|

Ukraine's effects on the global economy are still unfolding, still uncertain. Data for the month of March are beginning to come in and the results so far have been mixed: consumer sentiment is mostly sinking in contrast to business activity and sentiment which are stable if not improving, at least apart from China. March employment data so far have been positive with Germany's unemployment rate holding steady at 5.0 percent and the US rate slipping another 2 tenths to 3.6 percent. Not slipping, of course, is inflation which, everywhere you look, is surging, as it is in the Eurozone.

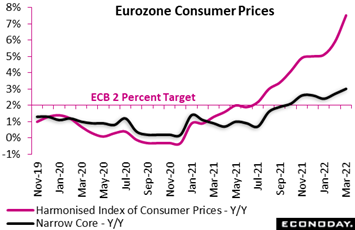

Inflation once again overshot expectations by a wide margin in March. A flash 7.5 percent annual rate was 1.6 percentage points above February's 5.9 percent final print to exceed the consensus by nearly a full percentage point. The headline rate now stands at yet another new record high and fully 5.5 percentage points above the ECB's 2 percent target. Inevitably it was energy again (44.7 percent after 32.0 percent) that did most of the damage with food, alcohol and tobacco (5.0 percent after 4.2 percent) also lifting the headline. The narrow core, however, was less unruly though this too, at 3.0 percent, chalked up another all-time peak. Inflation once again overshot expectations by a wide margin in March. A flash 7.5 percent annual rate was 1.6 percentage points above February's 5.9 percent final print to exceed the consensus by nearly a full percentage point. The headline rate now stands at yet another new record high and fully 5.5 percentage points above the ECB's 2 percent target. Inevitably it was energy again (44.7 percent after 32.0 percent) that did most of the damage with food, alcohol and tobacco (5.0 percent after 4.2 percent) also lifting the headline. The narrow core, however, was less unruly though this too, at 3.0 percent, chalked up another all-time peak.

Regionally, German inflation jumped from 5.5 to 7.6 percent, from 4.2 to 5.1 percent in France, and in Italy from 6.2 to 7.0 percent. Spain came in at 9.8 percent, up from 7.6 percent. Two countries bordering Russia, Lithuania and Estonia, occupied the two hottest spots, at annual rates of 15.6 and 14.8 percent.

Yet another surprisingly strong inflation report adds to the policy dilemma at the European Central Bank. The hawks on the Governing Council will be all the more concerned that inflation is out of control, though the doves will note the sharp deterioration underway in business and consumer sentiment. This month's ECB meeting should prove very interesting.

Positives for the inflation outlook are hard to find but do include a lack of acceleration for producer prices going into Russia's attack, at least for Italy. Following January's record 12.4 percent monthly leap, Italy's PPI rose just 0.2 percent, trimming the annual inflation rate from 41.8 percent to 41.4 percent. This was the first decline in the yearly rate since May 2020. Energy prices, which fell 0.6 percent, helped to keep the overall monthly change in check. Elsewhere, consumer goods and capital goods rose 0.5 percent while intermediates were up 1.6 percent. Excluding energy the PPI increased a further 1.0 percent, boosting the underlying annual rate from 11.0 to 11.7 percent. Yet February's update represents little more than a lull before the next storm. Energy prices climbed sharply in March and, in line with the rest of Europe, PPI trends will help to ensure that consumer prices in Italy will continue to climb for some while yet. Positives for the inflation outlook are hard to find but do include a lack of acceleration for producer prices going into Russia's attack, at least for Italy. Following January's record 12.4 percent monthly leap, Italy's PPI rose just 0.2 percent, trimming the annual inflation rate from 41.8 percent to 41.4 percent. This was the first decline in the yearly rate since May 2020. Energy prices, which fell 0.6 percent, helped to keep the overall monthly change in check. Elsewhere, consumer goods and capital goods rose 0.5 percent while intermediates were up 1.6 percent. Excluding energy the PPI increased a further 1.0 percent, boosting the underlying annual rate from 11.0 to 11.7 percent. Yet February's update represents little more than a lull before the next storm. Energy prices climbed sharply in March and, in line with the rest of Europe, PPI trends will help to ensure that consumer prices in Italy will continue to climb for some while yet.

