|

Most equity indexes were up last week with many indexes hitting their highest readings since June 2008. Investors appear to have pushed worries about Italy’s inconclusive elections aside along with U.S. government spending cuts. The week ended on a positive note when the U.S. February employment situation report was better than anticipated. Similarly, February export data from China also boosted morale.

Five central banks met and all five kept their respective monetary policies unchanged in March.

The ECB left its key interest rates unchanged despite some speculation about a 25 basis point cut — the refi rate remained at 0.75 percent and the rates on the deposit and marginal lending facilities at 0.0 percent and 1.50 percent respectively. ECB President Mario Draghi's press conference contained little in the way of fresh policy insights. In fact he gave very little away in terms of what and when the next move might be. The ECB left its key interest rates unchanged despite some speculation about a 25 basis point cut — the refi rate remained at 0.75 percent and the rates on the deposit and marginal lending facilities at 0.0 percent and 1.50 percent respectively. ECB President Mario Draghi's press conference contained little in the way of fresh policy insights. In fact he gave very little away in terms of what and when the next move might be.

Most recent economic data have been poor but pressure for additional monetary stimulus was probably eased to some extent by a rebound in February’s EU Commission's measure of economic sentiment and a surprisingly robust start to the year by retail sales. As widely anticipated, the 2013 growth forecast was revised weaker and now shows a range of minus 0.9 percent to minus 0.1 percent, down from the minus 0.9 percent to 0.3 percent projected in December. Next year now has a prediction of 0.6 percent to 2.0 percent compared with 0.2 percent to 2.2 percent last time. Official inflation expectations for 2013 were unchanged and so still carry a mid-point of 1.6 percent but have been adjusted down to only 1.3 percent in 2014, slightly lower than in December.

As expected, the monetary policy committee once again opted to leave Bank Rate at 0.5 percent and the asset purchase ceiling at £375 billion. The outcome disappointed a significant minority who thought a £25 billion increase was more than just a possibility. As expected, the monetary policy committee once again opted to leave Bank Rate at 0.5 percent and the asset purchase ceiling at £375 billion. The outcome disappointed a significant minority who thought a £25 billion increase was more than just a possibility.

The decision probably masked another split vote. In February there were three dissenters favoring a further loosening of monetary policy, including Governor Mervyn King. Economic news since then has been mixed and, in some instances, probably distorted by bad weather. However, on balance the data have been a little softer than the BoE expected. Private sector borrowing has yet to receive the boost hoped for from the Funding for Lending Scheme (FLS). In the MPC’s February Inflation Report the CPI inflation forecast was revised up again and now stays above its 2 percent target throughout the policy relevant horizon. Still, raising the ceiling on QE remains an option over coming months, even if the impending arrival of a new Governor, the Bank of Canada’s Mark Carney, in July increases the likelihood of maintaining the status quo near term.

As universally expected, the Bank of Japan left its monetary policy unchanged. Its interest rate range remains at zero to 0.1 percent. They also left the asset buying fund unchanged at ¥101 trillion. This meeting was the last for Masaaki Shirakawa and his two deputies. Their terms expire on March 19th after a five year term spent battling crises including the aftermath of Lehman Brothers' collapse in 2008 and the devastating March 2011 earthquake in Japan. As universally expected, the Bank of Japan left its monetary policy unchanged. Its interest rate range remains at zero to 0.1 percent. They also left the asset buying fund unchanged at ¥101 trillion. This meeting was the last for Masaaki Shirakawa and his two deputies. Their terms expire on March 19th after a five year term spent battling crises including the aftermath of Lehman Brothers' collapse in 2008 and the devastating March 2011 earthquake in Japan.

Investors are looking to the April 3rd and 4 meeting which will be the first for the new BoJ leadership. Asian Development Bank President Haruhiko Kuroda, a vocal advocate of aggressive easing, is expected to be installed as the new governor. He was nominated by Prime Minister Shinzo Abe to shake up the BoJ. The main opposition party, the Democratic Party of Japan, has indicated its support for Kuroda, suggesting he will be confirmed sometime this week. In a confirmation hearing last week, Kuroda said that buying longer dated Japanese government bonds would help end deflation. Gakushuin University economist Kikuo Iwata and BoJ Executive Director Hiroshi Nakaso will take the two deputy governor posts. Kuroda and Iwata are known as ‘pro-easing’ advocates. Kuroda vowed during a Diet hearing on Monday "to do whatever it takes." Markets are already focusing on just how bold he may be willing to be.

As expected, the RBA left its key cash rate at 3.0 percent where it has been since June 2012. The RBA has been looking for more rebalancing of the economy towards non-mining investment given that a slowdown in mining investment is already been occurring. With inflation under control, the Bank has more latitude in deciding policy. The February meeting minutes noted that the inflation outlook provided scope to ease policy further, should that be necessary to support demand. There were minimal changes in the wording of the Governor's statement from the one issued on February 5 following that "no change" decision. As expected, the RBA left its key cash rate at 3.0 percent where it has been since June 2012. The RBA has been looking for more rebalancing of the economy towards non-mining investment given that a slowdown in mining investment is already been occurring. With inflation under control, the Bank has more latitude in deciding policy. The February meeting minutes noted that the inflation outlook provided scope to ease policy further, should that be necessary to support demand. There were minimal changes in the wording of the Governor's statement from the one issued on February 5 following that "no change" decision.

