PMI in March, at 48.1, came in 1.4 points below the consensus which was a substantial miss for this indicator.

French First-Quarter GDP, First Estimate (Fri 05:30 GMT; Fri 07:30 CEST; Fri 01:30 EDT)

Consensus Forecast, Quarter over Quarter: 0.3%

First-quarter GDP in France is expected to rise a quarterly 0.3 percent versus a 0.7 percent rise in the fourth quarter.

German First-Quarter GDP, First Estimate (Fri 08:00 GMT; Fri 10:00 CEST; Fri 04:00 EDT)

Consensus Forecast, Quarter over Quarter: 0.2%

Consensus Forecast, Year over Year: 3.7%

The flash estimate for first-quarter GDP is quarter-over-quarter growth of 0.2 percent and year-over-year growth of 3.7 percent.

Eurozone M3 Money Supply for March (Fri 08:00 GMT; Fri 10:00 CEST; Fri 04:00 EDT)

Consensus Forecast, Year-over-Year: 6.3%

Broad money growth (on a 3-month basis) is expected to slow 3 tenths to an annual rate of 6.3 percent in March.

Italian First-Quarter GDP, First Estimate (Fri 08:00 GMT; Fri 10:00 CEST; Fri 04:00 EDT)

Consensus Forecast, Quarter over Quarter: -0.3%

Consensus Forecast, Year over Year: 5.6%

First-quarter GDP is expected to contract 0.3 percent on the quarter and expand 5.6 percent on the year.

Eurozone First-Quarter GDP, First Estimate (Fri 09:00 GMT; Fri 11:00 CEST; Fri 05:00 EDT)

Consensus Forecast: Quarter over Quarter: 0.3%

Consensus Forecast, Year over Year: 5.0%

First-quarter Eurozone GDP is expected to expand a quarterly 0.3 percent to match growth in the fourth quarter. The year-over-year rate in the first quarter is seen at plus 5.0 percent versus 4.6 percent growth in the fourth quarter.

Eurozone HICP Flash for April (Fri 09:00 GMT; Fri 11:00 CEST; Fri 05:00 EDT)

Consensus Forecast, Year over Year: 7.5%

Narrow Core

Consensus Forecast, Year over Year: 3.1%

The flash headline annual rate for April is seen rising 1 tenth to 7.5 percent; the narrow core rate is expected to rise 2 tenths to 3.1 percent.

Italian CPI, Preliminary for April (Fri 10:00 GMT; Fri 11:00 CEST; Fri 05:00 EDT)

Consensus Forecast, Year over Year: 6.8%

An annual rate of 6.8 percent is expected for April consumer prices. This would compare with 6.5 percent in March which was above the consensus and a 31-year high.

US Personal Income for March (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month over Month: 0.4%

US Consumption Expenditures

Consensus Forecast, Month over Month: 0.6%

US PCE Price Index

Consensus Forecast, Month over Month: 0.9%

Consensus Forecast, Year over Year: 6.8%

US Core PCE Price Index

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 5.3%

Personal income is expected to rise 0.4 percent in March with personal consumption expenditures expected to rise 0.6 percent. Inflation readings are expected at monthly gains of 0.9 percent overall but only 0.3 percent for the core (versus 0.6 and 0.4 percent respective gains in February) for annual rates of 6.8 and 5.3 percent (versus February's 6.4 and 5.4 percent).

US First-Quarter Employment Cost Index (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Quarter over Quarter: 1.1%

After 1.3 percent and 1.0 percent quarterly increases in the prior two quarters, forecasters see employment costs rising a heated 1.1 percent in the first quarter.

Canadian GDP for February (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month over Month: 0.8%

GDP for February is expected to rise 0.8 percent on the month versus a 0.2 percent rise in January. The annual growth rate in January was 3.5 percent.

China: CFLP Manufacturing PMI for April (Estimated: Sat 01:00 GMT; Sat 09:00 CEST; Fri 21:00 EDT)

Consensus Forecast: 49.1

The CFLP manufacturing PMI, at 49.5 in March, slipped back into contraction as expected due to Covid restrictions. April's consensus is for more of the same at a sub-50 level of 49.1.

|