|

Global Economics will be taking the next two weeks off. Next article will be dated January 6, 2023

It was a week of policy restraint, of limited action and increasingly guarded outlooks. For the U.S., had the markets over-interrupted the Federal Reserve’s signals for policy slowing? Or had the Fed over-communicated its shift? Or is it that inflation isn’t yet cooling sufficiently? Let’s break these issues down one at a time, starting with inflation.

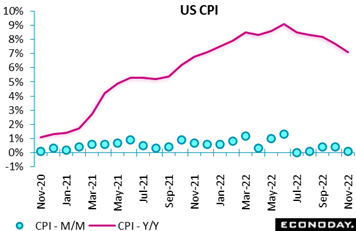

Tuesday was the first day of the Fed’s policy meeting and that morning saw what appeared to be a favorable consumer price report which offered more evidence that pressures may have already peaked. Headline inflation rose only 0.1 percent on the month in November and eased 6 tenths on the year to 7.1 percent, far above the Fed’s 2 percent target but still the best showing of the year. Food costs slowed, up 0.5 percent on the month which is less than half the monthly rates earlier in the year, while monthly energy costs contracted, down 1.6 percent for the best showing in nearly two years. Core inflation rose 0.2 percent on the month and eased 3 tenths on the year to 6.0 percent for its best showing since July. The headline and core results were at or below Econoday’s consensus ranges, meaning that as far as forecasters are concerned, they are all better than expected. Tuesday was the first day of the Fed’s policy meeting and that morning saw what appeared to be a favorable consumer price report which offered more evidence that pressures may have already peaked. Headline inflation rose only 0.1 percent on the month in November and eased 6 tenths on the year to 7.1 percent, far above the Fed’s 2 percent target but still the best showing of the year. Food costs slowed, up 0.5 percent on the month which is less than half the monthly rates earlier in the year, while monthly energy costs contracted, down 1.6 percent for the best showing in nearly two years. Core inflation rose 0.2 percent on the month and eased 3 tenths on the year to 6.0 percent for its best showing since July. The headline and core results were at or below Econoday’s consensus ranges, meaning that as far as forecasters are concerned, they are all better than expected.

But there were negatives in the report, especially rent of primary residence which accelerated a tenth to 0.8 percent on the month for an historically severe 7.9 percent annual rate. Communication, recreation, motor vehicle insurance, education, and apparel also contributed to the core increase.

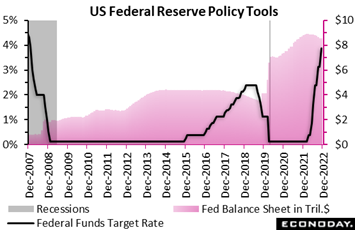

The big news Wednesday wasn’t the Fed’s downshift to a 50 basis point rate hike, this was signaled at the November FOMC and confirmed on November 30 when Jerome Powell repeated that the lagging impact of prior hikes had yet to work their way through the economic data. The big surprise was the quarterly economic projections: inflation and rate hikes ratcheted up and GDP ratcheted down. However much favorable November’s CPI proved to be, it didn’t help the Fed’s projections for its PCE price index (separate data from the CPI with more elaborate adjustments); these projections were raised 2 to 3 tenths across the board to 5.6 percent this year, to 3.1 percent for 2023 and to 2.5 percent for 2024, the latter still above the 2 percent target. The big news Wednesday wasn’t the Fed’s downshift to a 50 basis point rate hike, this was signaled at the November FOMC and confirmed on November 30 when Jerome Powell repeated that the lagging impact of prior hikes had yet to work their way through the economic data. The big surprise was the quarterly economic projections: inflation and rate hikes ratcheted up and GDP ratcheted down. However much favorable November’s CPI proved to be, it didn’t help the Fed’s projections for its PCE price index (separate data from the CPI with more elaborate adjustments); these projections were raised 2 to 3 tenths across the board to 5.6 percent this year, to 3.1 percent for 2023 and to 2.5 percent for 2024, the latter still above the 2 percent target.

