|

This past week, economic data pointed to a deep contraction in the fourth quarter. The alleged good news was a drop in headline inflation across the board – for consumers, producers, and imports. While the inflation news gives the Fed some leeway for continued monetary ease, the numbers clearly reflect a drop in demand from recession in the U.S. and overseas.

Equities are 0 for 2 this year for winning weeks. Stocks were pushed down by economic news pointing to a worsening recession, by negative earnings reports for the fourth quarter, and over renewed concerns that the worst is not over for banks and other financial firms. On the economic front, retail sales were abysmal, although not as bad as initially believed after price effects were sorted out. The other major economic indicator was industrial production - which pointed to a worsening manufacturing sector. Also, the Fed’s Beige Book was even gloomier than the December Beige Book. Equities are 0 for 2 this year for winning weeks. Stocks were pushed down by economic news pointing to a worsening recession, by negative earnings reports for the fourth quarter, and over renewed concerns that the worst is not over for banks and other financial firms. On the economic front, retail sales were abysmal, although not as bad as initially believed after price effects were sorted out. The other major economic indicator was industrial production - which pointed to a worsening manufacturing sector. Also, the Fed’s Beige Book was even gloomier than the December Beige Book.

Financial firms stood out this past week for huge fourth quarter losses, including $1.79 billion in red ink for Bank of America and $8.3 billion for Citigroup. Merrill Lynch – although being acquired by Bank of America – had much sharper than expected losses of over $15 billion.

It was not just the financials with earnings problems. Alcoa started off the fourth-quarter earnings season with an adjusted loss of 28 cents per share, which was nearly three times larger than the expected loss of 10 cents. As many expected, the retail sector is starting to clean house as Circuit City confirmed that it is going out of business.

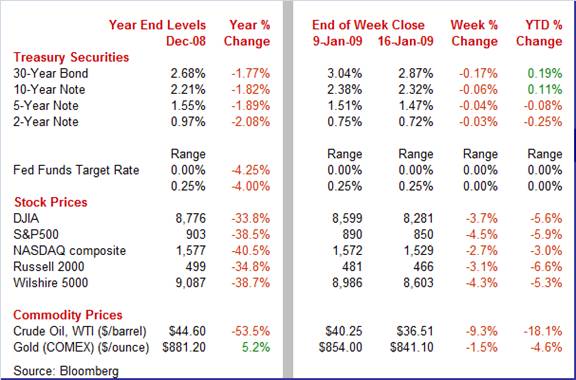

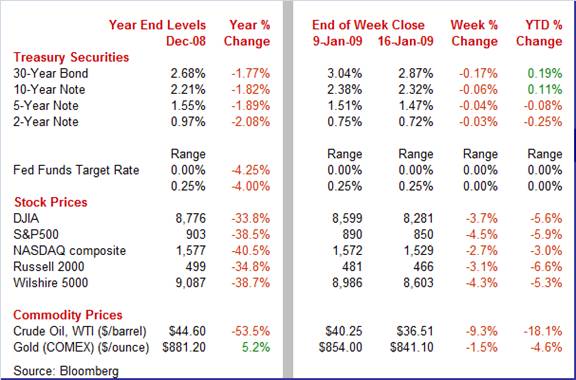

Equities were down this past week. The Dow was down 3.7 percent; the S&P 500, down 4.5 percent; the Nasdaq, down 2.7 percent; and the Russell 2000, down 3.1 percent.

For the year-to-date, major indexes are down as follows: the Dow, down 5.6 percent; the S&P 500, down 5.9 percent; the Nasdaq, down 3.0 percent; and the Russell 2000, down 6.6 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

The economy and the Fed bumped Treasury bond yields down this past week while rates on T-bills and T-notes were mixed but little changed. On the economic front, news of a deepening recession and lower inflation helped longer rates ease. Weak economic data included down numbers on retail sales, industrial production, Empire State, Philly Fed, and a gloomy Beige Book. The sharp declines in headline inflation for the CPI, PPI, and import price index also were favorable to lower bond rates. Long rates eased despite ongoing concern over heavy Treasury demand for money to fund current bailout programs as well as talked about fiscal stimulus expansion – leading to projected federal deficits topping $1 trillion for possibly several years.

