|

Progress is being made in the labor market and—for a change—good news was good news for equities at the end of the week.

Equities for this past week were flat to down. The week started on a sour note—with major indexes declining—despite better than expected economic news on construction outlays and on manufacturing from Markit and ISM. The good news was seen as putting early Fed taper back on the table. Also, mixed results from the Thanksgiving shopping weekend also weighed on stocks. Equities for this past week were flat to down. The week started on a sour note—with major indexes declining—despite better than expected economic news on construction outlays and on manufacturing from Markit and ISM. The good news was seen as putting early Fed taper back on the table. Also, mixed results from the Thanksgiving shopping weekend also weighed on stocks.

Equities continued downward Tuesday despite better-than-expected motor vehicle sales. Ford and General Motors declined as some investors worried that pent-up demand would no longer support the current pace of sales gains in coming months. At mid-week, good news again was bad news with favorable reports on ADP employment, new home sales, international trade, and ISM non-manufacturing. These, plus the Fed’s Beige Book, were seen as being favorable enough to raise the odds of taper at the December 17-18 FOMC meeting. And some traders were heading to the sidelines ahead of Friday’s employment situation report. Equities continued downward Tuesday despite better-than-expected motor vehicle sales. Ford and General Motors declined as some investors worried that pent-up demand would no longer support the current pace of sales gains in coming months. At mid-week, good news again was bad news with favorable reports on ADP employment, new home sales, international trade, and ISM non-manufacturing. These, plus the Fed’s Beige Book, were seen as being favorable enough to raise the odds of taper at the December 17-18 FOMC meeting. And some traders were heading to the sidelines ahead of Friday’s employment situation report.

Thursday, stocks headed further down on a sizeable decline in initial jobless claims and a higher-than-expected GDP number. But on Friday, much of the week’s losses were turned around with a better-than-expected employment report for November—but not one that was too strong. Payrolls topped forecasts and the unemployment rate unexpectedly dropped notably. Plus, FedSpeak for the day indicated that the Fed would be able to unwind QE gradually and still be data dependent—and possibly with more explicit guidance. Traders decided they liked Friday’s balance of moderately strong job growth and Fed comments on planning QE strategy.

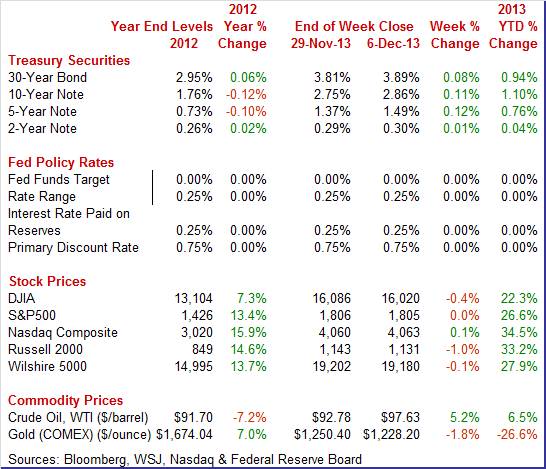

Equities were essentially unchanged or down this past week. The Dow was down 0.4 percent; the S&P 500, flat; the Nasdaq, up 0.1 percent; the Russell 2000, down 1.0 percent; and the Wilshire 5000, down 0.1 percent.

For the year-to-date, major indexes are up as follows: the Dow, up 22.3 percent; the S&P 500, up 26.6 percent; the Nasdaq, up 34.5 percent; the Russell 2000, up 33.2 percent; and the Wilshire 5000, up 27.9 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury yields firmed for the week despite some flight to safety to bonds from equities. The key reason was increased belief that the Fed might taper sooner than believed. Modest rate gains were seen on Monday, Wednesday, and Thursday due to better-than-expected economic reports. By Friday when the favorable jobs report posted, the rate rise had already been built in and the week ended with little change for the day. Treasury yields firmed for the week despite some flight to safety to bonds from equities. The key reason was increased belief that the Fed might taper sooner than believed. Modest rate gains were seen on Monday, Wednesday, and Thursday due to better-than-expected economic reports. By Friday when the favorable jobs report posted, the rate rise had already been built in and the week ended with little change for the day.

