|

Bad news is bad news and nobody, especially President Recep Tayyip Erdogan, wants to be told how extreme inflation has become, at a 19-year high of 36.1 percent for Turkey in a result that cost the head of the country's statistics agency his job. But so far global inflation numbers have yet to cost the jobs of those who may actually be responsible: monetary and fiscal policy makers who, to underpin demand, have flooded the global economy with liquidity. But let's be fair, what choice did they have? Putting policy aside, Covid's disruption to the supply chain is of course a very visible source of inflation, the pace of which, as we'll see in the week's data, hasn't yet slowed. But the week's employment updates (outside of Canada) were extremely favorable, while the week's central-bank news was mixed, with some banks on one page and some on another. The latter is a central feature right now of the global economy that we'll explore with the week's policy announcements.

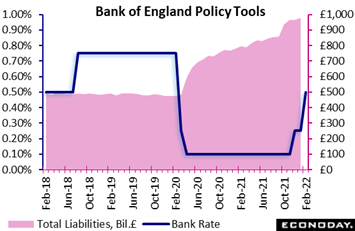

In the prior week we saw the US Federal Reserve turn to face inflation with the Bank of England in the latest week making the hawkish headlines. As widely expected, the BoE opted to raise Bank Rate by a further 25 basis points to 0.50 percent. This is the first time since 2004 that official rates have gone up at successive BoE meetings and so underlines the marked shift in the bank's view of where inflation is headed. And the hike could have been more severe as the incremental move only passed by one vote, 5 to 4; four members -- Jonathan Haskel, Catherine Mann, Dave Ramsden and Michael Saunders -- all wanted to see a larger 50-basis-point hike to 0.75 percent. In the prior week we saw the US Federal Reserve turn to face inflation with the Bank of England in the latest week making the hawkish headlines. As widely expected, the BoE opted to raise Bank Rate by a further 25 basis points to 0.50 percent. This is the first time since 2004 that official rates have gone up at successive BoE meetings and so underlines the marked shift in the bank's view of where inflation is headed. And the hike could have been more severe as the incremental move only passed by one vote, 5 to 4; four members -- Jonathan Haskel, Catherine Mann, Dave Ramsden and Michael Saunders -- all wanted to see a larger 50-basis-point hike to 0.75 percent.

The bank's QE programme was terminated at the end of last year in line with original plans but the latest announcement still has important implications for the bank's balance sheet. Although QE asset sales (Quantitative Tightening) will not start until Bank Rate has reached at least 1.0 percent, the 0.50 percent level marks the threshold for suspending the reinvestment of maturing QE assets, and this proposal received a unanimous 9-0 vote. The shift will see the balance shrink of its own accord, notably in March when nearly £28 billion of stock is due to run-off. The MPC similarly voted unanimously to begin reducing the stock of QE sterling non-financial investment-grade corporate bond purchases by ceasing to reinvest maturing assets and by a programme of corporate bond sales to be completed no earlier than towards the end of 2023. In other words, February's announcement should be viewed as more than just 25 basis points of tightening.

The fact that interest rates are going up again reflects official expectations that the UK economy is recovering quite strongly, notwithstanding Omicron effects, and that inflation pressures are still building. In particular, the previously forecast inflation peak of 6 percent in April, when the current cap on domestic energy bills is reviewed, has been raised to some 7 percent. Crucially too, the bank expects wage growth, already above pre-pandemic levels, to accelerate further due to a tight labour market.