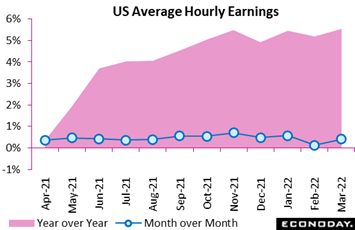

Helping to ensure that prices in the US will continue to climb are wage pressures. Average hourly earnings as tracked in the March employment report rose 0.4 percent on the month, lifting the annual rate to 5.6 percent from 5.2 percent. Jerome Powell is on the record saying wage pressures are the highest they've been in decades reflecting what he describes as a labor market that's "extremely tight". Nonfarm payrolls rose 431,000 in March, outsized on its own and following an upwardly revised 750,000 in February. Monthly payroll growth has averaged 600,000 over the past six months. For comparison, payroll growth averaged 198,000 per month in the 12 months heading into the 2020 pandemic. March's data are more likely than not to fuel expectations of more aggressive monetary tightening that could translate into a 50-basis-point rate hike as soon as the Fed's next policy meeting in early May. Helping to ensure that prices in the US will continue to climb are wage pressures. Average hourly earnings as tracked in the March employment report rose 0.4 percent on the month, lifting the annual rate to 5.6 percent from 5.2 percent. Jerome Powell is on the record saying wage pressures are the highest they've been in decades reflecting what he describes as a labor market that's "extremely tight". Nonfarm payrolls rose 431,000 in March, outsized on its own and following an upwardly revised 750,000 in February. Monthly payroll growth has averaged 600,000 over the past six months. For comparison, payroll growth averaged 198,000 per month in the 12 months heading into the 2020 pandemic. March's data are more likely than not to fuel expectations of more aggressive monetary tightening that could translate into a 50-basis-point rate hike as soon as the Fed's next policy meeting in early May.

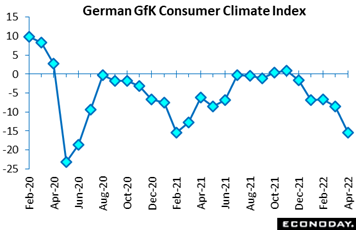

The March GfK survey points to deepening deterioration in German confidence. The consumer climate indicator was revised down 0.4 points to minus 8.5 in March for a nearly 2-point drop versus February, and is forecast to slide a full 7 points in April to minus 15.5 due to the war in Ukraine. April's predicted level, which has not been seen since some of the worst days of the pandemic, was more than 4 points weaker than the market consensus and nowhere close to normal levels of around 10. Following successive gains in January and February, economic expectations slumped 33 points in March to minus 8.9. This was their weakest outturn since May 2020 and compared with a 17.7 reading a year ago. In a similar vein, income expectations fell 25 points to minus 22.1, their worst level since January 2009 in the midst of the global financial crisis. However, the propensity to buy held up much better, sliding only 3.5 points to minus 2.1, albeit still its lowest mark since April 2020 and 14.4 points down on the year. The March GfK survey points to deepening deterioration in German confidence. The consumer climate indicator was revised down 0.4 points to minus 8.5 in March for a nearly 2-point drop versus February, and is forecast to slide a full 7 points in April to minus 15.5 due to the war in Ukraine. April's predicted level, which has not been seen since some of the worst days of the pandemic, was more than 4 points weaker than the market consensus and nowhere close to normal levels of around 10. Following successive gains in January and February, economic expectations slumped 33 points in March to minus 8.9. This was their weakest outturn since May 2020 and compared with a 17.7 reading a year ago. In a similar vein, income expectations fell 25 points to minus 22.1, their worst level since January 2009 in the midst of the global financial crisis. However, the propensity to buy held up much better, sliding only 3.5 points to minus 2.1, albeit still its lowest mark since April 2020 and 14.4 points down on the year.