If policy is informed by incoming data, then why didn’t the November CPI help the projections? Perhaps the projections, prepared in advance, didn’t include November’s update? If so, then so much for incoming data. In any case, Powell in his press conference stressed that “the lesson of history is not to stop raising rates too soon.” He did note that inflation data for October as well as November mostly eased, but warned that "substantially more evidence" of price moderation would be needed before policy makers conclude that inflation is on a downward path. For wage-push old schoolers, Powell repeatedly cited imbalances in the labor market: "We do see a very, very strong labor market," he said.

How high will U.S. rates go before enough is enough? The Fed’s own projection had been 4.6 percent to be hit next year; this is now 50 basis points higher at 5.1 percent. From where we are now that’s another 75 basis points in what may or may not be another 50 point move followed by 25 points or perhaps three equal 25 point installments. Yet if November’s CPI does prove to be the beginning of the end for inflation, then maybe the low end of the Fed’s forecast range may play out, that is only one more 25 point hike before policy neutrality is hit.

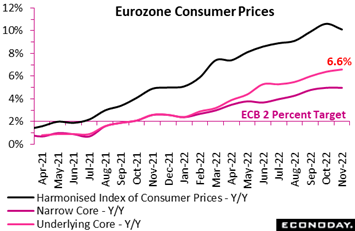

The European Central Bank also slowed its rate hike path in the week but, in some contrast to the Federal Reserve, had in hand a less favorable inflation report for November. Eurozone’s CPI was initially released two weeks prior but was updated at week’s end; the final at a 10.1 percent annual rate, up 1 tenth from the flash, but still down 5 tenths from October’s 10.6 percent record. Core readings were not revised: at 5.0 percent for the narrow core (excluding energy and food) and at a record 6.6 percent of the underlying core (excluding energy and unprocessed food). The European Central Bank also slowed its rate hike path in the week but, in some contrast to the Federal Reserve, had in hand a less favorable inflation report for November. Eurozone’s CPI was initially released two weeks prior but was updated at week’s end; the final at a 10.1 percent annual rate, up 1 tenth from the flash, but still down 5 tenths from October’s 10.6 percent record. Core readings were not revised: at 5.0 percent for the narrow core (excluding energy and food) and at a record 6.6 percent of the underlying core (excluding energy and unprocessed food).

Non-energy industrial goods were flat at 6.1 percent while services were a tick softer at 4.2 percent. Energy (34.9 percent after 41.5 percent) subtracted significantly but food, alcohol and tobacco (13.6 percent after 13.1 percent) again provided more heat.

Regionally, inflation rates were either flat or lower in most member states. France was steady at 7.1 percent as was Italy at 12.6 percent, but there were falls in Germany, down 3 tenths to 11.3 percent, and particularly Spain, down 6 tenths to 6.7 percent. The Baltic states continue to have the worst of it: Latvia at 21.7 percent with Estonia and Lithuania both at 21.4 percent.

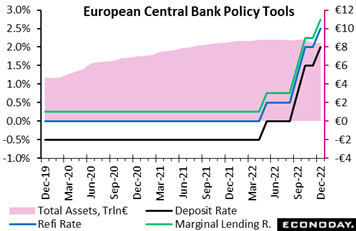

As Wednesday’s 50 point hikes made plain, November’s inflation data were nowhere near soft enough to prevent further ECB tightening. Indeed, the acceleration in core rates will have been one reason for the upward revision to the central bank's inflation forecast.

