|

However much the Ukraine crisis looks to raise energy and food prices and intensify supply dislocations, hawkish rhetoric won't be the theme from central banks that may well limit their inevitable rate increases to careful increments. Jerome Powell at his semiannual testimony said the US Federal Reserve will move "carefully and nimbly," stressing it can't be known how the invasion of Ukraine has changed the policy outlook. Powell said he is inclined to argue for an incremental 25-basis point hike at the bank's March 15-16 policy meeting. Last week we saw a limited hike from the Reserve Bank of New Zealand and no action at all from the Bank of Korea, a combination repeated this week from two other central banks.

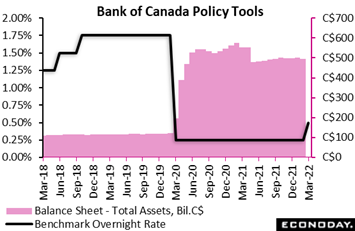

The Bank of Canada on Wednesday raised its policy rate to 0.50 percent from its record low 0.25 percent, its first rate hike since October 2018 as it seeks to cool off decades-high inflation and a hot housing market by gradually removing monetary stimulus. "As the economy continues to expand and inflation pressures remain elevated, the Governing Council expects interest rates will need to rise further," the bank projected. The bank will also be considering when to end the reinvestment phase and allow its holdings of Canadian government bonds to begin to shrink. The resulting quantitative tightening (QT) would complement increases in the policy interest rate. The Bank of Canada on Wednesday raised its policy rate to 0.50 percent from its record low 0.25 percent, its first rate hike since October 2018 as it seeks to cool off decades-high inflation and a hot housing market by gradually removing monetary stimulus. "As the economy continues to expand and inflation pressures remain elevated, the Governing Council expects interest rates will need to rise further," the bank projected. The bank will also be considering when to end the reinvestment phase and allow its holdings of Canadian government bonds to begin to shrink. The resulting quantitative tightening (QT) would complement increases in the policy interest rate.

The unprovoked invasion of Ukraine by Russia is "a major new source of uncertainty," the bank said. Energy and other commodities prices have risen sharply, adding to global inflation, and "negative impacts on confidence and new supply disruptions could weigh on global growth," the BoC warned. "The timing and pace of further increases in the policy rate, and the start of QT, will be guided by the bank's ongoing assessment of the economy and its commitment to achieving the 2 percent inflation target."

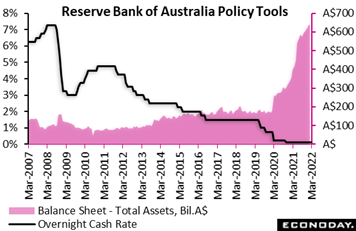

Even more cautious was the Reserve Bank of Australia which on Tuesday left its main policy rate, the cash rate, unchanged at a record low of 0.10 percent. Though Ukraine is a major uncertainty, officials remain confident that the domestic economy is sound and will recover quickly from the recent impact of the Omicron variant. They forecast GDP to grow by 4.25 percent in 2022 and 2.0 percent in 2023. They also retained their view that wage inflation will build gradually, forecasting that underlying inflation will increase further in coming quarters to around 3.25 percent, before declining to around 2.75 percent over 2023. RBA officials have consistently advised that they are "committed to maintaining highly supportive monetary conditions" and that they will not increase the cash rate until actual inflation is "sustainably" within their target range of 2 to 3 percent. Even more cautious was the Reserve Bank of Australia which on Tuesday left its main policy rate, the cash rate, unchanged at a record low of 0.10 percent. Though Ukraine is a major uncertainty, officials remain confident that the domestic economy is sound and will recover quickly from the recent impact of the Omicron variant. They forecast GDP to grow by 4.25 percent in 2022 and 2.0 percent in 2023. They also retained their view that wage inflation will build gradually, forecasting that underlying inflation will increase further in coming quarters to around 3.25 percent, before declining to around 2.75 percent over 2023. RBA officials have consistently advised that they are "committed to maintaining highly supportive monetary conditions" and that they will not increase the cash rate until actual inflation is "sustainably" within their target range of 2 to 3 percent.