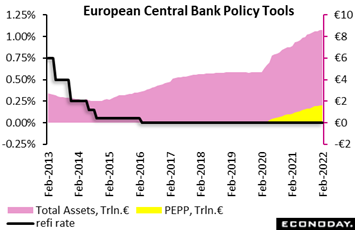

In contrast to the Fed and the BoE, the European Central Bank appears set to play waiting moves. The ECB, as expected, announced no changes. The central bank's plans for 2022 were laid down at December's deliberations and this, the first meeting of 2022, was always going to be too early for any modifications. Consequently, with regard to QE, asset purchases made under the pandemic emergency purchase programme (PEPP) will continue to be run down as it approaches its termination date at the end of March. However, principal payments from maturing securities purchased under the PEPP will continue to be reinvested until at least the end of 2024. In addition, for this month and next, buying under the longstanding asset purchase programme (APP) will remain at €20 billion per month. To limit the hit to overall QE from the loss of the PEPP, APP purchases in the second quarter will be doubled to €40 billion per month before being trimmed to €30 billion in the third quarter and reverting back to €20 billion thereafter for as long as deemed necessary. QT remains a long way down the road with QE only expected to end shortly before the first increase in official rates and outright asset sales only anticipated some time after that. In contrast to the Fed and the BoE, the European Central Bank appears set to play waiting moves. The ECB, as expected, announced no changes. The central bank's plans for 2022 were laid down at December's deliberations and this, the first meeting of 2022, was always going to be too early for any modifications. Consequently, with regard to QE, asset purchases made under the pandemic emergency purchase programme (PEPP) will continue to be run down as it approaches its termination date at the end of March. However, principal payments from maturing securities purchased under the PEPP will continue to be reinvested until at least the end of 2024. In addition, for this month and next, buying under the longstanding asset purchase programme (APP) will remain at €20 billion per month. To limit the hit to overall QE from the loss of the PEPP, APP purchases in the second quarter will be doubled to €40 billion per month before being trimmed to €30 billion in the third quarter and reverting back to €20 billion thereafter for as long as deemed necessary. QT remains a long way down the road with QE only expected to end shortly before the first increase in official rates and outright asset sales only anticipated some time after that.

For now at least, the interest rate outlook is similarly unchanged. Key rates still are seen at current or lower levels until inflation reaches 2 percent well ahead of the end of the forecast period and remains at that level over the remainder of the projection horizon.

Yet pressure on the central bank to adopt a less accommodative stance is building steadily and financial markets already anticipate at least two interest rate hikes before year-end. And ECB President Christine Lagarde, at her press conference, sounded less dovish than she usually does. She stressed that the bank “will not be complacent” with record-high inflation: “Compared to December, inflation risks are tilted to the upside, particularly in the near term.” She said the bank’s statement on policy reflected the view that “inflation is more likely to overshoot than undershoot.” The ECB moves only slowly but Lagarde's press conference suggests that the hawks are beginning to gain the upper hand; speculation about interest rate hikes in 2022 will gain ground. The next meeting in March will now begin to blink brightly on investors' radar. The bank's current monetary stance is becoming increasingly difficult to justify.

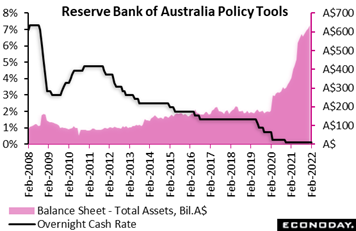

The Reserve Bank of Australia, like the ECB, is also in the go-slow camp. The RBA left its main policy rate, the overnight cash rate, unchanged at a record low of 0.10 percent, in line with the consensus forecast. Although officials have left policy rates on hold since 2020 they have also been scaling back their purchases of government bonds in recent months, indicating that they consider some reduction in accommodation to be appropriate. They advised in their latest statement that these purchases will cease in the coming week, reflecting their assessment that "faster-than-expected progress has been made towards the RBA's goals and further progress is likely." In particular, officials remain confident about the outlook for growth and have also noted that inflation has picked up more quickly than they expected. Although they acknowledge that the recent emergence of the Omicron variant and subsequent re-tightening of public health restrictions have impacted the economy, they argue that Australia's economic recovery has not been derailed. The Reserve Bank of Australia, like the ECB, is also in the go-slow camp. The RBA left its main policy rate, the overnight cash rate, unchanged at a record low of 0.10 percent, in line with the consensus forecast. Although officials have left policy rates on hold since 2020 they have also been scaling back their purchases of government bonds in recent months, indicating that they consider some reduction in accommodation to be appropriate. They advised in their latest statement that these purchases will cease in the coming week, reflecting their assessment that "faster-than-expected progress has been made towards the RBA's goals and further progress is likely." In particular, officials remain confident about the outlook for growth and have also noted that inflation has picked up more quickly than they expected. Although they acknowledge that the recent emergence of the Omicron variant and subsequent re-tightening of public health restrictions have impacted the economy, they argue that Australia's economic recovery has not been derailed.