Another recent survey by GfK on the consequences of the war in Ukraine found nine out of 10 Germans extremely or very concerned about the sharp rise underway in energy prices. In the case of groceries, the percentage of those concerned is 80 percent. Not helping confidence is the latest climb in Covid infections. Nationwide restrictions such as mask-wearing and vaccination requirements were lifted in March but high infection rates have forced several states to extend their measures into April. If sustained, the historically low level of consumer sentiment would almost certainly lead to a retrenchment in household spending. For now, consumption plans do not appear to have been impacted too negatively but should the war in Ukraine drag on and Covid restrictions remain in place, the picture could look very different.

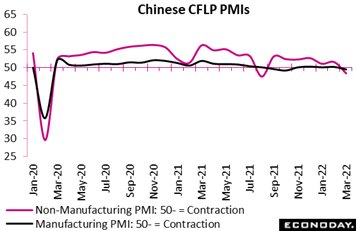

The pandemic right now is the big factor clouding the outlook for China. Official Chinese survey data indicate that the country's manufacturing sector contracted in March, with the headline CFLP index falling as expected to 49.5 from 50.2 in February. The CFLP non-manufacturing PMI also contracted, falling from 51.6 to a seven-month low of 48.4. Economic conditions in China remain heavily impacted by ongoing Covid outbreaks and strict public health restrictions put in place as part of the country's "Zero Covid" policy. Confirming the weakness is the Caixan manufacturing PMI which fell sharply from 50.4 in February to 48.1 in March for the sharpest pace of contraction since the onset of the pandemic in February 2020. The Ukraine invasion and ongoing supply-chain disruptions, not mention high energy prices, are also cited as factors weighing on activity and sentiment. This weakness looks set to continue in coming weeks, with a strict lockdown now in force in Shanghai that will likely strengthen the chances for additional policy easing by the People's Bank of China. Caixan's service PMI will be a highlight of the coming week's calendar. The pandemic right now is the big factor clouding the outlook for China. Official Chinese survey data indicate that the country's manufacturing sector contracted in March, with the headline CFLP index falling as expected to 49.5 from 50.2 in February. The CFLP non-manufacturing PMI also contracted, falling from 51.6 to a seven-month low of 48.4. Economic conditions in China remain heavily impacted by ongoing Covid outbreaks and strict public health restrictions put in place as part of the country's "Zero Covid" policy. Confirming the weakness is the Caixan manufacturing PMI which fell sharply from 50.4 in February to 48.1 in March for the sharpest pace of contraction since the onset of the pandemic in February 2020. The Ukraine invasion and ongoing supply-chain disruptions, not mention high energy prices, are also cited as factors weighing on activity and sentiment. This weakness looks set to continue in coming weeks, with a strict lockdown now in force in Shanghai that will likely strengthen the chances for additional policy easing by the People's Bank of China. Caixan's service PMI will be a highlight of the coming week's calendar.

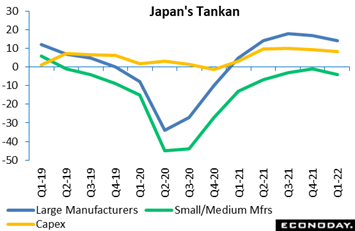

Covid is less of a factor right now for Japan though confidence as measured by the Tankan report slipped in the latest quarterly survey. The diffusion index for large manufacturers dipped to 14 in March from 17 in the December survey, while the index for smaller manufacturers stood at minus 4, down from minus 1. Yet these results were a little better than expected, especially given the spike in costs triggered by the war in Ukraine together with persistent chip shortages and supply constraints. How much the results fully reflect the impact of the March 16 earthquake that rocked northeastern Japan is unclear, causing Toyota and others to temporarily halt some factory operations due to damage to their parts suppliers and also forcing businesses and households to conserve energy to avert a blackout for the Tokyo metropolitan area. The survey also showed that large companies have turned more cautious about their capital investment for fiscal 2021 while smaller firms revised down their capex plans, failing to make their usual upward revisions toward the March 31 end of the fiscal year. Covid is less of a factor right now for Japan though confidence as measured by the Tankan report slipped in the latest quarterly survey. The diffusion index for large manufacturers dipped to 14 in March from 17 in the December survey, while the index for smaller manufacturers stood at minus 4, down from minus 1. Yet these results were a little better than expected, especially given the spike in costs triggered by the war in Ukraine together with persistent chip shortages and supply constraints. How much the results fully reflect the impact of the March 16 earthquake that rocked northeastern Japan is unclear, causing Toyota and others to temporarily halt some factory operations due to damage to their parts suppliers and also forcing businesses and households to conserve energy to avert a blackout for the Tokyo metropolitan area. The survey also showed that large companies have turned more cautious about their capital investment for fiscal 2021 while smaller firms revised down their capex plans, failing to make their usual upward revisions toward the March 31 end of the fiscal year.

