|

With little major economic news, market attention remained on the question of Fed tapering early or not. Fed Chairman Ben Bernanke gave his opinion during the Q&A part of a mid-week speech and traders took his words to heart—on the upside for equities and bonds. Earnings were generally favorable.

Equities posted sizeable gains this past week with easing of concern about possible early Fed tapering being the key factor. The Dow and the S&P 500 closed Friday at record highs. Equities posted sizeable gains this past week with easing of concern about possible early Fed tapering being the key factor. The Dow and the S&P 500 closed Friday at record highs.

Stocks advanced Monday as investors waited for Alcoa’s kickoff to earnings season after markets close. The strength in equities came as traders continued to react positively to Friday's monthly employment report, which showed stronger than expected job growth in the month of June.

Equities gained further Tuesday on Alcoa’s better-than-expected earnings and on relief that the Eurozone finance ministers agreed to pay Greece its next tranche of funds. At mid-week, major indexes were mixed with little reaction to the Fed minutes and while waiting for Fed Chairman Ben Bernanke’s after close speech. Equities gained further Tuesday on Alcoa’s better-than-expected earnings and on relief that the Eurozone finance ministers agreed to pay Greece its next tranche of funds. At mid-week, major indexes were mixed with little reaction to the Fed minutes and while waiting for Fed Chairman Ben Bernanke’s after close speech.

The big move was Thursday with sharp gains. This was despite a disappointing jobless claims report. It was almost entirely due to Bernanke’s Wednesday speech in which he was emphatic during Q&A that quantitative easing will likely stay in place for some time. Most indexes rose Friday based on continued momentum from Bernanke’s comments.

Stocks were mostly up moderately at week’s close. A disappointing reading on consumer sentiment was a negative for the day. But stocks got some help late in trading with comments from St. Louis Fed President James Bullard that the Fed should wait months or even quarters for better economic data before cutting back on monetary ease. The Dow was essentially flat for the day, tugged down by a significant decline in Boeing on news of a fire in one of its Dreamliners carrying cargo.

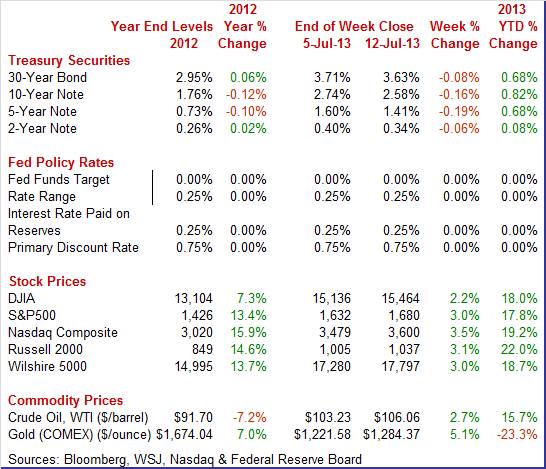

Equities were up this past week. The Dow was up 2.2 percent; the S&P 500, up 3.5 percent; the Nasdaq, up 3.5 percent; the Russell 2000, up 3.1 percent; and the Wilshire 5000, up 3.0 percent.

For the year-to-date, major indexes are up as follows: the Dow, up 18.0 percent; the S&P 500, up 17.8 percent; the Nasdaq, up 19.2 percent; the Russell 2000, up 22.0 percent; and the Wilshire 5000, up 18.7 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury rates reversed course this past week as worries about an early tapering of Fed asset purchases eased. Yields nudged down Monday as traders saw the previous week’s drop in prices as an opportunity for yield. Treasury yields dipped Tuesday ahead of Fed minutes and Bernanke’s speech on Wednesday. Treasury rates reversed course this past week as worries about an early tapering of Fed asset purchases eased. Yields nudged down Monday as traders saw the previous week’s drop in prices as an opportunity for yield. Treasury yields dipped Tuesday ahead of Fed minutes and Bernanke’s speech on Wednesday.

There was little reaction to the Fed minutes on Wednesday. But Chairman Bernanke’s comments after close Wednesday on continued ease sent rates down notably on Thursday. Yields edged up Friday on comments by Philadelphia Fed president Charles Plosser that asset purchases should end this year.

