|

However much Fed and ECB planners are sitting tight, there's at least one inflation fighter on the prowl. Andy Haldane, chief economist at the Bank of England, warned everyone on Friday that a full year of stimulus is stirring up inflation, a "tiger" he said who may prove difficult to tame; such an outcome he said raises a "tangible risk" of a policy reversal that Haldane believes isn't yet priced into the market. Contrast this with testimony at mid-week from the Fed's Jerome Powell who told US lawmakers that "it may take more than three years" for inflation to meet the central bank's 2 percent target. Before tapering down QE, Powell said that "substantial" progress toward the Fed's employment and inflation goals would be needed: "That's actual progress, not forecast progress," he said.

So let's take a look at what actual progress we're currently seeing, and let's start at the base of the supply chain in Canada. Industrial product prices continued to rise at the start of the year, up a sizable 2.0 percent on the month for the steepest increase in six years. This follows a nearly as sizable 1.7 percent monthly gain in December and lifted the annual inflation rate from 2.0 percent to 4.0 percent, its highest mark in more than two years. Pressures were broad-based including for lumber, agriculture, and energy with chemicals and metals also on the rise. Until recently the increase in the IPPI had been relatively restrained, but January's update suggests that pressures on consumer prices may now be starting to build. So let's take a look at what actual progress we're currently seeing, and let's start at the base of the supply chain in Canada. Industrial product prices continued to rise at the start of the year, up a sizable 2.0 percent on the month for the steepest increase in six years. This follows a nearly as sizable 1.7 percent monthly gain in December and lifted the annual inflation rate from 2.0 percent to 4.0 percent, its highest mark in more than two years. Pressures were broad-based including for lumber, agriculture, and energy with chemicals and metals also on the rise. Until recently the increase in the IPPI had been relatively restrained, but January's update suggests that pressures on consumer prices may now be starting to build.

An upward slope also appears in French producer prices, the green line of the accompanying graph that's about to cross a rather flat path for consumer prices. Annual PPI inflation (ex-construction) jumped from 1.0 percent contraction to 0.4 percent growth in January; the main boost came from mining and quarrying, energy and water; coke and refined petroleum products saw a sharp increase too. The CPI, in contrasting and very timely data for February, eased unexpectedly by a couple of tenths to a very tame and sleepy looking 0.4 percent. Deceleration was mainly tied to manufactured products that, along with a flat showing for services, offset a jump in energy costs. However much the green line supports BoE's Haldane, the blue line is one for Powell who firmly believes that consumer prices, as they have for the last generation, will show no more than moderate pressure at the very most. An upward slope also appears in French producer prices, the green line of the accompanying graph that's about to cross a rather flat path for consumer prices. Annual PPI inflation (ex-construction) jumped from 1.0 percent contraction to 0.4 percent growth in January; the main boost came from mining and quarrying, energy and water; coke and refined petroleum products saw a sharp increase too. The CPI, in contrasting and very timely data for February, eased unexpectedly by a couple of tenths to a very tame and sleepy looking 0.4 percent. Deceleration was mainly tied to manufactured products that, along with a flat showing for services, offset a jump in energy costs. However much the green line supports BoE's Haldane, the blue line is one for Powell who firmly believes that consumer prices, as they have for the last generation, will show no more than moderate pressure at the very most.

One area of inflation that has been on fire is home prices, which in the US are at record or near record appreciation, at 11.1 percent annually for Case-Shiller and 11.4 percent for FHFA, two reports posted in the week. Yet the surge may already have spent itself based on home sales which appear to have peaked even before interest rates jumped this month. January's 3-month average for new home sales fell 1.6 percent to an 882,000 rate, while the average for resales fell 0.8 percent to a 6.683 million annual rate. And pending resales are also signaling a top, down 2.8 percent in January to shave year-over-year growth by nearly 10 percentage points to 13.0 percent. This pending rate compares with 23.4 percent for final resales in January and further points to a developing downward slope for sales. All these reports track data before this month's sudden jump in interest rates, a jump that has already pulled mortgage applications lower. These latter numbers, posted by the Mortgage Bankers Association, show very steep declines over the past several weeks, a time when the 30-year conforming loan jumped by 16 basis points to an average 3.08 percent. And this was before the latest week when the US 10-year yield rose another dozen basis points to nearly 1.50 percent. One area of inflation that has been on fire is home prices, which in the US are at record or near record appreciation, at 11.1 percent annually for Case-Shiller and 11.4 percent for FHFA, two reports posted in the week. Yet the surge may already have spent itself based on home sales which appear to have peaked even before interest rates jumped this month. January's 3-month average for new home sales fell 1.6 percent to an 882,000 rate, while the average for resales fell 0.8 percent to a 6.683 million annual rate. And pending resales are also signaling a top, down 2.8 percent in January to shave year-over-year growth by nearly 10 percentage points to 13.0 percent. This pending rate compares with 23.4 percent for final resales in January and further points to a developing downward slope for sales. All these reports track data before this month's sudden jump in interest rates, a jump that has already pulled mortgage applications lower. These latter numbers, posted by the Mortgage Bankers Association, show very steep declines over the past several weeks, a time when the 30-year conforming loan jumped by 16 basis points to an average 3.08 percent. And this was before the latest week when the US 10-year yield rose another dozen basis points to nearly 1.50 percent.