A new development came from the Fed following through with earlier hints at getting involved with markets for longer maturities. The Fed – as part of its “credit easing” – bought $23.4 billion of Fannie Mae, Freddie Mac and Ginnie Mae mortgage bonds. Fed officials – including Chairman Bernanke – have been arguing that their efforts should focus on improving housing and mortgage markets. The Fed’s purchases of these agencies’ debt works toward that specific goal. These actions plus additional talk by regional Fed presidents that the Fed is still considering purchases of long-term Treasuries helped ease bond yields. A new development came from the Fed following through with earlier hints at getting involved with markets for longer maturities. The Fed – as part of its “credit easing” – bought $23.4 billion of Fannie Mae, Freddie Mac and Ginnie Mae mortgage bonds. Fed officials – including Chairman Bernanke – have been arguing that their efforts should focus on improving housing and mortgage markets. The Fed’s purchases of these agencies’ debt works toward that specific goal. These actions plus additional talk by regional Fed presidents that the Fed is still considering purchases of long-term Treasuries helped ease bond yields.

Flight to safety also was a factor this past week as a number of major financial institutions appeared to be more precarious than believed.

For this past week Treasury rates were mixed as follows: 3-month T-bill, up 5 basis points, the 2-year note, down 3 basis points; the 5-year note, down 4 basis points; the 10-year bond, down 6 basis points; and the 30-year bond, down 17 basis points.

Crude oil prices continued their downward spiral this past week, dropping close to $4 per barrel net. Oil is being hit hard by a plummet in demand from global recession. Prices swooned on news from the U.S. and about China – two heavy oil consumers. Negative economic news from the U.S. included retail sales, industrial production, two regional manufacturing surveys, and the Fed’s Beige Book. Late last week the International Energy Agency (IEA) released its latest forecast for world oil demand. The IEA lowered its estimate for 2009 demand by 940,000 barrels per day to 85.3 million. Notably, the IEA stated that Chinese oil demand would grow at its slowest rate in eight years as that economy’s growth cools somewhat. Also last week, OPEC cut its projection for world oil demand estimate for 2009 by 20,000 barrels to 85.66 million barrels a day. Finally, U.S. distillate inventories were up significantly more than expected. Crude oil prices continued their downward spiral this past week, dropping close to $4 per barrel net. Oil is being hit hard by a plummet in demand from global recession. Prices swooned on news from the U.S. and about China – two heavy oil consumers. Negative economic news from the U.S. included retail sales, industrial production, two regional manufacturing surveys, and the Fed’s Beige Book. Late last week the International Energy Agency (IEA) released its latest forecast for world oil demand. The IEA lowered its estimate for 2009 demand by 940,000 barrels per day to 85.3 million. Notably, the IEA stated that Chinese oil demand would grow at its slowest rate in eight years as that economy’s growth cools somewhat. Also last week, OPEC cut its projection for world oil demand estimate for 2009 by 20,000 barrels to 85.66 million barrels a day. Finally, U.S. distillate inventories were up significantly more than expected.

Net for the week, spot prices for West Texas Intermediate dropped $3.74 per barrel to settle at $36.51.

The fourth quarter ended deep in recession with early signs at the start of the year indicating that there is more of the same for the first quarter.

The consumer sector makes up the vast majority of the U.S. economy and right now that does not appear to be a good thing. Retail sales sank again in December, putting to rest any doubt that consumers are retrenching over job losses and fears of unemployment. Overall retail sales fell 2.7 percent in December, after a 2.1 percent decline the month before. The consumer sector makes up the vast majority of the U.S. economy and right now that does not appear to be a good thing. Retail sales sank again in December, putting to rest any doubt that consumers are retrenching over job losses and fears of unemployment. Overall retail sales fell 2.7 percent in December, after a 2.1 percent decline the month before.

Even though the plummet was widespread, it was led by a drop in gasoline sales - not taking into account price changes. That is, spending in real terms was not so bad. In fact, it is a good thing that gasoline is cheaper, freeing up income for other things.