For this past week Treasury rates were down as follows: 3-month T-bill, down 1 basis point; the 2-year note, down 6 basis points; the 5-year note, down 19 basis points; the 7-year note, down 22 basis points; the 10-year note, down 16 basis points; and the 30-year bond, down 8 basis points.

The spot price of West Texas Intermediate continued its recent upward trend. The spot price of West Texas Intermediate continued its recent upward trend.

After little change Monday, crude on Tuesday rose a little over a dollar a barrel, reacting to an upgrade in the Energy Information Administration’s price forecast for 2013 and moving in tandem with equities. At mid-week, WTI gained $2 per barrel after U.S. stockpiles fell significantly for a second consecutive week.

Thursday, oil traders focused on economic data instead of FedSpeak. WTI declined more than a dollar a barrel on the disappointing initial jobless claims. On Friday, crude rose about $1-1/2 on bets that U.S. stockpiles will continue to decline.

Net for the week, the spot price for West Texas Intermediate gained $2.83 per barrel to settle at $106.06. This is the highest close since March 12, 2012.

The Fed continued to take center stage but updates on the consumer sector also stood out.

The FOMC minutes of the June 18-19 meeting clarified the Fed's ongoing policy debate. Much was already known from the statement released at the end of the meeting and the many Fed speakers, but there were key clarifications and some mildly surprising detail. The minutes affirmed the statement's decision to retain the fed funds rate at a range of zero to 0.25 percent and to maintain the pace of the Fed's asset purchase programs. Disagreement among FOMC members was already known—some wanted asset purchase tapering soon while others focused on the need for further improvement in the labor market.

The division within the Fed may be broader than earlier believed. The dove camp may have turned more dovish than indicated by the statement which included a dissenting vote by St. Louis Fed president James Bullard. The minutes noted that two FOMC members worried that the downside risks to inflation had increased, with one of them suggesting that the statement more explicitly reflect this increased risk. Apparently, a non-voting member might have voted with Bullard if a voting member. However, several members judged that a reduction in asset purchases would likely soon be warranted. Two were particularly vocal that tapering should begin "relatively soon"—one more than the official dissent by Kansas City's Esther George.

The minutes emphasized that a decision on asset purchases is separate from one on the fed funds rate. Many members indicated that they do not anticipate selling mortgage backed securities as part of the Fed's exit strategy. Overall, the minutes reinforced a number of key points. First, that tapering of asset purchases is coming—but is data dependent. An increase in the fed funds rate also is coming but is much further down the road than when tapering begins. It is apparent that the Fed is in deep debate on how this process should take place—especially in terms in changes in guidance.

While the minutes held only modest new information, a key market mover was comments by Fed Chairman Ben Bernanke. After market close Wednesday, Fed Chairman Ben Bernanke spoke on the history of Federal Reserve policy. While his prepared comments were mostly on Fed history with nothing on plans on quantitative easing, Q&A pointed toward continued monetary ease. During Q&A, Bernanke reminded that changes in asset purchases are data dependent. He noted that not being transparent on policy might have had a worse reaction on markets. Bernanke stated that the current unemployment rate overstates the health of the economy. Highly accommodative monetary policy is what is needed for the foreseeable future, especially given fiscal restraint. Regarding pending changes in the fed funds rate, he emphasized that 6.5 percent unemployment is a threshold and not a trigger. It would be the point for discussing change in policy. He sees inflation as too low even though part of the reason is transitory (implicitly energy in past months) and that the Fed still aims for long-term inflation of 2 percent. On the issue of the dollar, the Fed chairman noted that the dollar has improved, that the Fed is focusing on domestic growth, and not taking growth from overseas. But the bottom line is that Bernanke was emphatic that monetary policy remains accommodative for some time.

Consumer sentiment slipped in the first read for July with the composite posting at 83.9 versus the final for June at 84.1. July fell short of market expectations for 84.1. Consumer sentiment slipped in the first read for July with the composite posting at 83.9 versus the final for June at 84.1. July fell short of market expectations for 84.1.