An underlying assumption of the inflation-tiger thesis is that the easing of Covid lockdowns will unleash a burst of animal spirits which as yet, however, remain mostly asleep. Yet pessimism is easing in a number of European confidence reports, including Germany's GfK consumer climate index and the Eurozone's economic sentiment index. Looking at Italy, business (green line) improved for a third month in a row in February, from 88.3 in January to 93.2 and its best mark since October. That said, the latest reading was still 5 points short of its pre-pandemic level last February. Consumer confidence (blue line) is at 101.4 and a 5-month high Manufacturing confidence (red line) advanced 3.4 points to 99.0 with this reading slightly above this time last year. The Italian economy will probably contract this quarter but, on current trends, the downturn may be rather less than markets are discounting. How inflationary this would prove, of course, is up for debate. An underlying assumption of the inflation-tiger thesis is that the easing of Covid lockdowns will unleash a burst of animal spirits which as yet, however, remain mostly asleep. Yet pessimism is easing in a number of European confidence reports, including Germany's GfK consumer climate index and the Eurozone's economic sentiment index. Looking at Italy, business (green line) improved for a third month in a row in February, from 88.3 in January to 93.2 and its best mark since October. That said, the latest reading was still 5 points short of its pre-pandemic level last February. Consumer confidence (blue line) is at 101.4 and a 5-month high Manufacturing confidence (red line) advanced 3.4 points to 99.0 with this reading slightly above this time last year. The Italian economy will probably contract this quarter but, on current trends, the downturn may be rather less than markets are discounting. How inflationary this would prove, of course, is up for debate.

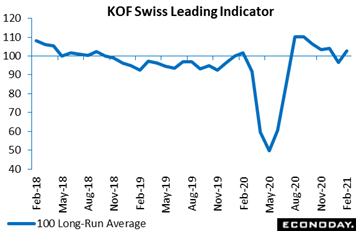

Similar improvement, that is less than red-hot improvement is being signaled by leading indicators from Switzerland. At 102.7, the headline measure is up 6.2 points this month to reverse much of January's 7.7 point slump. The rise also lifted the index back above its 100 long-run average. February's jump was tied to improvement in the services sector although manufacturing also provided a small boost. By contrast, foreign demand had a negative effect. The unexpectedly firm results suggest that GDP growth in Switzerland should be close to trend over the next few months (at a quarterly 0.3 percent in fourth-quarter data also released in the week). By and large, the Swiss economy, as detailed at the end of this article, is performing a bit better than expected.

One economy that has been performing much stronger than expected has been the UK, though February's indication on distributive trades is pointing in the opposite direction. At minus 45 percent, the balance of respondents reporting a yearly rise in volume sales was only 5 percentage points above January's 10-month low and well short of the market consensus. Only grocers saw any yearly growth in February volumes as non-store sales were just flat and other components markedly lower. The best guide to underlying trends, sales for the time of year, were less negative but are seen worsening again next month. In the same vein, while the orders balance improved somewhat, expected orders (minus 59 percent after minus 44 percent) were down steeply. With the UK lockdown still in place and set to be eased only very gradually, the Confederation of British Industry sees its headline falling very steeply to minus 62 in March in what would be a new pandemic low. One economy that has been performing much stronger than expected has been the UK, though February's indication on distributive trades is pointing in the opposite direction. At minus 45 percent, the balance of respondents reporting a yearly rise in volume sales was only 5 percentage points above January's 10-month low and well short of the market consensus. Only grocers saw any yearly growth in February volumes as non-store sales were just flat and other components markedly lower. The best guide to underlying trends, sales for the time of year, were less negative but are seen worsening again next month. In the same vein, while the orders balance improved somewhat, expected orders (minus 59 percent after minus 44 percent) were down steeply. With the UK lockdown still in place and set to be eased only very gradually, the Confederation of British Industry sees its headline falling very steeply to minus 62 in March in what would be a new pandemic low.