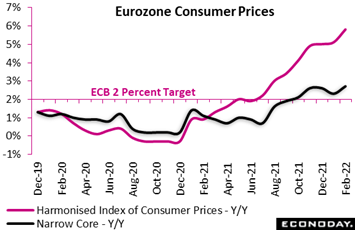

Inflation in the Eurozone again overshot expectations by a wide margin. February's 5.8 percent annual rate was up 0.7 percentage points versus January and 0.5 points stronger than the market consensus. The headline rate now stands at a new record high and nearly 4 percentage points above the European Central Bank's 2 percent target. The core rate was slightly better behaved but this too chalked up a fresh all-time peak. At 2.7 percent, the narrow gauge was up from 2.4 percent at the start of the year and 1.6 percentage points higher than in February 2021 The rate for non-energy industrial goods rose 0.9 percentage points to 3.0 percent while its services counterpart climbed 0.2 percentage points to 2.5 percent. Elsewhere, energy (31.7 percent after 28.8 percent) and food, alcohol and tobacco (4.1 percent after 3.5 percent) again inflated the headline rate. Inflation in the Eurozone again overshot expectations by a wide margin. February's 5.8 percent annual rate was up 0.7 percentage points versus January and 0.5 points stronger than the market consensus. The headline rate now stands at a new record high and nearly 4 percentage points above the European Central Bank's 2 percent target. The core rate was slightly better behaved but this too chalked up a fresh all-time peak. At 2.7 percent, the narrow gauge was up from 2.4 percent at the start of the year and 1.6 percentage points higher than in February 2021 The rate for non-energy industrial goods rose 0.9 percentage points to 3.0 percent while its services counterpart climbed 0.2 percentage points to 2.5 percent. Elsewhere, energy (31.7 percent after 28.8 percent) and food, alcohol and tobacco (4.1 percent after 3.5 percent) again inflated the headline rate.

Regionally, inflation in Germany jumped from 5.1 percent to 5.5 percent while the rate in France rose from 3.3 to 4.1 percent and in Italy from 5.1 to 6.2 percent. Spain weighed in at fully 7.5 percent, up from 6.2 percent. Inflation was also higher in all other member states. February's unexpectedly strong results continue to be dominated by energy and the spike in oil prices prompted by the Ukraine crisis will probably ensure more of the same this month. Yet core rates are clearly accelerating too which will not sit at all well with the ECB's hawks. As such and Ukraine aside, February's report may well widen the policy cracks on the Governing Council still further.

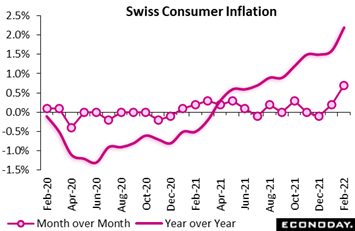

In line with the rest of Europe, consumer prices in Switzerland rose much more sharply than expected in February. A 0.7 percent monthly spike was more than three times the market consensus and lifted the annual inflation rate by fully 0.6 percentage points to 2.2 percent. This was the first time that the 2 percent mark has been breached since October 2008. Domestic prices were up 0.4 percent versus January, raising their yearly rate by also 0.4 percentage points to 1.3 percent. However, it was import prices that again did most of the damage, climbing 1.4 percent to put their annual rate at 4.9 percent, up nearly a full percentage point from last time. In line with the rest of Europe, consumer prices in Switzerland rose much more sharply than expected in February. A 0.7 percent monthly spike was more than three times the market consensus and lifted the annual inflation rate by fully 0.6 percentage points to 2.2 percent. This was the first time that the 2 percent mark has been breached since October 2008. Domestic prices were up 0.4 percent versus January, raising their yearly rate by also 0.4 percentage points to 1.3 percent. However, it was import prices that again did most of the damage, climbing 1.4 percent to put their annual rate at 4.9 percent, up nearly a full percentage point from last time.

Within the CPI basket, the main boost to the headline monthly change inevitably came from petroleum products (6.1 percent) which alone added almost 0.2 percentage points. Other sizeable contributions were made by clothing and footwear (3.3 percent) and household goods and services (1.6 percent). There were no monthly declines among the major categories. As a result, core prices (excluding unprocessed food and energy) increased a steep 0.6 percent, enough to lift the annual underlying rate from 0.8 to 1.3 percent, equaling its highest reading since September 2009. Yet this rate remains relatively well contained, in no small part due to the strength of the Swiss franc. Nonetheless, with energy and other commodity prices taking off this month on the back of the Ukraine invasion, March is likely to see both headline and core inflation move up again.