Excluding motor vehicles, retail sales decreased 3.1 percent, after retreating 2.5 percent in November. But excluding motor vehicles and gasoline, retail sales, declined a less scary 1.5 percent after a 0.2 percent dip in November.

By components, indeed the largest drop was for gasoline sales - which plummeted 15.9 percent and was price related. Still declines were widespread. The next largest decline was in building materials & garden equipment, down 2.9 percent. Consumers also are cutting back on new clothes and going out to eat - clothing fell 2.5 percent while food services & drinking places dropped 2.2 percent. Incidentally, motor vehicles slipped 0.7 percent.

By components, indeed the largest drop was for gasoline sales - which plummeted 15.9 percent and was price related. Still declines were widespread. The next largest decline was in building materials & garden equipment, down 2.9 percent. Consumers also are cutting back on new clothes and going out to eat - clothing fell 2.5 percent while food services & drinking places dropped 2.2 percent. Incidentally, motor vehicles slipped 0.7 percent.

Overall retail sales on a year-on-year basis in December were down 9.8 percent - compared to down 8.2 percent in November. Excluding motor vehicles, the year-on-year pace slipped to down 6.7 percent from down 4.3 percent in November.

Overall, nearly every major category fell in December. Yes, the consumer is retreating but December's number is not as troubling as the headline number because weakness was led by a cut in gasoline prices. But, no doubt, taking into account broad based declines over several months, consumer spending is depressed. We can expect to see the impact on retailer profits.

Sales are down and a big part of the reason is that consumers are worried about jobs and the economy. Consumer sentiment remains near historic lows. The Reuters/University of Michigan consumer sentiment index edged 8 tenths higher to 61.9 in an insignificant gain for the preliminary January reading. Sales are down and a big part of the reason is that consumers are worried about jobs and the economy. Consumer sentiment remains near historic lows. The Reuters/University of Michigan consumer sentiment index edged 8 tenths higher to 61.9 in an insignificant gain for the preliminary January reading.

The latest report focused on job conditions. Three-fourths of the survey sample expect the recession to continue throughout this year. Importantly, the fewest consumers in more than a half a century reported income gains in the latest survey. Despite lower inflation, most expect their inflation-adjusted income to fall this year. The news is not good for the retail sector.

The manufacturing sector is showing signs of worsening. Industrial production in December plummeted on lower auto assemblies plus broad-based weakness. Overall industrial production in December dropped 2.0 percent, following a 1.3 percent decline the month before. The all-important manufacturing component fell 2.3 percent after a 2.2 percent decline in November. For the other major components in December, utilities slipped 0.1 percent while mining output decreased 1.6 percent. The manufacturing sector is showing signs of worsening. Industrial production in December plummeted on lower auto assemblies plus broad-based weakness. Overall industrial production in December dropped 2.0 percent, following a 1.3 percent decline the month before. The all-important manufacturing component fell 2.3 percent after a 2.2 percent decline in November. For the other major components in December, utilities slipped 0.1 percent while mining output decreased 1.6 percent.

A key part of manufacturing weakness was in motor vehicle assemblies which dropped to an annualized pace of 6.64 million units in December from 7.60 million in November – a 12.6 percent fall. But weakness was widespread. Durables output fell 2.6 percent in December while nondurables dropped 2.1 percent. You have to go deep into the detail to find any positive at all for December – which was in aerospace & miscellaneous transportation equipment (i.e., Boeing production).

Overall capacity utilization in December fell to 73.6 percent from 75.2 percent in November and came in below the consensus forecast for 74.6 percent.

The bottom line is that manufacturing was dragging the economy down sharply in the fourth quarter. More recent news from regional manufacturing surveys is not much encouraging.

The manufacturing picture was bleak in December according to the Fed’s monthly report on industrial production. And more currently, the latest regional manufacturing surveys indicate that this sector is continuing to contract in January, although not quite at the rapid pace as in December. The manufacturing picture was bleak in December according to the Fed’s monthly report on industrial production. And more currently, the latest regional manufacturing surveys indicate that this sector is continuing to contract in January, although not quite at the rapid pace as in December.