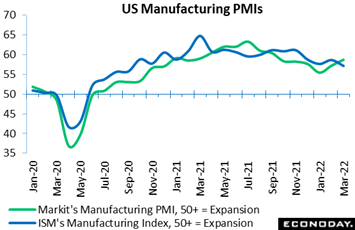

Like Japan, Covid is less of a factor for the US though Ukraine, of course, is an increasing one. How much the war is affecting US manufacturing is uncertain based on the separate results of the ISM and Markit PMI surveys. The ISM index slipped a point-and-a-half to a 57.1 level that missed Econoday's consensus by nearly 2 full points and is the lowest reading since September 2020. Surging energy and commodity prices triggered by Russia's invasion pulled down the index to offset what are easing concerns over supply constraints. Ominously, new orders fell very sharply, by 7.9 points to a 53.8 level that nevertheless remains above 50 to indicate monthly growth, just a sharply slower rate of growth. In contrast to the ISM, the manufacturing PMI actually accelerated in March, and especially at month end. This index ended March at 58.8, a six-month high and up a point-and-a-half from February and up 3 tenths from mid-month March, the latter comparison pointing to a month-end rate over 59. New orders are accelerating boosted by both domestic demand and, for this sample, export demand as well; backlog orders are building and the pace of output, benefiting from fewer supply snags, is rising. Employment is also rising as qualified workers are now, according to the PMI sample, more available. And Ukraine isn't hurting the sample's confidence. On the contrary, optimism among the sample has never been brighter. How Ukraine plays out in US economic data is anybody's guess right now. Like Japan, Covid is less of a factor for the US though Ukraine, of course, is an increasing one. How much the war is affecting US manufacturing is uncertain based on the separate results of the ISM and Markit PMI surveys. The ISM index slipped a point-and-a-half to a 57.1 level that missed Econoday's consensus by nearly 2 full points and is the lowest reading since September 2020. Surging energy and commodity prices triggered by Russia's invasion pulled down the index to offset what are easing concerns over supply constraints. Ominously, new orders fell very sharply, by 7.9 points to a 53.8 level that nevertheless remains above 50 to indicate monthly growth, just a sharply slower rate of growth. In contrast to the ISM, the manufacturing PMI actually accelerated in March, and especially at month end. This index ended March at 58.8, a six-month high and up a point-and-a-half from February and up 3 tenths from mid-month March, the latter comparison pointing to a month-end rate over 59. New orders are accelerating boosted by both domestic demand and, for this sample, export demand as well; backlog orders are building and the pace of output, benefiting from fewer supply snags, is rising. Employment is also rising as qualified workers are now, according to the PMI sample, more available. And Ukraine isn't hurting the sample's confidence. On the contrary, optimism among the sample has never been brighter. How Ukraine plays out in US economic data is anybody's guess right now.