As expected, and in line with the Bank of England and Swiss National Bank earlier Thursday and the Federal Reserve on Wednesday, the ECB adopted a slightly less aggressive approach to policy tightening. Having raised key interest rates by a record 75 basis points in both September and October, the December meeting saw a consensus-matching 50 point increase. The move lifted the deposit rate to 2.0 percent, the refi rate to 2.5 percent and the rate on the marginal lending facility to 2.75 percent. In addition, based on a substantial upward revision to its inflation outlook, the bank signaled that it expects "interest rates will still have to rise significantly" to meet its inflation goals. As expected, and in line with the Bank of England and Swiss National Bank earlier Thursday and the Federal Reserve on Wednesday, the ECB adopted a slightly less aggressive approach to policy tightening. Having raised key interest rates by a record 75 basis points in both September and October, the December meeting saw a consensus-matching 50 point increase. The move lifted the deposit rate to 2.0 percent, the refi rate to 2.5 percent and the rate on the marginal lending facility to 2.75 percent. In addition, based on a substantial upward revision to its inflation outlook, the bank signaled that it expects "interest rates will still have to rise significantly" to meet its inflation goals.

The revised economic forecasts put average harmonised inflation at 8.4 percent in 2022 (previously 8.1 percent), 6.3 percent in 2023 (5.5 percent) and 3.4 percent in 2024 (2.3 percent). Even in 2025 inflation is seen at 2.3 percent. More significantly, over the same period, the ex-food ex-energy core is predicted at 3.9 percent, 4.2 percent, 2.8 percent and 2.4 percent in 2025. In other words, both headline and core inflation are expected to hold above the 2 percent target over the entire forecast horizon, in itself implying that current policy is too loose. Risks are seen on the upside.

Revisions to real economic growth were not so marked but the ECB did acknowledge that the economy may contract in the current and next quarters, putting the Eurozone into a "relatively short-lived and shallow" recession. Risks here are on the downside.

The central bank has now increased key rates by a cumulative 250 basis points since the middle of the year but clearly believes that more is required in order to bring inflation back to target. In fact, in the face of the revised inflation forecast, it’s perhaps surprising that the rate hike was not larger. Still, the reduction in the pace of tightening at least suggests that the rate peak might not be too far away. Financial markets see 3-month money rates topping out just above 3.0 percent in 2023 and unless energy prices throw another wobbly, they may well not be far off.

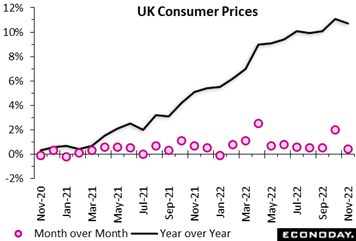

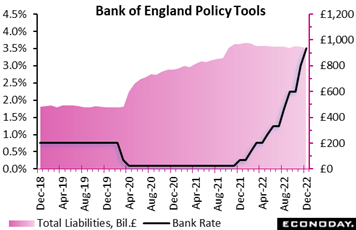

Of all the major banks, it’s the BoE that continues to face the highest inflation, but a little less so in November. A 0.4 percent monthly increase was 0.2 percentage points short of the market consensus and small enough to reduce the annual inflation rate from October's 11.1 percent to 10.7 percent. This was the first decline in the yearly rate since August but left inflation still fully 8.7 percentage points above target. Of all the major banks, it’s the BoE that continues to face the highest inflation, but a little less so in November. A 0.4 percent monthly increase was 0.2 percentage points short of the market consensus and small enough to reduce the annual inflation rate from October's 11.1 percent to 10.7 percent. This was the first decline in the yearly rate since August but left inflation still fully 8.7 percentage points above target.

The main contribution to the slowdown in the annual rate was transport where prices rose 0.1 percent on the month compared with a 1.7 percent spike over the same period a year ago. This largely reflected a much smaller rise in fuel charges (0.8 percent after 5.1 percent) and a fall in second-hand car prices (minus 0.2 percent after 3.1 percent) that alone subtracted nearly 0.2 percentage points. Alcohol and tobacco (0.6 percent after 2.6 percent), clothing and footwear (0.1 percent after 1.1 percent) and recreation and culture (0.6 percent after 1.1 percent) also weighed. The main upward effect came from restaurants and hotels where prices climbed 0.4 percent versus a 0.3 percent fall in November 2021.