Headline inflation has now been at or above the RBA's target range of 2.0 percent to 3.0 percent for three consecutive quarters and officials expect underlying price pressures to build in the near-term before moderating in 2023. They note, however, that there is uncertainty about how long global supply-side disruptions will continue to put upward pressure on prices and they also expect wage growth in Australia will remain too week for "some time yet" to keep inflation sustainably in its target range. RBA officials have consistently advised that they are "committed to maintaining highly supportive monetary conditions" and that they will not increase the cash rate until actual inflation is sustainably within their target range. Although inflation picked up sharply in the fourth quarter and has been at or above the target range for three consecutive quarters, officials argue that "it is too early to conclude that it is sustainably within the target band." And in a final note, officials advised that their decision to cease bond purchases does not imply a near-term increase in policy rates, a move that is likely to be "some time yet" down the road.

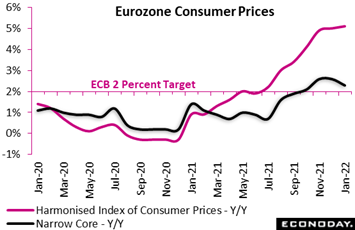

Global inflation news, on net so far this year, may not be pointing yet to easing but the worst of acceleration is probably behind us. Yet Eurozone consumer inflation did in fact accelerate again in January, at least at the headline level. A flash 5.1 percent annual rate was up a tick versus December's final print, a new record high for the region and some 8 tenths above the consensus. It is also 3.1 percentage points above the ECB's medium-term target. In theory, inflation in January should have been biased down by an unwinding of earlier German VAT distortions although it may be that these effects will take more time to ease the pressure in the data. Global inflation news, on net so far this year, may not be pointing yet to easing but the worst of acceleration is probably behind us. Yet Eurozone consumer inflation did in fact accelerate again in January, at least at the headline level. A flash 5.1 percent annual rate was up a tick versus December's final print, a new record high for the region and some 8 tenths above the consensus. It is also 3.1 percentage points above the ECB's medium-term target. In theory, inflation in January should have been biased down by an unwinding of earlier German VAT distortions although it may be that these effects will take more time to ease the pressure in the data.

Core inflation was better behaved than the headline rate in January. At 2.3 percent, the narrow gauge was down from 2.6 percent at year-end, its first fall since last July but only a 3-month low. All that said, January's headline rise was wholly attributable to energy (28.6 after 25.9 percent) and food, alcohol and tobacco (3.6 after 3.2 percent). Elsewhere, non-energy industrial goods inflation fell 6 tenths to 2.3 percent while services were flat at 2.4 percent.

Regionally, inflation in Germany decreased from 5.7 to 5.1 percent on tax effects. France (3.3 after 3.4 percent) and Spain (6.1 after 6.6 percent) also posted declines but the rate in Italy (5.3 after 4.2 percent) climbed particularly sharply. Inflation in most other member states also moved higher.

January's strong results again largely reflect the impact of steep rises in the cost of food and energy. Nonetheless, core inflation would seem to be sticky at levels well above the ECB's target and but for the German VAT changes both the headline and cores would have been higher still.

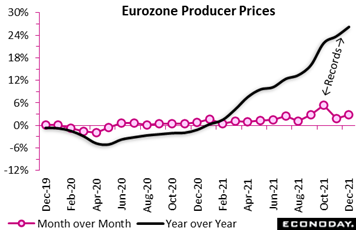

Consumer prices in the Eurozone will no doubt be directed by the path of producer prices which for once undershot the market consensus not, however, due to any decrease in pressure but to how high the forecasts were. December's 2.9 percent monthly surge was a tenth less than expected yet much sharper than November's 1.8 percent gain. It was also large enough to boost the annual inflation rate from 23.7 percent to 26.2 percent, yet another new all-time high. Prices have still risen by more than a full percentage point every month since last May. Consumer prices in the Eurozone will no doubt be directed by the path of producer prices which for once undershot the market consensus not, however, due to any decrease in pressure but to how high the forecasts were. December's 2.9 percent monthly surge was a tenth less than expected yet much sharper than November's 1.8 percent gain. It was also large enough to boost the annual inflation rate from 23.7 percent to 26.2 percent, yet another new all-time high. Prices have still risen by more than a full percentage point every month since last May.