In its statement, the RBA said once again that the inflation outlook would provide scope to ease further. It noted that global growth is forecast to be a little below average for a time, but the downside risks appear to have lessened over recent months. The United States is experiencing a moderate expansion and financial strains in Europe are considerably reduced compared with the situation through much of last year. Growth in China has stabilized at a fairly robust pace. Sentiment in financial markets is much improved compared with the middle of last year. Domestically, most indicators available suggest that growth was close to trend over 2012, led by very large increases in capital spending in the resources sector, while some other sectors experienced weaker conditions. Looking ahead, the peak in resource investment is approaching. As it does, there will be more scope for some other areas of demand to strengthen.

As expected, no changes were made to key interest rates — the target for the overnight rate remains at 1.0 percent and the deposit rate and Bank Rate stay at 0.75 percent and 1.25 percent respectively. The decision to maintain the policy status quo reflects the ongoing undershoot of both the Bank's growth and inflation forecasts. In its statement, the BoC watered down a little further the language of its already loosened January statement to suggest that current interest rate levels are here to stay for some time before a modest withdrawal of the existing monetary stimulus at some appropriate point. As tightening biases go, this is about as soft as could be realistically expected. Consequently, with the economy close to stagnating last quarter and a weak January employment report warning of a poor start to the current one, financial markets should continue to expect no BoC tightening until next year. As expected, no changes were made to key interest rates — the target for the overnight rate remains at 1.0 percent and the deposit rate and Bank Rate stay at 0.75 percent and 1.25 percent respectively. The decision to maintain the policy status quo reflects the ongoing undershoot of both the Bank's growth and inflation forecasts. In its statement, the BoC watered down a little further the language of its already loosened January statement to suggest that current interest rate levels are here to stay for some time before a modest withdrawal of the existing monetary stimulus at some appropriate point. As tightening biases go, this is about as soft as could be realistically expected. Consequently, with the economy close to stagnating last quarter and a weak January employment report warning of a poor start to the current one, financial markets should continue to expect no BoC tightening until next year.