First, the Empire State report showed modest improvement (less negative) in current readings for January but -- more importantly -- showed a deep breakdown in the 6-month outlook, a breakdown that underscores a deep pessimism among the region's manufacturers. First, the general business conditions index backed up to minus 22.2 from December's minus 27.9. But order readings barely show any improvement, at minus 22.8 for new orders and minus 26.1 for unfilled orders.

The really bad news in the Empire State report was the 6-month outlook where readings suddenly lurched into the negative column with the overall index plummeting to minus 4.0 from plus 18.1 in December.

The mid-Atlantic manufacturing sector also continues to contract – but not as quickly as in December. The Philadelphia Fed's January index for general business conditions came in at minus 24.3, up moderately from minus 36.1 in December. Both new orders and shipments contracted but at slower rates than in December.

In contrast to the Empire State report, gains were posted in the six-month outlook where the general business conditions index jumped nearly 18 points to 7.4. Taking both together suggests that the six-month outlook is uncertain.

The really good news this week actually has a lot of bad news just below the surface. The U.S. trade gap in November shrank sharply to $40.4 billion from a revised $56.7 billion shortfall in October. The U.S. trade deficit in November was the narrowest since $40.0 billion for November 2003. The really good news this week actually has a lot of bad news just below the surface. The U.S. trade gap in November shrank sharply to $40.4 billion from a revised $56.7 billion shortfall in October. The U.S. trade deficit in November was the narrowest since $40.0 billion for November 2003.

The good news is that dramatically lower oil prices helped bring the deficit down. The bad news is the nonoil imports are slipping due to a drop in demand. Also, economic growth abroad is falling, cutting into U.S. exports. In November, exports posted a 5.8 percent drop while imports plunged a monthly 12.0 percent. The overall improvement in November was led by the oil deficit which narrowed to $19.4 billion from $32.3 billion in October. The nonoil goods deficit also shrank - to $31.4 billion from $35.3 billion the month before. The bottom line is that the improvement in the trade deficit is good only from the angle of cheaper oil. Everything else about the report points to continued recession in the U.S. and overseas.

In December, consumer inflation continued downward – and it was not just a fall in gasoline prices. The headline CPI fell 0.7 percent in December, following a 1.7 percent decrease in November. Meanwhile, core CPI inflation was unchanged after no change the month before. In December, consumer inflation continued downward – and it was not just a fall in gasoline prices. The headline CPI fell 0.7 percent in December, following a 1.7 percent decrease in November. Meanwhile, core CPI inflation was unchanged after no change the month before.

For the latest month, energy plunged a monthly 8.3 percent, with gasoline prices falling 17.2 percent. Food posted a 0.1 percent decrease.

The core was kept soft by several key components. Declines were seen in apparel, new & used vehicles, and lodging away from home. Also, owners’ equivalent rent posted a very small gain. The core was kept soft by several key components. Declines were seen in apparel, new & used vehicles, and lodging away from home. Also, owners’ equivalent rent posted a very small gain.

The Fed must feel good about inflation for now. Year-on-year, headline inflation is down 0.1 percent (seasonally adjusted) in December from 1.0 percent in November while the core is up 1.7 percent, compared to up 2.0 percent in November. By any measure, consumer inflation is well the Fed’s implied target range of 1-1/2 to 2 percent, giving the Fed some leeway to keep easing. But the weak prices just emphasize the depth of the current recession.

Producer price inflation in December continued its streak of energy induced monthly declines. The overall PPI fell 1.9 percent, following a 2.2 percent drop in November. The core PPI rate rose 0.2 percent after edging up 0.1 percent in November. The market had projected a 0.1 percent rise for December. Producer price inflation in December continued its streak of energy induced monthly declines. The overall PPI fell 1.9 percent, following a 2.2 percent drop in November. The core PPI rate rose 0.2 percent after edging up 0.1 percent in November. The market had projected a 0.1 percent rise for December.

As in recent months, energy led the headline PPI down. For the latest month energy dropped 9.3 percent, led by a 25.7 percent plunge in gasoline prices. Even food was weak with a 1.5 percent decline.

The core rate was moderate despite a 1.2 percent rebound in passenger car prices and a 0.8 percent boost in light truck prices. Within the core, weakness was largely in capital equipment outside of light trucks.