For this past week Treasury rates were up as follows: the 2-year note, up 1 basis point; the 5-year note, up 12 basis points; the 7-year note, up 12 basis points; the 10-year note, up 11 basis points; and the 30-year bond, up 8 basis points. The 3-month T-bill was unchanged.

The spot price of WTI crude posted a strong gain for this past week. Crude started the week by rising a dollar a barrel as reports from Markit and ISM indicated that the manufacturing sector was strengthening. The spot price of WTI crude posted a strong gain for this past week. Crude started the week by rising a dollar a barrel as reports from Markit and ISM indicated that the manufacturing sector was strengthening.

The biggest daily move—up over $2 per barrel— was Tuesday on news that TransCanada Corp. (TRP) will begin operating the southern portion of its Keystone XL pipeline to the Gulf Coast in January. The pipeline will reduce supply to Cushing.

WTI rose a dollar a barrel on a Wednesday on the weekly inventory report showing a drop in inventories for the first time in 11 weeks. Prices were little changed Thursday and Friday.

Net for the week, the spot price for West Texas Intermediate gained $4.85 per barrel to settle at $97.63.

Economic news was mostly favorable this past week. Job growth improved but there are some demand and supply issues that may affect quarter growth.

Real GDP growth for the third quarter came in stronger than expected but not in a good way. Real GDP was revised up to 3.6 percent annualized, compared to the 2.8 percent advance estimate and 2.5 percent in the second quarter. Analysts expected 3.1 percent for the third quarter revision. Real GDP growth for the third quarter came in stronger than expected but not in a good way. Real GDP was revised up to 3.6 percent annualized, compared to the 2.8 percent advance estimate and 2.5 percent in the second quarter. Analysts expected 3.1 percent for the third quarter revision.

The upward revision was largely due to a higher estimate for inventory growth. Small upward revisions were in nonresidential fixed structures and government purchases. Net exports were revised down (higher imports and lower exports). Small downward revisions were in PCEs and residential investment. Demand numbers were little changed. Final sales of domestic product were nudged down to 1.9 percent, compared to the initial estimate of 2.0 percent and 2.1 percent in the second quarter. Final sales to domestic purchasers (which exclude net exports) were bumped up to 1.8 percent versus the first estimate of 1.7 percent and 2.1 percent in the second quarter.

Reviewing GDP overall instead of marginal changes from revisions, the increase in real GDP in the third quarter primarily reflected positive contributions from private inventory investment, personal consumption expenditures (PCE), exports, nonresidential fixed investment, residential fixed investment, and state and local government spending that were partly offset by a negative contribution from federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The GDP price index was raised marginally to an annualized gain of 2.0 percent, compared to the advance estimate of 1.9 percent and second quarter growth of 0.6 percent. The core GDP price index was unrevised at 1.9 percent, following an annualized rise of 0.9 percent in the second quarter.

Overall, demand is still sluggish and forward momentum will depend on how much inventories are worked off in the fourth quarter.

After the latest employment report, taper talk may be on the table at this month’s FOMC meeting. Total payroll jobs in November advanced 203,000, following a revised increase of 200,000 for October (originally up 204,000) and after a revised gain of 175,000 for September (previous estimate was 163,000). Analysts forecast a 180,000 rise. The net revisions for September and October were up 8,000. Private payrolls expanded 196,000 after gaining 214,000 in October. Expectations were for 173,000 in November. After the latest employment report, taper talk may be on the table at this month’s FOMC meeting. Total payroll jobs in November advanced 203,000, following a revised increase of 200,000 for October (originally up 204,000) and after a revised gain of 175,000 for September (previous estimate was 163,000). Analysts forecast a 180,000 rise. The net revisions for September and October were up 8,000. Private payrolls expanded 196,000 after gaining 214,000 in October. Expectations were for 173,000 in November.

The unemployment rate dropped to 7.0 percent from 7.3 percent in October. The consensus called for a 7.2 percent unemployment rate. The November number is the lowest in five years. However, part of the reason for the decline was a low participation rate—some of which is related to retirement by baby boomers.

Turning back to the payroll portion of the report, goods-producing jobs grew by 44,000 after increasing 31,000 in October. Manufacturing jumped 27,000 after rising 16,000. Construction gained 17,000 in November, following an increase of 12,000 the month before. Mining slipped 2,000 after rising 3,000 in October.