Let's not end the week with another indication of cooling but on an indication of recovery. US durable goods orders rose a surprisingly strong 3.4 percent in January, benefiting from a major rebound for commercial aircraft. Excluding a 7.8 percent advance in transportation equipment, orders were still up a very decent 1.4 percent, more than twice Econoday's consensus. New orders for commercial aircraft totaled $5 billion in the month for the best showing ‒ by far ‒ since February 2020 and before the pandemic. Core capital goods, which exclude aircraft as well as defense goods, rose a solid 0.5 percent in January in the latest indication of strength for business investment. Let's not end the week with another indication of cooling but on an indication of recovery. US durable goods orders rose a surprisingly strong 3.4 percent in January, benefiting from a major rebound for commercial aircraft. Excluding a 7.8 percent advance in transportation equipment, orders were still up a very decent 1.4 percent, more than twice Econoday's consensus. New orders for commercial aircraft totaled $5 billion in the month for the best showing ‒ by far ‒ since February 2020 and before the pandemic. Core capital goods, which exclude aircraft as well as defense goods, rose a solid 0.5 percent in January in the latest indication of strength for business investment.

Whether inflation is awakening and tapering to begin, or whether inflation is dead and monetary stimulus already spent, a bearish feel for the stock market is easy to come by, at least it is when interest rates are spiking. China's Shanghai lost 5.1 percent in the week, falling 1.5 percent in a Monday session that saw China tighten rules on funding for online lenders and raise capital requirements for banks lending to tech platforms. European shares were also mostly lower including Germany's DAX which lost 1.5 percent in the week. Jerome Powell's assurances that inflation is a long ways off helped trim losses on Tuesday while upbeat comments on stimulus prospects from top Democrats helped shares on Wednesday. And Mount Etna wasn't the only eruption in the week as shares of GameStop and AMC Entertainment shot higher at midweek in a reminder of the great day-trader short squeeze, raising questions whether it has permanently altered the landscape of the market. Whether inflation is awakening and tapering to begin, or whether inflation is dead and monetary stimulus already spent, a bearish feel for the stock market is easy to come by, at least it is when interest rates are spiking. China's Shanghai lost 5.1 percent in the week, falling 1.5 percent in a Monday session that saw China tighten rules on funding for online lenders and raise capital requirements for banks lending to tech platforms. European shares were also mostly lower including Germany's DAX which lost 1.5 percent in the week. Jerome Powell's assurances that inflation is a long ways off helped trim losses on Tuesday while upbeat comments on stimulus prospects from top Democrats helped shares on Wednesday. And Mount Etna wasn't the only eruption in the week as shares of GameStop and AMC Entertainment shot higher at midweek in a reminder of the great day-trader short squeeze, raising questions whether it has permanently altered the landscape of the market.

Gains for producer prices along with improvement in many reports including confidence readings are taking forecasters by surprise, based on Econoday's consensus divergence indexes which are running hot and indicating that economic data have, on net, been beating expectations soundly. Germany leads the way at plus 46 followed by Italy at 38 and the UK at 36. Scores for Switzerland and the US, at 16 and 15, are also solidly positive, with two countries of note in the negative column: Canada at minus 7 and France at minus 41, the latter pulled down by the country's soft CPI report. Yet how long actual CPI reports will remain soft is a fair question to ask, especially if the bulk of economic data continues to surprise to the upside.

**Contributing to this article were Jeremy Hawkins in London, Brian Jackson in Sydney, and Mace News in New York

The week opens with February's first update on Chinese manufacturing, a CFLP report that's set to be published on Sunday Chinese time. Consumer inflation data will be Monday's focus, from both Italy and Germany where February's flashes are seen steady to cooler. Harmonised consumer prices will follow from the Eurozone on Tuesday with Switzerland to post its CPI on Wednesday. Data from South Korea will include consumer prices on Thursday preceded on Tuesday by industrial production. Market-moving data from the US will bookend the week, first Monday with ISM manufacturing where strength is once again the call and then Friday with the February employment report where strength is not the call. A policy announcement from the Reserve Bank of Australia on Tuesday may also be one of the week's highlights, perhaps offering hints on how central banks plan to position the chance that stimulus, given rapidly declining Covid rates and rapidly increasing interest rates, may have to be withdrawn, at least sooner than later.

