|

Markets have been fixated with how and when the U.S. fiscal cliff would be resolved. This past week included passage of an income tax package that retained income tax cuts for most individuals. But spending cuts were not addressed. And the status of Fed policy has regained attention. However, the good news is that the economy continues to grow moderately.

Equities focused on the federal fiscal cliff this past week. Stocks rallied Monday on positive comments that a deal was being made to resolve the tax rate portion of the fiscal cliff. Both legislative leaders and President Obama indicated that a deal was very close. Markets were closed Tuesday for the New Year’s Day holiday. But lawmakers returned to Washington on January 1 to end uncertainty on income tax rates with an almost midnight vote in the House of Representatives to send legislation to President Obama for his signature. Equities surged Wednesday on passage of the partial relief (tax side—but not spending side) of the fiscal cliff. Economic news was mostly favorable as the Markit PMI and ISM manufacturing index posted in mildly positive territory. Equities focused on the federal fiscal cliff this past week. Stocks rallied Monday on positive comments that a deal was being made to resolve the tax rate portion of the fiscal cliff. Both legislative leaders and President Obama indicated that a deal was very close. Markets were closed Tuesday for the New Year’s Day holiday. But lawmakers returned to Washington on January 1 to end uncertainty on income tax rates with an almost midnight vote in the House of Representatives to send legislation to President Obama for his signature. Equities surged Wednesday on passage of the partial relief (tax side—but not spending side) of the fiscal cliff. Economic news was mostly favorable as the Markit PMI and ISM manufacturing index posted in mildly positive territory.

Stocks were little changed for most of Thursday but slipped after the release of Fed FOMC minutes in the afternoon. The minutes suggested that QE3 and QE4 might end by close of 2013. This led to a mild decline in stocks for the day. At week’s close, the employment report for December was seen a mildly positive even though headline numbers were essentially as expected. Detail was stronger for earnings and hours worked. And FedSpeak clarified that loose monetary policy likely would go beyond 2013 even though the Fed would be monitoring economic conditions. For the week, the S&P 500 closed at a 5-year high—the highest since December 31, 2007. Stocks were little changed for most of Thursday but slipped after the release of Fed FOMC minutes in the afternoon. The minutes suggested that QE3 and QE4 might end by close of 2013. This led to a mild decline in stocks for the day. At week’s close, the employment report for December was seen a mildly positive even though headline numbers were essentially as expected. Detail was stronger for earnings and hours worked. And FedSpeak clarified that loose monetary policy likely would go beyond 2013 even though the Fed would be monitoring economic conditions. For the week, the S&P 500 closed at a 5-year high—the highest since December 31, 2007.

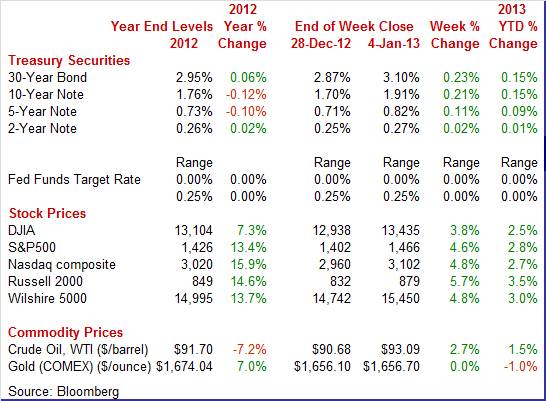

Equities were up this past week. The Dow was up 3.8 percent; the S&P 500, up 4.6 percent; the Nasdaq, up 4.8 percent; the Russell 2000, up 5.7 percent; and the Wilshire 5000, up 4.8 percent. Equities were up this past week. The Dow was up 3.8 percent; the S&P 500, up 4.6 percent; the Nasdaq, up 4.8 percent; the Russell 2000, up 5.7 percent; and the Wilshire 5000, up 4.8 percent.

Equities were up in December. The Dow was up 0.6 percent; the S&P 500, up 0.7 percent; the Nasdaq, up 0.3 percent; the Russell 2000, up 3.3 percent; and the Wilshire 5000, up 1.0 percent.

Equities were mostly down in the fourth quarter with the Dow down 2.5 percent; the S&P 500, down 1.0 percent; the Nasdaq, down 3.1 percent percent; the Russell 2000, up 1.4 percent; and the Wilshire 5000, down 0.3 percent. Equities were mostly down in the fourth quarter with the Dow down 2.5 percent; the S&P 500, down 1.0 percent; the Nasdaq, down 3.1 percent percent; the Russell 2000, up 1.4 percent; and the Wilshire 5000, down 0.3 percent.