Private service-providing jobs gained 152,000, following a 183,000 boost the prior month. The November rise was led by professional and business services (up 35,000) and retail trade (up 22,000).

Government jobs rebounded 7,000 in after declining 14,000 in October.

Wage growth posted at 0.2 percent, following a 0.1 percent rise in October. The median market forecast was for a 0.2 percent gain. The average workweek nudged up to 34.5 hours from 34.4 hours and matched analysts’ forecast for 34.5 hours.

Looking ahead, private aggregate weekly earnings rose 0.7 percent, pointing to a healthy gain for private wages & salaries of the personal income report. Production worker hours in manufacturing were 0.5 for the month, suggesting a significant gain in the manufacturing component for November industrial production.

Given that payrolls topped expectations with a moderately healthy gain, the FOMC likely will at a minimum increase its discussion of tapering QE.

Personal income was weak in October, slipping 0.1 percent, following two very strong months at plus 0.5 percent. The decline is the first since January and may be related to the impact of the government shutdown on private wages. Wages & salaries were especially soft, up only 0.1 percent following gains of 0.4 and 0.6 percent in the two prior months. Personal income was weak in October, slipping 0.1 percent, following two very strong months at plus 0.5 percent. The decline is the first since January and may be related to the impact of the government shutdown on private wages. Wages & salaries were especially soft, up only 0.1 percent following gains of 0.4 and 0.6 percent in the two prior months.

Overall consumer spending picked up a bit as expected at the beginning of the fourth quarter but not by much, to plus 0.3 percent in October versus plus 0.2 percent in September. Strength was in durable goods reflecting strong auto sales. Smaller gains were posted for nondurable goods and services. Overall consumer spending picked up a bit as expected at the beginning of the fourth quarter but not by much, to plus 0.3 percent in October versus plus 0.2 percent in September. Strength was in durable goods reflecting strong auto sales. Smaller gains were posted for nondurable goods and services.

Inflation readings are very soft with the price index unchanged and the core index up only 0.1 percent. The year-on-year rate for the price index is only plus 0.7 percent with the core year-on-year rate at plus 1.1 percent, both declining in the month and both well below the Fed's goal of 2 percent.

The good news is that November likely be a better month for personal income based on aggregate earnings and motor vehicle sales.

Heavy incentives made November an especially good month for vehicle sales, in fact the best month by far since early 2007. Unit sales of cars and light trucks came in at a much greater-than-expected annual rate of 16.4 million, easily beating out Econoday expectations for 15.7 as well as high-end expectations for 16.1 million. Heavy incentives made November an especially good month for vehicle sales, in fact the best month by far since early 2007. Unit sales of cars and light trucks came in at a much greater-than-expected annual rate of 16.4 million, easily beating out Econoday expectations for 15.7 as well as high-end expectations for 16.1 million.

Combined domestics and imports jumped a monthly 7.7 percent following a 0.6 percent rise in October. Details show across-the-board gains. For November, light trucks increased 8.8 percent while cars gained 6.7 percent. Imports sold better than domestic-made, up 9.3 percent versus up 7.3 percent.

The jobs market is improving and the nation's vehicle fleet is aging, two factors behind the accelerating strength in vehicle sales. The motor vehicle component, in what would be the second month in a row, looks to give the monthly retail sales report another very strong boost.

Apparently, the fiscal issues in Washington currently are not on the front burner as sentiment made a comeback in early December. Consumer sentiment is building quickly this holiday season, at 82.5 for the early December reading versus 75.1 for final November and 72.0 at mid-month November. The latest reading is the best since July. Apparently, the fiscal issues in Washington currently are not on the front burner as sentiment made a comeback in early December. Consumer sentiment is building quickly this holiday season, at 82.5 for the early December reading versus 75.1 for final November and 72.0 at mid-month November. The latest reading is the best since July.

A striking gain in the report is the current conditions component, up nearly 10 points to 97.9 which is also the best reading since July. The gain in this component is an early indication of strength for monthly December-vs-November comparisons.

Also showing a gain is the expectations component, up nearly 6 points to 72.7 for the first plus 70 reading since August. A separate reading on the 12-month economic outlook really improved, to 95 versus November's 79. Also showing a gain is the expectations component, up nearly 6 points to 72.7 for the first plus 70 reading since August. A separate reading on the 12-month economic outlook really improved, to 95 versus November's 79.