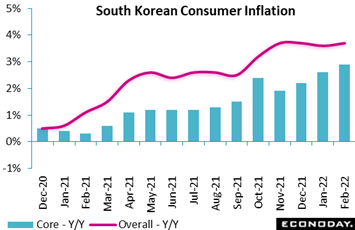

Inflation in Asia has generally been less alarming but, in South Korea as well as Australia and New Zealand, pressures are building. South Korea's headline consumer price index rose 3.7 percent on the year in February, up slightly from an increase of 3.6 percent in January and, for the 11th consecutive month, remaining well above the Bank of Korea's 2 percent target. The index advanced 0.6 percent on the month, as it did previously. Although the year-over-year increase in food prices slowed from 5.5 percent to 3.6 percent, this was offset by stronger year-over-year increases in utilities costs and transport prices. Underlying price pressures also picked up in February. Core CPI, excluding food and energy, rose 0.4 percent on the month after increasing 0.6 percent previously, with year-over-year growth increasing from 2.6 percent to 2.9 percent, its highest level since 2015. Most categories of spending recorded stronger price increases. Inflation in Asia has generally been less alarming but, in South Korea as well as Australia and New Zealand, pressures are building. South Korea's headline consumer price index rose 3.7 percent on the year in February, up slightly from an increase of 3.6 percent in January and, for the 11th consecutive month, remaining well above the Bank of Korea's 2 percent target. The index advanced 0.6 percent on the month, as it did previously. Although the year-over-year increase in food prices slowed from 5.5 percent to 3.6 percent, this was offset by stronger year-over-year increases in utilities costs and transport prices. Underlying price pressures also picked up in February. Core CPI, excluding food and energy, rose 0.4 percent on the month after increasing 0.6 percent previously, with year-over-year growth increasing from 2.6 percent to 2.9 percent, its highest level since 2015. Most categories of spending recorded stronger price increases.

At last week's Bank of Korea meeting, officials left the main policy rate unchanged at 1.25 percent after increasing it by 25 basis points in each off the previous three meetings. Officials noted that volatility in global financial markets has increased in response to the Ukraine crisis and concerns about the likely pace of policy tightening by the Federal Reserve, but they also advised that they will "appropriately adjust the degree of policy accommodation" to meet their growth and inflation objectives. Officials also revised up their assessment of the inflation outlook from that made at their prior meeting in January. Officials now see it running "substantially above 3.0 percent for a considerable time" compared with their previous view that it would "run in the 3.0 percent range for a considerable time".

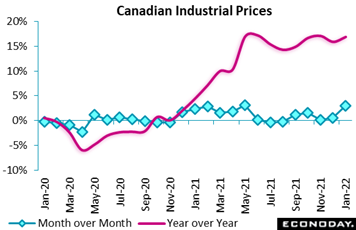

How high consumer inflation runs will ultimately depend on whether pressures at the producer level can stabilize. Russia's invasion is putting this outlook at risk. Global data for producer prices generally lag those for consumer prices but data coming in for January are largely unfavorable. In a fifth consecutive monthly advance, industrial product prices in Canada surged 3.0 percent, the largest gain since May 2021, bringing the 12-month rate to 16.9 percent. Excluding a 9.5 percent increase in energy and petroleum product prices, the IPPI was still up 2.4 percent on the month and 14.1 percent from a year earlier. All industrial groups posted higher prices on the month and year-over-year, except for machinery and equipment, which was flat from December. The monthly price appreciation was driven by refined petroleum energy products, up 10.6 percent on the month and 48.0 percent year-over-year, and lumber and other sawmill products, which rose 14.6 percent on the month and 15.0 percent from January 2021. In particular, strong wood demand for residential construction in Canada and the United States combined with limited supply and supply chain constraints to push softwood lumber prices higher. These results, which precede February's trucker blockade, suggest that inflationary pressures continued to build which should confirm the Bank of Canada, which next meets in mid-April, in its goal to rein in inflation. How high consumer inflation runs will ultimately depend on whether pressures at the producer level can stabilize. Russia's invasion is putting this outlook at risk. Global data for producer prices generally lag those for consumer prices but data coming in for January are largely unfavorable. In a fifth consecutive monthly advance, industrial product prices in Canada surged 3.0 percent, the largest gain since May 2021, bringing the 12-month rate to 16.9 percent. Excluding a 9.5 percent increase in energy and petroleum product prices, the IPPI was still up 2.4 percent on the month and 14.1 percent from a year earlier. All industrial groups posted higher prices on the month and year-over-year, except for machinery and equipment, which was flat from December. The monthly price appreciation was driven by refined petroleum energy products, up 10.6 percent on the month and 48.0 percent year-over-year, and lumber and other sawmill products, which rose 14.6 percent on the month and 15.0 percent from January 2021. In particular, strong wood demand for residential construction in Canada and the United States combined with limited supply and supply chain constraints to push softwood lumber prices higher. These results, which precede February's trucker blockade, suggest that inflationary pressures continued to build which should confirm the Bank of Canada, which next meets in mid-April, in its goal to rein in inflation.