November’s surprisingly soft inflation report came as some relief to the BoE but it left inflation still well above target. As widely expected, December’s BoE meeting delivered a ninth successive hike in Bank Rate. The benchmark rate was raised by an as-expected 50 basis points to 3.5 percent, its highest level since October 2008. However, reflecting the increasingly divergent views on where the economy and inflation are headed, the vote was even more widely split than in November. Both Swati Dhingra and Silvana Tenreyro wanted no change at all while Catherine Mann wanted another 75 basis point increase. November’s surprisingly soft inflation report came as some relief to the BoE but it left inflation still well above target. As widely expected, December’s BoE meeting delivered a ninth successive hike in Bank Rate. The benchmark rate was raised by an as-expected 50 basis points to 3.5 percent, its highest level since October 2008. However, reflecting the increasingly divergent views on where the economy and inflation are headed, the vote was even more widely split than in November. Both Swati Dhingra and Silvana Tenreyro wanted no change at all while Catherine Mann wanted another 75 basis point increase.

The decision reflected a still very cautious view of inflation but also an acknowledgement that price rises are probably close to peaking: November's 10.7 percent inflation rate was below the bank's expectations, sterling's trade weighted index had appreciated and global supply problems eased. Even so, the labour market remained very tight and the vacancies-to-unemployment ratio elevated. Moreover, annual growth of private sector regular pay picked up further and was 0.5 percentage points stronger than anticipated last month.

For the real economy, GDP is now expected to decline only 0.1 percent this quarter, a couple of ticks less than anticipated in November, but household consumption was seen as weak and most housing market indicators had continued to soften. Surveys of investment intentions also worsened further. Recession remains the dominant feature of 2023 and is still projected to be the longest on record.

Thursday’s decision lifted Bank Rate closer to its ultimate peak level but upcoming inflation data will probably have to surprise significantly on the downside if further rate rises are to be avoided. At 3.5 percent, the benchmark rate is still some way short of the 4.5 percent currently priced in by financial markets for the middle of next year. Even so, the widening splits on the MPC suggest that securing a majority in favour of additional tightening will become increasingly difficult; it may well be that borrowing costs are rather closer to their terminal level than many currently suppose.

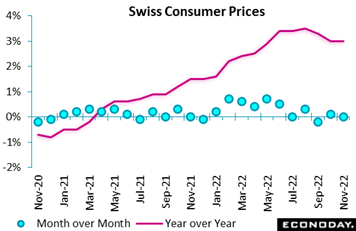

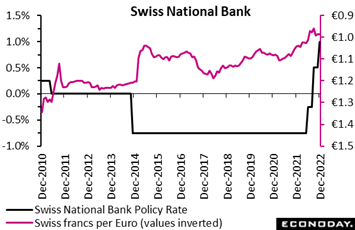

Prices pressures in Switzerland look comparatively dormant if not positively benign; November's update suggests the CPI is close to peaking. In data released at the beginning of the month, consumer inflation was unchanged in November leaving the yearly inflation rate at 3.0 percent, matching both the market consensus and remaining the lowest mark since May. Prices pressures in Switzerland look comparatively dormant if not positively benign; November's update suggests the CPI is close to peaking. In data released at the beginning of the month, consumer inflation was unchanged in November leaving the yearly inflation rate at 3.0 percent, matching both the market consensus and remaining the lowest mark since May.

Domestic prices were also steady on the month, lifting their 12-month rate from 1.7 percent to 1.8 percent. However, import prices dipped 0.1 percent, reducing their yearly rate from 6.9 percent to 6.3 percent.

Within the CPI basket, the largest monthly increase was in alcohol and tobacco (0.8 percent) ahead of household goods and services (0.5 percent). Gains here were essentially offset by falls in restaurants and hotels (0.9 percent) and food and soft drink (0.5 percent). Petroleum products (minus 1.3 percent) also subtracted. Consequently, core prices (excluding unprocessed food and energy) edged just 0.1 percent firmer although this was enough to nudge the annual underlying rate a tick higher to 1.9 percent.