Gas prices are stable making for stable readings in inflation expectations. Both the 1- and 5-year outlooks are little changed, at 3.0 percent and 2.8 percent respectively.

This report underscores the strength of the November jobs report and is very welcome news for the nation's retailers who had been concerned that low levels of consumer confidence would hold down holiday spending.

Both national surveys on manufacturing showed notable improvement in their latest reports, suggesting this sector is picking up some momentum again.

The nation's manufacturing sector grew solidly in November based on Markit Economics' composite index which was well over 50, at a 10-month high of 54.7 versus 54.3 for the mid-month flash reading and versus 51.8 for final October.

The outlook for December is also solid as new orders, the most important and most heavily weighted component of the composite, rose strongly to 56.2 for a 3-1/2 point gain from October. But the strength is not coming from foreign demand as new export orders, at 51.4, remain subdued.

According to the ISM manufacturing index, manufacturing turned in its best month in 2-1/2 years with November rising to 57.3 from October's already strong 56.4. New orders, up 3 points to 63.3, was also the strongest in 2-1/2 years. Export orders, unlike the reading in the PMI manufacturing index, were very strong, at 59.5 for the strongest rate of monthly growth since early last year. And new orders are piling up into backlogs which are at 54.0 which is very strong for this reading. According to the ISM manufacturing index, manufacturing turned in its best month in 2-1/2 years with November rising to 57.3 from October's already strong 56.4. New orders, up 3 points to 63.3, was also the strongest in 2-1/2 years. Export orders, unlike the reading in the PMI manufacturing index, were very strong, at 59.5 for the strongest rate of monthly growth since early last year. And new orders are piling up into backlogs which are at 54.0 which is very strong for this reading.

Strength in orders points to gains ahead for production which was already humming at a 62.8 level in November. Employment growth has been soft but at 56.5 is at a 1-1/2 year high.

The trade deficit improved in October and for the right reason—exports were up. The October trade gap narrowed to $40.6 billion from $43.0 billion in September. October was close to analysts’ expectations for a $40.2 billion deficit. Exports rebounded 1.8 percent after slipping 0.1 percent in September. Imports rose 0.4 percent in October, following a 1.6 percent increase the month before. The trade deficit improved in October and for the right reason—exports were up. The October trade gap narrowed to $40.6 billion from $43.0 billion in September. October was close to analysts’ expectations for a $40.2 billion deficit. Exports rebounded 1.8 percent after slipping 0.1 percent in September. Imports rose 0.4 percent in October, following a 1.6 percent increase the month before.

The shrinking of the trade shortfall was led by goods excluding petroleum which narrowed to $39.3 billion from $41.8 billion in September.

The petroleum deficit nudged down to $19.6 billion from $19.9 billion in September. The services surplus improved to $19.6 billion from $19.4 billion.

The October trade numbers indicate that the recovery may be benefitting again from exports. This likely will result in upward revisions to forecasts for fourth quarter GDP growth.

New home sales surged 25.4 percent in October to a very solid 444,000 million annual rate. This is the highest rate since early in the year. New home sales surged 25.4 percent in October to a very solid 444,000 million annual rate. This is the highest rate since early in the year.

Tight supply has been limiting sales all year. Due to the big jump in sales, supply at the October sales rate fell sharply to 4.9 months from 6.4 months.

A plus is that high home prices are not as much of a drag as they have been on sales. The median price fell a sharp 4.5 percent in October to $245,800.

One month is only one month, but the October new home sales report is a rare plus in what has been a run of weak news out of the housing sector.

The boost in new home sales has not yet carried into new housing construction. Construction outlays made a comeback in October but it was from the public sector. Overall construction outlays rebounded 0.8 percent after declining 0.3 percent in September. Public construction spending jumped a monthly 3.9 percent, following a 1.9 percent decrease the month before. The boost in new home sales has not yet carried into new housing construction. Construction outlays made a comeback in October but it was from the public sector. Overall construction outlays rebounded 0.8 percent after declining 0.3 percent in September. Public construction spending jumped a monthly 3.9 percent, following a 1.9 percent decrease the month before.