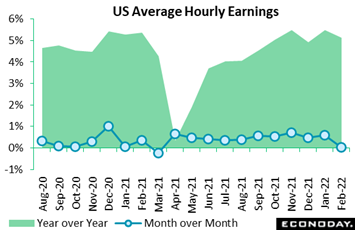

But not all inflation readings were building going into the Ukraine crisis, at least not wages in the US. Average hourly earnings were expected to jump 0.5 percent on the month but came in unchanged instead with the year-over-year rate falling 6 tenths to 5.1 percent versus expectations for 5.8 percent. These results could point to less wage-push risk were it not for the extraordinary strength of the report overall, showing a very substantial 678,000 rise in nonfarm payrolls, a result that exceeded Econoday's high estimate for a second straight month. The unemployment rate fell 2 tenths to 3.8 percent, which is very low for the US, while the participation rate rose 1 tenth to 62.3 percent, both pointing to acceleration in the American labor market. Yet climbing oil prices tied to the Ukraine crisis could weigh on business confidence and the global economic outlook, in turn weighing on hiring as well. But not all inflation readings were building going into the Ukraine crisis, at least not wages in the US. Average hourly earnings were expected to jump 0.5 percent on the month but came in unchanged instead with the year-over-year rate falling 6 tenths to 5.1 percent versus expectations for 5.8 percent. These results could point to less wage-push risk were it not for the extraordinary strength of the report overall, showing a very substantial 678,000 rise in nonfarm payrolls, a result that exceeded Econoday's high estimate for a second straight month. The unemployment rate fell 2 tenths to 3.8 percent, which is very low for the US, while the participation rate rose 1 tenth to 62.3 percent, both pointing to acceleration in the American labor market. Yet climbing oil prices tied to the Ukraine crisis could weigh on business confidence and the global economic outlook, in turn weighing on hiring as well.

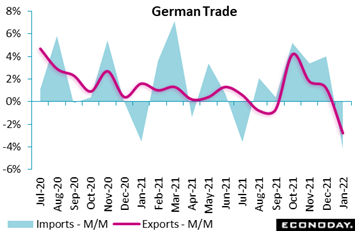

The increasing exclusion of Russia from global commerce, as well disruptions in Ukraine, will further dislocate supply chains. International trade has been having a rough time, whether tariff wars in the Trump years or Brexit. Going into the Ukraine crisis, German trade was uneven. Though the country's merchandise trade surplus rose in January, up €1.3 billion to €9.4 billion, the rise masked contraction on both sides of the ledger. Exports fell 2.8 percent on the month, their first decline since September, while imports dropped a steeper 4.2 percent, their first setback since last July. Exports to non-EU countries increased a monthly 6.2 percent while imports were down 1.3 percent. Comparable figures for trade with the UK were down 2.4 percent and 0.4 percent respectively, suggesting that Brexit is still denting total trade flows across the Channel. Note that German exports to the Russian Federation, in data that proceeded the catastrophe, rose 14.4 percent to €2.6 billion while imports were up 18.9 percent at €3.9 billion. The increasing exclusion of Russia from global commerce, as well disruptions in Ukraine, will further dislocate supply chains. International trade has been having a rough time, whether tariff wars in the Trump years or Brexit. Going into the Ukraine crisis, German trade was uneven. Though the country's merchandise trade surplus rose in January, up €1.3 billion to €9.4 billion, the rise masked contraction on both sides of the ledger. Exports fell 2.8 percent on the month, their first decline since September, while imports dropped a steeper 4.2 percent, their first setback since last July. Exports to non-EU countries increased a monthly 6.2 percent while imports were down 1.3 percent. Comparable figures for trade with the UK were down 2.4 percent and 0.4 percent respectively, suggesting that Brexit is still denting total trade flows across the Channel. Note that German exports to the Russian Federation, in data that proceeded the catastrophe, rose 14.4 percent to €2.6 billion while imports were up 18.9 percent at €3.9 billion.