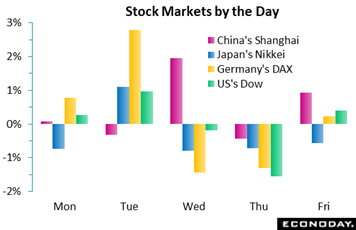

Asian risk appetite was dented on Monday by China’s partial lockdown in Shanghai and new worries about supply chain trouble. In the UK Bank of England Governor Andrew Bailey warned of a big hit to growth from rising oil prices. Markets in Europe got a lift Tuesday on reports that Russia would reduce its military activity near Kyiv, news in addition to other seemingly positive comments from negotiators on both sides. Growth stocks outperformed led by technology while defensive sectors lagged; Bitcoin and crypto assets surged for a second straight day, in a sign of renewed risk-taking. Asian risk appetite was dented on Monday by China’s partial lockdown in Shanghai and new worries about supply chain trouble. In the UK Bank of England Governor Andrew Bailey warned of a big hit to growth from rising oil prices. Markets in Europe got a lift Tuesday on reports that Russia would reduce its military activity near Kyiv, news in addition to other seemingly positive comments from negotiators on both sides. Growth stocks outperformed led by technology while defensive sectors lagged; Bitcoin and crypto assets surged for a second straight day, in a sign of renewed risk-taking.

Hopes for progress on Ukraine peace talks and expectations for Chinese policy stimulus bolstered Chinese equities. Property and banking stocks advanced after reports suggesting regional Chinese regulators would ease restrictions on property prices. But in Japan, yen strength and outflows from stocks entering their ex-dividend period undercut the Nikkei as markets as did a weaker-than-expected Japanese retail sales data. In Europe, news that Germany and Austria were warning of natural gas rationing added to a bearish mood, along with German and UK inflation readings that exceeded expectations.

Chinese stocks were hurt by news that the US Securities and Exchange Commission has added new names to its list of US-listed Chinese firms failing to meet its disclosure requirements. News that China’s manufacturing sector contracted in March was another negative. Putin's demand that Russian oil be purchased in rubles aggravated concerns about supply disruptions, offset in part by news the US would release up to 180 million barrels of oil from its reserves. Other US news included a batch of hawkish comments from Federal Reserve officials, including Federal Open Market Committee voter Esther George who renewed expectations for a series of 50-basis point rate hikes starting in May. Chinese tech stocks bounced back Friday on reports suggesting the US and China would compromise on audit rules. The very strong and mostly as-expected US employment had little impact.

Canada remains on top of Econoday's consensus divergence scores at plus 50, holding unchanged from the prior week as the country's GDP in January, though modest at monthly growth of 0.2 percent, hit expectations. The weak PMIs for China were not substantially weaker than expected, helping China to hold at 38, while Switzerland, at 28, got a lift from much stronger-than-expected SVME PMI data that point to significant acceleration underway in the country's business activity. A jump in retail sales also helped the Swiss score.

Japan data were missing expectations in the week though the country's score, at 20, got a lift from the rolling off of especially disappointing results in prior weeks. At 17, UK data included a better-than-expected fourth-quarter GDP revision and hotter-than-expected house prices as tracked by Nationwide.

Data from both France at 8 and Italy at minus 10 are roughly hitting expectations as is German data at minus 11; unemployment came in as expected while weaker-than-expected results for Germany's GfK consumer climate and retail sales reports were offset by the country's excessively overheated CPI (the latter perhaps betraying troubles for the real economy). Pulled down by the ISM, the US ended the week at minus 21, while the Eurozone, at minus 27, would be even further behind the pack if not for the sky high HICP. EC economic sentiment, the continent's unemployment data and manufacturing PMI all missed the mark during the week.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Monetary policy will be highlighted by the Reserve Bank of Australia which will make an announcement on Tuesday. Though no change in rates is expected, the RBA's statement could be adjusted to signal a greater chance of a rate hike later in the year. On Friday, the Bank of India will also make an announcement with no change expected, this despite global price pressures on food and fuel. Inflation data will be limited to European producer prices on Monday and Korean consumer prices on Tuesday, with employment data set for the Swiss unemployment rate on Thursday and the Canadian labour force survey on Friday, the latter expected to show a sizable employment gain for the month of March. Germany will post manufacturers' orders on Wednesday and industrial production on Thursday with France to post industrial production on Tuesday. Consumer data will include Japanese household spending on Tuesday and Eurozone retail sales on Thursday. Other reports to watch: Canadian trade data on Tuesday, US ISM services also on Tuesday, and Caixan's services PMI for China on Wednesday.