Energy (up 7.0 percent on the month) once again dominated the overall monthly change but all the other major subsectors posted fresh gains too. Intermediates were up 0.7 percent, consumer non-durables 0.6 percent, durables 0.2 percent and capital goods 0.3 percent. As a result, the core PPI increased 0.5 percent, down from November's 0.9 percent, but still raising the annual underlying rate from 9.8 percent to 10.0 percent, also a new record.

Regionally, prices were higher on the month in all member states. Among the largest four countries, the national PPI increased 1.0 percent in France, a whopping 5.0 percent in Germany, 0.9 percent in Italy and 3.7 percent in Spain. The highest yearly rate, in Ireland, now stands at a remarkable 99.2 percent. The December update widens the gap between Eurozone PPI and HICP inflation to an unprecedented 21.2 percentage points and the difference between the core rates to 7.7 percentage points. Pipeline inflation pressures continue to build and may well mean that the ECB will have to change tack on its highly accommodative policy stance rather sooner than it may currently intend.

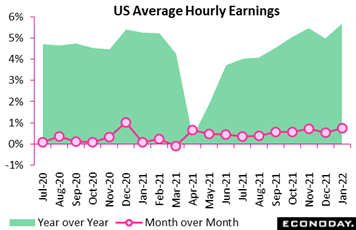

Price pressures, originating at the producer level and passing through to the consumer level then pass through into wages. Wage-push inflation, according to doctrine, is where the makers of monetary policy draw the line. And there is plenty for them to worry about in the latest US employment report that, in addition to extraordinarily strong employment growth, shows no let up in average hourly earnings, rising 0.7 percent on the month and 5.7 percent on the year, both outside the high estimates in Econoday's survey of forecasters. This is good news of course for workers but will be perceived as an unwanted signal of danger by the Fed, that policy is behind the inflation curve risking a more severe-than-forecast series of rate hikes and with that a bumpier ride ahead for the economy and financial markets. January's report was also headlined by an astounding 467,000 jump in nonfarm payrolls, which was nearly 200,000 above the high estimate. Price pressures, originating at the producer level and passing through to the consumer level then pass through into wages. Wage-push inflation, according to doctrine, is where the makers of monetary policy draw the line. And there is plenty for them to worry about in the latest US employment report that, in addition to extraordinarily strong employment growth, shows no let up in average hourly earnings, rising 0.7 percent on the month and 5.7 percent on the year, both outside the high estimates in Econoday's survey of forecasters. This is good news of course for workers but will be perceived as an unwanted signal of danger by the Fed, that policy is behind the inflation curve risking a more severe-than-forecast series of rate hikes and with that a bumpier ride ahead for the economy and financial markets. January's report was also headlined by an astounding 467,000 jump in nonfarm payrolls, which was nearly 200,000 above the high estimate.

Eurozone labour market data lag that of the US, but the latest news which was for the month of December is also unmistakably strong. Following a very favorable 287,000 decline in November, joblessness fell a further 185,000 to 11.481 million. As a result, the headline unemployment rate dropped from 7.1 percent to a surprisingly low 7.0 percent, some 4 tenths below its pre-pandemic level in February 2020 . The latest drop in the rate reflects fresh declines in France (7.4 after 7.5 percent), Italy (9.0 after 9.1 percent) and Spain (13.0 after 13.4 percent). Germany, at only 3.2 percent, was unchanged. The December update reinforces the picture of strong demand for labor across much of the region, consistent with total output having reclaimed its pre-crisis level last quarter. For the ECB's hawks, this will be seen as further proof that policy should not be so accommodative yet crucially, wages, unlike the US, have yet to respond. Eurozone labour market data lag that of the US, but the latest news which was for the month of December is also unmistakably strong. Following a very favorable 287,000 decline in November, joblessness fell a further 185,000 to 11.481 million. As a result, the headline unemployment rate dropped from 7.1 percent to a surprisingly low 7.0 percent, some 4 tenths below its pre-pandemic level in February 2020 . The latest drop in the rate reflects fresh declines in France (7.4 after 7.5 percent), Italy (9.0 after 9.1 percent) and Spain (13.0 after 13.4 percent). Germany, at only 3.2 percent, was unchanged. The December update reinforces the picture of strong demand for labor across much of the region, consistent with total output having reclaimed its pre-crisis level last quarter. For the ECB's hawks, this will be seen as further proof that policy should not be so accommodative yet crucially, wages, unlike the US, have yet to respond.