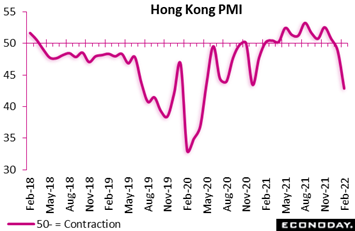

We'll end the week's data rundown with a look at an economy that is being hit by Covid. Hong Kong's PMI indicates the city-state's economy contracted for the second consecutive month and at a significantly sharper pace in February, with the survey's headline index falling to 42.9 from 48.9 in January. This is the lowest level since April 2020 during the initial stages of the pandemic. Hong Kong authorities have in recent weeks tightened already very strict public health restrictions in response to the Omicron variant; the impact on economic activity and sentiment seems likely to persist for some time. Survey respondents reported that output, new orders, and new export orders all fell at a sharper pace in February, with demand from mainland China also weakening further. Respondents also reported a fall in payrolls. The survey's measure of business confidence fell to a 13-month low. The survey shows weaker growth in input costs and that respondents lowered their selling prices in an effort to boost sales. We'll end the week's data rundown with a look at an economy that is being hit by Covid. Hong Kong's PMI indicates the city-state's economy contracted for the second consecutive month and at a significantly sharper pace in February, with the survey's headline index falling to 42.9 from 48.9 in January. This is the lowest level since April 2020 during the initial stages of the pandemic. Hong Kong authorities have in recent weeks tightened already very strict public health restrictions in response to the Omicron variant; the impact on economic activity and sentiment seems likely to persist for some time. Survey respondents reported that output, new orders, and new export orders all fell at a sharper pace in February, with demand from mainland China also weakening further. Respondents also reported a fall in payrolls. The survey's measure of business confidence fell to a 13-month low. The survey shows weaker growth in input costs and that respondents lowered their selling prices in an effort to boost sales.

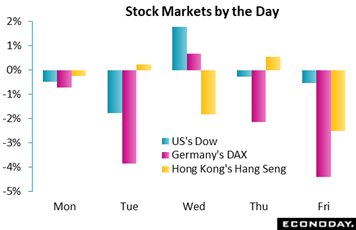

Asia/Pacific markets recovered early declines on Monday on a report that Ukraine and Russia would hold talks. Earlier equities had declined on news that Putin had raised Russia’s level of nuclear alert. BP dropped 7.4 percent on Monday after it announced it would exit from its stake in Roseneft, the Russian-state-controlled energy giant, which fell 42 percent in London trading. Gazprom, another state-controlled energy company, dropped 53 percent as Royal Dutch Shell followed suit. Asia/Pacific markets recovered early declines on Monday on a report that Ukraine and Russia would hold talks. Earlier equities had declined on news that Putin had raised Russia’s level of nuclear alert. BP dropped 7.4 percent on Monday after it announced it would exit from its stake in Roseneft, the Russian-state-controlled energy giant, which fell 42 percent in London trading. Gazprom, another state-controlled energy company, dropped 53 percent as Royal Dutch Shell followed suit.

Investors resumed their flight from risk Tuesday as Russia stepped up its attacks. Travel & leisure, banks, and autos & parts led the selloff. Airlines were hit by travel disruptions including the closure of Russian airspace. Banks were hit by declines in market interest rates as investors pushed back expectations for ECB rate hikes to next year. Autos & parts sold off on supply chain disruptions, rising commodities prices and expectations for weaker demand.

Highly-valued tech stocks and electric vehicles lagged on Wednesday in Hong Kong as the Hang Seng index dropped 1.8 percent. Uncertainty over the Hong Kong government's plans to impose restrictions or other steps to cope with rising Covid deaths added to negative sentiment. Powell on Wednesday affirmed he would ask for a 25-basis point rate increase at the Fed's policy meeting in two weeks, but expressed caution about fallout from the Ukraine crisis and suggested the Fed would move cautiously after what looks to be an approaching rate hike. Investors seized on headlines suggesting Russian and Ukrainian officials were prepared to resume talks, as some investors bought into the narrative that oil prices are peaking and the Ukraine crisis would recede. Bond yields rose sharply as cyclicals rallied including financials, materials, and industrials as investors moved back into stocks.