However much inflation may be peaking, the Swiss National Bank on Thursday once again underlined its determination to get consumer prices back under its control. December's Monetary Policy Assessment (MPA) saw the policy rate hiked a further 50 basis points to 1.0 percent. The move, which was in line with market expectations, means rates have now been raised a cumulative 175 basis points since tightening began in June. However much inflation may be peaking, the Swiss National Bank on Thursday once again underlined its determination to get consumer prices back under its control. December's Monetary Policy Assessment (MPA) saw the policy rate hiked a further 50 basis points to 1.0 percent. The move, which was in line with market expectations, means rates have now been raised a cumulative 175 basis points since tightening began in June.

In line with the September edition, the latest MPA also indicates that the central bank will intervene in the foreign exchange markets on both sides as necessary. This suggests the bank is content with current levels of the franc and wants to avoid significant divergence in either direction.

Despite the flat CPI report for November, the bank’s updated inflation forecast is slightly higher through 2024 than last time. At 2.0 percent at the end of 2023 and 1.8 percent at the end of 2024, the new projections are up from the 1.7 percent predicted for both dates in September's MPA. In addition, at 2.1 percent at the end of the forecast horizon (Q3 2025), inflation is back above 2 percent and climbing.

GDP this year is still put at 2.0 percent, unchanged from September's call. However, weaker demand from abroad and high energy prices are expected to curb economic activity markedly in 2023 when GDP is seen expanding just 0.5 percent. Moreover, there remain high levels of uncertainty surrounding the projections and risks are on the downside.

December’s tightening probably puts the policy rate quite close to its terminal level. Even so, while recent developments have been relatively favorable, inflation is still historically high and, more significantly, expected to be above target at the end of the SNB's new forecast. As such, the central bank is likely to retain a tightening bias and another hike, though a possibly smaller one, is very possible at the next MPA in March next year.

Turning back to the Federal Reserve’s updated projections, GDP for next year was cut by 7 tenths to only 0.5 percent (the same projection as Switzerland), a level perhaps not skirting recession but something close to it. Many business surveys in the U.S. have been signaling contraction for a number of months, some for quite a number of months. Regional manufacturing surveys from the Fed’s district banks started dipping in the spring and since September have almost uniformly been in negative ground. The latest week saw both Empire State (New York Fed) and the Philadelphia Fed miss expectations, at minus 11.2 and minus 13.8 respectively. Empire State has been in contraction in six of the last eight months while the report’s six-month outlook is now more depressed than it was during the worst of the Covid wave. The Philadelphia Fed’s sample has reported contraction in order volumes for seven months straight. Not surprisingly, manufacturing output as definitively measured in the industrial production report fell 0.6 percent in November for the first monthly contraction since June. On a year-over-year basis, output volumes were up only 1.4 percent for the thinnest rate of inflation-adjusted growth in nearly two years. Something to consider when thinking about recession in 2023. Turning back to the Federal Reserve’s updated projections, GDP for next year was cut by 7 tenths to only 0.5 percent (the same projection as Switzerland), a level perhaps not skirting recession but something close to it. Many business surveys in the U.S. have been signaling contraction for a number of months, some for quite a number of months. Regional manufacturing surveys from the Fed’s district banks started dipping in the spring and since September have almost uniformly been in negative ground. The latest week saw both Empire State (New York Fed) and the Philadelphia Fed miss expectations, at minus 11.2 and minus 13.8 respectively. Empire State has been in contraction in six of the last eight months while the report’s six-month outlook is now more depressed than it was during the worst of the Covid wave. The Philadelphia Fed’s sample has reported contraction in order volumes for seven months straight. Not surprisingly, manufacturing output as definitively measured in the industrial production report fell 0.6 percent in November for the first monthly contraction since June. On a year-over-year basis, output volumes were up only 1.4 percent for the thinnest rate of inflation-adjusted growth in nearly two years. Something to consider when thinking about recession in 2023.