|

|

2012 |

2013 |

% Change |

|

Index |

31-Dec |

March 1 |

March 8 |

Week |

Year |

| Asia/Pacific |

|

|

|

|

|

|

| Australia |

All Ordinaries |

4664.6 |

5100.9 |

5137.5 |

0.7% |

10.1% |

| Japan |

Nikkei 225 |

10395.2 |

11606.4 |

12283.6 |

5.8% |

18.2% |

| Hong Kong |

Hang Seng |

22656.9 |

22880.2 |

23092.0 |

0.9% |

1.9% |

| S. Korea |

Kospi |

1997.1 |

2026.5 |

2006.0 |

-1.0% |

0.4% |

| Singapore |

STI |

3167.1 |

3269.5 |

3289.5 |

0.6% |

3.9% |

| China |

Shanghai Composite |

2269.1 |

2359.5 |

2318.6 |

-1.7% |

2.2% |

|

|

|

|

|

|

|

| India |

Sensex 30 |

19426.7 |

18918.5 |

19683.2 |

4.0% |

1.3% |

| Indonesia |

Jakarta Composite |

4316.7 |

4811.6 |

4874.5 |

1.3% |

12.9% |

| Malaysia |

KLCI |

1689.0 |

1637.4 |

1654.0 |

1.0% |

-2.1% |

| Philippines |

PSEi |

5812.7 |

6642.3 |

6833.8 |

2.9% |

17.6% |

| Taiwan |

Taiex |

7699.5 |

7964.6 |

8015.1 |

0.6% |

4.1% |

| Thailand |

SET |

1391.9 |

1539.6 |

1566.9 |

1.8% |

12.6% |

|

|

|

|

|

|

|

| Europe |

|

|

|

|

|

|

| UK |

FTSE 100 |

5897.8 |

6378.6 |

6483.6 |

1.6% |

9.9% |

| France |

CAC |

3641.1 |

3699.9 |

3840.2 |

3.8% |

5.5% |

| Germany |

XETRA DAX |

7612.4 |

7708.2 |

7986.5 |

3.6% |

4.9% |

| Italy |

FTSE MIB |

16273.4 |

15675.4 |

16204.0 |

3.4% |

-0.4% |

| Spain |

IBEX 35 |

8167.5 |

8187.1 |

8628.1 |

5.4% |

5.6% |

| Sweden |

OMX Stockholm 30 |

1104.7 |

1199.2 |

1215.1 |

1.3% |

10.0% |

| Switzerland |

SMI |

6822.4 |

7602.0 |

7744.8 |

1.9% |

13.5% |

|

|

|

|

|

|

|

| North America |

|

|

|

|

|

|

| United States |

Dow |

13104.1 |

14089.7 |

14397.1 |

2.2% |

9.9% |

|

NASDAQ |

3019.5 |

3169.7 |

3244.4 |

2.4% |

7.4% |

|

S&P 500 |

1426.2 |

1518.2 |

1551.2 |

2.2% |

8.8% |

| Canada |

S&P/TSX Comp. |

12433.5 |

12773.1 |

12835.6 |

0.5% |

3.2% |

| Mexico |

Bolsa |

43705.8 |

43869.6 |

44322.5 |

1.0% |

1.4% |

Equities were up despite headwinds earlier in the week from tepid economic data. Investors instead focused on central bank announcements. Better than expected international data from China, Japan and the U.S. propelled equities upward on Friday even though German industrial data were weaker than forecast. As expected, both the Bank of England and the European Central Bank left their monetary policies unchanged. The FTSE was up 1.6 percent, the CAC bounced up 3.8 percent, the DAX jumped 3.6 percent and the SMI gained 1.9 percent. Equities were up despite headwinds earlier in the week from tepid economic data. Investors instead focused on central bank announcements. Better than expected international data from China, Japan and the U.S. propelled equities upward on Friday even though German industrial data were weaker than forecast. As expected, both the Bank of England and the European Central Bank left their monetary policies unchanged. The FTSE was up 1.6 percent, the CAC bounced up 3.8 percent, the DAX jumped 3.6 percent and the SMI gained 1.9 percent.

Investors here appeared to be trading on international rather than domestic data. Traders appeared to ignore German manufacturing orders and industrial production (excluding construction) data — both unexpectedly declined in January, indicating that the recovery in Germany could be losing momentum. New orders received by Germany manufacturers decreased 1.9 percent while output slid 0.4 percent on the month.

Earlier in the week, markets were buoyed after China maintained its economic growth target at 7.5 percent for 2013, while lowering its inflation target to 3.5 percent from previous year's 4 percent. The European markets also received a boost from the better than expected retail sales report from the Eurozone and the smaller than expected decrease in the service sector as reported by the Markit service PMI.

The behavior of the Japanese equity market and the Nikkei especially has been the story in this region. The index has been rising since November, continued through the election of Shinzo Abe as the new prime minister in December and into 2013 as investors waited for a new chairman to be named to head the Bank of Japan. Now with Asian Development Bank President Haruhiko Kuroda about to be confirmed by the Japanese Diet, expectations have soared. The Nikkei’s climb has in no small way been implemented by the swooning yen. The value of the yen has been aggressively attacked by Abe. On the week, most indexes advanced with the notable exceptions of the Kospi (down 1.0 percent) and Shanghai Composite (down 1.7 percent). The behavior of the Japanese equity market and the Nikkei especially has been the story in this region. The index has been rising since November, continued through the election of Shinzo Abe as the new prime minister in December and into 2013 as investors waited for a new chairman to be named to head the Bank of Japan. Now with Asian Development Bank President Haruhiko Kuroda about to be confirmed by the Japanese Diet, expectations have soared. The Nikkei’s climb has in no small way been implemented by the swooning yen. The value of the yen has been aggressively attacked by Abe. On the week, most indexes advanced with the notable exceptions of the Kospi (down 1.0 percent) and Shanghai Composite (down 1.7 percent).

The Nikkei was up a heady 5.8 percent on the week. It climbed to 12,284 — the level held before the failure of Lehman Brothers in 2008, bolstered by the yen's renewed weakness amid expectations the Bank of Japan will launch aggressive easing measures under the new BoJ leadership. Another factor contributing to the positive sentiment was news that Japan's economy pulled out of its 2012 downturn earlier than expected. The country revised up its gross domestic product figures for the October to December period to show a 0.2 percent annualized increase in the quarter compared to last month's initial reading of a 0.4 percent contraction.

The dramatic rally in Japanese stocks, which started in the middle of November, has maintained strong momentum. This is in contrast with Chinese equities, where the rally that started late last year and has lost some of its earlier drive — especially last week. The decline started with heavy selling on Monday after Beijing announced new measures to control the property market. However, Shanghai Composite rallied 2.3 percent Tuesday after outgoing Premier Wen Jiabao promised increased fiscal spending in 2013 in a bid to deliver economic growth of 7.5 percent for the year. The inflation target was lowered to 3.5 percent from 4 percent in the previous year, according to remarks prepared for the country's annual parliament meetings beginning Tuesday.

The U.S. dollar advanced last week against most of its major counterparts including the yen, euro, pound sterling, Swiss franc and the Canadian dollar. Only the Australian dollar managed to advance. The dollar climbed to the highest level since 2009 against the yen after Friday’s better than anticipated employment situation report. The U.S. currency rallied after the Labor Department reported the nation’s jobless rate unexpectedly slid to 7.7 percent — a four year low. Improving employment data in the U.S. contrasts vividly with the Eurozone’s record 11.9 percent unemployment rate in January. The U.S. dollar advanced last week against most of its major counterparts including the yen, euro, pound sterling, Swiss franc and the Canadian dollar. Only the Australian dollar managed to advance. The dollar climbed to the highest level since 2009 against the yen after Friday’s better than anticipated employment situation report. The U.S. currency rallied after the Labor Department reported the nation’s jobless rate unexpectedly slid to 7.7 percent — a four year low. Improving employment data in the U.S. contrasts vividly with the Eurozone’s record 11.9 percent unemployment rate in January.