Ukraine worries hit European equities again on Thursday as commodity prices rose and stagflation fears increased. Disappointment over lack of progress in Russia-Ukraine peace talks hit risk assets, along with gloomy comments from French President Emmanuel Macron after a telephone call with Putin. Equities also reacted badly to reports showing Russia was making progress in its assault, with refugees fleeing to the West in huge numbers. Oil prices retreated from highs amid speculation that Iran could soon reach a nuclear deal with the West and restore its oil output to global markets.

Missiles fired at a Ukrainian nuclear plant triggered sell-offs on Friday. Markets mostly looked past better-than-expected monthly US employment figures as Russia's war on Ukraine obliterates other concerns. Investors are focusing on the effects of anti-Russia sanctions, Russian retaliation, soaring commodities prices, and supply chain disruptions.

Economists are accurately forecasting global results as the bulk of the world's major economies are within a 15 point plus-or-minus corridor of zero on Econoday's consensus divergence index. Switzerland at 17 stands just above this group though the strength is deceptive and price-related, reflecting the unexpected jump in the country's CPI. Canada is on the other side, but just marginally at minus 18 reflecting underperformance going into the effects of the trucker strike, not to mention the effects of Ukraine that will be impacting economic data across the world.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

The European Central Bank's announcement on Thursday will offer an early look at how monetary policy is being shaped by the war in Ukraine. Adjustments to QE, not rates, may well be the bank's focus. Inflation data will be concentrated on Thursday: first Japanese PPI, then Chinese CPI and PPI, then the US CPI, the latter expected to show substantial pressure. Employment data will include the Swiss unemployment rate on Monday and then on Friday, Canada's labour force survey for February (a month of trucker-led dislocation).

An early assessment of how the Ukraine events are impacting consumer sentiment will be the University of Michigan's mid-month update on Friday. Other consumer data will include Japanese household spending on Thursday.

Supply-side data will begin with German manufacturers' orders on Monday, German industrial production on Tuesday, Italian industrial production on Wednesday, and UK industrial production on Friday as well as industrial production from India, also on Friday. Chinese trade data for the combined months of January and February are estimated for release on Monday; on Tuesday Canada will post January's merchandise trade balance (the month pre-dating trucker blockades). Also released will be a fiscal update from the US with the monthly Treasury statement on Thursday and monthly GDP from the UK on Friday.

Chinese Merchandise Trade Balance for January/February (Estimated for Monday local time, release time not set)

Consensus Forecast: US$99.5 billion

Consensus Forecast: Imports - Y/Y: 17.0%

Consensus Forecast: Exports - Y/Y: 15.0%

China's trade surplus usually beats expectations and did so substantially in December as exports, up 20.9 percent on the year, remained robust at the same time that imports, up 19.5 percent, slowed. Forecasters see a US$99.5 billion surplus for the 2-month period covering January and February which would compare with US$94.46 billion in the single month of December.

Swiss Unemployment Rate for February (Mon 06:45 GMT; Mon 07:45 CET; Mon 1:45 EST)

Consensus Forecast, Adjusted: 2.3%

The unemployment rate has been steadily falling and is expected to edge a further 1 tenth lower to 2.3 percent.

German Manufacturers' Orders for January (Mon 07:00 GMT; Mon 08:00 CET; Mon 02:00 EST)

Consensus Forecast, Month over Month: 0.9%

Consensus Forecast, Year over Year: 5.4%

Manufacturers' orders were in recovery at least before Ukraine, easily beating expectations the last two reports. After December's 2.8 percent monthly gain, forecasters see a 0.9 percent increase for January.

German Industrial Production for January (Tue 07:00 GMT; Tue 08:00 CET; Tue 02:00 EST)

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: -1.9%

Industrial production is expected to rise 0.5 percent on the month in January after slipping a disappointing 0.3 percent in December.

Canada Merchandise Trade Balance for January (Tue 13:30 GMT; Tue 08:30 EST)

Consensus Forecast: C$1.4 billion

For January, a month predating trucker blockades, Canada is expected to post a surplus of C$1.4 billion versus a fractional December deficit of C$0.14 billion that reflected a burst of cellphone imports.