The two greatest economies, the U.S. and China, are now very substantially missing expectations. Aside from Tuesday’s CPI, data from the U.S. were disappointing during the week, especially contraction in industrial production and also retail sales. Econoday's Consensus Divergence Index, at minus 40, is at its lowest point since July, indicating that forecasters are substantially overestimating the strength of U.S. economic data. The ECDI also echoes Wednesday's FOMC projections that saw a significant downgrade ahead for GDP.

Chinese results have been even worse. Industrial production, fixed asset investment and especially retail sales all came up short. China’s ECDI is at minus 64 indicating that overall economic activity is now falling a long way behind market expectations. Relaxation of the zero-Covid policy may help but, on current trends, the economy will need additional stimulus if it is to get anywhere close to hitting government growth targets.

Recent outperformance in the Eurozone has given way to a string of results that have surprised both on the upside and downside. As a result the ECDI, at minus 3, is close to zero to signal that overall economic activity is running in line with market expectations.

At minus 11 in the UK, the ECDI remains below zero but when excluding prices (ECDI-P) moves to plus 4 to indicate that the unexpected weakness has been concentrated in the inflation data. This may help to explain why the BoE opted to trim last week’s increase in Bank Rate to 50 basis points.

In Switzerland, the ECDI and ECDI-P (both minus 28) remain in negative surprise territory and will have been a factor in the SNB’s decision last week to reduce its policy rate hike to 50 basis points from 75 points. Further negative readings would bolster the likelihood of official interest rates being close to their terminal levels.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Japan’s consumer price index, which has been soaring and is expected to rise further, will be posted on Friday as will U.S. updates for the PCE price indexes where increasing pressures are not expected (the PCE indexes are part of the personal income and outlays report).

Other U.S. data in the week are also expected to hold steady or sink further: housing starts and permits on Tuesday, consumer confidence on Wednesday, new home sales and durable goods orders both on Friday.

Canada will see a run of important releases headlined by consumer prices on Wednesday, where favorable results are the expectations, preceded by what is expected to be a strong rebound for retail sales on Tuesday and no change for monthly GDP on Friday.

German data include sentiment updates for Ifo on Monday and GfK on Wednesday and a PPI report on Tuesday where less pressure is expected. The Eurozone will be post its consumer flash on Tuesday.

Monetary policy will include the loan prime rate from China, estimated for Tuesday release, and the Bank of Japan announcement, definitively set for Tuesday. No change for either is expected.

China Loan Prime Rate (Estimated for Tuesday, December 20, time not set)

Consensus Change: One-Year Rate: 0 basis points

Consensus Level: 3.65%

Consensus Change: Five-Year Rate: 0 basis points

Consensus Level: 4.30%

The People's Bank of China is not expected to change its loan prime rates, at 3.65 percent for the 1-year rate and 4.30 percent for the 5-year.

German Ifo for December (Mon 0900 GMT; Mon 10:00 CET; Mon 0400 EST)

Consensus Forecast, Business Climate: 87.2

Consensus Forecast, Current Conditions: 92.5

Consensus Forecast, Business Expectations: 82.0

After back-to-back gains, the business climate index is not expected to improve further in December, at a consensus 87.2 versus November’s 86.3 which was more than a point above expectations. Current conditions are seen at 92.5 versus 93.1 with business expectations seen at 82.0 versus 80.0.

Bank of Japan Announcement (Expected sometime between 11:30 and 12:00 JST on Tuesday, December 20)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: -0.10%

The Bank of Japan is expected to maintain its easing stance at upcoming meetings until at least Governor Haruhiko Kuroda's second five-year term ends in early April. Officials do not expect consumer inflation to be anchored around its 2 percent target any time soon after what they see as a temporary spike to over 3 percent this year while supply exceeds demand in the Japanese economy. Real wages have been falling in Japan and service prices remain weak.