Overall import prices were extremely weak in December but downward pressure came mainly from falling prices for oil and other commodities. Import prices fell 4.2 percent in December after plunging 7.0 percent the month before. In the latest month, petroleum import prices fell a whopping 21.4 percent. But excluding petroleum, import prices fell a more moderate 1.1 percent after a 1.8 percent decline in November. Overall import prices were extremely weak in December but downward pressure came mainly from falling prices for oil and other commodities. Import prices fell 4.2 percent in December after plunging 7.0 percent the month before. In the latest month, petroleum import prices fell a whopping 21.4 percent. But excluding petroleum, import prices fell a more moderate 1.1 percent after a 1.8 percent decline in November.

But import prices even outside petroleum are dominated by other commodities. The industrial supplies category is the broader end-use category that includes petroleum. This component fell 12.5 percent in December. Industrial supplies excluding petroleum declined 5.1 percent and included paper, selected building materials, unfinished metals, finished metals, and nonmetals related to durable goods. Industrial supplies excluding petroleum make up 19 percent of the overall import price index with petroleum and petroleum products making up another 15 percent.

But import prices even outside petroleum are dominated by other commodities. The industrial supplies category is the broader end-use category that includes petroleum. This component fell 12.5 percent in December. Industrial supplies excluding petroleum declined 5.1 percent and included paper, selected building materials, unfinished metals, finished metals, and nonmetals related to durable goods. Industrial supplies excluding petroleum make up 19 percent of the overall import price index with petroleum and petroleum products making up another 15 percent.

Outside of industrial supplies, import price weakness was significantly less. In fact, the foods, feeds & beverages component rebounded 2.3 percent in the latest month while consumer goods excluding autos posted a 0.1 percent rise. However, capital goods and automotive goods slipped 0.3 percent and 0.2 percent, respectively. Indeed, import prices are falling but primarily due to a downward swing in commodities prices. Global demand has fallen overall but outside of commodities, import prices are only modestly soft.

Outside of industrial supplies, import price weakness was significantly less. In fact, the foods, feeds & beverages component rebounded 2.3 percent in the latest month while consumer goods excluding autos posted a 0.1 percent rise. However, capital goods and automotive goods slipped 0.3 percent and 0.2 percent, respectively. Indeed, import prices are falling but primarily due to a downward swing in commodities prices. Global demand has fallen overall but outside of commodities, import prices are only modestly soft.

On a year-ago basis in December, import price changes were as follows: total, down 9.3 percent; total excluding petroleum, up 0.9 percent; petroleum, down 47.0 percent; foods, feeds & beverages, down 26.7 percent; capital goods, up 0.3 percent; automotive goods, up 0.7 percent; and consumer goods excluding autos, up 2.2 percent.

Economists and policy makers have written off the fourth quarter as deeply negative. Now, anecdotal information from regional Fed contacts indicates that the first quarter may not be much better. The Beige Book prepared for the January 27-28 FOMC meeting reported very gloomy conditions for the economy. Activity decreased across a range of industries – notably retailing, manufacturing, residential construction, and commercial construction. Slowing was also seen in transportation services and tourism. Credit markets show signs of worsening in some regards as overall lending activity declined in several Districts, with tight or tightening lending conditions reported in most Districts.

The consumer sector is seen as down with holiday sales generally negative with deep discounting still not helping much. Only discount retailers did relatively well. Housing is the segment of the economy that needs to stabilize before the rest of the economy can pick up, according to many economists and Fed officials. But the Beige Book is discouraging on that count. Home sales are “quite slow” in most Fed Districts. Disconcertingly, home sales cancellations are up significantly. Showroom traffic is weak and home prices are still slipping.

Overall, the Beige Book indicates that the recession is worsening. The important housing sector has not stabilized and consumers are holding on to their wallets.

The economy remains mired in recession and markets are still trying to figure out the cross currents. The real sector numbers are likely to be negative for a number of months as housing may actually get worse, consumers retrench, and state and local government spending cuts add to the economic woes. For the Treasury market, there are serious cross currents. The economy is weak and inflation is low. But the federal deficit is ballooning. It is just a matter of time before the deficit problems outweigh the recession. Meanwhile, equities are still peering into the future trying to determine when economic recovery begins and trying to time when it actually makes sense for stocks to rebound. But for now, such a boost seems a little while off – or at least should be.