In the private sector, residential outlays dipped 0.6 percent in October, following a 1.7 percent boost the month before. But subcomponent news was mixed. New 1-family spending declined 0.6 percent after rising 1.7 percent. Strength was in new multi-family outlays, up 2.2 percent after jumping 4.3 percent in September. Residential outlays excluding new home fell 1.2 percent, following a gain of 3.6 percent the month before.

On a year-ago basis, construction was up 5.3 percent in October, compared to 3.2 percent the month before.

The latest Beige Book shows little change from the last. Reports from the 12 Federal Reserve Districts indicated that the economy continued to expand at a modest to moderate pace from early October through mid-November. Seven Fed Districts see growth as "moderate" while five characterize growth as "modest."

On the labor market front, jobs increased in five Districts while others were unchanged.

Manufacturing activity expanded at a modest to moderate pace in most Districts during the reporting period. Consumer spending increased in almost all Districts at a modest to moderate pace. Sales of new motor vehicles continued at a moderate to strong pace across most Districts.

Residential real estate activity improved in six Districts, while remaining steady or softening in other Districts. Some slowing in single-family home sales was attributed to seasonal factors.

Price inflation is contained, with phrases such as "minimal," "no change," and "stable" being common across most Districts.

Overall, the latest Beige Book report shows continued but modest growth and little inflation. The report will allow the Fed to hold off taper

Odds are the Fed will not taper at the December 17-18 FOMC meeting other than a token amount at the most.

There are signs of improvement in three key sectors—the labor market, housing, and manufacturing. Now, the big issue is for the Fed to convince financial markets that it can ease the recovery’s dependence on quantitative easing in a manner that is the right balance between timing and magnitude. Such convincing will likely start with the December 18 FOMC statement. In the meantime, there is a balancing act for the fourth quarter growth rate. Much of third quarter growth came from a jump in private inventories. Unless there is a strengthening in goods demand, there likely will be some pullback—but at least the auto sector is doing its part for demand.

Following in the footsteps of last week’s revision to GDP based on higher inventories and not final sales, the focus will be on retail sales. The business inventory report will likely get more attention than usual to see how in line sales and stocks may be for the fourth quarter.

The NFIB Small Business Optimism Index fell in October a sharp 2.3 points to 91.6. According to NFIB deepening pessimism over the economic outlook and the outlook for sales were major negatives pulling the small business optimism index down. Plans to increase employment also fell sharply with 7 of 10 components negative in the month. The report cited the government shutdown and fiscal standoff as negative factors for the October report as well as what it describes as the failed launch of the president's universal health care program.

NFIB Small Business Optimism Index Consensus Forecast for November 13: 92.4

Range: 91.5 to 94.0

The Labor Department’s Job Openings and Labor Turnover Survey for September showed 3.913 million job openings, little changed from 3.8.44 million in August. The number of job openings decreased in arts, entertainment, and recreation and was little changed in all remaining industries and in all four regions. The number of hires in September was 4.585 million, essentially unchanged from 4.559 million in August. The number of hires was little changed for total private and government, as well as for all industries and all four regions. There were 4.426 million total separations in September, little changed from 4.405 million in August. The number of total separations for total private and government were little changed.

JOLTS job openings Consensus Forecast for October 13: 3.905 million

Range: 3.895 million to 3.925 million

Wholesale inventories rose 0.4 percent in September with August revised sharply higher to plus 0.8 percent. But sales, at plus 0.6 percent, were in step with the build with the stock-to-sales ratio in the sector unchanged at 1.18. Autos in the wholesale sector have been swinging up and down the past two months. Excluding autos, wholesale inventories for the two months, at plus 0.8 percent in September and plus 0.6 percent for August, showed a slightly greater rate of build than total wholesale inventories.

Wholesale inventories Consensus Forecast for October 13: +0.4 percent

Range: +0.2 to +0.6 percent

The U.S. Treasury monthly budget report showed deficit reduction being extended into the first month of the government's new fiscal year, at $91.6 billion versus a deficit of $120.0 billion in October last year for a 24 percent improvement. But about $8 billion of the improvement was tied to calendar timing, shaving the actual year-on-year improvement to 17 percent. Receipts were up 8 percent from a year ago led by a gain in corporate income taxes. Outlays were down 5 percent but were perhaps held down temporarily by the government closing. Defense spending was down a year-on-year 8 percent with net interest expense down 18 percent.