German PPI for November (Tue 0700 GMT; Tue 0800 CET; Tue 0200 EST)

Consensus Forecast, Month over Month: -1.5%

Consensus Forecast, Year over Year: 31.5%

November’s monthly change is seen falling 1.5 percent with the year-over-year increase at 31.5 percent, the latter would compare with October’s 34.5 percent.

US Housing Starts for November (Tue 1330 GMT; Tue 0830 EST)

Consensus Forecast, Annual Rate: 1.400 million

US Building Permits

Consensus Forecast: 1.495 million

Residential construction has been slowing and slowing significantly. November’s annualized rates are expected at 1.400 million for starts and 1.495 for permits which would compare with 1.425 and 1.512 million in October.

Canadian Retail Sales for October (Tue 1330 GMT; Tue 0830 EST)

Consensus Forecast, Month over Month: 1.5%

Retail sales in October are expected to rebound a sharp 1.5 percent following a 0.5 percent decline in September.

Eurozone: EC Consumer Confidence Flash for December (Tue 1500 GMT; Tue 1600 CET; Tue 1000 EST)

Consensus Forecast: -21.3

Consumer confidence in December is expected to rise to minus 21.3 versus November’s minus 23.9.

Germany: GfK Consumer Climate for January (Wed 0700 GMT; Wed 0800 CET; Wed 0200 EST)

Consensus Forecast: -37.5

Consumer climate has been deeply depressed, at minus 40.2 in December following November’s record low at minus 41.9. January’s consensus is minus 37.5.

Canadian CPI for November (Wed 1330 GMT; Wed 0830 EST)

Consensus Forecast, Month over Month: 0.0%

Consensus Forecast, Year over Year: 6.6%

Consumer prices are expected to be unchanged on the month in November for a year-over-year rate of 6.6 percent. September’s rates were 0.7 and 6.9 percent.

US Consumer Confidence Index for December (Wed 1500 GMT; Wed 1:00 EST)

Consensus Forecast: 101.0

The consumer confidence index is expected to edge higher to a marginally less depressed 101.0 versus November’s 100.2.

Japanese Consumer Price Index for November (Thu 2330 GMT; Fri 0830 JST; Thu 1830 EST)

Consensus Forecast, Year over Year: 3.9%

Consumer inflation has been soaring, to 3.7 percent in October with November seen 2 tenths higher at 3.9 percent.

US Durable Goods Orders for November (Fri 1330 GMT; Fri 0830 EST)

Consensus Forecast: Month over Month: -0.7%

Consensus Forecast: Ex-Transportation - M/M: 0.0%

Forecasters see durable goods orders falling 0.7 percent in November following a 1.1 percent rise in October. Ex-transportation orders are seen unchanged.

US Personal Income for November (Fri 1330 GMT; Fri 0830 EST)

Consensus Forecast, Month over Month: 0.3%

US Consumption Expenditures

Consensus Forecast, Month over Month: 0.2%

US PCE Price Index

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 5.5%

US Core PCE Price Index

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 4.6%

Personal income is expected to rise 0.3 percent in November with consumption expenditures expected to increase 0.2 percent. These would compare with respective October gains of 0.7 and 0.8 percent. Inflation readings for November are expected at monthly increases of 0.2 percent both overall and for the core (versus plus 0.3 and plus 0.2 percent respectively) for annual rates of 5.5 and 4.6 percent (versus October’s 6.0 and 5.0 percent).

Canadian GDP for October (Fri 1330 GMT; Fri 0830 EST)

Consensus Forecast, Month over Month: 0.0%

No change is expected October GDP versus a run of marginal gains.

US New Home Sales for November (Fri 1500 GMT; Fri 1000 EST)

Consensus Forecast, Annual Rate: 600,000

After rebounding to a 632,000 annualized rate in October, new home sales in November are expected to resume their trend lower to a 600,000 rate.

|