The yen dropped against all its 16 major counterparts as a government report showed Japan’s current account deficit widened in January. The currency extended a second weekly loss against the dollar as the Ministry of Finance said the deficit in the current account, the widest measure of trade, increased to ¥364.8 billion in January, up from ¥264.1 billion a month ago. Japan’s currency has slumped 9.4 percent against the dollar this year as Prime Minister Shinzo Abe pushed the Bank of Japan to add to stimulus to beat deflation.

In the currency market, the sudden spike in tensions on the Korean peninsula added to the more dominant U.S. growth led demand for the dollar. Having said earlier in the week it was scrapping its armistice with South Korea, North Korea threatened the United States on Thursday with a preemptive nuclear strike after accusing it of warmongering. The dollar was up against a basket of major currencies but most of the focus was on its continued rise against the yen.

|

|

2012 |

2013 |

% Change |

|

|

Dec 31 |

Mar 1 |

Mar 8 |

Week |

2013 |

| U.S. $ per currency |

|

|

|

|

|

|

| Australia |

A$ |

1.040 |

1.020 |

1.024 |

0.4% |

-1.6% |

| New Zealand |

NZ$ |

0.829 |

0.824 |

0.821 |

-0.4% |

-0.9% |

| Canada |

C$ |

1.007 |

0.974 |

0.972 |

-0.2% |

-3.5% |

| Eurozone |

euro (€) |

1.319 |

1.302 |

1.300 |

-0.1% |

-1.4% |

| UK |

pound sterling (£) |

1.623 |

1.503 |

1.493 |

-0.7% |

-8.0% |

|

|

|

|

|

|

|

| Currency per U.S. $ |

|

|

|

|

|

|

| China |

yuan |

6.231 |

6.223 |

6.216 |

0.1% |

0.2% |

| Hong Kong |

HK$* |

7.750 |

7.754 |

7.756 |

0.0% |

-0.1% |

| India |

rupee |

54.995 |

54.905 |

54.291 |

1.1% |

1.3% |

| Japan |

yen |

86.750 |

93.560 |

96.000 |

-2.5% |

-9.6% |

| Malaysia |

ringgit |

3.058 |

3.097 |

3.106 |

-0.3% |

-1.5% |

| Singapore |

Singapore $ |

1.222 |

1.240 |

1.247 |

-0.5% |

-2.0% |

| South Korea |

won |

1064.400 |

1084.560 |

1090.460 |

-0.5% |

-2.4% |

| Taiwan |

Taiwan $ |

29.033 |

29.633 |

29.664 |

-0.1% |

-2.1% |

| Thailand |

baht |

30.580 |

29.770 |

29.740 |

0.1% |

2.8% |

| Switzerland |

Swiss franc |

0.916 |

0.944 |

0.952 |

-0.9% |

-3.8% |

| *Pegged to U.S. dollar |

|

|

|

|

|

|

| Source: Bloomberg |

|

|

|

|

|

|

February composite PMI covering both manufacturing and services was 50.2, slightly down from January’s 50.4. The services business activity index was 51.1, down from 51.5 the month before and the lowest since October. However, it signaled modest activity for the fourth consecutive month. Manufacturing output continued to decline at a modest rate, extending the contraction to nine months. Service sector growth was seen in both activity and incoming new business. Employment also rose, while confidence in the outlook improved to a joint survey-high. Cost pressures intensified, however, with input prices rising at the strongest rate for over four years, reflective of increased fuel prices and a weaker yen. In contrast, competitive pressures led to another decline in output charges. February composite PMI covering both manufacturing and services was 50.2, slightly down from January’s 50.4. The services business activity index was 51.1, down from 51.5 the month before and the lowest since October. However, it signaled modest activity for the fourth consecutive month. Manufacturing output continued to decline at a modest rate, extending the contraction to nine months. Service sector growth was seen in both activity and incoming new business. Employment also rose, while confidence in the outlook improved to a joint survey-high. Cost pressures intensified, however, with input prices rising at the strongest rate for over four years, reflective of increased fuel prices and a weaker yen. In contrast, competitive pressures led to another decline in output charges.