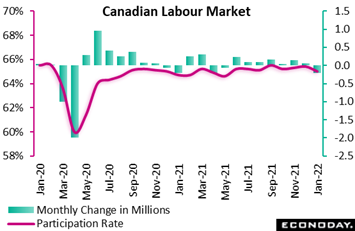

An inescapable conclusion from the US and Eurozone data is that Omicron is not having a dramatic effect on the jobs market. This, however, is not the indication from Canada whose January employment report fell far below expectations. Amid the reintroduction of Covid restrictions, employment plunged 200,100 in January versus expectations for a 50,000 increase. The unemployment rate rose to 6.5 percent from 6.0 percent in December, the first increase in nine months. The decline was led by part-time employment, which was down 117,400, while full-time jobs shrunk by 82,700. The participation rate dropped to 65.0 percent from 65.4 percent in December. Job losses were concentrated in the services sector, which shed 223,100 positions. Within services, accommodation and food accounted for over half of January's employment decline, with 112,900 jobs lost over the month, or 56 percent of all job losses. Information, culture and recreation shed 48,400 positions, business, building and other support services was down 21,900 and wholesale and retail trade down 18,400. Health care and social assistance was among the few winners, with 10,200 positions created on the month. Total hours worked fell 2.2 percent and average hourly wages slowed, up 2.4 percent year-over-year versus 2.7 percent the two previous months. January's report certainly won't speed up what is expected to be a run of rate hikes this year from the Bank of Canada, nor will the convoys of counter-Covid truckers who may continue to tie up choke points. An inescapable conclusion from the US and Eurozone data is that Omicron is not having a dramatic effect on the jobs market. This, however, is not the indication from Canada whose January employment report fell far below expectations. Amid the reintroduction of Covid restrictions, employment plunged 200,100 in January versus expectations for a 50,000 increase. The unemployment rate rose to 6.5 percent from 6.0 percent in December, the first increase in nine months. The decline was led by part-time employment, which was down 117,400, while full-time jobs shrunk by 82,700. The participation rate dropped to 65.0 percent from 65.4 percent in December. Job losses were concentrated in the services sector, which shed 223,100 positions. Within services, accommodation and food accounted for over half of January's employment decline, with 112,900 jobs lost over the month, or 56 percent of all job losses. Information, culture and recreation shed 48,400 positions, business, building and other support services was down 21,900 and wholesale and retail trade down 18,400. Health care and social assistance was among the few winners, with 10,200 positions created on the month. Total hours worked fell 2.2 percent and average hourly wages slowed, up 2.4 percent year-over-year versus 2.7 percent the two previous months. January's report certainly won't speed up what is expected to be a run of rate hikes this year from the Bank of Canada, nor will the convoys of counter-Covid truckers who may continue to tie up choke points.

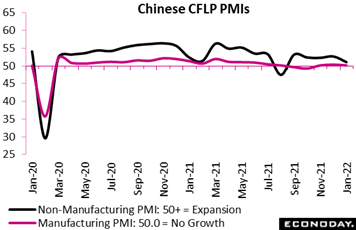

One country that is actually adding stimulus is China and the latest purchasing manager indexes, which are softening, suggest more of the same, that the economy needs policy support. Conditions in the manufacturing sector were again stagnant in January, with manufacturing index edging lower to 50.1 from 50.3 in December. Elsewhere in the economy, the CFLP non-manufacturing PMI also showed weaker growth with this index falling from 52.7 to a five-month low of 51.1. A composite measure, the General PMI, fell from 52.2 in December to 51.0 in January. Tight public restrictions imposed across China as part of the country's "Zero-Covid" response to ongoing outbreaks continues to weigh on economic activity. Note that Chinese economic data during January and February will be scarce, the result of the lunar new year. PMIs, however, both the official CFLP set and the private Caixan set, will not be interrupted. Watch for Caixan's composite report first thing Monday in the coming week -- and strength isn't the expectation. One country that is actually adding stimulus is China and the latest purchasing manager indexes, which are softening, suggest more of the same, that the economy needs policy support. Conditions in the manufacturing sector were again stagnant in January, with manufacturing index edging lower to 50.1 from 50.3 in December. Elsewhere in the economy, the CFLP non-manufacturing PMI also showed weaker growth with this index falling from 52.7 to a five-month low of 51.1. A composite measure, the General PMI, fell from 52.2 in December to 51.0 in January. Tight public restrictions imposed across China as part of the country's "Zero-Covid" response to ongoing outbreaks continues to weigh on economic activity. Note that Chinese economic data during January and February will be scarce, the result of the lunar new year. PMIs, however, both the official CFLP set and the private Caixan set, will not be interrupted. Watch for Caixan's composite report first thing Monday in the coming week -- and strength isn't the expectation.