Looking ahead, the month of November typically shows a deficit for the month. Over the past 10 years, the average deficit for the month of November has been $106.0 billion and $141.1 billion over the past 5 years. The November 2012 deficit came in at $172.1 billion.

Treasury Statement Consensus Forecast for November 13: -$155.0 billion

Range: -$167.0 billion to -$140.0 billion.

Initial jobless claims for the November 30 week fell a very sizable 23,000 to 298,000 for the lowest level since September and the second lowest level of the recovery. In a reversal of prior special factors tied to the government shutdown and counting problems in California, initial claims have now fallen in 7 of the last 8 weeks with the 4-week average down for 5 weeks in a row and now at 322,250 for the lowest level since September. Jobless claims are coming down but holiday adjustments raise uncertainty for the latest week. The Labor Department warned that this year's late Thanksgiving is clouding the accuracy of its seasonal adjustments.

Jobless Claims Consensus Forecast for 12/7/13: 325,000

Range: 315,000 to 350,000

Retail sales in October were moderately healthy with more components positive than not. Overall retail sales gained 0.4 percent after no change in September. Autos helped, increasing 1.3 percent after a decline of 1.2 percent in September. Excluding autos, sales advanced 0.2 percent in October after rising 0.3 percent in September. But gasoline prices weighed down sales. Gas station sales slipped 0.6 percent in October, following a 0.2 percent increase the month before. Excluding both autos and gasoline, sales increased 0.3 percent, matching the pace in September.

Retail sales Consensus Forecast for November 13: +0.6 percent

Range: +0.2 to +1.4 percent

Retail sales excluding motor vehicles Consensus Forecast for November 13: +0.3 percent

Range: -0.4 to +0.6 percent

Less motor vehicles & gasoline Consensus Forecast for November 13: +0.2 percent

Range: -0.3 to +0.7 percent

Import prices in October were down a sharp 0.7 percent in the month and exports prices were down almost as much, 0.5 percent. A major factor on the import side was sharp contraction in petroleum products, down 3.6 percent in the month. Excluding petroleum, import prices were unchanged. Prices of imported finished goods, which offer indications on consumer prices, were likewise flat showing very little monthly change. Contraction in agricultural prices, down 1.5 percent in the month, was a factor on the export side. But even excluding agricultural products, export prices fell 0.4 percent.

Import prices Consensus Forecast for November 13: -0.8 percent

Range: -1.2 to +0.2 percent

Export prices Consensus Forecast for November 13: -0.3 percent

Range: -0.3 to +0.2 percent

Business inventories rose 0.6 percent in September following 0.4 percent builds in the prior two months. September sales, however, edged only 0.2 percent higher which was below two prior gains of 0.3 percent and 0.6 percent. Among components, retail inventories rose a heavy 0.9 percent against no change for sales which drove the stock-to-sales ratio up 2 notches to 1.42 from 1.40. This is the heaviest reading since January. The build was centered in autos which rose 1.9 percent in September but, in a positive, auto inventories on the wholesale side are unusually low.

Business inventories Consensus Forecast for October 13: +0.3 percent

Range: -0.1 to +0.5 percent

The producer price index in October declined 0.2 percent after dipping 0.1 percent the month before. The core rate, which excludes both food and energy, firmed to 0.2 percent after rising 0.1 percent in September. Food prices rebounded 0.8 percent after falling 1.0 percent in September. Energy fell 1.5 percent, following a gain of 0.5 percent in September. Gasoline prices dropped 3.8 percent in October, following a dip of 0.1 percent the month before. For the core, leading the October advance, prices for passenger cars climbed 1.7 percent. By contrast, the index for light motor trucks edged down 0.1 percent.

PPI Consensus Forecast for November 13: -0.1 percent

Range: -0.2 to +0.5 percent

PPI ex food & energy Consensus Forecast for November 13: +0.1 percent

Range: 0.0 to +0.2 percent

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books.

He can also be found on a weekly broadcast talking about the U.S. economy, the easiest way to find him is by going to iTunes and searching for "Simply Economics."

Econoday Senior Writer Mark Pender contributed to this article.

|