|

There's little, conventional or otherwise, that policy makers aren't doing to add liquidity to the markets and limit the unfolding contraction in the global economy. Covid-19 infection rates have yet to slow in Europe and, apparently, have only begun to accelerate in the US. But Asian infection rates have been stabilizing, and though global economic data are beginning to crack from the virus, the results so far are at least containable and reversible. Not all the global PMIs collapsed in March and the week's run of consumer sentiment reports, tracking the last two weeks of shutdowns and crisis, offered mostly consistent results. The news isn't good, but it could have been worse.

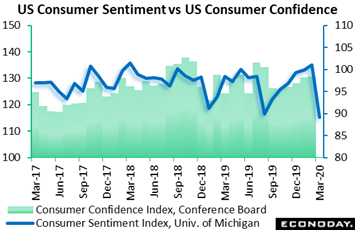

Consumer sentiment in the US fell sharply in March, ending the crisis month at 89.1 which was down 6.8 points from mid-month and, in one of the very largest declines of the last 50 years, down 11.9 points from February. Looking at March's progression, scores moved from the mid-90s area early in the month to the mid-80s later in the month. Yet on the positive side, this index has been much lower in prior troubles, sliding into the 50s during the financial crisis 12 years ago. And however much the monthly drop is concerning, the 89.1 headline level is no more than a 4-year low. Putting the negatives aside, this report holds out hope that should virus effects begin to moderate, consumer sentiment would be within quick striking distance of its old highs. Consumer sentiment in the US fell sharply in March, ending the crisis month at 89.1 which was down 6.8 points from mid-month and, in one of the very largest declines of the last 50 years, down 11.9 points from February. Looking at March's progression, scores moved from the mid-90s area early in the month to the mid-80s later in the month. Yet on the positive side, this index has been much lower in prior troubles, sliding into the 50s during the financial crisis 12 years ago. And however much the monthly drop is concerning, the 89.1 headline level is no more than a 4-year low. Putting the negatives aside, this report holds out hope that should virus effects begin to moderate, consumer sentiment would be within quick striking distance of its old highs.

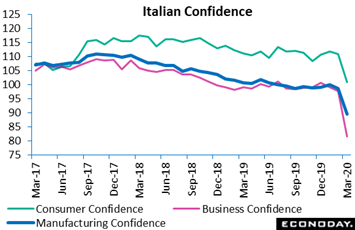

The worst virus effects apparently are still ahead for the US, a contrast to Italy where the worst is now being endured. Italian business sentiment in March (red line in graph) fell more than 16 points to 81.7 and, like US consumer confidence, one of the steepest declines on record. When looking at manufacturing apart from other sectors (blue line), morale is less pessimistic in a trend apparent in other countries, coming in at 89.5 in March but still down 9.3 points from February. The report's consumer confidence index (green line) slumped almost 10 points to 101.0 which wasn't as bad as expected but still a 5-year low. Taken together, the results are certainly no surprise and could fall further if the infection curve fails to peak soon. The worst virus effects apparently are still ahead for the US, a contrast to Italy where the worst is now being endured. Italian business sentiment in March (red line in graph) fell more than 16 points to 81.7 and, like US consumer confidence, one of the steepest declines on record. When looking at manufacturing apart from other sectors (blue line), morale is less pessimistic in a trend apparent in other countries, coming in at 89.5 in March but still down 9.3 points from February. The report's consumer confidence index (green line) slumped almost 10 points to 101.0 which wasn't as bad as expected but still a 5-year low. Taken together, the results are certainly no surprise and could fall further if the infection curve fails to peak soon.