This week’s big event is not directly economic but political – Tuesday’s inauguration of Barack Obama as president of the U.S. Count on markets coming to a near standstill during official ceremonies. Yes, banks and markets are open on inauguration day in the U.S. Otherwise, it is a very quiet week. The only market moving indicator is housing starts out on Thursday morning.

MLK, Jr. Holiday. Banks and markets closed in U.S.

U.S. presidential inauguration. Banks open. Markets open.

Housing starts in November plummeted another 18.9 percent. The November pace of 0.625 million units annualized was down 47.0 percent year-on-year. The decline in starts was led by the multifamily component which dropped 23.3 percent while the single-family component fell 16.9 percent. Starts are not likely to resume an uptrend soon due to continued heavy inventory overhang of both existing and new homes for sale.

Housing starts Consensus Forecast for December 08: 0.615 million-unit rate

Range: 0.575 million to 0.679 million-unit rate

Initial jobless claims appear to have gotten past the usual wide swings during the shortened holiday weeks. Initial claims and continuing claims moved toward their 4-week averages, giving a cleaner perspective on a weak jobs market. Initial claims rose 54,000 in the January 10 week to 524,000 from 470,000 in the prior week Now that the depth of the recession has sunk in on management, will layoffs accelerate in the first quarter'

Jobless Claims Consensus Forecast for 1/17/08: 610,000

Range: 500,000 to 680,000

Econoday Senior Writer Mark Pender contributed to this article.

|

![[Econoday]](images/econoday_logo_slim.gif)

![[Econoday]](images/logo.gif)

Equities are 0 for 2 this year for winning weeks. Stocks were pushed down by economic news pointing to a worsening recession, by negative earnings reports for the fourth quarter, and over renewed concerns that the worst is not over for banks and other financial firms. On the economic front, retail sales were abysmal, although not as bad as initially believed after price effects were sorted out. The other major economic indicator was industrial production - which pointed to a worsening manufacturing sector. Also, the Fed’s Beige Book was even gloomier than the December Beige Book.

Equities are 0 for 2 this year for winning weeks. Stocks were pushed down by economic news pointing to a worsening recession, by negative earnings reports for the fourth quarter, and over renewed concerns that the worst is not over for banks and other financial firms. On the economic front, retail sales were abysmal, although not as bad as initially believed after price effects were sorted out. The other major economic indicator was industrial production - which pointed to a worsening manufacturing sector. Also, the Fed’s Beige Book was even gloomier than the December Beige Book.

BONDS

BONDS A new development came from the Fed following through with earlier hints at getting involved with markets for longer maturities. The Fed – as part of its “credit easing” – bought $23.4 billion of Fannie Mae, Freddie Mac and Ginnie Mae mortgage bonds. Fed officials – including Chairman Bernanke – have been arguing that their efforts should focus on improving housing and mortgage markets. The Fed’s purchases of these agencies’ debt works toward that specific goal. These actions plus additional talk by regional Fed presidents that the Fed is still considering purchases of long-term Treasuries helped ease bond yields.

A new development came from the Fed following through with earlier hints at getting involved with markets for longer maturities. The Fed – as part of its “credit easing” – bought $23.4 billion of Fannie Mae, Freddie Mac and Ginnie Mae mortgage bonds. Fed officials – including Chairman Bernanke – have been arguing that their efforts should focus on improving housing and mortgage markets. The Fed’s purchases of these agencies’ debt works toward that specific goal. These actions plus additional talk by regional Fed presidents that the Fed is still considering purchases of long-term Treasuries helped ease bond yields. Crude oil prices continued their downward spiral this past week, dropping close to $4 per barrel net. Oil is being hit hard by a plummet in demand from global recession. Prices swooned on news from the U.S. and about China – two heavy oil consumers. Negative economic news from the U.S. included retail sales, industrial production, two regional manufacturing surveys, and the Fed’s Beige Book. Late last week the International Energy Agency (IEA) released its latest forecast for world oil demand. The IEA lowered its estimate for 2009 demand by 940,000 barrels per day to 85.3 million. Notably, the IEA stated that Chinese oil demand would grow at its slowest rate in eight years as that economy’s growth cools somewhat. Also last week, OPEC cut its projection for world oil demand estimate for 2009 by 20,000 barrels to 85.66 million barrels a day. Finally, U.S. distillate inventories were up significantly more than expected.