Consumer may be feeling better about the current economy, but they are less optimistic about the future. Weakness was in the expectations component which dropped to 73.8 from 77.8 in June.

However, current conditions improved to 99.7 in mid-July from 93.8 for June. The current conditions index is at its highest level since mid-2007. However, current conditions improved to 99.7 in mid-July from 93.8 for June. The current conditions index is at its highest level since mid-2007.

The economic outlook index was little changed at 103.0 versus 104.0 in June.

However, recent increases in gasoline prices have boosted the near-term outlook for inflation as the one-year expectations rose to 3.3 percent from 3.0 percent in June. The five-year outlook held steady at 2.9 percent.

The labor market continues to improve but slowly. The number of job openings in May was 3.828 million, little changed from April’s 3.800 million. The number of job openings was little changed over the month in most industries but rose in retail trade and fell in professional and business services. The number of job openings rose in the Midwest but was essentially unchanged in the other three regions. The labor market continues to improve but slowly. The number of job openings in May was 3.828 million, little changed from April’s 3.800 million. The number of job openings was little changed over the month in most industries but rose in retail trade and fell in professional and business services. The number of job openings rose in the Midwest but was essentially unchanged in the other three regions.

Both hires and separations are oscillating upward with hires running a little higher than separations. In May, there were 4.441 million hires versus 4.395 million the month before. The hires rate was 3.3 percent. The hires rate was little changed in all industries and regions over the month.

There were 4.323 million total separations in the month of May—slightly up from 4.287 million in April. The separations rate was 3.2 percent. Total separations include quits, layoffs and discharges, and other separations.

Consumers were out in force in May as consumer credit rose a sharp $19.6 billion. Revolving credit jumped $6.6 billion for the largest gain since May last year and the second largest of the recovery. The gain points to a jump in credit card use which, if extended, would be a big plus for retailers. But the trend for revolving credit has been very flat, up one month and down the next which raises the risk that May's gain will be an outlier. Consumers were out in force in May as consumer credit rose a sharp $19.6 billion. Revolving credit jumped $6.6 billion for the largest gain since May last year and the second largest of the recovery. The gain points to a jump in credit card use which, if extended, would be a big plus for retailers. But the trend for revolving credit has been very flat, up one month and down the next which raises the risk that May's gain will be an outlier.

Non-revolving credit also jumped in the month, up $13.0 billion for yet another outsized gain that reflects both strong car sales but also gains in the student loan component that are tied in part to ongoing government acquisitions of student loans from private lenders, acquisitions that do not necessary reflect current student borrowing. Non-revolving credit also jumped in the month, up $13.0 billion for yet another outsized gain that reflects both strong car sales but also gains in the student loan component that are tied in part to ongoing government acquisitions of student loans from private lenders, acquisitions that do not necessary reflect current student borrowing.

The consumer indications in this report are favorable and in line with what turned out to be a solid month for retail sales in May. The key point is that many consumers are comfortable enough with the economy to take on additional debt.

The May rise in consumer credit likely should not be disconcerting as consumer delinquency rates have been declining notably, indicating that consumer balance sheets have improved significantly since the recession.

Inflation worsened in June at the producer level. The June producer price index jumped 0.8 percent, following a 0.5 percent boost in May. The core rate, which excludes both food and energy, firmed to 0.2 percent after rising 0.1 percent the month before. Inflation worsened in June at the producer level. The June producer price index jumped 0.8 percent, following a 0.5 percent boost in May. The core rate, which excludes both food and energy, firmed to 0.2 percent after rising 0.1 percent the month before.

Food prices moderated to a 0.2 percent rise, following a rebound of 0.6 percent in May. Energy spiked 2.9 percent in June after a 1.3 percent boost in May. Gasoline prices surged 7.2 percent, following a 1.5 percent rise in May. Higher prices for home heating oil and diesel fuel also contributed to the rise in the finished energy goods index. Food prices moderated to a 0.2 percent rise, following a rebound of 0.6 percent in May. Energy spiked 2.9 percent in June after a 1.3 percent boost in May. Gasoline prices surged 7.2 percent, following a 1.5 percent rise in May. Higher prices for home heating oil and diesel fuel also contributed to the rise in the finished energy goods index.