For 2012 (year end versus year end), stocks were up with the Dow up 7.3 percent; the S&P 500, up 13.4 percent; the Nasdaq, up 15.9 percent; the Russell 2000, up 14.6 percent; and the Wilshire 5000, up 13.7 percent.

For the year-to-date (12/31 through 1/4), major indexes are up as follows: the Dow, up 2.5 percent; the S&P 500, up 2.8 percent; the Nasdaq, up 2.7 percent; the Russell 2000, up 3.5 percent; and the Wilshire 5000, up 3.0 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury yields jumped this past week on reversal of flight to safety and on flow into equities. This started Monday as a fiscal cliff deal appeared to be close to reality. Rates continued to rise Wednesday after actual passage of a deal Tuesday night in the House of Representatives. Mid-range and longer rates gained Thursday after Fed minutes indicated that quantitative easing might no longer weigh on rates after 2013. Yields were little changed Friday as the employment situation was about as expected at the headline level. Treasury yields jumped this past week on reversal of flight to safety and on flow into equities. This started Monday as a fiscal cliff deal appeared to be close to reality. Rates continued to rise Wednesday after actual passage of a deal Tuesday night in the House of Representatives. Mid-range and longer rates gained Thursday after Fed minutes indicated that quantitative easing might no longer weigh on rates after 2013. Yields were little changed Friday as the employment situation was about as expected at the headline level.

For this past week Treasury rates were up as follows: 3-month T-bill, up 7 basis points; the 2-year note, up 2 basis points; the 5-year note, up 11 basis points; the 7-year note, up 17 basis points; the 10-year note, up 21 basis points; and the 30-year bond, up 23 basis points.

For broader perspective, short-term rates continue to be held captive to exceptionally low policy rates by the Fed. However, longer-rate in recent weeks have drifted upward as concerns have eased about European sovereign debt and some officials within the Fed have argued that quantitative easing may end sooner than recently believed. Still, this is a minority position within the Fed—for now.

The spot price of oil essentially tracked progress on the fiscal cliff and the stock market this past week. West Texas Intermediate gained over a dollar a barrel on Monday and Wednesday but slipped on concern about Fed policy on Thursday’s release of FOMC minutes. Crude edged up Friday on a favorable employment report, hitting its highest settle since mid-September 2012. The spot price of oil essentially tracked progress on the fiscal cliff and the stock market this past week. West Texas Intermediate gained over a dollar a barrel on Monday and Wednesday but slipped on concern about Fed policy on Thursday’s release of FOMC minutes. Crude edged up Friday on a favorable employment report, hitting its highest settle since mid-September 2012.

Net for the week, the spot price for West Texas Intermediate increased $2.41 per barrel to settle at $93.09.

The recovery continues as December employment posts moderate gains and mild positives were seen in manufacturing and housing. And the consumer is boosting the economy with new auto purchases.

There were some positives in the latest jobs report. The unemployment rate held steady at an as-expected 7.8 percent in December. There were some positives in the latest jobs report. The unemployment rate held steady at an as-expected 7.8 percent in December.

Payroll jobs in December were also as expected, gaining 155,000 following an increase of 161,000 in November (originally up 146,000) and a rise of 137,000 in October (previously up 138,000). The net revisions for October and November were up 14,000. Analysts forecast a 155,000 rise for November.

Private payrolls were a little healthier than projected, rising 168,000 in December after increasing 171,000 the prior month. The consensus called for a 157,000 increase. Private payrolls were a little healthier than projected, rising 168,000 in December after increasing 171,000 the prior month. The consensus called for a 157,000 increase.

In the private sector, relative strength was in the goods-producing sector which rebounded 59,000 in December after a 1,000 dip the month before. Construction jobs posted a 30,000 gain, following a 10,000 drop in November. Manufacturing employment improved 25,000 after a 5,000 rise the month before. While motor vehicle jobs rose in December, manufacturing employment saw stronger gains in other industries. Mining increased 3,000 in the latest month.

However, growth slowed in service-providing industries—perhaps over concerns about the fiscal cliff. Private service-providing jobs rose 168,000 in December after a 171,000 increase in November. But the December figure did top expectations for a 157,000 boost.

Government jobs fell 13,000 in December after dipping 10,000 the month before.

Workers may be finally benefitting from moderate improvement in the labor market. Average hourly earnings increased 0.3 percent in December, following a 0.3 percent gain in November. The market consensus was for a 0.2 percent rise. The average workweek nudged up to 34.5 hours from 34.4 hours in November. Analysts projected 34.4 hours.