Fourth quarter gross domestic product contracted at an unrevised 0.6 percent quarterly rate. The decline in total output, which remains the sharpest since the start of 2009, left GDP 0.9 percent lower on the year. Private consumption, having slipped 0.1 percent in the third quarter, dropped a quarterly 0.4 percent while gross fixed capital formation followed a 0.8 percent decline with a steeper decrease of 1.1 percent. At the same time, government consumption was off 0.1 percent for the third consecutive quarter and reduced inventory accumulation subtracted 0.1 percentage points from the bottom line, although this was 0.2 percentage points less than last time. In contrast to the third quarter, there was no stimulus from foreign trade. With exports and imports both dropping 0.9 percent on the quarter, net exports were only flat after boosting GDP by 0.5 percentage points in each of the previous two quarters. It was all bad news for the larger four economies with Germany matching the headline quarterly decline, Italy down 0.9 percent, Spain 0.8 percent weaker and France off 0.3 percent. A mixed picture elsewhere included another solid performance by Estonia (0.9 percent) but contractions in the majority, led by Portugal (1.8 percent) ahead of Cyprus (1.0 percent) and Slovenia (also 1.0 percent). Fourth quarter gross domestic product contracted at an unrevised 0.6 percent quarterly rate. The decline in total output, which remains the sharpest since the start of 2009, left GDP 0.9 percent lower on the year. Private consumption, having slipped 0.1 percent in the third quarter, dropped a quarterly 0.4 percent while gross fixed capital formation followed a 0.8 percent decline with a steeper decrease of 1.1 percent. At the same time, government consumption was off 0.1 percent for the third consecutive quarter and reduced inventory accumulation subtracted 0.1 percentage points from the bottom line, although this was 0.2 percentage points less than last time. In contrast to the third quarter, there was no stimulus from foreign trade. With exports and imports both dropping 0.9 percent on the quarter, net exports were only flat after boosting GDP by 0.5 percentage points in each of the previous two quarters. It was all bad news for the larger four economies with Germany matching the headline quarterly decline, Italy down 0.9 percent, Spain 0.8 percent weaker and France off 0.3 percent. A mixed picture elsewhere included another solid performance by Estonia (0.9 percent) but contractions in the majority, led by Portugal (1.8 percent) ahead of Cyprus (1.0 percent) and Slovenia (also 1.0 percent).

January retail sales were up 1.2 percent after dropping 0.8 percent the month before. On the year, sales were down 1.3 percent. The recovery was led by the non-food sector which, excluding auto fuel, saw a 2.0 percent monthly bounce that unwound a decent portion of the declines recorded over the previous four months. Sales of food, drink & tobacco advanced a more modest 0.8 percent after a 0.6 percent contraction in December. Regionally the monthly headline advance was in no small way attributable to a 3.1 percent spurt in Germany that more than reversed December's 2.1 percent slump. However, Belgium matched the German increase for its third consecutive monthly advance. Elsewhere Portugal (4.2 percent) and Luxembourg (1.3 percent) also gained but there were declines in Ireland (1.0 percent), Malta (1.6 percent) and Finland (1.2 percent). January retail sales were up 1.2 percent after dropping 0.8 percent the month before. On the year, sales were down 1.3 percent. The recovery was led by the non-food sector which, excluding auto fuel, saw a 2.0 percent monthly bounce that unwound a decent portion of the declines recorded over the previous four months. Sales of food, drink & tobacco advanced a more modest 0.8 percent after a 0.6 percent contraction in December. Regionally the monthly headline advance was in no small way attributable to a 3.1 percent spurt in Germany that more than reversed December's 2.1 percent slump. However, Belgium matched the German increase for its third consecutive monthly advance. Elsewhere Portugal (4.2 percent) and Luxembourg (1.3 percent) also gained but there were declines in Ireland (1.0 percent), Malta (1.6 percent) and Finland (1.2 percent).

January manufacturing orders dropped 1.9 percent after increasing a revised 1.1 percent the month before. On the year, orders are down 2.5 percent. Basics declined 0.4 percent on the month while consumer & durable goods were off 2.8 percent and capital goods slid 2.9 percent. Domestic orders posted a 0.6 percent decline following an increase of 0.3 percent last time. Within this basics were up 1.1 percent and consumer & durables were 1.0 percent higher — but gains here were more than offset by a 2.5 percent slump in capital goods. Overseas orders were down 3.0 percent from December with the Eurozone component falling 4.1 percent and the rest of the world 2.3 percent. Basic goods (down 6.6 percent) were especially weak. January manufacturing orders dropped 1.9 percent after increasing a revised 1.1 percent the month before. On the year, orders are down 2.5 percent. Basics declined 0.4 percent on the month while consumer & durable goods were off 2.8 percent and capital goods slid 2.9 percent. Domestic orders posted a 0.6 percent decline following an increase of 0.3 percent last time. Within this basics were up 1.1 percent and consumer & durables were 1.0 percent higher — but gains here were more than offset by a 2.5 percent slump in capital goods. Overseas orders were down 3.0 percent from December with the Eurozone component falling 4.1 percent and the rest of the world 2.3 percent. Basic goods (down 6.6 percent) were especially weak.