China: CFLP Manufacturing PMI for February (Sun 01:00 GMT; Sun 09:00 CST; Sat 20:00 EST)

Consensus Forecast: 51.1

The government's official CFLP manufacturing PMI will open up China data for the month of February which, after slowing 6 tenths to 51.3 in January, is expected to slow a bit further to 51.1.

Italian CPI, Preliminary for February (Mon 10:00 GMT; Mon 11:00 CET; Mon 05:00 EST)

Consensus Forecast, Month over Month: 0%

Consensus Forecast, Year over Year: 0.5%

Driven higher by energy prices, Italian consumer prices ended up much stronger than expected in January, at a 0.7 percent monthly gain and 0.4 percent annual gain that were both revised 2 tenths higher than the flash. Expectations for February's first reading are no change on the month for a 0.5 percent gain on the year.

German CPI, Preliminary for February (Mon 13:00 GMT; Mon 14:00 CET; Mon 08:00 EST)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 1.1%

With a prior cut in value-added taxes reversed, January headline inflation jumped 0.8 percent on the month to an annual 1.0 percent, both of which were higher than expected. Monthly change for February is expected at plus 0.4 percent with the annual rate up a tick at 1.1 percent.

US: ISM Manufacturing Index for February (Mon 15:00 GMT; Mon 10:00 EST)

Consensus Forecast: 58.9

Led by new orders and an exceptionally strong build in backlog orders, ISM's manufacturing report has been hinting at the question of overheating. Consensus for February's index is 58.9 versus January's 58.7.

South Korean Industrial Production for January (Mon 23:00 GMT; Tue 08:00 KST; Mon 18:00 EST)

Consensus Forecast, Month over Month: 1.0%

Consensus Forecast, Year over Year: 5.3%

A 1.0 percent monthly increase is expected for industrial production in January versus a sharp 3.7 percent rise in December. Year-over-year production is seen at plus 5.3 percent versus December's 3.4 percent.

Reserve Bank of Australia Announcement (Tue 03:30 GMT; Tue 14:30 AEDT; Mon 22:30 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.10%

The Reserve Bank of Australia is expected to keep its policy rate unchanged at 0.10 percent after holding it steady in December and cutting it by 15 basis points in November. The bank extended its direct purchase program, due to be completed mid-April, by an additional A$100 million of government bonds. With the economy recovering better than expected, no action is expected for the March meeting.

Eurozone HICP Flash for February (Tue 10:00 GMT; Tue 11:00 CET; Tue 05:00 EST)

Consensus Forecast, Year over Year: 1.0%

Narrow Core

Consensus Forecast, Year over Year: 1.1%

Inflation pressures in January rose substantially and far exceeded expectations, posting overall year-over-year growth of 0.9 percent and growth of 1.4 percent for the narrow core. February's consensus is mixed: up a tenth to 1.0 percent for the former and down 3 tenths to 1.1 percent for the latter.

South Korean Consumer Price Index for February (Wed 23:00 GMT; Thu 08:00 KST; Wed 18:00 EST)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 1.0%

Annual CPI is expected to rise to 1.0 percent in February versus January's 0.6 percent pace. Monthly change in February is seen at plus 0.4 percent.

Swiss CPI for February (Thu 07:30 GMT; Thu 08:30 CET; Thu 02:30 EST)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: -0.3%

Consumer prices have been showing less deflation but deflation all the same, down 0.5 percent on the year in January which, nevertheless, was the best reading since February 2020. February's expectations are an annual rate of minus 0.3 percent with monthly change seen at plus 0.3 percent.

Eurozone Retail Sales for January (Thu 10:00 GMT; Thu 11:00 CET; Thu 05:00 EST)

Consensus Forecast, Month over Month: -1.1%

Retail sales are expected to fall 1.1 percent in January following December's much stronger-than-expected 2.0 percent rebound that followed, however, a 5.7 percent slump in November.

US Initial Jobless Claims for the February 27 week (Thu 13:30 GMT; Thu 08:30 EST)

Consensus Forecast: 790,000

Jobless claims for the February 27 week are expected to rise 60,000 to 790,000 after the prior week's sharp and unexpected 111,000 fall to 730,000, a level that, nevertheless, is three times higher than before the pandemic.

US Employment Situation for February (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast: Change in Nonfarm Payrolls: 140,000

Consensus Forecast: Unemployment Rate: 6.3%

Recovery in the labor market has been slow and uneven with lower-wage jobs caught in steep contraction. A moderate rise of 140,000 is Econoday's consensus for February nonfarm payrolls following January's disappointing increase of 49,000.

|