Crude oil prices continued their downward spiral this past week, dropping close to $4 per barrel net. Oil is being hit hard by a plummet in demand from global recession. Prices swooned on news from the U.S. and about China – two heavy oil consumers. Negative economic news from the U.S. included retail sales, industrial production, two regional manufacturing surveys, and the Fed’s Beige Book. Late last week the International Energy Agency (IEA) released its latest forecast for world oil demand. The IEA lowered its estimate for 2009 demand by 940,000 barrels per day to 85.3 million. Notably, the IEA stated that Chinese oil demand would grow at its slowest rate in eight years as that economy’s growth cools somewhat. Also last week, OPEC cut its projection for world oil demand estimate for 2009 by 20,000 barrels to 85.66 million barrels a day. Finally, U.S. distillate inventories were up significantly more than expected. The consumer sector makes up the vast majority of the U.S. economy and right now that does not appear to be a good thing. Retail sales sank again in December, putting to rest any doubt that consumers are retrenching over job losses and fears of unemployment. Overall retail sales fell 2.7 percent in December, after a 2.1 percent decline the month before.

The consumer sector makes up the vast majority of the U.S. economy and right now that does not appear to be a good thing. Retail sales sank again in December, putting to rest any doubt that consumers are retrenching over job losses and fears of unemployment. Overall retail sales fell 2.7 percent in December, after a 2.1 percent decline the month before.  By components, indeed the largest drop was for gasoline sales - which plummeted 15.9 percent and was price related. Still declines were widespread. The next largest decline was in building materials & garden equipment, down 2.9 percent. Consumers also are cutting back on new clothes and going out to eat - clothing fell 2.5 percent while food services & drinking places dropped 2.2 percent. Incidentally, motor vehicles slipped 0.7 percent.

By components, indeed the largest drop was for gasoline sales - which plummeted 15.9 percent and was price related. Still declines were widespread. The next largest decline was in building materials & garden equipment, down 2.9 percent. Consumers also are cutting back on new clothes and going out to eat - clothing fell 2.5 percent while food services & drinking places dropped 2.2 percent. Incidentally, motor vehicles slipped 0.7 percent. Sales are down and a big part of the reason is that consumers are worried about jobs and the economy. Consumer sentiment remains near historic lows. The Reuters/University of Michigan consumer sentiment index edged 8 tenths higher to 61.9 in an insignificant gain for the preliminary January reading.

Sales are down and a big part of the reason is that consumers are worried about jobs and the economy. Consumer sentiment remains near historic lows. The Reuters/University of Michigan consumer sentiment index edged 8 tenths higher to 61.9 in an insignificant gain for the preliminary January reading.  The manufacturing sector is showing signs of worsening. Industrial production in December plummeted on lower auto assemblies plus broad-based weakness. Overall industrial production in December dropped 2.0 percent, following a 1.3 percent decline the month before. The all-important manufacturing component fell 2.3 percent after a 2.2 percent decline in November. For the other major components in December, utilities slipped 0.1 percent while mining output decreased 1.6 percent.

The manufacturing sector is showing signs of worsening. Industrial production in December plummeted on lower auto assemblies plus broad-based weakness. Overall industrial production in December dropped 2.0 percent, following a 1.3 percent decline the month before. The all-important manufacturing component fell 2.3 percent after a 2.2 percent decline in November. For the other major components in December, utilities slipped 0.1 percent while mining output decreased 1.6 percent.  The manufacturing picture was bleak in December according to the Fed’s monthly report on industrial production. And more currently, the latest regional manufacturing surveys indicate that this sector is continuing to contract in January, although not quite at the rapid pace as in December.