January industrial production was unchanged on the month and was down 1.3 percent on the year. Excluding construction output slumped 0.4 percent and was down 1.4 percent from a year ago. Manufacturing output declined 0.2 percent after gaining 1.0 percent at the end of 2012. It reflected a 1.5 percent drop in capital goods, only partially offset by increases in consumer goods (1.6 percent) and intermediates (0.6 percent). Elsewhere, energy posted a 2.3 percent contraction but construction was up 3.0 percent. January industrial production was unchanged on the month and was down 1.3 percent on the year. Excluding construction output slumped 0.4 percent and was down 1.4 percent from a year ago. Manufacturing output declined 0.2 percent after gaining 1.0 percent at the end of 2012. It reflected a 1.5 percent drop in capital goods, only partially offset by increases in consumer goods (1.6 percent) and intermediates (0.6 percent). Elsewhere, energy posted a 2.3 percent contraction but construction was up 3.0 percent.

Fourth quarter joblessness rose an additional 124,000 or 0.4 percent from the previous period to 2.944 million. As a result, the unemployment rate climbed 0.3 percentage points to a higher than expected 10.2 percent. Including overseas territories, the jobless rate was 10.6 percent, up 0.4 percentage points from a slightly weaker revised third quarter level. Significantly, the latest deterioration in French labour markets was much more marked than in the third quarter when the number of people out of work increased by a relatively modest 29,000. The fourth quarter jump was the largest since the same period in 2009. Fourth quarter joblessness rose an additional 124,000 or 0.4 percent from the previous period to 2.944 million. As a result, the unemployment rate climbed 0.3 percentage points to a higher than expected 10.2 percent. Including overseas territories, the jobless rate was 10.6 percent, up 0.4 percentage points from a slightly weaker revised third quarter level. Significantly, the latest deterioration in French labour markets was much more marked than in the third quarter when the number of people out of work increased by a relatively modest 29,000. The fourth quarter jump was the largest since the same period in 2009.

January seasonally adjusted merchandise trade deficit widened out from €5.4 billion in December to a larger than expected €5.9 billion. The headline deterioration reflected a contraction in both sides of the balance sheet with exports down 2.4 percent on the month and imports off 1.0 percent. The former were hit by a sharp drop in overseas purchases of aerospace and auto products following a strong showing in December. However, food exports performed well. Compared with a year ago, exports were unchanged while imports expanded 0.7 percent. January seasonally adjusted merchandise trade deficit widened out from €5.4 billion in December to a larger than expected €5.9 billion. The headline deterioration reflected a contraction in both sides of the balance sheet with exports down 2.4 percent on the month and imports off 1.0 percent. The former were hit by a sharp drop in overseas purchases of aerospace and auto products following a strong showing in December. However, food exports performed well. Compared with a year ago, exports were unchanged while imports expanded 0.7 percent.

Fourth quarter gross domestic product was revised to unchanged on the quarter from a contraction of 0.1 percent. GDP expanded at an annualized rate of 0.2 percent. On the year, GDP was up 0.4 percent. CAPEX was revised to a decline of 1.5 percent on the quarter from the initial estimate of a 2.6 percent drop. On the quarter, domestic demand was up 0.2 percent after shrinking the quarter before. Private consumption was up 0.5 percent after sinking 0.5 percent in the third quarter. Exports dropped 3.7 percent, subtracting 0.5 percentage points from growth. Fourth quarter gross domestic product was revised to unchanged on the quarter from a contraction of 0.1 percent. GDP expanded at an annualized rate of 0.2 percent. On the year, GDP was up 0.4 percent. CAPEX was revised to a decline of 1.5 percent on the quarter from the initial estimate of a 2.6 percent drop. On the quarter, domestic demand was up 0.2 percent after shrinking the quarter before. Private consumption was up 0.5 percent after sinking 0.5 percent in the third quarter. Exports dropped 3.7 percent, subtracting 0.5 percentage points from growth.

January retail sales were up 0.9 percent after declining 0.4 percent in December. On the year, sales were up 3.0 percent after increasing 2.4 percent in December. The largest contributor to the increase was other retailing (2.6 percent) followed by household goods retailing (1.3 percent), food retailing (0.3 percent), cafes, restaurants & takeaway food services (1.0 percent) and clothing, footwear & personal accessory retailing (0.7 percent). Partially offsetting the increases was a decline in department stores (0.6 percent). The state which was the largest contributor to the increase was New South Wales (1.3 percent), followed by Victoria (1.0 percent), Queensland (0.9 percent), Tasmania (1.4 per cent), South Australia (0.4 per cent), the Northern Territory (1.3 per cent) and the Australian Capital Territory (0.8 per cent). These increases were partially offset by a decline in Western Australia (0.4 percent). January retail sales were up 0.9 percent after declining 0.4 percent in December. On the year, sales were up 3.0 percent after increasing 2.4 percent in December. The largest contributor to the increase was other retailing (2.6 percent) followed by household goods retailing (1.3 percent), food retailing (0.3 percent), cafes, restaurants & takeaway food services (1.0 percent) and clothing, footwear & personal accessory retailing (0.7 percent). Partially offsetting the increases was a decline in department stores (0.6 percent). The state which was the largest contributor to the increase was New South Wales (1.3 percent), followed by Victoria (1.0 percent), Queensland (0.9 percent), Tasmania (1.4 per cent), South Australia (0.4 per cent), the Northern Territory (1.3 per cent) and the Australian Capital Territory (0.8 per cent). These increases were partially offset by a decline in Western Australia (0.4 percent).