A little noticed portion of the establishment survey (payroll survey) was the aggregate weekly hours table which was very positive. For all employees, aggregate weekly hours gained 0.4 percent in December, matching the pace in November.

Turning to the household survey, the unemployment rate actually rose almost one-tenth—but just not on a rounded basis. The more detailed rate was 7.849 percent in December (just missing being rounded up to 7.9 percent) versus 7.753 percent in November. Household employment rose 28,000 in December while the number of unemployed increased 164,000.

Looking ahead, payroll details indicate continued momentum in personal income and industrial production for December. Private aggregate earnings jumped 0.7 percent in December, suggesting a significant rise in the private wages & salaries component in personal income. Production worker hours in manufacturing increased 0.4 percent, indicating a likely notable gain in the manufacturing component of industrial production for December.

Overall, improvement in the labor market may be gaining some traction—especially if fiscal cliff worries ease for businesses. And if FedSpeak moves away from ending QE4 in 2013.

Motor vehicle sales for domestics and imports held strong in December at an annualized 15.4 million units versus 15.5 million units in November. Sales were helped in part by replacement needs from damage from Hurricane Sandy. Domestics posted at 12.0 million units—matching the November pace. Nevertheless, for total new vehicle sales in December do fall short of November which points to weakness for the motor vehicle component of the monthly retail sales report. Motor vehicle sales for domestics and imports held strong in December at an annualized 15.4 million units versus 15.5 million units in November. Sales were helped in part by replacement needs from damage from Hurricane Sandy. Domestics posted at 12.0 million units—matching the November pace. Nevertheless, for total new vehicle sales in December do fall short of November which points to weakness for the motor vehicle component of the monthly retail sales report.

Manufacturing has been sluggish or even negative depending on the report measure. But the latest manufacturing surveys have activity in positive territory—although only modestly.

The final December reading for Markit Economics' PMI manufacturing report posted a moderately positive 54.0—though down two tenths from the flash reading but up a solid 1.2 points from November's 52.8. Any reading over 50 indicates monthly growth in general business activity with December's higher reading indicating a greater rate of growth than November. In fact, 54.0 is the strongest final reading since May.

There's very little change from the flash reading at mid-month with new orders, at 54.7 for a 1.1 point gain from November, a stand-out positive for the month. Backlog orders show slight growth, which of course is a positive, while the new export orders index, at 52.6 for a 2.3 point gain, was a special positive that hints at recovery in foreign markets.

ISM’s manufacturing index has been running below the Markit measure and that continued in December. ISM's headline composite index showed only marginal growth in general activity, at 50.7 which however was better than November's sub-50 reading of 49.5. New orders were flat and unchanged at 50.3 though new export orders are suddenly showing growth at 51.5 for the first plus 50 reading since May. Employment was a plus, up nearly 4.3 points to 52.7 for the best reading since June. Other details show a slowing in deliveries, perhaps the result of thinning inventories, and only modest pressure on input prices. ISM’s manufacturing index has been running below the Markit measure and that continued in December. ISM's headline composite index showed only marginal growth in general activity, at 50.7 which however was better than November's sub-50 reading of 49.5. New orders were flat and unchanged at 50.3 though new export orders are suddenly showing growth at 51.5 for the first plus 50 reading since May. Employment was a plus, up nearly 4.3 points to 52.7 for the best reading since June. Other details show a slowing in deliveries, perhaps the result of thinning inventories, and only modest pressure on input prices.

The U.S. second largest state economy showed improvement in manufacturing in December. Texas factory activity edged up in December as the production index, a key measure of state manufacturing conditions, rose from 1.7 to 2.7, which is consistent with slow growth-somewhat over the breakeven point of zero. However, the new orders index remained near zero, slipping from plus 0.4 in November to minus 0.9 in December. The U.S. second largest state economy showed improvement in manufacturing in December. Texas factory activity edged up in December as the production index, a key measure of state manufacturing conditions, rose from 1.7 to 2.7, which is consistent with slow growth-somewhat over the breakeven point of zero. However, the new orders index remained near zero, slipping from plus 0.4 in November to minus 0.9 in December.

Perceptions of broader business conditions improved markedly in December. The general business activity index emerged from negative territory, rising sharply to 6.8 as a result of a drop in the share of contacts reporting that conditions worsened. The company outlook index also turned positive, jumping 14 points to 9.2, its best reading since March.

Expectations regarding future business conditions improved sharply in December. The index of future general business activity surged to plus 7.9, up from minus 5.3, with the share of contacts reporting worsened future expectations falling from 25 to 14 percent. The index tracking the future company outlook rose from 1.8 to 14.7.