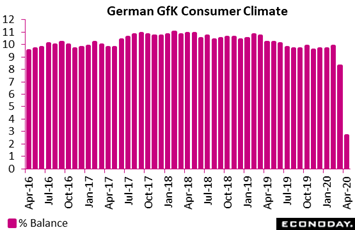

Germany has yet to suffer the same level of outbreak as Italy, but the damage to consumer confidence is every bit as severe if not more so. Following an unusually steep downward revision to March to 8.3, the overall climate outlook for April is seen slumping further to 2.7. This would be its weakest reading in more than 10 years and only 1 tenth above the record low hit during the financial crisis. Among the components, economic expectations fell the most, decreasing by 20.4 points to minus 9.2 and some 27.3 points below a year ago for their worst mark in nearly 8 years. Income expectations fell to a 7-year low with the propensity to spend matching its steepest decline in 12 years. Yes, these results are truly grim and warn of a major setback for household consumption in Germany over coming months. Germany has yet to suffer the same level of outbreak as Italy, but the damage to consumer confidence is every bit as severe if not more so. Following an unusually steep downward revision to March to 8.3, the overall climate outlook for April is seen slumping further to 2.7. This would be its weakest reading in more than 10 years and only 1 tenth above the record low hit during the financial crisis. Among the components, economic expectations fell the most, decreasing by 20.4 points to minus 9.2 and some 27.3 points below a year ago for their worst mark in nearly 8 years. Income expectations fell to a 7-year low with the propensity to spend matching its steepest decline in 12 years. Yes, these results are truly grim and warn of a major setback for household consumption in Germany over coming months.

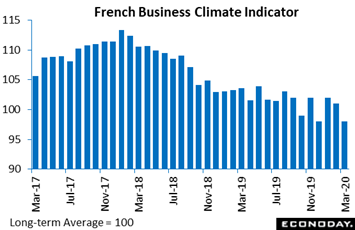

A bit less grim is the confidence news from France as manufacturing sentiment held up rather better than expected in March. At 98, the overall business climate dropped only 3 points versus February and while this still equaled its lowest reading since October 2014, it remained within the recent range. The index surprisingly found support in both past output and new orders. However, it was hit hard by expectations. Here, both the personal production outlook and, in particular, the general industry outlook posted sharp losses. The latter saw its weakest mark since mid-2013. A bit less grim is the confidence news from France as manufacturing sentiment held up rather better than expected in March. At 98, the overall business climate dropped only 3 points versus February and while this still equaled its lowest reading since October 2014, it remained within the recent range. The index surprisingly found support in both past output and new orders. However, it was hit hard by expectations. Here, both the personal production outlook and, in particular, the general industry outlook posted sharp losses. The latter saw its weakest mark since mid-2013.

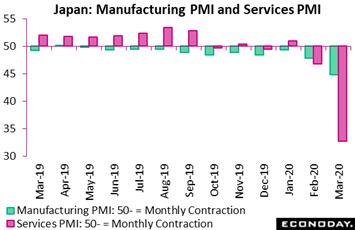

Like confidence surveys, PMI surveys are nimble and quick and offer the first look at any one month. The message from the week's global run of March PMI flashes is clear: Extremely abrupt, substantial slowing centered in services with manufacturing, despite all the shutdowns, showing less weakness. Japan's results offer an example, with March's flash PMI for services sinking more than 14 points to 32.7 and the worst reading in 13 years of available data. Service providers reported declines in output, new orders, new export orders, employment and business sentiment. Input costs increased at a slower pace and selling prices were reduced. Turning to manufacturing, this PMI fell comparatively modestly, down 3 points to 44.8 for March but, nevertheless, an 11-year low. Like services, production, new orders, and new export orders for manufacturers all fell in March as did employment and business sentiment. Like confidence surveys, PMI surveys are nimble and quick and offer the first look at any one month. The message from the week's global run of March PMI flashes is clear: Extremely abrupt, substantial slowing centered in services with manufacturing, despite all the shutdowns, showing less weakness. Japan's results offer an example, with March's flash PMI for services sinking more than 14 points to 32.7 and the worst reading in 13 years of available data. Service providers reported declines in output, new orders, new export orders, employment and business sentiment. Input costs increased at a slower pace and selling prices were reduced. Turning to manufacturing, this PMI fell comparatively modestly, down 3 points to 44.8 for March but, nevertheless, an 11-year low. Like services, production, new orders, and new export orders for manufacturers all fell in March as did employment and business sentiment.