Fourth quarter gross domestic product was up 0.6 percent on the quarter and 3.1 percent when compared with the same quarter a year ago. In seasonally adjusted terms, the main contributors to expenditure on GDP were total public gross fixed capital formation (1.1 percentage points) and net exports (0.6 percentage points). The main detractors were total private gross fixed capital formation (-0.9 percentage points) and changes in inventories (-0.4 percentage points). Final consumption expenditures edged up 0.1 percent on the quarter and 2.5 percent from a year ago. Gross fixed capital formation was up 0.8 percent and 5.9 percent on the year. Fourth quarter gross domestic product was up 0.6 percent on the quarter and 3.1 percent when compared with the same quarter a year ago. In seasonally adjusted terms, the main contributors to expenditure on GDP were total public gross fixed capital formation (1.1 percentage points) and net exports (0.6 percentage points). The main detractors were total private gross fixed capital formation (-0.9 percentage points) and changes in inventories (-0.4 percentage points). Final consumption expenditures edged up 0.1 percent on the quarter and 2.5 percent from a year ago. Gross fixed capital formation was up 0.8 percent and 5.9 percent on the year.

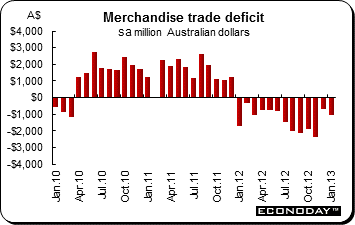

January merchandise trade deficit widened to A$1.057 billion from a revised deficit of A$688 million in December. Exports were down 0.7 percent on the month but edged up 0.1 percent from a year ago. Both rural and non–rural goods were down 3 percent. Non–monetary gold was up 17 percent while net exports of goods under merchanting rose 200 percent. Services were up 2 percent. The main component contributing to the decline in rural goods was other rural, down 10 percent. Partly offsetting this drop was the cereal grains & cereal preparations component, up 12 percent. The main components contributing to the decline in exports of non–rural goods were coal, coke & briquettes (down 5 percent), other manufactures (down 8 percent) and metals excluding non–monetary gold (down 9 percent). Imports were up 0.7 percent. Capital goods were up 5 percent while consumption goods were 3 percent higher. However, intermediate and other merchandise goods slid 3 percent and non–monetary gold were down 2 percent. Contributing to imports of consumption goods were non–industrial transport equipment (up 8 percent) and food and beverages mainly for consumption (up 5 percent). The main components contributing to the increase in capital goods imports were telecommunications equipment (up 52 percent) and capital goods (up 7 percent). January merchandise trade deficit widened to A$1.057 billion from a revised deficit of A$688 million in December. Exports were down 0.7 percent on the month but edged up 0.1 percent from a year ago. Both rural and non–rural goods were down 3 percent. Non–monetary gold was up 17 percent while net exports of goods under merchanting rose 200 percent. Services were up 2 percent. The main component contributing to the decline in rural goods was other rural, down 10 percent. Partly offsetting this drop was the cereal grains & cereal preparations component, up 12 percent. The main components contributing to the decline in exports of non–rural goods were coal, coke & briquettes (down 5 percent), other manufactures (down 8 percent) and metals excluding non–monetary gold (down 9 percent). Imports were up 0.7 percent. Capital goods were up 5 percent while consumption goods were 3 percent higher. However, intermediate and other merchandise goods slid 3 percent and non–monetary gold were down 2 percent. Contributing to imports of consumption goods were non–industrial transport equipment (up 8 percent) and food and beverages mainly for consumption (up 5 percent). The main components contributing to the increase in capital goods imports were telecommunications equipment (up 52 percent) and capital goods (up 7 percent).

February unadjusted merchandise trade surplus was a surprising $15.25 billion — analysts expected a deficit of $10 billion. Exports jumped 21.8 percent on the year against expectations of 11.8 percent. However, imports dropped 15.2 percent. Analysts expected imports to be down 9.2 percent. Year to date, the trade balance was a surplus of $44.15 billion compared with a deficit of $4.24 billion in the first two months of 2012. On a seasonally adjusted basis, imports were up 6.5 percent from a year ago after increasing 3.4 percent in Japan. February seasonally adjusted exports were up 20.6 percent after increasing 12.4 percent in January. February unadjusted merchandise trade surplus was a surprising $15.25 billion — analysts expected a deficit of $10 billion. Exports jumped 21.8 percent on the year against expectations of 11.8 percent. However, imports dropped 15.2 percent. Analysts expected imports to be down 9.2 percent. Year to date, the trade balance was a surplus of $44.15 billion compared with a deficit of $4.24 billion in the first two months of 2012. On a seasonally adjusted basis, imports were up 6.5 percent from a year ago after increasing 3.4 percent in Japan. February seasonally adjusted exports were up 20.6 percent after increasing 12.4 percent in January.