The manufacturing picture was bleak in December according to the Fed’s monthly report on industrial production. And more currently, the latest regional manufacturing surveys indicate that this sector is continuing to contract in January, although not quite at the rapid pace as in December. The really good news this week actually has a lot of bad news just below the surface. The U.S. trade gap in November shrank sharply to $40.4 billion from a revised $56.7 billion shortfall in October. The U.S. trade deficit in November was the narrowest since $40.0 billion for November 2003.

The really good news this week actually has a lot of bad news just below the surface. The U.S. trade gap in November shrank sharply to $40.4 billion from a revised $56.7 billion shortfall in October. The U.S. trade deficit in November was the narrowest since $40.0 billion for November 2003.  In December, consumer inflation continued downward – and it was not just a fall in gasoline prices. The headline CPI fell 0.7 percent in December, following a 1.7 percent decrease in November. Meanwhile, core CPI inflation was unchanged after no change the month before.

In December, consumer inflation continued downward – and it was not just a fall in gasoline prices. The headline CPI fell 0.7 percent in December, following a 1.7 percent decrease in November. Meanwhile, core CPI inflation was unchanged after no change the month before.  The core was kept soft by several key components. Declines were seen in apparel, new & used vehicles, and lodging away from home. Also, owners’ equivalent rent posted a very small gain.

The core was kept soft by several key components. Declines were seen in apparel, new & used vehicles, and lodging away from home. Also, owners’ equivalent rent posted a very small gain. Producer price inflation in December continued its streak of energy induced monthly declines. The overall PPI fell 1.9 percent, following a 2.2 percent drop in November. The core PPI rate rose 0.2 percent after edging up 0.1 percent in November. The market had projected a 0.1 percent rise for December.

Producer price inflation in December continued its streak of energy induced monthly declines. The overall PPI fell 1.9 percent, following a 2.2 percent drop in November. The core PPI rate rose 0.2 percent after edging up 0.1 percent in November. The market had projected a 0.1 percent rise for December.  Overall import prices were extremely weak in December but downward pressure came mainly from falling prices for oil and other commodities. Import prices fell 4.2 percent in December after plunging 7.0 percent the month before. In the latest month, petroleum import prices fell a whopping 21.4 percent. But excluding petroleum, import prices fell a more moderate 1.1 percent after a 1.8 percent decline in November.

Overall import prices were extremely weak in December but downward pressure came mainly from falling prices for oil and other commodities. Import prices fell 4.2 percent in December after plunging 7.0 percent the month before. In the latest month, petroleum import prices fell a whopping 21.4 percent. But excluding petroleum, import prices fell a more moderate 1.1 percent after a 1.8 percent decline in November.  But import prices even outside petroleum are dominated by other commodities. The industrial supplies category is the broader end-use category that includes petroleum. This component fell 12.5 percent in December. Industrial supplies excluding petroleum declined 5.1 percent and included paper, selected building materials, unfinished metals, finished metals, and nonmetals related to durable goods. Industrial supplies excluding petroleum make up 19 percent of the overall import price index with petroleum and petroleum products making up another 15 percent.

But import prices even outside petroleum are dominated by other commodities. The industrial supplies category is the broader end-use category that includes petroleum. This component fell 12.5 percent in December. Industrial supplies excluding petroleum declined 5.1 percent and included paper, selected building materials, unfinished metals, finished metals, and nonmetals related to durable goods. Industrial supplies excluding petroleum make up 19 percent of the overall import price index with petroleum and petroleum products making up another 15 percent. Outside of industrial supplies, import price weakness was significantly less. In fact, the foods, feeds & beverages component rebounded 2.3 percent in the latest month while consumer goods excluding autos posted a 0.1 percent rise. However, capital goods and automotive goods slipped 0.3 percent and 0.2 percent, respectively. Indeed, import prices are falling but primarily due to a downward swing in commodities prices. Global demand has fallen overall but outside of commodities, import prices are only modestly soft.

Outside of industrial supplies, import price weakness was significantly less. In fact, the foods, feeds & beverages component rebounded 2.3 percent in the latest month while consumer goods excluding autos posted a 0.1 percent rise. However, capital goods and automotive goods slipped 0.3 percent and 0.2 percent, respectively. Indeed, import prices are falling but primarily due to a downward swing in commodities prices. Global demand has fallen overall but outside of commodities, import prices are only modestly soft.