Construction is not quite as strong as earlier believed. But the housing sector is still on an uptrend. In November, construction spending declined 0.3 percent, following a 0.7 percent gain the month before. Construction is not quite as strong as earlier believed. But the housing sector is still on an uptrend. In November, construction spending declined 0.3 percent, following a 0.7 percent gain the month before.

The dip in November was led by a 0.7 percent drop in private nonresidential construction. Public construction decreased 0.4 percent in the latest month.

On the upside, private residential outlays gained 0.4 percent in November, following a 1.3 percent jump the prior month. For the latest month, new one-family outlays gained 1.3 percent while new multifamily construction spending rose 0.5 percent. Outlays on private residential excluding new homes dipped 0.7 percent in November.

On a year-ago basis, overall construction was up 7.7 percent in November versus 9.1 percent the prior month.

The positive in the construction outlays report is that housing continues to improve-which also is a plus for the consumer sector.

The minutes of the December 11-12, 2012 FOMC meeting showed heavy debate about quantitative easing. On the economy, participants saw the economy growing about as previously expected although jobs growth was a little better. However, various members were concerned about monitoring quantitative easing. Some saw QE4 as complicating the Fed’s exit strategy from extremely loose monetary policy. FOMC participants indicated that some of the quantitative easing programs should end before the close of 2013. This could mean the end of Treasury purchases or mortgage-backed securities sooner than believed if this view takes hold. It was noted that additional asset purchases could create difficulties. The worry is that inflation and/or inflation expectations could rise.

�With regard to the possible costs and risks of purchases, a number of participants expressed the concern that additional purchases could complicate the Committee's efforts to eventually withdraw monetary policy accommodation, for example, by potentially causing inflation expectations to rise or by impairing the future implementation of monetary policy. Participants also discussed the implications of continued asset purchases for the size of the Federal Reserve's balance sheet. Depending on the path for the balance sheet and interest rates, the Federal Reserve's net income and its remittances to the Treasury could be significantly affected during the period of policy normalization.�

However, FedSpeak later in the week appeared to back off on the likelihood of ending quantitative easing in 2013. Given that there are more doves than hawks voting on the FOMC, it is likely that there will be more FedSpeak in the near term in behalf of continued ease.

Not much changed in terms of the view of the economy.

�In their assessments of the economic outlook, many participants thought that the pace of economic expansion would remain moderate in 2013 before picking up gradually in 2014 and 2015. This outlook was little changed from their projections at recent meetings. Hurricane Sandy was expected to weigh on economic growth in the current quarter, but rebuilding could provide some temporary impetus early in 2013. Participants' forecasts, which generally were conditioned on the view that it would be appropriate to maintain a highly accommodative monetary policy for a considerable time, included an outlook for a continued gradual decline in the unemployment rate toward levels judged to be consistent with the Committee's mandate over the longer run, with inflation running near the Committee's 2 percent longer-run goal.�

European sovereign debt problems were seen as less of a problem.

As stated in the latest FOMC policy announcement, the Fed switched guidance from date based to indicator based—on labor market data and forecasts for inflation.

�Most participants favored replacing the calendar-date forward guidance with economic thresholds, and several noted that the consistency between the 'mid-2015' reference in the Committee's October statement and the specific quantitative thresholds being considered at the current meeting provided an opportunity for a smooth transition.�

The bottom line is that there is a significant minority within the FOMC who are concerned about how to unwind quantitative easing. On the other hand, the majority still wants extremely loose policy for an extended period. Neither is really news if one has been paying attention. But it seems traders and investors will have to pay attention to potential changes in both monetary policy and fiscal policy for months to come.

While some uncertainty was removed with the reinstatement of most income tax rate cuts, more uncertainty is still ahead. On the fiscal front, the federal debt ceiling is looming along with blunt spending cuts. And the Fed is still defining its new policy on guidance based on labor market numbers and inflation forecasts. Regardless, Fed policy is expected to remain loose for some time while fiscal policy is the big question mark. But currently, the economy is modestly positive and the resolution of income tax rates is a positive. However, traders and investors must prepare for much greater than average commentary and debate on fiscal and monetary policy in 2013.

With a light schedule, this week’s highlights include consumer sector updates. Consumer credit will give insight on consumer willingness to spend while jobless claims will continue to work through seasonality issues. International trade will be parsed for impact from Europe in recession and Asia fluctuating in terms of growth rates.