Turning to the core, a major contributor to the June increase was prices for passenger cars, which rose 0.8 percent. An advance in the index for light motor trucks also was a factor in higher finished core prices.

For the overall PPI, the year-ago rate accelerated to 2.5 percent from 1.8 percent in May (seasonally adjusted). The core rate held steady at 1.6 percent.

Headline inflation was up sharply in June—largely due to energy—but core also was on the warm side. It is just one month of data but at the Fed, the hawks will be pointing to these numbers, arguing for early tapering.

The consumer sector showed cross currents on whether improving or not but on balance show slow improvement. The latest producer price report indicates that we are likely in for further headline numbers on inflation in the near term on the high side. For now, traders believe that early tapering has been postponed.

With worries over early tapering of Fed asset purchases being ongoing drama in the markets, focus will be on Fed Chairman Ben Bernanke’s testimony before Congress on Wednesday and Thursday. With the manufacturing sector soft and with recent data on the consumer sector mixed, industrial production and retail sales will garner market attention. Also, with housing sales stronger in recent months, the question is whether that momentum will carry over to housing starts.

Retail sales in May increased 0.6 percent on the month. Retail sales excluding just autos and excluding both autos and gasoline were up 0.3 percent from April, much as expected. Most sales sub-categories were up on the month. Auto sales were up 1.8 percent, gaining for a second consecutive month after increasing 0.7 percent in April. Sales at gasoline stations edged down 0.2 percent thanks to declining prices. Elsewhere, notable gains were seen building materials and food. Significant declines were seen in furniture and home furnishing stores and electronics & appliances. More recently, unit new auto sales jumped 4.2 percent in June, indicating a strong number for the auto component of retail sales.

Retail sales Consensus Forecast for June 13: +0.8 percent

Range: +0.4 to +1.0 percent

Retail sales excluding motor vehicles Consensus Forecast for June 13: +0.5 percent

Range: +0.3 to +1.0 percent

Less motor vehicles & gasoline Consensus Forecast for June 13: +0.3 percent

Range: +0.1 to +0.6 percent

The Empire State manufacturing index

The Empire State index may have jumped back into the plus column but all the key sub-indexes were well in the negative camp to point to contraction underway in the region's manufacturing sector this month. The general business conditions index jumped from minus 1.43 in May to plus 7.84 in June. New orders, at minus 6.69 versus minus 1.17 in May, were down for a second straight month.

Empire State Manufacturing Survey Consensus Forecast for July 13: 5.00

Range: 1.00 to 10.00

Business inventories rose 0.3 percent in April following a dip of 0.1 percent in March and no change in February. Business sales dipped 0.1 percent, following a 1.2 percent drop in March. More recently, factory inventories for May were unchanged.

Business inventories Consensus Forecast for May 13: 0.0 percent

Range: -0.3 to +0.4 percent

The consumer price index for May made only a partial rebound at the headline level, rising 0.1 percent after falling 0.4 percent in April. The core CPI—excluding food and energy—rose 0.2 percent versus 0.1 percent in April. By major components outside the core, energy rose 0.4 percent after a drop of 4.3 percent in April. Gasoline was unchanged after decreasing 8.1 percent. Electricity and natural gas were responsible for the rise in energy. The food component dipped 0.1 percent in May, following a rise of 0.2 percent the month before. For the core measure, shelter costs rose 0.3 percent. Advances in the indexes for airline fares, recreation, and apparel also contributed to the rise in the core. In contrast, the indexes for medical care and used cars and trucks declined in May.

CPI Consensus Forecast for June 13 +0.4 percent

Range: 0.0 to +0.5 percent

CPI ex food & energy Consensus Forecast for June 13: +0.2 percent

Range: +0.1 to +0.2 percent

Industrial production was unchanged in May after declining 0.4 percent in April. The manufacturing component edged up 0.1 percent, following a decline of 0.4 percent in April. Excluding motor vehicles, manufacturing rose only 0.1 percent in May after a 0.4 percent decrease the prior month. The output of utilities decreased in May after a drop of 3.2 percent the month before. This component weakness was the main reason for the miss at the headline level. Production at mines gained 0.7 percent after rebounding 1.1 percent in April. Capacity utilization for total industry decreased to 77.6 percent in May from 77.7 percent the month before. Expectations were for 77.9 percent.