Italian Industrial Production for January (Wed 09:00 GMT; Wed 10:00 CET; Wed 04:00 EST)

Consensus Forecast, Month over Month: 0.6%

Consensus Forecast, Year over Year: 5.0%

Industrial production, which fell 1.0 percent in December, is expected to rebound 0.6 percent in January.

Japanese Producer Price Index for February (Thu 00:50 GMT; Thu 08:50 JST; Wed 19:50 EST)

Consensus Forecast, Month over Month: 0.6%

Consensus Forecast, Year over Year: 8.7%

Producer prices are expected to rise 0.6 percent on the month in February for a year-over-year rate of 8.7 percent from 8.6 percent in January.

Chinese CPI for February (Thu 01:30 GMT; Thu 09:30 CST; Wed 20:30 EST)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 0.9%

Consumer prices are expected to rise 0.4 percent on the month in February for a very modest 0.9 percent year-over-year rate.

Chinese PPI for February (Thu 01:30 GMT; Thu 09:30 CST; Wed 20:30 EST)

Consensus Forecast, Year over Year: 9.0%

Producer prices are expected to rise at a 9.0 percent annual rate in February which would compare with 9.1 percent in January.

European Central Bank Announcement (Thu 12:45 GMT; Thu 13:45 CET; Thu 07:45 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.0%

Against the backdrop of Ukraine, the ECB is not expected to change rates, focusing squarely on QE. The PEPP should still end this month but while it looked likely that they would introduce an end-date for the APP, that may not play out. The general theme will likely be one of trying to keep markets calm, promising to provide as much liquidity as needed.

US CPI for February (Thu 13:30 GMT; Thu 08:30 EST)

Consensus Forecast, Month over Month: 0.7%

Consensus Forecast, Year over Year: 7.9%

US CPI Core, Less Food & Energy

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: 6.4%

Consumer prices have been extremely elevated and have been consistently exceeding expectations. January's 0.6 percent monthly increases for the overall headline and the core beat expectations by 1 tenth for both; February's consensus are gains of 0.7 percent and 0.5 percent for the core. Annual rates are seen at 7.9 and 6.4 percent which would compare with 7.5 and 6.0 percent.

US Treasury Statement for February (Thu 19:00 GMT; Thu 14:00 EST)

Consensus Forecast: -$124.0 billion

Forecasters see a $124.0 deficit in February that would compare with a year-ago February deficit of $310.9 billion. As of January (the fourth month of the government's fiscal year), the fiscal year-to-date deficit of $259.0 billion was 65 percent smaller than at the same time in the prior fiscal year.

Japanese Household Spending for January (Fri 00:30 GMT; Fri 08:30 JST; Thu 19:30 EST)

Consensus Forecast , Month over Month: -2.7%

Consensus Forecast , Year over Year: 3.6%

Household spending, which has missed expectations the last two reports, is expected to decrease 2.7 percent on the month in January for a 3.6 percent increase on the year. Retail sales for January, which have already been released, fell 1.9 percent on the month and were up 1.6 percent on the year.

UK Industrial Production for January (Fri 07:00 GMT; Fri 02:00 EST)

Consensus Forecast, Month over Month: 0.3%

Industrial production in January is expected to rise a monthly 0.3 percent. Production in December was a little stronger than anticipated, rising 0.3 percent on the month.

UK GDP for January (Fri 07:00 GMT; Fri 02:00 EST)

Consensus Forecast, Month over Month: 0.3%

GDP in the month of January is expected to rise 0.3 percent following an unexpected 0.2 percent dip in December.

India Industrial Production for January (Fri 12:00 GMT; Fri 17:30 IST; Fri 07:00 EST)

Consensus Forecast, Year over Year: 0.1%

Industrial production, which was up 0.4 percent on the year in December, is expected to rise 0.1 percent in January.

Canadian Labour Force Survey for February (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast: Employment Change: 125,000

Employment had been strong and consistently beating expectations before January's deep contraction of 200,100. February's consensus is for a 125,000 rebound.

US Consumer Sentiment Index, Preliminary March (Fri 15:00 GMT; Fri 10:00 EST)

Consensus Forecast: 61.7

Consumer sentiment has been moving deeper into long-term lows and no improvement is expected for March, at a consensus 61.7 versus 62.8 in February.

|