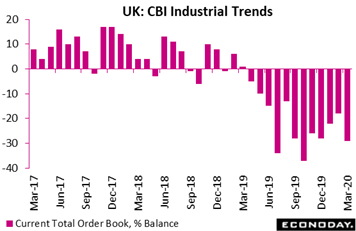

Manufacturing indications from the UK were also something short of a complete disaster. At minus 29 percent in March, the headline orders balance for CBI's industrial tends survey was down sharply from February's minus 18 percent but still broadly in line with expectations and well above the minus 60 percent territory during the global financial crisis. Past output was actually less negative than in February but expectations for the coming quarter sank to their worst level since April 2009. Exports were also very weak. Expected selling prices showed a significant increase but this may reflect more hope than anything else. Manufacturing indications from the UK were also something short of a complete disaster. At minus 29 percent in March, the headline orders balance for CBI's industrial tends survey was down sharply from February's minus 18 percent but still broadly in line with expectations and well above the minus 60 percent territory during the global financial crisis. Past output was actually less negative than in February but expectations for the coming quarter sank to their worst level since April 2009. Exports were also very weak. Expected selling prices showed a significant increase but this may reflect more hope than anything else.

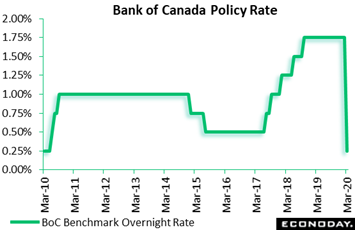

For global monetary policy, the increase in mass fire appears to be winding down, if nothing else because there's no ammo left. Central banks have been cutting policy rates to the zero line, or like Reserve Bank of India whose policy rate is now 4.40 percent, to a 10-year low. The Bank of Canada has been especially aggressive, cutting its policy rate over the past few weeks from 1.75 percent to only 0.25 percent to match the record low. The BoC, like others, also launched a commercial paper repurchase program and said it will start buying C$5 billion of Canadian government securities per week and make buying adjustments along the way until recovery is in sight. The bank, also like others, said it is ready to take further action if needed. For global monetary policy, the increase in mass fire appears to be winding down, if nothing else because there's no ammo left. Central banks have been cutting policy rates to the zero line, or like Reserve Bank of India whose policy rate is now 4.40 percent, to a 10-year low. The Bank of Canada has been especially aggressive, cutting its policy rate over the past few weeks from 1.75 percent to only 0.25 percent to match the record low. The BoC, like others, also launched a commercial paper repurchase program and said it will start buying C$5 billion of Canadian government securities per week and make buying adjustments along the way until recovery is in sight. The bank, also like others, said it is ready to take further action if needed.

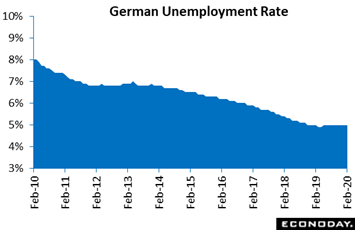

Tuesday of the coming week will see German unemployment for March. The virus effect in the US, an economy not known for labor security, was overwhelming in March as a record 3.283 million jobless filed initial claims in the March 21 week alone. Germany's unemployment rate has been solidly steady at 5.0 percent going well back into last year, and forecasters, despite virus effects, see only a 1 tenth uptick in March's rate to 5.1 percent. Looking back at February, businesses in Germany were hiring as the number of people out of work fell 10,000 to 2.262 million. In a negative, though, the number of vacancies extended their long slide, down 4,000 to 709,000. Tuesday of the coming week will see German unemployment for March. The virus effect in the US, an economy not known for labor security, was overwhelming in March as a record 3.283 million jobless filed initial claims in the March 21 week alone. Germany's unemployment rate has been solidly steady at 5.0 percent going well back into last year, and forecasters, despite virus effects, see only a 1 tenth uptick in March's rate to 5.1 percent. Looking back at February, businesses in Germany were hiring as the number of people out of work fell 10,000 to 2.262 million. In a negative, though, the number of vacancies extended their long slide, down 4,000 to 709,000.