The NFIB Small Business Optimism Index fell a very sharp 5.6 points in November to 87.5, one of the lowest readings on record which the report attributes to "an overwhelmingly negative response" among small businesses to the outcome of the presidential election. Hurricane Sandy was not a factor, said the report which made comparisons by isolating states hit by the storm. Nine of 10 factors declined in the month with sales expectations and earnings trends especially weak. The one factor that did improve was employment.

NFIB Small Business Optimism Index Consensus Forecast for December 12: 87.9

Range: 85.0 to 92.0

Consumer credit outstanding posted its third strong increase in a row in October. But there are pluses and minuses in the details. Consumer credit outstanding jumped $14.2 billion, following a $12 billion gain in September. Much of the gain was once again tied to loans for students. This likely reflected the soft jobs market and students continuing to stay in school. However, strong sales of autos were also driving up borrowing. Student and auto loans are part of the nonrevolving component which was up $10.8 billion in the month. The revolving side, where credit cards are tracked, popped up $3.4 billion following the prior month's $2.2 billion decline.

Consumer credit Consensus Forecast for November 12: +$13.2 billion

Range: +$6.0 billion to +$15.0 billion

Initial jobless claims for the December 29 week continued to be skewed by seasonal factors, showing a 10,000 rise to a larger-than-expected total of 372,000. The improvement in the prior week was revised away with a sizable 12,000 upward revision to 362,000. Special factors are so extreme that it is hard to get a read from the four-week average. At 360,000, the average is nearly 50,000 lower than the month-ago trend which is a large spread that would normally point to big improvement in the labor market. But the month-ago comparison is as distorted as the current average, in this case less to holiday factors and more to Hurricane Sandy. Also, the Labor Department made significant estimates of its own due to missing data from state offices, many of which have been closed for the holidays.

Jobless Claims Consensus Forecast for 1/5/13: 362,000

Range: 345,000 to 375,000

Wholesale inventories rose a very sizable 1.6 percent in October against a strong but less sizable 0.9 percent rise in wholesale sales, driving up the wholesale stock-to-sales ratio by one tenth to 1.16. Inventories of farm products and energy products both showed sizable increases in the month as did inventories of metals and electrical goods. On the sales side, the month showed strong gains for farm products, autos, and furniture.

Wholesale inventories Consensus Forecast for November 12: +0.3 percent

Range: -0.1 to +0.9 percent

The U.S. international trade gap in October widened somewhat on higher oil imports and on slippage in the services surplus. Weakness in Europe and Japan is hitting the shores of the U.S. as the decline in exports was widespread. The trade deficit worsened to $42.2 billion from $40.3 billion in September. Exports fell 3.6 percent in October, following a 3.1 percent rebound the month before. Imports fell 2.1 percent after gaining 1.5 percent in September. The widening in the trade gap was led by the petroleum deficit which increased to $24.6 billion in October from $21.6 billion in September. However, the non-petroleum goods shortfall shrank to $33.8 billion from $35.2 billion for the previous month. The services surplus slipped to $16.9 billion from $17.0 billion in September.

International trade balance Consensus Forecast for November 12: -$41.1 billion

Range: -$45.0 billion to -$39.8 billion

Import prices in November dipped 0.9 percent with the year-on-year rate at minus 1.6 percent. Petroleum prices have pulled the year-on-year rate into the minus column now for six of the last seven months. A look at finished goods prices shows declines for both capital goods, down 0.3 percent, and for consumer goods excluding autos which fell 0.1 percent. Reflecting softness in foreign demand were export prices which for finished goods, like they are for imports, showing no more than marginal pressure with capital goods up 0.2 percent and with prices for consumer goods excluding autos down 0.2 percent.

Import prices Consensus Forecast for December 12: +0.1 percent

Range: -0.5 to +0.3 percent

Export prices Consensus Forecast for December 12: -0.1 percent

Range: -0.5 to +0.4 percent

The U.S. Treasury monthly budget report for November showed a monthly deficit of $172.1 billion and was much greater than expected but most of the difference reflects calendar timing of payments. Adjusting for calendar shifts so far this fiscal year, the Treasury says the budget was running only slightly worse than last year, at $269 billion versus $266 billion. Looking ahead, the month of December typically shows a moderate deficit for the month. Over the past 10 years, the average deficit for the month of December has been $22.2 billion and $51.8 billion over the past 5 years. The December 2011 deficit came in at $86.0 billion.

Treasury Statement Consensus Forecast for December 12: -$20.0 billion

Range: -$65.0 billion to +$12.8 billion.

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books.

Econoday Senior Writer Mark Pender contributed to this article.

|