January seasonally adjusted trade deficit was C$0.2 billion, down from a smaller revised C$0.3 billion deficit in December. The minimal improvement was attributable to 2.1 percent monthly increase in exports that just more than offset a smaller 1.9 percent increase in imports. Volumes showed a slightly worse picture with imports gaining 1.8 percent or twice the rate of exports. Exports to the U.S. were up 2.6 percent from December which, with imports advancing 2.1 percent, saw the bilateral surplus widen to C$4.3 billion from C$4.0 billion last time. Among the major commodity groups exports were boosted by a 6.7 percent monthly bounce in energy and a 10.5 percent jump in metal and non-metallic mineral products. There was also a solid 5.6 percent gain in industrial, chemical, rubber & plastic products. However, auto exports dropped 7.6 percent and metal ores & non-metallic mineral products were off 16.0 percent, largely due to weakness in copper. On the import side, energy products were up 11.8 percent from December and metal ores & non-metallic mineral grew nearly 37 percent. Industrial machinery, equipment & parts also were up 5.3 percent. However, non-metallic mineral products slid 10.8 percent. January seasonally adjusted trade deficit was C$0.2 billion, down from a smaller revised C$0.3 billion deficit in December. The minimal improvement was attributable to 2.1 percent monthly increase in exports that just more than offset a smaller 1.9 percent increase in imports. Volumes showed a slightly worse picture with imports gaining 1.8 percent or twice the rate of exports. Exports to the U.S. were up 2.6 percent from December which, with imports advancing 2.1 percent, saw the bilateral surplus widen to C$4.3 billion from C$4.0 billion last time. Among the major commodity groups exports were boosted by a 6.7 percent monthly bounce in energy and a 10.5 percent jump in metal and non-metallic mineral products. There was also a solid 5.6 percent gain in industrial, chemical, rubber & plastic products. However, auto exports dropped 7.6 percent and metal ores & non-metallic mineral products were off 16.0 percent, largely due to weakness in copper. On the import side, energy products were up 11.8 percent from December and metal ores & non-metallic mineral grew nearly 37 percent. Industrial machinery, equipment & parts also were up 5.3 percent. However, non-metallic mineral products slid 10.8 percent.

February employment was up 50,700 increase following January's unrevised 21,900 decline and was the largest increase since November's 56,300 advance. The jobless rate held steady at 7.0 percent as the participation rate edged up to 66.7 percent. The increase in employment was dominated by full time positions which were up 33,600 from last time. Part time jobs were 17,200 higher. Private sector payrolls expanded 29,200 ahead of a 9,400 increase in the public sector headcount and 12,000 gain in the number of self-employed. The goods producing sector as a whole remained weak, shedding 8,600 jobs as manufacturing contracted a sizeable 25,600. Construction advanced 15,800 and agriculture was up 7,300 but there were also declines in natural resources (6,000) as well as utilities (100). Services employment climbed 59,300. Within this, trade (13,200), professional, scientific & technical services (26,200) and accommodation & food (21,100) all enjoyed a good month. Public administration was also up 16,300. Declines were generally limited with education (down 12,100) leading the way. February employment was up 50,700 increase following January's unrevised 21,900 decline and was the largest increase since November's 56,300 advance. The jobless rate held steady at 7.0 percent as the participation rate edged up to 66.7 percent. The increase in employment was dominated by full time positions which were up 33,600 from last time. Part time jobs were 17,200 higher. Private sector payrolls expanded 29,200 ahead of a 9,400 increase in the public sector headcount and 12,000 gain in the number of self-employed. The goods producing sector as a whole remained weak, shedding 8,600 jobs as manufacturing contracted a sizeable 25,600. Construction advanced 15,800 and agriculture was up 7,300 but there were also declines in natural resources (6,000) as well as utilities (100). Services employment climbed 59,300. Within this, trade (13,200), professional, scientific & technical services (26,200) and accommodation & food (21,100) all enjoyed a good month. Public administration was also up 16,300. Declines were generally limited with education (down 12,100) leading the way.

Five of the major central banks met — all left their respective monetary policies unchanged as expected. Data were mixed but there were promising improvements in China’s exports, Japan’s GDP and U.S. employment.

Data next week focuses on merchandise trade and industrial production data for the most part. Australia’s labour force survey will be parsed carefully by equity and foreign exchange markets. The U.S. begins daylight savings time on Sunday, March 10, 2013.

| The following indicators will be released this week... |

| Europe |

|

|

| March 11 |

Germany |

Merchandise Trade (January) |

|

France |

Industrial Production (January) |

|

Italy |

Gross Domestic Product (Q4.2012 final) |

| March 12 |

UK |

Industrial Production (January) |

|

|

Merchandise Trade (January) |

| March 15 |

Eurozone |

Harmonized Index of Consumer Prices (February final) |

| |

|

|

| Asia/Pacific |

|

|

| March 11 |

Japan |

Machinery Orders (January) |

| March 12 |

Japan |

Corporate Goods Price Index (February) |

|

|

Tertiary Activity Index (January) |

| March 14 |

Australia |

Labour Force Survey (February) |

| |

|

|

Anne D Picker is the author of International Economic Indicators and Central Banks.

|