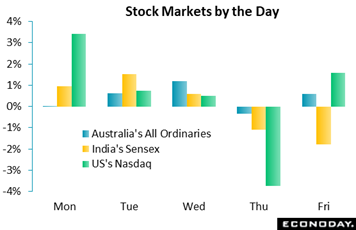

The week started off favorably despite Atlanta Fed President Raphael Bostic's comment to the Financial Times that he would consider, if warranted by the economic data, raising the federal funds rate by 50 basis points in March. Italy got a boost from an easing in political uncertainty with Sergio Mattarella's return as president, which looks to allow Mario Draghi to remain as prime minister. The week started off favorably despite Atlanta Fed President Raphael Bostic's comment to the Financial Times that he would consider, if warranted by the economic data, raising the federal funds rate by 50 basis points in March. Italy got a boost from an easing in political uncertainty with Sergio Mattarella's return as president, which looks to allow Mario Draghi to remain as prime minister.

Tuesday's decision by the Reserve Bank of Australia to end its asset purchases matched expectations but its guidance on interest rates leaned to the dovish side, that it's too early to conclude that inflation will end up stabilizing within the bank's 2 to 3 percent target band. Though giving up much of their early gains, the All Ordinaries rose 0.6 percent in the session.

India’s Sensex rose 2.5 percent on the week and 1.5 percent on Tuesday as the government maintained its supportive fiscal stance that includes a big jump in proposed capital spending. Technology, pharma, and financials led the gains.

Risk appetite in the US took a pause at midweek, first from US troop deployment to Eastern Europe in a show of NATO support. Then hitting the market was an earnings miss and poor guidance from Meta which plunged 26 percent on Thursday, pulling down internets and digital businesses including Snap, down 24 percent, Spotify, down 17 percent, and Pinterest, down 10 percent.

Thursday's rate hike from the Bank of England and no action from the European Central Bank came as no surprise to the markets which on Friday got a lift from strong Amazon earnings as well as the giant surge in US employment, one however offset by further gains in wages that the raise the risk of greater Federal Reserve action.

Global economic data, on net, are generally hitting expectations, evident in Econoday's consensus divergence scores which range from plus 39 for the UK whose data are beating consensus estimates to minus 39 for Japan which is coming up short. UK surprises in the week included a strong PMI construction report and further gains for the Nationwide house price index. For BoE watchers, Econoday's ECDI score supports the dissenters in their call for more aggressive rate hikes. Italy, at plus 18, has been at the top of the scoreboard more than any other economy in what may help explain Mario Draghi's political success. At plus 14, France, like Italy, has been a consistently strong performer which may be a positive indication for Emmanuel Macron's possible reelection efforts.

The US, benefiting from Friday's employment report, climbed nearly 20 points to end the week at plus 16. Outside of a brief pop higher to 23 in late January, this is the best level so far this year for the US ECDI.

Switzerland is at minus 1, which is virtually at the zero line to indicate economists are nailing their forecasts for this economy. After only two weeks in the positive column, China swung back into the negative zone but only marginally so, to minus 7 following the soft PMIs. The Eurozone, hit by a dramatic 3.0 percent monthly collapse in December retail sales, is at minus 8 while Germany, likewise hit by a drop in retail sales, is at minus 11. Canada, where the impact of trucker action will soon appear in the data, is at minus 25. Japan's minus 39 brings up the rear and follows weak industrial production data and an especially weak retail sales report that fell 1.0 percent on the month in December.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Central bank news in the coming week will be highlighted by the Reserve Bank of India which is scheduled to make an announcement on Wednesday. No action is expected. US consumer prices on Thursday, which aren't expected to cool at all, will headline the week's inflation news with Japanese producer prices coming out on Thursday. Demand-side news will include Japanese household spending on Tuesday with supply-side news including German industrial production on Monday and UK industrial production on Friday. China's Caixan services PMI will kickoff the week on Monday with Swiss unemployment data also posted on Monday, Canadian merchandise trade on Tuesday, and the US Treasury statement on Thursday also worth watching. German CPI on Friday will be a revision for January.