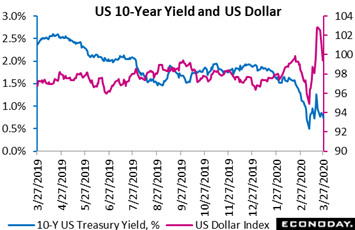

The US government's $2.2 trillion emergency support package, signed by President Trump on Friday, is roughly 1/10 the size of the federal government's existing debt ($23.4 trillion par value), matches the size of annual GDP ($2.2 trillion in current US dollars), and is twice size of the annual budget deficit itself ($1.1 trillion in fiscal 2019). How smoothly the government can raise the $2 trillion will depend on how agreeable buyers of US Treasuries will be; this group is made up of private domestic investors, foreign investors and also includes the Federal Reserve which is ready to buy however much it has to. As of Wednesday, March 25, the Fed held $3.0 trillion in Treasuries in its own account, a huge amount equaling more than 10 percent of the government's existing debt and which testifies to the bank's unlimited buying power (printing power). But how much direct buying is too much, and when will diminishing returns kick in? How far can any central bank go in buying its own government debt? Maybe pretty far actually, as long as the underlying currency doesn't buckle. But if currency values begin to diverge sharply, the success of buying one's own government bonds may also diverge; those with stronger currencies paying lower interest rates and those with weaker currencies having to pay higher rates. With rates most everywhere at the zero line or below, monetary policy makers have no place else to turn during this crisis: Quantitative Easing is the only game left in town. The US government's $2.2 trillion emergency support package, signed by President Trump on Friday, is roughly 1/10 the size of the federal government's existing debt ($23.4 trillion par value), matches the size of annual GDP ($2.2 trillion in current US dollars), and is twice size of the annual budget deficit itself ($1.1 trillion in fiscal 2019). How smoothly the government can raise the $2 trillion will depend on how agreeable buyers of US Treasuries will be; this group is made up of private domestic investors, foreign investors and also includes the Federal Reserve which is ready to buy however much it has to. As of Wednesday, March 25, the Fed held $3.0 trillion in Treasuries in its own account, a huge amount equaling more than 10 percent of the government's existing debt and which testifies to the bank's unlimited buying power (printing power). But how much direct buying is too much, and when will diminishing returns kick in? How far can any central bank go in buying its own government debt? Maybe pretty far actually, as long as the underlying currency doesn't buckle. But if currency values begin to diverge sharply, the success of buying one's own government bonds may also diverge; those with stronger currencies paying lower interest rates and those with weaker currencies having to pay higher rates. With rates most everywhere at the zero line or below, monetary policy makers have no place else to turn during this crisis: Quantitative Easing is the only game left in town.

March indications confirm that the global economy is breaking lower, but not completely collapsing. In any case, early indications provided by anecdotal surveys should always be looked at carefully and especially so now when sample sizes, due to shutdowns, may be unusually low. If this is case, then results could be skewed toward more positive responses; that is Reponses sent in by those firms that are still conducting business. In any case, there's no question that a sizable recession appears to be here.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

March is the month to watch in the week's upcoming data beginning with leading indicators from Switzerland and economic sentiment in the Eurozone, both on Monday. Also for March and also for Monday, preliminary German CPI data will be watched for initial virus-related price effects. The German unemployment rate will be Tuesday's highlight, having held long steady at 5.0 percent going into the virus. Also picking up March's effects will be Tuesday's monthly consumer confidence report from the US and Japan's Tankan survey which, on Wednesday, will be for the first quarter. The first March reading on Swiss manufacturing will also be posted Wednesday followed closely by Caixan's March PMI for Chinese manufacturing where forecasts believe the worst is already over. Weekly jobless claims in the US, which surged to well over 3 million in the prior week, will be posted on Thursday followed on Friday by the monthly US employment report, data for which, however, were sampled early in March before the bulk of layoffs hit.

Switzerland: KOF Swiss Leading Indicator for March (Mon 07:00 GMT; Mon 09:00 CEST; Mon 03:00 EDT)

Consensus Forecast: 85%

The KOF Swiss leading indicator is expected to fall sharply to 85 percent in March after rising solidly in February to 100.9 percent.