Eurozone PPI for February (Mon 09:00 GMT; Mon 11:00 CEST; Mon 05:00 EDT)

Consensus Forecast, Month over Month: 1.3%

Consensus Forecast, Year over Year: 31.6%

Producer prices in February are expected to rise a monthly 1.3 percent versus a 5.2 percent spike in January with the annual rate seen at 31.6 percent versus 30.6 percent.

Korean CPI for March (Mon 23:00 GMT; Tue 08:00 KST; Mon 19:00 EDT)

Consensus Forecast, Year over Year: 4.0%

Annual CPI is expected to accelerate to 4.0 percent in March versus 3.7 percent in February.

Japanese Household Spending for February (Mon 23:30 GMT; Tue 08:30 JST; Mon 19:30 EDT)

Consensus Forecast , Month over Month: -1.5%

Consensus Forecast , Year over Year: 2.7%

Household spending is expected to decrease 1.5 percent on the month for a 2.7 percent increase on the year in February. Retail sales for February, which have already been released, were down 0.8 percent on both the month and the year.

Reserve Bank of Australia Announcement (Tue 04:30 GMT; Tue 14:30 AEST; Tue 00:30 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.10%

Though the Reserve Bank of Australia is not expected to change its policy rate of 0.10 percent, the statement could heat up expectations for a rate hike later in the year.

French Industrial Production for February (Tue 06:45 GMT; Tue 08:45 CEST; Tue 02:45 EDT)

Consensus Forecast, Month over Month: -0.5%

Industrial production is expected to fall 0.5 percent on the month in February following a better-than-expected 1.6 percent rise in January.

Canada Merchandise Trade Balance for February (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast: C$2.55 billion

For the month of February and the effects of the trucker blockade, Canada is expected to post a surplus of C$2.55 billion versus a January surplus of C$2.618 billion.

US: ISM Services Index for March (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 58.5

The ISM services PMI, at 56.5 in February, was solid but slowing going into the Ukraine crisis. March's consensus is re-acceleration to 58.5.

China: Caixin Services PMI for March (Wed 00:45 GMT; Wed 09:45 CST; Tue 20:45 EDT)

Consensus Forecast: 49.6

March's Caixan services PMI is expected to ease to 49.6 versus 50.2 in February.

German Manufacturers' Orders for February (Wed 06:00 GMT; Wed 08:00 CEST; Wed 02:00 EDT)

Consensus Forecast, Month over Month: -0.2%

Consensus Forecast, Year over Year: 6.1%

Manufacturers' orders have risen the last three reports to easily beat expectations each time. After January's 1.8 percent monthly gain, forecasters see a 0.2 percent decrease for February.

Swiss Unemployment Rate for March (Thu 05:45 GMT; Thu 07:45 CEST; Thu 1:45 EDT)

Consensus Forecast, Adjusted: 2.2%

The Swiss unemployment rate has been steadily falling. For March the adjusted rate is expected to hold unchanged at 2.2 percent.

German Industrial Production for February (Thu 06:00 GMT; Thu 08:00 CEST; Thu 02:00 EDT)

Consensus Forecast, Month over Month: -0.2%

Industrial production is expected to fall 0.2 percent in February after rising a surprisingly strong 2.7 percent in January.

Eurozone Retail Sales for February (Thu 09:00 GMT; Thu 11:00 CEST; Thu 05:00 EDT)

Consensus Forecast, Month over Month: 0.6%

Consensus Forecast, Year over Year: 6.2%

Retail sales have substantially missed expectations the past two reports, rising only 0.2 percent in January after falling 2.7 percent in December. A 0.6 percent monthly increase is expected for February.

Reserve Bank of India Announcement (Friday local time)

Consensus Change: 0.0 basis points

Consensus Level: 4.00%

The Reserve Bank of India is not expected to change its 4.00 percent policy rate. At the last meeting in February, the RBI downgraded its outlook saying the domestic recovery was "yet to be broad-based" and that a favorable harvest would drive down headline inflation.

Canadian Labour Force Survey for March (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Employment Change: 100,000

Employment data have been volatile, falling 200,100 in January and then jumping 336,600 in February. March's expectations are a gain of 100,000.

|