China: Caixin Services PMI for January (Mon 01:45 GMT; Mon 09:45 CST; Sun 20:45 EST)

Consensus Forecast: 50.0

January's Caixan services PMI is expected to slow noticeably to a dead flat 50.0 versus December's 53.1 which was better than expected.

Swiss Unemployment Rate for January (Mon 06:45 GMT; Mon 07:45 CET; Mon 1:45 EST)

Consensus Forecast, Adjusted: 2.4%

The adjusted unemployment rate, which has been consistently edging lower since May, is expected to hold unchanged at 2.4 percent in January. Before the pandemic hit in early 2020, this rate was at 2.3 percent.

German Industrial Production for December (Mon 07:00 GMT; Mon 08:00 CET; Mon 02:00 EST)

Consensus Forecast, Month over Month: 0.6%

Industrial production is expected to rise 0.6 percent on the month in December after slipping a disappointing 0.2 percent in November.

Japanese Household Spending for December (Mon 23:30 GMT; Tue 08:30 JST; Mon 18:30 EST)

Consensus Forecast , Month over Month: 0.7%

Consensus Forecast , Year over Year: 0.4%

Household spending is expected to increase 0.7 percent on the month and 0.4 percent on the year in December. Retail sales for December, which have already been released, fell 1.0 percent on the month and were up 1.4 percent on the year.

Canada Merchandise Trade Balance for December (Tue 13:30 GMT; Tue 08:30 EST)

Consensus Forecast: C$2.10 billion

Canada is expected to post a December surplus of C$2.10 billion versus a November surplus of C$3.13 billion that was higher than expected and benefited from wide gains for exports.

Reserve Bank of India Announcement (Anytime Wednesday, release time not set)

Consensus Change: 0.0 basis points

Consensus Level: 4.00%

The Reserve Bank of India is not expected to change its 4.00 percent policy rate. At its last meeting in December, the RBI said the recovery was increasingly broad-based though downside risks were many including tighter monetary policy in major global economies.

Japanese Producer Price Index for January (Wed 23:50 GMT; Thu 08:50 JST; Wed 18:50 EST)

Consensus Forecast, Year over Year: 8.2%

Producer prices are expected to rise a year-over-year 8.2 percent in January versus 8.5 percent in December. Until December's results, which were lower than expected, Japan's PPI data had exceeded expectations for three reports in a row.

US CPI for January (Thu 13:30 GMT; Thu 08:30 EST)

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: 7.3%

US CPI Core, Less Food & Energy

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: 5.9%

Consumer prices, though slowing in spots, have been extremely elevated and consistently exceeding expectations, including December's monthly gains of 0.5 percent overall and 0.6 percent for the core. January's expectations are for more of the same, 0.5 percent for both. Annual rates are seen accelerating 7.3 and 5.9 percent which would compare with 7.0 and 5.5 percent.

US Treasury Statement for January (Thu 19:00 GMT; Thu 14:00 EST)

Consensus Forecast: +$0.5 billion

Forecasters see a $0.5 billion surplus in January that would compare with a year-ago January deficit of $162.8 billion.

UK Industrial Production for December (Fri 07:00 GMT; Fri 02:00 EST)

Consensus Forecast, Month over Month: 0.1%

Consensus Forecast, Year over Year: 0.6%

Industrial production in December is expected to inch 0.1 percent higher on the month. Production in November was surprisingly good, rising 1.0 percent.

US Consumer Sentiment Index, Preliminary January (Fri 15:00 GMT; Fri 10:00 EST)

Consensus Forecast: 67.5

Consumer sentiment has been sitting at long-term lows and virtually no improvement is expected for February, at a consensus 67.5 versus 67.2 in December.

|