Industrial production Consensus Forecast for June 13: +0.2 percent

Range: -0.1 to +0.7 percent

Manufacturing production component Consensus Forecast for June 13: +0.2 percent

Range: +0.1 to +0.3 percent

Capacity utilization Consensus Forecast for June 13: 77.7 percent

Range: 77.4 to 77.8 percent

NAHB housing market index for June was up a very sharp 8 points to 52. The monthly point gain was the largest since the 2002 recovery with the index level above 50 for the first time since the 2006 boom years. A plus 50 reading indicates that home builders, as a group, are more optimistic than pessimistic. And above 50 were two of the report's three components led by the six-month outlook, at a very upbeat 61, followed by the current sales component which was strong at 56. Bringing up the rear at 40 was the traffic component

NAHB housing market index Consensus Forecast for July 13: 52

Range: 48 to 54

Housing starts in May rebounded a monthly 6.8 percent after plunging 14.8 percent in April. The May starts annualized level of 0.914 million units was up 28.6 percent on a year-ago basis. The gain in starts was led by a monthly 21.6 percent jump in the multifamily component after a 32.2 percent fall in April. The single-family component rose 0.3 percent, following a 4.2 percent decrease in April. Permits dipped after a very strong April. Permits eased 3.1 percent in May after jumping 12.9 percent the month before. May's annualized pace of 0.974 million units was up 20.8 percent on a year-ago basis.

Housing starts Consensus Forecast for June 13: 0.951 million-unit rate

Range: 0.915 million to 0.985 million-unit rate

Housing permits Consensus Forecast for June 13: 0.990 million-unit rate

Range: 0.975 million to 1.010 million-unit rate

Fed Chairman Ben Bernanke gives semi-annual testimony before the House Financial Services Committee in Washington.

The Beige Book being prepared for the July 30-31 FOMC meeting is released mid-afternoon ET. Again, traders will be focusing on the characterization of the recovery and especially if there is improvement in the labor force. These can affect market views on whether there is any acceleration in Fed plans to taper. From the June 5 Beige Book, overall economic activity expanded at a "modest to moderate pace."

Initial jobless claims for the July 6 week shot up but were filled with special factors. Claims jumped 16,000 to a 360,000 level. The 4-week average was up a sizable 6,000 to 351,750 which, against the month-ago comparison, was also up 6,000. There were a number of special factors. First is the holiday shortened week followed by summer retooling in the auto sector, which is now getting underway, as well as the end of the school year. All these factors made the latest report very hard to read. The latest data for continuing claims were for the June 29 week and the results were mixed. Continuing claims rose 24,000 to 2.977 million but the 4-week average was down 3,000 to just make a new recovery low of 2.971 million.

Jobless Claims Consensus Forecast for 7/13/13: 344,000

Range: 319,000 to 355,000

Fed Chairman Ben Bernanke gives semi-annual testimony before the Senate Banking Committee in Washington.

The general business conditions index of the Philadelphia Fed's Business Outlook Survey surged to 12.5 in June from minus 5.2 in May. Importantly, new orders surged to 16.6 from May's minus 7.9. This was a substantial gain that points to rising activity through the region's manufacturing sector.

Philadelphia Fed survey Consensus Forecast for July 13: 9.0

Range: -2.0 to 15.0

The Conference Board's index of leading indicators inched only 0.1 percent higher in May with strength confined entirely to the financial components: interest rates, the stock market, and credit activity. Other readings were flat to negative with unemployment claims exerting the most drag. Factory readings were mildly negative, underscoring the uncertain outlook for the manufacturing sector, and building permits were also a negative.

Leading indicators Consensus Forecast for June 13: +0.3 percent

Range: +0.1 to +0.5 percent

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books.

Econoday Senior Writer Mark Pender contributed to this article.

|