Eurozone: EC Economic Sentiment for March (Mon 09:00 GMT; Mon 11:00 CEST; Mon 05:00 EDT)

Consensus Forecast: 90.3

Going into the virus, the European Commission's economic sentiment index had posted four straight increases but forecasters for March see a double-digit loss to 90.3 versus February's 103.5.

German CPI, March Flash (Mon 12:00 GMT; Mon 14:00 CEST; Mon 08:00 EDT)

Consensus Forecast, Month-to-Month: 0.1%

Consensus Forecast, Year-over-Year: 1.4%

After a 0.4 percent climb in February, consumer prices in Germany are expected to rise only 0.1 percent in a March report that will offer an early indication on coronavirus effects. Year-on-year, March's call is 1.4 percent and down from February's 1.7 percent.

French CPI, March Flash (Tue 06:45 GMT: Tue 08:45 CEST; Tue 02:45 EDT)

Consensus Forecast, Year-over-Year: 0.9%

French consumer prices were up 1.4 percent on the year in February with March's consensus down 5 tenths to 0.9 percent.

German Unemployment Rate for March (Tue 07:55 GMT; Tue 09:55 CEST; Tue 03:55 EDT)

Consensus Forecast: 5.1%

For the month of March and the virus outbreak, Germany's unemployment rate is expected to rise only incrementally, to 5.1 percent from 5.0 percent, a rate that has held in place since May last year.

US Consumer Confidence Index for March (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 111.0

The consumer confidence report had been holding steady and showed only limited effect from the coronavirus in February. For March, however, forecasters see the index falling very severely, from 130.7 to 111.0.

Japanese First-Quarter Tankan (Tue 23:50 GMT; Wed 08:50 JST; Tue 19:50 EDT)

Consensus Forecast, Large Manufacturers: -10

Virus effects are expected to be very apparent in the first-quarter Tankan survey, at a consensus of minus 10 for large manufacturers that would compare with zero in the fourth quarter.

China: Caixin Manufacturing PMI for March (Wed 01:45 GMT; Wed 09:45 CST; Tue 21:45 EDT)

Consensus Forecast: 45.8

Coronavirus effects in China made for February severe contraction in the Caixin manufacturing PMI, falling nearly 11 points to 40.3. But for March, significant recovery is expected, to a consensus 45.8.

Switzerland: SVME PMI for March (Wed 07:30 GMT; Wed 09:30 CEST: Wed 3:30 EDT)

Consensus Forecast: 46.6

The first March reading on Swiss manufacturing activity is expected to show sharp deterioration, to 46.6 for the SVME PMI versus February's already weak 47.8.

US: ISM Manufacturing Index for March (Wed 14:00 GMT; Wed 10:00 EDT)

Consensus Forecast: 43.5

Virus effects on anecdotal manufacturing surveys have been limited compared to much more severe effects on the service sector. But for March, forecasters see ISM manufacturing falling very sharply to 43.5 versus February's nearly unchanged conditions at 50.1.

US Initial Jobless Claims (Thu 12:00 GMT; Thu 08:00 EDT)

Consensus Forecast: 3.0 million

Initial jobless claims, after spiking by a record 3.283 million in the March 21 week, are expected to total another 3.0 million in the March 28 week. The prior week's increase in claims, centered in accommodation and food services, was unprecedented.

US Employment Report for March (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Nonfarm Payrolls Change: -148,000

Consensus Forecast: Unemployment Rate: 3.9%

Substantial contraction is the expectation for nonfarm payrolls, at a consensus decline of 148,000 for March versus what were extraordinarily strong increases (and already forgotten) of 273,000 in both January and February. The unemployment rate is expected to jump 4 tenths in March to 3.9 percent with the participation rate falling 2 tenths to 63.2 percent. Average hourly earnings, not in focus anymore given cuts underway in the labor market, are expected to rise 0.2 percent on the month for 3.0 percent yearly growth. Rounding out the consensus forecasts: average workweek down to 34.1 from 34.4 hours, private payrolls at minus 188,000, and manufacturing payrolls at minus 20,000.

|